If One Type Of Mortgage Isnt Right For You You Have Many Others To Choose From

Lindsay VanSomeren is a credit card, banking, and credit expert whose articles provide readers with in-depth research and actionable takeaways that can help consumers make sound decisions about financial products. Her work has appeared on prominent financial sites such as Forbes Advisor and Northwestern Mutual.

If youre like most people, youll need to take out a mortgage to buy a home. According to the U.S. Census Bureau, 96% of people who bought a home in 2020 purchased it with a mortgage.

But when you start shopping around for a mortgage, its easy to get overwhelmed. There are lots of different types of mortgages, each of which is better for some people than others. Heres how to tell which type of mortgage might be best for you.

You May Like: Can You Do A Reverse Mortgage On A Condo

The Six Main Types Of Mortgages

Not all mortgage products are created equal. Some have more stringent guidelines than others. Some lenders might require a 20% down payment, while others require as little as 3% of the homes purchase price. To qualify for some types of loans, you need pristine credit. Others are geared toward borrowers with less-than-stellar credit.

The U.S. government isnt a lender, but it does guarantee certain types of loans that meet stringent eligibility requirements for income, loan limits, and geographic areas. Heres a rundown of various possible mortgage loans.

Fannie Mae and Freddie Mac are two government-sponsored enterprises that buy and sell most of the conventional mortgages in the U.S.

What Information Should You Take To The Lender

Your lender will need to know how much money you have coming in and how much money you pay out in expenses each month. When you apply for a mortgage loan, take the following information with you:

- Your addresses for the past two years. If you’re renting now, bring the name and address of your landlord.

- Your employers for the last two years. Bring your pay stubs for the past few months.

- Bring a copy of your tax forms for the last two years any divorce papers to show alimony or child support you receive retirement benefit information and information on any other income you have. If you are self-employed, you will need a certified profit and loss statement.

- Bank account numbers and balances as well as information about any other savings or investments you have.

- The year, make, and value of any vehicles you own. If your vehicles are financed, information on the finance company and payment amounts.

- Information about all your debts or bills, account numbers and how much you owe.

- If you have ever filed for bankruptcy, be sure to bring the bankruptcy petition or discharge.

- If you are a veteran, bring your certificate of eligibility or discharge form.

- Bring identification with your picture on it and your social security number.

Also Check: How Much Is Mortgage On A 1 Million Dollar House

What Is The Best Type Of Mortgage Loan For Me

There are six main types of mortgages, which one suits you better?

- LW

Finding the right property is only half the battle unless you can buy it entirely in cash. The other half is determining which mortgage is best for you.

Because you’ll be repaying your mortgage over a long period of time, it’s critical to find a loan that meets your needs and fits within your budget.

When you borrow money from a lender, you’re entering into a legally binding agreement to repay the loan over a specified period of time.

Mortgages come in a variety of shapes and sizes. While the 30-year fixed-rate mortgage is the most common, it is by no means your only option.

Your lenders will inquire about your income, credit history, and the type of home you want to purchase. They’ll then use that information to suggest loan options that are right for you.

Although the United States government is not a lender, it does guarantee certain types of loans that meet strict income, loan limit, and geographic area requirements. Here’s a rundown of the various types of mortgage loans available.

Which Of These Loan Options Is Strongly Recommended For First

Now that you know about the best types of mortgage loans for first-time homebuyers, the next step is knowing which to go with. Considering VA and USDA loans are intended for a specific type of homebuyer, the loans strongly recommended to first-time homebuyers are conventional or FHA loans.

So which one is better? In general, an FHA loan is a great option for those with a lower credit score looking to avoid the expensive upfront costs of purchasing a home. However, if you have a great credit score, a conventional loan can provide homeowners with valuable benefits in the long run.

