Provide The Creditor An Action Plan

Telling the creditor exactly what you want from them makes it easier to help you. Youve already done the hard work of coming up with a solution now all they have to do is say yes.

Be specific with your direction and tell the creditor exactly what you want them to do. This could mean a simple Contact me at your earliest convenience to further discuss your options or asking them, Please place my monthly payments on hold for the next 3 months.

Whatever action you ask them to take, you need to make it clear to them that this action is necessary for you to save the loan.

Loan Modification Request Tips

The key to successfully requesting a loan modification starts with clearly explaining the reason that you fell behind on your mortgage payments. It’s also essential that you express a sincere desire to correct the situation and explicitly request consideration for a modification. Make it clear that you want to go forward and that you are willing to do all in your power to ‘make things right.’ While there is no guarantee that your request will be granted, lenders are often willing to work with borrowers who are proactive in seeking modifications rather than allowing outstanding loans to fall further behind and move toward foreclosure. You may find that the banker is willing to work with you to keep your home.

Save

Explain The Situation The Right Way

We know that, especially when youre writing about a topic as sensitive as your financial situation, it can be tough to strike the right balance between emotional and professional.

You want the mortgage lender to take pity on you and feel for your circumstances. But you dont want to come off as too angry, entitled, or even unstable.

The best way to explain your situation is as briefly as possible and as bluntly as possible.

Although you might enjoy calling your friends and complaining about how your husband cheated on you with your nanny and your neighbor and your kids teacher?

The bank really doesnt care and really doesnt need to know that information.

Instead, try something like:

My husband, the sole income provider for the family, and I are going through a divorce. I do not have the financial stability to pay for a divorce lawyer, take care of my daily expenses, and pay for rent on a new apartment while also making my mortgage payments on our shared home.

I am actively looking for and applying to jobs, but at this time, have not yet been able to find employment.

This tells the bank what they need to know, nothing more and nothing less.

Read Also: Do I Need To Get Prequalified For A Mortgage

How To Describe Your Hardship

The first paragraph should focus on introducing yourself and your particular situation. This will be the section that explains exactly what your hardship is and establish your desire to work with the lender to continue paying off your debts.

Heres an example for a medical hardship letter:

Im writing to you because I was unable to work for several months due to an injury. During this time, our emergency savings were exhausted and we fell behind on our debts. Now that I am healed from my injury and ready to return to work, I believe I could resume regular payments if you would make adjustments to our loan.

This paragraph works because it is brief. With only four lines, it doesnt drag on but clearly explains the situation without too many unnecessary details. It also mentions that the borrower would be ready to resume payments if given a modification.

Of course, not every situation will be resolved. For example, you might not have an injury that has fully healed. If your hardship was permanent, youll have to explain that your situation has changed, but still intend to resume making payments with the creditors help.

Heres an example for a divorce hardship letter:

Again, the focus is on explaining quickly what happened and why the borrower has fallen behind on your payments. It also mentioned that they believe they can resume making payments if the creditor agrees to work with them.

Hardship Request Due To Serious Illness

A serious illness – whether your own or that of a family member – can definitely cause financial hardship. If your mortgage is past due as the result of dealing with a serious illness, the letter below can provide a good starting point for you to create your own hardship request.

The government website Making Home Affordable.gov provides homeowners with detailed information about the Obama Administration programs to assist homeowners with loan modifications and refinancing. Make use of free self-assessment tools and calculators. Connect with free counseling resources or locate homeowner events in your community.

There is a wealth of information available to assist homeowners in danger of foreclosure. The Making Home Affordable program was started specifically to help people who are facing foreclosure and to revitalize the housing industry. It is there for your benefit.

Also Check: How Much Would A 100k Mortgage Cost Monthly

What Is Considered Extreme Financial Hardship

Serious or extreme financial hardship occurs when the individual or family member experiences a sudden and unexpected illness or accident or other extraordinary and unforeseeable circumstances caused by events beyond the control of the consumer. Each state defines in law what an extreme financial hardship may be, and consumers should consult with a financial consultant if they feel they are experiencing extreme financial hardship, which they may qualify for.

What To Include In A Hardship Letter

Many people make the mistake of spending very little time thinking about and drafting their hardship letter or, even worse, they simply copy a sample letter off the Internet. Because the loss mitigation representative who will review your file has most likely read literally hundreds of these letters, it’s imperative that your letter be genuine. The best hardship letters don’t use a template or use templates only as a starting point but also include personal, honest information. You don’t need to write a lengthy sob story, but you should be forthright about your situation. A brief hardship letter works best. The letter definitely shouldn’t to exceed one page. Just state the facts that are relevant to making your case.

