How Does Refinancing Work

The process of refinancing a mortgage is similar to the process of getting one in the first place. You typically start by shopping around and comparing interest rates and other terms with various mortgage lenders to see which has the best offer. Then you compare that offer with the terms of your existing loan.

If your credit has improved since you were approved for your first loan, you may have a good chance of qualifying for more favorable terms.

As you go through this process, keep an eye on the closing costs. For example, if refinancing your loan with a new lender costs $5,000 upfront, and your new monthly payment is just $100 lower than what you’re currently paying, you’ll need to stay in the home at least 50 months to make the move worth it.

Also, watch out for things like prepayment penalties, which can cause problems down the road if you pay off the mortgage early or refinance again.

Apply For The Best Offer And Lock In The Rate

After reviewing the terms of each loan, consider negotiating with lenders to get the terms and rate youre looking for. Once youve identified the refinance loan you want to go with, youll officially apply for the loan.

The refinancing process varies among lenders however, most give the option of locking in your interest rate. Locking in the rate prevents it from increasing if market rates rise before you close on the loan. Some lenders allow you to lock your rate for free, while others may charge a fee.

The Cost Of Refinancing Your House

In general, refinancing includes the following closing costs outlined below:

Application fee. Lenders impose this charge to cover the cost of checking a borrowers credit report, and the initial cost to process the loan request.

Title insurance and title search. This charge covers the cost of a policy, which is usually issued by the title insurance company, and insures the policy holder for a specific amount, covering any loss caused by discrepancies found in the property’s title. It also covers the cost to review public records to verify ownership of the property.

Lender’s attorney review fees. The company or lawyer who conducts the closing will charge the lender for fees incurred, and in turn, the lender will charge those fees to the borrower. Settlements are conducted by attorneys representing the buyer and seller, real estate brokers, escrow companies, title insurance companies and lending institutions. In most situations, the individual conducting the settlement is providing their services to the lender. Borrowers may be required to pay for other legal fees and services related to their loan, which is then provided to the lender. They may want to retain their own attorney for representation in the settlement, and all other stages of the transaction.

Don’t Miss: What Is Loss Mitigation Mortgage

Learn About Refinancing & How To Find Out If The Process Could Be Worth It For You

Looking to refinance? See options to lower your interest rate, payment, change terms, consolidate debt / get cash out, or take advantage of specialized loan products and programs.

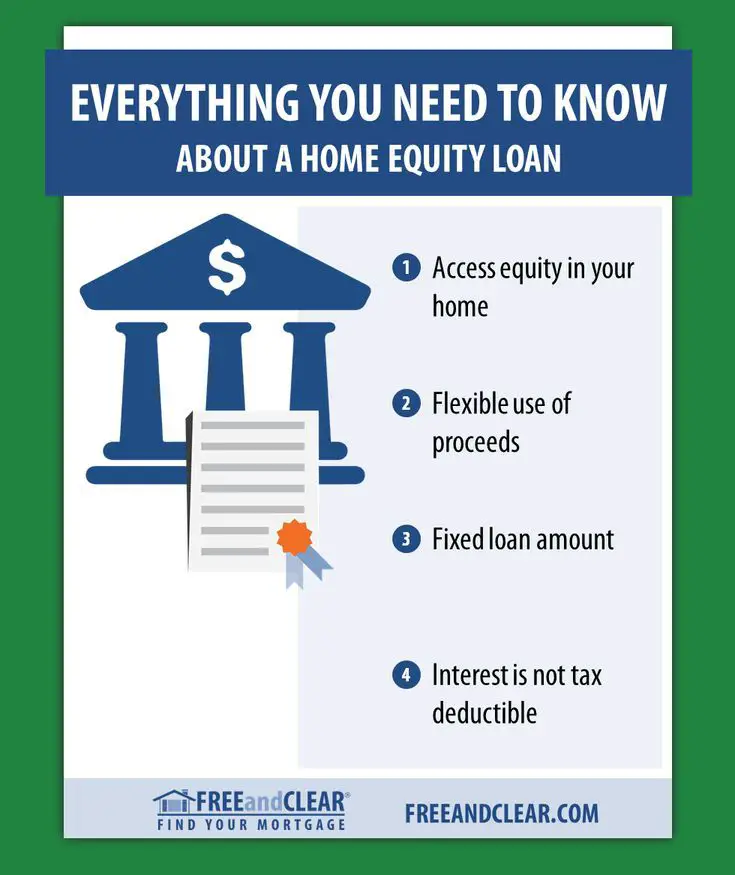

Which lending option is right for you depends on a number of factors, such as how much equity you have in your home, how long you plan to stay in your home and if you want to receive money back. Before you decide, you should understand the basics.

