Conditional Approval Vs Pre Approval The Lenders Network

Conditional approval means you have been approved for a loan once certain conditions are met. These conditions may be that you sell your current home, provide

As suggested, a conditional loan approval means that your mortgage underwriter is mostly satisfied with your mortgage application.

A conditional approval is a step between pre-approval and closing. It means your loan approval is subject to conditions that must be met before

The Bottom Line On Conditional Mortgage Approval

Conditional loan approval on a mortgage makes you a stronger buyer. And it may be a requirement in some situations, like new construction.

Even better, getting conditional approval for a home loan doesn’t require much extra work. For any mortgage to close, you’ll need to provide the right documentation to your lender and have that loan go through underwriting. Conditional mortgage approval simply involves getting a letter proving this part of the process is complete.

Automated Findings Of Approve/eligible Per The Automated Underwriting System

An AUS approval is also not a real approval unless your documents support the information listed on your loan application. If you say that you earn $5,000 per month but your paystubs show $4,000 per month income, you dont have approval. If the software asks for a bank statement showing that your down payment is coming from savings, and you never get around to providing that statement, you dont have approval. At Gustan Cho Associates, there are no overlays. An AUS approval is almost always a real approval as long as you meet the underwriting conditions and nothing changes in your file.

You May Like: Who Is Rocket Mortgage Owned By

Conditional Loan Approval Vs Pre

When first researching how to apply for a home loan, its common for buyers to mistake the conditional approval process with the pre-approval process. Both involve submitting a lot of the same paperwork, after all. The main difference between the two is that pre-approval comes first. The information you submit during the pre-approval is reviewed by one of our Mortgage Advisors to give the PacRes lending team an idea if you qualify for a loan. However, this review occurs before the underwriting process and is not the same as the strict documentation review that our underwriting team conducts.

A conditional approval, on the other hand, comes after the pre-approval process when our underwriters have verified your information. Conditional approvals are generally stronger than pre-approval alone, as its more likely that youll be approved for the loan if its known that you meet all the criteria. When purchasing a home, this kind of leverage makes it more likely that your offer will be accepted. Your offer is less likely to fall through due to lending issues, making a conditional approval more enticing to a seller.

Loan Officers Not Properly Qualifying Borrowers Prior To Issuing Pre

Often, lenders issue prequalification letters without pulling a credit report or seeing any documents. Mortgage preapproval or conditional approval is much more valuable. To get a preapproval, you must apply for a mortgage and supply any documents and information the underwriter wants. The underwriter examines these things and issues a conditional approval or mortgage preapproval letter. Sometimes, borrowers believe that they have a conditional approval or mortgage preapproval when what they really have is just a prequalification.

