Canada’s Most Popular Mortgage: The 5

In Canada, out of the $1.2 trillion CAD in outstanding residential mortgages in May 2021, the 5-year fixed rate mortgage takes the crown with over $660 billion, or more than 50%, of all mortgages in Canada. There are more 5-year fixed rate mortgages than all variable rate mortgages combined. The 5-year fixed rate mortgage is so popular that the CMHC uses the Bank of Canada’s 5-Year Benchmark Posted Rate for itsmortgage stress test.

Other Factors Besides Your Credit Score

Remember, FICO is looking only at the difference your credit score makes in the chart above.

Lenders will check more than your credit history when you apply for a new mortgage loan. They will also need to know your:

- Debt-to-income ratio This ratio measures how much of your income goes toward existing monthly debts

- Income stability Homebuyers need to show W2 forms or pay stubs to prove a steady income. If youre selfemployed, you can provide tax forms or even bank statements

- Down payment Most loans require a minimum down payment amount . Putting more than the minimum down could help lower your interest rate

- Home equity for refinancing Mortgage refinance lenders will check your home equity which, measures how much your home value exceeds your mortgage debt. Having more equity can lower your rate

In short, the better your personal finances look, the lower your mortgage interest rate will be. Taking steps like raising your credit score or savings for a bigger down payment before you buy can help you get the best rates available.

Example Of Mortgage With Different Rates And Aprs

Here are examples comparing different interest rates and APRs for a $300,000, 30-year fixed-rate mortgage:

| $503,235 | $534,463 |

If youre planning to stay in your home for a shorter period and want to purchase discount points to lower your rate, you need to do the math to determine your break-even point. Bankrates mortgage points calculator will help. Simply put, you need to stay in the home long enough to allow enough time for the rate savings to balance out those extra upfront costs.

You May Like: Does Rocket Mortgage Sell Their Loans

Why Do Banks Offer Different Mortgage Rates

Not all banks offer the same mortgage rates. In fact, some banks can offer very different rates for what is otherwise the same product. For example, the advertised rate for a 5-year fixed-term mortgage could be 0.5% higher from TD Bank than from BMO .

Why is this the case? Well, itâs because each bank has different lending criteria, and is comfortable with different amounts of risk. Other factors like desired market share, competition, and marketing policy will also change a bankâs pricing strategy. This is why you need to shop around and compare rates from multiple banks whenever you get a new mortgage, renew your mortgage, or refinance.

Open Vs Closed Mortgages

If youâre wondering whether to get an open or closed mortgage, the answer is, while an open mortgage may make sense in certain circumstances, the overwhelming majority of Canadians opt for a closed mortgage. While open mortgages have extra flexibility that you might need, closed mortgages are by far the more popular choice not only due to their lower rates, but also because most home buyers do not intend to pay off their mortgages in the short term. Moreover, fixed-rate open mortgages do not exist and variable-rate mortgages are very rare. The most common type of open mortgage is the Home Equity Line of Credit . Below are some quick facts about the differences between open and closed mortgages, and you can also find more detailed information about them here.

Also Check: Chase Mortgage Recast

What Is A High

A mortgage with a down payment below 20% is known as ahigh-ratio mortgage. The term ratio refers to the size of your mortgage loan amount as a percentage of your total purchase price.

All high-ratio mortgages require the purchase of CMHC insurance, since they generally carry a higher risk of default.

What Are Today’s Mortgage Rates

You can see Guaranteed Rate’s mortgage rates today up above, but if this is your first home buying experience, you might have more basic questions. Like “what is a mortgage rate” and “what do today’s mortgage rates mean for you?” Every mortgage comes with the expectation that the amount borrowed will eventually be paid back in full. However, borrowing that much money comes with a cost, and simply paying off the principal loan wont erase your debt.

Just like any other business, lenders need to make a profit on the products they offer, like mortgages and personal loans. Thats why loans almost always come with the added stipulation of interest payments, which act as the cost of borrowing money.

Also Check: Rocket Mortgage Qualifications

Ontarios Housing Market Trend

Ontarios new tagline is A Place to Grow, which is also whats expected for the provinces population. The Ontario Ministry of Finance projects the population of Ontario will increase some 30.2% over the next two decades, bringing the total population to 18.5 million by July 1, 2041.

There are so many incredible aspects to Canadas most populous province, from its lush natural resources to its growing cities. That and solid job growth make the population boom less of a surprise.

