Staying Within Your Budget

To qualify for a mortgage, you have to prove to your lender that you can afford the amount youre asking for.

Mortgage lenders and mortgage brokers use your financial information to calculate your monthly housing costs and total debt load. They use this information to determine what you can afford.

Lenders and brokers consider information such as:

- your income

- your expenses

- the amount youre borrowing

- your debts

- any other debts

Make Sure You Can Show Where Your Deposit Is Coming From

- Savings will need to be evidenced with bank statements and large lump sum transfers will have to be explained. Online statements can satisfy some lenders here but will need your name and address. Some online facilities dont allow this so check yours now.

- Gifted deposits will typically require a letter from the person giving you the money but the format of this will vary depending on the lender so they will need to be in a position to sign this when you apply for the mortgage.

- If you are raising the money on another property it may make sense to start this process earlier to ensure you have the money available when you need it.

Evidence Of Where Your Deposit Is Coming From

This is important as lenders will need to see Proof of Deposit to understand where your deposit is coming from.

- If your deposit is from your savings, youll need to provide evidence via bank statements and any large payments will need to be explained. The bank statements will also need to show your name and address.

- Gifted mortgage deposits will usually require a signed letter from the person who is gifting you the money. At NatWest, we require a signed letter or email from the gifting party, confirming the gift is either non repayable or repayable.

