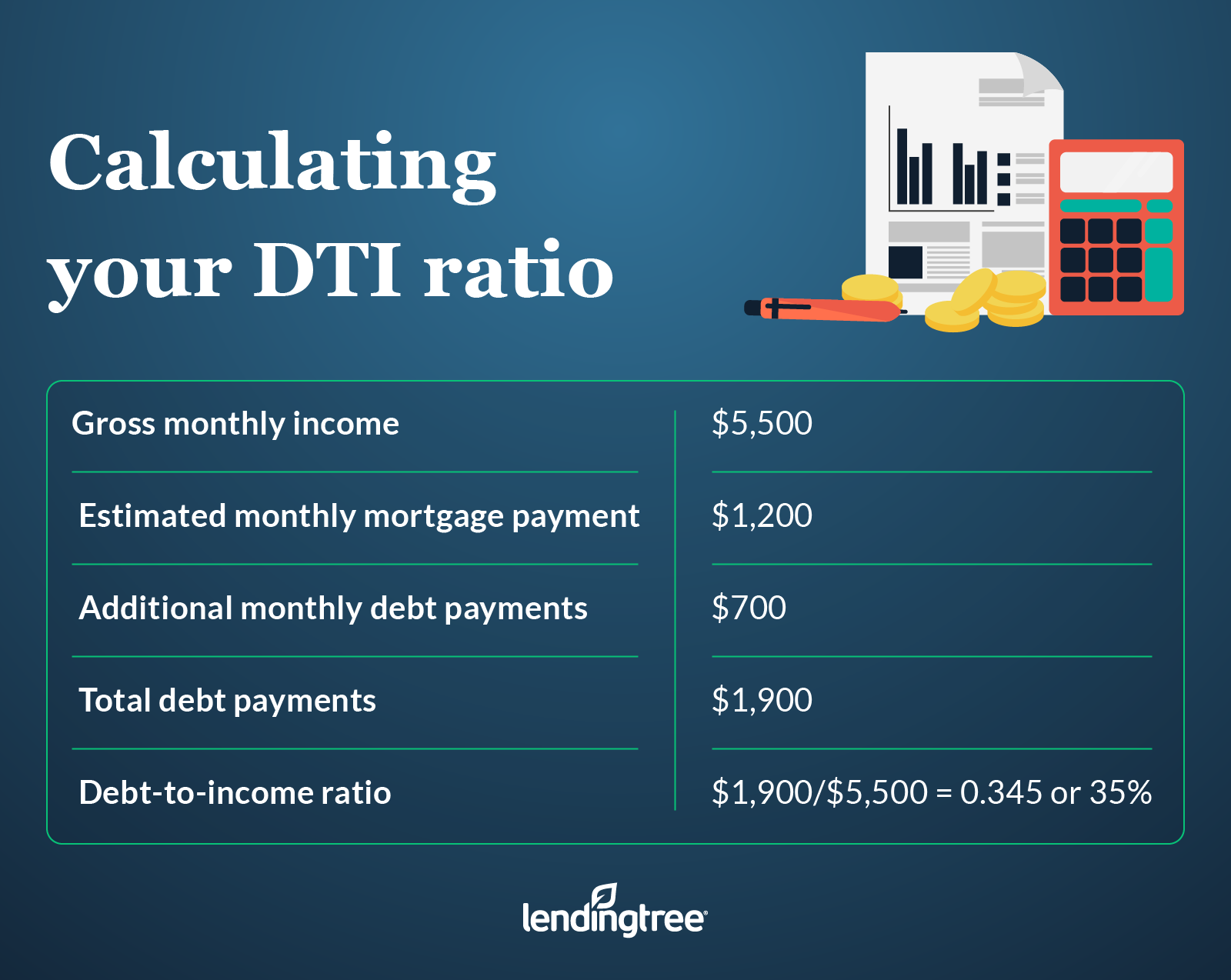

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month.Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, to the calculation.Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

How To Use Our Debt

Your DTI ratio is an important part of the how much house can I afford decision. Knowing your DTI provides a good indication of what to expect from the mortgage preapproval process.

