What Is Pmi Insurance

Not to be confused with homeowners insurance, PMI is mortgage insurance required on most loans when buyers dont pay at least 20 percent of the homes purchase price as a down payment. Policies cover a percentage of the loan in the event that the borrower defaults, but they do not stop the foreclosure. They pay when the home doesnât have enough value to be sold for the loan amount in a foreclosure sale.

Most conventional mortgage lenders use the 20 percent threshold because they believe itâs enough of a cushion to regain the loan value in the event of a foreclosure. But thats not a hard-and-fast rule.

More importantly, you can sometimes have your PMI insurance cancelled once you reach 20 percent equity in your home. Keep in mind that housing markets can cause this number to vary widely even during the early years of the loan.

Do All Lenders Require Pmi

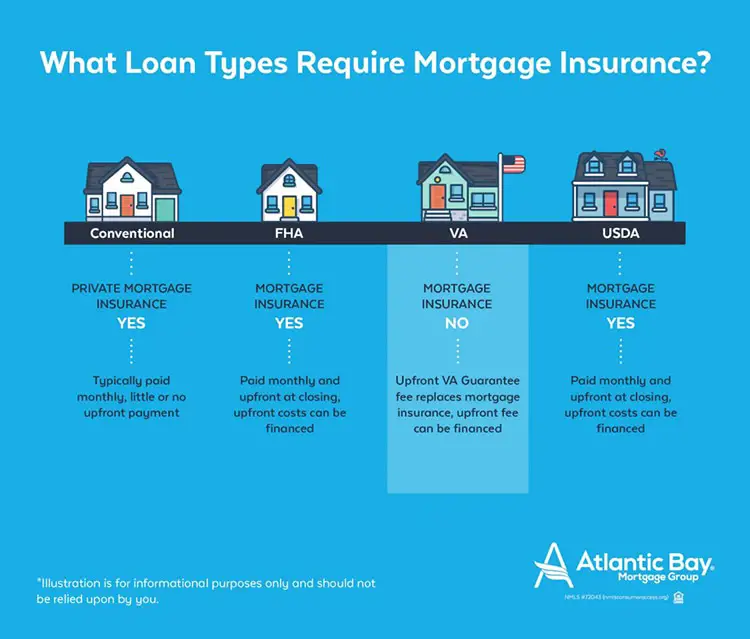

As a rule, most lenders require PMI for conventional mortgages with a down payment less than 20 percent. However, there are exceptions to the rule, so you should research your options if you want to avoid PMI.

For example, there are low down-payment, PMI-free conventional loans, such as PMI Advantage from Quicken Loans. The lender will waive PMI for borrowers with less than 20 percent down, but also bump up your interest rate, so you need to do the math to determine if this kind of loan makes sense for you.

Some government-backed programs dont charge mortgage insurance. For example, if youre eligible, VA loans dont require it. This can be helpful for homebuyers who dont have enough saved up to make a large down payment.

FHA loans require their own mortgage insurance, though the rates can be lower than PMI. However, you wont have an option to cancel the insurance even after you reach the right equity threshold. In the long term, this can be a more expensive option. Your credit score wont affect the insurance rate for FHA loans, though it could be higher if you put down less than 5 percent.

How Much Does Private Mortgage Insurance Cost

- Just like mortgage interest rates it depends on your particular loan scenario

- More risk results in a higher premium

- A combination of high risk factors will lead to the highest price

- Work with your bank or broker to shop PMI and/or run different scenarios to drive down the cost

The cost of private mortgage insurance can vary greatly and carries its own pricing adjustments, just as the associated home loan does.

In other words, your LTV, credit score, loan balance, the amount of coverage, transaction type , loan type , loan-to-value ratio, and premium type can all come into play.

The greater the combined risk factors, the higher the cost of PMI, similar to how a mortgage rate increases as the associated loan becomes more high-risk.

