Changes To The Tax Code

Beginning in 2018, the limits on qualified residence loans were lowered. Now, couples filing jointly may only deduct interest on up to $750,000 of qualified home loans, down from $1 million in 2017. For married taxpayers filing separate returns, the cap is $375,000 it was previously $500,000.

These limits include any combination of qualified loans, such as mortgages, home equity loans and HELOCs.

For example, if you have a first mortgage that is $300,000 and a home equity loan thats $200,000, all the interest paid on both of those loans may be deductible since you didnt exceed the $750,000 cap.

If you took out a mortgage and or home equity loan/HELOC on or before December 15, 2017, you can still deduct the interest on up to $1 million in loans.

Home Equity Loan Tax Deduction

With a home equity loan, which is often referred to as a âsecond mortgage,â you receive a lump-sum payment based on your equity that will need to be paid back over the life of the loan.

As with HELOCs, home equity loan interest is tax-deductible only if itâs used for buying, building, or renovating your home.

Get essential money news & money moves with the Easy Money newsletter.

Free in your inbox each Friday.

Sign up now

Who Gets To Take The Deduction

You do, if you are the primary borrower, you are legally obligated to pay the debt and you actually make the payments. If you are married and both you and your spouse sign for the loan, then both of you are primary borrowers. If you pay your son’s or daughter’s mortgage to help them out, however, you cannot deduct the interest unless you co-signed the loan.

Also Check: Reverse Mortgage For Mobile Homes

Deduction Is Poorly Designed To Promote Homeownership

The mortgage interest deduction is intended to encourage homeownership. Proponents of homeownership subsidies claim that expanding the number of homeowners has broader benefits for society, such as causing households to take better care of their homes and become more involved in their communities than they would if they were renters. The evidence for these claims is mixed. But regardless of the benefits of expanding homeownership, the mortgage interest deduction is poorly designed to achieve this goal.

When The Mortgage Interest Deduction Is Beneficial

For example, consider a married couple in the 24% income tax bracket who paid $20,500 in mortgage interest for the previous year. This tax year, they wonder if itemizing deductions would yield a larger tax break than the $25,100 standard deduction. If the total of their itemized deductions exceeds the standard deduction, they will receive a larger tax break.

After totaling their qualified itemized deductions, including the mortgage interest, they arrive at $32,750 that can be deducted. Since this is larger than the standard deduction, it offers a greater benefit: $7,860 vs. $6,024 .

Don’t Miss: Rocket Mortgage Launchpad

Cool I Paid A Mortgage This Year That Means I Can Deduct The Interest Paid Right

Not quite. You cannot just deduct the interest from any ol mortgage. There are a few caveats, and if youre in a more complicated situation than what is listed below, consult an accountant or take a look at the IRS form 936. In general, you can deduct the interest:

-

If this is your primary residence. The vast majority of people fall into this category. A primary residence means you live at the property you are using to deduct and its not some rental / passive income property.

-

If its a second home, you do not need to live there all the time. However, if you rented this second home out, you do need to be there for either 14 days more or 10% more than the number of days that you rented the home out. For example, if you rented the home out for 60 days, you need to have lived there for at least 66 days.

-

If the mortgage is actually a home equity loan, you need to show that you used the money from the home equity loan to buy, build, or substantially improve the property that youre trying to claim this deduction on. In other words, if you take out a home equity but use the extra cash to buy an expensive car, you cannot deduct the interest paid on this loan. But if you used it to remodel and finally build that gazebo in the back, youre good to go.

What Are Special Circumstances

Life sometimes isnt black or white, but gray. Just like you need to understand your home loan options, you need to know the special situations where the IRS says you might or might not qualify for the mortgage interest deduction.

You can deduct these items as home mortgage interest: A late payment charge if it wasnt for a specific service performed in connection with your mortgage loan. A mortgage prepayment penalty, provided the penalty wasnt for a specific service performed or cost incurred in connection with your mortgage loan.You cannot deduct the interest paid for you if you qualified for mortgage assistance payments for lower-income families under Section 235 of the National Housing Act.

Recommended: Guide to Buying, Selling, and Updating Your Home

Recommended Reading: Does Rocket Mortgage Sell Their Loans

A Mortgage Interest Deduction Example

Let’s compare two homeowners who each have two outstanding mortgage balances and want to claim the mortgage interest deduction. Homeowner A owes $400,000 for the mortgage on their main home purchased before Dec. 16, 2017, and another $250,000 on a mortgage used to purchase a vacation home in spring 2018.