For example:

-

If your housing-related monthly debts are below 28%, you may qualify for a larger loan amount than originally expected

-

If your total debts are above 36%, it may explain why you werent approved despite good credit

-

If your DTI is 50% or above, you may have to pay down a substantial portion of your debts before you can purchase a home

The Bottom Line On Dti Ratios

Your debt-to-income ratio is an important part of the mortgage qualification process. If your debts are too high to justify the loan, you could be disqualified even if you have stellar credit and a steady paycheck. DTI ratio requirements vary from lender to lender, but its rare to find a lender who will accept a back-end DTI ratio above 45%.

Keep in mind that just because a DTI ratio calculation says you can afford a certain home price doesnt mean that you need to spend that much. Many people arent comfortable spending 45% of their income on debt payments — when you add in things like taxes, groceries, and other things that aren’t considered in the DTI calculation, such a high debt load could be overwhelming. So, in addition to determining if a home meets your lenders DTI standards, its still important to make sure your new housing payment will fit your budget.

Read Also: Recasting Mortgage Chase

Purchase A Cheaper Home

If you have low interest student loans which will take many years to extinguish it may make sense to start your housing journey with a cheaper home that is a bit smaller or a bit further from work in order to get started on the housing ladder.

Some people view renting as throwing money away, but even if you put 20% down on a home you are 5X leveraged into a single illiquid investment. Getting laid off during a recession can lead to forclosure.

Over the long run other financial assets typically dramatically outperform real estate. Buying a home for most people is more about investing in emotional stability instead of seeking financial returns.

Real Estate Price Appreciation

Real estate can see sharp moves in short periods of time, though generally tends to keep up with broader rates of inflation across the economy over long periods of time. In 2006 near the peak of the American housing bubble the New York Times published an article titled This Very, Very Old House about a house on the outskirts of Amsterdam which was built in 1625. They traced changes in property values in the subsequent nearly 400 years to determine it roughly tracked inflation.