Don’t Miss: Recast Mortgage Chase

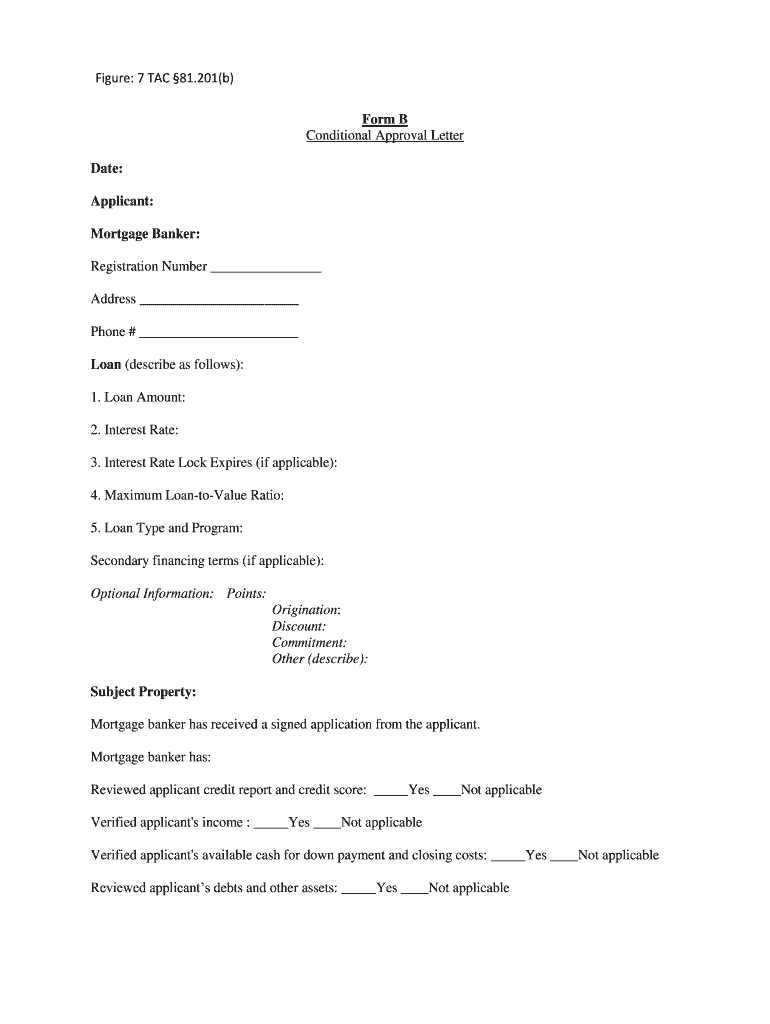

What Do They Ask For In Conditional Approval

To issue a conditional approval, the lender must assess your assets, income, and credit report. After the conditional underwriter examines your financial information, they may issue a mortgage conditional approval if they are mostly satisfied with your file but still need a couple of things resolved.Apr 20, 2021