Homeowner B owes $600,000 on a mortgage for their main home that was originated before Dec. 16, 2017. In fall 2019, they took out a $300,000 home equity loan to cover college expenses and consolidate non-mortgage debt.Maximum mortgage interest deductionLoan #1Loan #2Total Qualifying Loan BalanceHomeowner A$1 million or $750,000 $400,000$250,000$650,000Homeowner B$1 million or $750,000 $600,000$300,000$600,000

How do the rules apply here? For Homeowner A, their $400,000 mortgage is less than both the $1 million and $750,000 limits. Because the $250,000 began after the cutoff date, we must use the $750,000 limit. Homeowner A borrowed a new mortgage for their vacation home, which means they may qualify to deduct the interest on that loan as well as the mortgage on their main home.

The grand total of both loans is less than the $750,000 limit, giving Homeowner A the opportunity to fully deduct the interest paid on both loans. But, if they had borrowed a home equity loan or line of credit against their main home to buy their vacation home, the interest on that loan or line wouldnt be deductible.

What Loans Qualify For A Mortgage Interest Deduction

There are a few types of home loans that qualify for the mortgage interest tax deduction. These include a home loan to buy, build or improve your home. While the typical loan is a mortgage, a home equity loan, line of credit or second mortgage may also qualify. You can also use the mortgage interest deduction after refinancing your home . Just make sure the loan meets the previously listed qualifications and that the home in question is used to secure the loan.

Read Also: Reverse Mortgage Manufactured Home

It Actually Reduced The Homeownership Rate

Emmons says the MID can hurt low- and middle-income earners by driving up house prices and making homeownership less attainable. Thats because tax benefits like the mortgage interest deduction are capitalized into house prices, pushing them higher than they otherwise would be. Citing research published in the February 2018 American Economic Review, Emmons explores findings that the previous incarnation of the MIDbefore tax reformdid not encourage homeownership.

In fact, he says, it reduced the homeownership rate by about 5 percentage points. It raised house prices so much through the capitalization of tax benefits that homes became out of reach for some buyers, he explains.

So Whats The Deal With This $750000 Figure

Prior to 2017, you would be able to deduct the interest paid up to $1 million in principal. With the Tax Cuts and Jobs Act of 2017, that threshold unfortunately lowered to $750,000. But what does this actually mean? The easiest way to explain it is with examples, seen below.

But before getting into the examples, its important to highlight some details about the TCJA, especially for those who bought a home in late 2017, early 2018, as you may still be eligible to deduct up to the $1 million threshold!

You are eligible to be grandfathered into the previous law before TCJA if:

- You bought your home before December 15th, 2017 or

- If you entered into a written binding contract before January 1, 2018 and subsequently closed before April 1st, 2018

Else, tough luck and $750,000 will be your limitation. But regardless of whichever category you fall into, the below examples apply all the same, just with different numbers. Lets jump into it.