Longterm Stock Market Returns

Convert Your Answer To A Percentage

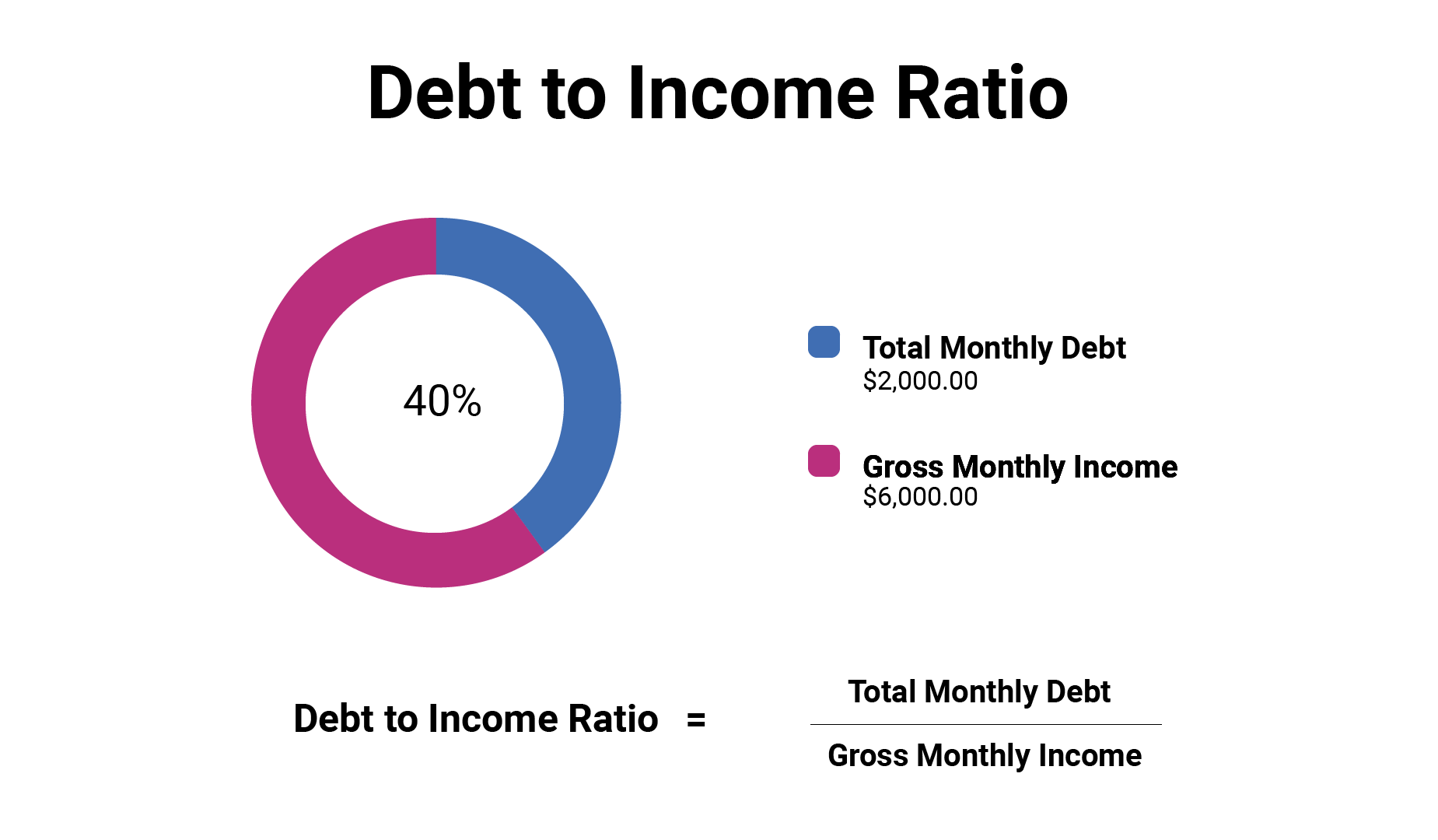

The final result is your debt-to-income ratio.

Lets work through an example. Assume you pay rent at a monthly rate of $1,000, a car payment of $400 and a minimum credit card payment of $150. Lets also assume that you have a gross monthly income of $5,000. Your debt-to-income ratio is $1,550 divided by $5,000, which equals .31 . Lenders consider those with a lower DTI to present a lower credit risk. Not only will you more likely be preapproved, youll also likely qualify for a lower interest rate. The lower your DTI, the less credit risk you are to lenders.

Donât Miss: Fha Loan Limits Texas

Don’t Miss: 10 Year Treasury Yield Mortgage Rates

How Lenders View Your Dti Ratio

Lenders look at debt-to-income ratios because research shows borrowers with high DTIs have more trouble making their payments.

Each lender sets its own debt-to-income ratio requirement. Not all creditors, such as personal loan providers, publish a minimum debt-to-income ratio, but generally it will be more lenient than for, say, a mortgage.

Note that a debt-to-income ratio of 43% is generally the highest mortgage lenders will accept for a qualified mortgage, which is a loan that includes affordability checks.

You may find personal loan companies willing to lend money to consumers with debt-to-income ratios of 50% or more, and some exclude mortgage debt from the DTI calculation. Thats because one of the most common uses of personal loans is to consolidate credit card debt.

The required debt-to-income ratio for student loan refinancing varies by lender but generally, lenders look for DTIs of 50% or lower.

» MORE: Learn how to pay off debt in three steps

What Should You Do To Improve The Dti Ratio

- You can increase your EMIs toward a personal loan that you have availed. Though this will temporarily increase your DTI ratio , it will, in the long run, bring down your total debt considerably. This, in turn, will reflect well on your DTI ratio.

- Do not acquire more debt.

- Postpone a few large purchases if you can. This will give you more time to save and help you make a larger lump sum payment in time.

- Dont forget to keep track of the debt-to-income ratio every month. This will make it easier for you to notice deviations if any, and take corrective measures.

Availing of the financial assistance you need is easier with pre-approved offers on personal loans from Bajaj Finserv. All you need to do is share a few details and get your pre-approved offer.