So if the home is an investment property with a low FICO score, the cost will be higher than a primary residence with an excellent credit score.

The type of mortgage insurance also matters, such as borrower-paid versus lender-paid, along with annual premiums vs. single premiums, refundable vs. non-refundable, and so on.

Per the Insurance Information Institute , mortgage insurance premiums can range from $250 to $1,200 per year, though its not uncommon to pay several hundred a month for coverage if youve got a large loan amount and very little down payment.

Lets look at a quick PMI cost example:

Purchase price: $200,000 Loan-to-value ratio : 95% Mortgage insurance premium: 0.70% of loan amount

Recommended Reading: When Will My Mortgage Insurance Drop Off

What Is Pmi How Private Mortgage Insurance Works

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Buying a home usually has a monster obstacle: coming up with a sufficient down payment. How much you put down on a conventional mortgage one that’s not federally guaranteed will determine whether you’ll have to buy PMI, or private mortgage insurance.

Typically a lender will require you to buy PMI if you put down less than the traditional 20%.

Private Mortgage Insurance Example

Lets take a second and put those numbers in perspective. If you buy a $300,000 home, you could be paying somewhere between $1,500 $3,000 per year in mortgage insurance. This cost is broken into monthly installments to make it more affordable. In this example, youre likely looking at paying $125 $250 per month.

Read Also: Does Down Payment Affect Mortgage Rate

Mortgage Insurance Vs Home Insurance

Mortgage insurance doesn’t cover you or your home. It’s not a substitute for a home insurance policy, which protects the structure of your home, personal belongings, and your pocketbook in case you’re financially liable for something. Home insurance is typically required by your lender no matter the size of your down payment and is highly recommended even after you pay off your home. Mortgage insurance, however, is only required if you’re unable to make a 20% down payment on a new home loan or refinance.

If you’re going through the home-buying process and have additional questions about insurance, check out our guide to home insurance for first-time buyers.

Use A Second Mortgage To Avoid Pmi

An alternative to paying PMI at all is to use a piggyback loan. You obtain a first mortgage in an amount equal to 80 percent of the home value, which thus avoids the PMI requirement, and you also take out a second mortgage in an amount equal to the sale price of the home less the amount of your down payment and less the amount of the first mortgage.

You May Like: Can You Undo A Reverse Mortgage

The Private Mortgage Insurance Cancellation Act

The PMI Cancellation Act, officially known as the Homeowners Protection Act, gives homeowners the right to remove and cancel PMI insurance as soon as they have built up enough equity in the property. While lender rules may vary on how you can cancel PMI, they have to give you an opportunity to do so.

Savvy homebuyers ask about the PMI schedule when signing loan documents. They want to know when the soonest they can drop PMI is based on regular payments. Accelerating payments by paying down principal may allow you to drop PMI sooner than later.

How Do I Pay For Pmi

There are several different ways to pay for PMI. Some lenders may offer more than one option, while other lenders do not. Before agreeing to a mortgage, ask lenders what choices they offer.

The most common way to pay for PMI is a monthly premium.

- This premium is added to your mortgage payment.

- The premium is shown on your Loan Estimate and Closing Disclosure on page 1, in the Projected Payments section. You will get a Loan Estimate when you apply for a mortgage, before you agree to this mortgage.

- The premium is also shown on your Closing Disclosure on page 1, in the Projected Payments section.

Sometimes you pay for PMI with a one-time up-front premium paid at closing.

- This premium is shown on your Loan Estimate and Closing Disclosure on page 2, in section B.

- If you make an up-front payment and then move or refinance, you may not be entitled to a refund of the premium.

Sometimes you pay with both up-front and monthly premiums.

- The up-front premium is shown on your Loan Estimate and Closing Disclosure on page 2, in section B.

- The premium added to your monthly mortgage payment is shown on your Loan Estimate and Closing Disclosure on page 1, in the Projected Payments section.

