Fixed Rate Loan Vs Adjustable Rate Loan

Mortgages are available with two different types of interest rates: fixed and adjustable.

- On a fixed-rate loan, the interest rate stays the same for the entire life in the loan. That means you lock in the interest rate of todays market for the next 15-30 years.

- On an adjustable-rate loan, the interest rate varies along with the broader financial market. Its likely to go up and down over the course of the loan, which could cause big swings in your mortgage payments.

Rates right now are historically low. An adjustable-rate mortgage might get you a lower interest rate upfront, but you have to be prepared for that to go up over time.

If youre looking at that adjustable-rate mortgage, and youre getting in at what is probably the bottom now, odds are your rates are going to be higher, Bacon said.

But if you plan to stay in this home for many years, youll likely want to lock in a low fixed rate now.

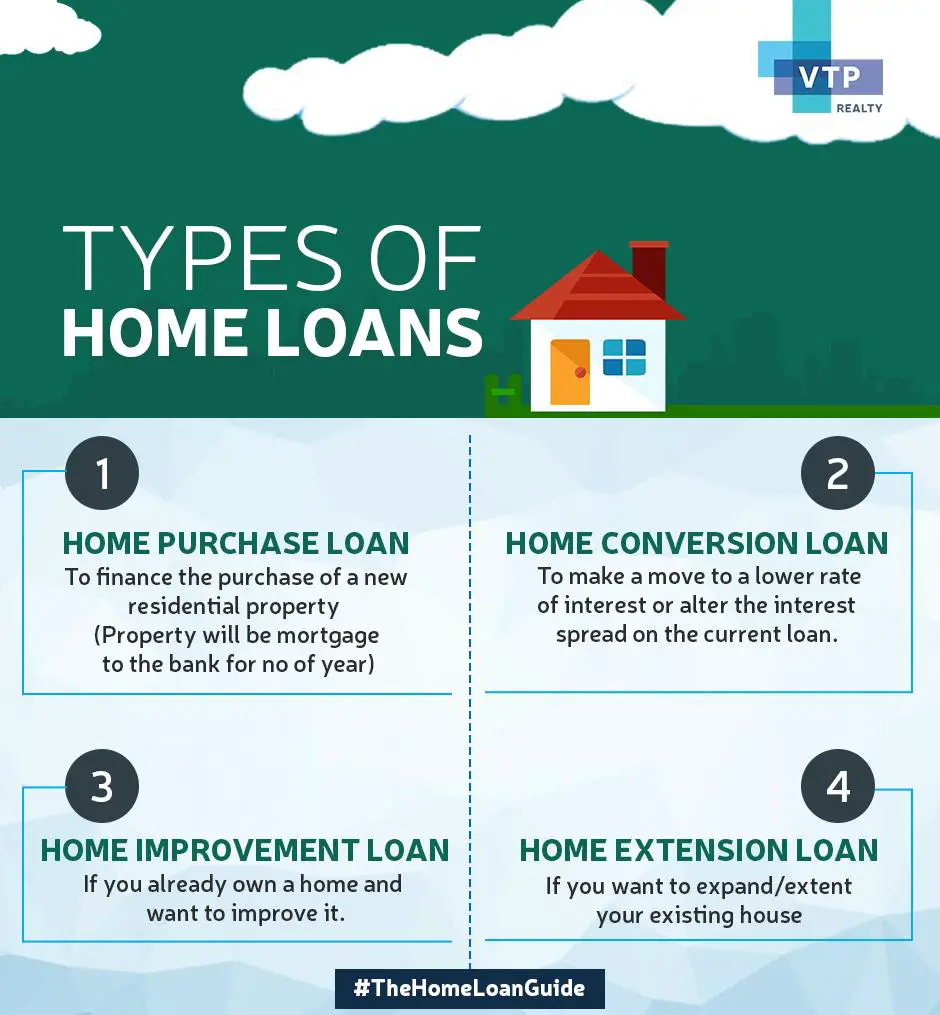

Types Of Mortgage Loans

With so many alternatives on the market, choosing the best mortgage loan can be stressful. Before selecting a mortgage loan or lender, find out about the different mortgage types, terms, and types of interest rates.

Below, well guide you through the process of selecting a mortgage to purchase, build, or renovate your home.

Mortgage Insurance: What You Need To Know

Mortgage insurance helps you get a loan you wouldnt otherwise be able to.

