Potential Uses For The Td Homeequity Flexline

Because it offers much lower interest rates than many other TD credit products, it could be a good idea to use for the following:

- Debt consolidation,

- Education costs, and

- In case of an emergency

As well, using a HELOC can also be a strategy to invest with, such as with theSmith Maneuver Tax Strategy.

What’s The Best Loan Term

One important thing to consider when choosing a mortgage is the loan term, or payment schedule. The loan terms most commonly offered are 15 years and 30 years, although you can also find 10-, 20- and 40-year mortgages. Mortgages are further divided into fixed-rate and adjustable-rate mortgages. The interest rates in a fixed-rate mortgage are the same for the duration of the loan. For adjustable-rate mortgages, interest rates are fixed for a certain number of years , then the rate adjusts annually based on the market rate.

One important factor to take into consideration when deciding between a fixed-rate and adjustable-rate mortgage is the length of time you plan on living in your home. Fixed-rate mortgages might be a better fit for people who plan on staying in a home for a while. While adjustable-rate mortgages might offer lower interest rates upfront, fixed-rate mortgages are more stable over time. However you could get a better deal with an adjustable-rate mortgage if you only have plans to keep your house for a couple years. The best loan term is entirely dependent on an individual’s situation and goals, so be sure to take into consideration what’s important to you when choosing a mortgage.

Find the Best Refinance Rates with the CNET Rate Alert

How Do I Get A Mortgage

Getting a mortgage is the most important part of the homebuying process. Its likely the largest loan youll ever take out. So finding the right lender and getting the best deal can save you thousands of dollars over the life of the loan.

Heres what you need to do.

There are lots of different types of lenders. Looking at the loans and programs that banks, credit unions, and brokers offer will help you understand all of your options.

If youre looking for a specific type of loan, like a VA loan or a USDA loan, then make sure that the lender offers these mortgages.

2. Apply for preapproval

Before you start shopping for a home, youll need a preapproval letter. A mortgage preapproval is different from a formal loan application in that it doesnt affect your credit and doesnt guarantee youre approved. But it does give you an idea of your likelihood of approval.

3. Submit an application

Once youre ready to start comparing loan offers, submit an application. Until you apply, the lender wont be able to give you an official estimate of the fees and interest rate you qualify for.

To find the lowest rate and fees, you should submit applications with two or three lenders. Once you have each Loan Estimate in hand, its easier to compare and determine which offer is best for you.

4. Underwriting and closing

Recommended Reading: Does Prequalification For Mortgage Affect Credit Score

Key Mortgage Terms Explained

We know that when it comes to choosing a mortgage, there’s a lot of jargon to get your head around. That’s why we’ve listed some common mortgage terms here.

Loan-to-value

This represents the percentage of the property value you want to borrow. For example, a £100,000 property with an £80,000 mortgage would be an 80% LTV. The maximum LTV we’ll lend you depends on your individual situation, the property, the loan you choose and the amount you borrow.

Initial interest rate This is the initial percentage rate at which we calculate the interest on the mortgage.

Variable rateWhen your initial mortgage rate ends, the interest on your mortgage will be calculated using the HSBC Standard Variable Rate or HSBC Buy to Let Variable rate. This will vary over the term of the loan and is set internally. HSBC Standard Variable Rate and HSBC Buy to Let Variable Rate do not track the Bank of England base rate.

Initial interest rate period This is the period during which the fixed or tracker rate applies. For fixed and tracker rate mortgages, when the specified period expires, the rate will revert to the HSBC Standard Variable Rate/Buy-to-let Variable Rate.

Annual Percentage Rate of Charge The APRC represents the overall cost for comparison and can be used to compare mortgages.

Booking feeA fee charged on some mortgages to secure a particular mortgage deal.

Annual overpayment allowance

Your Rights And Responsibilities As A Borrower

Its important to know your rights as a mortgage borrower. When applying for a mortgage, your lender must provide information such as your mortgage principal amount, your mortgage interest rate, your annual percentage rate , term, payments, amortization, prepayment privileges and charges, and other fees. This can be provided in an information box in your mortgage agreement.