Lenders might offer you more than one option. Ask the loan officer to help you calculate the total costs over a few different timeframes that are realistic for you.

Don’t Miss: What Is A Conventional Home Mortgage Loan

If Your Mortgage Is From A Minnesota

Minnesota law, unlike federal law, allows homeowners to benefit from market appreciation. Under Minnesota law, the value of your home is based on what it would be worth if you sold it today. For instance, if you bought your home for $100,000 with 5 percent down and your house is now worth $130,000, you probably are eligible to cancel PMI under Minnesota law because you owe less than 80 percent of the market-value of your home.

You will need to hire an appraiser to establish the market value of your home to prove that you owe less than 80 percent of its current value. You should feel confident in the market value of your house before you obtain an appraisal. If the appraisal value falls short, you will have paid for the appraisal and must still continue to pay PMI, as well. Minnesota law gives you the right to shop for and pick an appraiser, as long as he or she is reasonably acceptable to your lender. A Minnesota-chartered lender cannot reject your appraiser without reason and cannot require you to pick only from a short list approved by the lender. Nonetheless, before you pay for the appraisal, contact your lender and make sure that the appraiser is acceptable.

When Do You Have To Pay Pmi

PMI must be paid as a condition of conventional mortgage loans if your down payment is less than 20%. For example, if the price of your new home is $200,000 and you’re only able to pay $7,000 up front, then you pay PMI because your down payment is only 3.5% of your home’s purchase price.

Down payment < 20% of the purchase price = PMI

Down payment > 20% of the purchase price = No PMI

Don’t Miss: What Does Points Mean On A Mortgage Loan

Should I Pay Off My Pmi Early

Its very important that you cancel your mortgage insurance as soon as you can because the savings can be significant for your monthly payments. If you have a 30-year fixed-rate loan for $300,000, you’ll have nine payments left between reaching 20% equity and having your PMI automatically canceled at 22% equity. If you cancel early, you could save thousands of dollars, depending on your interest rate.

How Much Is Pmi

The average annual cost of PMI typically ranges from 0.58% to 1.86% of the original loan amount, depending on your credit score, according to a 2021 report from Genworth Mortgage Insurance, Ginnie Mae and the Urban Institute. Borrowers with excellent credit get the lowest PMI rates.

Those averages were calculated using a $265,375 mortgage the loan balance youd have if you bought a $275,000 home and made a 3.5% down payment.

At those rates, PMI could cost anywhere from around $1,539 to $4,936 per year, or about $128 to $411 a month.

The cost of private mortgage insurance depends on several factors:

-

The size of the mortgage loan. The more you borrow, the more you pay for PMI.

-

Down payment amount. The more money you put down for the home, the less you pay for PMI.

-

Your credit score. PMI will cost less if you have a higher credit score. Generally you’ll see the lowest PMI rates for a credit score of 760 or above.

-

The type of mortgage. PMI may cost more for an adjustable rate mortgage than a fixed-rate mortgage. Because the rate can go up with an adjustable rate mortgage, the loan is riskier than a fixed-rate loan, so PMI is likely higher.

Estimating the cost of PMI before you get a mortgage can help you determine how much home you can afford.

Typically, the PMI cost, called a premium, is added to your monthly mortgage payment. You can see the premium on your loan estimate and closing disclosure mortgage documents in the projected payments section.

Recommended Reading: Can You Refinance A Mortgage More Than Once

How To Get Rid Of Pmi

If you opt for BPMI when you close your loan, you can write to your lender in order to avoid paying it once you reach 20% equity. If you’re a Rocket Mortgage® client, you can avoid the process of finding a stamp altogether and just give us a call at 508-0944.

Your letter should be sent to your mortgage servicer and include the reason you believe youre eligible for cancellation. Reasons for cancellation include the following:

- Reaching 20% equity in your home.

- Based on significant improvements to your home. If youve made home improvements that substantially increase the value of your home, you can have mortgage insurance removed. If your loan is owned by Fannie Mae, you must have 25% equity or more. The Freddie Mac requirement is still 20%.