Also Check: How Are Mortgage Approvals Calculated

Other Possible Reasons For Hardship Requests

There are many reasons other than unemployment, divorce and serious illness that may lead to a homeowner needing to request a loan modification. You can still use one of the sample letters provided in this article as a guide for writing a letter to your lender. Simply download the letter that most closely matches your situation and edit the text to accurately describe your circumstances.

A few of the many reasons that can be used to request a loan modification include:

- Adjustable rate mortgage reset

- Damage to property

- Death of spouse or co-borrower

- Failed business

- Reduced income

When Applying For A Short Sale Or Other Foreclosure Avoidance Option Your Lender Might Ask You To Write A Hardship Letter Or Fill Out A Hardship Affidavit

In a “short sale,” homeowners sell their property for less than the total balance remaining on their mortgage loan. The lender agrees to accept the sale proceeds and release the mortgage lien from the home. The proceeds from the sale pay off a portion of the loan balance. Short sales are one way for borrowers to avoid foreclosure.

When applying for a short sale or another loss mitigation option, like a loan modification, your lender might ask you to write a hardship letter or fill out a hardship affidavit.

While this article specifically addresses short sales, the process of creating a hardship letter is the same, no matter what form of loss mitigation you’re pursuing.

You May Like: How To Pay Off Mortgage In 5 Years

What Is The Goal Of The Hardship Letter

Now that youve stated your hardship and discussed what you have done so far, you need to state more explicitly what you want from your creditor. This is the paragraph where you can directly ask what you expect the lender to do.

For example:

I believe a reduced interest rate would allow me to afford to make my payments going forward. Id like to discuss this with you as soon as possible so we can work together to find a solution.

Short and to the point, this message tells the lender exactly what you expect, and what they should consider. By providing a solution that will solve both you and the lenders problem, you can prove that you are willing to do the work you are proposing.

Cares Act Mortgage Relief Explained

Its important to understand what the CARES Act offers in the way of mortgage relief and whos eligible.

The CARES Act permits mortgage borrowers who are experiencing a COVID-19-related financial hardship to seek forbearance of their loan for a limited time .

Forbearance means the lender agrees to suspend your mortgage payments with no threat of foreclosure on your property.

The CARES Act lets borrowers request an initial forbearance period up to 180 days. At the end of that 180 day period, they can then request to extend this period for an extra 180 days adding up to 12 months maximum.

You May Like: How Much Would Mortgage Be On A 500 000 House

If You Want To Avoid Foreclosure With A Short Sale Deed In Lieu Or Loan Modification You Might Need To Write A Hardship Letter

If you apply for a loan modification, short sale, or deed in lieu of foreclosure so that you can avoid a foreclosure, one of the requirements will usually be for you to write a hardship letter.

Read on to learn what constitutes a hardship, what should go in a hardship letter, and how to get assistance if you need help writing one.

Writing A Financial Hardship Letter: Wrapping Up

We hope that this post has helped you to learn what it takes to write a financial hardship letter.

Whether youre able to refinance your mortgage or end up going with a short sale?

We want you to know that well likely be able to come up with a fast and fair solution.

Were committed to creating a win-win or no deal situation for both ourselves and, more importantly, for you.

Spend some time on our website to learn more about where we buy houses, how you can stop foreclosure with our help, and how to get an offer on your home in just a few days.

We look forward to working with you to ensure that you get the best possible offer.

Recommended Reading: What Is The Average 15 Year Mortgage Rate

How To Write An Effective Hardship Letter

Like many Americans, you may have fallen on tough times and have either started to fall behind on mortgage payments or you are bound to shortly. You’ve heard that the government has programs that may help you stabilize and your lender could be willing to offer an alternative if you don’t perfectly qualify for federal relief. You contact the bank to see what can be done and with the paperwork they provide, they request that you construct a letter to explain your hardship. Simple, right?

Unfortunately, like most people who are worried about a potential mortgage default, your current financial instability isn’t due to a single event. Rather, the result has come through a series of misfortunes that, when pooled together, lead to a lack of income needed to stay current. Though it would be easy to write a 4 page essay on why you are requesting assistance, drowning your audience with words will be as ineffective as omitting the explanation altogether.

