How Long Does A Preapproval Last

Many mortgage preapprovals are valid for 90 days, though some lenders will only authorize a 30- or 60-day preapproval. If your preapproval expires, getting it renewed can be as simple as your lender rechecking your credit and finances to make sure there have been no major changes to your situation since you were first preapproved.

Mortgage Rates Where You Live

Mortgage or refinance rates depend on different factors, including where you live. To better understand what rates you may qualify for, including what the average mortgage or refinance rate is in your area, take a look at Credit Karmas mortgage rate marketplace and our latest state-specific guides.

When Is The Best Time To Get A Mortgage Preapproval

The same as with mortgage prequalification, the best time to get a mortgage preapproval is when youre ready to start shopping for a house. In fact, were going to let you in on a little secretyou can skip prequalification and go straight for preapproval.

When you receive your preapproval, keep one important fact in mind: Your lender will likely approve you for way more money than you should consider spending on a home. Stick with these two guidelines and youll have a home you can truly afford, while you work toward bigger financial goals like saving for retirement or paying for your kids college:

Youll be tempted to look at more expensive homes, especially when you see how much your lender thinks you can afford. But a huge mortgage payment will ultimately make your home a curse, not the blessing it should be.

Read Also: Can I Get A Reverse Mortgage On A Condo

What Does It Mean To Be Preapproved

Getting preapproved may be a better indication that you’ll get approved for a loan or cardbut it depends on the process. For example, if you’re preapproved for a credit card online, the card issuer may be using preapproval and prequalified to mean the same thing.

Additionally, you may have received preapproval offers for loans or credit cards by mail, phone or email. These prescreened offers generally mean you appeared on a credit reporting agency’s list of consumers that meet a creditor’s criteria, and have been sent a firm offer of credit as a result.

If you respond to the offer and apply, the creditor must offer you the same terms as in the mailing. But those terms may have a range, and you won’t know your exact offer until you apply and agree to a hard inquiry.

Whether you applied or received an unsolicited offer saying you’re preapproved, there’s still no guarantee you’ll get approvedespecially if factors like your income, collateral or credit history have recently changed.

Mortgage and car loan preapprovals, however, are a contrast to preapproval for other types of credit and can involve a fairly complex application and review process. You may need to submit tax returns, proof of income and bank statements and agree to a credit check. The mortgage or auto lender could take some time to review and verify these documents, and they may then offer you a loan preapproval letter that’s good for several months.

Why Should I Get Preapproved

If a preapproval doesnt get you a loan right away, why get one? Preapprovals have several benefits:

- Its easier to shop: Many real estate agents require you to get preapproved before you shop for a home. Preapprovals make the house hunting process easier for you and your real estate agent.

- It makes your offer stronger: If youre shopping in a competitive housing market, a preapproval can be crucial to getting your offer accepted. Sellers arent just looking for the highest offer. Theyre also looking for offers that arent likely to fall through. A preapproval tells buyers you can get financed for the amount youve offered.

- It gives you time to sort out issues: There are reasons both buyers and sellers may need to get to closing fast. Getting preapproved means youre getting the bulk of the mortgage process done upfront. That way, once youve had an offer accepted, you can just focus on getting ready for your move.

You May Like: Recasting Mortgage Chase

How Long Does It Take To Get Preapproved

Depending on the mortgage lender you work with and whether you qualify, you could get a preapproval in as little as one business day, but it usually takes a few days or even a week to receive and, if you have to undergo an income audit or other verifications, it can take longer than that. In general, if you have your paperwork in order and your credit and finances look good, its possible to get a preapproval quickly.

Why Should You Get Pre

There are many reasons why you should get pre-approved. The most important reason is that you will get an accurate idea of how much home you can afford. This can help to target your home search and ensure you only look at houses that are truly in your price range. A pre-approval letter also helps you prove to real estate agents and sellers that youre a credible buyer and able to act fast when you find the home you want to buy. Some sellers might even require buyers to submit a pre-approval letter with their offers, though having a pre-approval letter does not guarantee that your offer will be accepted by a seller. A pre-approval letter can make you stand out in a competitive real estate market. If you make an offer on a house without a pre-approval, your offer may not be taken as seriously as an offer from another person with a pre-approval.

You May Like: Recast Mortgage Chase

What Does A Preapproval Letter Include

A preapproval letter includes your name, the price of the home you gave when requesting the preapproval, the loan amount youre preapproved for and the expiration date of the preapproval. Some lenders also include conditions related to the preapproval in the letter, such as it only applying to a single-family home instead of multi-family property.

Why Is It Important To Get Pre

Getting pre-approved for a mortgage gives a person bargaining power since they have mortgage financing already lined up and can therefore make an offer to the seller of a home in which they are interested. Otherwise the prospective buyer would have to go out and apply for a mortgage before making an offer and potentially lose the opportunity to bid on a home.

