Does The Federal Reserve Decide Mortgage Rates

The Federal Reserve doesnt determine mortgage rates directly. Instead, it influences the rate indirectly by deciding on short-term interest rates. These rates are ones that financial institutions use to borrow from each other and which the government issues short-term bonds.

Ultimately, the Federal Reserve uses these rates to help guide the economy by encouraging growth and keeping inflation under control. Lowering rates is often a sign of trying to stimulate the economy with new big-ticket purchases such as homes.

Whenever the Federal Open Market Committee decides to raise or lower short-term interest rates, lenders raise or lower theirs accordingly.

When Should Jumbo Loans Be Avoided

You may want to avoid a jumbo loan if you doubt your ability to meet its stiff qualification requirements. In addition, if you feel you may need to resell the property quickly at some point in the future, you may want to consider how energetic the local real estate market is. If the market is slow, or if the property is vastly more expensive than most neighboring properties, it may prove difficult to resell. Even in vigorous markets, potential buyers will likely be subject to the same lengthy mortgage-vetting process you’d have to go through as a buyer, and that can lengthen the amount of time required to complete the sale.

Qualifying for a jumbo mortgage can be a daunting process, and the loan will likely be costly in terms of interest rates and fees even for applicants with very good credit. If your sights are set on an exceptionally expensive property, and you have the means to qualify, a jumbo loan may be the best option for financing your dream home.

Who Should Take Out A Jumbo Loan

How much you can ultimately borrow depends, of course, on your assets, your credit score, and the value of the property you’re interested in buying. These mortgages are considered most appropriate for a segment of high-income earners who make between $250,000 and $500,000 a year. This segment is known as HENRY, an acronym for high earners, not rich yet. Basically, these are people who generally make a lot of money but don’t have millions in extra cash or other assets accumulatedyet.

While an individual in the HENRY segment may not have amassed the wealth to purchase an expensive new home with cash, such high-income individuals do usually have better credit scores and more extensively established than the average homebuyer seeking a conventional mortgage loan for a lower amount. They also tend to have more solidly established retirement accounts. They often have been contributing for a longer period of time than lower-income earners.

Don’t expect a big tax break on a jumbo loan. The cap on the mortgage interest deduction is limited to $750,000 for new mortgage debt.

These are just the sorts of individuals that institutions love to sign up for long-term products, partly because they often need additional wealth management services. Plus, it’s more practical for a bank to administer a single $2 million mortgage than 10 loans valued at $200,000 apiece.

Also Check: How Is Debt To Income Ratio Calculated For A Mortgage

How Big A Mortgage Can I Afford

How much you can borrow will depend on factors such as your credit score, income, assets, and the value of the property. Jumbo mortgages are generally the best for someone who is a high-income earneressentially, someone who can afford the higher payments.

Even if lenders offer a specific loan amount, it doesnt mean you need to purchase a home up to that limit. Carefully consider how much you want to pay and can easily afford so that you can achieve your other financial goals, like saving for retirement. A good rule of thumb is using the front-end DTI to determine your maximum affordability, which shouldn’t exceed 28% of your income.

What Are Jumbo Mortgages

Jumbo loans are a type of mortgage designed for financing a home purchase or refinance with a balance that exceeds loan limits set by the Federal Housing Finance Agency . The FHFA is the government organization that oversees and regulates certain mortgage guidelines to help protect borrowers and lenders alike. Mortgages that do not meet, or conform to, FHFA standards are considered non-conforming mortgages. Rather than being backed by the government, jumbo loans are issued by private companies like Better Mortgage.

To offset the additional risk, jumbo mortgage providers need more reassurance from borrowers that they will be able to pay back the loan. This means jumbo loans often come with stricter qualifying requirements and higher interest rates. Unlike conforming loan borrowers, jumbo borrowers typically need high credit scores, larger down payment amounts, more assets, and lower debt-to-income ratios to be approved.

Jumbo loan limits and amounts

Conforming loan limits are updated by the FHFA every year to reflect the current average home price in the United States. In 2021, the conforming loan limit was set at $548,250 for most areas in the country. However, that limit extends up to $822,375 in certain high-cost areas. Any loan amount above the conforming loan limit range qualifies as a jumbo mortgage. FHFA loan limits are set on a countywide basis, so youll want to check the maximum conforming loan limit map to determine the exact threshold for your location.

