How Long Can You Lock In A Mortgage Rate

Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesnt process the loan before the rate lock expires, youll need to negotiate a lock extension or accept the current market rate at the time.

Even if you have a lock in place, your interest rate could change because of factors related to your application such as:

- A new down payment amount

- The home appraisal came in different from the estimated value in your application

- There was a sudden decrease in your credit score because you are delinquent on payments or took out an unrelated loan after you applied for a mortgage

- Theres income on your application that cant be verified

Talk with your lender about what timelines they offer to lock in a rate as some will have varying deadlines. An interest rate lock agreement will include: the rate, the type of loan , the date the lock will expire and any points you might be paying toward the loan. The lender might tell you these terms over the phone, but its wise to get it in writing as well.

Understanding The Default Rate

It is the borrowers responsibility to make on-time payments as per the initial agreement with the financial institution. Whether through a mortgage payment or a credit card agreement, the borrower may fail to make the payments. To be considered a defaulted consumer loan, multiple consecutive payments have not been received over several months.

Defaulting on a loan will damage the borrowers , making it difficult to receive approvals on loans in the future. Even if a future loan were to be approved, the low credit score would likely lead to a much higher interest rate on loans.

Before being considered a defaulted loan, a loan with a missed payment is a delinquent loan. The period in which a loan is delinquent is the duration in which the lending institution allows some time to pass before declaring the loan defaulted. During such a time, the borrower must act and make up missed payments to avoid the consequences of a defaulted loan.

If the borrower still does not make up their missed payments, the lender will eventually write off the loan and declare it to be in default. The timeframe for default may vary depending on the type of loan. For student loans, default is approximately 270 days or nine months that no payments have been received.

Implications For Policy Design

This study has important implications for designing mortgage modification policies to limit default and foreclosures. Specifically, it indicates that inability to pay is a major cause of defaultaccounting for nearly two-thirds of defaults during the Great Recessionand suggests that policies that reduce monthly mortgage payments can substantially raise the number of homeowners who pay their mortgage.

The findings also suggest that current federal guidelines for reducing monthly payments as specified in the Dodd-Frank Act may not be sufficient to substantially reduce foreclosures. The Dodd-Frank program automatically assumes that households are willing to tolerate a drop in consumption that is the same as the income decline that they experience. Our results show that about 32 percent of households who default will not be willing tolerate such a large reduction in consumption. Consequently, modification guidelines may need to be adjusted along these lines.

Other types of modification policies, such as reducing principal to entice borrowers with negative equity to continue to pay, are likely to be a far more expensive option to reduce default. This is because nearly all borrowers with negative equity, but with the ability to pay, choose to remain current. Consequently, offering principal reductions to those with negative equity may result in very large, unintended subsidies to this group of borrowers.

Read Also: What Percentage Of Your Income Should Be For Mortgage

Work On A Plan With Your Lender

Lets say you can predict youre going to hit some bumps in the road and youre going to miss a few payments. Reach out to your lender in advance. Let them know whats causing the delinquency, when you expect to be back on track again and how much you can pay in the meantime. Many lenders are willing to work with you if you communicate with them ahead of time.

Remember, lenders dont want to foreclose on homes. Most lenders would rather work with you to find a way to keep you from defaulting on your mortgage.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Mortgage Delinquency Rate Falls To Historic Low

Serious delinquency level is still 45% higher than pre-pandemic

The national mortgage delinquency dropped to an all-time low in May, continuing two consecutive months of a decline since March.

The overall delinquency rate slightly dropped five basis points from April to 2.75% in May, according to Black Knight. The delinquency rate is 42% lower than the same period a year ago.

A total of 1.46 million properties were in early-stage delinquencies, defined as borrowers who missed a single mortgage payment, which is a slight increase of 0.2% from April due to typical seasonal patterns. Its more than a 71% drop from the same period in 2021.

