What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

How To Lower Your Monthly Payments

If your mortgage calculator results are not yielding the lower monthly payments you hoped for, here are several techniques to try:

- Lower purchase price: The less you borrow, the lower your mortgage payment

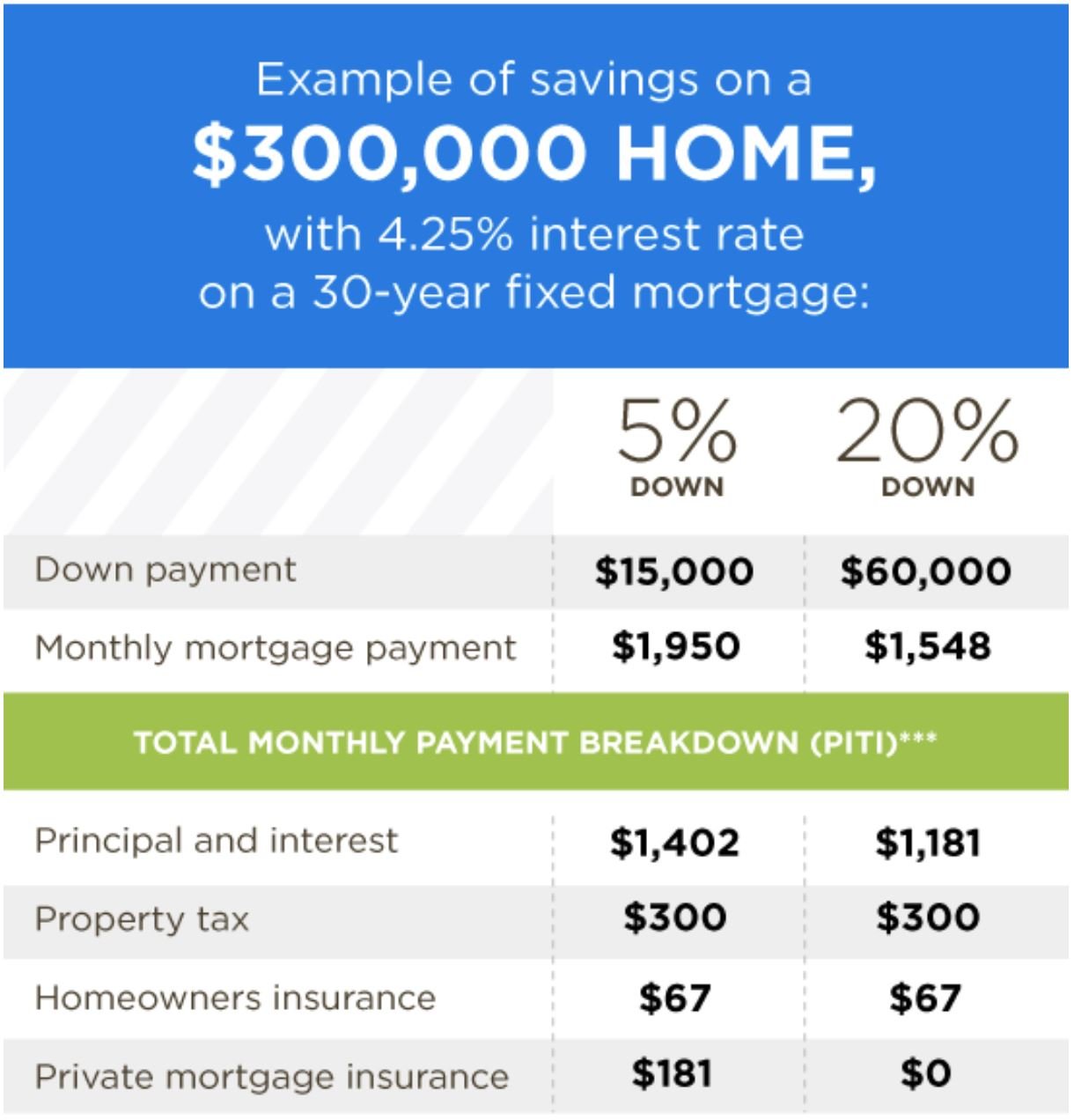

- Bigger down payment: Putting more money down means youll borrow less. Also, the best mortgage rates generally go to borrowers with larger down payments, among other qualifying factors

- Avoid private mortgage insurance: When you put at least 20% down on a conventional loan or 20% home equity on a refinance you can avoid paying monthly private mortgage insurance premiums

- Longer loan term: A longer loan term means lower monthly payments. However, you will pay more in total interest over the life of the loan

- Shop for a lower rate: Rate shopping doesnt have to take long, and its well worth the savings. Here are tips to get your best mortgage rate

How Much Do I Qualify For Mortgage

This rule says that your mortgage payment should be no more than 28% of your pre-tax income, and your total debt should be no more than 36% of your pre-tax income.