*Terms and conditions apply

Recommended Reading: Mortgage Recast Calculator Chase

Whats A Good Debttoincome Ratio

As a rule of thumb, a good debttoincome ratio is 40% or less when youre applying for a mortgage. That means your combined debts and housing costs dont exceed 40% of your pretax income each month. That said, a lower debttoincome ratio is always better. The lower your debttoincome ratio is, the better mortgage rate youll get and the more youll be able to afford when buying a home.

Does Your Dti Affect Your Credit Score

Your debt-to-income ratio does not affect your credit scores credit-reporting agencies may know your income but do not include it in their calculations.

But your credit-utilization ratio, or the amount of credit youre using compared with your credit limits, does affect your credit scores. Credit reporting agencies know your available credit limits, both on individual cards and in total, and most experts advise keeping the balances on your cards no higher than 30% of your credit limit. Lower is better.

To reduce your debt-to-income ratio, you need to either make more money or reduce the monthly payments you owe.

Recommended Reading: Can You Get A Reverse Mortgage On A Condo

Weigh Your Monthly Debt Payments Against Your Income To See If Youre Overextended

A debt-to-income ratio is a key factor that lenders use to determine if youll be approved for a loan. During the underwriting process after you apply for a loan, the underwriter will check your debt-to-income ratio to see if you can afford the loan payments. If your DTI is too high, you wont get approved for the loan.

For consumers, debt-to-income is an easy way to measure the overall health of your finances. You can check your DTI to see if you have too much debt for your income. If your debt ratio is too high, then you know to scale back and focus on debt repayment. If you need help, call to speak with a trained credit counsellor for a free debt and budget evaluation.

Loans Which Dont Use Dti For Approval

Mortgage lenders use DebttoIncome to determine whether homes are affordable for a U.S. home buyer. They verify income and debts as part of the process. However, there are several highprofile mortgage programs which ignore the DTI calculation.

Among these programs is the popular suite of streamline refinances available via the FHA, the VA and Fannie Mae and Freddie Mac.

You May Like: Can You Do A Reverse Mortgage On A Condo

Typical Monthly Costs Included In The Debt

- mortgage loans and home equity loans on other properties you own

- housing costs on subject property including homeowners insurance, mortgage insurance, property tax, HOA dues

All the above count against your income, so if you can eliminate or reduce these debts, your income go will further in terms of what youre able to afford.

When it comes to plastic, the minimum credit card payment listed on your credit report will be considered. All the more reason to apply for a mortgage when all your credit cards are paid off, with no new charges, if practical.

Some banks and lenders allow installment credit cards such as those issued by American Express to be excluded from the debt-to-income ratio as they often account for thousands of dollars a month, and likely get paid off in full monthly.

Calculating A 25% Dti

- Monthly Social Security Income : $6,000

- Monthly recurring debts: $500

- Monthly W2 income: $10,000

- Monthly recurring debts: $1,500

- Monthly selfemployment income: $10,000

- Monthly recurring debts: $2,000

- Monthly housing payment: $2,500

Most mortgage programs require homeowners to have a DebttoIncome of 40% or less, but loan approvals are possible with DTIs of 45 percent or higher. In general, mortgage applicants with elevated DTI must show strength on some other aspect of their application.

This can include making a large down payment showing an exceptionallyhigh credit score or having large amounts of reserves in the bank accounts and investments.

Also, note that once a loan is approved and funded, lenders not longer track DebttoIncome ratio. Its a metric used strictly for loan approval purposes. However, as a homeowner, you should be mindful of your income versus your debts. When debts increase relative to income, longterm saving can be affected.

Also Check: 10 Year Treasury Vs 30 Year Mortgage

When You Apply For A Loan Like A Mortgage Auto Loan Or Personal Loan Lenders Often Want To Know How Much Debt You Have Compared To How Much Money You Earn In Other Words They Want To Know Your Debt

Your debt-to-income ratio, or DTI, is a calculation of your monthly debt payments divided by your gross monthly income.

Lets take a look at how to calculate your debt-to-income ratio, learn why your DTI matters, understand what a good debt-to-income ratio looks like and how to lower your DTI ratio.