Changes to your mortgage agreement will need to be made in writing within 30 days, or it can be disclosed electronically. Your lender must also give you a renewal statement at least 21 days before the end of your term, or let you know if they will not be renewing your mortgage. If your lender is a member of the Canadian Banking Association, which includes most major banks operating in Canada, your lender may have agreed to provide additional information, such asonline financial calculatorsor other information that can be used to calculate mortgage prepayment charges.

Your lender also has rights, such as the right to inspect your title or the right to sell your home if you dont make your mortgage payments.

You also have responsibilities as a mortgage borrower. It’s important to carefully read your mortgage agreement and ask your lender questions if you don’t fully understand any terms or conditions.

Recommended Reading: What Does Gmfs Mortgage Stand For

Should I Choose A Two Three Or Five

One of the biggest benefits of fixing your mortgage for a set period of time is the fact that youll know exactly what your repayments will be for the duration of the fixed term. This is a great way to budget effectively, as well as protecting you from any interest rate rises while you are locked into the deal. Fixed rate mortgages of two, three or five years are short to medium-term agreements.

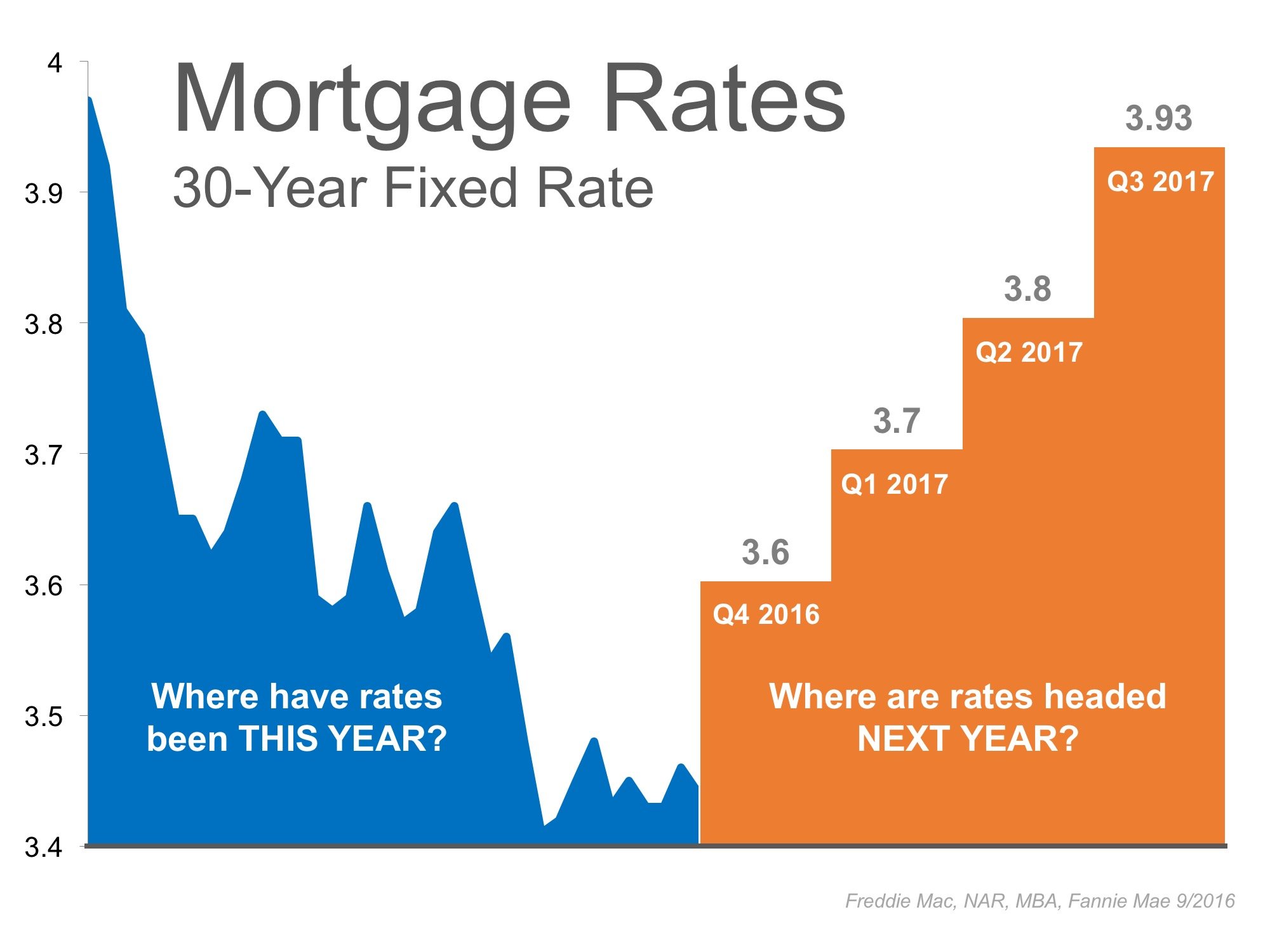

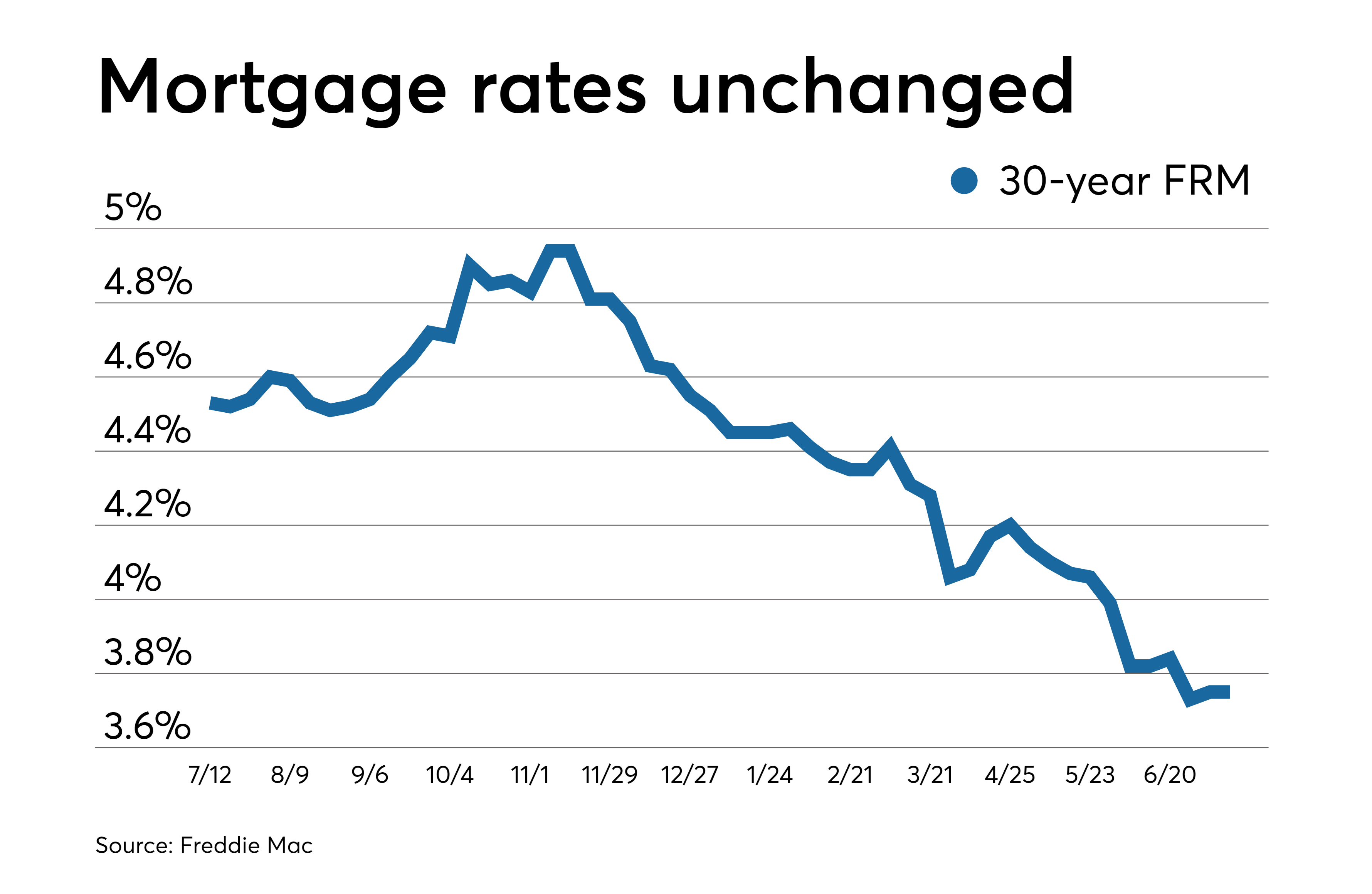

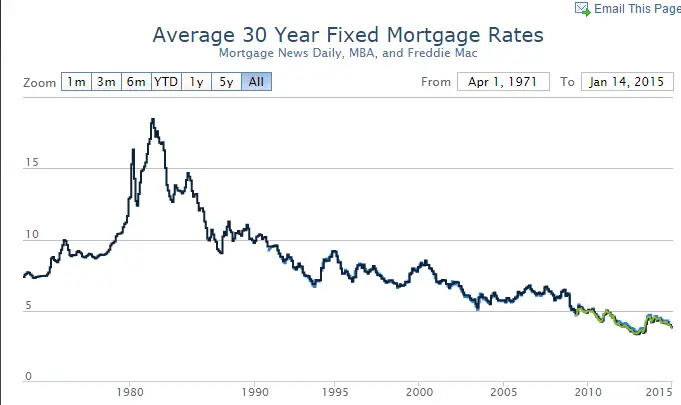

Choosing a short or medium-term fixed rate mortgage means that youll be protecting yourself from any unexpected interest rate rises for the duration. While providers are currently offering some of the lowest interest rates on record, this is attractive to many people who take the view that rates are more likely to rise than to fall. However, by choosing a two, three or five year fixed rate mortgage, you are not locking yourself into a deal for too long, giving you flexibility if rates do drop.

Canada Vs Usa Mortgage Terms

Canadas mortgage term lengths are relatively short when compared to mortgages in the United States. The most common mortgage in the U.S. is the 30-year fixed mortgage, which means that homeowners dont need to renew their mortgage for the entirety of their amortization. This is a large departure from the Canadian mortgage market, where homeowners expect to renew and renegotiate their mortgage rates often.

You May Like: Does Chase Allow Mortgage Recast

Buy To Let Interest Rates

The Fixed and Variable Rates shown below are applicable from 1st June 2013. These rates are available to existing EBS customers only.

Buy to Let – Standard Variable Rate

Cost per ‘000

Buy to Let – Fixed Rates

Cost per ‘000

Im a Tracker Rate Mortgage Holder

- If you avail of a fixed rate, our tracker rate commitment to you is deemed to be at an end and the lenders prevailing variable rate will apply on expiry of this fixed term. Just so youre in the know, if you avail of a fixed rate, you will lose the ability to avail of a Tracker Rate Mortgage in the future.

- If you wish to convert your mortgage to a fixed rate and you are on a tracker rate, you will need to contact your local EBS office to get an additional Tracker to Fixed Conversion Declaration. This can then be completed and submitted together with the Existing Business Fixed Rate Conversion Form.

