How To Find Recorded Mortgages

Recorded mortgages provide protection for lenders as well as property owners. The practice of publicly documenting an agreement, which is legally binding, becomes significant in the event that a deed, mortgage or lien gets lost, stolen or damaged. Some mortgages that are issued by private lenders or created via seller-financed notes are not recorded and may take additional research to find. A recorded mortgage is fairly easy to locate.

1.

Find recorded mortgages using online resources. For example, in California, you can find them on CA.gov. Some counties may not display information online however, you can initiate a request in person, in writing or by phone.

2.

Go to the county recorder’s office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder’s office. Check with the tax assessor or other municipal office where you live for more details. You may also locate information in court records that have not been updated on various websites.

References

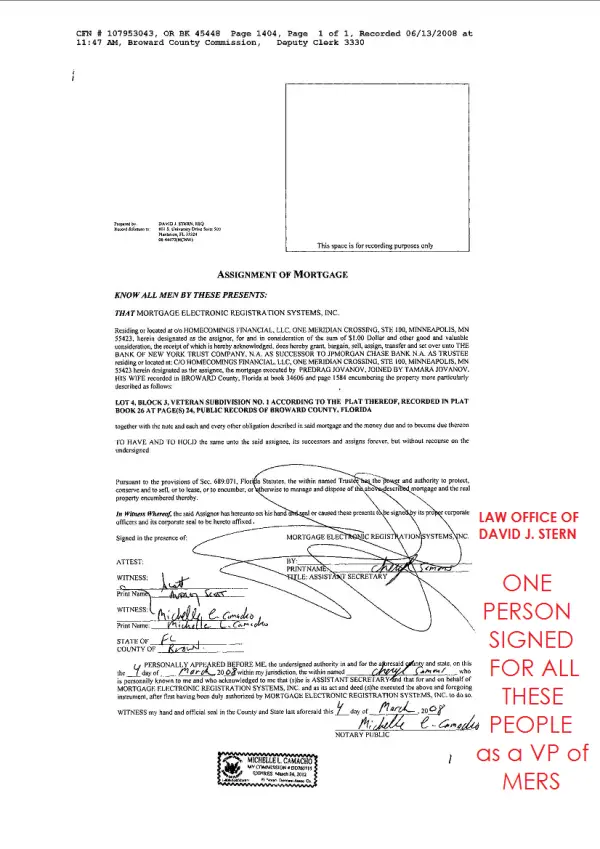

The Importance Of The Mortgage Electronic Registration System

While MERS doesnt have much impact to borrowers and homeowners, it is important for lenders. If a loan is tracked by MERS, lenders wont have to submit new paperwork every time a loan is sold. If a loan is sold often during its lifetime, which does happen, this can save lenders a significant amount of time and paperwork.

Get approved to refinance.

