What Is Deferred Interest

Deferred interest is when interest payments are deferred on a loan during a specific period of time. You will not pay any interest as long as your entire balance on the loan is paid off before this period ends. If you do not pay off the loan balance before this period ends, then interest charges start accruing.

Deferred interest options are also available on mortgages, known as a deferred interest mortgage or a graduated-payment mortgage.

Deferred Interest On A Loan Isnt As Great As It Sounds And Could End Up Costing You A Lot Of Money

Deferred interest loans are a type of loan with deferred interest, which is when the interest due on the loan is not paid until sometime in the future. The main purpose behind these types of loans is to allow people to use money without having to pay interest. These types of loans can be thought of as a type of interest free loan, which allows people to be able to get more purchasing power than they would have if they had merely saved the money that they didnt have beforehand.

If youve ever taken out a student loan, then you probably know what its like being at least somewhat familiar with deferred interest payments. If you notice your monthly payment includes some money towards paying off your debt, but doesnt show up later on as payments towards the interest accrued on your loan, you know that you are paying deferred interest.

This is the main thing that separates deferred interest loans from normal loans However, there are a lot of differences between deferred interest loans and student loans. Student loans typically have very small amounts of interest each month, so it is perfectly suited for making the payments towards paying off your debt while still having enough money to use for your comfortability and convenience.

Deferred interest is a poisonous snake waiting to strike from a wrapped gift with a bow on top.

Hows that for a visual metaphor?

Understand what deferred interest means and all the consequences before you decide to go down that road.

Are The Deferred Payments Erased Or Cancelled

The mortgage deferral agreement does not cancel, erase or eliminate the amount owed on your mortgage. At the end of the agreement, you will have to resume payment according to your regular payment schedule.

NOTE: The interest that hasnt been paid during the deferral period continues to be added to the outstanding principal of your mortgage. This can affect the total amount you owe in accordance with the original payment schedule.

Read Also: Is A Home Equity Line Of Credit Considered A Mortgage

What Happens At The End Of The Deferral Period

When the agreement to defer your mortgage payments comes to an end, you are required to resume payments.

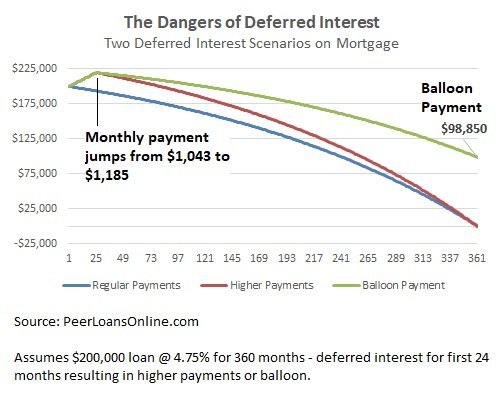

The good news is you do not have to suddenly come up with a lump sum or balloon payment to catch up on all deferred payments. The bad news is, when you resume payment, your monthly mortgage payment will be higher than it was pre-deferral, and heres why:

Most mortgage lenders, including the big six banks, add interest charged during the deferral to your mortgage and will recalculate future payments. Payments will be adjusted so that you pay off your mortgage at the same date you would have before deferring. Paying off what is now a higher mortgage outstanding at the same end date means your monthly payment must go up.

Here is an example:

A $200,000 mortgage at 3% with a 15-year amortization has a monthly mortgage payment of $1,379. After deferral, amortizing $202,981 over the remaining 14 years and 6 months requires a monthly payment of $1,438.

The end result is an increase in your monthly mortgage payment in our example 4.3% or $59 a month.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Don’t Miss: What Is The Payoff On My Mortgage

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

What To Do If You Cant Pay Deferred Mortgage Payments

Home » Blog » What To Do if You Cant Pay Deferred Mortgage Payments

Reading time: 9 minutes

2020-10-08

When the COVID-19 crisis hit at the beginning of 2020, millions of Canadians saw their income reduced significantly or lost it altogether. Renters struggled with rent payments homeowners were worried about meeting their monthly mortgage payment.

The government took widespread measures to provide citizens with financial support during the pandemic through programs like CERB. Mortgage lenders stepped up with payment deferral programs to help homeowners experiencing financial hardship due to COVID-19.

Close to 1 million Canadians1 deferred more than $1 billion2 in mortgage payments each month during the program. And while mortgages accounted for 88%3 of all loan balances deferred, this only represented 27% of all credit accounts. Canadians struggled with more than mortgages 32% of account deferrals were credit cards, 10% were auto loans, and 13% of deferral requests were for bill payments.