As a result of its popularity, home prices in Southern Ontario are expected to continue rising. Prices are particularly prone to inflation in Ontarios Golden Horseshoe region where immigration is high, land is limited by the protected green belt and homes remain in short supply.

That, in turn, implies that Ontario mortgage amounts will grow faster than the national average.

Look At Apr Not Just Rate

Usually, lenders express the interest rate as an annual percentage. An APR gives borrowers a more comprehensive measure of the cost to borrow money than the interest rate alone does.

The APR includes the interest rate, any points, mortgage broker fees, and other charges you pay to borrow money. So when youre comparing options, youll want to review each lenders APR to indicate the true cost of borrowing.

The Consumer Financial Protection Bureau, a government agency, offers a tool to look at state-by-state rates a borrower with a particular credit score might expect to receive.

To get an idea of what your mortgage payments may be, you can use a mortgage calculator.

Also Check: Bofa Home Loan Navigator

How Do I Compare Current Mortgage Rates

Because mortgage rates are so individual to the borrower, the best way to find the rates available to you is to get quotes from multiple lenders. If you’re early in the homebuying process, apply for prequalification and/or preapproval with several lenders to compare and contrast what they’re offering.

If you want a broader idea without yet talking to lenders directly, you can use the tool below to get a general sense of the rates that might be available to you.

Are Mortgage Rates The Only Aspect To Consider When Choosing Between Lenders

A 4% mortgage rate versus a 3% mortgage rate may not seem like a huge difference, but that one-percentage point translates into a huge difference in the monthly mortgage payment. Although our rate and monthly payments are a large factor when choosing a mortgage, its also important to focus on the level of service that different lenders provide.

Take into consideration the level of expertise of the loan officer. Are they knowledgeable about new laws and regulations regarding home loans? Ask about the speed of the process before making a final decision. Consider the lenders reputation, ability to provide guidance for a smooth transaction , and other costs such as points and fees, and APR.

Also Check: Rocket Mortgage Payment Options

Current Mortgage Refinance Rates

Refinancing became a bit more expensive today as 30-year fixed and 15-year fixed refinance mortgages saw their average rates go higher. If youve been considering a 10-year refinance loan, just know average rates also moved up.

The average refinance rates are as follows:

Check out mortgage rates that meet your distinct needs.

Close On Your New Home

Once youve been officially approved for a mortgage, youre nearing the finish line. All thats needed at that point is to complete the closing, which is when youll pay closing costs and receive the mortgage funds .

The closing process differs a bit from state to state, Ailion says. Mainly it involves confirming the seller has ownership and is authorized to transfer title, determining if there are other claims against the property that must be paid off, collecting the money from the buyer, and distributing it to the seller after deducting and paying other charges and fees.

The closing costs youre responsible for can include:

- Appraisal fee

- Origination and/or underwriting fee

- Title services fee

During your closing, the closing agent will provide a detailed statement to the parties of where the money came from and went. The agent will also enter the transaction into the public record and deliver the deed to the buyer.

Read Also: Mortgage Recast Calculator Chase

What Factors Into Current Mortgage Rates

Mortgage interest rates are heavily influenced by external factors like inflation, the Federal Reserve, your lenders specific fees and other economic trends. These monetary forces work together to establish market norms and standardize current mortgage rates for lenders to follow.

Given the constant ebb and flow of the real estate economy, many buyers will wait for the timing to be perfect before pursuing a home purchase. Even borrowers who can afford a mortgage in the current market might hold off on their purchase if the external pressure of the economy is expected to bring down home mortgage rates even further.

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan and is built into your monthly payment. Mortgage fees are usually paid upfront and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

Don’t Miss: 10 Year Treasury Vs 30 Year Mortgage

How Can I Calculate How Much My Ontario Mortgage Payments Would Be

Our Ontario Mortgage Payment Calculator will help you figure out how much youll pay with any rate you find on the site. It only takes a few minutes to use, so give it a try. You can modify the mortgage amount, mortgage term and type, amortization and payment type to see how your mortgage options and payment amount are impacted.

What Are The Benefits Of A 20

The main benefit of a 20-year mortgage is the savings homeowners receive from lower interest rates and paying it off sooner than 30 years. For instance, if you purchase a home for $300,000 and put 20% down. Instead of a 30-year mortgage at 3.25%, you opt for the 20-year term at 3%, you can save around $49,313.50 in interest throughout the lifetime of the loan.