Also Check: Can You Get A Reverse Mortgage On A Condo

Types Of Mortgage Loans Faq

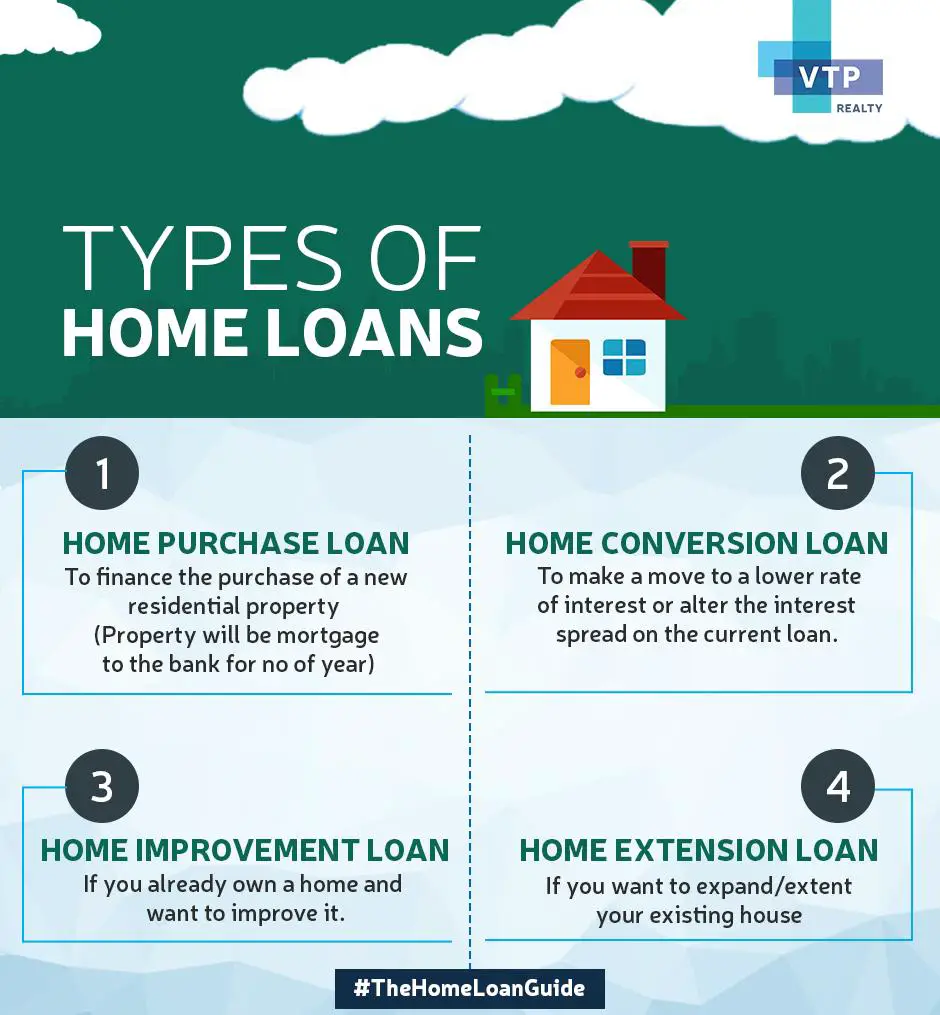

What are the 4 types of home loans?

The four main types of home loans are conventional loans, FHA loans, VA loans, and USDA loans. Conventional loans are not backed by the federal government, but most need to meet lending guidelines set by Fannie Mae and Freddie Mac. FHA, VA, and USDA loans are all backed by the federal government but offered by private lenders. Most major lenders offer all four mortgage programs, though USDA loans can be a little harder to come by.

What is the most common type of home loan?

The most common type of home loan is a conventional mortgage, which is any mortgage not backed by the federal government. This is what most people think of as a standard mortgage. Conventional loans are flexible down payments can range from 3 to 20 percent or more, and you only need a 620 credit score to qualify with most lenders. These loans make up about 80 percent of the mortgage market, according to the ICE Mortgage Technology Origination Report.

What type of home mortgage is best?

The best type of home loan depends on your situation. If you have great credit and a 20 percent down payment, conventional loans usually offer the best value. If you need extra help qualifying due to lower credit scores or income, an FHA loan might be better. And if youre a qualifying veteran or military member, a VA loan is almost always the best bet. Your loan officer can help you compare loan options and find the right loan for your needs.

Are there mortgages with no down payment?

Fixed Vs Variable Home Loan

A fixed-rate loan is one that allows you to lock-in the current interest rate at the time of settlement. This means that the lender can not make any adjustments to the interest rate, whether it be up or down. Depending on your situation and needs, you may want to fix a rate for up to 5 years, although the lifetime of the loan itself may be 25 or 30 years.

Though some people might like the security of knowing exactly how much their repayments will be, they might lose out on falling interest rates as the market changes.