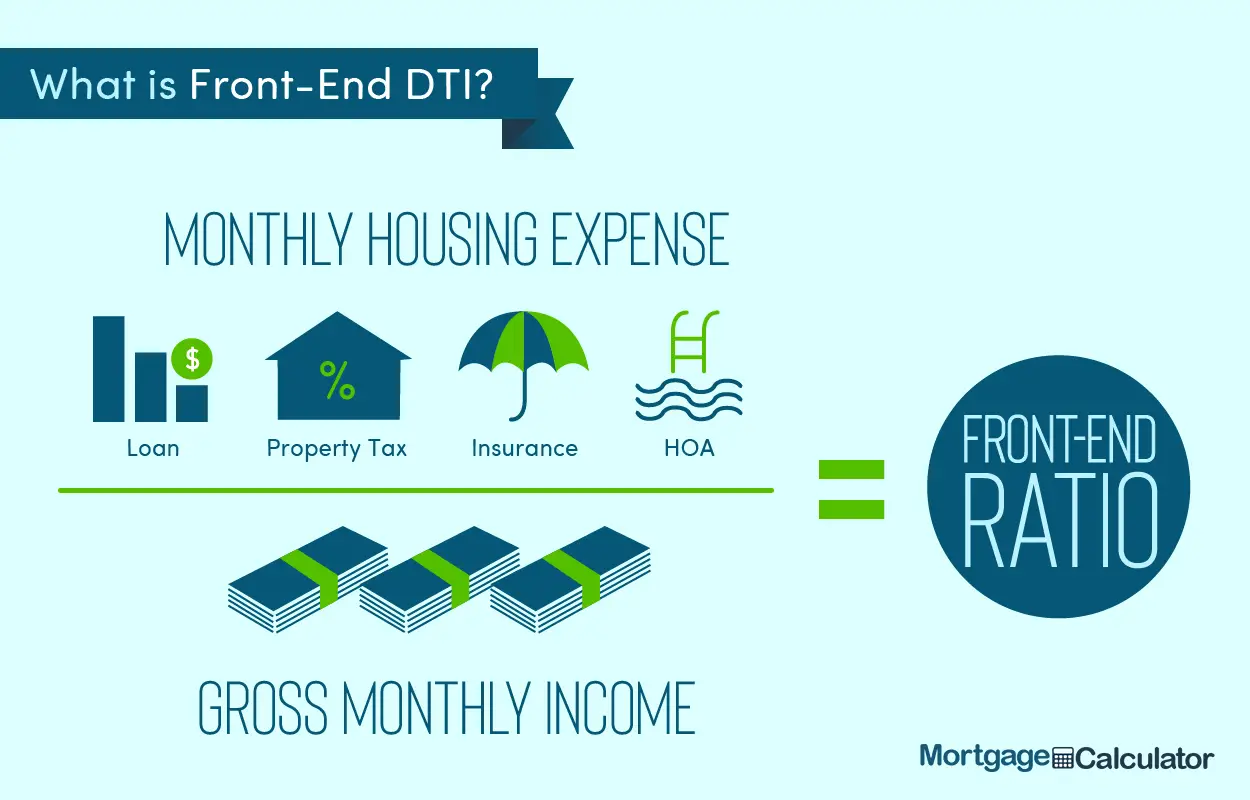

Front End And Back End Ratios

Lenders often divide the information that comprises a debt-to-income ratio into separate categories called front-end ratio and back-end ratio, before making a final decision on whether to extend a mortgage loan.

The front-end ratio only considers debt directly related to a mortgage payment. It is calculated by adding the mortgage payment, homeowners insurance, real estate taxes and homeowners association fees and dividing that by the monthly income.

For example: If monthly mortgage payment, insurance, taxes and fees equals $2,000 and monthly income equals $6,000, the front-end ratio would be 30% .

Lenders would like to see the front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association loans. The higher the percentage, the more risk the lender is taking, and the more likely a higher-interest rate would be applied, if the loan were granted.

Back-end ratios are the same thing as debt-to-income ratio, meaning they include all debt related to mortgage payment, plus ongoing monthly debts such as credit cards, auto loans, student loans, child support payments, etc.

