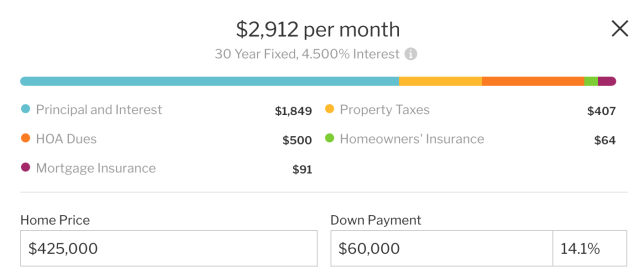

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

How Much Is A 300k Mortgage Per Month Uk

Typically, the longer your repayment term, the less itll cost per month, but the more youll likely pay back overall. For example, if you take out a £300,000 mortgage over 30 years at a rate of 3.92%, youd pay £1,418 per month and £510k overall. But a 10-year term would cost £3,026 a month and £363k in total.

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

What Is An Interest

An interest-only mortgage is a loan with monthly payments only on the interest of the amount borrowed for an initial term at a fixed interest rate. The interest-only period typically lasts for 7 – 10 years and the total loan term is 30 years. After the initial phase is over, an interest-only loan begins amortizing and you start paying the principal and interest for the remainder of the loan term at an adjustable interest rate.

Using an interest-only mortgage payment calculator shows what your monthly mortgage payment would be by factoring in your interest-only loan term, interest rate and loan amount. The result is your estimated interest-only mortgage payment for the interest-only period and doesnt account for the principal payments youll make later when the loan beings amortizing.

Read Also: Reverse Mortgage On Condo

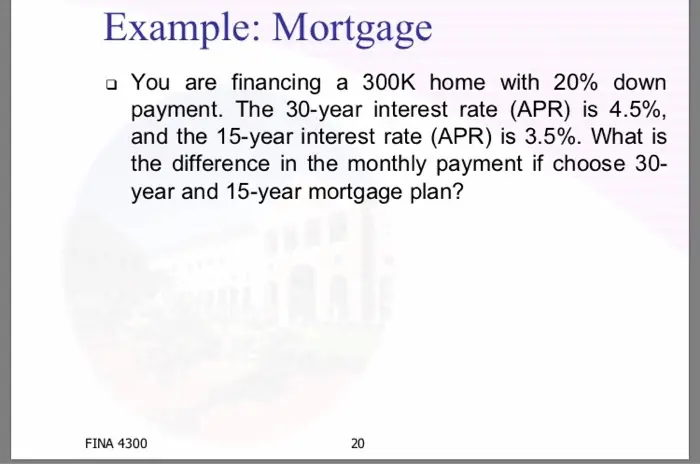

Whats The Monthly Payment On A $300000 Mortgage

The answer to this question depends on several variables. When calculating your monthly mortgage payment, you have to factor in your interest rate, home price, loan term, down payment amount, and whether you need to pay private mortgage insurance, or PMI.

For example, a lower interest rate or higher down payment could lower your monthly payment. But if you take out a larger loan or receive a higher interest rate, this could increase your monthly note.

Manually estimating your monthly mortgage payment involves some complex calculations. But you can also use a mortgage payment calculatorto easily get an idea of how much your monthly payment might be on a $300,000 mortgage. Here are two examples.

Saskatchewans Regulations Taxes And Fees

Although many mortgage regulations in Canada are the same across the country, each province has their own mortgage rates, taxes and fees. Unlike most provinces, Saskatchewan, there is no land transfer tax like in many other provinces. There is however a small land title fee to be paid with your closing costs

Don’t Miss: Rocket Mortgage Launchpad

What House Can I Afford On 50k A Year

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. Thatâs because salary isnât the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Amortization Schedule For A $300000 Mortgage

What is amortization?

Your amortization period is the total number of years you have to pay off your mortgage.

When you take out a mortgage, you agree to pay the principal and interest over the life of the loan. Your interest rate is applied to your balance, and as you pay down your balance, the amount you pay in interest changes.

This means that at the beginning of your loan, a big percentage of your payment is applied to interest. With each subsequent payment, you pay more toward your balance.

