How To Lower Your Monthly Mortgage Payment

- Choose a longer loan. With a longer term, your payment will be lower .

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more gets you off the hook for private mortgage insurance .

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

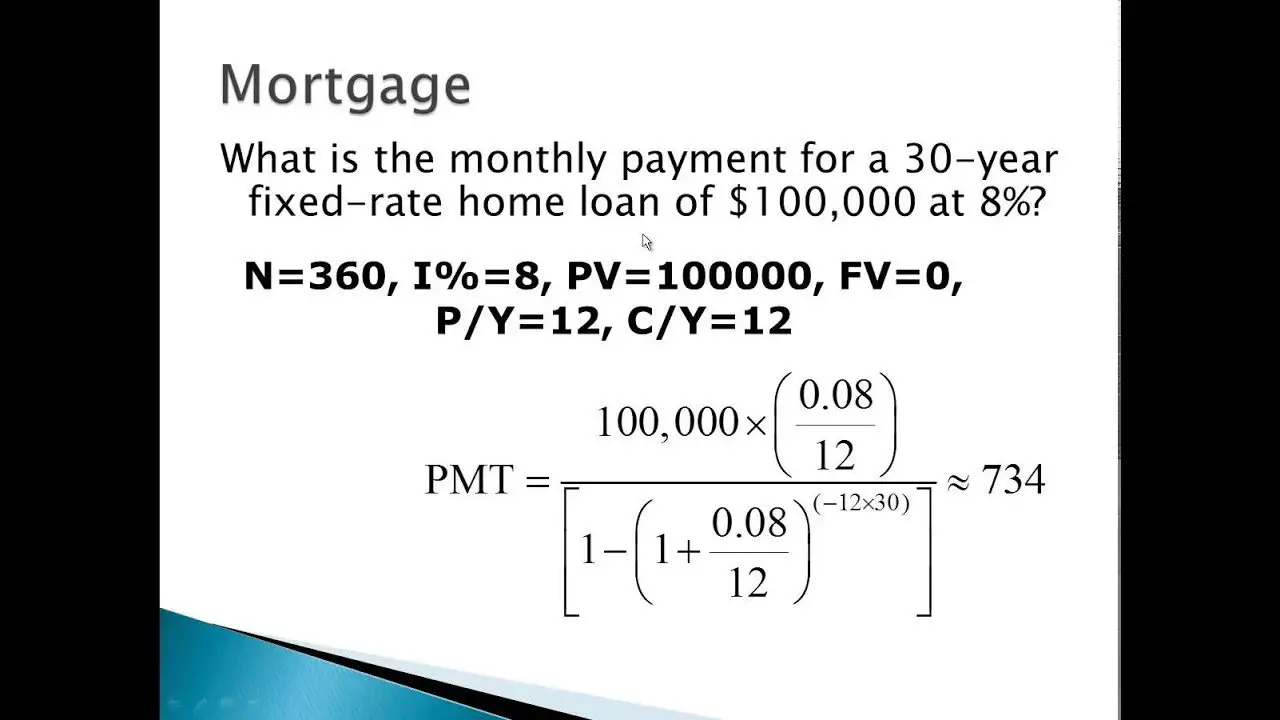

What Is Mortgage Formula

The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan.

Fixed Monthly Mortgage Repayment Calculation = P * r * n /

where P = Outstanding loan amount, r = Effective monthly interest rate, n = Total number of periods / months

On the other hand, the outstanding loan balance after payment m months is derived by using the below formula,

Outstanding Loan Balance=P * /

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Mortgage Formula

Nper: The Number Of Payments Youll Make On A Loan

Once youve established your monthly interest rate, youll need to enter the number of payments youll be making. Since were calculating the monthly payment, we want this number in terms of months.

For example, a 30-year mortgage paid monthly will have a total of 360 payments , so you can enter “30*12”, “360”, or the corresponding cell *12. If you wanted to calculate a five-year loan that’s paid back monthly, you would enter “5*12” or “60” for the number of periods.