Read Also: Rocket Mortgage Launchpad

Federal Housing Administration Mortgage Loans

A Federal Housing Administration mortgage is a home loan that is backed by the government and easier to qualify for compared to a conventional loan. If youre a first-time homebuyer with a lower credit score and looking to contribute a smaller down payment, then this may be the home loan for you.

FHA loans can last 15 to 30 years with a fixed interest rate, meaning you wont have to worry about a fluctuating monthly payment. These loans are also preferred by first-time homebuyers with lower incomes because they have the most flexible eligibility requirements.

If you have a credit score over 580, then you can put down a minimum of 3.5%. But if your credit score is between 500 and 579, then youll need to have a down payment of at least 10%. Similar to a conventional loan, youll need to invest in mortgage insurance if you plan to put down less than 20%.

Requirements for First-Time Homebuyers

- Minimum credit score of 500

- Debt-to-income ratio: 57% or lower

- Down payment minimum: 3.5% to 10%

- Loan size maximum: $822,375

How Can Someone Decide Between A Conventional Mortgage Vs A Government

Anthony Park, author:

It really depends on if you qualify. If you do qualify for FHA or VA mortgages, those are no-brainers. just because the terms are so favorable. If you dont qualify, you fall back by default onto conventional mortgages.

The most common government loan thats widely available to almost everyone is the FHA loan. Theres a couple of reasons why somebody would go with FHA instead of conventional one. Their credit is a little on the crummy side, lets say below 700. You can get conventional with down to a 620 score, but the mortgage insurance gets really expensive. FHA doesnt discriminate no matter how perfect or crappy your credit is, the mortgage insurance is the same.

Read Also: Chase Mortgage Recast

Other Considerations: Variable Vs Fixed Rate Loans

This is a key question youll need to consider regardless of the loan type you pick. Most of the loan options above are available either as fixed-rate or variable-rate loans.

If you choose a fixed-rate mortgage, your interest rate is set when you take out the loan and wont change when interest rates go up or down. This means your monthly payments will stay steady for the life of the loan.

With a variable-rate loan, also known as an adjustable-rate mortgage, your interest rate may go up or down depending on market conditions. Adjustable-rate mortgages typically start with a lower interest rate than a fixed-rate loan but will change after a certain number of years. If interest rates go up, so will your monthly payment.

How to choose? Fixed-rate loans are lower risk over the term of the loan and offer more certainty, even though the initial interest rate tends to be higher. Variable-rate loans can be a good option for people who know theyll be moving before the introductory period of their loan ends. Historically, about 75% of home buyers choose a fixed-rate loan, according to the Consumer Financial Protection Bureau.

How To Start Your Mortgage Search

Each home loan program has unique benefits that cater to a certain type of buyer. Your goal should be to find the one that matches your wants and your needs.

Here are a few questions you should be asking yourself as you explore the different loan types:

- Which loan has the lowest monthly payment?

- What option requires the least amount upfront?

- What option will cost me less over time?

- Which loan type is suitable for my credit score?

- How does my income affect the products for which Im eligible?

- Whats my price range for home buying?

- How long do I plan to stay in the home?

Your answers to these questions will help you evaluate the different types of mortgages below and think about which one could be best for your situation.

You May Like: Reverse Mortgage For Condominiums

Jumbo Loans: The Most Common Nonconforming Loan

A jumbo loan is a high-value loan that exceeds the GSEs conforming loan limits, which are typically lower than non-conforming loan rates. These are the most common type of nonconforming loan.

But jumbo loans commonplace in the more expensive metropolitan areas of the country increasingly have interest rates comparable to conforming loans. Limits on jumbo loans vary by lender.

Jumbo loan down payments required will vary depending on loan amount and credit score. You may need 10.01% down to qualify.

Lenders will carefully look at your finances and cash reserves before they give you a loan. Your lender may require you to have up to 12 months of mortgage payments in your savings account before you can get a loan. You’ll also need a higher credit score compared to other loan types.

Should I Go For A Fixed Rate Mortgage

A fixed rate mortgage is when the rate is fixed for a set number of years, after which it reverts to the lenders standard variable rate. More than 60% of homeowners chose a fixed rate mortgage in 2019, according to a survey conducted by Which.

