What Affects Your Mortgage Rate In Canada

There are a few different types of mortgage interest rates in Canada: Fixed interest rates, variable interest rates, or a hybrid combination of the two. These mortgage rate options will affect how your interest rate changes over time. Your mortgage rate will also be affected by certain factors that your mortgage lender will look at.

What Are The Mortgage Rate Trends For 2021

This year, rates have fluctuated but overall they have been low compared to rate history. But, many experts believe rates will rise in 2021.

As the economy recovers and the Federal Reserve announced its plan to scale back its low-rate policies the likely outcome will be rising mortgage rates. However, the expectation among experts isnt for skyrocketing rates overnight, but rather a gradual rise over time.

Recently, though, rates have been volatile. News of the Omicron COVID-19 variant has created fresh economic uncertainty and is putting upward pressure on rates. At the same time, rates are getting downward pressure due to the highest inflation in nearly 40 years.

Long term, experts still expect rates to slowly increase as the economy recovers. The recent volatility could continue through the end of the year and into 2022.

How Do You Pay Interest On A Heloc

With a HELOC mortgage, the entire line of credit available is not advanced upfront. Rather, you have the freedom to use as much or as little of the HELOC as you choose, and you only pay interest on the amount you have withdrawn.

Interest is calculated daily at a variable rate attached to Prime. However, HELOC rates are often higher than variable mortgage rates, and the relationship to Prime can technically change anytime at the discretion of your lender.

For example, a variable mortgage rate is often Prime +/- a number, like Prime 0.35%. HELOC rates, however, are set at Prime + a number and your lender can technically change that number anytime.