Don’t Miss: Which Type Of Loan Is Best For Mortgage

Breaking Down Jumbo Loan Qualifications

Larger loans come with increased amounts of risk for both mortgage lenders and borrowers. To ensure you can afford to take on a jumbo mortgage, qualifying guidelines are stricter than those for a traditional conforming loan. While exact underwriting requirements may depend on the lender, here are some general guidelines and questions to consider when it comes to jumbo mortgages:

What are the jumbo loan minimum down payment requirements?

In the past, lenders have usually required a 20% down payment minimum for borrowers to be approved in a jumbo loan application. However, more flexible options may be available depending on the lender you choose..

At Better Mortgage, jumbo loans are available to borrowers with down payments of just 10%. But keep in mind that 10% can be quite a chunk of change given the higher price tag of the homes. For example, a 10% down payment on the minimum jumbo loan amount is nearly $55,000.

At Better Mortgage, getting pre-approved for a Jumbo Loan is just as quick and simple as it is with any other type of loan. Similar to the process for conforming loans, pre-approval for a Jumbo Loan starts with online pre-approval: youll be asked to provide basic information about your household income, debts, and assets, and Better will run a soft credit check which wont impact your score. You can learn more about the specific product details and limits here.

What credit score do you need for a jumbo loan?

What is the jumbo loan DTI requirement?

Get The Details On How You Can Qualify For A Larger Mortgage Loan

A jumbo loan is a conventional mortgage that doesn’t conform to the loan limit guidelines set by Fannie Mae and Freddie Mac.

For 2022, the conforming loan limit is $647,200 in most areas of the country. In expensive locations such as New York City and many communities in California, the loan limit is $970,800. Loans that exceed these limits are considered jumbo loans.

Conventional mortgages are loans offered by private lenders without a guarantee from the federal government.

Also Check: Can I Add My Daughter To My Mortgage

Benefits Of Jumbo Loans

- Dream home: The biggest benefit of jumbo loans is the opportunity to get financing to purchase a high-quality property or dream house.

- Low down payment: It is possible to get a down payment of as low as 10%.

- Interest rates: In recent times, jumbo interest rates have been quite competitive, if not lower, compared to conventional mortgages. Hence, jumbo loans make it possible to finance a home of your dreams without being limited by conforming loan limits.

- Flexibility: Borrowers have the flexibility to choose the type of jumbo loan that suits their needs. There are 15-year or 30-year mortgage loans and fixed-rate or adjustable-rate mortgage loans.

How To Know If A Jumbo Loan Is Right For You

Jumbo loans are designed for higher-priced properties. They come with more stringent qualifying requirements, which could sometimes mean higher monthly payments and higher interest rates. Because of this, theyre best reserved for buyers with good credit, consistent income, and lower levels of debt.

If you do decide a jumbo loan is right for you, its imperative you shop around for your lender. Jumbo loan standards vary widely, and shopping around can help you get the best rate, lowest closing costs, and most appropriate mortgage for your needs.

Use Credible to get started and compare interest rates from multiple mortgage lenders in just a few minutes.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Read Also: How Much Home Mortgage Can I Afford

Comparing Jumbo Loans & Conforming Loans

If youre buying an expensive home, you can expect its peripheral costs to also be a bit pricey. The same principal applies to jumbo loans, especially if theyre well above the conforming loan limit for your county.

While many lenders will consider lowering their down payment requirements for jumbo loan applicants, most still call for the industry standard of 20%. If you make a down payment of less than 20%, you may be on the hook for private mortgage insurance , which isnt cheap. These stipulations are the same with conforming loans.

Any time youre dealing with a larger mortgage, fees are inherently going to be higher. These usually include origination fees, title insurance, inspection fees and service fees, which are all collectively known as closing costs. Be prepared to pay for these when you finally close on your new home.

Because a jumbo loan cannot be backed by Fannie Mae or Freddie Mac and they are quite large, their interest rates may be higher than their conforming loan counterparts. On the bright side, many lenders jumbo and conforming rates are getting closer than they once were. In general, though, expect to get a somewhat high interest rate.

How To Qualify For A Jumbo Mortgage Loan

When considering buying a new home, choosing a mortgage is one of the most important decisions you will make. For high-value homes, this can be a challenge if the mortgage amount requested exceeds loan limits set by the Federal Housing Finance Agency . In some cases, you can get full funding through multiple loans, but this can get complicated and may cost you more in the long run.

