If I Meet A Minimum Credit Score Will I Be Accepted For A Mortgage

Not necessarily as lenders take lots of factors regarding your affordability into consideration. You are more likely to be accepted if you meet a minimum score as this suggests that youre a careful borrower.

However, its also important to prepare for your application for a mortgage by organising your:

-

Pay slips and proof of bonuses/commission and tax paid or self-assessment tax accounts if youre applying for a self-employed mortgage

-

Passport, birth certificate and drivers license

-

Proof of deposit

-

Proof of address

-

Gift letter If you’re receiving help with your deposit, the lender will need a letter from the person providing the gift explaining that they are gifting the deposit and understand that they in no way own any share of the property being mortgaged or expect the money to be paid back.

Lenders work across a lot of different criteria, and your credit score is just one part, so even if you do not meet the minimum levels, you should speak to one of our specialist mortgage advisors to see how we can help.

What Is A Good Credit Score

The definition of a ‘good’ credit score is different for every credit reference agency. For example, according to Experian, a credit score of 700 or above is generally considered good, while your score is excellent if it is 800 or above. An excellent score with Equifax would usually be around the 475 mark.With TransUnion, based on your credit score you are given a rating out of five. A score between 628 and 710 is given the highest rating of 5, which is considered excellent. A high score means that lenders are more likely to consider you a lower risk as a borrower.

Check Your Credit Report For Free

Obtain your credit reports for free at AnnualCreditReport.com and review them carefully. More than one-third of participants in recent Consumer Reports research found errors on their reports, and these mistakes can be costly. Depending on the error, you might have an incorrect open loan attached to your name, an incorrectly-filed late payment or some other issue that can drag down your credit score.

If you see a mistake or outdated item generally seven years, but sometimes longer for bankruptcies, liens and judgments contact Equifax, Experian or TransUnion. Each of the credit bureaus has a process for correcting errors and out-of-date information.

Also Check: Who Is Rocket Mortgage Owned By

Take Advantage Of Credit

The UltraFICO and Experian Boost programs track the movement of cash in your bank account, and in many cases, your score can go up based on this data.

For example, 60 percent of those who have completed the Experian Boost process experienced credit score increases. The average increase was 12 points. The change was even bigger for those who fall into the poor or bad credit categories: 87 percent of those who started with a score lower than 579 saw an average increase of 22 points.

While youre working to boost your score, keep an eye on it, too. Many banks also offer credit monitoring for their customers, which can be a good idea to utilize in tandem. Youll be able to get a sense of when and why your score goes up or down.

Getting A Mortgage With Fair Credit

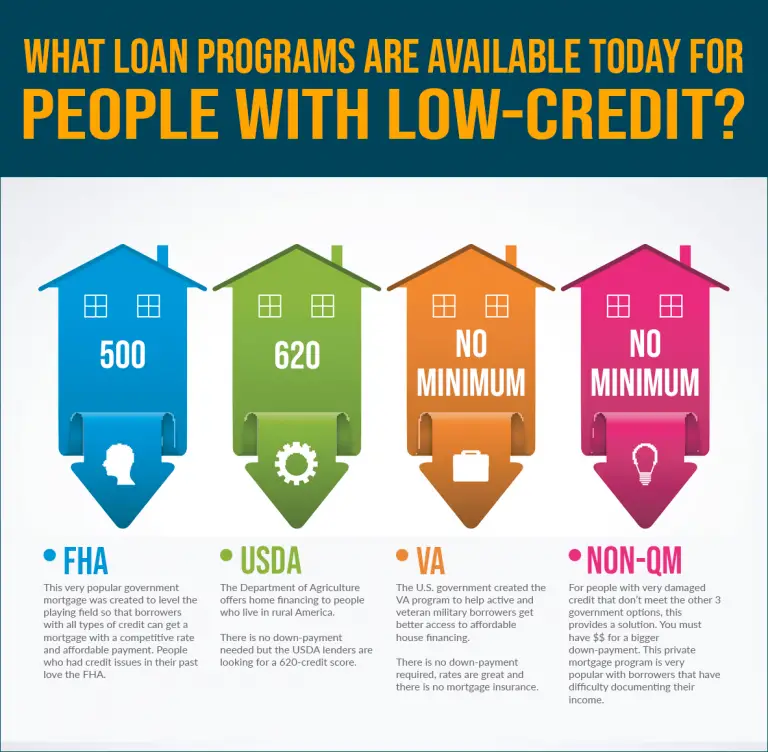

Contrary to popular belief, its actually possible to get a mortgage with fair credit. Most mortgage lenders will provide prime-level loan rates with credit scores as low as 620. Some will go as low as 600, and a few as low as 580.

