How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Can My Fha Monthly Payment Go Up

Yes. Here are a few instances when your monthly payment can go up, even after youve closed the loan and moved in:

-

If you have an adjustable-rate mortgage, your interest rate can rise after your initial fixed-interest rate term ends.

-

Escrow items built into your monthly payment, such as property taxes or homeowners insurance premiums, are likely to go up over time. While you can’t do much about property taxes aside from moving to a different area you can always shop around for a new homeowners insurance policy.

-

If you run behind on making a monthly payment, you can expect a late payment fee.

How We Calculate How Much House You Can Afford

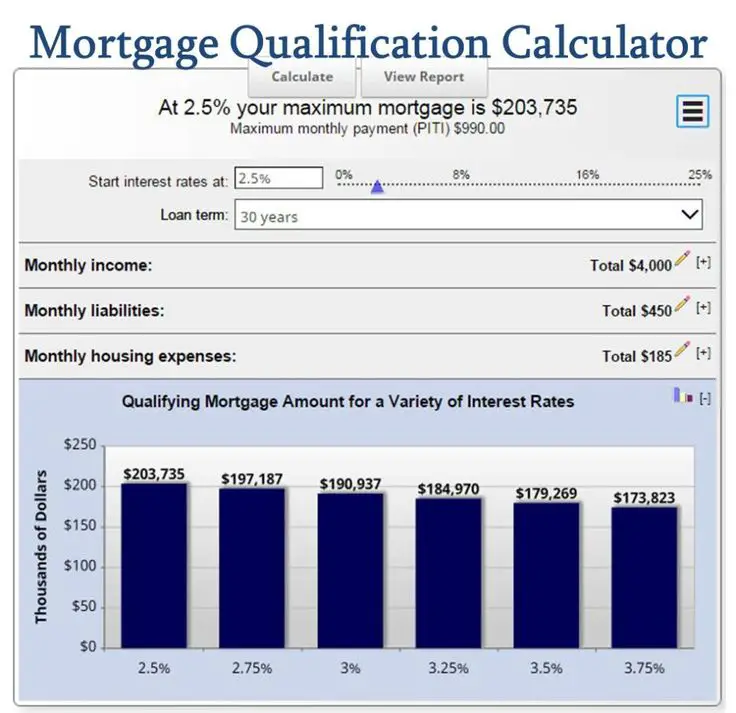

Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved for a down payment, and what your monthly debts or spending looks like. This estimate will give you a brief overview of what you can afford when considering buying a house.Go one step further by applying some of the advanced filters for a more precise picture of what you can afford for a future residence by including the costs associated with homeownership. The advanced options include things like monthly homeowners insurance, mortgage interest rate, private mortgage insurance , loan type, and the property tax rate. The more variables you enter into the home affordability calculator will result in a closer approximation of how much house you can afford.

Don’t Miss: Rocket Mortgage Qualifications

A Higher Credit Score Could Increase What You Can Borrow

Your has a big part to play in how much you can borrow. In the most extreme cases a low credit score could prevent a mortgage lender from even considering you or, more likely, a low score could mean that the lender uses a lower multiple of your income to decide how much you can borrow.

Thats why youll want to make sure your credit score is up to scratch before you even consider applying for anything. Our guide on improving your credit rating will be able to help you with this.

Estimate Your Monthly Mortgage Payments

In addition to using the above affordability calculator, you may want to check out our monthly mortgage repayment calculator to estimate your monthly payments for various loan scenarios.

The following calculator automatically updates payment amounts whenever you change any loan input, so if you adjust the interest rate, amount borrowed or loan term you will automatically see the new monthly fixed-rate and interest-only repayments.

Total Cost

We also offer a calculator with amortisation schedules for changing loan rates, so you can see your initial loan repayments and figure out how they might change if interest rates rise.

Read Also: Chase Mortgage Recast

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if youre in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

How To Calculate How Much House You Can Afford

To produce estimates, both Annual Property Taxes and Insurance are expressed here as percentages. Generally speaking, and depending upon your location, they will generally range from about 0.5% to about 2.5% for Taxes, and 0.5% to 1% or so for Insurance.

Front End and Back End debt ratios are to determine how much of your monthly gross income can be used for your mortgage debt and how much can be used to satisfy all your regular obligations . The 28% and 36% ratios are standard in the mortgage world, but lenders may have other combinations available, such as 33%/38%.