Fortunately, jumbo mortgage loans are specifically designed to finance high-value homes that fall outside the limitations set by government-sponsored enterprises Fannie Mae and Freddie Mac. Jumbo mortgages give borrowers the option to use one mortgage to finance their high-value home. However, the increased loan amount and risk for lenders mean borrowers must meet stricter requirements.

Recommended Reading: What’s The Mortgage Rate

What Are The Qualifications For A Jumbo Mortgage

Jumbo loans tend to have more strict underwriting rules than conventional or FHA loans due the nature of these loans. Borrowers are generally required to

- Have good credit and a lower debt-to-income ratio

- Put at least 10% down at closing

- Retain additional funds in reserve after closing. The amount of reserves required may vary depending on credit scores and other factors.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

Who Should Consider A Jumbo Loan

If you want to buy a home that costs more than the conforming loan limit for the county it’s in, you might want to consider a jumbo loan. This option makes the most sense if you’re in a good position to qualify for it.

First, you should have a high income so you can afford the mortgage payments. Let’s say you’re shopping for a $700,000 mortgage. A rough estimate says that with a 6.5% interest rate on a 30-year fixed-rate loan, you’re looking at monthly payments of a little over $4,400. If you have no other debt payments, you’d need an income of almost $12,300 a month to keep your debt-to-income ratio below 36%.

You also want to have a good credit score and significant cash reserves in the bank. It’s hard to achieve those conditions overnight, so for most people, a jumbo loan is only worth considering once their finances have been on sound footing for a while.

And finally, shopping for a jumbo loan is often more feasible if you already own a home. If you’ve built up equity, you have a store of value that you can use to make the big down payment needed for a jumbo loan. A borrower taking out a jumbo loan generally won’t qualify for a down payment assistance program, so it’s on you to come up with the full amount.

Buy your next home like a pro

From how much to save for a down payment to how long home inspections take, find what you need to know in our Home Buying 101 series.

Donât miss out on your dream home

Sarah Brodsky

Recommended Reading: What’s The Difference Between Quicken Loans And Rocket Mortgage

What Are The Conforming Loan Limits

Fannie and Freddie set limits called conforming loan limits on how high your mortgage can be. Conforming loan limits vary by state and market. In 2022, you can only borrow up to $647,200 for a single-family unit in most parts of the U.S.

However, conforming loan limits go as high as $970,800 in Alaska and Hawaii, where the median price of a home is far above the national average. In other high-cost areas, loan limits are set on a county-by-county basis.

To find the conforming limits where youre looking to buy a home, check this FHFA map.

Why You Should Trust Phoenix Home Loan With Your Jumbo Loan Application

Jumbo home loans are defined as any loan amount above $548,250, but most potential property owners fear the down payment required. Contrary to what other brokers say, Jumbo loans do not necessarily require 20% down. Some financing solutions require as little as 5% down payment, allowing you to easily buy your dream home.Based on our experience working with many clients over several years, we believe that you can rely on us for your jumbo mortgage needs. The Highly Motivated Vercellino Team is ready to answer any further questions you have about jumbo loans. We can also show you the steps for how to start one.

Also Check: Why Do Banks Need Bank Statements For A Mortgage

Jumbo Loan Vs Conventional Loan

There are several noticeable differences between Jumbo and conventional mortgages. Some of them are the following:

- Secured by: Conventional mortgages are secured by Fannie Mae and Freddie Mac, whereas Jumbo mortgages are not.

- Stringent requirements: For people, a bunch of qualifying requirements like down payment, credit score, mortgage insurance, and debt to income ratioDebt To Income RatioThe Debt to Income ratio measures the ability of an individual or entity to pay back their debt or installments easily without any financial struggle.read more for jumbo mortgages is challenging to meet compared to conventional mortgage requirements. For example, a jumbo mortgage requires adequate cash reserve, whereas a limited reserve is acceptable for getting a traditional mortgage.

- Property type: Jumbo mortgages are for purchasing luxury properties in the best areas, unlike conventional mortgages.

- Mortgage limit: GSEs update the limit for conventional mortgages, whereas jumbo mortgages have no fixed upper limit.

Benefits & Disadvantages Of A Jumbo Loan

The benefit of securing a jumbo loan mortgage is as simple as being able to purchase and finance a home thats worth more. For borrowers who want to purchase that home on the waterfront or a larger estate, these loans become the only route to doing so unless you make a large down payment.