- Take note, if the tracker to Fixed Conversion Declaration is not completed, your request to convert your mortgage account to an existing business fixed rate will not be processed.

A Final Note on Interest Rate Conversion

Fixed or Variable?

Td Bank Variable Mortgage Rates

A TD Bank variable rate mortgage provides you with fixed payments over your mortgage term however, the interest rate will fluctuate with any changes inTD Bank’s prime rate. If TDs prime rate goes down, less of your payment will go towards your interest and more of your payment will go towards paying off your principal. If TD’s prime rate goes up, more of your payment will go towards interest costs and less will go towards your mortgage principal. As a result, this can be a great financial tool for those expecting interest rates in Canada to fall in the upcoming year. Another option may also be a convertible mortgage, which is avariable rate mortgagethat allows you to convert to a fixed rate mortgage at any time.

| 1.55% | $1,609 |

The rates shown are for insured mortgages with a down payment of less than 20%. You may get a different rate if you have a low credit score or a conventional mortgage. Rates may change at any time.

Read Also: Who Is Rocket Mortgage Owned By

What Is A Mortgage Rate Hold

A mortgage rate hold is the locking in of a specified mortgage rate for a set period of time. This only applies to fixed rate mortgages, since the interest rate of variable rate mortgages can fluctuate.

Once you have a TD Mortgage Pre-Approval, you get a 120-day rate hold which holds the interest rate on your pre-approval term for 120 days subject to all the conditions, even if interest rates go up.

What Drives Changes In 5

When Canada Bond Yields rise, sourcing capital to fund mortgages becomes more costly for mortgage lenders and their profit is reduced unless they raise mortgage rates. The reverse is true when market conditions are good.

In terms of the spread between the mortgage rates and the bond yields, mortgage lenders set this based on their desired market share, competition, marketing strategy and general credit market conditions.

You May Like: Rocket Mortgage Requirements

Lowest Nationally Available Mortgage Rates

| TERM |

|---|

*Home equity line of credit

Rates in the accompanying table are as of Thursday, from providers that lend in at least nine provinces and advertise rates on their websites. Insured rates apply to those buying with a down payment of less than 20 per cent, or those switching a pre-existing insured mortgage to a new lender. Uninsured rates apply to refinances and purchases of more than $1-million and may include applicable lender rate premiums.

Robert McLister is an interest rate analyst, mortgage strategist and columnist. You can follow him on Twitter at .

Factors That Can Affect Your Personal Interest Rate

Itâs important to understand that the best mortgage rate you qualify for may change depending on your unique borrowing profile. Here are some of the factors that influence what mortgage rate you qualify for:

The type of mortgage: If your mortgage is for a refinance, rather than a purchase or renewal, youâll be eligible for higher rates. For individuals with an existing mortgage who have good credit and more than 20% equity in their homes, in addition to refinancing, you can also explore a home equity line of credit .

Your down payment: If youâre purchasing a home andyour down payment is less than 20% of the purchase price and the value of the home you are purchasing is less than $1 million, youâll be required to purchase mortgage default insurance . This insurance is added to your mortgage amount and, while it will cost you money, it will result in a lower mortgage rate as your mortgage is less risky for your lender. If youâre renewing your mortgage, in order to be eligible for the lowest mortgage rates you would have needed to purchase CMHC insurance on the original mortgage.

Your intended use of the property: Your mortgage rate will be higher if you plan to rent your property out vs. live in it as your primary residence.

You May Like: Does Chase Allow Mortgage Recast

Fairway Independent Mortgage Corporation: Best For First

With more than 700 branches, Fairway Independent Mortgage Corporation can offer an in-person experience to both first-time and repeat homebuyers across the U.S.

Strengths: TIf youve never taken out a mortgage before, Fairway has an extensive glossary of mortgage terms you can read up on, several mortgage calculators and a homebuyer guide with a checklist, dos and donts and more. The lender also offers first-time homebuyer-friendly loans, including FHA loans, and a mobile app, FairwayNow, where you can send direct messages and track your loan status.