Below, you can estimate your monthly mortgage repayments on a $300,000 mortgage at a 3% fixed interest rate with our amortization schedule over 10- and 25- years.

At a 3% fixed-rate over 10-years, youd pay approximately $2,896.82monthly. Over the course of a year, thats a total of $34,761.84 in mortgage payments. In the table below, compare how much you would pay toward both interest and the principal amount each year.

| Year | |

|---|---|

| $34,204 | $0 |

At a 3% fixed-rate over 25-years, youd pay approximately $1,422.63 monthly. Over the course of a year, thats a total of $17071.56 in mortgage payments. In the table below, compare how much you would pay toward both interest and the principal amount each year.

| Year |

|---|

About our promoted products

Don’t Miss: Rocket Mortgage Loan Types

What Are The Parts Of A Mortgage Payment

A mortgage payment includes principal and interest, and sometimes additional costs are rolled into the loan.

- Principal balance This is the amount you originally borrowed a portion of your mortgage payment is applied directly to your outstanding loan balance. As you pay down your loan over years, the amount of your payment that goes toward the principal increases.

- Interest This is the amount a lender charges you for borrowing money. Your interest rate and loan term determine how much youll pay over the life of the loan. In the early years of your mortgage, a larger portion of your payment will go toward paying interest.

- Escrow costs If you choose to use an escrow accountor your lender requires it, your property taxes and insurance premiums will be included in your mortgage payment.

Donât Miss: Chase Recast

Who Is Not A Good Candidate For The Interest

Klein is quick to point out that interest-only mortgages arent for everyone. Some people think interest-only loans will help them buy more house or that they can afford more, he says. Thats not always the case since the standards are more stringent. Qualifying for interest-only loans is much harder than qualifying for a normal, qualified mortgage , he explains. Often, the standards for an interest-only mortgage will include higher credit scores, more cash reserves and assets, and higher household income than a traditional amortized loan, which means a portion of the monthly mortgage payment goes toward the principal. After the Great Recession in part caused by subprime loans for people who couldnt afford them lenders and investors are more cautious about extending interest-only loans.

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Use This Fha Mortgage Calculator To Get An Estimate

An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. FHA loans have lower credit and down payment requirements for qualified homebuyers. For instance, the minimum required down payment for an FHA loan is only 3.5% of the purchase price. The FHA mortgage calculator includes additional costs in the estimated monthly payment. Such as, a one-time, upfront mortgage insurance premium and annual premiums paid monthly.

This FHA loan calculator provides customized information based on the information you provide. But, it assumes a few things about you. For example, that youre buying a single-family home as your primary residence. This calculator also makes assumptions about closing costs, lenders fees and other costs, which can be significant.

Estimated monthly payment and APR example: A $175,000 base loan amount with a 30-year term at an interest rate of 4.125% with a down-payment of 3.5% would result in an estimated principal and interest monthly payment of $862.98 over the full term of the loan with an Annual Percentage Rate of 5.190%.1

Which Mortgage Calculators Can You Use

There are online mortgage calculators you can use on our website. And while calculating your costs ahead of applying for a £300,000 mortgage can help you to avoid nasty surprises , bear in mind that these calculators wont provide you with an accurate cost, only a rough idea of what you may be eligible for.

For a more accurate calculation on how much a £300,000 mortgage could cost you, speak to a specialist.

Also Check: Mortgage Recast Calculator Chase

You May Like: Are Discount Points Worth It

Choosing The Right Down Payment Amount For You

Phew! That was a lot of information. But youre now much better equipped to decide which sort of mortgage will work best for you.

Of course, many maybe most home buyers have limited options. Because you cant get a zerodownpayment loan unless youre eligible for one. And you cant get a Fannie or Freddie loan unless your credit scores 620 or better.

As importantly, you cant duck mortgage insurance unless your savings add up to a 20% down payment or you qualify for a VA loan.

So many will find their choices whittled down to one by their circumstances. And those who still have two choices will have to pick with one eye on mortgage insurance and the other on monthly payments.

You can easily learn what your options are by getting a preapproval from a mortgage lender.

