What Is A Fixed

A fixed-rate mortgage is a home loan that has the same interest rate for the life of the loan. This means your monthly principal and interest payment will stay the same. The proportion of how much of your payment goes toward interest and principal will change each month due to amortization. Each month, a little more of your payment goes toward principal and a little less goes toward interest.

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

Mortgage Interest Compounding In Canada

Mortgage interest in Canada is compounded semi-annually. This means that while you might be making monthly mortgage payments, your mortgage interest will only be compounded twice a year. Semi-annual compounding saves you money compared to monthly compounding. Thats because interest will be charged on top of your interest less often, giving interest less room to grow.

To see how this works, lets first look at credit cards. Not all credit cards in Canada chargecompound interest, but for those that do, they usually are compounded monthly. The unpaid interest is added to the credit card balance, which will then be charged interest if it continues to be unpaid. For example, you purchased an item for $1,000 and charged it to your credit card which has an interest rate of 20%. You decide not to pay it off and make no payments. To simplify, assume that there is no minimum required payment.

The same applies to mortgages, but instead of monthly compounding, the compounding period for mortgages in Canada is semi-annually. Instead of adding unpaid interest to your balance every month like a credit card, a mortgage lender is limited to adding unpaid interest to your mortgage balance twice a year. In other words, this affects your actual interest rate based on the interest being charged.

Don’t Miss: How To Process A Mortgage Loan

Mortgage Rates In Ontario

Mortgage brokers and certain lenders can charge different mortgage interest rates depending on the province. Ratehub.ca has a comprehensive page of the best mortgage rates in Ontario. The most current Ontario mortgage rates are already included in the calculator above, so you can trust the numbers we provide to be accurate.

What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

Read Also: What Does Taking Out A Second Mortgage Mean

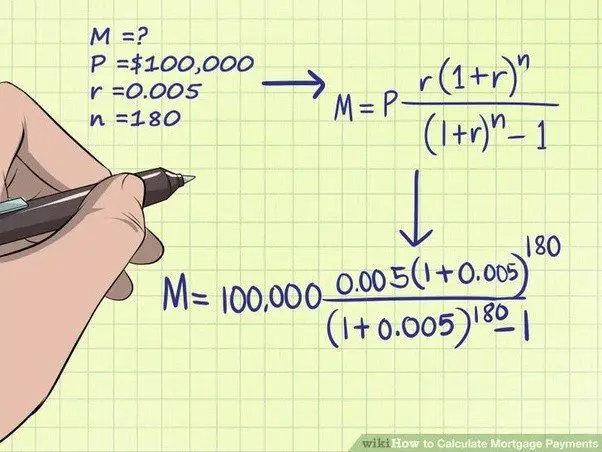

Figuring Out Your Unpaid Principal Loan Balance

If you want to know your unpaid principal loan balance that is remaining after you make your first mortgage payment, you can use our amortization calculator. But if you’d like to understand how to figure it out on your own, read on.

First, take your principal loan balance of $100,000 and multiply it by your 6% annual interest rate. The annual interest amount is $6,000. Divide the annual interest figure by 12 months to arrive at the monthly interest due. That number is $500.

Since your December 1 amortized payment is $599.55, to figure the principal portion of that payment, you would subtract the monthly interest number from the principal and interest payment . The result is $99.55, which is the principal portion of your payment.

Now, subtract the $99.55 principal portion paid from the unpaid principal balance of $100,000. That number is $99,900.45, which is the remaining unpaid principal balance as of December 1. If you are paying off a loan, you must add daily interest to the unpaid balance until the day the lender receives the payoff amount.

You know now that your unpaid principal balance after your December payment will be $99,900.45. To figure your remaining balance after your January 1 payment, you will compute it using the new unpaid balance:

With each consecutive payment, your unpaid principal balance will drop by a slightly higher principal reduction amount over the previous month.

Mortgage Interest Is Paid In Arrears

In the United States, interest is paid in arrears. Your principal and interest payment will pay the interest for the 30 days immediately preceding your payment’s due date. If you are selling your home, for example, your closing agent will order a beneficiary demand, which will also collect unpaid interest. Let’s take a closer look.

For example, suppose your payment of $599.55 is due December 1. Your loan balance is $100,000, bearing interest at 6% per annum, and amortized over 30 years. When you make your payment by December 1, you are paying the interest for the entire month of November, all 30 days.