- Based on increases in your home value not related to home improvements. If youre requesting removal of your mortgage insurance based on natural increases in your property value due to market conditions, Fannie Mae and Freddie Mac require you to have 25% equity if the request is made 2 5 years after you close on your loan. After 5 years, you only have to have 20% equity. In any case, youll be paying for BPMI for at least 2 years.

For your request to cancel mortgage insurance to be honored, you have to be current on your mortgage payments and an appraisal has to be done to verify property value.

Whats Next: Considering A Loan With Pmi

Private mortgage insurance is a trade-off. Paying PMI can help you get a loan with a smaller down payment, which can be a big help for first-time homebuyers or other people who havent been able to save up enough cash to make a 20% down payment on a home.

However, PMI adds to your monthly costs and is coverage for your lender and not you. As you consider whether to take out a loan with PMI, you must balance these two factors and decide whether one outweighs the other.

If you dont have enough money for a 20% down payment, a loan with PMI is not your only option. Some lenders offer loans with a low down payment that do not require PMI, and some state housing finance agencies may offer loans without mortgage insurance as well. Your interest rate may be higher with these loans, however, which may or may not be more expensive than PMI in the long run.

Your lender should be able to help you run the numbers for several different loan options with and without PMI so you can make the best decision.

Also Check: Do Medical Collections Affect Getting A Mortgage

Can You Reduce Or Eliminate Pmi

If you’re concerned about this extra expense, you’ll be relieved to know that PMI usually ends before your loan does since lenders only require you to pay PMI while your LTV is above 80%. Once your LTV is below 80%, you can request to stop paying PMI.

To determine when your loan will reach the point where you no longer need PMI, lenders use an amortization schedule. If you opted to pay PMI at closing, your lender already used this schedule to calculate your total PMI amount. In most cases, you can’t reduce or get a refund for part of your upfront premium.

If you pay a monthly premium, you may be able to eliminate PMI a little early since lenders end PMI automatically when you’re scheduled to reach the 78% LTV point. You may qualify for early PMI termination if you meet the following criteria:

- Your LTV is 80% or lower

- Your loan started on or after July 29, 1999, when the Homeowners Protection Act began

- You’re current on your mortgage payments

Call your lender to cancel PMI early if you meet these qualifications. Typically, your lender will request a broker price opinion to confirm the current market value of your home. Your lender needs this data to calculate your current LTV. If the value of your home has decreased significantly, your LTV may have increased, which could disqualify you for early PMI termination.

What Is Private Mortgage Insurance And Is It Required

If youre in the market to buy a home, you may have heard your lender or real estate agent mention Private Mortgage Insurance , a special type of coverage that may be required depending on your down payment amount. But, PMI isnt just for first-time homebuyers. In fact, homeowners with less than 20 percent equity in their home are likely paying toward this type of coverage.

The mortgage lenders at Chesapeake Bank know that purchasing a home is a major investment. So, to help answer some of your questions about mortgages and insurance requirements, weve compiled a list of FAQs about PMI.

Private Mortgage Insurance FAQs

What is PMI and when is it required? Private Mortgage Insurance is a special type of insurance policy on conventional loans that protects lenders against loss if a borrower defaults or stops making payments on their loan. PMI is required for conventional loans where borrowers make a down payment of less than 20 percent of the homes purchase price or they refinance with less than 20 percent equity.

Does PMI benefit the homeowner in any way? One of the biggest benefits of PMI is that it makes it possible to buy a home with less than 20 percent down. This can help all homebuyers, especially first-time buyers, be able to purchase a home and expand their cash-flow options, like keeping cash on hand for other uses or in case of an emergency.

How is PMI typically paid? PMI is paid one of two ways:

How can I calculate the cost of PMI for my mortgage?

Don’t Miss: How To Purchase A House That Has A Reverse Mortgage