You May Like: Can You Do A Reverse Mortgage On A Condo

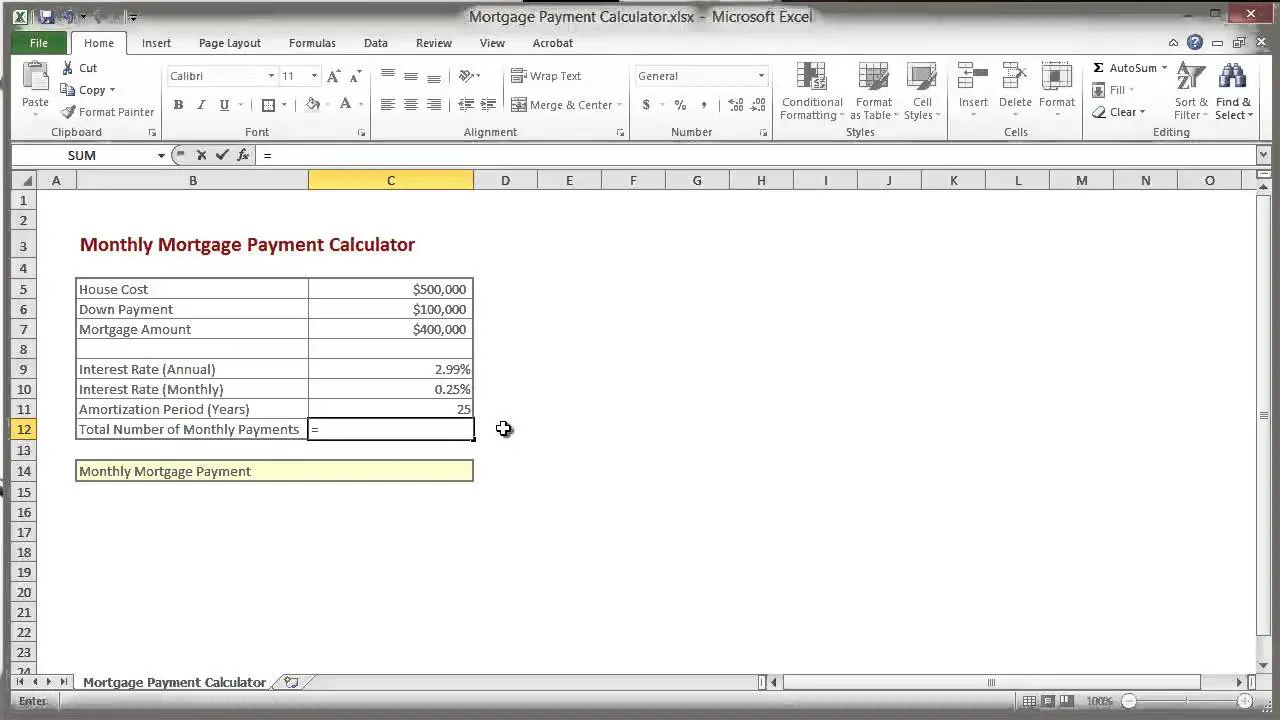

Calculating Mortgage Payments Using A Spreadsheet Program

How To Calculate Monthly Mortgage Payment In Excel

For most of modern people, to calculate monthly mortgage payment has become a common job. In this article, I introduce the trick to calculating monthly mortgage payment in Excel for you.

Calculate monthly mortgage payment with formula

To calculate monthly mortgage payment, you need to list some information and data as below screenshot shown:

Then in the cell next to Payment per month , B5 for instance, enter this formula =PMT, press Enter key, the monthly mortgage payments has been displayed. See screenshot:

Tip:

1. In the formula, B2 is the annual interest rate, B4 is the number of payments per year, B5 is the total payments months, B1 is the loan amount, and you can change them as you need.

2. If you want to calculate the total loancost, you can use this formula =B6*B5, B6 is the payment per month, B5 is the total number of payments months, you can change as you need. See screenshot:

Read Also: 10 Year Treasury Yield Mortgage Rates

Visit Our Fantastic Service And Parts Centers

After you purchase your vehicle, enjoy the assurance that your model has come from a dealership that’s dedicated to supporting you for as long as you drive your vehicle. Our service and parts centers are made up of a team of expert technicians that are automotive enthusiasts and care about the health and integrity of your vehicle. That’s why we only house OEM parts.

Stop by and see us today to find your next dream model among our new or used inventory or take care of that pesky repair that you’ve been putting off. We can’t wait to welcome you in person to your Permian Ford dealership.