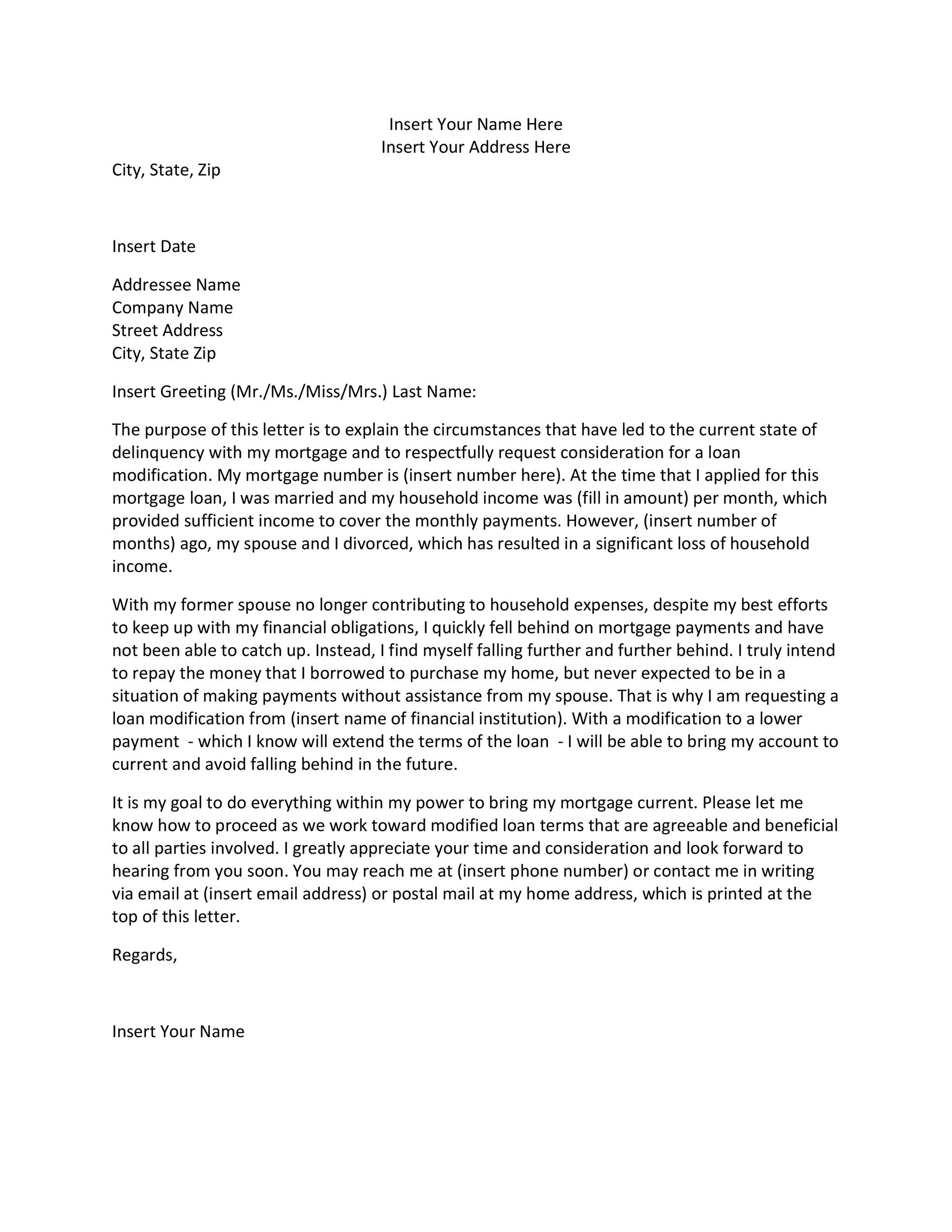

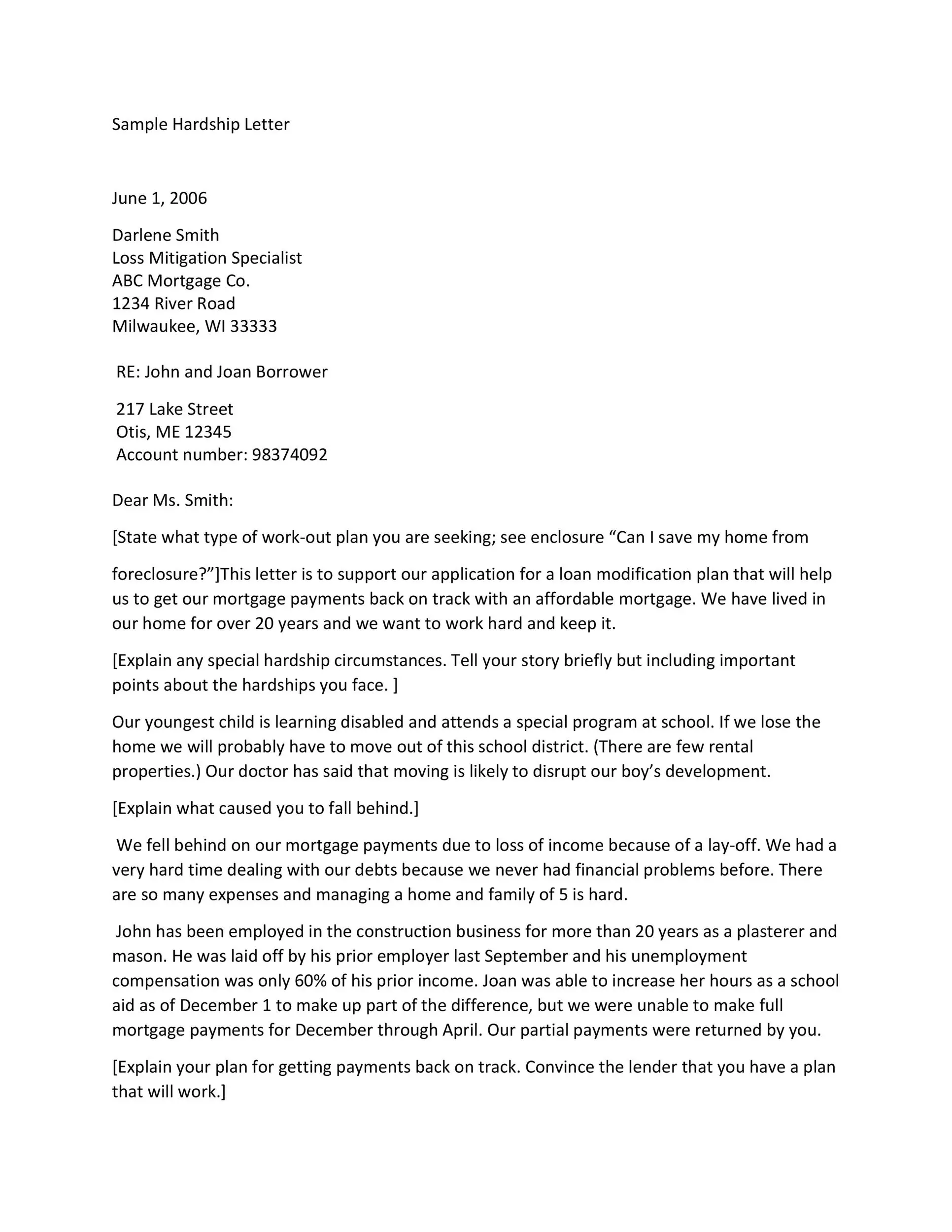

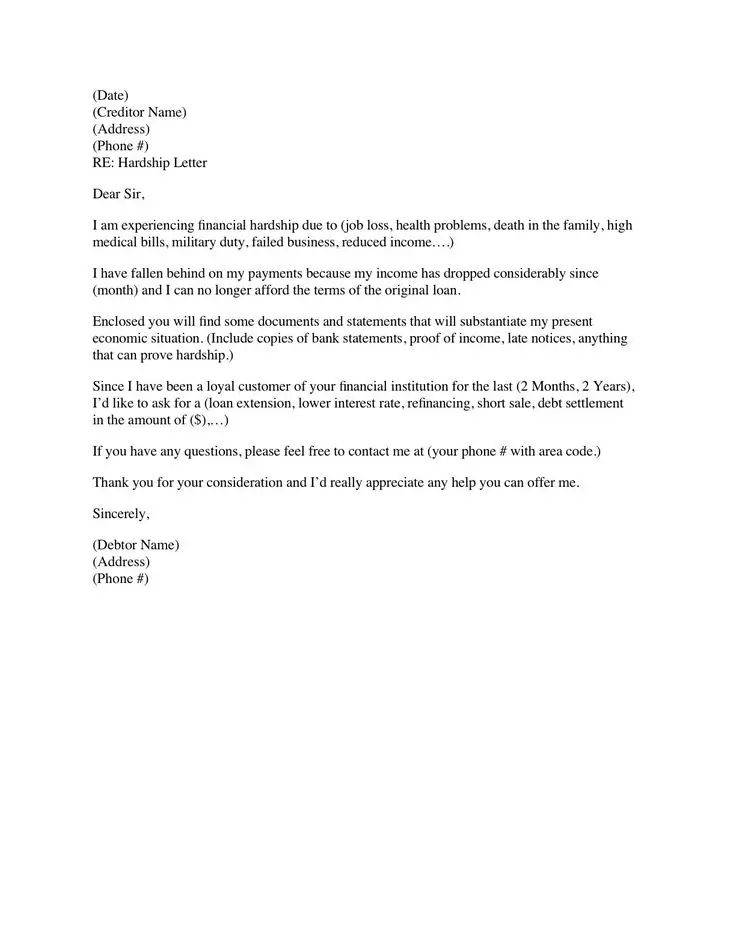

Three Hardship Letter Templates

Here are three sample hardship letters that can be used as starting points for your own lender communication documents. Select the template that most closely matches your situation, then customize it to match your specific situation. Simply click the image of the letter you want to use to access a customizable PDF document that you can edit, save and print. If you need assistance downloading the templates, check out these helpful tips.

Recommended Reading: Who Offers 20 Year Mortgages

Importance Of The Hardship Letter Or Affidavit

With a short sale, the main thing the lender will evaluate is whether the amount they’ll receive in the short sale is as much as they expect to get from selling the property following a foreclosure. If it is beneficial for the lender to do a short sale and you meet the criteria, you’ll be approved. The hardship letter or affidavit is merely part of the process.

What Constitutes Hardship

Although an underwater mortgage is one of the qualifications for a short sale, a bank is under no obligation to agree with you when you assert your home is worth less than the mortgage balance on it. In fact, lenders are likely to be opposed to mortgage holders who want to walk away from their home or modify loan terms just because the property is no longer worth the amount they paid for it.

Because fraud is punishable under law, it is important for you to assess whether you are truly in a hardship situation. Spell out in the hardship letter the exact circumstances or life changes that make it impossible to meet the payments and to maintain the home given the current mortgage rate and terms.