Mortgage performance continues to be strong, with inflow of new delinquencies still running below pre-pandemic levels, said Andy Walden, vice president of enterprise research at Black Knight. With fewer new borrowers becoming delinquent, both overall and early-stage delinquency rates continue to trend downward.

Some 595,000 properties were considered seriously delinquent, in which loan payments are more than 90 days past due, but not in foreclosure. That metric dropped 7% in May from the previous month. However, the number of properties in serious delinquency were 45% above pre-pandemic levels.

The country is still working through a surplus from the serious delinquencies that surged in the second quarter of 2020 as borrowers struggled to pay back their loans at the start of the pandemic, Walden said.

Presented by: Auction.com

Don’t Miss: What Do You Need To Provide To Get A Mortgage

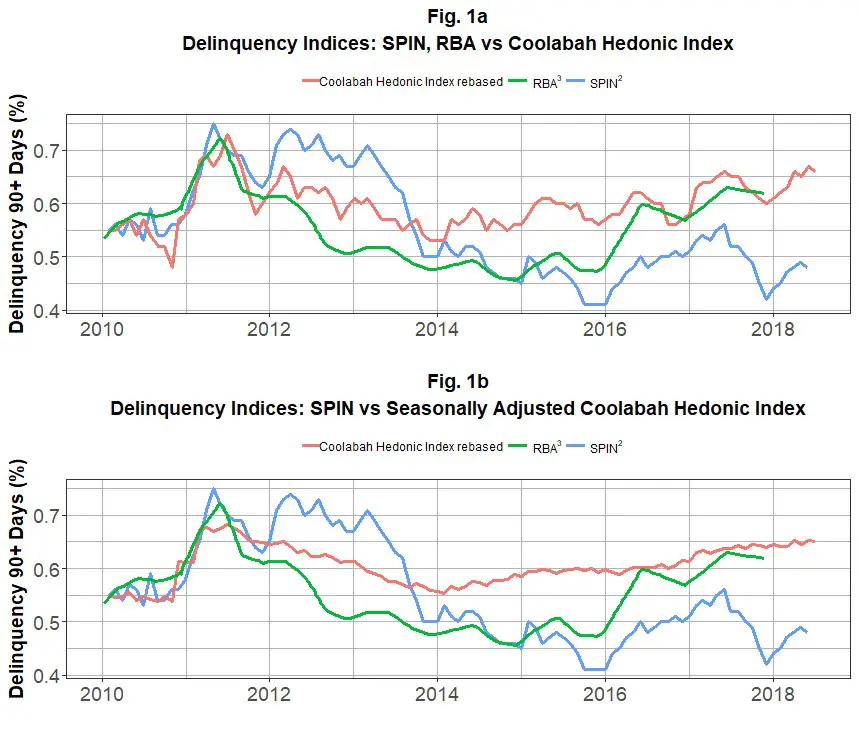

Motivation And Innovations In Our Study

In the absence of micro-data in the public domain, we estimated new aggregate models for the UKs mortgage repossessions and arrears with quarterly data for 1983-2014 that were motivated by a conceptual double trigger framework for foreclosures and payment delinquencies . An important innovation is that difficult-to-observe variations in loan quality and access to refinancing, and the shifts in lenders forbearance policy, are estimated by common latent variables in a system of equations for arrears and repossessions. This greatly improves on the flawed but widespread use of loan-to-value measures. We also introduce, for the first time in the literature, a theory-justified estimate of the proportion of mortgages in negative equity as a key driver of aggregate repossessions and arrears. This measure is based on an average debt-to-equity ratio, corrected for regional deviations, and uses a functional form for the distribution of the debt-to-equity ratio checked on Irish micro-data from the Bank of Ireland, and Bank of England snapshots of negative equity . We further systematically address serious measurement bias in the months-in-arrears measures, neglected in previous UK studies. Finally, a universal assumption in previous UK studies of a proportional relationship between repossessions and arrears is relaxed in our system.

