Mortgage Loan Calculator For Refinancing Or Home Purchase Payments

Get estimates for home loan payments to help you decide what you can afford.

This simple Mortgage Loan Calculator enables you to calculate what your monthly mortgage payments will be – including the principal, interest, property taxes and home insurance . The result you get will be relevant for a wide variety of different mortgage types. It will also display your projected repayment schedule, taking into account your principal loan amount, interest rate, and any additional prepayments you intend to make

G Initial Escrow Payment At Closing

- Escrow homeowners insurance: Lenders may also require you to place some amount in an escrow account to cover homeowners insurance in case you fail to make a payment further down the line. This ensures that the home will be covered for some number of months even if you run into financial trouble. This, along with the property tax escrow described below, are most common when your down payment is less than 20%. Your Loan Estimate should show you the amount youll be required to put in escrow to cover two months of homeowners insurance.

- Escrow property taxes: Since the government, in some cases, can place a lien on a house that has unpaid property taxes, or even foreclose on that house, lenders try to make sure that borrowers stay current on their taxes. Tax liens have priority over mortgage liens, so the government would have claim on the house before the lender. An escrow account for taxes gives the lender a backup if you do miss some tax payments and makes a property tax lien less likely to occur

How To Lower Your Monthly Mortgage Payment

- Choose a longer loan. With a longer term, your payment will be lower .

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more gets you off the hook for private mortgage insurance .

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

Recommended Reading: How Does Rocket Mortgage Work

What Are The Different Types Of 203k Loans

The first is the regular or standard 203k, which is given for properties that need things like structural repairs, remodeling, a new garage, or landscaping the second is the streamlined or limited 203k, which is given for energy conservation improvements, new roofing, new appliances, or non-structural repairs such as painting.

How Much Are Closing Costs

Enter your loan details in our closing costs calculator to get an estimate of the fees you’ll pay at closing also referred to as mortgage settlement.

The calculator breaks your closing costs down into five categories: property-related fees, loan-related fees, mortgage insurance fees, property tax and homeowners insurance, and title fees. To learn more about each of these charges, be sure to read mortgage closing costs, explained.

Use the closing costs calculator:

Before shopping for a home. As you begin budgeting and saving, estimate your closing costs and find potential savings.

When shopping for a mortgage lender. Lenders must submit their offers to you in the form of a Loan Estimate that shows your closing costs. Use this calculator to understand the terminology, compare your offers and choose the best one.

When shopping for a home. While youre waiting for your dream home to come on the market, you can be pricing inspectors, title agencies, etc., so youll be ready to engage them when you have an accepted offer.

Getting ready to buy a home? Well find you a highly rated lender in just a few minutes.

Enter your ZIP code to get started on a personalized lender match.

Don’t Miss: Bofa Home Loan Navigator

How Much Is A Downpayment On A 300k House

If you are purchasing a $300,000 home, youd pay 3.5% of $300,000 or $10,500 as a down payment when you close on your loan. Your loan amount would then be for the remaining cost of the home, which is $289,500. Keep in mind this does not include closing costs and any additional fees included in the process.

Can You Afford A 23000000 Mortgage

Is the big question, can your finances cover the cost of a £230,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £230,000.00

Do you need to calculate how much deposit you will need for a £230,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

You May Like: Can You Do A Reverse Mortgage On A Condo

What Does Piti Stand For +

PITI is an acronym used to shorten the following terms:

- Principal the amount you owe your lender, not including interest

- Interest the payment made to your lender for the service of providing the loan

- Property Taxes added fees required by the government

- Home Insurance protection for your property and loan

This PITI calculator is designed to take all of these costs into consideration, giving you an accurate idea of your loans monthly and annual repayments.

Which Is The Best Mortgage Calculator

The 5 Best Mortgage Calculators: How Much Can You Borrow? Google. This is a very recent feature for Google, allowing you to search phrases like what mortgage can I afford at 900 a month or mortgage calculator. Realtor.coms Mortgage Calculator. I like this calculator for its simplicity. CNN Money. Another calculator I like for its simplicity. Zillow. UpNest Home Loans.

Also Check: 10 Year Treasury Yield And Mortgage Rates

How Does Credit Affect Your Mortgage Affordability

The first step a lender typically takes upon receipt of a mortgage application is a credit checka request for your credit score and credit report from one or more of the three national credit bureaus .

Lenders typically have a minimum credit score they’re willing to consider when evaluating borrowers. Different lenders have different minimum score or “cut-off” requirements. Lenders use credit scores when deciding whether to offer a loan as well as when determining the fees and interest rates to charge.