There are drawbacks to jumbo loan mortgages, though. They tend to be harder to obtain, requiring a larger amount of income. You also need to show proof of income, credit score, and have a larger down payment to purchase them.

Jumbo or Conventional Loan? Which Is Better?

As you consider jumbo home loan options, compare them to the availability of traditional loans called conforming loans. The most common type of conforming loan is the conventional loan, which is also the type of loan thats most often compared to jumbo loans.

The biggest difference between jumbo loans and conventional loans is the size of the loan. When you hope to buy a home thats worth more and you plan to finance a large portion of that purchase, youll need a larger loan.

Its also important to consider the difference in jumbo loan rates and conventional loan rates. Interest rates are potentially higher with jumbo loans because the lender is taking on more risk. However, rates are very competitive across most lenders. If you have a good credit score and the income to make payments, they are likely to offer a competitive rate.

Don’t Miss: How Do You Get A Mortgage To Build A House

Jumbo Vs Conforming Loan

That jumbo loan amounts are higher than conforming loan amounts isnt the only characteristic that sets them apart.

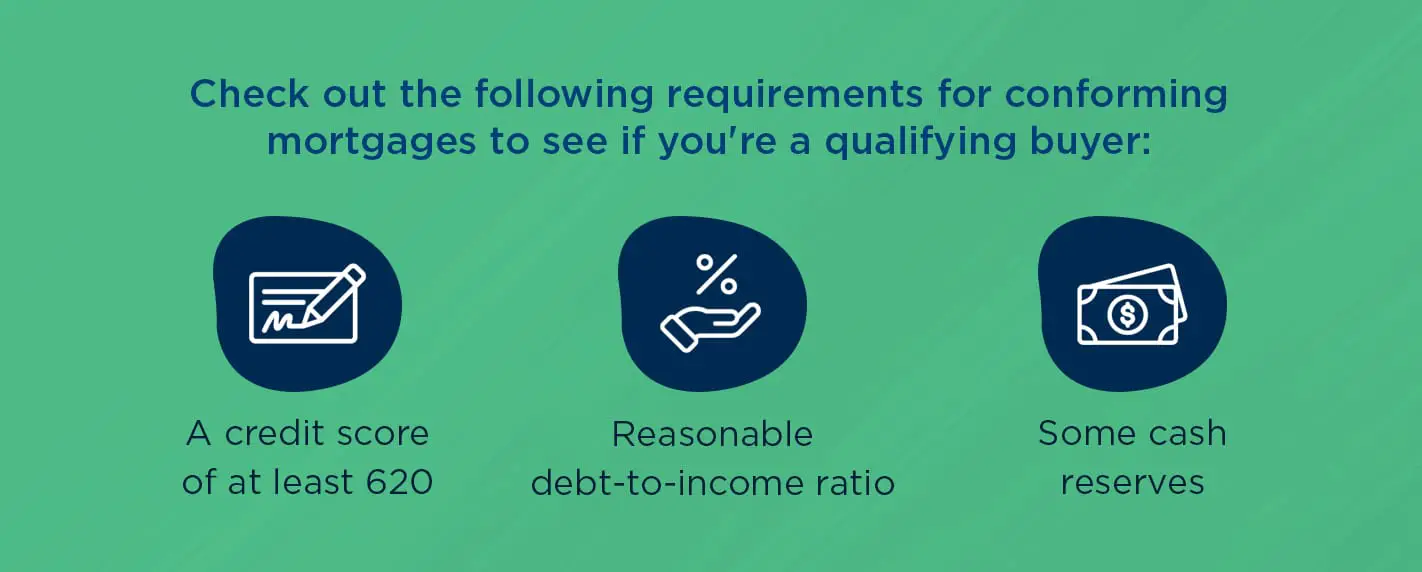

For one, youll need a good credit score. Conforming lenders have a 620 minimum jumbo lenders typically want to see a minimum credit score of 700.

Jumbo loans are typically manually underwritten, meaning a loan underwriter physically reviews each mortgage application and decides on approval or denial. This differs from conventional loans, which are often processed through an automated underwriting system.

Youll also need a significantly larger down payment. As discussed above, lenders often require 20% down for a jumbo mortgage. By contrast, its possible to qualify for a conforming loan with a minimum 3% down payment.