You May Like: Rocket Mortgage Qualifications

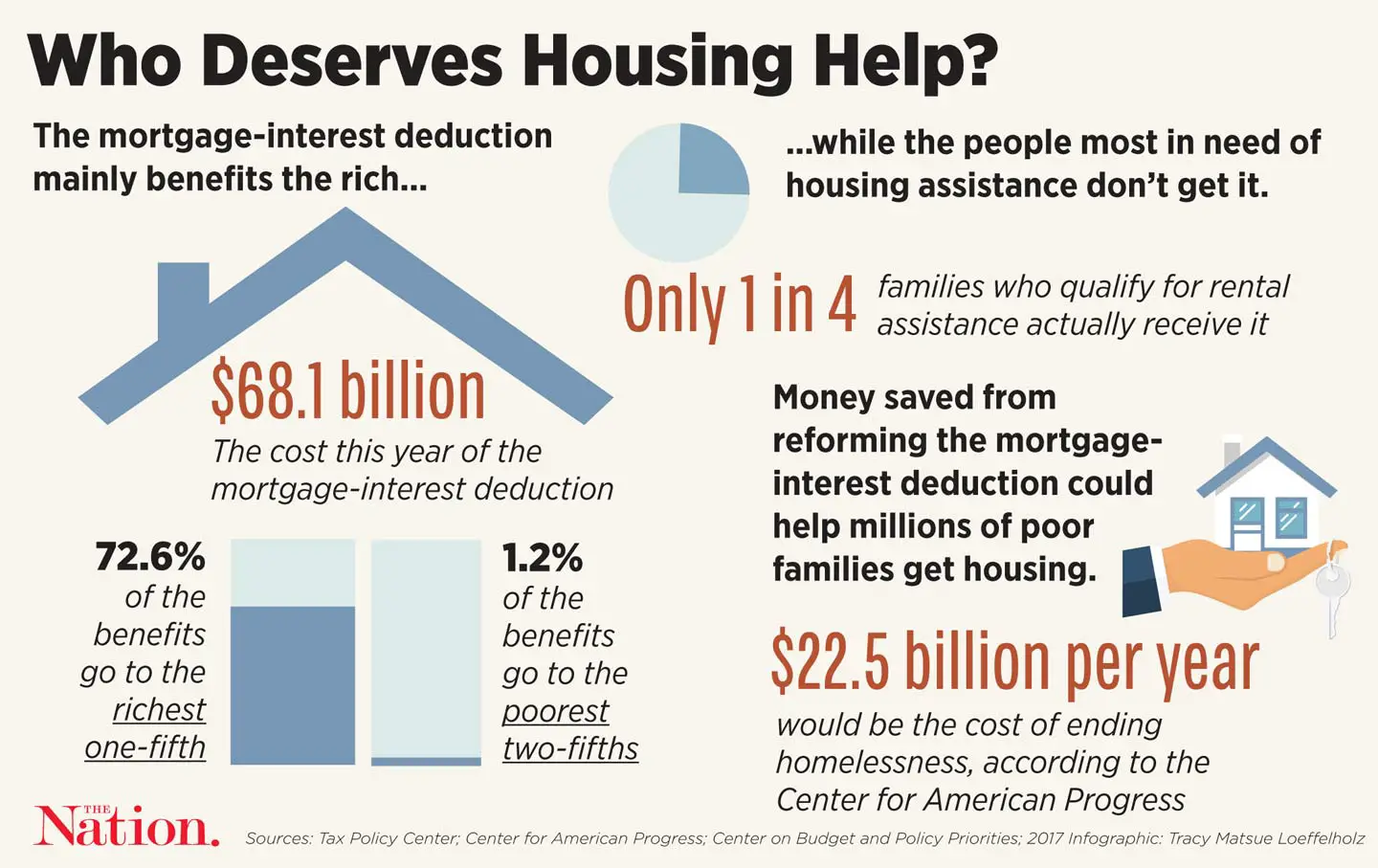

Who Takes The Mortgage Interest Deduction

The benefits of the deduction go primarily to high-income taxpayers because high-income taxpayers tend to itemize more often, and the value of the deduction increases with the price of a home. For example, estimates for 2018 show that less than 4 percent of taxpayers earning under $50,000 will claim the deduction, and these taxpayers will receive less than 1 percent of the tax expenditures overall benefits. Taxpayers making over $200,000 will make up 34 percent of claims and take 60 percent of the benefits. While the total value of the deduction went down due to the TCJA, the share of benefits is now more concentrated among high-income taxpayers due to more taxpayers opting for the more generous standard deduction.

Who Qualifiesfor The Mortgage Interest Deduction

The TaxCuts and Jobs Act of 2017 changed the rules for the mortgage interestdeduction.

Since2017, if you take the standard deduction, you cannot deduct mortgageinterest.

For the 2020tax year, the standarddeduction is $24,800 for married couplesfiling jointly and $12,400 for single people or married people filingseparately.

But if you use itemized deductions instead of claiming the standard deduction, you candeduct the interest you pay each tax year on mortgage debt. This includes any mortgage loan used to buy, build, or improve your home.

You may also be able to deduct interest on a home equity loan or line of credit , as long as the loan was used for one of those three purposes.

Read Also: How Much Is Mortgage On A 1 Million Dollar House

Refinanced Loan Points That Have Been Paid

Refinancing can be inconvenient, but it has significant benefits. You can subtract the points you paid for the new loan if you recently refinanced. You can not, however, deduct all points at once. You must spread them out evenly over the course of your loan. You can deduct 2 points per year if your loan is for 20 years and you have 40 points.

Shouldyou Claim The Mortgage Interest Deduction

Remember, you can take the mortgage tax deduction only ifyou itemize your taxes. And thats only worth doing for taxpayers whose write-offs exceed the standard deduction.

Forexample, say you and your spouse own a home with a $315,000 mortgage loan. Youritemized deductions might look something like this:

- Mortgage interest: $9,500

- Property taxes: $3,000

- Charitable donations: $2,000

Yourtotal itemized deductions come out to $14,500. In this case, as a couple filingjointly, youd want to take the $24,800 standard deduction because it farexceeds your itemized deductions.

But if you were a single homeowner with the same itemized deductions or a married one filing separately youd want to itemize. Thats because the sum of your itemized deductions is greater than the standard deduction of $12,400.

Consult a professional tax advisor

As withany major decision, consult a professional when deciding how to file taxes. Alicensed tax advisor can review your situation and let you know how to deductmortgage interest or if you should at all.

How to claim the home mortgage interestdeduction

To claimthe mortgage interest deduction, a taxpayer should use Schedule A which is partof the standard IRS 1040 tax form.

Your mortgagelender should send you an IRS 1098 tax form which reports the amount ofinterest you paid during the tax year. Your loan servicer should also providethis tax form online.