To apply for a refinance, youll need to provide information about your income, assets and debts, plus any special circumstances that may impact your ability to repay.

In addition, the lender will arrange for an appraisal of your home, flood determination, a title search and title insurance. They may also set up an escrow account to pay for necessary insurance and property taxes.

What Documents Do I Need To Refinance My Mortgage

To refinance your mortgage, youll need to supply identification, income verification and credit information. Be sure to ask your lender for a list of documents youll need. The faster you can give the lender everything they need to process your loan, the quicker youll be able to close.

Heres a general checklist:

- W-2s or 1099s

- Appraisal

You May Like: What Is The Recommended Percentage Of Income For Mortgage

Securing Your Interest Rate

After youre initially approved, you may be able to lock in your interest rate to ensure it doesnt increase before you close on the loan.

Rate locks typically last between 15 and 60 days, depending on the loan type, your location and a few other factors. Alternatively, you may be offered a mortgage rate lock with a float down feature. This option would allow you to reduce your interest rate if that rate falls during your lock period.

Refinancing A Mortgage Step By Step

Ready to tackle the refinance process? Go!

Set your goal. Reduce monthly payments? Shorten the loan term? Get rid of FHA mortgage insurance?

Shop for the best mortgage refinance rate. Keep an eye on fees, too.

Apply for a mortgage with three to five lenders. Submit all applications within a two-week period to minimize the impact on your credit score.

Choose a refinance lender. To pick the best offer, compare the Loan Estimate document each lender provides after you apply. The Loan Estimate will tell you how much cash youll need for closing costs.

Lock your interest rate. When you lock the interest rate, it cant be changed during a specified period. You and the lender will try to close the loan before the rate lock expires.

Close on the loan. This is when youll pay those closing costs that were listed in the Loan Estimate and again in the Closing Disclosure. Closing on a refinance is like closing on a purchase loan, with one main difference: No one hands you the keys to the home at the end.

Also Check: Which Credit Union Is Best For Mortgage

What Does It Mean To Refinance A House

When you refinance the mortgage on your house, youre essentially trading in your current mortgage for a newer one, often with a new principal and a different interest rate. Your lender then uses the newer mortgage to pay off the old one, so youre left with just one loan and one monthly payment.

There are a few reasons people refinance their homes. You can use a cash-out refinance to make use of your homes equity or a rate-and-term refinance to get a better interest rate and/or lower monthly payment. A refinance could also be used to remove another person from the mortgage, which often happens in the case of divorce. Finally, you can even add someone to the mortgage.

How Does Refinancing A Home Mortgage Work

With the economy suffering more than ever due to the COVID-19 pandemic, consumers are looking to do everything they can to get a leg up financially. That means taking advantage of every offer, discount and negotiating tactic to lower expenses.

Thankfully, interest rates are currently lower than they’ve been in years and homeowners are scrambling to take advantage of the refinancing options available. These low rates won’t last, so time is of the essence for anyone looking to close a deal.

If refinancing is a new topic for you, we’ve got you covered. Here’s what you need to know about how a home mortgage refinance works.

Also Check: How Much Mortgage Can I Get On 30 000 Salary

How To Refinance A Mortgage

If youre thinking about refinancing a mortgage, heres a step-by-step guide on the process. Before you refinance, its important to understand how long it will take for the costs of refinancing to pay off compared to how long you plan to stay in the home. Youll also want to ensure you can afford the new payment and youll have enough equity remaining in your home. To get a good deal, shop around between mortgage lenders.

Consider the interest rates as well as closing costs.

