Today’s Mortgage Rates In Ohio

| Product |

|---|

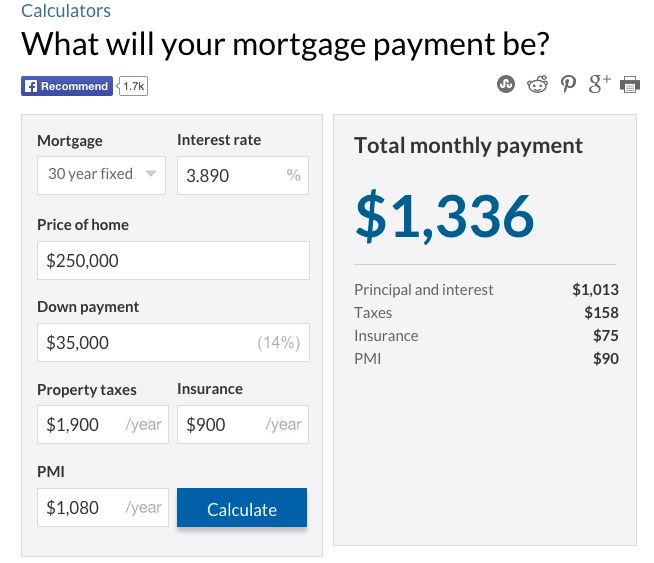

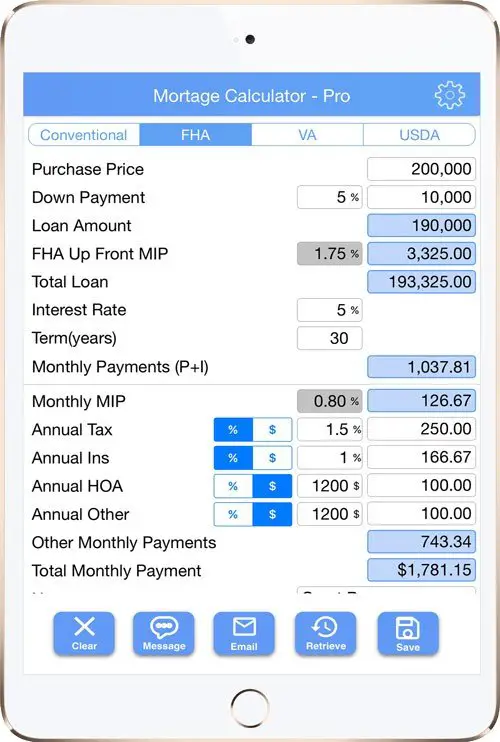

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Total Monthly Payment

Based on a $350,000 mortgage

Based on a $350,000 mortgage

| Remaining Mortgage Balance |

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Increase Your Down Payment

The smaller the amount of your mortgage, the smaller your monthly payments. If youre able to put at least 20% of the home price towards yourdown payment, youll be able to avoid PMI. Even if you cant afford a complete 20% down payment, boosting your down payment will help you get PMI removed sooner. In fact, boosting your down payment by 5% can lower your monthly PMI fees.

What Happens To My Cmhc Insurance If I Change Lenders

If you choose to change lenders when its time to renew your insured mortgage, you do not have to pay for CMHC insurance again. CMHC insurance covers your mortgage until it is paid off, and will follow you from lender to lender. Simply provide your CMHC certificate of insurance or certificate number.

Read Also: Recast Mortgage Chase

We Hope To See You Again Soon

Youre about to leave Regions to use an external site.

Regions provides links to other websites merely and strictly for your convenience. The site that you are entering is operated or controlled by a third party that is unaffiliated with Regions. Regions does not monitor the linked website and has no responsibility whatsoever for or control over the content, services or products provided on the linked website. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

How Much Do I Need To Put Down

A down payment of 20% or more will get you the best interest rates and the most loan options. But you dont have to put 20% down to buy a house. There are a variety of low-down-payment options available for home buyers. You may be able to buy a home with as little as 3% down, although there are some loan programs that require no money down.