Generally speaking, your best mortgage bet with fair credit is an FHA mortgage. They wont accept poor credit, but theyre more lenient than conventional mortgages.

If you do apply for a conventional mortgage, you might get a better deal if you have some offsetting factors. These include the following:

- Making a large down payment 20% or more of the purchase price.

- Having only a small increase in your new house payment.

- Buy less house than you can afford.

- Get a cosigner who has good or excellent credit.

Any of these factors can enable you to get a conventional mortgage even with a low credit score. However, lenders wont go below a 580 credit score, and not many will go below 620. Check with the lenders in your area that are known to be the most lenient with credit.

If youre looking for a good site that aggregates the best mortgages online and presents you with the lowest rates, check out Credible. NMLS# 1681276 Credible Operations, Inc. is based in North Carolina at 320 Blackwell St. Ste 200, Durham, NC 27701.

Credible can help match you with the right lender based on your needs and credit quality, and the whole process takes a matter of minutes.

Also Check: Who Is Rocket Mortgage Owned By

How Can I Get Something Wrong On My Credit Report Removed

If you think that information on your credit report is wrong, you have the right to dispute it with the company that has registered the error. This can sometimes be a tedious process but errors on credit reports can delay mortgage applications and can exclude you from access to the best rates.

If you decide to seek help from a mortgage broker, youll be happy to know that they can assist with helping you to get bad credit removed from your record as well as advising you on how to improve your score with the CRAs in the UK.

Other Factors That Could Affect Eligibility

Although a provider will look at your credit history when assessing your application, they might also base their lending decision on the following variables

- Your income and employment status:The more you earn, the more you could borrow, but how you make your money will also be of interest to the provider when theyre calculating the size of your mortgage. A specialist provider might be needed if youre self-employed or are hoping to get a mortgage based on bonuses, overtime or commission. Furthermore, there are specialist lenders for customers who are looking for a mortgage on low income.

- Your age:Some providers wont cater for borrowers over 75, others 85 and a minority will lend with no upper age limit, as long as theyre confident the borrower will be capable of repaying their loan debt in retirement.

- Your outgoings:Other significant outgoings may affect the amount youre able to borrow.

- The property type:Properties with non-standard construction might require a specialist.

Read Also: 10 Year Treasury Vs Mortgage Rates

Adjusting The Debt To Credit Ratio

To effectively qualify for a mortgage loan with bad credit, it may be beneficial to adjust ones debt to credit ratio. In other words, adjust the amount of money you owe so that it is lower than the amount of credit you currently have available. Improving this ratio is one of the quickest methods to improve a poor credit rating thereby, making your application more attractive to lenders.

What Mortgages Can You Get With Bad Credit

Buying a house with bad credit can be tricky. Fewer lenders are likely to let you borrow money, which means:

-

There will be a smaller range of mortgages to choose from

-

Those you can get are likely to be more expensive

-

You will usually need a higher deposit

However, some offer mortgages designed for bad credit. These loans are provided by specialist bad credit mortgage lenders and building societies rather than larger high street banks.

These mortgages are also known as adverse credit or subprime mortgages and work in the same way as normal home loans. As well as checking your credit record, lenders will ensure you can afford repayments on the mortgage by looking at your income, outgoings and financial situation.

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

Build Yourself A Good Credit History

You need to prove that you can manage your borrowing well, so you need to have some borrowings to manage. To do this, you will need to take out a line of credit of some sort a mobile phone contract might help a little, but it does not carry the same weight as a loan from a major bank, so youll need to think carefully about how to proceed. Here are a few suggestions:

The whole point of building a good credit history is to improve your credit rating, and therefore your chances of successfully getting a mortgage. Stay on top of things now to avoid ending up in a poor position again in the future.

Register To Vote Or Your Chances Might Be Scuppered

This is a potential dealbreaker. While you can have a perfect credit score without being on the electoral roll, it’s very difficult to get a mortgage without it. Lenders use electoral roll data in identity checks .

Your credit file will say if you’re on the electoral roll or not, but you can also check with your local council. Do this as early as possible. While you can usually be added within a month, in late summer and early autumn it could take longer.

If you’re not on it, you can register on the electoral roll for free. If you’re not a UK, Irish or EU national and thus can’t get on the electoral roll to vote, then you can put a notice of correction on your file, saying you have other proofs of address and ID you can offer lenders .