Fixed rate mortgages are a popular option, because you know exactly what your monthly repayments will look like over a set period. You are shielded from any increases in interest rates by the Bank of England during your fixed rate period.

However you may pay more for a fixed rate mortgage than you would with a variable rate mortgage and you wont benefit if interest rates fall so you could be trapped in a higher rate mortgage. You also limit your ability to remortgage, as fixed rate mortgages almost always come with early redemption fees.

Also Check: Requirements For Mortgage Approval

Is A Discounted Mortgage A Good Option

A discounted mortgage is offered by lenders that want to attract you to their more expensive SVR by dropping their rates temporarily. The discount will be offered for an introductory period usually between two and five years after which youll be back on their more pricey mortgage.

If youre struggling with the initially high costs of home ownership in the first few years of buying, a discounted mortgage can help significantly but you need to consider whether this is the right option or if fixing your rates would be better. Its also possible to find a discounted tracker mortgage, which can be very competitive.

If you choose a discounted mortgage, you need to be careful about what happens when the introductory period ends. Its important to understand if and when you can remortgage, and anticipate how much your monthly repayments could increase by so that you are clear on what you can afford in the future.

Choosing The Right Loan Type

Each loan type is designed for different situations. Sometimes, only one loan type will fit your situation. If multiple options fit your situation, try out scenarios and ask lenders to provide several quotes so you can see which type offers the best deal overall.

Conventional

- VA: For veterans, servicemembers, or surviving spouses

- USDA: For low- to middle-income borrowers in rural areas

- Local: For low- to middle-income borrowers, first-time homebuyers, or public service employees

Loans are subject to basic government regulation.

Generally, your lender must document and verify your income, employment, assets, debts, and credit history to determine whether you can afford to repay the loan.

Ask lenders if the loan they are offering you meets the governments Qualified Mortgage standard.

Qualified Mortgages are those that are safest for you, the borrower.

Also Check: Mortgage Rates Based On 10 Year Treasury

Conforming Vs Nonconforming Loans

You might think your loan starts when you buy your house and ends when you pay it off, but thats not the case at all. Your mortgage has a very active life after its originated for your closing.

If its a conforming loan, it almost immediately gets purchased by Fannie Mae or Freddie Mac, the government-sponsored enterprises that keep our mortgage markets liquid. Most mortgages are conforming loans. That means the loan meets the minimum standards for purchase set by the GSEs.

Most lenders sell their mortgage loans to Fannie or Freddie shortly after closing. This frees up cash flow and allows lenders to continue issuing loans.

A loan must be at or below a certain dollar amount to conform. In most parts of the country, the conforming limit is $548,250. If you want to buy a home that’s more expensive than that, you’ll need a jumbo loan.

Best For Flexible Down Payment Options

Who’s this for? Chase Bank provides several options for homebuyers who would prefer to make a lower down payment on their home. The traditional advice has been to make a down payment that’s about 20% of the price of the home, however, Chase offers a loan option called the DreaMaker loan that would allow homebuyers to make a down payment that’s as low as 3% .

This option is made for those who can only afford a smaller down payment, but it also comes with stricter income requirements compared to their other loans , according to the Chase team). If you meet the income requirements for the DreaMaker loan, this option could be very attractive for those who would prefer to make a down payment that’s as small as possible so they can have more money reserved for other homebuying expenses.

In addition to the DreaMaker loan, Chase also offers a conventional loan, FHA loan, VA loan and jumbo loan . Much like other lenders, Chase has a minimum credit score requirement of 620 for their mortgage options.

Chase offers mortgage terms that range from 10 years to 30 years, as well as fixed rate and adjustable-rate mortgages . This lender also offers discounts for existing customers, but the requirements are rather high: For $500 off your mortgage processing fee, you need to have $150,000$499,999 between Chase deposit accounts and Chase investment accounts $500,000 or more in these accounts can get you up to $1,150 off the processing fee.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

Choose The Right Type Of Mortgage

This is where most articles dive into a bunch of mind-numbing mortgage terms. Just know that there are special types of loans for borrowers:

-

With a military connection.

-

Who would like to live in a rural or suburban area.

-

Who have a lower credit score.

-

Who are buying a house that’s a little or a lot more expensive than standard loan guidelines allow.

If you don’t exactly fit any of the descriptions above, you’re probably a good candidate for the conventional loans most lenders like best.