Here are some types of hardships that might help you get your short sale approved:

- Unemployment

- Reduced income caused by a furlough, a new job, your partner’s job loss, or a pay cut

- An illness or other medical emergency

- A job transfer

- Increased expenses and excessive debts

- A need for major repairs or maintenance on the home

Lenders are far less interested in protecting your credit score than in recouping their loanor as much of it as they can. So your hardship letter must clearly state that granting the request for a loan modification or short sale is the best way for the lender to be able to do that.

Recommended Reading: What Does A Cosigner Do For A Mortgage

Talk To A Financial Couch

A financial coach can help you explore all of your options and ask for the right kind of help. They can also review your letter before you send it to make sure youve communicated effectively and havent made any serious errors.

The writing process and content of a hardship letter can be personal, but our trained, professional coaches are committed to protecting your personal information.

Reasons A Financial Hardship Letter Is Required

In order to help them determine whether your situation can be resolved with loan modification, a financial hardship letter provides lenders an understanding of the financial difficulties you currently face. Youll need to write a hardship letter even if youve spoken to a customer care representative of the lender and have explained to them your circumstances. The reason for this is simple: it is highly likely that the customer care representative you spoke to didnt write down what you said or only wrote bits of what you narrated to him/her. As a result of this, your lender doesnt have any formal record of your financial problems. Fortunately, by writing down your problems in a hardship letter, you can