Recommended Reading: Can You Get A Reverse Mortgage On A Condo

Factors In Your Ohio Mortgage Payment

In addition to your monthly mortgage payment, youll have property taxes and insurance to deal with as associated homeowner costs. Ohios property tax rates are higher than the national average, with an effective rate of 1.48%. Property taxes in the Buckeye State pay for county services such as parks, police departments and schools. Youll find a different tax rate for each county in Ohio, depending on individual budgets and needs.

Property appraisals are conducted once every six years. Your appraisal will equal market value which is used to determine assessed value, which can vary county to county. If you want to maximize property tax savings, you can check if you qualify for any Ohio property tax exemptions.

As for insurance, the average Ohio homeowner paid $2,107 towards their annual homeowners insurance premium, according to data from insurance.com. Ohio ranked as one of the least expensive states for homeowners insurance. It helps that the state isnt near a coastline or a wildfire-prone area. That said, Ohio suffered damage during Hurricane Ike in 2008 and Superstorm Sandy in 2012, according to the Insurance Information Institute. While homeowners policies usually cover hail and wind damage, flood damage generally is excluded. If you want flood insurance, you can find a policy through the National Flood Insurance Program .

Considerations For Extra Payments

Pay Off Higher Interest Debts First

Paying off your mortgage early isn’t always a no-brainer. Though it can help many people save thousands of dollars, it’s not always the best way for most people to improve their finances.

Compare your potential savings to your other debts. For example, if you have , it makes more sense to pay it off before putting any extra money toward your mortgage that has only a 5 percent interest rate.

Further, unlike many other debts, mortgage debt can be deducted from income taxes for those who itemize their taxes.

Also consider what other investments you can make with the money that might give you a higher return. If you can make significantly more with an investment and have an emergency savings fund set aside, you can make a bigger financial impact investing than paying off your mortgage. It is worth noting volatilility is the price of admission for higher earning asset classes like equities & profits on equites can be taxed with either short-term or long-term capital gains taxes, so the hurdle rate for investments would be the interest rate on your mortgage plus the rate the investments are taxed at.

Also Check: Mortgage Recast Calculator Chase

Standard Vs Itemized Income Tax Deductions

The 2017 Tax Cuts and Jobs Act bill increased the standard deduction to $12,000 for individuals and married people filing individually, $18,000 for head of household, and $24,000 for married couples filing jointly. These limits have increased every year since. In 2021 the standard deduction for single filers & married filing separately is $12,550. Head of households can deduct $18,800 whie married joint filers can deduct $25,100.

Before the standard deduction was increased through the passage of the 2017 TCJA 70% of Americans did not itemize their taxes. Many homeowners will not pay enough mortgage interest, property taxes & local income tax to justify itemizing the expenses – so the above interest savings may not lead to income tax savings losses for many Americans. If you do not plan on itemizing your taxes enter zero in your marginal tax rate to remove the impact of mortgage interest deductions from your calculation.

The new tax law also caps the deductiblility of property taxes combined with either state income or sales tax at $10,000. The mortgage interest deductibility limit was also lowered from the interest on $1 million in debt to the interest on $750,000 in debt. Mortgages originated before 2018 will remain grandfathered into the older limit & mortgage refinancing of homes which had the old limit will also retain the old limit on the new refi loan.

Is Your Mortgage Payment Calculator Free

Yes, our mortgage payment calculator is free. In fact, all of our calculators, articles, and rate comparison tables are free. Ratehub.ca earns revenue through advertising and commission, rather than by charging users. We promote the lowest rates in each province offered by brokers, and allow them to reach customers online.

Also Check: Chase Recast Mortgage

Land Transfer Tax In Ontario

Ontarios land transfer tax is calculated as a percentage of the propertys value, using the purchase price as an estimate. The LTT is a marginal tax with rates varying from 0.5% to 2.0% of a homes value depending on its purchase price. For detailed information on rates and calculations see our Ontario land transfer tax page.