Recommended Reading: Chase Mortgage Recast Fee

What Is The Difference Between Pre

Both pre-qualification and pre-approval involve a review of an applicant’s credit report. The difference is the degree of credit review. Pre-qualification involves a quick review of one’s credit and only provides a potential borrower with a general idea of how much mortgage they could qualify for and under what terms. Pre-approval involves a full credit review, while only offered for a limited time window, provides the potential borrower with a solid offer of credit from a lender with which they can use to make good faith offers on homes for sale.

How Regentology Can Help You In Finding A Pre

Regentology connects you with the best loan officers in your area to help you get the most competitive rates. Finding the right mortgage company can be confusing and many will surprise you with heavy fees. Our network of loan officers will be upfront and honest every step of the way.

Every situation is unique, and every borrower is unique. You should speak with an expert about your situation so that they can help you. We will link you with a loan officer that knows your requirements and can assist you in obtaining a mortgage. If you have any questions, please contact us.

Don’t Miss: Can You Refinance A Mortgage Without A Job

When To Get Pre

A prequalification can make sense when youre in the early stages of preparing to buy a home.

This information is valuable for planning purposes. Youll have an idea of how much to save for your down payment and closing costs, and youll know what to expect with regard to a mortgage payment.

And if youre denied a prequalification, you can take steps to improve your financial situation before buying. This might include paying your bills on time, saving more cash, paying down debt, and fixing errors on your credit report.

S To Get Preapproved Vs Prequalified

A mortgage preapproval takes a more in-depth look at your finances than when you get prequalified. The lender will collect supporting documentation before issuing an approval.

Youll provide your lender with the following documents:

- Paycheck stubs for the last 30 days

- W-2s or 1099s for the past two years

- Tax returns from the previous two years

- Info on any other sources of income

- Bank account statements from the past 60 to 90 days

- Rental history

The lender must verify that your income is consistent and stable and that you have enough cash saved for your down payment and closing costs.

A mortgage preapproval also involves a closer look at your credit reports. The lender not only considers your credit score but also your recent credit history. Theyll look specifically at your payment history and your current debts.

Recommended Reading: Chase Mortgage Recast

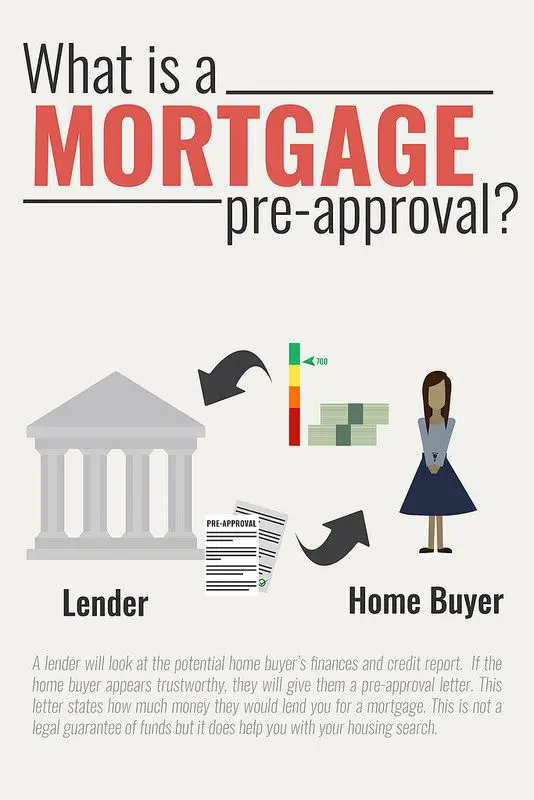

What Is Mortgage Preapproval

Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place. You will complete a mortgage application and the lender will verify the information you provide. Theyll also perform a credit check. If youre preapproved, youll receive a preapproval letter, which is an offer to lend you a specific amount, good for 90 days.

Questions To Ask Your Lender Or Broker When Getting Preapproved

When getting preapproved, ask your broker or lender the following:

- how long they guarantee the preapproved rate

- if you will automatically get the lowest rate if interest rates go down while youre preapproved

- if the pre-approval can be extended

Ask your lender or broker about anything you dont understand.

Don’t Miss: Bofa Home Loan Navigator

Going To A Lender To Get Pre

Once you feel you’re ready to buy a house, getting the right mortgage is the next important decision you’ll make. To be sure you’re getting the best deal, talk with multiple lenders and compare their mortgage interest rates and loan options see types of mortgages.

With pre-qualification, the loan officer will ask for information about your income, job, monthly bills, amount you have available for a down payment, and possibly some other information. They will then provide you with an estimate.

Mortgage Prequalification Vs Preapproval

The terms preapproval and prequalification are sometimes used interchangeably, but theyre not the same.