Don’t Miss: Rocket Mortgage Qualifications

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

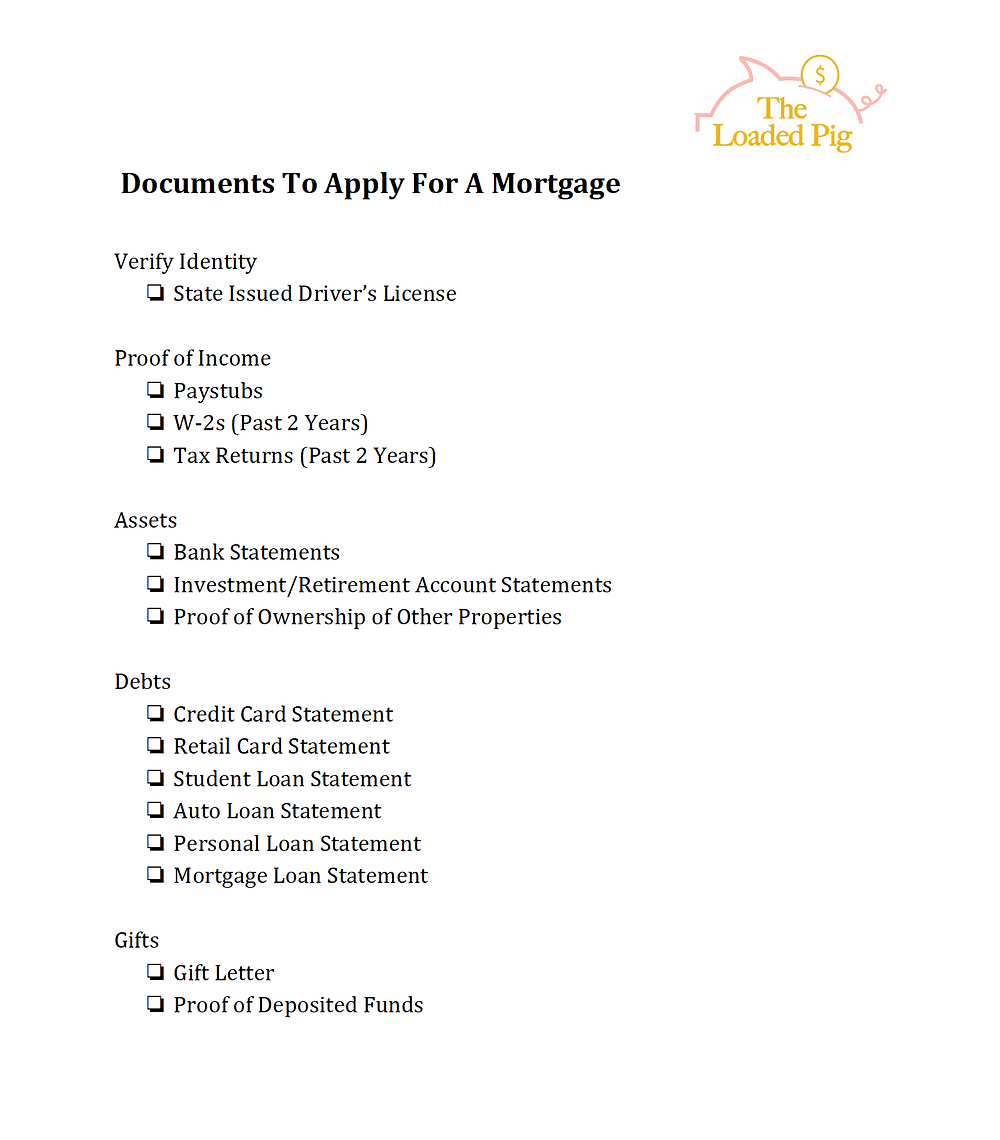

Mortgage Loan Application Checklist

Mortgage lenders request so much documentation to ensure loaning you money isn’t too risky. If the lender fails to properly qualify you for the mortgage loan and you end up defaulting, the lender may not receive any assistance from government-sponsored agencies. As you go into the homebuying process, be prepared to provide the following documents:

- Current driver’s license or state-issued identification card

- Social security number

- Proof of employment for the past two years: W-2s, pay stubs, signed federal tax return

- Proof of income outside of employment, e.g. canceled checks from child support or alimony, copy of lease showing rental income, etc.

- List of current debts

Recommended Reading: Reverse Mortgage Manufactured Home

Calculate The Total Cost Of Your Mortgage

The lender or the broker will do this for you, but make sure they explain all the charges and fees, including any conditional charges and fees, such as early repayment penalties.

Some brokers will charge a fee for advice, receive a commission from the lender or a combination of both. They will tell you about their fees and the type of service they can provide at your initial meeting. In-house bank and building society advisers dont normally charge a fee for their advice.

You will be shown the total yearly cost of a mortgage expressed as a percentage of the loan. This will be shown as an Annual Percentage Rate of Charge calculation and includes any fees such as valuation or redemption fees associated with your mortgage. This APRC will help provide a more thorough comparison between the different mortgages deals available.

Getting a mortgage is about more than just the monthly payments. You also need to budget for the other costs such as solicitor fees and Stamp Duty.

Find out more in A guide to mortgage fees and costs

Consider Getting A Mortgage Decision In Principle

Once you’ve found a mortgage deal that suits your circumstances, you might want to get a , also referred to as an agreement in principle or AIP.

As the name suggests, it involves a lender agreeing ‘in principle’ to give you a mortgage, subject to final checks and approval of the property you intend to buy.

Getting a decision in principle usually involves a credit check, so we’d advise only doing this when formally applying for the mortgage, or if an estate agent asks for one to check you’re a credible buyer.

If you experience the latter, try to obtain the decision in principle with a lender who runs a soft credit check, as it’s best to keep the number of hard credit checks to a minimum. Your broker can help you with this.

Each lender is different, but a decision in principle will typically last for six months. If your property search takes longer than you planned, you may need to get a new decision in principle.

You May Like: 10 Year Treasury Yield And Mortgage Rates

So Are You Ready For A Mortgage

You can ask your mortgage broker to see if you would qualify for a mortgage in the price range you are thinking of. People refer to this as aNo form found. Be careful here the truth is a pre-approval is not a cast-iron contract. And it is pre-approving you, not the property you may end up trying to buy.

But its definitely worth something if your broker says no way you are ready, you can be pretty sure you are not. And you will learn what you still have to do to get ready for prime time and when that will be.