You May Like: Recasting Mortgage Chase

Can I Get A Mortgage With No Credit History

Many lenders will carry out a credit search when you apply for a mortgage, checking your current and previous credit history, as this can be a good indicator of your ability to service the loan applied for. A lack of credit history could have an influence but solely would not necessarily stop a mortgage being approved.

How Can I Get A Mortgage With A Low Credit Score

That depends a lot on just how low your credit score is. There was a time when people with poor credit could get a mortgage without too much trouble and at the time banks were lending money pretty freely. Unfortunately as you already know, the bubble burst and the banks have long since tightened up.

As a result, if your credit is very poor then you probably wont be able to get a mortgage. But if you are border line / have a poor to fair credit rating there are a few things you might be able to do to help your case a little:

Don’t Miss: Reverse Mortgage On Condo

You May Also Be Interested In

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. YOUR HOME OR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

For online mortgage comparison and advice Gocompare.com introduces customers to Mojo Mortgages which is authorised and regulated by the Financial Conduct Authority. Mojo Mortgages is a trading name of Lifes Great Limited. Gocompare.coms relationship with Lifes Great Limited is limited to that of a business partnership, no common ownership or control exists between us. Please note, we cannot be held responsible for the content of external websites and by using the links stated to access these separate websites you will be subject to the terms of use applying to those sites.

What Is The Maximum Credit Score

The maximum credit score for each credit reference agency is:

- Experian: 0999

| 604-627 | 628-710 |

For Experian, a score of 881-960 is considered to be good, while 420-465 is considered to be good for Equifax. TransUnion states that 604-627 indicates a good credit score. Credit scores higher than this are rated as excellent.

Having the best credit score possible doesnt guarantee you a mortgage. In addition, a low credit score doesnt mean you wont qualify. Theres a lot more for lenders to assess, which well take a look at next.

Read Also: Mortgage Recast Calculator Chase

Fixing Or Preventing Bad Credit

Having bad credit is not the end of the world. It still may be possible for lenders to give you a loan, provided your credit score is not too low. But be aware that you may pay a higher interest rate and more fees since you are more likely to default . So its in your best interest to improve your credit score in order to get a lower interest rate, which can save you thousands in the long run.