Also Check: Reverse Mortgage Mobile Home

Bank Rates Vs Broker Rates

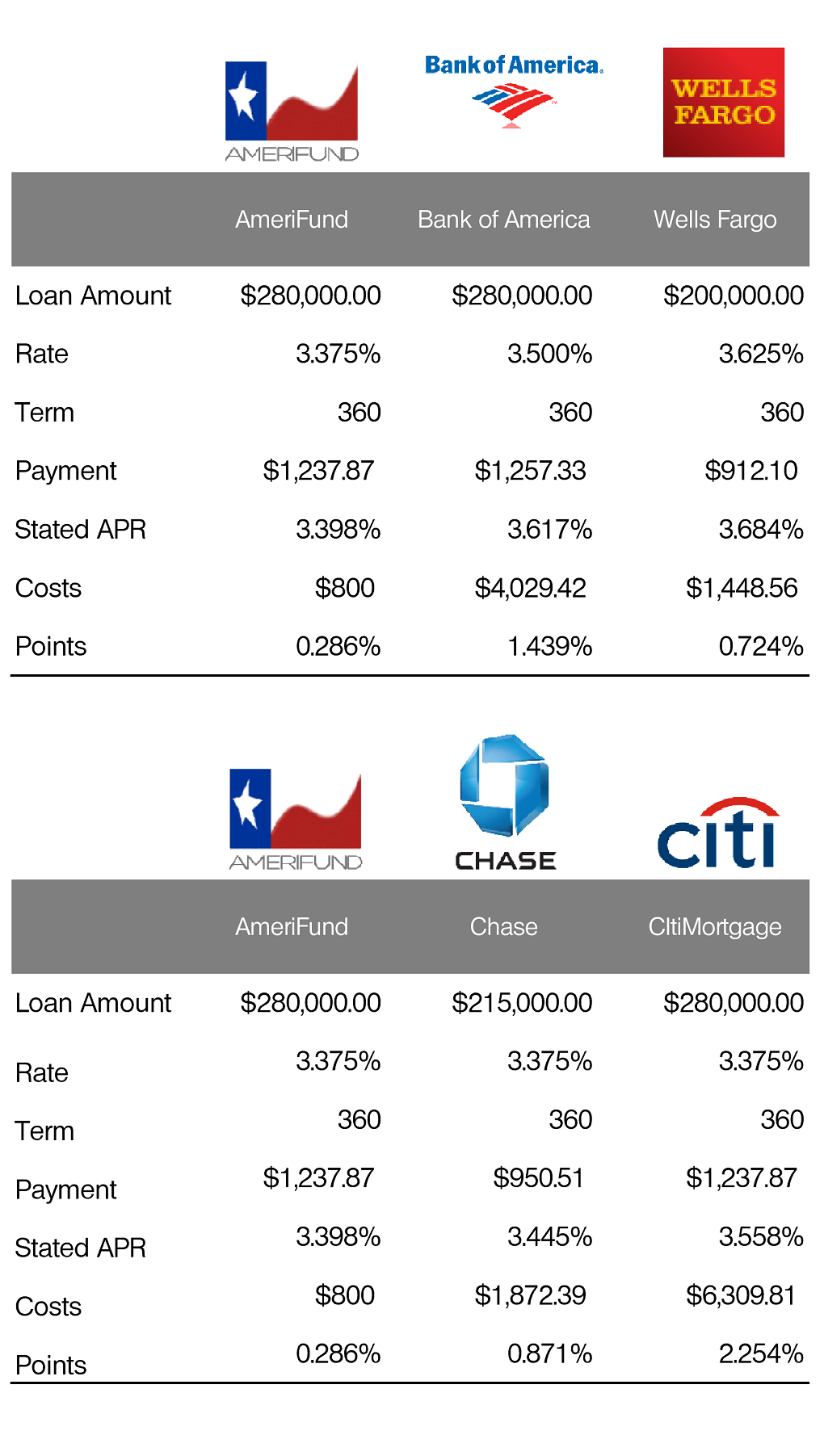

As you may have noticed, bank mortgage rates are almost always higher than those of mortgage brokers. That is because mortgage brokers have access to rates from multiple banks and credit unions, as well as insurance and trust companies. That means they can essentially “shop around” for you. Brokers also receive discounts from lenders based on the high volume of their business, which they can pass along to you.

As a result, itâs unlikely that a bank will post a lower rate than a mortgage broker. However, if you present the lowest market rate to your bank as part of the negotiation process, they may offer to match it. That said, we donât recommend pitting the banks and brokers against each other to compete for your business. What we do recommend is comparing broker mortgage rates and bank mortgage rates alongside each other, and deciding which offer is best for you.

What Should I Do If Im Having Difficulties Paying My Mortgage Because Of Coronavirus

If youre having difficulties making your mortgage payments, then contact your lender straightaway. The deadline for applying for a mortgage holiday ended on 31 March 2021, but the government has agreed with mortgage lenders to offer individual help to households with financial problems because of the coronavirus pandemic. The Financial Conduct Authority has also issued guidance to make sure that home repossessions should only happen as a last resort and when all other reasonable attempts to resolve the situation have failed.

Recommended Reading: Can You Refinance A Mortgage Without A Job

How Do I Choose The Best Mortgage Lender

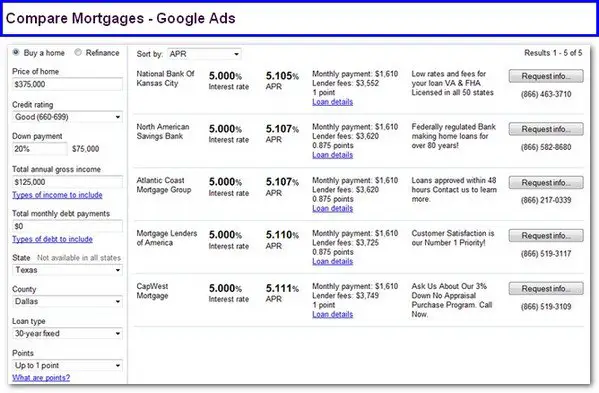

You should always compare several different lenders when shopping for a home loan. Not only will the rates and fees vary, but the quality of service as well. Regardless of what lender you end up working with, its important to find someone that can help your individual challenges. For example, if youre a military veteran getting a VA loan, youll want to work with someone who has experience with those types of loans.