Related Articles

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

Proof Of Address For Each Application

As stated above, this can be your driving license which can be used as either proof of address or proof of identity, but not both. This can also include:

- Bank statement from a different account to which your salary is paid into from the last three months.

- Utility bill dated in the last three months.

- Council Tax bill for the current year.

- PAYE coding letter from HMRC for the current year.

- Benefits award letter.

Please note that mobile phone bills, car insurance policy and TV license are not acceptable.

What Do You Need To Bring With You

- Several pieces of government-issued identification, preferably those including a photo.

- Your current address and at least two previous addresses .

- If youre renting, a letter from your landlord confirming your rent history.

- The name and address of your current employer and past employers .

- Proof of employment, including pay stubs or other proof of income , your position with your current employer and past employers depending on how long youve been working there. Other useful documents include a T4 or, if you are self-employed, Notices of Assessment for the previous two years.

- Proof of a down payment and where your down payment will come from . If a family member will be paying for a portion of your down payment, you will also need a signed letter from them acknowledging the purpose of the gift, and that it is non-repayable.

- Recent financial statements for the past several months to show your down payment as well as the contact information for your bank.

- Your current debts and other financial obligations .

- Information about the property you are looking to purchase, including a copy of the MLS listing, a signed Offer to Purchase, cancelled deposit checks, copies of previous appraisals, building specifications, current property tax statements, heating costs and condominium fees once you have made an offer on a home.

Don’t Miss: Monthly Mortgage On 1 Million

Loan Application Information Required

The first thing youll do when applying for a mortgage is complete a federally required mortgage application. Regardless of whether the application is in the paper format linked here, an online form, or done verbally with your loan officer, this linked document contains the application with the information youll need to provide, including:

- Full name, birth date, Social Security number, and phone number

- Residence history for at least two years. If youre a renter, your rent payment is needed. If youre an owner, all mortgage, insurance and tax figures are needed for your primary residence and all other properties owned.

- Employment history for at least two years, including company name, address, phone number, and your title.

- Income history for at least two years. If you receive commissions, bonuses, or are self-employed, you must provide two years of bonus, commission, or self-employed income received. Most lenders average variable and self-employed income over two years.

- Asset account balances including all checking, savings, investment, and retirement accounts.

- Debt payments and balances for credit cards, mortgages, student loans, car loans, alimony, child support, or any other fixed debt obligations.

- Confirmation whether youve had bankruptcies or foreclosures within the past seven years, whether youre party to any lawsuits, or you co-sign on any loans.

- Confirmation if any part of your down payment will be borrowed.

What To Provide To Your Lender Or Mortgage Broker

Before preapproving you, a lender or mortgage broker will look at:

- your assets

- your income

Youll need to provide the following:

- identification

- proof you can pay for the down payment and closing costs

- information about your other assets, such as a car, cottage or boat

- information about your debts or financial obligations

For proof of employment, you may have to provide:

- a proof of your current salary or hourly pay rate (for example, a recent pay stub

- your position and length of time with the employer

- notices of assessment from the Canada Revenue Agency for the past 2 years, if youre self-employed

Your lender or mortgage broker may ask you to provide recent financial statements from bank accounts or investments. This will help them determine if you have the down payment.

Your debts or financial obligations may include your monthly payments for:

Also Check: Chase Mortgage Recast

If Your Deposit Is From Savings

If we need to see the deposit in your bank account statements, well let you know in your Decision in Principle.

The number of bank statements well need depends on the location of your savings account:

- Within the UK and European Economic Area well need to see 1 statement.

- Outside of the UK and EEA well need to see 3 months of statements.

- If we do not need to see your deposit, we wont ask to see any bank statements.

Debt Service Ratios Analysis

Your mortgage broker/agent or lender will need to make sure that you can carry a mortgage. They will do this by performing a Debt Service Ratio Analysis, basically comparing your debt to your income to see whether you can afford the mortgage loan you want.