There are two main differences between mortgage prequalification and preapproval:

Don’t Miss: Monthly Mortgage On 1 Million

How To Get A Mortgage Pre

To get pre-approved, you will need to speak with a mortgage expert, broker, or lender, and fill out an application. Youll be required to submit legal documentation and financial statements and agree to a credit check.

Then, your lender will consider:

- How much you can afford for your down payment

- Your savings for other moving costs

- Where your funding came from

- Your credit score

Receive Your Mortgage Preapproval Letter

When you get preapproved, you usually get a preapproval letter. There are a few reasons the preapproval letter is important. First, real estate agents typically want to see your preapproval letter before they show you houses. This ensures they dont waste time showing you homes outside your budget.

Second, the preapproval letter is something you can share with the homes seller when you make an offer. It shows you wont have problems getting financed for the amount youre offering.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

How To Get Pre

Knowing the importance of mortgage pre-qualification may leave you wondering how to get pre-qualified in the first place. Your pre-qualification status and amount depend on different factors that lenders see from various documents you submit. Lenders verify certain aspects of your finances and your history, such as:

You may be asked to include relevant names, addresses and account numbers with the information you provide. Lenders may also ask for records of rent payment, divorce decrees or related court orders and documents from bankruptcy or foreclosure.

Why Is Getting Approved For A Mortgage Important

Getting approval for your mortgage means that a lender has reviewed your financial situation and confirmed your ability to take on mortgage payments.

When you get a mortgage approval, your lender estimates how much you can afford to borrow, what your interest rate could be and how much your mortgage payments could be. You and your real estate agent can use this information to focus on homes you can afford.

A mortgage approval also proves to sellers that you can afford the home theyre selling. Without first securing approval from a lender, the seller might not trust your offer is genuine. Your offer might not be accepted and even if it is, offering to buy a home without lender approval can slow down your mortgage loan application.

Also Check: Chase Recast Calculator

Are There Drawbacks To A Pre

There aren’t any great drawbacks to obtaining a single pre-approval, but having several in a short period can potentially harm your ability to borrow.

Pre-approvals will be visible on your credit file as a loan enquiry, and having many in quick succession and with multiple lenders might create the impression that you’re financially unstable.

While this shouldn’t discourage you from seeking pre-approval, it does mean it’s a good idea to wait until you’re seriously considering a purchase, rather than applying early in the process when you might just be entertaining the idea.

If youre not quite ready to apply, you can get an idea of how much you may be able to borrow using the Suncorp Bank Borrowing Limit Home Loan Calculator.

What Do You Need To Get A Mortgage Preapproval

Remember how easy it was to get prequalified? You didnt have to do anything, right? Well, get ready. To get preapproved, you have to give your lender a lot of documents, including all of the following:

Proof of Income and Employment

- Paystubs from the last 30 days

- W-2s from the last two years

- Personal federal tax returns from the last two years

Plus more if any of these apply to you:

- Freelance or business tax returns from the last two years

- If retired, your benefit reward letter, your last two years of 1099 forms and tax returns

Proof of Assets

- Bank statements from the last two months of all your accounts: checking, savings, Roth IRA, 401 and stocks. The statements must show your name, account number and the name of your bank.

- If someone in your family is helping you pay for the house, a gift letter signed and dated by the person helping you.

Proof of Identification

- A copy of your drivers license

- Your social security number or card

- Your lender will check your credit. Theyll do this on their own, so you wont have to submit anything.

You May Like: Rocket Mortgage Conventional Loan

How Do I Get A Mortgage Pre

First, find out how much you can spend on a mortgage with our mortgage affordability calculator. Then book an appointment with us for more help. Meet with usOpens a new window in your browser..

Scott on: CIBC Mortgage Advisors

Dont forget, once you find your dream home, you need to complete a full application to be approved for a mortgage2.

Ensure you have all the documents necessary for the mortgage application process with our required mortgage documents checklist .Opens a new window in your browser.

Get Quotes From Different Mortgage Lenders

Just as you want to get the best deal on the house you buy, you also want to get the best deal on your home loan.

Every lender has different guidelines and interest rate options, which can have a big effect on your monthly payments. If you only get preapproved with one lender, youre stuck with what it has to offer. When you get preapproved with multiple lenders, you can choose the offer thats best for you. Many lenders offer the ability to apply for preapproval, including Bank of America,Better Mortgage and Rocket Mortgage.

Its important to do your homework before choosing potential lenders. You should research each lender and even the loan officer who would be handling your mortgage there can be a big difference in knowledge and experience depending on who processes your application.

After you choose some lenders, youll provide the information needed to complete the preapproval application process. An underwriter may examine your preapproval application to determine how much you can borrow. If an underwriter hasnt reviewed your application, you havent been fully preapproved so be sure to ask about the status of your application during the process.

Once the lender has all the documents it needs, it typically only takes a few days for the lender to let you know whether youre preapproved and how much youve been approved for. But the preapproval process can take longer if you have a past foreclosure, bankruptcy, IRS lien or poor credit.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage