Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The 5-year fixed rate mortgage is the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wont have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

What You Should Know About Adjustable

Adjustable-rate mortgage loans are inherently riskier than fixed-rate mortgages. Although your introductory rate may be ultra-low, theres a good chance rates could rise at some point in your loan term.

A higher interest rate means a bigger monthly mortgage payment. And if rates rise enough, a homeowner could get priced out of their home which is a dangerous position to be in.

The risk of rising rates is the main reason most home buyers choose a fixed-rate mortgage over an ARM. However, if you know youll move or refinance before the introductory period ends, an ARM may offer a lower interest rate and savings on your mortgage payment.

If youre considering an ARM for its money-saving benefits, here are a few things you should know about this type of mortgage before opting in.

ARM rate caps make these loans less risky than you think

Today, most adjustable-rate mortgages come with rate caps. These reduce your exposure to risk by limiting the amount your rate can rise in any given year and over the life of the loan.

Rate caps are usually expressed like this: 2/2/5.

Following is the meaning for each, in order:

Still, caps are there to protect you.

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

Don’t Miss: 10 Year Treasury Yield Mortgage Rates

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisors mortgage rate tables to get the latest information.

The lower the rate, the less youll pay on a mortgage. Todays rate environment is considered extremely well-priced for borrowers. However, depending on your financial situation, the rate youre offered might be higher than what lenders advertise or what you see on rate tables.

If youre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage point . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

Read Also: Rocket Mortgage Launchpad

Us Department Of Agriculture Loans

USDA loans are geared towards homebuyers with low to moderate incomes. It provides a zero downpayment option to borrowers with credit scores not lower than 640. The USDA home financing program was designed to aid economic development in areas with low populations in the country.

To be eligible for a USDA loan, you must purchase a house in a USDA rural area. This may seem like a limitation if you want to live in a city. However, 97 percent of land in the U.S. is actually qualified for USDA home financing. You just might find a house near a good location. Consider this option before you cross it out your list.

Qualifying for USDA Loans

To qualify for a USDA loan, borrowers should have a minimum credit score of 640. If your credit rating is lower than 640, you must provide additional documentation of your payment history to get approval. For front-end DTI ratio, you must not go beyond 29 percent. Likewise, your back-end DTI ratio must not be over 41 percent.Be sure to check the USDA income limits in your preferred home location. This will also determine if you can obtain a USDA loan. There are different income limits for households with 1 to 4 members and larger families with 5 to 8 family members. For example, under the 2008 Housing and Economic Recovery Act , high-cost areas for 1 to 4 member households are set at $212,55.

What Do I Need To Refinance My Mortgage With A Fixed Rate Loan

A 30 year mortgage could be very beneficial, but you need to consider how long you plan to stay in your new home. If what matters most to you is having lower mortgage payments each month, you should consider a 30 year fixed rate mortgage with the help of a loan officer.

Recommended Reading: Does Rocket Mortgage Sell Their Loans

Real Estate Deal Volume & Appreciation

- Fannie Mae anticipates home sales which were at 6 million units in both 2018 and 2019 will end 2020 with 6.2 million transactions and will see 6.1 million transactions in 2021.

- Real estate appreciation in the United States during 2018 and 2019 ran at 5.1% and 4.2%. In 2020 Fannie Mae anticipates home prices to increase 5.5% and increase a further 2.6% in 2022.

Do I Get A Lower Rate If I Make A Bigger Down Payment

Generally, not. The lowest rates in Canada are typically offered on default insured mortgages. Those are for people who put down less than 20% on their home purchase. Low insured rates are also available to people who transfer their already-insured mortgage to a new lender. Those who put down 20% or more get conventional rates, which are usually higher than insured rates. Occasionally, however, someone putting down 35% or more on a home purchase under $1 million can get great rates similar to high-ratio rates.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Tips To Get The Lowest Mortgage Rate

To get the best rate possible, it helps to get your finances shipshape before applying for a mortgage.

For example, managing debts well and keeping your credit score up can help you qualify for a lower interest rate. As can savings for a bigger down payment.

Dont worry. Nobodys expecting miracles. But small improvements can make a worthwhile difference in the mortgage rate youre offered.

Here are some quick hits:

Few of us can afford to boost our savings and pay down our debts at the same time. So focus on areas where you think you can make the biggest difference. Youll see the biggest improvement in your credit scores by paying down highinterest, revolving credit accounts such as credit cards.

The other big way to lower your interest rate is by shopping around.

Mortgage lenders have flexibility with the rates they offer. Some will offer you lower rates than others because theyre more favorable toward your particular situation.