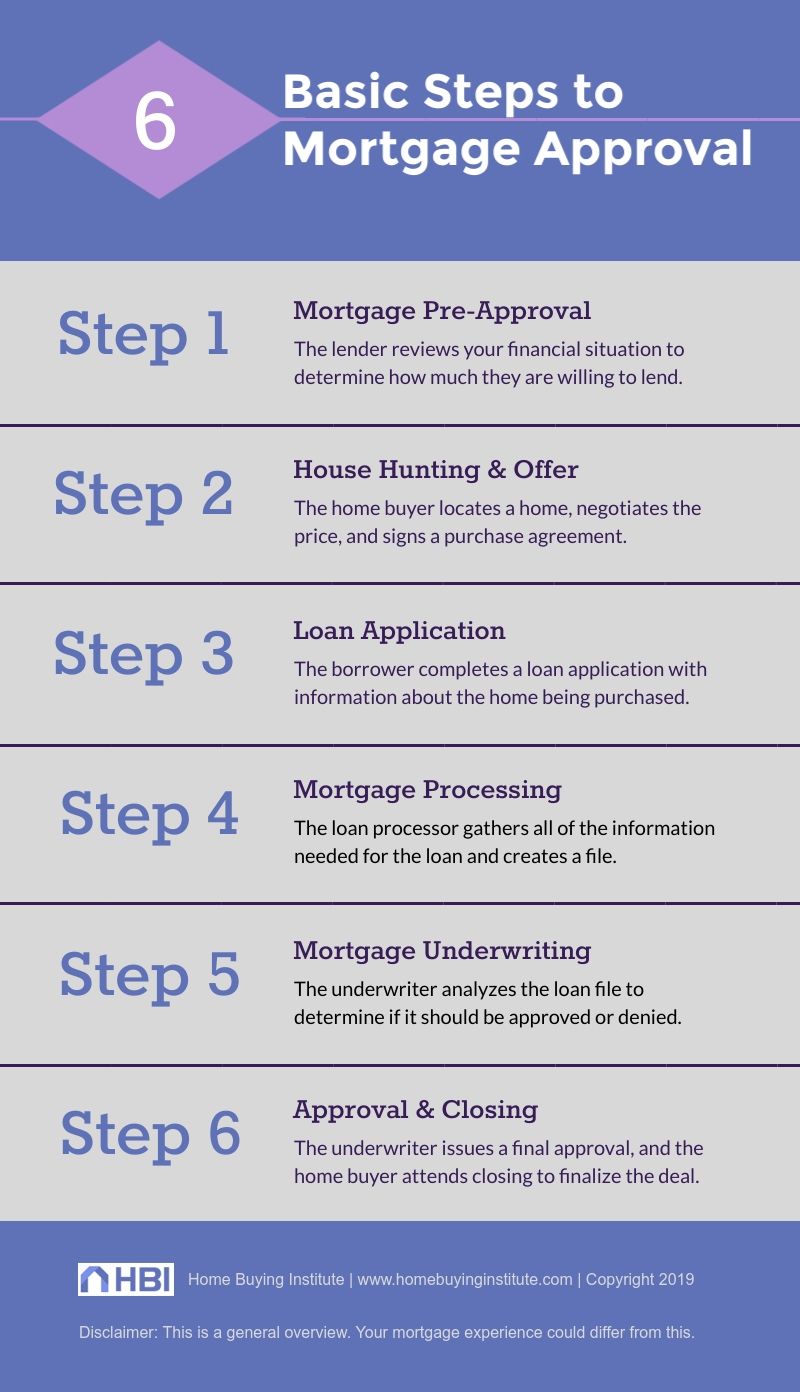

Whats The Process Of Applying For Conditional Approval

Conditional approval usually involves a simple application process.

In assessing you for conditional approval, a lender will consider your needs and objectives and generally look at four key things:

Most people apply for conditional approval when theyâre serious about their property search. It pays to have done some preliminary research on budgets and repayments.

You should also have narrowed your property type and location down and have done some research on the property market. Thatâs because conditional approval comes with a timeframe, often around three months.

Once youâve found the perfect property and youâve been given conditional approval, you should check with your lender about which documents youâll need to provide to turn your conditional approval into a home loan.

You May Like: 10 Year Treasury Yield Mortgage Rates

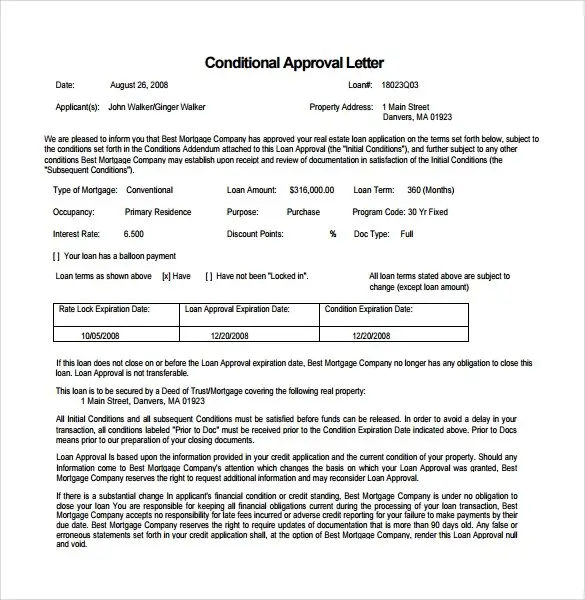

What Is Conditional Approval

Conditional approval is a statement from a mortgage lender indicating a mortgage will get approved provided specific conditions are met at the time of closing. Conditional loan approval does not guarantee a mortgage will actually be approved. Rather, it means the lender willing to loan a specific amount of money, provided the applicant meets certain criteria.

For example, conditional approval for a home loan might hinge on that home appraising for a certain amount of money. Or, it might depend on a mortgage lender verifying an applicant’s employment status prior to that home loan actually closing. If your mortgage is conditionally approved, your lender will generally outline the conditions that will need to be met so there are no surprises.

What Is Needed For Approval

Understanding conditional approval is one thing, but what do you need to reach that stage and go past it? You will need:

- Several years of financial statements and proof of income

- Income verification with check stubs and bank statements

- Income tax returns from the last few years

- Proper insurance verification

- Letters about down payment if its a gift

- Appraisals of assets, such as property, jewelry, and art

Don’t Miss: 70000 Mortgage Over 30 Years

Is Conditionally Approved A Good Thing

Yes. Once you have received conditional approval, it shows you are moving through the loan process and, thus far, proving you are a pretty safe bet to reach unconditional approval. In addition, when a loan is conditionally approved, it gives you more leverage when you make an offer on a house. A seller will likely give you priority over another buyer who has only achieved pre-approval status, particularly if the seller is hoping to speed up the closing process.

Dangers In Buying High Ticket Items During The Mortgage Process

Many furniture and/or appliance stores may offer zero interest and no payments for one year if you purchase at their stores. However, this is not good when you are going through the mortgage process. The mortgage underwriter will pull credit throughout the mortgage process. Just before issuing a clear to close, the mortgage underwriter will do a soft credit pull. Any credit inquiries will show up on your credit report. The mortgage underwriter will want to know about the credit inquiry, the outcome of the credit inquiry how much debt you have incurred, and what the monthly payment is.