If you are now facing the end of your mortgage payment deferral period, here is what you need to know about what happens to your payments and what to do if you cant pay your new, post-deferral mortgage payments.

Recommended Reading: Who Offers 20 Year Mortgages

Payment Option Adjustable Rate Mortgages

In the mortgage market, lenders can offer borrowers a payment-option adjustable-rate mortgage. This type of product is one of the most common loans where negative amortization will occur.

In an adjustable-rate mortgage, borrowers pay both a fixed rate and a variable rate of interest. Payment options will likely start with a low fixed interest rate for a short period of time. Once the borrower reaches a specified reset date, they will then have several options on the type of payment they would like to make in the variable rate portion of the loan.

The borrower might make the minimum fixed interest payment. They may also have the option to pay only interest. They can also pay the standard variable rate that is required or they may also have other options determined by the lender. In all scenarios except for the standard loan payment, the borrower will incur deferred interest since the payment is below the standard amount. The excess balance is then added to the outstanding balance.

In a payment-option ARM, the borrower has various options at each payment time. They may choose to make the minimum payment in one month followed by a higher payment in the following month. Payment option ARMs were designed to help borrowers with volatile income levels since borrowers can choose from any payment option at each month when the payment is required.

Types Of Deferred Interest Mortgages

One form of deferred interest mortgage is the balloon payment mortgage. This mortgage offers lower monthly payments with a larger payment due later. The risk of these loans is that your financial situation may not improve to support the payment of your balloon when its due.

Other deferred payment options are the graduated-payment mortgage, a type of loan in which payments steadily increase. Youll need to plan for how youll make these payments when they increase.

A payment-option ARM is a loan product that lets you choose how your payment will be structured, such as:

- A reduced-interest payment with the remaining interest due added to your principal

- An interest-only payment

- A traditional principal and interest payment

You May Like: Can Low Credit Score Get Mortgage

During A Suspended Payment Forbearance Plan What Happens To The Interest On The Mortgage Loan

During a forbearance plan, interest is not paid but still accrues. After the forbearance plan is complete, if the borrower is approved for another workout option, the type of workout option offered will determine how the interest is handled. For example, if the mortgage loan is brought current via a COVID-19 payment deferral, the missed principal and interest payments will not be capitalized into the new modified UPB. Instead, the borrowers missed payments will be placed into a non-interest bearing balance due at maturity of the mortgage loan or earlier payoff.

Note: This FAQ is from the Fannie Mae COVID-19 Frequently Asked Questions.

See below for more information on COVID-19:

How Deferred Interest Offers Get Tricky

Deferred interest seems like a great deal on the surface. You get to divide up the hefty cost of that refrigerator or set of tires you need across, say, 12 months, without paying interest making your purchase much more affordable.

The devil and the risk of having to pay that deferred interest after all is in the details. Thats why its crucial to go over the fine print of any offer very carefully. Here are some of the details you need to watch out for when reviewing deferred interest offers:

Also Check: How Much Is Mortgage Insurance In Michigan

Deferred Interest Credit Cards

While less common, you may also see deferred interest offered on credit cards. This works the same way a deferred interest loan does: There are no interest charges on the card’s balance for a set period as long as you pay off your balance by the end of the predetermined time.

If you aren’t able to pay it off in time, however, you’ll owe all of the interest that accrued up until that point. Just as with a deferred interest loan, this steep fee can set you back by a lot, especially if you weren’t expecting it.

A better alternative is a 0% intro APR credit card, which offers a no-interest introductory period for a set time, such as one year. During that time, you pay no interest, but interest also does not accrue. That means if you’re carrying a balance once the introductory period ends, you will only pay interest charges moving forwardnot retroactively like you would with a deferred interest credit card.

What Is A Mortgage Deferral

A mortgage deferral is an agreement between you and your financial institution. It allows you to delay your mortgage payments for a defined period of time.

After the deferral period ends, you resume making your mortgage payments. You also have to repay the mortgage payments you defer. Your financial institution determines how you repay the deferred payments.

This can include:

- extending the mortgage amortization period

- adding the deferred payments to your mortgage balance at the end of your term

- increasing your regular payment amount after the deferral period is over

This means your regular mortgage payments can be higher, depending on how you need to repay the deferred payments.

During the deferral period, your financial institution continues to charge interest on the amount you owe. They will add this amount to your outstanding mortgage balance. With a higher mortgage principal, your interest fees are higher. This could cost you additional thousands of dollars over the life of your mortgage.

If you expect to continue to experience financial hardship once your mortgage deferral period ends, consider your options now.