Just so, how much can I borrow for a mortgage based on my income?

Four components make up the mortgage payment, which are: interest, principal, insurance, and taxes. A general rule is that these items should not exceed 28% of the borrowers gross income. However, some lenders allow the borrower to exceed 30% and some even allow 40%.

Also, how much do I need to make to afford a 300k house? The oldest rule of thumb says you can typically afford a home priced two to three times your gross income. So, if you earn $100,000, you can typically afford a home between $200,000 and $300,000.

Likewise, how much do I need to make for a 250k mortgage?

To afford a house that costs $250,000 with a down payment of $50,000, youd need to earn $43,430 per year before tax. The monthly mortgage payment would be $1,013. Salary needed for 250,000 dollar mortgage.

How much should I spend on a house if I make 100k?

Some experts suggest that you can afford a mortgage payment as high as 28% of your gross income. If true, a couple who earn a combined annual salary of $100,000 can afford a monthly payment of about $2,300/month. That could translate to a $450,000 loan, assuming a 4.5% 30-year fixed rate.

You May Like Also

Don’t Miss: How Do Mortgage Rates Work

How To Increase Your Home Affordability

You can take some steps to improve your financial situation so that you can afford to spend more on a home. These tips can help you increase your homebuying budget:

- Raise your credit score. Paying bills on time, paying down your debt balances, keeping credit accounts open, reviewing your credit report regularly, and disputing errors on the report can help improve your credit score

- Save more money. The more you can put down on a home, the more favorable the loan terms. Focusing on saving up for a larger down payment can increase your home affordability

- Pay down debt. If you have higher interest debt, such as credit card bills or auto loans, paying these down may help you toward your homebuying goal. Focus on debts with the highest payments first

- Search for homes in lower-cost areas. Home prices vary across the country. So do property taxes. Looking for homes in less-expensive areas with lower taxes or no HOA duesmight mean you can get a larger house for less

- Shop around for the best mortgage lender. Different lenders offer different loan products with different requirements and terms. Shop around and get pre-approved with multiple lenders to see which one is the best fit for you

Working on one or more of these things can help you afford more house on a $100k salary.

Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

Don’t Miss: How Much Mortgage On 80k Salary

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

Where To Get A $100000 Mortgage

To get a $100,000 mortgage loan or any mortgage for that matter youll need to shop around with various lenders.

Because rates and terms can vary from one lender to the next, this will allow you to get the lowest rate and most affordable loan possible.

You can reach out to various mortgage lenders individually and request quotes, though this may take some time. Credible offers a more efficient option. With Credible, you can compare all of our partner lenders at once and receive prequalified rates in a matter of minutes.

Read Also: How Much Would A Mortgage Be For 250 000

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

How Much Can I Afford

Everyone knows you cant spend 100% of your income on housing. You still have to pay for food, utilities, and actually having fun every once in a while.

Mortgage lenders and the Canadian Mortgage and Housing Corporation know this too, which is why they have two guidelines they follow when deciding whether to approve your mortgage: gross debt service and total debt service ratios.

You May Like: What Lender Has The Lowest Mortgage Rates

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

How To Get A $100000 Mortgage

Getting a $100,000 mortgage isnt as complicated as it seems.

Once youre ready to apply, just follow this nine-step process, and youll be well on your way to buying the home of your dreams:

Learn More: How Long It Takes to Buy a House

Also Check: How To Cut 30 Year Mortgage In Half

Tips To Help You Determine An Appropriate Home Cost

When attempting to determine how much mortgage you can afford, a general guideline is to multiply your income by at least 2.5 or 3 to get an idea of the maximum housing price you can afford. If you earn approximately $100,000, the maximum price you would be able to afford would be roughly $300,000. There are other factors to take into consideration as well, including your credit score, the interest rate you are able to procure, and the amount you are able to put down.

Another rule to adhere to when determining how much home you can afford is that your monthly mortgage payment should not surpass 28% of your monthly income. For example, if you make $100,000 per year, your monthly mortgage payment should not exceed $2,333. A few other important rules to follow are that your total debt should not exceed 40% of your monthly earnings and your total monthly housing payments should be over 32% of your total monthly income.

How Much Is A 100000 Mortgage A Month

When considering taking out a £100,000 mortgage, one of the key things to think about is how much it is going to cost you each month. Depending on the size of your deposit and the amount you borrow, your monthly repayments could vary quite considerably.