Don’t Miss: Can You Get A Reverse Mortgage On A Condo

Ultimate Guide To Conditional Approvals On Mortgages

At the beginning of the mortgage application process, you may hear the term conditional approval and wonder what this means. What does it mean to be conditionally approved for a mortgage, and what should your next steps be? Find out with this simple guide.

Understanding Mortgage Conditions During The Mortgage Process

One condition comes in and opens up more questions for instance, your bank statement shows a huge deposit or a bunch of bounced checks that require additional explanation. You fail to provide the conditions requested. The lender changes or cancels the loan program. Its best to change NOTHING once you have approval. If you say that your down payment will come from savings, dont decide to borrow it instead. Dont apply for new credit or increase your debts until after you close your loan. And pay all bills on time to protect your credit rating.

Read Also: How Much Is Mortgage On 1 Million

Advantages Of Being Conditionally Approved

You likely have been told to get preapproved before house hunting, but when you have conditional approval, you will have a slight edge in terms of bargaining. When you have conditional approval and enter into a bidding war, you will be considered more seriously than a candidate who lacks this type of approval.

For those who are looking to build a home, a conditional approval may help them move through the process faster. Builders dont want to commit to the expenses of construction without the guarantee that you are going to be approved.

Conditional approval can also help with getting you to close quicker. Because underwriting can take some time, having much of it done before you start house hunting or building makes the process go faster. The documents have already been approved, so you will be ready to close when the time comes.

What Happens After The Underwriter Approves The Loan

Once you satisfy all of the conditions and the lender is sure nothing has changed with your finances, then you will receive loan approval. With the final approval, you will get the clear to close that signifies all conditions are met. While final approval is a big deal and very exciting, it is not the last step.

Final approval is the okay that the conditions on your conditionally approved loan were met. The final approval is verification that you can sign the loan documents. However, there is still more you need to do. You are not fully in the clear. Make sure you do not change anything that could cause the lender to revoke your final approval. During the period between loan approval and actually getting the keys, do not make any drastic financial changes. Only spend money on basics and essentials, do not buy a new car, sign up for new credit card accounts, or move around any large sums of money.

You still will have a few more things to do before you can officially get the keys to your new home. After the underwriter signs off on the loan, they will conduct a final review to double-check that all of your documentation is correct. The lender will also do a check on your credit and employment status one more time.

Recommended Reading: Chase Recast

Clear To Close Timeline

How many days before closing do you receive mortgage approval? Clear to close timelines vary by lender and even underwriting team. There are also unique conditions that could extend the clear to close timeline, like irregularities in a loan application or spikes in mortgage team workloads. When lending activity is high in other words, when a lot of people are applying for mortgages and refis it may take underwriters more time to process loans.

Why Being Approved With Conditions Has Its Advantages

As you are likely aware, getting pre-approved for a mortgage is one of the first steps you should take before you start house hunting. Not only does a pre-approval help you determine your budget, but it also makes you more of a competitive buyer in hot markets .

When this is coupled with a conditional underwriting approval, your bargaining position is even stronger, and sellers are more likely to see you as the more serious candidate. Alternatively, if you are looking to build your own home, your builder may require conditional approval before construction can begin.

Thus, a conditional approval is also advantageous here because most builders prefer assurances that the purchase/project is, in fact, going to pass the underwriting stage.

Recommended Reading: Rocket Mortgage Requirements

Can You Be Denied After A Conditional Approval

Clients with a conditional approval for a home loan are at risk for denial if they fail to meet any of the conditions laid out by the lender.

Here are a few reasons why a client might be denied:

- The underwriter is unable to verify the data provided by the client.

- The home the client is trying to purchase has an unexpected lien.

- The client has a judgment on their record.

- The home inspection or home appraisal came in with unexpected issues.

- The client experienced a decrease in income.

- The client had negative entries on their credit report.

Your loan may also be denied if any of the additional information you submit doesnt match up with what the lender was given at the time of the initial mortgage approval. If you have a loss of income or buy a new car at the same time youre trying to get your mortgage, this could throw off your DTI and cause the lender to deny your loan on the basis that its now too high.

What Is The Difference Between Conditional And Unconditional Approval

At an early stage, you may receive ‘conditional approval’, which means the lender has approved your loan if you meet certain additional requirements. … Once the lender has what they need, the next step is called ‘unconditional approval’, which is the lender’s final decision to approve you for the loan.