To find a trusted lender, you can look at online reviews, or even better, ask around. Your real estate agent and friends who recently purchased a home are great sources for mortgage lender recommendations. Try comparing a variety of different mortgage lenders. The best mortgage lender for you may be a bank, credit union, mortgage broker, or an online mortgage lender, depending on your situation.

Which Mortgage Lenders Do You Compare

Youll find mortgage deals from across the market, including some of the biggest providers in the UK, including Barclays, HSBC, TSB Nationwide, Nat West and Santander, as well as other lenders like the Post Office. Some deals are available direct from the lender while others are only available through a mortgage broker, such as our trusted partner London & Country Mortgages Ltd **.

Read Also: Rocket Mortgage Payment Options

About Compare The Market

We know comparing insurance and utilities isnt much fun. So at Compare the Market its all about keeping it simple. We do all the legwork to help you find the right product for you at the right price. And you can trust us to be impartial we make money when you switch or take out a new product, so its in our interests to help you make the right choice.

Start Your Search Online For A Mortgage

Finding a mortgage and applying with L& C is a simple four-step process.

Step 1 See how much you could borrow and what your monthly payments are likely to cost using our L& C calculators or the online Mortgage Finder.

Step 2 Answer a few more questions online, or speak to an adviser to find out which deals you are likely to qualify for and get expert advice on the best deal for you.

Step 3 Apply easily for your mortgage online well pre-populate the application form with the information youve given us already, so theres no need to tell us twice.

Step 4 Once youve submitted your application you can keep track of the whole process online 24/7. Our experts are on hand to offer free advice if you need help or support at any stage, and well appoint a dedicated case manager wholl do all the legwork for you.

Read Also: Recast Mortgage Chase

Big 5 Bank Mortgage Rates

-

Answer a few quick questions and see the lowest rates you can qualify for.

-

Apply online

Apply for your mortgage instantly and easily using our secure online application.

-

Connect with our mortgage advisors

Questions or comments? Book a call and one of our mortgage advisors will walk you through all the details

Look At Smaller Lenders

In addition to considering a mortgage from the big banks and online lenders, research smaller, lower-profile players such as credit unions and community banks.

Search online with the name of your home state and terms like community bank mortgage, S& L mortgage, and credit union mortgage.

We found some competitive options this way. Not too far from Consumer Reports Yonkers, N.Y., headquarters, Maspeth Federal Savings in Maspeth, N.Y., was showing an annual percentage rate of 4.008 percent for a conventional 30-year fixed loan. Cleveland-based Third Federal Savings & Loan was showing a 30-year fixed-rate conventional loan with an APR of 4.47 percent.

Gumbinger says these smaller lenders typically have better rates for adjustable-rate mortgages and offer better terms and rates to people with variable income streams, like the self-employed. Thats because they often dont sell those loans in the secondary market as larger banks do, Gumbinger says: Because lenders are putting these loans on their books, they can price them any way they wish.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

What Are Todays Mortgage Rates

On Thursday, December 23, 2021, according to Bankrates latest survey of the nations largest mortgage lenders, the average 30-year fixed mortgage rate is 3.190% with an APR of 3.350%. The average 15-year fixed mortgage rate is 2.500% with an APR of 2.710%. The average 5/1 adjustable-rate mortgage rate is 2.740% with an APR of 4.070%.

Factor: Your Property Type

Youll generally get better mortgage rates if you live in the property being financed. Non-owner-occupied properties, for example, tend to have higher rates due to the added risk to the lender. Thats especially true if theyre rented out.

As well, properties that are less liquid rarely qualify for the lowest rates due to potential resale risk if a customer defaults.