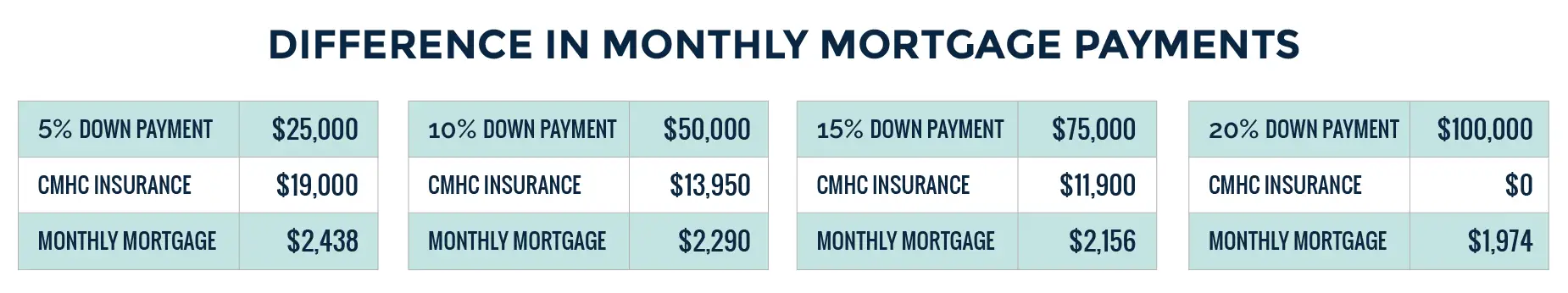

Of course, the size of your deposit and the length of time you borrow for will have a direct impact on your monthly repayments. So if you were to increase your deposit to 20%, your monthly repayments on a £100,000 mortgage would be lower than if you only put down a 5% deposit.

Similarly, the longer you borrow for, the more interest you will pay over the life of the mortgage but the cheaper it will be each month.

To give you an idea of how much a £100,000 mortgage might cost each month, weve put together some examples below.

As a guide only, the tables below provide an indication of monthly payments.

| INTEREST ONLY 100k |

|---|

The monthly cost of a £100,000 mortgage will vary according to three main factors:

Read Also: Can Three People Be On A Mortgage

Quickly Estimate The Cost Of Interest Rate Shifts

For any fixed-rate mortgage, select the closest approximate interest rate to your loan from the left column, then scroll look at the payment-per-thousand column for the respective amount to multiply the number by. Then multiply that number by how many hundreds of thousands your home loan is.

- A 3% APR 15-year home loan costs $6.9058 per thousand. If you bought a $100,000 home that would mean the monthly payment would be 100 * $6.9058, so move the decimal places 2 spots to the right and you get a monthly payment of $690.58.

- The total loan cost would be 100 * $1,243.05 Again, move the decimal 2 places to the right & you get $124,305.

- And then if you wanted to figure out the cost of interest you would subtract the $100,000 from $124,305 to get $24,305.

Another way of thinking of the first thousand from the full cost per thousand category is that it includes the thousand you borrowed, so if you subtracted the first thousand from any of these figures that would represent the portion of spending allocated to interest on the loan.

This table scales by 1/8th of a percent from 2% to 10%. At the lower end 0%, 0.5% & 1.0% are added to highlight how little banks pay depositors relative to what they charge creditors. And at the top end 15%, 20% & 25% were added to show how extreme the spread is between deposits and what a credit card might charge a borrower.

| Interest Rate |

|---|

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Also Check: How Much Mortgage Can I Get On 50k Salary

Can I Get A 100000 Buy

Assuming theres a property on the market that this loan will cover and you pass the lenders eligibility and affordability checks, theres no reason why not.

There are things you should keep in mind when applying for a buy to let mortgage, though.

Firstly, the deposit requirements are typically higher, with some lenders expecting as much as 25%, although others may offer you a BTL mortgage with a 15% deposit.

Certain providers have minimum income requirements for BTL, too, with around £25,000 being standard, but affordability usually comes down to the viability of the investment i.e. whether the propertys forecast rental income will cover the monthly mortgage repayments by 125-130%.

Also take note that there are lenders who only offer BTL mortgages to borrowers who have owned and lived in their home for at least six months, although some specialist providers offer buy to let deals to first-time buyers, subject to their eligibility requirements being met.

Most BTL mortgages are offered on an interest only basis. See the section below to find out what the monthly repayments on a £100,000 interest only mortgage might be.

What Is The Best Mortgage Term For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Recommended Reading: What Is A Pre Qualified Mortgage

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter your and your partnerâs income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you donât know them.

With these numbers, youâll be able to calculate how much you can afford to borrow. You can also change your amortization period and mortgage rate to see how that would affect your mortgage affordability and your monthly payments.