In accordance with a widespread industry practice known as risk-based pricing, applicants with the highest credit scores typically are offered the lowest interest rates available. Those with lower credit scores are typically charged higher interest . The basis for this is the fact that individuals with higher credit scores are statistically less likely than those with lower scores to miss payments and require lenders to initiate collections, foreclosure or other loss-prevention measures.

Mortgage lenders often offer numerous loan packages, with different interest rates and fees, targeted to borrowers whose credit scores fall within a specific numerical rangesfor instance, one offer for applicants with credit scores of 800 or better another for those with scores of 720 to 799 and another for those with scores of 650 to 719. These are purely hypothetical examples each mortgage lender sets its own credit score requirements.

What Are The Different Loans And Programs For First

While the 28/36 rule applies most conventional mortgage lenders, certain programs designed to help first-time homebuyers, veterans and certain low-income home buyers allow some exceptions:

- Mortgages backed by the Federal Housing Administration, known as FHA loans, are designed to help first-time homebuyers qualify for mortgages and allow back-end DTIs of up to 43%.

- Mortgages known as VA Loans, issued through the U.S. Department of Veterans Affairs, are geared toward veterans, service members and qualifying spouses, and allow back-end DTIs of 41%.

- The maximum back-end DTI allowed on USDA Loansmortgages issued under guidelines set by the U.S. Department of Agriculture to help low-income borrowers buy homes in certain rural areasis 46%.

- State and national programs designed to assist with homeownership may be able to help if you’re having trouble meeting the down-payment requirements for a loan, or if your income falls below the level needed to secure some conventional loans.

The factors that determine the amount of a monthly mortgage loan, including your credit score and history and down payment amount, along with your monthly non-housing debt expenses, play a major role in determining how much income you’ll need to afford a mortgage. Understanding DTI and the 28/36 rule can help you anticipate your needs and plan for the mortgage-application process.

If you need to improve your DTI, there are two things you can do:

Don’t Miss: Requirements For Mortgage Approval

What Will My Mortgage Cost

See examples of costs for different mortgage types, payment terms and interest rates.

The monthly payment and rate you’ll pay until your introductory period ends.

Follow-on payments and rate

The payments and rate you’ll pay after your introductory period ends if you dont change anything.

Use the annual percentage rate of charge to compare the cost of our mortgages, including interest and fees, with those from other lenders.

Mortgage fee

You can pay this fee when you submit a mortgage application, or add it to the amount you borrow.

Total of monthly payments

The information below shows roughly how your monthly payments will affect your mortgage balance over time. But they don’t include any other fees or payments you may need to make.

Loan to value

The percentage of the property value that you’re going to borrow. We divide your mortgage amount by the property value to work out the LTV.

Early repayment charge

The amount you’ll pay if you want to pay off the mortgage early or make an overpayment that’s more than we’ve agreed to.

Fixed-rate

Your rate stays the same for a set period, so your monthly payments remain the same even if our base rate changes.

Tracker

Your rate is a certain amount above our base rate. If base rate goes up or down, your payments will too .

Offset

Money you have in another account with us is used to lower the mortgage balance we charge interest on. All our offset mortgages are trackers.

Filter your results

How Much Will My Va Loan Payment Be

There are a variety of factors that play into the calculation of your monthly loan payment. Typically, the factors affecting your monthly payment include the home price, down payment, interest rate, and if you have to pay the VA funding fee.

As with any mortgage calculator, these numbers are estimates. To get exact figures, contact Veterans United Home Loans and speak with a home loan specialist.

Also Check: Can You Get A Reverse Mortgage On A Condo

Who Is This Calculator For +

This calculator is most useful if you:

- Calculate mortgage rates you are considering

- Compare differences of various home loan term programs

- Haven’t decided on what type of loan you want yet

- Want to get an idea of monthly or annual cost of buying a property

- Are looking to assess the long term benefit of making prepayments in addition to regular loan repayments

Today’s Mortgage Rates In Ohio

| Product |

|---|

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

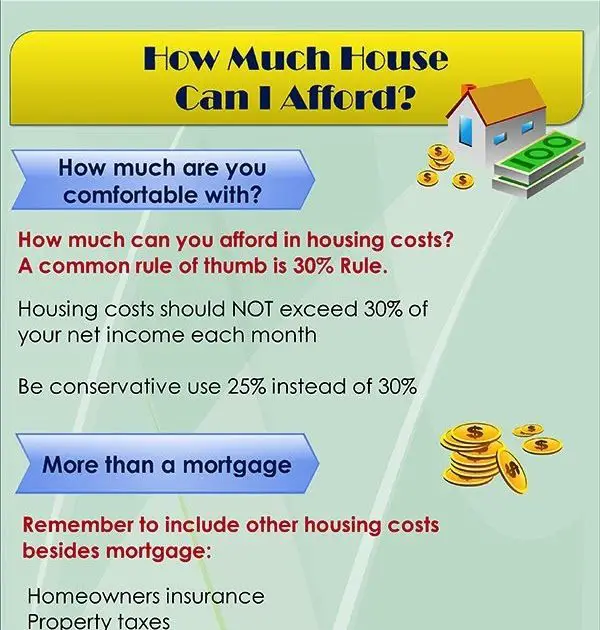

Not sure how much you can afford? Try our home affordability calculator.