Read Also: Chase Mortgage Recast

Should I Use A Mortgage Broker In Bc

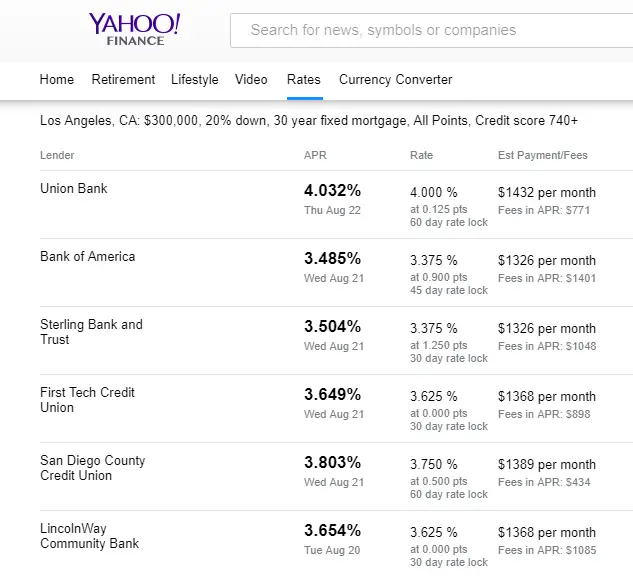

Your mortgage is likely to be the biggest financial decision you ever make, and getting a great deal can save you thousands of dollars over time. Comparing rates and offers from different lenders is the best way to find your ideal mortgage.

Of course, with so many lenders, mortgages, and offers on the market, thatâs a daunting task. A good mortgage broker makes it more manageable, as they have access to, and knowledge of, multiple lenders and products on the market.

As well as being convenient, mortgage brokers often have access to exclusive offers and volume discounts, allowing them to get a better rate than whatâs advertised publicly – even from the big banks. BC mortgage brokers can also help by giving you advice on current mortgage deals, your credit history, or help you access a HELOC if you need one.

Mortgage brokers are also free for you to use, so thereâs no risk in speaking to one about your mortgage. At worst, youâll get free personalized advice on the mortgage process, and at best youâll get a great mortgage rate that saves you thousands.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

Where Can I Get A Mortgage In Canada

There several different places Canadians can turn to get a mortgage. First, its important to identify the difference between a mortgage lender and a mortgage broker.

A mortgage lender lends money to prospective homebuyers directly. They can include a wide range of companies, including banks, trust companies, loan companies, credit unions, caisses populaires and mortgage companies.

A mortgage broker, on the other hand, will not lend money directly to you. Mortgage brokers arrange your transaction by seeking out a lender for you.

While some lenders will only work directly with prospective homeowners, other mortgage products are only offered through mortgage brokers. Since mortgage brokers have access to several lenders at once, they might be able to provide you with a broader range of prospective offers.

LowestRates.ca compares banks, brokers and other lenders all at the same time so you dont have to go through the trouble. And ultimately, we get you the best mortgage rate from one of our trusted partners. Fill out a form to get started.

Canadians facing overheated housing markets, we cant overemphasize the importance of mortgage rate comparison.

Don’t Miss: Requirements For Mortgage Approval

Consider Interest Rates And Closing Costs

The interest rate is important, but theres more to compare. Is there a prepayment penalty if you decide to refinance at some point? What are the total closing costs? Closing costs generally amount to 2% to 5% of the price of the home. If your home costs $150,000, expect to pay $3,000 to $7,500 in costs. Thats a big range, so it behooves you to see what a lender typically charges. The loan estimate sheet you get from your lender will give you the real numbers to check out before you sign on the dotted line.

How Our Comparison Tool Works

Our comparison tool works by searching through 12,000 deals from 90 lenders.

Using our comparison tool is a great first step to seeing what the market has to offer, but if you want a clearer view along with some expert advice, and chat to one of our advisers.

You can also arrange a quick, free call back and speak to an adviser over the phone.

You May Like: Reverse Mortgage For Condominiums

How Do I Lock In A Mortgage Rate

Once youve selected your lender and are moving through the mortgage application process, you and your loan officer can discuss your mortgage rate lock options. Rate locks can last between 30 and 60 days, or even more if your loan doesnt close before your rate lock expires, expect to pay a rate lock extension fee.

When Should I Get A Mortgage

Before you start looking at properties, its a good idea to get a mortgage Agreement in Principle to help establish your budget.

Youll need to provide your mortgage broker or lender with details about your finances to get one.