Find Your Lowest Rate Today

You should comparison shop widely, no matter what sort of mortgage you want. As federal regulator the Consumer Financial Protection Bureau says:

Shopping around for your mortgage has the potential to lead to real savings. It may not sound like much, but saving even a quarter of a point in interest on your mortgage saves you thousands of dollars over the life of your loan.

Mortgage rate methodology

The Mortgage Reports receives rates based on selected criteria from multiple lending partners each day. We arrive at an average rate and APR for each loan type to display in our chart. Because we average an array of rates, it gives you a better idea of what you might find in the marketplace. Furthermore, we average rates for the same loan types. For example, FHA fixed with FHA fixed. The end result is a good snapshot of daily rates and how they change over time.

Read Next

Popular Articles

Resources

Recommended Reading: Mortgage Rates Based On 10 Year Treasury

How To Use Our Mortgage Rate Table

Our mortgage rate table is designed to help you compare the rates youre being offered by lenders to know if it is better or worse. These rates are benchmark rates for those with good credit and not the teaser rates that make everyone think they will get the lowest rate available. Of course, your personal credit profile will be a significant factor in what rate you actually get quoted from a lender, but you will be able to shop for either new purchase or refinance rates with confidence.

Are Mortgage And Refinance Rates Rising Or Falling

Another day, another top Federal Reserve official warning that the central bank will do whatever it takes to tame inflation. Yesterday, it was Federal Reserve Bank of St. Louis President James Bullards turn to repeat that message.

Mr. Bullard took the view that the economy was strong enough to absorb the Feds plans, which include higher general interest rates and the rapid scaling back of its bond holdings, which include trillions of dollars of mortgage bonds. Both those policies are likely to push mortgage rates higher.

Some are concerned that too aggressive a line from the Fed could cause a recession. And it may well.

But that argument was blunted yesterday by new weekly jobless figures. In the week ending Apr. 2, the number of new claims for unemployment insurance was 166,000. And that was the lowest figure since November 1968.

So, the Fed thinks it has plenty of elbow room to rein in inflation without causing too much harm to the broader economy. Well have to wait to see if its right. But, for now, its policies should continue to exert upward pressure on mortgage rates.

Read the weekend edition of this daily article for more background.

Also Check: Monthly Mortgage On 1 Million

What Controls A Variable Interest Rate

Your variable interest rate is directly controlled by your lender via theirPrime Rate. Each lender can choose to increase or decrease their own prime rate, in turn increasing or decreasing your variable interest rate.

Lenders will usually adjust their prime rate to reflect changes in theBank of Canadas Policy Interest Rate. This means that lenders will tend to have similar or identical prime rates. All major Canadian banks currently have a prime rate of 2.45%.