Most lenders will require that your monthly housing costs , including mortgage payments, property taxes, condo fees and heating expenses, are no more than 32 per cent of your gross monthly income.

They also want to know that your total monthly debt load, including for example car loans or leases and credit card payments , is not more than 44 per cent of your gross monthly income.

As well as qualifying for the mortgage loan at the rate offered by the lender, if you are putting less than 20 per cent of the purchase price down and are therefore applying for a high-ratio mortgage, you will also need to qualify at the Bank of Canadas five-year fixed posted mortgage rate, which is usually higher. In that case your lender will also require that housing costs are no more than 39 per cent of your monthly income.

Read Also: Can You Refinance A Mortgage Without A Job

Proof Of Other Income Sources

You can use other sources of income in your mortgage application, but you’ll have to provide proof that you’ll continue to receive this income in the future. Child support and alimony are common sources of non-employment income. A copy of your divorce decree and bank statements showing deposits will confirm any child support or alimony you’re receiving.

Proof Of Income And Deposit

- Your last 3 payslips

- Your last 3 bank statements, showing your name and address

- If youâre self-employed, your last 3 years of tax returns and tax year overviews

- Proof of other types of income, like bonuses and rental income

- Proof of your deposit

- If your deposit is a gift, youâll need a letter from the person giving it to you confirming they donât expect to be repaid

You May Like: What Information Do You Need To Prequalify For A Mortgage

What Qualifies As A Good Credit Score

For those who arent as familiar with their credit score, its a three-digit number that encompasses all your credit-related activity into one cumulative average. In Canada, credit scores range anywhere from 300 to 900. The higher your credit score is, the better your chances are of getting approved for various loans and other credit products. Generally speaking, a score of 650 and above is considered good and means that you are a low default risk and a better candidate for lending. A credit score of 750 or higher is deemed excellent.

Loans Canada Lookout

What Documentation Do You Need

Throughout the entire application process, you’re proving your creditworthiness to lenders by providing official statements that outline your financial status, along with other legal and certifiable documentation.

Youâll need to verify your annual income, which means supplying tax returns, recent pay stubs or other proof of income. Lenders might also request the following: bank statements, credit history, rental history, and assets and debts. Additional documents you should have on hand include a signed copy of the sale agreement between you and the seller, identification, and, if necessary, documents that explain credit blemishes like late payments and run-ins with collections.

Also Check: Rocket Mortgage Launchpad

What Do I Need To Apply For A Self

The story is different and potentially much harder if you are self-employed or work as a contractor.

Instead of providing three months worth of bank statements, it’s more likely you will need around 18 months to a full two years of business income, including tax returns.

Banks and other mortgage lenders want to assess what your net income is, but more importantly, how reliable it is. Usually, if you are a full-time permanent employee, the lender trusts that your income is secure.

However, if you are self-employed, then your income is likely to fluctuate from month to month, according to your most successful periods of the year. As a result, the mortgage lender will want to get a better sense of your income by seeing how it fluctuates over a prolonged period of time.

Unfortunately, that means that your income could be determined on a more conservative basis. Even if you think your net income is high enough to get the mortgage you want, the lender might not see it that way because they don’t want to take the extra risk.

You may also need a higher deposit amount than the usual 15% and possibly a stronger credit score than someone who has a full-time permanent job.

It’s also important to remember to keep your personal credit products separate from your business.

It might be considered okay in your line of work to miss a payment and carry it over into the next month, but if you do it on a personal credit card it will negatively impact your score.

How To Get A Mortgage: A Three Step Process

Now that you understand the basics of mortgages, youre probably wondering about the first steps for securing a mortgage. Should you go straight to your bank or is it better to shop around? How do you work out how much mortgage you can afford?

Weve identified three key steps to help you start your mortgage application journey:

You May Like: Rocket Mortgage Conventional Loan