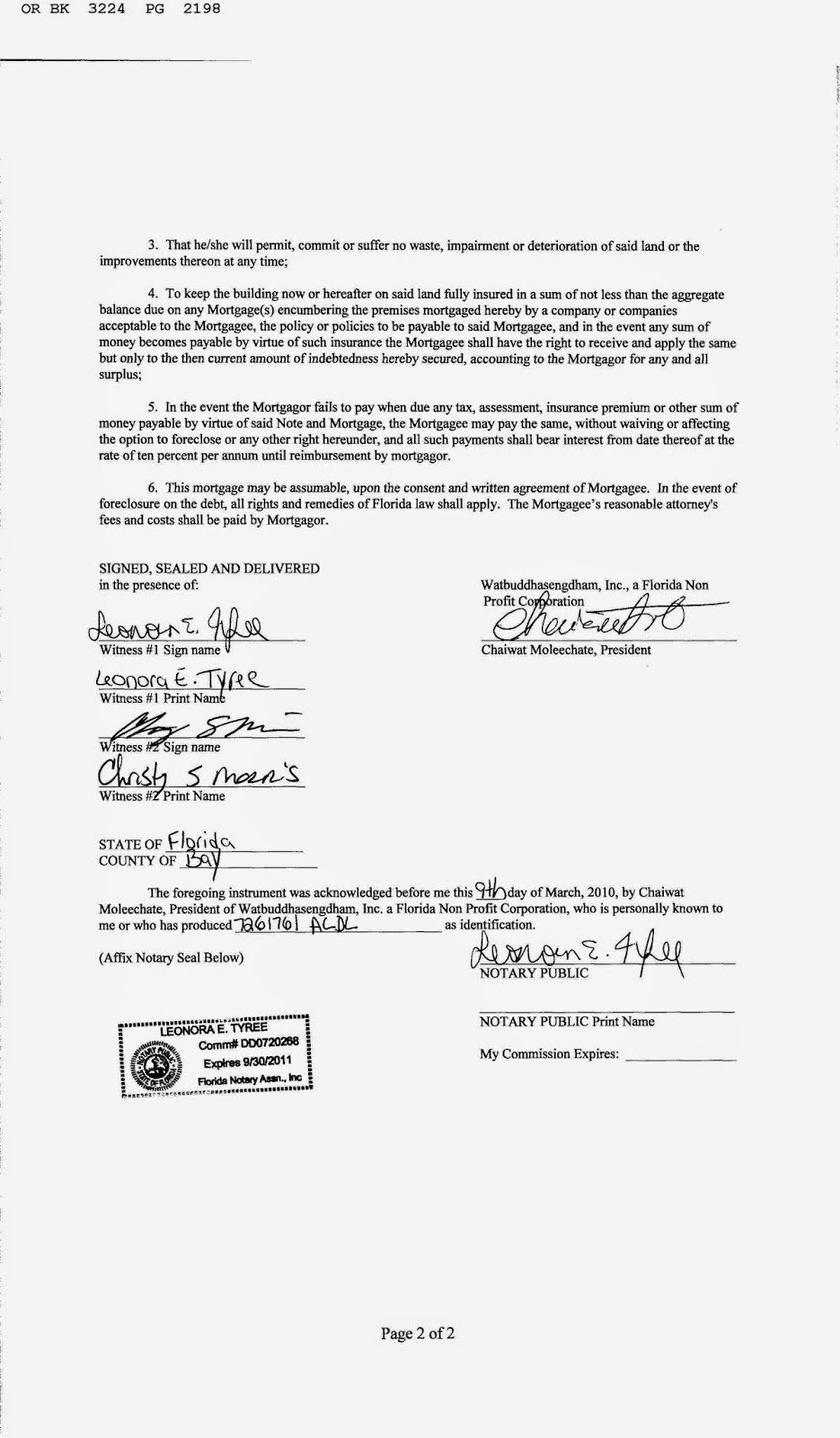

Mortgages And Deeds Of Trust: Security For The Loan

Again, the mortgage or deed of trust secures the loan. Along with standard covenants between the lender and borrower, the mortgage or deed of trust contains an acceleration clause. This clause permits the lender to demand that the loan’s entire balance be repaid if the borrower defaults, like by not making payments. Generally, the lender must provide notice to the borrower before accelerating the loan. If the borrower doesn’t cure the default, the lender may begin foreclosure proceedings. Foreclosure is the legal process where real estate that’s secured by a mortgage or deed of trust is sold to satisfy the underlying debt.

The mortgage or deed of trust will also state the:

- borrowers’ names

- property address, and

- legal description of the property.

The mortgage or deed of trust is recorded in the county land records, usually shortly after the borrowers sign it.

If the loan is fully repaid, the lender will record a release of mortgage or a reconveyance of deed in the county land records.

Some States Use Documents Other Than a Mortgage or Deed of Trust

Instead of mortgages and deeds of trust, a few states use different, similar-sounding documents for loan transactions.In Georgia, for example, the most commonly-used contract that gives a lender a security interest in a property is called a “security deed.”