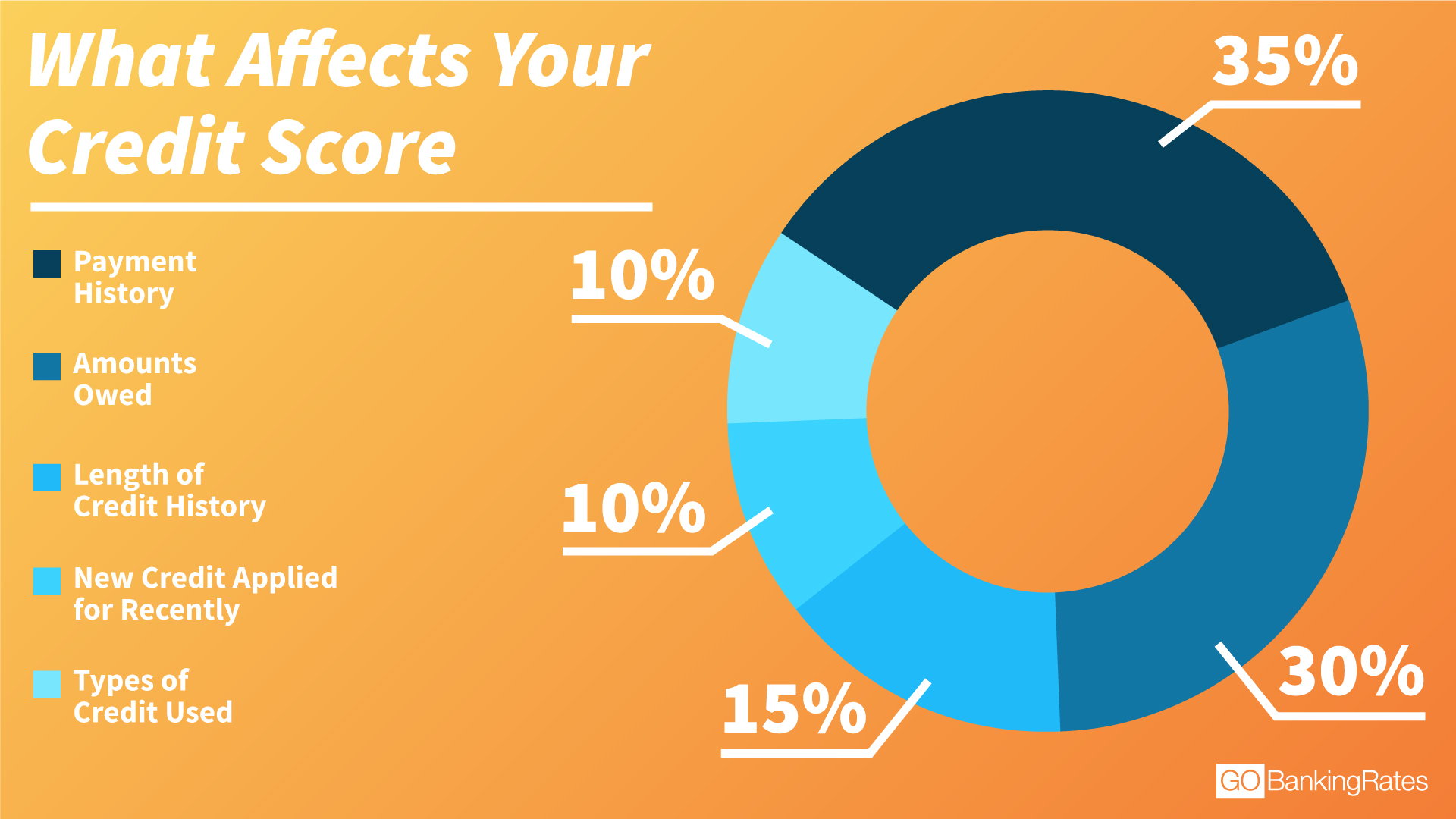

Mortgage lenders look at the age, dollar amount, and payment history of your different credit lines. That means opening accounts frequently, running up your balances, and paying on time or not at all can impact your credit score negatively. Just changing one of these components of your spending behavior can positively affect your credit score.

There are ways you can improve your credit score, such as paying down your debts, paying your bills on time, and disputing possible errors on your credit report. But on the flip side, there are ways you can also hurt your score, so remember:

- DONT close an account to remove it from your report .

- DONT open too many credit accounts in a short period of time.

- DONT take too long to shop around for interest rates. Lenders must pull your credit report every time you apply for credit. If you are shopping around with different lenders for a lower interest rate, there is generally a grace period of about 30 days before your score is affected.

Mortgage With Fair Credit: Yes Its Possible

Many people with fair credit think they cant get a mortgage. After all, those with fair credit are not among the credit score elite those individuals with credit scores of 800 or more.

Instead, faircredit borrowers are likely to have some late payments and maybe even a missed payment or two.

But there is some good news: You can get a mortgage with fair credit.

In fact, savvy lenders may be very interested in your business.

Read Also: Chase Recast Mortgage

Be Ready To Explain The Bad Credit Rating

One option to overcome the bad credit rating is to discuss the credit score with your bank and explain the reason for this history. If you bring in evidence of payments made on time regarding rent and utilities for at least one year, you may be able to show a steady income. The reason why discussing a bad credit rating is beneficial is because lenders tend to be amenable to borrowers who can prove an ability to meet mortgage repayments.

What Credit Score Is Needed To Buy A House

You dont need flawless credit to get a mortgage. In some cases, scores can even be in the 500s. But because credit scores estimate the risk that you wont repay the loan, potential lenders will reward a higher score with more choices and lower interest rates.

For most loan types, the credit score needed to buy a house is at least 620. But higher is better, and borrowers with scores of 740 or more will get the lowest interest rates.

Don’t Miss: Chase Recast Calculator

How This Site Works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances and remember we focus on rates not service.

- We don’t as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and it’s rarely made public until it’s too late .

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We often link to other websites, but we can’t be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the MoneySuperMarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code.

Can I Get A Mortgage With No Credit Rating

At first glance, it doesnt make sense. If youve never gone into debt before or needed to borrow money, then surely it stands to reason youll be seen as someone who is responsible with money? This should make you a sure be for an easy mortgage application.

Unfortunately, this is not the case, and by having very little or no history of credit you are likely to be in as poor a position or perhaps actually worse off as someone with a chequered financial past.

When assessing applicants, lenders look for patterns of behaviour that prove you are capable of borrowing money and paying it back on time, without incurring defaults, delays or penalties. With no record of borrowing and repaying, there is no way of telling how you manage your finances or how you would handle a large loan amount, and therefore you are viewed as a high risk.

This might not seem fair, but its how the world of credit works. But now we know this, we can work on ways to improve your credit score.

Recommended Reading: Reverse Mortgage For Condominiums