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Don’t Miss: Does Prequalification For Mortgage Affect Credit Score

Whats The Minimum Amount You Can Put Down

The mortgage you can get largely depends on your personal circumstances.

Weve already mentioned some of the restrictions on certain loans. But lets take a deeper dive into the requirements for low and zerodown mortgages.

VA loans

To get a zerodown VA loan , you need a Certificate of Eligibility. And the VA has strict rules about those.

Veterans, activeduty service members, members of the National Guard, and reservists typically qualify along with some surviving spouses.

Youll need an acceptable credit history as well. Some mortgage lenders are happy with a credit score of 580, but many want 620660 or higher. Shop around if your scores low.

USDA loans

USDA mortgages are backed by the U.S. Department of Agriculture as part of its rural development program. Like the VA loan program, USDA allows a 0% down payment .

Youll have to buy in an eligible rural area to qualify. However, your occupation doesnt have to be connected to agriculture in any way.

You must also have an income thats low or moderate for the area where youre buying. Not sure whether yours is? Use this lookup tool to check whether your qualify.

According to Experian: While the USDA doesnt have a set credit score requirement, most lenders offering USDAguaranteed mortgages require a score of at least 640. This is the minimum credit score youll need to be eligible for automatic approval through the USDAs automated underwriting system.

Conforming loans

Can You Get A 300k Buy

Yes, you can, although the rules around buy-to-let properties are different to residential ones. Mortgage lenders often expect you to meet minimum income requirements and put down a larger deposit of say 25%. And while there are lenders wholl accept a smaller deposit like 15%, you would need both a suitable property and sufficient rental income thats at least 125% of your mortgage payments .

Also Check: Recasting Mortgage Chase

Why Is Adopting A Loan Repayment Strategy Important

As you can see from some of the earlier examples, even small changes to your repayments can save you thousands of dollars in the long run. A saving of just 0.25% on your home loan will make a giant dent in the total interest paid over 30 years or switching to bi-weekly or fortnightly payments can decrease the amount of time it will take to pay off your loan.

Small adjustments can lead to major changes, so testing different options in the mortgage repayment calculator is worth the effort. And while its still best to speak to a professional, which you can do for free here, this calculator is an ideal starting point. You can also try testing our Borrowing Power Calculator to have an idea of how much you can afford to borrow.

How Much Income Is Needed For A 200k Mortgage +

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a broader range of interest rates.

Also Check: Chase Recast Calculator

Monthly Payments On A $300000 Mortgage

At a 3% fixed interest rate, your monthly mortgage payment on a 25-year mortgage might total approximately $1,422.63 a month, while a 10-year mortgage might cost approximately $2,896.82 a month.

Note that your monthly mortgage payments may differ slightly depending on the type of interest rate , your mortgage term, payment frequency, taxes and possible other fees.

-

See your monthly payments by interest rate.

Interest $1,667.50

What Deposit Do I Need For A 300k Mortgage

One of the most important factors when determining how much youre able to borrow and what your mortgage will end up costing is the size of your deposit.

The higher the deposit you have, the better your chances of getting a £300,000 mortgage and accessing the cheapest or most competitive mortgage rates available on the market.

That being said, the number of higher loan to value mortgages has increased considerably over the last few years with some lenders have started to provide mortgage products with 90% LTVs and a small number willing go up to 95% .

Read Also: What Does Rocket Mortgage Do

What Are The Pros Of Using An Interest

Ready to see if an interest-only mortgage is a good fit for you? Here are some of the benefits.

- One of the biggest benefits of it is your monthly payment is significantly less than an amortized loan, Klein explains.

- Because interest payments on your primary residence are tax-deductible , 100 percent of your interest-only mortgage is tax-deductible if you itemize.

- For properties where the owner will sell or refinance before the interest-only term expires, it can be smart. For instance, one of Kleins clients is refinancing to an interest-only loan on a large home. Even with a slightly higher interest rate, the client will save approximately $2,000 per month, which he will put towards his kids college education. By the time the seven-year interest-only period is up, the homeowner will either refinance to a fixed-rate mortgage or will be ready to downsize and sell the home.