Figure 4: An annotated version of forbearance and loan quality/credit access functions4

Current Conforming Loan Limits

On November 30, 2021 the Federal Housing Finance Agency raised the 2022 conforming loan limit on single family homes from $548,250 to $647,200 – an increase of $98,950 or 18.05%. That rate is the baseline limit for areas of the country where homes are fairly affordable. In higher-cost areas like San Francisco or New York City the single-family home loan limit can go as high as $970,800.

Here is an overview of the current limits based on the number of units in a building. Limits in the third row apply to Alaska, Guam, Virgin Islands, Washington D.C & Hawaii.

| Units |

|---|

Don’t Miss: How To Prequalify For A Home Mortgage

How Are Mortgage Rates Determined

Mortgage rates, in general, are determined by a wide range of economic factors, including the yield U.S. Treasury bonds, the economy, mortgage demand and the Federal Reserve monetary policy.

Borrowers have no control over the wider economy, but they can control their own financial picture to get the best rate available. Typically, borrowers with higher FICO scores, lower debt-to-income ratios and a larger down payment can lock in lower rates.

Related:How To Improve Your Credit Score

Mortgage Default: What It Is How To Avoid It And What To Do If Your Home Is On The Line

The real estate business has been going strong for the past few years. Despite the healthy market, there are still homeowners who struggle to make payments on their mortgage every month.

Your mortgage defaults when you cant make your monthly payments anymore. Are you teetering on the precipice of mortgage default or are you already in default? If so, we have some tips to help you.

Recommended Reading: Should I Refinance My Jumbo Mortgage

Income Tax Calculator: Estimate Your Taxes

The drop in the nations overall mortgage delinquency rate in January marked the 10th consecutive month of year-over-year declines. According to CoreLogic, this trend can be attributed to two familiar factors: escalating home prices and a strong job market. Home prices continue to reach new highs, posting 20% year-over-year growth in February. Meanwhile, the latest jobs report shows that the country added an average of 562,000 positions per month in the first quarter of 2022.

While the foreclosure rate declined compared to January 2021, the expiration of moratoriums in some states caused the number of foreclosures to rise from December 2021. Nevertheless, the January 2022 foreclosure rate was flat from December and is still the lowest recorded since at least 1999.

The large rise in home prices up 19% in January from one year earlier, according to CoreLogic indexes for the U.S. has built home equity and is an important factor in the continuing low level of foreclosures, said CoreLogics chief economist Frank Nothaft. Nonetheless, there are many homeowners that have faced financial hardships during the pandemic and are emerging from 18 months of forbearance. The U.S. may experience an uptick in distressed sales this year as some owners struggle to remain current after forbearance and loan modification.

State and metro takeaways

When Should You Lock In Your Mortgage Rate

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires.

If you dont lock in right away, a mortgage lender might give you a period of timesuch as 30 daysto request a lock, or you might be able to wait until just before closing on the home.

Once you find a rate that is an ideal fit for your budget, its best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While its not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

If you dont lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs.

Also Check: What Is The Cost Of Mortgage Insurance

Assessing The Contributions Of Ability

To understand the contributions of ability-to-pay factors and negative equity to mortgage defaults, we need to go beyond evaluating the sign of the hazard ratios. The contributions of each variable will depend on both the magnitude of the hazard ratios and the distributions of the observed data. For example, a hazard ratio for a particular characteristic may be very large, but if that characteristic does not exhibit much variation, including among the set of loans that default, then it cannot be considered an economically significant driver of mortgage defaults. However, determining the share of total variation explained by each variable is difficult in multiplicative models such as Cox models.

Notes:Dots represent the relative hazard ratio of the 99th percentile observation to the 1st percentile bars represent the interquartile range hazard ratios that are less than 1 are inverted Estimate from model excluding the SEIFA variable

Notes:Dots represent the relative hazard ratio of the 99th percentile observation to the 1st percentile bars represent the interquartile range hazard ratios that are less than 1 are inverted Estimate from model excluding the SEIFA variable

Overall, these results are also consistent with the double-trigger hypothesis ability-to-pay factors appear to be the most important determinants of entries to arrears and negative equity of transitions to foreclosure.