If you are closing your loan on October 15, you will prepay the lender interest from October 15 through October 31.

It may seem like you get 45 days free before your first payment is due on December 1, but you do not. You will pay 15 days of interest before you close, and another 30 days of interest when you make your first payment.

Also Check: What Is The Hiro Mortgage Program

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Determining The Best Mortgage

Once you have a good idea of what your mortgage payments look like, try using the best Canadian mortgage rates to see how much you can save. Also explore our Mortgage Guides to learn more about mortgage payments and everything else you need to know when it comes to choosing the ultimate mortgage.

*Mortgage payment calculator disclaimer:

The mortgage payment calculator is intended to help you compare different mortgage options and understand your expected payment schedule. However, the mortgage payment calculation should not be used in isolation to influence your mortgage decision-making. Be sure to consult with a mortgage broker or lender about the various mortgage financing and payment options you can take advantage of. We’ll be happy to connect you with a licensed mortgage advisor. The best bet is to first start with analyzing different mortgages, which youcan do on RATESDOTCAhere.

Also Check: How Much Is A Mortgage A Month

What Is A Mortgage Principal

A principal is the original amount of a loan or investment. Interest is then charged on the principal for a loan, while an investor might earn money based on the principal that they invested. When looking at mortgages, the mortgage principal is the amount of money that you owe and will need to pay back. For example, perhaps you bought a home for $500,000 afterclosing costsand made a down payment of $100,000. You will only need to borrow $400,000 from a bank or mortgage lender in order to finance the purchase of the home. This means that when you get a mortgage and borrow $400,000, your mortgage principal will be $400,000.

Your mortgage principal balance is the amount that you still owe and will need to pay back. As you make mortgage payments, your principal balance will decrease. The amount of interest that you pay will depend on your principal balance. A higher principal balance means that youll be paying more mortgage interest compared to a lower principal balance, assuming the mortgage interest rate is the same.

How To Calculate Mortgage Using Our Calculator

Our mortgage calculator is very easy and simple to use, heres the steps:

- Insert your home price in Home Price field.

- Insert how much is the down payment in USD or in percent in Down Payment field.

- Choose your mortgage interest rate in Interest Rate field.

- Choose your mortgage term in years in Mortgage Term field

For the advanced options like taxes and fees click on Show Advanced Options and follow these steps:

- If you have to pay property tax per month, insert how much in Property Tax field.

- If you have to pay homeowners insurance per month, insert how much in Homeowners Insurance field.

- If you have to pay HOAs fees per month, insert how much in HOA fees field.

- Your taxes and fees will be added to your monthly payment

Dont Miss: Chase Mortgage Recast

Don’t Miss: How To Get A 2nd Mortgage

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if youre in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Dont Miss: Reverse Mortgage For Condominiums

What Mortgage Payment Options Do I Have

The frequency of your mortgage payments can be monthly, weekly or bi-weekly, depending on your mortgage terms and conditions.

Mortgage payments can be made in the following ways:

- Monthly mortgage payments

- Weekly accelerated payments

- Semi-monthly (twice a month, e.g., on the 1st and 16th of each month.

Accelerated payments help you pay off your mortgage quicker compared to other payment schedules, helping you avoid thousands of dollars in interest. About 350,000 borrowers increased their payment frequency in 2019, found MPC.

When you choose to make accelerated mortgage payments, you end up making the equivalent of 13 monthly payments per year. The result is that you pay off the mortgage years earlier, saving thousands of dollars on interest.

Heres an example of how payments change based on frequency, assuming a $100,000 mortgage at 3% interest amortized over 25 years.

Also Check: How Long For Mortgage Pre Approval

Why Use A Mortgage Payment Calculator

When planning to buy a home, its easy to focus on the headline figures, like the final purchase price or your overall mortgage amount. But in many way, the most relevant number for your mortgage will be your regular repayments. After all, your mortgage payments are the amount that youll need to take from your pay cheque each month to keep your mortgage under control.

Using a mortgage payment calculator like the one above takes the guess work out of your mortgage payments. Our calculator lets you understand how much youll need to pay each month for any size of mortgage, with any rate. This means you can compare homes and mortgage products with confidence, all the while knowing exactly how much youll be on the hook for in each scenario.