Agreements in Principle are normally valid for 90 days, which should give you plenty of time to find your perfect home. Once your offer on a property has been accepted, you can start the full mortgage application.

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

What Are The Prepayment Options In British Columbia

Your mortgage prepayment option determines how you can increase the size of your monthly payments, or whether you can make a lump-sum payment directly towards the principal on your mortgage. Your options will be set out in your mortgage contract.

The first prepayment option you have is to increase your monthly payment amount by a certain, set percentage. This increase in payment will reduce youramortization period and thus, the total interest paid on your mortgage.

A second option is to make a lump-sum payment directly towards the principal of your mortgage. The percentage amount by which you are allowed to make this lump sum repayment is based upon your mortgage’s initial principal value.

A Guide To Home Equity Line Of Credit

A home equity line of credit is one of the best ways to access the equity youve built up in your home. Its a low cost alternative to other lines of credit like credit cards or personal loans, backed by the equity you’ve built in your home. Despite the benefits, its important to know some details about HELOCs before you decide to take one out.

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

How Much Does 1 Point Lower Your Interest Rate

The exact amount that your interest rate is reduced depends on the lender, the type of loan, and the overall mortgage market. Sometimes you may receive a relatively large reduction in your interest rate for each point paid. Other times, the reduction in interest rate for each point paid may be smaller. Each lender has their own pricing structure, and some lenders may be more or less expensive overall than other lenders – regardless of whether you’re paying points or not. When comparing offers from different lenders, ask for the same amount of points or credits from each lender to see the difference in mortgage rates.

How To Compare Mortgage Rates In 5 Steps

Its easy to compare mortgage rates and fees if you know what youre doing. There are five basic steps:

That last step comparing Loan Estimates is key to finding the best mortgage rate and most affordable mortgage overall.

How to read your Loan Estimates

A Loan Estimate is a standard document youll receive after completing a mortgage application with any lender.

The LE lists everything you need to know about a mortgage before signing on, including the interest rate, lender charges, loan length, repayment terms, and more.

Sample loan estimate, Page 1. Image: CFPB

The first page of the Loan Estimate clearly states your mortgage interest rate and projected monthly payment. Those are the numbers people often pay most attention to when shopping for home loans.

But the interest rate isnt the only part worth looking at.

You should also compare the estimated closing costs with each lender, as well as the closing cost breakdown shown on page two.

Sample loan estimate, Page 2. Image: CFPB

Finding the best rate and fee combo

At the end of the day, the lowestrate loan isnt always the best offer.

Also Check: Rocket Mortgage Loan Types

How To Get A First

Youre generally expected to put down at least a 10% deposit on your first home and you should aim to get an Agreement in Principle before you start viewing properties.

If youre worried about saving for a mortgage the governments Help to Buy scheme could help with the costs.

You could even look into to make things a little more affordable.

Our guide to first-time buyer mortgages helps you with all the basics so you can find the right deal for your budget.

What The December 2021 Mortgage Rate Forecast Means For You

Todays rates are still exceptionally low compared to historical rate standards. If rates remain in a similar ballpark in December, thats great news for borrowers who havent refinanced yet, or those who could potentially benefit from refinancing again. Low rates and rising home prices have given homeowners all sorts of options to refinance. You could tap your home equity with a cash-out refinance to consolidate high-interest debt or finance a home improvement project. A rate and term refinance could lower your interest rate and reduce your monthly payment.

Keep in mind that your interest rate isnt everything. Make sure your plan accounts for what youll pay upfront in closing costs, specifically the lender fees, which can greatly increase the cost of refinancing.

Unfortunately for homebuyers, todays hot housing market has pushed prices higher. Many buyers may be eligible for rock-bottom rates, only to have potential savings erased by the need to pay more to get an offer accepted. Some experts see signs that home prices are starting to cool, ever so slightly. But dont expect prices to drop. They are likely to continue to increase, just at a slower pace. Rather than trying to time the market, its best to understand how much house you can afford and stay within your budget. If now is the right time for you to buy, then consider expanding your search to more affordable areas.

Also Check: Reverse Mortgage Manufactured Home