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

Also Check: Reverse Mortgage Mobile Home

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

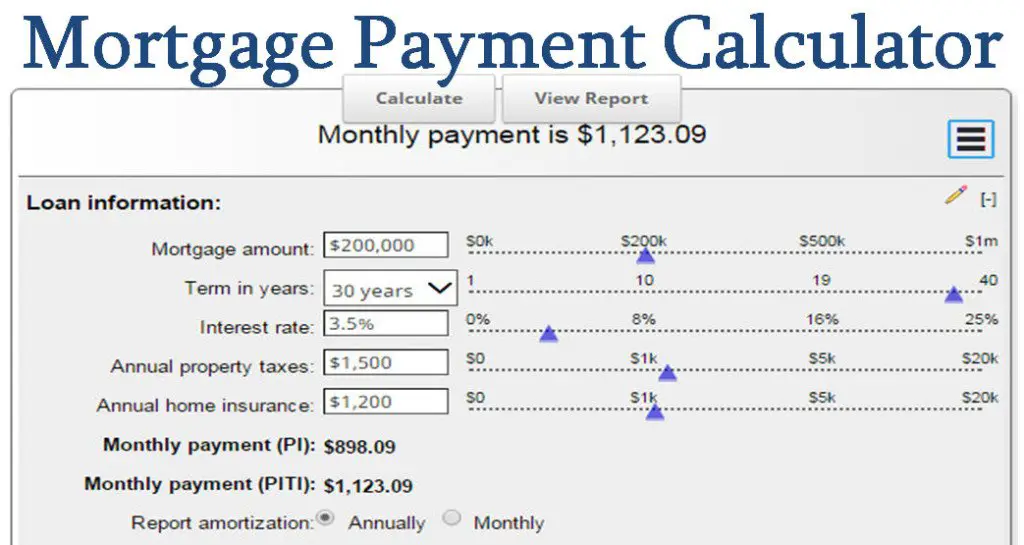

How To Calculate Mortgage Payments

Calculating mortgage payments used to be complex, but mortgage payment calculators make it much easier. Our mortgage payment calculator gives you everything you need to test different scenarios, to help you decide what mortgage is right for you. Heres a little more information on how the calculator works.

You May Like: Who Is Rocket Mortgage Owned By

How Do You Calculate A Loan Payment

Heres how you would calculate loan interest payments.

then What is the formula for calculating a 30 year mortgage? Multiply the number of years in your loan term by 12 to get the number of total payments for your loan. For example, a 30-year fixed mortgage would have 360 payments .

Which formula should be used to correctly calculate the monthly mortgage payment? Use the formula P= L / to calculate your monthly fixed-rate mortgage payments. In this formula, P equals the monthly mortgage payment.

The Three Numbers You’ll Need

There are several factors that go into estimating how much your regular mortgage payments will be. These 3 numbers are particularly important:

1. The total mortgage amount: This is the price of your new home, less the down payment, plus mortgage insurance, if applicable.

2. The amortization period: This is the total life of your mortgage, and the number of years the mortgage payments will be spread across.

3. The mortgage rate: This is the rate of interest you pay on your mortgage.

Also Check: Does Rocket Mortgage Sell Their Loans

How To Calculate Your Monthly Mortgage Payment

The following calculator is a basic mortgage calculator. However, it does show you all the necessary information you need to calculate your monthly mortgage payment. To use this calculator, enter in the amount of your down payment and your monthly payment amount. You will then see the amount you will pay in interest and principal.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Don’t Miss: Reverse Mortgage For Condominiums

Get Help Calculating Monthly Mortgage Payments

The terms and details of your mortgage will impact your financial standing for years to come. It is essential to understand all aspects of your home loan and the payment schedule you will be using throughout the life of the mortgage.

At SimpleShowing, talented, experienced real estate professionals can help you navigate the complicated and confusing process of acquiring a mortgage. Contact a knowledgeable representative for complete information on the wide range of realtor services to assist in the home buying experience.

Executing The Pmt Function

The formula now reads:

Once you’ve entered all of the data points, you can press enter to execute the function. This will tell you your monthly payment amount:

As you can see above, the monthly principal and interest payment for this mortgage comes out to $1,342.05. This is shown as a negative figure because it represents monthly money being spent.

If this calculator isnt the right fit for you, you can try to determine how rates, terms, and loan amounts impact your payment.

Also Check: Mortgage Recast Calculator Chase

What To Expect From Your Mortgage Payment

The mortgage calculator is a great tool for anyone who has recently taken out a mortgage. It can be a little overwhelming to figure out what your monthly payments will be and how long it will take to pay off the mortgage.

The mortgage calculator is a great tool to use to figure out these things. You should also use the mortgage calculator as a way to figure out how much interest youre paying in order to pay off the mortgage faster.

What To Expect When Visiting Our Dealership

There are many reasons to visit Permian Ford Lincoln, from the vehicles we sell to the online car shopping tools we provide. You’llfind all sorts of trucks and SUVs in our new inventory, and we love to talk about what makes our new Ford models so great. You may prefer the value of one of our used vehicles. Of course, it’s more than just our vehicles that draw drivers to us as we have a Ford service center near Andrews, TX that is where to come for everything from oil changes to Ford accessories!