Costs To Expect When Buying A Home In Minnesota

If youre still in the initial stages of home-buying planning, youll want to consider some of the one-time upfront costs. One of the first costs youll come across is a home inspection. This is when you find a home youd like to buy. Generally most buyers will arrange for a home inspection after putting in an offer on the house, but some buyers will negotiate for a pre-offer inspection. Whichever you choose, the cost is the same. Most home inspections run between about $350 and $500, and depend on the size and type of home. Smaller square footage dwellings and condos generally are on the lower end of the scale. While a home inspection covers structural system, roof, plumbing, electrical and more, it wont cover specialties such as radon, termite damage or mold. If youd like to arrange additional tests, it will cost you extra and is optional.

One of the last costs youll factor in is a bundle of service fees and charges known as closing costs. These fees are for your mortgage lender, the state and county and a number of other entities, depending on who was involved in the mortgage and buying process. The exact sum depends on a number of factors, and youll pay it on the day you finalize paperwork and get keys to the property.

Recommended Reading: Reverse Mortgage Manufactured Home

When To Use A Mortgage Calculator

You can use a mortgage calculator at nearly any stage of your home buying process. If you are just getting started in your home search, it can help you set a budget for your purchase. First, decide on an amount that you can comfortably pay each month for your home. Next, estimate how much you can apply to the principal and interest by subtracting rough estimates for taxes, home insurance, PMI, and homeowners association fees .

Research average interest rates to know what you can expect to pay in interest based on your credit score. This will help ensure that your mortgage calculator results are accurate for your situation.

If youve already begun looking at specific homes in your search, you can plug in the relevant information for your favorite homes to help you calculate your estimated monthly mortgage payments. Remember to make sure that youre inputting all of the information you have to get a better idea of exactly how much the home would cost each month.

Find Out Whether You Need Private Mortgage Insurance

Private mortgage insurance is required if you put down less than 20% of the purchase price when you get a conventional mortgage, or what you probably think of as a “regular mortgage.” Most commonly, your PMI premium will be added to your monthly mortgage payments by the lender.

The exact cost will be detailed in your loan estimate, but PMI typically costs between 0.2% and 2% of your mortgage principal.

Oftentimes, PMI can be waived once the homeowner reaches 20% equity in the home.

You May Like: Rocket Mortgage Loan Requirements

Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

Signs It’s Time To Refinance

Falling Interest Rates

One of the best signs that it’s a good time is that interest rates have dropped or that you now qualify for lower interest rates based on your improved credit score or credit history. A two-point interest rate deduction on a $200,000 home could save you tens of thousands of Dollars over the life of a 30-year, fixed-rate loan. Typically, a full point or two is necessary to make refinancing worth your while. The savings from a half-point or less may take years to offset expenses, depending on the terms of your loan.

Shift From Adjustable to Fixed Rates

Another good reason to refi is if you want to get out of an adjustable-rate mortgage or to eliminate a second mortgage loan, or a piggyback loan. When your ARM is going to reset to a higher interest rate, you may be able to shift into a fixed-rate loan with a lower interest rate. Of course, your credit history will need to have improved significantly from when you were approved for the original loan. You can also refi to consolidate two loans into one single loan with one monthly payment.

Shift Into a Conventional Loan

FHA loans are easier to qualify for than conventional loans, allowing both low down payments and lower credit scores. FHA loans typically charge mortgage insurance premium for the life of the loan. By shifting over to a conventional loan a homeowner can drop the insurance requirement so long as they have at least 20% equity in their home.