Most Expensive States For Home Buyers

![[Chart] Mortgage default rate versus rising home prices [Chart] Mortgage default rate versus rising home prices](https://www.mortgageinfoguide.com/wp-content/uploads/chart-mortgage-default-rate-versus-rising-home-prices-housingwire.png)

The recent economic crisis may have dealt the US housing market a devastating blow, but it is slowly returning to form. Spurred on by a strengthening economy and record low interest rates, real estate markets across the country are returning to their pre-recession levels. But as consumers return to the market, housing costs have begun to rise, particularly in some of the most desirable regions of the nation. For a greater perspective on the rising cost of home-ownership, let’s take a quick look at the 5 most expensive states for home buyers in the U.S.

Recommended Reading: How Much Of My Mortgage Payment Is Interest

How Your Credit Score Affects Your Mortgage Rate

You dont need a high credit score to qualify for a home purchase or refinance, but your .

This is because credit history determines risk level.

Historically speaking, borrowers with higher credit scores are less likely to default on their mortgages, so they qualify for lower rates.

For the best rate, aim for a credit score of 720 or higher.

Mortgage programs that dont require a high score include:

- Conventional home loans minimum 620 credit score

- FHA loans minimum 500 credit score or 580

- VA loans no minimum credit score, but 620 is common

- USDA loans minimum 640 credit score

Ideally, you want to check your credit report and score at least 6 months before applying for a mortgage. This gives you time to sort out any errors and make sure your score is as high as possible.

If youre ready to apply now, its still worth checking so you have a good idea of what loan programs you might qualify for and how your score will affect your rate.

You can get your credit report from AnnualCreditReport.com and your score from MyFico.com.

How Can I Get A Default Removed From My Credit Report

Unless there is an error with your default, you will not be able to get it removed from your credit report. In fact, it will take six years for a default to no longer appear on your credit report.

If you believe that a default is erroneous, you can ask a credit agency to change or remove it. After you submit your request, the credit agency will contact your lender for more information and confirm the accuracy of your request. At the end of the day, you cannot edit or remove the default without confirmation and permission from your lender.

You May Like: How Late Can You Be On Your Mortgage

Modelling And Forecasting Mortgage Delinquency And Foreclosure In The Uk

Mortgage delinquencies and foreclosures have serious implications, not just for the households affected, but for the financial stability of the economy. The solvency of the mortgage lenders is affected, and their ability to extend credit. This column identifies three key drivers of delinquency and foreclosure rates in the UK the debt service ratio, the proportion of homes in negative equity, and the unemployment rate and compares the rates with those in the US. It also discusses the data constraints that have hindered previous analyses.

Average Mortgage Debt Per Family

From 2010 to 2013 the number of families with home-secured debt fell from 47.0% to 42.9%. These numbers reflect both a decline in home-ownership, and a reticence on the part of consumers to take out extended home equity loans. That being said, home-secured debt remains the most common type of debt held by families in the US.

Again, according to the latest census numbers, the conditional median value of home-secured debt for families in the United States fell by 2% from $117,500 in 2010 to $115,000 in 2013. The conditional mean value of home-secured debt during the same period fell from $165,400 to $156,700, showing a 5% drop in the average home-secured debt being held by families in the US. These declines clearly show a loss of consumer confidence following the financial crisis of 2008. Still, forecasts are positive, and all economic predictors point to an uptick in mortgages and other home-secured loan products.

Don’t Miss: What Are The Best Mortgage Lenders

Mortgage Rates By Region

Of course, mortgage rates are also influenced by region, and where you buy a home will have a big impact on the available interest rates. Currently, rates are lowest on the upper East coast, with New York and New Jersey leading the country in most affordable mortgage rates. Arizona, New Mexico, and Florida continue to have the highest rates in the country, following the historical trends. To see where your state ranks among the national averages, check out this handy interactive map. It’s updated regularly so you can track the rise and fall of mortgage rates in your region of the country.