Recommended Reading: Recast Mortgage Chase

Definition And Examples Of Monthly Loan Payments

When you receive a loan from a lender, you receive an amount called the principal, and the lender tacks on interest. You pay back the loan over a set number of months or years, and the interest makes the total amount of money you owe larger. Your monthly loan payments will typically be broken into equal payments over the term of the loan.

How you calculate your payments depends on the type of loan. Here are three types of loans you’ll run into the most, each of which is calculated differently:

- Interest-only loans: You dont pay down any principal in the early yearsonly interest.

- Amortizing loans: You’re paying toward both principal and interest over a set period. For instance, a five-year auto loan might begin with 75% of your monthly payments focused on paying off interest, and 25% paying toward the principal amount. The amount you pay on interest and principal changes over the loan term, but your monthly payment amount does not.

- A credit card gives you a line of credit that acts as a reusable loan as long as you pay it off in time. If you’re late making monthly payments and carry your balance to the next month, you’ll likely be charged interest.

Why Use A Mortgage Payment Calculator

When planning to buy a home, it’s easy to focus on the headline figures, like the final purchase price or your overall mortgage amount. But in many way, the most relevant number for your mortgage will be your regular repayments. After all, your mortgage payments are the amount that you’ll need to take from your pay cheque each month to keep your mortgage under control.

Using a mortgage payment calculator like the one above takes the guess work out of your mortgage payments. Our calculator lets you understand how much you’ll need to pay each month for any size of mortgage, with any rate. This means you can compare homes and mortgage products with confidence, all the while knowing exactly how much you’ll be on the hook for in each scenario.

You May Like: Chase Recast Calculator

Rate: Each Periods Interest Rate In Percentage Terms

Lenders usually quote interest rates on an annual basis but this data point uses a periodic interest rate . Since we are calculating the monthly payment, we want to find the periodic rate for a single month. To do this, we’ll divide the interest rate by the number of periods to find the monthly interest rate.

For example: Say you want to calculate a monthly mortgage payment using a 5% interest rate. Youd enter: “5%/12” or “0.05/12”, or the corresponding cell /12. Once you enter the interest rate, type a comma to move to the next data point.

Caution: If you simply enter “5/12” instead, Excel will interpret this as a 500% annual rate paid monthly. Entering “5” will result in a 500% interest rate each month.

What It Means For Consumers

Calculating your monthly payments can help you figure out whether you can afford to use a loan or credit card to finance a purchase. It helps to take the time to consider how the loan payments and interest add to your monthly bills. Once you calculate your payments, add them to your monthly expenses and see whether it reduces your ability to pay necessary and living expenses.

If you need the loan to finance a necessary item, prioritize your debts to try and pay the ones that cost you the most as early as possible. As long as there’s no prepayment penalty, you can save money by paying extra each month or making large lump-sum payments.

It helps to talk to your lender before you begin making extra or lump-sum payments. Different lenders might increase or decrease your monthly payments if you change your payment amount. Knowing in advance can save you some headaches down the road.

Read Also: What Does Gmfs Mortgage Stand For

What Is A Monthly Mortgage Payment Calculator

Contents

A Monthly Mortgage Payment Calculator will help you figure out how much your monthly mortgage payment will be based on the applicable data, such as loan amount, rate, number of years of mortgage, etc. When entering the data that is relevant to your situation, the mortgage calculator will give you the payment based on that data.

Estimated monthly payments typically include principal, interest, property taxes, and homeowners insurance. By showing additional options like credit score, ZIP code, and HOA fees, you will get a more precise payment estimate. This will enable you to enter the homebuying process with a more accurate understanding of how to calculate mortgage payments and make a confident purchase.

How To Calculate Mortgage Using Our Calculator

Our mortgage calculator is very easy and simple to use, here’s the steps:

- Insert your home price in “Home Price” field.

- Insert how much is the down payment in USD or in percent in “Down Payment” field.

- Choose your mortgage interest rate in “Interest Rate” field.

- Choose your mortgage term in years in “Mortgage Term” field

For the advanced options like taxes and fees click on “Show Advanced Options” and follow these steps:

- If you have to pay property tax per month, insert how much in “Property Tax” field.

- If you have to pay homeowner’s insurance per month, insert how much in “Homeowner’s Insurance” field.

- If you have to pay HOA’s fees per month, insert how much in “HOA fees” field.

- Your taxes and fees will be added to your monthly payment

Don’t Miss: Chase Mortgage Recast