Refinancing To Convert To An Arm Or Fixed

While ARMs often start out offering lower rates than fixed-rate mortgages, periodic adjustments can result in rate increases that are higher than the rate available through a fixed-rate mortgage. When this occurs, converting to fixed-rate mortgage results in a lower interest rate and eliminates concern over future interest rate hikes.

Conversely, converting from a fixed-rate loan to an ARMwhich often has a lower monthly payment than a fixed-term mortgagecan be a sound financial strategy if interest rates are falling, especially for homeowners who do not play to stay in their homes for more than a few years.

These homeowners can reduce their loan’s interest rate and monthly payment, but they will not have to worry about how higher rates go 30 years in the future.

If rates continue to fall, the periodic rate adjustments on an ARM result in decreasing rates and smaller monthly mortgage payments eliminating the need to refinance every time rates drop. When mortgage interest rates rise, on the other hand, this would be an unwise strategy.

Also Check: What Is Current Interest Rate On Reverse Mortgage

Why Would I Refinance My Mortgage

Good question refinancing your mortgage isnt something you do on a whim. There are plenty of benefits to refinancing your mortgage, but its not for everyone. Heres why people do it:

To get a better interest rate on your mortgage. If interest rates are lower now than they were when you got your home loan, refinancing can allow you to take advantage of them. That could mean paying off your mortgage sooner, or taking the same amount of time to pay it off with smaller monthly payments.

But snagging an interest rate thats only slightly lower may not be worth it. Expert opinions vary, but most recommend that the rate of your refinanced mortgage be at least two percent lower than your current. When refinancing, youll still be subject to the vast number of fees and charges that come with any mortgage.

To switch types of mortgage. If your mortgage is of the adjustable-rate variety, you might have been drawn in by a low-interest rate at the beginning of the loan. But if youre looking for more stability when it comes to your debt, switching to a fixed-rate mortgage can be very appealing. Not to mention, your fixed-rate mortgage will be immune to rising increase rates, too. Learn more about the basics of home loans and mortgages here.

If you currently have a fixed-rate mortgage and are planning on selling your home in the near future, refinancing to an adjustable-rate mortgage , which typically has lower interest rates, could be for you.

Consider The Value In Refinancing Right Now

In Denver, home values are still at all-time highs. This means you may have considerably more equity in your home today than you did just a year ago. For example, according to Trulia, the Denver housing market has seen the median home sales price rose over 7 percent from 2017 to 2018. That means your home could be worth significantly more right now giving you access even more equity.

Equity is the amount of unmortgaged value on the home. For example, if your home is worth $300,000 in 2017, it may now be worth 7 percent more, or $351,000. Lets say your mortgage balance, or the amount you owe your lender is $225,000. That means you now have $126,000 in equity. You could refinance your home loan, take out some of that equity, and use it to achieve other goals you have.

- Use the funds to pay off high-interest rate credit cards.

- Do some home remodeling and renovations to increase your propertys value even more.

- Use the funds to finance investments such as to start a business.

- Set aside enough cash to cover 6 months to 1 years expenses in the unfortunate happens and you are without income for an extended period of time.

You May Like: Will Life Insurance Cover Mortgage

Do You Need An Appraisal During The Refinancing Process

Depending on the type of loan youre applying for, your lender may not require an appraisal on your home during the house refinancing process. For example, homeowners with an existing loan backed by the Federal Housing Administration or the U.S. Department of Veterans Affairs may be able to skip a refinance appraisal if they choose an FHA streamline refinance or VA interest rate reduction refinance loan , respectively.

For other loan types, your lender may offer an appraisal waiver and instead use an alternative method to value the home. This can often save time and money instead of doing a full appraisal. Keep in mind that the homes value will determine whether you qualify for a refinance and will play a role in how much you can borrow against your equity if you plan to do a cash-out refinance.

For example, conventional mortgages typically require a maximum LTV ratio of 80% for a cash-out refinance. If, for instance, you owe $300,000 on your mortgage, and you wanted to borrow an additional $50,000 against your equity, that means your home would need to appraise for at least $437,500. To figure out your LTV ratio, divide the balance of your mortgage by the homes value.