You May Like: Chase Recast Calculator

Find Out Whether You Need Private Mortgage Insurance

Private mortgage insurance is required if you put down less than 20% of the purchase price when you get a conventional mortgage, or what you probably think of as a “regular mortgage.” Most commonly, your PMI premium will be added to your monthly mortgage payments by the lender.

The exact cost will be detailed in your loan estimate, but PMI typically costs between 0.2% and 2% of your mortgage principal.

Oftentimes, PMI can be waived once the homeowner reaches 20% equity in the home. You also may pay a different type of mortgage insurance if you have another mortgage, such as an FHA mortgage.

Also Check: How To Buy Defaulted Mortgages From Banks

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

The Length Of A Home Loan Term

The loan term refers to how long you have to pay off a loan. Shorter terms mean higher monthly payments with less interest. Longer terms flip this scenario, meaning more interest is paid, but the monthly payment is lower.

When youre looking at monthly payments, its important to balance dueling goals of affordability while at the same time trying to pay as little interest as possible.

One strategy that might be helpful is to put extra money toward the monthly principal payment when you can. This will result in paying less total interest over time than if you just made your regular monthly payment.

You can also take a look at recasting your mortgage to lower your payment permanently. When you recast, your term and interest rate stays the same, but the loan balance is lowered to reflect the payments youve already made. Your payment is lower because the interest rate and term remain.

One thing to know about recasting is that sometimes theres a fee, and some lenders limit how often you do it or if they let you do it at all. However, it can be an option worth looking into, because it might be cheaper than the closing costs on a refinance.

Read Also: What Are The Top Mortgage Companies

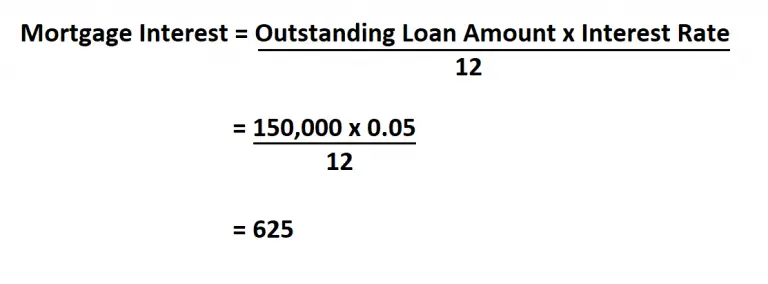

Computing Daily Interest Of Your Mortgage

To compute daily interest for a loan payoff, take the principal balance times the interest rate, and divide by 12 months, which will give you the monthly interest. Then divide the monthly interest by 30 days, which will equal the daily interest.

Suppose, for example, that your uncle gives you $100,000 for a New Year’s Eve present, and you decide to pay off your mortgage on January 5. You know that you will owe $99,800.40 as of January 1, but you will also owe five days of interest. How much is that?

- $99,800.40 x 6% = $5,988.02. Divide by 12 months = $499. Divide by 30 days = $16.63 x 5 days = $83.17 interest due for five days.

- You would send the lender $99,800.40 plus $83.17 interest for a total payment of $99,883.57.

Does Mortgage Payments Include Property Tax

Many mortgage lenders require you to payproperty taxesthrough your lender in your regular mortgage payment, with your lender then paying your municipality. This is because failing to pay your property taxes can lead to your municipality placing a lien on your property, which will be placed in the front-of-the-line before your lender’s claim on your home.

If you pay your property taxes through your lender, then your lender will estimate an amount that would need to be paid every month in order to cover the total amount of property taxes for the entire year. If the amount that the lender collected is not enough to cover the actual property tax due, then the lender will advance the due amounts to the municipality and charge you for the shortfall.

Your lender may charge you interest on the amount of any shortfall. The lender may pay you interest if you have overpaid and have a surplus. Property tax bills or property tax notices are required to be sent to your lender, as failing to send it may mean the collected property tax amounts are not accurate.

Some lenders allow you to pay property taxes on your own. However, they have the right to ask you to provide evidence that you have paid your property tax.

If paying property taxes on your own, your municipality may have different property tax due dates. Property tax might be paid one a year, or in installments through a tax payment plan. Installments might be monthly or semi-annually.

Read Also: How To Shop Around For Best Mortgage Rates