Total Monthly Payment

Based on a $350,000 mortgage

Based on a $350,000 mortgage

| Remaining Mortgage Balance |

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Also Check: Does Chase Allow Mortgage Recast

How Do You Calculate Closing Costs On A House

As you’ll see from the results provided by the closing cost calculator, the settlement fees you’ll pay are a collection of lender and third-party charges. On the Loan Estimate, you’ll find that the total cash required at settlement will also include one other major expense: the down payment.

Here are the closing costs behind the numbers:

Cost estimation. The top result shows total closing costs, in dollars and as a percentage of the mortgages value . Youll also see total costs for the services you can shop for and which prices are fixed.

Breakdown of costs. The next section shows you a breakdown of prices for 13 typical closing costs. Those include work done by the lender to evaluate and process the loan, work done by professionals like an appraiser and perhaps a surveyor to assess the property, and other fees for things like mortgage insurance, a title search, property tax and homeowners insurance.

Services you can shop for. The Breakdown of costs section also shows which services you can shop for: Under each fee youll see a note saying Fixed or Shop.

Refine your results. The closing cost calculators default setting offers estimates for many of the fees. For example, the calculators default price for an appraisal is $350. But appraisal fees vary and might be $300 or $450, depending where you live. If you know the exact cost of a service or product youll use, type it into the calculator to improve your results.

My First Texas Home Loan

State program

Closing cost assistance

What you need to know

The My First Texas Home program offers 30-year, fixed-interest rate mortgages for first-time home buyers and veterans. The program includes down payment and closing cost assistance of up to 5% of the mortgage amount as a no-interest, no-monthly-payment second lien. In order to be eligible for this… Read More

Don’t Miss: Rocket Mortgage Launchpad

How To Use The Mortgage Loan Calculator

We have done our best to make this calculator as simple and user-friendly as possible, but if you arent sure where to start, try following these steps:

Local Economic Factors In Ohio

The Buckeye States known for its leading export commodities: motor vehicles and machinery. General Electric, General Motors, Ford and Whirlpool all have a major presence in this Midwestern state. The manufacturing sector leads the nation in production of plastics, rubber, fabricated metals and more. In Q3 2020, Ohio had a state GDP of $683 billion, according to the U.S. Bureau of Economic Analysis. In fact, it is consistently one of the largest state economies in the country.

Some of Ohios top employers are Walmart, Cleveland Clinic, Kroger, Mercy Health and Ohio State University, according to the Ohio Department of Development. Several Fortune 500 companies have headquarters in Ohio including Cardinal Health, Procter & Gamble, Nationwide and Progressive.

Ohios unemployment rate for December 2020 was 5.5% compared to the national rate of 6.7%, according to the Bureau of Labor Statistics. Income didnt fare well either, according to data from the Bureau of Economic Analysis. In 2019, Ohios per capita personal income of $50,199 was well below the national average of $56,490.

You May Like: Who Is Rocket Mortgage Owned By

A Look At The Calculator Inputs

Home Value: Home value is the potential purchase price of the home, not including a down payment.

Down Payment: The down payment is an upfront amount paid towards the principal. VA loans do not require a down payment, and most choose $0 down. However, if you decide to put money down, it can reduce the VA funding fee – if required – and your overall monthly payment.

Interest Rate: The interest rate is the cost of borrowing. Interest rates in the calculator include APR, which estimates closing costs and fees, and is the actual cost of borrowing. Interest rates in the calculator are for educational purposes only, and your interest rate may differ.

Loan Term: Loan term is the length you wish to borrow – typically 15 or 30 years.

Interest rates typically vary based on a handful of factors, including credit score. Estimate your credit score for a more accurate VA loan payment.

Loan Type: VA loans provide both purchase and refinance options. Calculations for loan types differ due to the VA funding fee. If you’re calculating a cash-out or IRRRL, we have a specific calculator for VA refinancing here.

VA Specifics: VA specifics relate to the VA funding fee. Borrowers with a disability rating of 10% or more, have a Purple Heart or are a surviving spouse are exempt from the VA funding fee. Borrowers who aren’t exempt and have used a VA loan before are subject to a slightly higher VA funding fee.