You May Like: Recasting Mortgage Chase

What Qualifies For The Mortgage Interest Deduction

Its not just the interest part of your monthly payment that qualifies for the mortgage interest deduction. You may also be able to deduct late payment fees, discount points and mortgage insurance premiums.

You can deduct the points you pay to reduce your mortgage interest rate either in the year you pay them or proportionately over the life of your loan. You can do the same for points the seller pays when you buy a home, or points you pay on a home equity loan or HELOC whose proceeds you use to build, buy or substantially improve your home.

Points you pay on a mortgage for a second home can only be deducted over the loans life, not in the year you pay them, however. Refinancing points usually also must be deducted over the loans life.

In 2019 and 2020, mortgage insurance premiums are tax deductible as mortgage interest, too. Private mortgage insurance, FHA mortgage insurance premiums, FHA up-front mortgage insurance, the VA funding fee, the USDA guarantee fee and the UDSAs annual mortgage insurance all qualify.

However, this deduction phases out for married-filing-jointly taxpayers with an adjusted gross income above $100,000 and single or married-filing-separately taxpayers with an AGI above $50,000. Once your AGI reaches $109,000 , you cant deduct mortgage insurance at all.

How Does The Mortgage Interest Deduction Benefit Housing And Homeownership

Homeownership is a superb tax shelter, and tax rates favor homeowners. Sometimes, the mortgage interest deduction can overshadow the desire for the pride of ownership as well. As long as your mortgage balance is smaller than the price of your home, mortgage interest is fully deductible on your tax return.

The ability to deduct the interest on a mortgage continues to be a big benefit of owning a home. And the more recent your mortgage, the greater your tax savings.

As homeowners build equity the increased wealth leads to greater consumer spending that spurs business activity and provides a positive multiplier effect that creates jobs and income throughout the economy. Every 10% increase in total housing market wealth would translate to approximately $147 billion in additional consumer spending, or 0.8% of GDP, as well as billions of dollars in new federal tax revenue.

Recommended Reading: Recast Mortgage Chase

What Is The Mortgage Interest Tax Deduction

The mortgage interest tax deduction is a tax benefit available to homeowners who itemize their federal income tax deductions. States that assess an income tax also may allow homeowners to claim this deduction on their state tax returns, regardless of whether they itemize on their federal returns. New York is one example.

However, dont confuse a tax deduction with a tax credit. A tax credit reduces how much tax you pay dollar for dollar. If you owe $1,000 and get a $100 tax credit, your tax bill drops to $900. If you get a $100 deduction, you only save a percentage of $100. If youre in the 24% federal income tax bracket, your tax savings will be $24. Youll still owe $976.

Taking The Mortgage Interest Deduction For Your 2021 Tax Filing

While almost all homeowners qualify for the mortgage interest tax deduction, you can only claim it if you itemize your deductions on your federal income tax return by filing a Schedule A with Form 1040 or an equivalent form.

Because of this, youll have to decide whether its better to deduct the mortgage interest by itemizing or taking the standard deduction. The standard deduction for tax year 2021 is $12,550 for single filers and $25,100 for married taxpayers filing jointly. For tax year 2022, those amounts are rising to $12,950 for single filers and $25,900 for married joint filers.

Lets say youre a single homeowner who spent $18,000 in mortgage interest in 2021. It would make sense in this scenario to itemize your deductions, as youll reduce your taxable income by a greater amount than you would if you were to take the standard deduction.

If youre not sure which is the better route to take, consult a tax professional to help you understand the best move for your financial situation.

Read Also: 10 Year Treasury Vs Mortgage Rates

How Does The Mortgage Interest Tax Deduction Work In 2021

The mortgage interest tax deduction can be enough to allow homeowners to itemize their deductions instead of claiming the standard deduction on their income tax return. The itemized deduction has historically been the single largest deduction for most homeowners.

But that may no longer be the case.

The 2021 Tax Cuts and Jobs Act reduced the amount of the mortgage interest deduction for loans over $750,000. At the same time, the TCJA increased the standard deduction. With a lower limit on mortgage interest deduction, many homeowners are now taking the standard deduction instead.

How To Receive A Mortgage Interest Deduction

In order to receive a mortgage interest deduction, you need to ensure that you obtain and fill out all of the appropriate forms. At the beginning of the year, you should receive a Form 1098 from your mortgage lender. The 1098 will state exactly how much you paid in interest and mortgage points over the course of the year, and act as proof that youre entitled to receive a mortgage interest deduction. Be aware that you will only receive this form if you have paid at least $600 in interest during the tax year.

To qualify, you will also need to itemize your deductions and report them on Schedule A, Form 1040. This form will have you list all of your deductions, including donations to charity, medical expenses and the information about your mortgage interestfound on your 1098.

Don’t Miss: Rocket Mortgage Payment Options