A 20-year mortgage has more affordable monthly payments than a 15-year mortgage. Although youll most likely save even more in interest with the 15-year mortgage, the monthly payment will be higher, which can be burdensome for some borrowers.

Read Also: How Much Is Mortgage On 1 Million

Average Mortgage Rates 2019 To Today

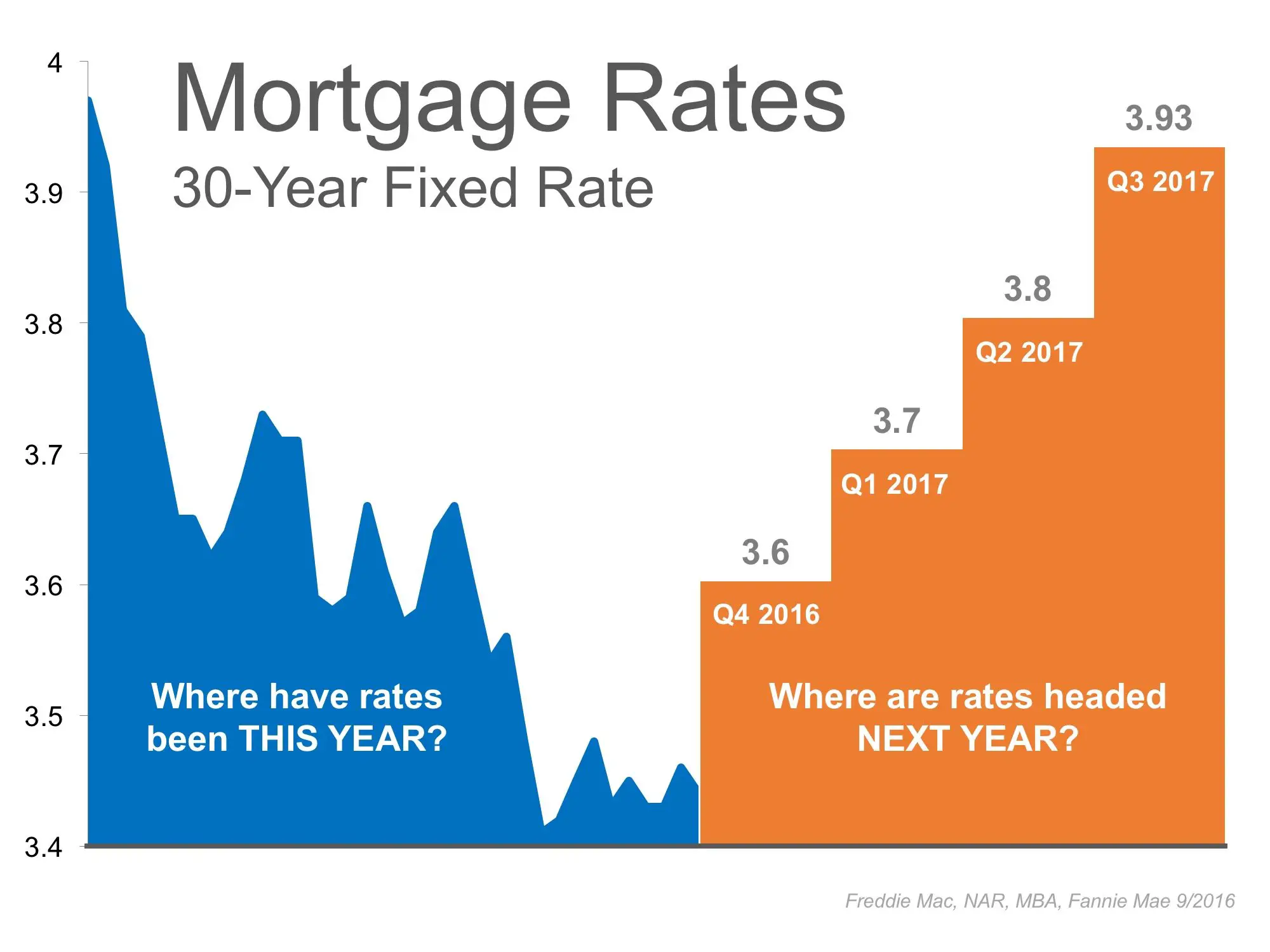

Since 2019, the real estate market has seen historic changes that have had a significant impact on mortgage interest rates. While rates remained relatively steady throughout 2019, the coronavirus pandemic changed the living priorities for millions of people, resulting in a rush of prospective homebuyers looking for a new home.