Weaknesses: Youll have to talk to a loan officer to find out rates and fees these arent available readily on Fairways website.

Selecting A Mortgage Term

Choosing between a short-term mortgage or a long-term mortgage can also affect your interest rate. A short-term mortgage generally offers a lower rate, and, as it requires more frequent renewal, you can benefit from lower interest rates when you renew, if rates stay low at your renewal. Long-term mortgages, on the other hand, offer stability, as you wonât need to renew it often. However, long-term mortgage holders may not be able to take advantage of lower interest rates if the market fluctuates.

Don’t Miss: Who Is Rocket Mortgage Owned By

How Big A Mortgage Can I Afford

In general, homeowners can afford a mortgage thats two to two-and-a-half times their annual gross income. For instance, if you earn $80,000 a year, you can afford a mortgage from $160,000 to $200,000. Keep in mind that this is a general guideline and you need to look at additional factors when determining how much you can afford such as your lifestyle.

First, your lender will determine what it thinks you can afford based on your income, debts, assets, and liabilities. However, you need to determine how much youre willing to spend, your current expensesmost experts recommend not spending more than 28 percent of your gross income on housing costs. Lenders will also look at your DTI, meaning that the higher your DTI, the less likely youll be able to afford a bigger mortgage.

Dont forget to include other costs aside from your mortgage, which includes any applicable HOA fees, homeowners insurance, property taxes, and home maintenance costs. Using a mortgage calculator can be helpful in this situation to help you figure out how you can comfortably afford a mortgage payment.

When Is The Right Time To Get A Mortgage

Before you apply for a mortgage, you should have a proven reliable source of income and enough saved up to cover the down payment and closing costs. If you can save at least 20% for a down payment, you can skip paying for private mortgage insurance and qualify for better interest rates.

The best time to apply is when youre ready. But there are other details to consider when timing your home purchase. Because home sales slow down during the winter, you may be able to get a better price in the spring. However, general nationwide trends dont always apply to every real estate market. Talk with local experts in your home shopping area to get a better sense of the market.

Also Check: Who Is Rocket Mortgage Owned By

What Is The Difference Between A Fixed And A Variable Interest Rate At Td

A fixed interest rate means your interest rate, along with your principal and interest payments, will stay exactly the same during your mortgage term.

With a variable interest rate, your interest rate can fluctuate based on changes in our TD Mortgage Prime Rate. While your payments will remain the same, the amounts from each payment that go toward the principal and interest can vary.

How Do I Lock In A Mortgage Rate

Once youve selected your lender and are moving through the mortgage application process, you and your loan officer can discuss your mortgage rate lock options. Rate locks can last between 30 and 60 days, or even more if your loan doesnt close before your rate lock expires, expect to pay a rate lock extension fee.

Recommended Reading: Does Getting Pre Approved Hurt Your Credit

Who Benefits From A Fixed Mortgage Rate

Those who have a set limit as to the total mortgage payment that they can afford will benefit the most from Canadian fixed mortgage rates. All you have to do is determine the maximum amount you can pay for a mortgage, and get a fixed-rate mortgage that sets the payment at or below what you can afford. This payment will never change, so there is never any worry as to whether you will be able to pay the loan in the future. Again, if you like stability, the fixed-rate mortgage is right for you.

Pros And Cons Of A Short

- You are not locked in to a set interest rate for more than a few years, enabling you to seek a new deal if there is a better offer available.

- You can budget effectively, safe in the knowledge that for the agreed fixed term period your mortgage repayments wont change.

- You are protected from unexpected interest rate rises during the fixed period.

- You are likely to have a higher interest rate for a fixed rate compared to a variable rate mortgage.

- You could incur additional fees each time you need to remortgage, which will likely be more often with a shorter-term fixed mortgage.

- If interest rates were to fall further, you will not benefit as you may be locked into a higher rate.

Recommended Reading: Can You Refinance A Mortgage Without A Job