You May Like: What Does Gmfs Mortgage Stand For

Mortgage Approved With Conditions Then Denied

As explained previously, receiving conditional approval does not ensure that you will be able to close on your home loan. Borrowers must meet the criteria that the underwriter requests after receiving conditional approval.

The following are some examples of conditions:

- Rental verification

Sometimes, additional documents may be required in the loan declined after conditional approval situation, such as:

- Bankruptcy documents

- Verification of foreclosure on stated dates

Once You Begin To Think About Buying A Property A Conditional Approval Also Known As Pre

Conditional approval is similar to full finance approval except that the property you intend to purchase has not yet been determined. It gives you clear guidelines on how much money you have to work with. Some conditions usually need to be met before full finance approval will be granted.

Your Loan Market mortgage adviser will organise conditional approval so you can negotiate with confidence a good price on the property you intend to purchase or bid at auction, knowing your buying power. Its easy to get caught up in the excitement at auction – conditional approval lets you know the impact additional bids will have on your repayments.

- Home loan conditional approval is free

- Its valid for up to 3 months

- You can shop for your home with confidence

- Final unconditional finance approval is faster

Types of home loan conditional approvalThere are a number of different types of home loan pre-approval, from a simple phone-based pre-approval through to written pre-approvals. Many of these are indications only of what the bank is willing to lend you. To be sure of your borrowing capacity you will need to secure a written pre-approval. You may need to pay some application fees, but the security is worth it, and you are then free to negotiate with confidence or bid at auction.

Related content

Don’t Miss: Does Rocket Mortgage Service Their Own Loans

Should I Go With A Variable Fixed Or Split Interest Rate Loan

All have their own benefits but also considerations youâll need to take into account.

07 Sep 2017

The information contained in this article is intended to be of a general nature only. It has been prepared without taking into account any personâs objectives, financial situation or needs. realestate.com.au recommends that you seek independent legal, financial, and taxation advice before acting on any information in this article.

realestate.com.au Pty Ltd ACN 080 195 535 is a credit representative of Smartline Operations Pty Ltd ACN 086 467 727 . Please refer to our for information relating to our activities.

About home loan specialists

REA can connect you with our banking partner ubank, a division of National Australia Bank Limited ABN 12 004 044 937 and part of the NAB Group, or introduce you to a mortgage broker accredited with Smartline Operations Pty Ltd ACN 086 467 727 , who can talk to you about home loans from a range of lenders. Smartline is a wholly-owned subsidiary of REA. Ubank Credit is provided by AFSH Nominees Pty Ltd Australian Credit Licence 391192. Ubank is the mortgage manager for UHomeLoan products.

Can I Be Denied A Mortgage Loan At Closing

Its not common, but it could happen. One reason for last-minute denials could be that you recently changed jobs after youve already received your approval letter. Many lenders will do a final review of your financial documents just before closing, including employment status, so if they see youve just moved to a new job they will need to do another verification of employment and monthly income. If you must change jobs during this delicate time, communicate this to your lenders right away they might be able to help reduce the damage to your mortgage application.

Another reason loan denial might happen is if you open a new line of credit or run up your credit cards. Both of these scenarios will raise your debt-to-income ratio and thats not what a lender wants to see as you take on a massive home loan. To be on the safe side, refrain from making any of these changes this is not the time to buy a car or new furniture for the house.

Don’t Miss: Reverse Mortgage Manufactured Home

How To Apply For Conditional Approval

The mortgage process starts with finding suitable lenders for your individual situation. For example, if youre unable to offer a down payment, you might consider lenders that offer USDA loans.

Most potential borrowers apply for a mortgage with their preferred financial institution . Your bank may also offer perks for existing customers, like a discount on closing costs.

However, its important to gather information from various lenders about interest rates, down payment requirements, expected closing costs and customer service. You wont be able to obtain an exact quote for your specific loan unless you continue with the application process. A pre-qualification can give you some preliminary loan details to use for comparison purposes.

Once youve decided on a lender that meets your loan criteria, you can begin the official application process. Most applications today can be easily submitted online. Youll be asked to provide personal data like your Social Security number and your income.

From this point, you could receive a preapproval in a matter of days and a conditional approval about one to two weeks later .