How Mortgage Refinancing Benefits Homeowners

Your personal finances are bound to change over the years. Youll build home equity your income may increase maybe youll pay off credit card debts and improve your credit reports.

As your finances improve, youll likely have access to better mortgage options than you did when you bought your home. Some of the benefits of mortgage refinancing include:

- Saving money by borrowing at a lower rate. Mortgage interest rates are constantly in flux. If rates have fallen since you took out a home loan, theres a good chance you can refinance to a lower rate and save even if your finances look exactly as they did when you bought the house

- Changing the features of your home loan when you refinance. You can choose the number of years in your loan you can choose the nature of your interest rate and, you can even choose what you pay in mortgage closing costs

- Own your home sooner, drop mortgage insurance, and get cash out. Many homeowners refinance to get a lower mortgage rate. But a refinance mortgage can also help you pay your home off more quickly, eliminate mortgage insurance, or tap your home equity to pay off debt or fund home improvements

- Some borrowers might be able to benefit from a mortgage interest deduction. Mortgage interest is often tax-deductible so if you can combine other debt into your mortgage, you may be able to deduct the interest paid on that debt. However, always consult a tax professional first before making any decision that could affect you taxes

Don’t Miss: Where To Refinance Mortgage With Bad Credit

Final Thoughts On Mortgage Refinance

If youve reviewed your financial goals and decided its the right time to refinance, your next step is to find the best mortgage refinance lenders.

There are some other things you should do, too:

- Know what your home is worth

The internets estimate of your homes value isnt always accurate. You should learn the fair market value as reported by your local tax commissioner. Its also a good idea to get a sense of how much other homes in your neighborhood are worththat plays a role in your own homes value.

- Protect your credit score

Make your payments on time, pay off debts, and make any other positive financial changes you can.

- Get your home ready for an appraisal

Your house is likely to be appraised as part of the refinance process. You may want to make some changes to your home, such as repainting and cleaning your basement.

When Does It Make Sense To Refinance A Mortgage

When to refinance your mortgage depends on your goals and financial situation. If you can reach your break-even point, it may be a good option for you.

As TransUnion explains, Your break-even point is when the savings you will have earned with a lower, refinanced interest rate are greater than the costs you will have undergone to refinance.

To find out what your break-even point is, divide the total cost of the refinancing loan youre considering by the monthly savings you would make.

For example, lets say your refinancing fees are $2,000 and you would save $200 per month by taking the loan and lowering your interest rate. Simply divide 2,000 by 200. Your break-even point is 10 months. If you continue to live in the home youre refinancing for more than 10 months, youll save money, and refinancing may be worth the effort.

Other factors to consider before applying to refinance:

-

Your credit score

Do you know how credit scores affect mortgage rates? Some lenders reject refinance applications based on low scores, which can be anything below 600. Even if your application is approved, your credit score will influence the interest rate you pay.

-

Federal interest rates

If current mortgage refinance ratesare high, you may not want to refinance. In this case, even someone with a good credit score may not get a low-interest rate. A mortgage refinance calculator can help you figure out what the rate is likely to be.

-

How long you plan to stay in the house

-

The value of your home

Read Also: How Much Is A Jumbo Mortgage In Ny

Why Should You Refinance Your Mortgage

Refinancing your mortgage might seem like a risky move, but there are several reasons why you may consider it.

A mortgage refinance may allow you to get lower interest rates. Even half a percentage point can make a significant difference over the life of your loan. If youre planning to live in your home for the foreseeable future, you can make this work to your advantage.

You could find yourself in a situation where you need to fulfill a financial obligation immediately. This could include paying for college tuition or a medical emergency. Refinancing your mortgage allows you to tap into your homes equity and take it out as a lump sum. You can use the cash to pay off existing debts with high interest rates.

The section below outlines a comprehensive list of factors to consider. Youll find more details about why a mortgage refinance may be a solid financial decision for you.

You can reduce your monthly payments by qualifying for lower interest rates. For example, moving from a 6% interest rate to 3% results in over $4,000 in savings each year. MoneyGeeks mortgage refinance calculator can show you how much you can save if you decide to refinance.