If you cant afford a 20 percent down payment, you will likely have to pay for mortgage insurance. You may choose to get a conventional loan with private mortgage insurance , or an FHA, VA, or USDA loan.

Mortgage insurance usually adds to your costs.

Depending on the loan type, you will pay monthly mortgage insurance premiums, an upfront mortgage insurance fee, or both.

Mortgage insurance protects the lender if you fall behind on your payments. It does not protect you.

Your credit score will suffer and you may face foreclosure if you dont pay your mortgage on time.

You May Like: Can You Get A Reverse Mortgage On A Mobile Home

One Year Traditional Arms

A mortgage loan in which the interest rate changes based on a specific schedule after a fixed period at the beginning of the loan, is called an adjustable rate mortgage or ARM. This type of loan is considered to be riskier because the payment can change significantly. In exchange for the risk associated with an ARM, the homeowner is rewarded with an interest rate lower than that of a 30 year fixed rate. When the homeowner acquires a one year adjustable rate mortgage, what they have is a 30 year loan in which the rates change every year on the anniversary of the loan.

However, obtaining a one-year adjustable rate mortgage can allow the customer to qualify for a loan amount that is higher and therefore acquire a more valuable home. Many homeowners with extremely large mortgages can get the one year adjustable rate mortgages and refinance them each year. The low rate lets them buy a more expensive home, and they pay a lower mortgage payment so long as interest rates do not rise.

Can You Handle Interest Rates Moving Higher?

The traditional ARM loan which resets every year is considered to be rather risky because the payment can change from year to year in significant amounts. Unless the buyer plans to quickly flip the property or has plenty of other assets and is using an interest-only loan as a tax write off, almost anyone taking adjustable rates should try to pay extra in order to build up equity in case the market turns south.

Best For Debt Consolidation And Major Purchases

If you have high-interest credit card debt, a personal loan may help you pay off that debt sooner. To consolidate your debt with a personal loan, youd apply for a loan in the amount you owe on your credit cards. Then, if youre approved for the full amount, youd use the loan funds to pay your credit cards off, instead making monthly payments on your personal loan.

Depending on your credit, a personal loan may offer a lower interest rate than your credit card and a lower interest rate could mean big savings. It may help to get an idea of what the average debt consolidation rate is.

A personal loan may also be a good choice if you want to finance a major purchase, like a home improvement project, or you have other big costs like medical bills or moving expenses.

Read Also: 10 Year Treasury Vs 30 Year Mortgage

Loan Programs And Mortgages For Different Property Types

Many people think of an existing single-family home when they think about homeownership or buying residential real estate. Purchases of this type of property are common, after all. But there are other residential real estate purchases that might be perfect for your lifestyle and/or financial situation.

One of the biggest differences between purchasing a single-family home and a different type of property comes down to the financing. Existing, habitable homes are generally financed with a conventional mortgage, jumbo loan, VA loan, or FHA loan .

Thankfully, there are other mortgages for different property types. Lets break down some of the most common property types and what those mortgage loans might look like.

Watch Out For Credit Requirements And Interest Rates

Since unsecured personal loans dont require collateral, lenders usually turn to your credit reports and credit scores to help determine if youre a good candidate for a loan. In general, people with higher credit scores will be eligible for better loan terms.

You may be eligible for an unsecured personal loan even if you have fair or bad credit. But you may want to shop around to make sure the interest rate and monthly payment is affordable for your budget.

Recommended Reading: Chase Mortgage Recast Fee

Fixed Vs Adjustable Rate Mortgages

A fixed-rate mortgage is a mortgage where your interest rate is fixed for the entire term of your loan. If you close on a 30-year mortgage on Jan. 1, 2022, at an interest rate of 2.99%, and you never move, refinance, or make additional payments, then your interest rate is still 2.99% when you make your final payment on Jan. 1, 2052. A mortgage calculator can show you the impact of different rates on your monthly payment.

An Adjustable-Rate Mortgage conversely has a rate that changes at set periods of time. The most common mortgage ARMs are 7/1 and 5/1, but technically any ARM term is possible. On a 7/1 ARM, the rate remains the same for the first seven years and is then adjusted every single year thereafter.

Adjustable rate mortgages became very popular prior to the subprime mortgage crisis because they offered lower initial payments, but then lead to a wave of foreclosures as the rates increased and made the mortgage payments unaffordable for thousands of Americans. ARMs are risky for most borrowers and are generally not a great choice unless they intend to pay off their mortgage or refinance before their rate adjusts.