Where Mortgage Rates Are Headed

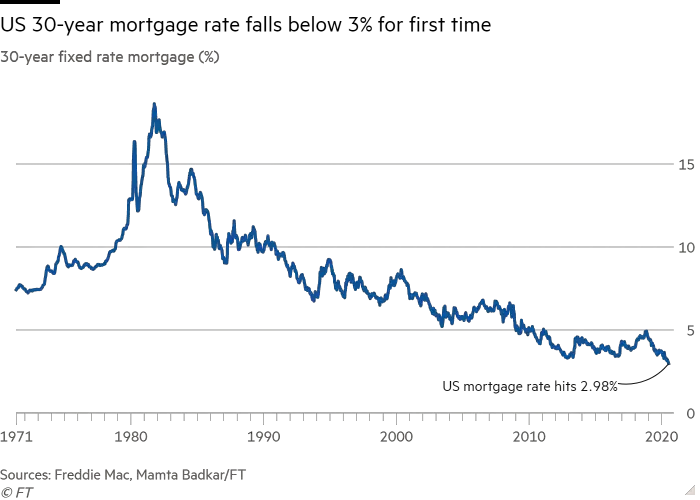

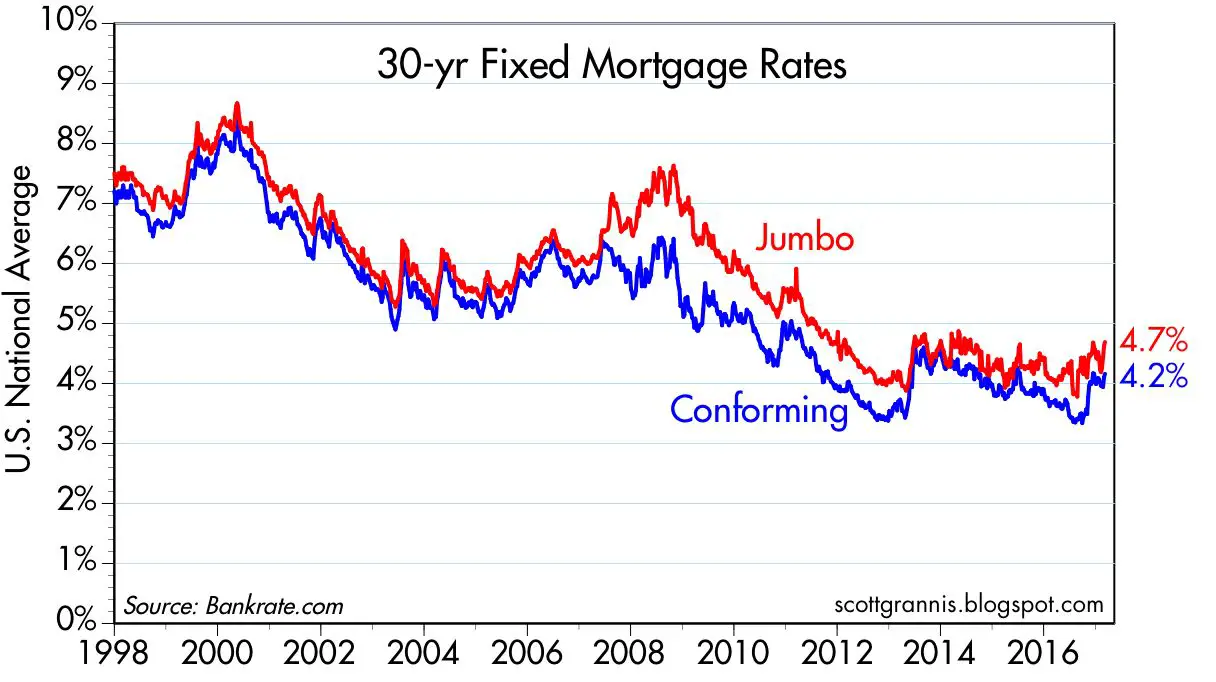

Mortgage rates plunged early in the pandemic and scraped record lows below 3 percent at the start of 2021. The new year, however, has been characterized by rising rates. The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and many experts think the average rate on this loan will be 3.5 to 4 percent by the end of 2022. Thats still great by historical standards though. The ultra-low rates of 2020 and 2021 were an anomaly, but even 4 percent is a deal in the scheme of things.

Mortgage rates continue to surge, as they have since the beginning of the year, as the outlook takes shape for Fed rate hikes that are sooner and faster than previously expected, McBride says. Mortgage rates are still well below 4 percent but in an environment of already sky-high home prices, more would-be homebuyers are priced out with each move higher in mortgage rates.

Also Check: Recasting Mortgage Chase

How We Calculate Our Refinance Rates

The table below shows where refinance rates were headed in the last week.

These refinance interest rates are provided by Bankrate. The information is based on consumers that fit a certain profile, such as the home is an owner occupied single family residence. If your personal situation doesnt meet or exceed the standards of this survey, then its likely youll end up with a refi rate higher than whats listed..

Bankrate is owned by Red Ventures, Nextadvisors parent company.

Average refinance interest ratesTake a look at mortgage refinance rates for a number of different loans.

Managing Your Mortgage Payments

Purchasing a 30-year fixed loan means making consistent payments for three decades. Thats a long time, so you must stay on top of your payments. This is why its important to secure a stable career and build savings. You must keep paying your loan even during emergencies. The same goes even when youre retired and not yet fully paid on your loan.

Before you agree to any real estate deal, you should understand how mortgage payments work. One important document you should use is the amortization schedule. This breaks down your monthly payments so you know how much goes toward your interest charges and principal loan.

- Principal This is the amount you borrowed from your lender. It also indicated the outstanding balance you still owe after making several payments.

- Interest This is the payment lenders charge to service your loan. Interest costs are higher when your principal is large. Likewise, interest increases the longer it takes to pay down a loan.

Calculate Your PITI Costs

Mortgage payments are not just comprised of interest and principal payments. You must also pay for real estate taxes and homeowners insurance. When taken together, this is called PITI costs or Principal, Interest, Taxes, and Insurance. If you check your PITI expense, you can calculate the total cost of your monthly payments. Finally, while principal and interest payments remain the same, your insurance and property taxes may change over the years.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

When To Lock Your Mortgage Rate

Keep an eye on daily rate changes. But if you get a good mortgage rate quote today, dont hesitate to lock it in.

Remember, if you can secure a 30year mortgage rate below 3% or 4%, youre paying less than half as much as most American homebuyers in recent history. Thats not a bad deal.

*Average rates are for sample purposes only. Your own interest rate will be different. See our mortgage rate assumption here.