Recommended Reading: Rocket Mortgage Conventional Loan

What Is A Reinscription Of A Mortgage

Louisiana civil law states that mortgages must be inscribed, or recorded, with the town clerk’s office. After a period of 10 years has elapsed, the lender must reinscribe the mortgage for another 10-year period, assuming the mortgage has a term longer than 10 years. The purpose of reinscribing a mortgage guarantees the lender priority rights to proceeds upon sale of the home.

What Is A Recording Fee

The term recording fee refers to an expense charged by a government agency for registering or recording the purchase or sale of a piece of real estate. The transaction is recorded so it becomes a matter of public record. Recording fees are generally charged by the county where the transaction takes place since it maintains records of all property purchases and sales. The amount of the recording fee varies from county to county.

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Documentation For Mortgage Release

To get the release of the mortgaged, the States have to provide their forms that borrowers get from a town, city, or county recorders offices. But to releases the mortgage lien, the lenders must have a record of the document with an authorized signature. Once the lenders recorded the document then your property will free and clear from mortgage claim.

How Does A Deed Of Trust Work

In exchange for a deed of trust, the borrower gives the lender one or more promissory notes. A promissory note is a document that states a promise to pay the debt and is signed by the borrower. It contains the terms of the loan including information such as the interest rate and other obligations.

Once a loan is completely repaid, the promissory note will be marked paid in full and the deed will be returned to the buyer. While the buyer is paying off the home, the lender will keep the promissory note, whereas the buyer only gets to keep a copy for their records.

Don’t Miss: Recasting Mortgage Chase

How Mortgage Records Are Used

Public mortgage records can tell you a lot about a home and its owner. Potentially, your clients could leverage this information to get a better price. For example, mortgage records may show if the sellers are divorcing. Using this information, your client could offer a lower price, knowing that the sellers are motivated to get rid of the property.

You also can find out how many times the home has been listed, removed, and relisted. This gives you peek into the listing and potential problems: Did the owner remove it because the market was slow or because something was wrong with the house? Was the seller just testing the market the first time? If so, it may mean the owner is motivated to sell, again giving your client an opportunity to offer a lower price.

Is A Reverse Mortgage Expensive

Home equity conversion mortgages , the most common type of reverse mortgage, bring a number of fees and costs. Some are one-time fees, and some are ongoing costs.

Before even taking on the reverse mortgage, all borrowers taking out a HECM reverse mortgage loan must undergo counseling from a U.S. Department of Housing and Urban Development -approved reverse mortgage counselor. Counseling costs will vary, depending on the agency and the borrowers specific circumstances. Other fees include origination fees, closing costs, and mortgage insurance premiums. Youll also have to pay servicing fees to the lender for costs such as sending account statements, distributing loan proceeds, and making certain that you keep up with the loan requirements.

Read Also: Mortgage Rates Based On 10 Year Treasury

How Much Does Cost Of This Process

When you buy a home, it comes with other fees attached. Some payment gives in advance. The remaining loan will pay when you switch your lender or pay off your property debt.

You have to find the hidden fees when you shop for mortgages. Sometimes these fees can add a significant amount to your home loans. In these hidden fees, one of the mortgage release fees.

Deed Of Trust Foreclosures

Nonjudicial foreclosures are typical in states that use deeds of trust. The lender can foreclose without going to court if the deed of trust contains a power of sale clause. State law lays out the procedural requirements for nonjudicial foreclosures.

Nonjudicial foreclosures tend to be much quicker than judicial foreclosures.

Don’t Miss: Does Rocket Mortgage Service Their Own Loans

Definition Of A Mortgage Deed

Related Articles

A mortgage deed is a legally binding agreement, using property as collateral for a loan. When you purchase a home, you make payments on a home loan. The mortgage deed is the paperwork you sign that allows the lender to put a lien on the property until the loan is paid. When people say they make a monthly mortgage payment, they actually mean they make a monthly loan payment while the mortgage deed secures the property for the lender.