Pay Off Your Loan Faster

Extract Home Equity

You May Like: Rocket Mortgage Requirements

How To Account For Closing Costs

Once you’ve calculated the total principal and interest expense on your mortgage, factoring in closing costs or fees will be straightforward. Since closing costs are paid in full when you close on the loan, you can simply add them to your overall loan cost without using any long formulas. Some examples of upfront closing costs include the following:

- Mortgage lender fees

- Third-party mortgage fees

- Prepaid mortgage costs

While there may be other categories of upfront fees, the process for calculating them remains the same: Just add them to the total cost of the mortgage loan. Keep in mind that this will exclude any added monthly expenses paid in escrow, like taxes or homeowner’s insurance. Our next section explains how to factor in monthly expenses.

Should I Include Projected Repair Costs In My Monthly Payment Calculation

Repair costs arent something you should include in your monthly payment calculation but you absolutely should keep them in mind. If the property you are considering is in need of significant repairs or renovations you will absolutely need to consider how you will cover those costs before you sign on to a mortgage on the home.

Don’t Miss: Rocket Mortgage Payment Options

Can You Afford The Loan

Lenders tend to offer you the largest loan that theyll approve you for by using their standards for an acceptable debt-to-income ratio. However, you dont need to take the full amountand its often a good idea to borrow less than the maximum available.

Before you apply for loans or visit houses, review your income and your typical monthly expenses to determine how much youre comfortable spending on a mortgage payment. Once you know that number, you can start talking to lenders and looking at debt-to-income ratios. If you do it the other way around , you might start shopping for more expensive homes than you can afford, which affects your lifestyle and leaves you vulnerable to surprises.

Its safest to buy less and enjoy some wiggle room each month. Struggling to keep up with payments is stressful and risky, and it prevents you from saving for other goals.