The Different Types Of Loans In Canada: Explained

Interest rates can be a very complicated matter to understand, especially for first-time home buyers who are unfamiliar with the rules and regulations surrounding loans in Canada. However, understanding interest rates is not something you have to master all by yourself, so here is an explanation of different types of loans.

Read Also: Chase Mortgage Recast

Loan Against Insurance Policies:

If you have an insurance policy, you can apply for a loan against it. Only those insurance policies that are aged over 3 years are eligible for such loans. The insurer can themselves offer a loan amount on your insurance policy. Approaching the bank for the same is optional. You need to submit all the documents related to the insurance policy to the bank.

Recommended Reading: Max Fha Loan Amount Texas 2021

How Your Mortgage Payments Are Calculated

Mortgage lenders use factors to determine your regular payment amount. When you make a mortgage payment, your money goes toward the interest and principal. The principal is the amount you borrowed from the lender to cover the cost of your home purchase. The interest is the fee you pay the lender for the loan. If you agree to optional mortgage insurance, the lender adds the insurance charges to your mortgage payment.

Read Also: Rocket Mortgage Conventional Loan

Conforming & Jumbo Loans

The government housing promotion agencies Fannie Mae and Freddie Mac provide guidelines for the required income and down payment for aspiring borrowers. The Federal Housing Finance Administration FHFA stipulates limits on the size of loan amounts, given income and credit scores of applicants.

Together, these guidelines and limits seek to limit the risk of default. The Government Sponsored Entities that provide loan guarantees do not protect mortgages issued outside of the conformance limits.

A conforming conventional loan is a conventional mortgage that conforms to the Federal Agency guidelines. In contrast, Jumbo Loans exceed the limits laid down.

Accordingly, they attract a higher interest rate as the lenders seek to cushion themselves against the increased risk of default without the backing of a federal guarantee.