Tip

Once the loan has been paid in full- the lien release for mortgage deed is filed at the county property records office and releases the lender’s interest in the property.

What Are The Costs Of A Reverse Mortgage

HUD adjusted insurance premiums for reverse mortgages in October 2017. Since lenders cant ask homeowners or their heirs to pay up if the loan balance grows larger than the homes value, the insurance premiums provide a pool of funds that lenders can draw on so that they dont lose money when this happens.

One change was an increase in the up-front premium, from 0.5% to 2.0%, for three out of four borrowers and a decrease in the up-front premium, from 2.5% to 2.0%, for the other one out of four borrowers. The up-front premium used to be tied to how much borrowers took out in the first year, with homeowners who took out the mostbecause they needed to pay off an existing mortgagepaying the higher rate. Now, all borrowers pay the same 2.0% rate. The up-front premium is calculated based on the homes value, so for every $100,000 in appraised value, you pay $2,000. Thats $6,000 on a $300,000 house, for example.

All borrowers must also pay annual MIPs of 0.5% of the amount borrowed. This change saves borrowers $750 a year for every $100,000 borrowed and helps offset the higher up-front premium. It also means that the borrowers debt grows more slowly, preserving more of the homeowners equity over time, providing a source of funds later in life, and increasing the possibility of being able to pass down the home to heirs.

Recommended Reading: Rocket Mortgage Launchpad

How A Reverse Mortgage Works

With a reverse mortgage, instead of the homeowner making payments to the lender, the lender makes payments to the homeowner. The homeowner gets to choose how to receive these payments and only pays interest on the proceeds received. The interest is rolled into the loan balance so that the homeowner doesnt pay anything up front. The homeowner also keeps the title to the home. Over the loans life, the homeowners debt increases and home equity decreases.

As with a forward mortgage, the home is the collateral for a reverse mortgage. When the homeowner moves or dies, the proceeds from the homes sale go to the lender to repay the reverse mortgages principal, interest, mortgage insurance, and fees. Any sale proceeds beyond what was borrowed go to the homeowner or the homeowners estate . In some cases, the heirs may choose to pay off the mortgage so that they can keep the home.

Reverse mortgage proceeds are not taxable. While they might feel like income to the homeowner, the Internal Revenue Service considers the money to be a loan advance.

Will My Documents Stay Safe

Parties using an eMortgage may worry about the safety of their documents and personal information. But documents in an eMortgage might be even more secure than they would otherwise.

Significant precautions are taken to ensure that only those who are supposed to have access to the documents actually do. The digital nature of the paperwork allows for the opportunity to create additional layers of security. Additionally, digital documents remove the possibility of someone misplacing any sensitive information.

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

What Does Mortgage Principal Mean

Mortgage principal is another term for the amount of money you borrowed. In addition to the amount you borrowed, your mortgage principal may also include fees you were charged to secure your loan. In many cases, these fees are added to your loan amount and paid off over time.

When referring to your mortgage payment, the principal amount of your mortgage payment is the portion that goes against your outstanding balance.

If you borrow $200,000 on a 30-year term to buy a house, your monthly principal and interest payments may be about $950. Part of that $950 will go toward the $200,000 you owe your lender, and the rest will go to interest. Your total monthly payment will likely be higher, as youll also have to pay taxes and insurance.

How A Deed Of Reconveyance Works

State laws generally require a mortgage lender to submit the deed of reconveyance documentation to the county recorder or borrower within a certain time frame after payoff typically 30 or 60 days, Hernandez says. In some states, the lender sends you the notice directly, and you handle dealing with the county to record it.

If they dont do this, they can face a penalty, Hernandez says.

If youre selling your home but havent paid off your mortgage yet, a deed of reconveyance still plays a role in the final stage of the closing process: The money from the buyer pays off the rest of the loan, which then triggers issuance of the deed. In this case, the title company typically handles recording it.