According to FreddieMac, a typical mortgage rate for a 15-year fixed loan in 2019 came with a 3.5% interest rate, down a half percentage point from the year before. Throughout 2020, however, mortgage rates saw a steep drop that followed the COVID-19 outbreak. By December of that year, the national average mortgage rate for a home purchase on a 15-year plan fell to 2.2%.

That trend continued in the early weeks of 2021, but ended with a rise in mortgage rates toward the end of January. As you can see in the graphs above, current mortgage rates can heavily fluctuate from year to year.

How Some Lenders Can Offer Lower Mortgage Rates Than Others

Its always easier to find the lowest mortgage rates than to find the lowest borrowing cost. Thats because lenders like to add gotchyas to their mortgage agreements. These are surprises that boost your cost of borrowing later. Here are four examples of such pitfalls:

Don’t Miss: Recast Mortgage Chase

Canada Vs Usa Mortgage Terms

Canadas mortgage term lengths are relatively short when compared to mortgages in the United States. The most common mortgage in the U.S. is the 30-year fixed mortgage, which means that homeowners dont need to renew their mortgage for the entirety of their amortization. This is a large departure from the Canadian mortgage market, where homeowners expect to renew and renegotiate their mortgage rates often.

Today’s Mortgage Rates: Still Near Historic Lows

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

For today, December 23rd, 2021, the current average mortgage rate for a 30-year fixed-rate mortgage is 3.324%, the average rate for a 15-year fixed-rate mortgage is 2.614%, and the average rate for a 5/1 adjustable-rate mortgage is 3.142%. Rates are quoted as annual percentage rate for new purchase.

A home is one of the biggest purchases you’ll ever make. Current mortgage rates are significantly lower than they were a year ago. You can save thousands of dollars simply by paying attention to the interest rate on your loan.

To land the best mortgage deal for you, it’s important to shop around with multiple lenders. Check out the most recent mortgage rates and get personalized quotes as well as a full rundown of your estimated monthly payment.

Read Also: Rocket Mortgage Requirements

How Does My Credit Score Affect My Mortgage Rate

Your credit score directly affects your mortgage ratethose with low credit scores wont be able to qualify for the best rates out there. What this means is that borrowers could end up paying more throughout the loan. Even a quarter of a percent difference could mean saving thousands of dollars in interest.

The reason why your credit score is so important to lenders is that its an indicator of your risk profileit shows the chances youll pay back your loan on time and in full. Lenders want to see a higher score as it shows that borrowers have a record of on-time payments to their creditors.

Your credit score is made up of information from your credit report, which includes information about open and closed credit accounts, your payment history, and more. These reports are created by credit bureausEquifax, Experian, and TransUnion. Because your credit history is so vital to your score, experts recommend checking your credit report to check for any discrepancies or what could be affecting your score before applying for a loan.

Mortgage Interest Rates Today

Here’s what you need to know to lock in the best rate possible for that home loan.

Now’s the time to get an awesome mortgage rate on your dream home.

In response to market volatility at the outset of the COVID-19 pandemic, the Federal Reserve cut its benchmark interest rate for the first time in more than a decade, creating a ripple effect in the market. For homebuyers, this has meant home mortgage rates at historic lows. It’s a great time to investigate the mortgage rate you could qualify for on a future home.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

Interest Rates In Two Crises

Heres a look at interest rate fluctuations in two turbulent eras.

In the early 2000s, lenders began offering risky mortgage options, known as subprime mortgages, to borrowers with poor credit.

An overheated housing market combined with subprime loan programs helped lead to the Great Recession, from December 2007 to June 2009, despite the Federal Reserve having drastically cut interest rates from 5.25% in September 2007 to 2% in April 2008.

For the next decade, the Fed kept interest rates very low to encourage borrowing and reinvigorate the economy. In 2018, it started to steadily increase short-term rates. Then came three rate cuts in 2019.

In March 2020, citing disruption caused by the coronavirus outbreak, the Fed cut the federal funds ratethe benchmark for most interest ratesto nearly zero.

And in January 2021, the Fed maintained its target for the federal funds rate at a range of 0% to 0.25%.

The Feds rate decisions usually drive shorter-term products like home equity lines of credit and credit cards.

Still, mortgage rates and the federal funds rate usually move in the same direction.