provide your lender a formal record of your financial situation. Once your lender has a hardship letter from you that clearly describes your financial situation, there will be no need for the lender to second guess about your problem which in turn will make it easy for the lender to decide whether to approve you for a workout plan.

It is important for you to keep in mind that not all financial setbacks make you eligible for loan modification or a workout plan. In your hardship letter, you need to prove that you face genuine hardships that have affected your ability to pay. Following are some of the hardship that lenders generally consider:

Don’t Miss: Can You Get A Mortgage With Fair Credit Score

Visit Our Loans Center

- Mandatory reduced hours or hourly wage

- Underemployment after loss of previous job

- Death of a borrower

- Permanent or short term disability

- Serious illness of a household member

- Increase in child care expenses

- Mortgage loan and payment changes

Pros And Cons: For Sale By Owner

If youve ever considered selling your home without a listing agent, here are a few pros and cons of a for-sale-by-owner you should think about before making your final decision. While an agent can certainly be helpful, its not impossible to sell your home independently. Some homeowners find that selling without a realtor better suits their needs.

Content on this site is not intended to create, and does not constitute, an attorney-client relationship between the user or any other person. The information provided should not be used as a substitute for competent legal advice from a lawyer whom user has retained. No content provided any User is intended to provide, and in no event shall it be treated as providing, legal advice.

Company

You May Like: Do You Have To Pay Taxes On A Reverse Mortgage