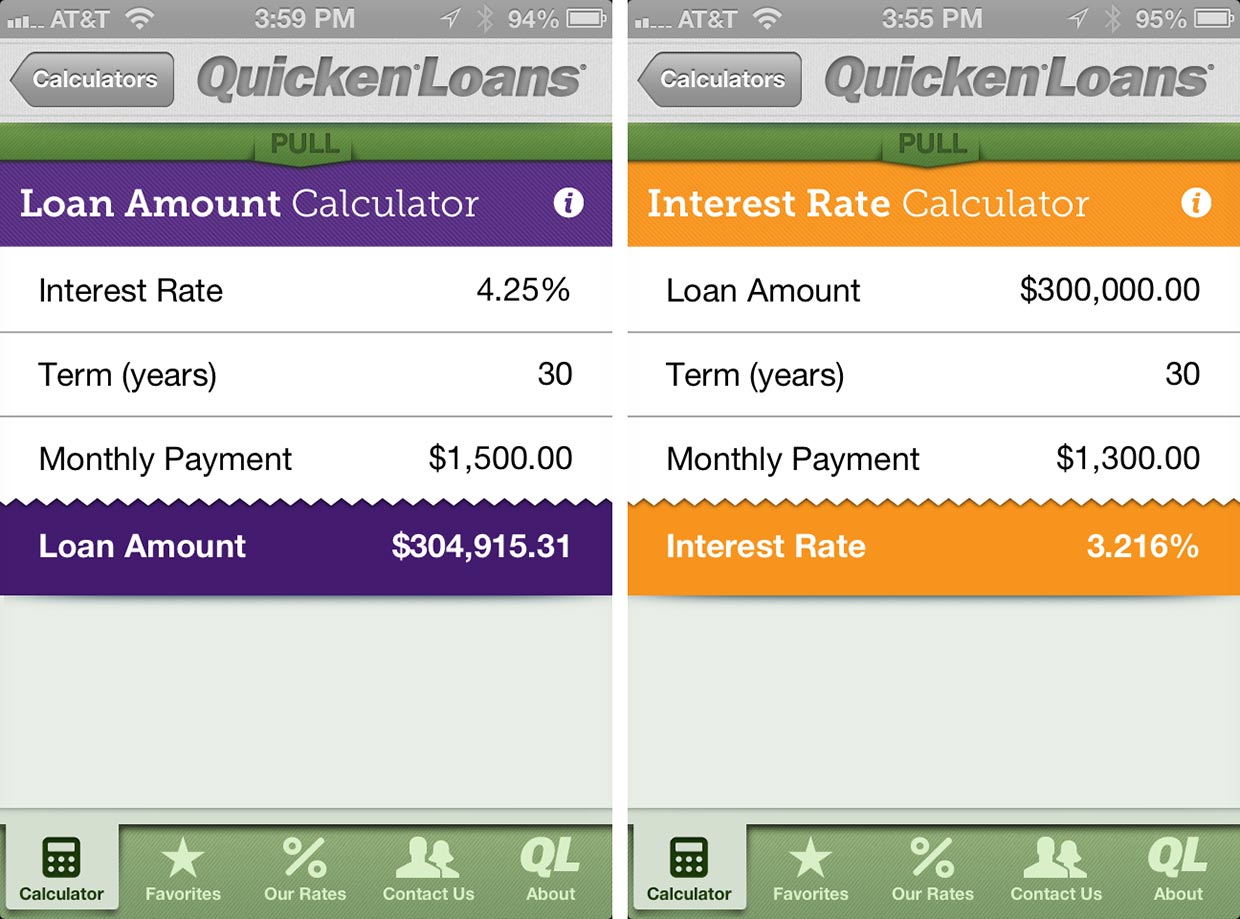

How Do I Use The Mortgage Calculator

Start by providing the home price, down payment amount, loan term, interest rate and location. If you want the payment estimate to include taxes and insurance, you can input that information yourself or well estimate the costs based on the state the home is located in. Then, click Calculate to see what your monthly payment will look like based on the numbers you provided.

Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options.

Recommended Reading: Rocket Mortgage Conventional Loan

In Addition To Principal And Interest The Mortgage Payment Calculator Covers Important Considerations Including Pmi:

- Private mortgage insurance this is an extra layer of protection for the lender that is required with some loans. If you buy a house with less than 20% down payment or equity, some lenders will require PMI. Certain lenders also require it with conventional loans if they are not backed by the government.

- Hazard insuranceprotects you as a homeowner against the costs of damage from fire, vandalism, smoke and other causes. It is commonly confused with a homeowners insurance policy, so it is important to clarify that it is not a separate policy but part of a homeowners policy.

- Property taxeswhen you buy a home, property taxes can be factored into your monthly mortgage payment. These taxes are generally imposed by the county, and often include local taxes for school districts, utilities or city governments. Property tax rates and rules vary depending on your location. These local and government factors will be considered when you enter your information in our mortgage payment calculator.

Tips To Shave The Mortgage Balance

Most mortgages require the home buyer purchase private mortgage insurance to protect the lender from the risk of default. If the borrower do not put a 20% down payment on the house and obtain a conventional loan you must pay for this insurance premium which could be anywhere from 0.5% to 1% of the entire loan. That means that on a $200,000 loan, you could be paying up to $2,000 a year for mortgage insurance. That averages out to $166 a month . This premium is usually rolled into your monthly payment and protects the lender in case you default. It does nothing for you except put a hole in your pocket. Once the equity reaches 20% of the loan, the lender does not require PMI. So if at all possible, save up your 20% down payment to eliminate this drain on your finances.

Another way to save money on your mortgage in addition to adding extra to your normal monthly payments is the bi-weekly payment option. You pay half of a mortgage payment every two weeks instead of the usual once monthly payment. This essentially produces one extra payment a year since there are 26 two- week periods. At the end of the year you will have made 13 instead of 12 monthly payments. So on the 30 year $200,000 loan at 5% example we have been using, the interest was $186,511.57 using monthly payments. If using bi-weekly payments, the interest is only $150,977.71 saving you $35,533.86 over the life of the loan.

Read Also: 10 Year Treasury Vs 30 Year Mortgage