What Are The Different Types Of Mortgage Loans

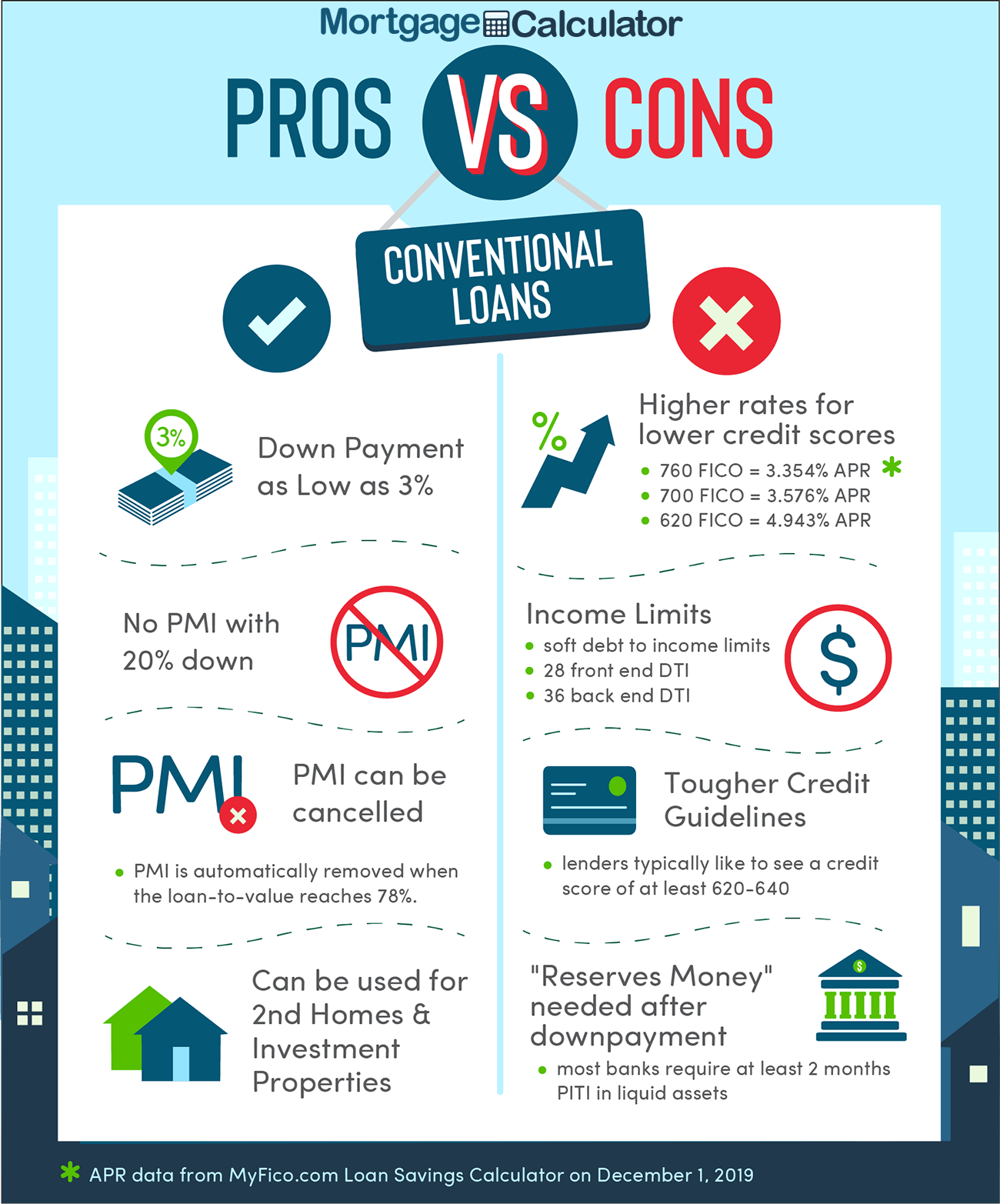

Mortgage types for homebuyers are categorized as conventional or government-backed and can be either conforming or nonconforming. Depending on the type of loan, you might have to choose between fixed or adjustable interest rates.

- Conventional loans: Conventional loans are mortgages issued by private lenders. They are not guaranteed by the federal government. A conventional loan can be conforming, with limits set by the government and Fannie Mae and Freddie Mac, which back conforming loans or nonconforming, with less standardization for eligibility, pricing and features. A jumbo loan with a high dollar amount is an example of a nonconforming loan.

- Government loans: These loans are insured by the government and often have more lenient eligibility requirements than conventional loans. Examples of government loans include FHA, VA and USDA home loans.

- Fixed-rate mortgages: A fixed-rate mortgage includes a set interest rate for the entire duration of the loan.

- Adjustable-rate mortgages: An adjustable-rate mortgage has a rate thats initially fixed for a set period, then it adjusts. For example, a 5/1 adjustable-rate mortgage has a fixed interest rate for the first five years of the loan duration, then there’s an annual adjustment.

Don’t Miss: Reverse Mortgage Mobile Home

How They Get Paid

Mortgage brokers charge a fee for their services, about 1% of the loan amount. Their commission can be paid by the borrower or lender. You can take a loan at par pricing, which means you wont pay a loan origination fee and the lender agrees to pay the broker. However, mortgage lenders typically charge higher interest rates. Some brokers negotiate an up-front fee with you in exchange for their services. Make sure you ask prospective brokers how much their fee is and who pays for it.

Us Department Of Agriculture Loans

Buyers in rural and suburban areas may qualify for loans backed by the USDA. These set income limits, have low down payment requirements and generally tend to favor lower-income purchases of rural real estate in demarcated areas.

The credit criteria vary from area to area, and overall, are not as strict as prohibitive as the federally backed urban equivalents.

Don’t Miss: Rocket Mortgage Requirements

Why Homebuyers Use This Type Of Loan

- Interest rates are usually lower than for fixed-rate loansat least at the start of the loan.

- Some homebuyers use ARMs to keep their payments lower near the beginning of the loan. This can work in their favor if they plan to resell or refinance the home, especially before the ARMs first rate adjustment.

Different Types Of Mortgages In Canada

There are plenty of options when it comes to mortgages in Canada. Before you make any final decisions, always make sure to compare rates to ensure youre getting the most value possible.

Open Mortgages

If youre looking to make large payments toward your mortgage or pay off the entire thing without penalties, then an open mortgage is the best choice for you because it offers maximum flexibility in exchange for some fluctuation in interest rates.

Closed Mortgages

A closed mortgage means youre committing to a predetermined interest rate over a specific period of time. With this option you can select a fixed or variable rate depending on your preference or specific needs.

Conventional/Low-Ratio Mortgages

This is a mortgage where the down payment is equal to 20% or more of the propertys purchase price/value. Normally this type of mortgage doesnt require mortgage protection insurance.

High-Ratio Mortgages

A high-ratio mortgage is the opposite of conventional, where the borrower is contributing less than 20% of the purchase price/value as a down payment. These types of mortgages require mortgage default insurance through one of Canadas mortgage insurance companies: Canada Mortgage and Housing Corporation , Genworth Financial or Canada Guarantee.