You May Like: How To Remove Pmi From Your Fha Mortgage

Deferred Interest Vs 0% Apr

A 0% APR offer is different from deferred interest. In the case of 0% APR, one will not need to pay any amount of interest, and the interest shall only start to accrue once the promotion ends. If there is a minimum balance left at the end of the offer, then the interest will incur on that small amount only whereas, in a deferred interest loan, a sizeable retroactive charge is built for the promotional period.

Extended Mortgage Payment Deferral

Extended mortgage payment deferrals are for a longer period than the standard deferral period. You may be able to defer your mortgage payment beyond the allowed period.

Usually, you can only defer your payments up to a predefined amount. After you reach this amount, you have to start making your regular payments again.

If you have an insured mortgage, the financial institution needs approval from the insurer before approving your request.

Don’t Miss: Do Medical Collections Affect Getting A Mortgage

How Mortgage Deferral Affects Your Principal Balance And Interest

During COVID-19, CMHC-insured mortgages were eligible for up to 6 months of payment deferrals. Non-insured mortgages deferral periods are at the discretion of your lender but were similar.

Deferring your mortgage payments does not erase, cancel, or eliminate any of the amount owed.

While you skipped mortgage payments, you did not reduce any principal during the deferral period.

Your mortgage lender also continued to charge interest during the deferral period. This interest is added to your outstanding mortgage balance, which means that the total amount you owe is now higher.

For example, at a fixed interest rate of 3%, every $200,000 in mortgage debt deferred for six months will add $2,981.40 in accumulated interest to the principal. The new mortgage balance owing at the end of the period would be $202,981.

How Deferred Interest Works

Deferred interest allows you to temporarily pay less interest than lenders typically charge. The offer is typically attached to a store card, which is where you charge the purchase. You can spot deferred interest when you see the term same as cash or no interest loan for 12 months. You’ll notice an influx of these offers around the winter holidays, as retailers entice buyers to spend extra on gifts and pay for them later. Online retailers and their branded credit cards also make these offers.

Let’s say you want to buy a couch for $2,000. The furniture store offers no interest for 36 months if you use the store card to pay for it. You put your couch on the store card, which has a 22% APR. Your card may set your minimum payments to be enough to pay off the couch in 36 months, but you should do the math to confirm. $2,000 divided by 36 is $55.56, which means you should pay at least $56 per month to have it paid off at the 36-month mark, but you can pay it off sooner to have a cushion. If you pay it off on time, you essentially had an interest-free loan.

If you miss a payment or two or pay less than $56 per month, you’ll miss the deadline. You’ll be charged the balance that’s left on the couch plus 36 months of accrued interest at 22%. Your no interest purchase now has a significant amount of interest.

Recommended Reading: How Much Interest Will I Pay Mortgage Calculator

Will A Mortgage Company Defer A Payment

A mortgage company will typically agree to defer a payment however, the decision to do so will depend entirely on the lender. In many cases, the deferral can be a win-win scenario for both you and the lender, since it will help you to avoid foreclosing on your home. If you suspect that you will need to defer a payment, then you should speak with the lender as soon as possible.

With this in mind, many lenders will typically approve a deferral if you can prove that you are experiencing financial hardships. Income statements, medical bills, and termination letters can all be used as proof of your financial hardship. It is important that you also prove that the hardship is temporary. If you cannot prove that you will be able to resolve your financial hardship in a timely fashion, then your request for a deferral might be denied.

How To Avoid Getting Hit With Deferred Interest

Avoiding deferred interest is straightforward you just have to follow through on the exact terms of the offer, including paying off your balance in full before the promotional period expires. Also make sure you make your minimum payments on time. And for the best chance of success, you should wait to make additional purchases on the card until after your special-financing balance has been paid off.

A simple calculation can show you how much you need to pay off each month to avoid having deferred interest applied to your account. Divide the balance you owe on your card by the number of billing cycles remaining before your deferred interest period expires. The result is the smallest amount youd have to pay each billing cycle to pay the balance off in full before the promotion expires.

Consider paying the balance in full as soon as you can avoid cutting it too close to the deadline. And, assuming its the only balance youre carrying on the card, try to pay more than the minimum amount each month. This builds up some wiggle room in the payment schedule, putting you in a better position to handle unforeseen expenses that might pop up before the deferred interest deadline.

You May Like: What Are Current Mortgage Rates In Oregon

Have You Tried To Negotiate A Deal That Works For You

You can try to negotiate a deal with your lender. For example, a lender may agree to wave your late fees once you get caught up on your missed payments. No matter the financial hardship, you will need to present a strong case for how you will resume payments in the future if they are going to allow you to defer your mortgage payment or cut you slack in another way.