During the lead-up to closing, the title company will reach out to your lender and ask for a payoff statement reflecting everything owed up to the day of closing, Hernandez says. At closing, the title company will send the payoff to your lender and proof of that payment to your buyers lender.

You May Like: Reverse Mortgage For Mobile Homes

Accessing Public Mortgage Records

So how do you find all this information? First, you need to obtain information on the current homeowner. In most cases, you’ll be able to find what you need with the name you may also need the full address or other identifying information.

- Step 1: You need to know what county the property is in. Then, find out where that county keeps its records. Some counties keep mortgage records in the courthouse or clerk’s office. In some cases, the town itself handles the document. Go to the website of whichever office maintains the records.

- Step 2: On the website, there will be a form to fill out to access records. Enter all the information it requires to see the results. Some websites will allow you to view records online others might require that you physically go to the office.

- Step 3: If you have to go to the office, someone there should be able to help you find the documents you need. You should be able to view hard copies of the mortgage records. There may be a small fee to access records.

In addition, mortgage professionals can find mortgage records from around the United States without leaving home at CourthouseDirect.com.

How Does Recording Of Real Estate Records Work

Just as in any transaction, keeping an official paper trail and record of any sale or change in ownership is an important part of verifying the history of a given property or purchase. Recording the act of putting a document into official county records is an important process that provides a traceable chain of title to a property. There are more than 100 types of documents that can be recorded, depending on the type of property and type of real estate transaction. The most common documents are related to mortgages, deeds, easements, foreclosures, estoppels, leases, licenses, and fees, among other kinds of documents.

The most important real estate documents list ownership, encumbrances, and lien priority. These are used to maintain proper real estate transactions.

You May Like: What Does Gmfs Mortgage Stand For

What Is A Mortgage

A mortgage is an agreement between you and a lender. Sometimes referred to as a mortgage note, the mortgage establishes that if you dont make the payments on your home loan that you agreed to, the lender can take back your home. If you review your mortgage note, you may also see the terms mortgagor versus mortgagee. In legal terms, the borrower is the mortgagor and the lender is the mortgagee.

How Does It Mean To Mortgage Release

The lender has the certificate of title as long the owner will not give full payment of mortgage debt. If you are paying off, selling, or refinancing your property, a mortgage release has recorded to the legal released of the current lender from the mortgage obligation.

The discharge authority or lender should provide their mortgage release forms. Your lender also must have a full credit assessment on your financial condition.

To get the title of mortgage release, you have to work with the mortgage company to:

The Releases of the mortgage completes in 90 days time duration can be shorter, longer depends on your financial condition.

Also Check: Reverse Mortgage For Condominiums

What Is A Digital Closing Or Eclosing

A standard mortgage closing typically involves all parties sitting around a table, signing stacks of paperwork. In an eClosing, both the documents and the signatures are often electronic. Theyll look a bit different from state to state since the remote notarization laws vary.

- In-person electronic signing: Using this method, the mortgage documents are electronically signed and notarized, but the parties are there in-person.

- Remote ink signing: With this type of closing, parties sign paper documents while a notary witnesses the signing via webcam. Once the signing is complete, the parties mail them to the notary.

- Remote electronic signing: This is a fully remote and digital process, often referred to as remote online notarization , where both parties sign electronically as a notary witnesses via webcam. Once the signing is complete, the notarization is done electronically. This is available for those looking to refinance in some states. At this time, Rocket Mortgage® isn’t doing RON purchase closings.

- Hybrid in-person and remote signing: Some closings may involve any combination of in-person or remote meetings, with either electronic or ink signature, to accommodate state and local laws.

Fully remote closings are legal in about half of states, while lawmakers in a handful of others have introduced legislation to legalize this practice. If you live in a state that has passed a law to allow for remote notarization, you may be able to have eClosing for your mortgage closing.