Fixed-Rate Mortgages

Adjustable-Rate Mortgages

Home Equity Lines Of Credit

You May Like: Reverse Mortgage Manufactured Home

What Type Of Mortgage Should I Get

Whether youre refinancing your mortgage, renewing your mortgage or applying for the first time, there is no right or wrong answer in terms of which mortgage is best for you. Do your homework, have a solid grasp on your financial situation, assess your needs and seek advice from a professional to better understand your options.

When it comes to buying a home, theres a lot to learn and mortgages are just the start. But creating a solid foundation through learning and understanding, will ensure that no matter what home you decide to buy and how, youre prepared and confident with your decision.

Open And Closed Mortgages

There are a few differences between open and closed mortgages. The main difference is the flexibility you have in making extra payments or paying off your mortgage completely.

Open mortgages

The interest rate is usually higher than on a closed mortgage with a comparable term length. It allows more flexibility if you plan on putting extra money toward your mortgage.

An open mortgage may be a good choice for you if you:

- plan to pay off your mortgage soon

- plan to sell your home in the near future

- think you may have extra money to put toward your mortgage from time to time

Closed mortgages

The interest rate is usually lower than on an open mortgage with a comparable term length.

Closed term mortgages usually limit the amount of extra money you can put toward your mortgage each year. Your lender calls this a prepayment privilege and it is included in your mortgage contract. Not all closed mortgages allow prepayment privileges. They vary from lender to lender.

A closed mortgage may be a good choice for you if:

- you plan to keep your home for the rest of your loans term

- the prepayment privileges provide enough flexibility for the prepayments you expect to make

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

Home Equity Loans And Reverse Mortgages

Both these products allow homeowners to capitalize on the equity of their homes. Home Equity Loans are the general form of a loan secured against property already in possession of the borrower.

Reverse mortgages were designed for homeowners over the age of 62. A popular version of this instrument is the Home Equity Conversion Mortgage , insured by the Federal Government.

This allows retirement age homeowners to borrow against a portion of the value of their home the home equity. It is tailored around the liquidity profiles of retirees and does not require repayment before the death or sale of the underlying property.

Conventional Loan Vs Fha And Other Government

Next, you need to determine if you qualify for a conventional loan or government-backed mortgage.

- If you have a strong credit history: Conventional mortgages are usually best for prospective homebuyers with a strong credit history, stable income and the ability to make a down payment of at least 5%. Conventional mortgage loans can be used to finance a primary residence, secondary home or investment property.

- If you have low to moderate income: Government-backed mortgages are typically easier to qualify for than conventional mortgage loans. They have more relaxed lending guidelines and payment terms.

Don’t Miss: Chase Recast

You Should Get A Government

As you can see, not all government-insured loans are created equal.

Consider taking out an FHA loan if you have weaker credit or lower income, and its the only way you can afford to buy your first home.

For veterans and military spouses, VA loans generally make for the best option if you qualify for them. But compare the life-of-loan interest and fees for your own VA loan and conventional loan quotes for a personalized analysis. You can run these numbers using a free online mortgage calculator such as MortgageCalculator.org.

Like VA loans, USDA loans tend to cost less over the life of the loan than their conventional counterparts. Still run the numbers for your own loan quotes before deciding however.

Bottomline About Types Of Home Loans

Since there is such a wide variety of mortgage types and loans, choosing the best option will depend on the property, its location and value, and the borrowers credit history and score.

There are government-backed options for those with low credit scores, a high debt-to-income ratio, and for first-time homebuyers. Potential borrowers should plan and determine what term, interest rates and lender offers the best option to afford their home and stick to their financial goals.

- Categories

You May Like: Rocket Mortgage Vs Bank

Conforming Vs Jumbo Mortgages

First, figure out how much you need to borrow.

- If you need to borrow less than $548,250: A regular conforming loan works. You can get conforming loans from both conventional and government lenders. With a conforming loan, you’ll typically be able to make a lower down payment or pay a lower interest rate than with a nonconforming loan that is not backed by a government-sponsored enterprise .

- If you need to borrow more than $548,250: Jumbo mortgages are best for those who want to buy a really expensive house and also have the credit score to qualify. Generally, nonconforming loans are best for high-income homebuyers who want to borrow above the limits of conforming loans and are willing to make a larger down payment.

Most mortgages have a fixed rate and a 30-year term.