Don’t Miss: How Does The 10 Year Treasury Affect Mortgage Rates

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

What Is Front End Ratio Calculator

3.9/5Front End RatioCalculatorcalculate

Similarly, you may ask, how do you calculate the front end ratio?

To calculate the front–end ratio, add up your expected housing expenses and divide it by how much you earn each month before taxes . Multiply the result by 100 and that is your front–end DTI ratio.

Additionally, how do you calculate your debt to income ratio? To calculate your debt-to-income ratio:

Thereof, what is front end debt to income ratio?

The front–end debt-to-income ratio is a variation of the debt-to-income ratio that calculates how much of a person’s gross income is going toward housing costs. In contrast, a back-end DTI calculates the percentage of gross income going toward other types of debt like credit cards or car loans.

What is a good back end ratio?

Many lenders have a rule of thumb that a borrower’s back–end ratio should not exceed 36%, though a borrower with good credit puts lenders a bit more at ease in special cases.

You May Like: Rocket Mortgage Qualifications

Debt In An Fha Dti Calculation

When you apply for a loan, you’ll need to disclose all debts and open lines of credit even those with without current balances. In a lender’s mind, a zero-balance open line of credit is a risk, because you’re only one shopping spree away from being in more debt.

Make sure that your DTI calculations include all student loans, all credit card payments and auto loans. Your auto and estimated mortgage payments should include amounts for monthly auto and homeowner insurance premiums. You also will need to include any loans you’ve received from family or friends, medical payments, alimony or child support and other regular monthly amounts owed.

Let’s use the following example to calculate a back-end debt ratio:

What Can I Do As A Borrower

To prepare for your home loan application, its usually best you cut out or at least reduce unused debt facilities.

For example, if you have a $2,000 limit on your credit card but find that you rarely use this amount per month, consider cancelling it.

Another example is expenses that arent vital and can be easily cut from your spending such as entertainment subscriptions, going to the pub, gym memberships, going to music festivals or sporting events, or simply eating take-away on a regular basis.

Please call us on 1300 889 743 or fill in our and we can weigh up your home loan options.

There are lenders out there that dont apply debt to income ratios caps.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

How To Choose A Mortgage Lender

There is no shortage of lending options these days. But with so many choices, shopping for the right lender can feel overwhelming. After all, the best mortgage loan depends on more than a low interest rate. The first step to choosing a mortgage lender is research. Comparing your options should help you find the service best suited to you. Here are some options worth considering during your search for the perfect home loan.

For help with homebuying and other financial questions, consider working with a financial advisor.

The Va Interest Rate Reduction Refinance Loan

The is another refinance program which waives traditional home loan DebttoIncome requirements. Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W2s and pay stubs.

The VA Streamline Refinance is available to military borrowers who can show that theres a benefit to the refinance either in the form of a lower monthly payment or a change from an ARM to a fixedrate loan.

Recommended Reading: Reverse Mortgage Mobile Home

What Your Debt To Income Ratio Means

Your final result will fall into one of these categories.

- 36% or less is the healthiest debt load for the majority of people. If your debt-to-income ratio falls within this range, avoid incurring more debt to maintain a good ratio. You may have trouble getting approved for a mortgage with a ratio above this amount.

- 37% to 42% isn’t a bad ratio to have, but it could be better. If your ratio falls in this range, you should start reducing your debts.

- 43% to 49% is a ratio that indicates likely financial trouble. You should start aggressively paying your debts to prevent an overloaded debt situation.

- 50% or more is an extremely dangerous ratio. This means that more than half of your income goes toward debt payments each month. You should be aggressively paying off your debts. Don’t hesitate to seek professional help.

Dti Ratio And Credit Scores

Your DTI never directly affects your or . may know your income but they dont include it in their calculations. Your is still factored into your home loan application. However, borrowers with a high DTI ratio may have a high credit utilization ratio which accounts for 30 percent of your credit score. Lowering your credit utilization ratio will help boost your credit score and lower your DTI ratio because you are paying down more debt.

Don’t Miss: Bofa Home Loan Navigator