Don’t Miss: 10 Year Treasury Vs 30 Year Mortgage

How We Calculate Your Home Value

Mortgage data: We use current mortgage information when calculating your home affordability.

Closing costs: We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home.

Homeowners insurance: We assume homeowners insurance is a percentage of your overall home value.

Debt-to-income threshold : We recommend that you do not take on a monthly home payment which is more than 36% of your monthly income. Our tool will not allow that ratio to be higher than 43%.

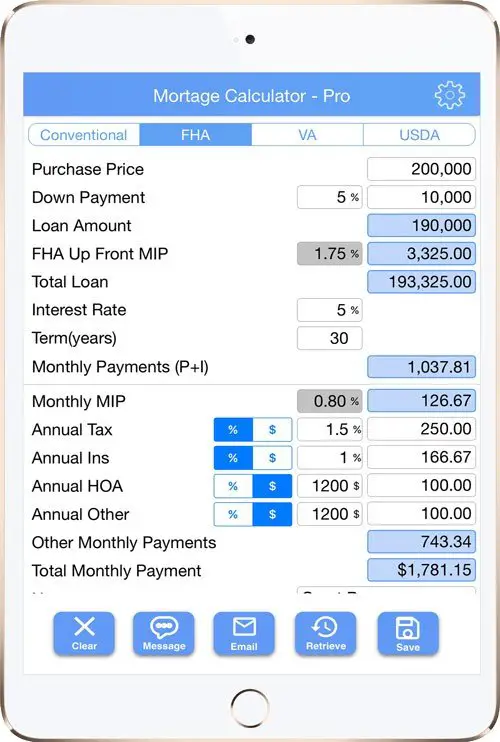

Mortgage Type: The type of mortgage you choose can have a dramatic impact on the amount of house you can afford, especially if you have limited savings. FHA loans generally require lower down payments , while other loan types can require up to 20% of the home value as a minimum down payment.

…read more

| * Includes a $ required monthly mortgage insurance payment.Other Expenses |

| Accuracy Grade*=A |

Rent vs Buy

Determining How Much You Can Afford

Financial Leverage & Economic Risks

If you put 20% down on your home that investment is using 5x leverage. If you put 10% down that investment is using 10x leverage. The results of the above calculator can offer a rough idea of max loan qualification, however for most people it is better not to get close to the limit so they have a financial cushion in case of a layoff or a downturn in the broader economy.

When mortgage lenders evaluate your ability to afford a loan, they consider all the factors in the loan, such as the interest rate, private mortgage insurance and homeowner’s insurance. They also consider your own financial profile, including how the monthly mortgage payment will add to your overall debt and how much income you are expected to make while you are paying for the home.

Obtaining Investment Returns

Those who are seeking investment returns will usually obtain higher returns in the stock market & stock investments are much more liquid & easier to sell than homes. Over the longterm real estate generally appreciates only slightly better than the inflation rate across the broader economy. Since 1963 U.S. residential real estate has appreciated about 5.4% per year in the United States. Over the past 140 years U.S. stocks have returned 9.2%.

Recommended Reading: Requirements For Mortgage Approval

What Monthly Expenses Do You Have

! Please enter an amount less than }.

Estimate your monthly expenses such as groceries, transportation, child care, insurance, shopping, media and regular contributions to savings.

Please do not include rent or housing expenses.

If you’re buying a home with a spouse, partner, friend or family member, include their monthly expenses as well.

If this amount is higher than your monthly income before taxes, please contact us to discuss your options.

Step 6 of 6

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Don’t Miss: Rocket Mortgage Loan Types

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Gross Debt Service Ratio

How Down Payment Size Impacts Home Equity

| Percentage | |

|---|---|

| $250,000 | $0 |

The rule of thumb still stands: 20% of the home value is the ideal amount of money for a down payment. This amount buys you equity in the home, which helps secure the loan. When you donât have a least 20% to put down, you have to find alternate means to secure the mortgage.

This can mean private mortgage insurance , which is an added monthly charge to secure your loan. If you donât have enough money for a down payment, many lenders will require that you have mortgage insurance. Youâll have to pay your monthly mortgage as well as a monthly insurance payment, so itâs not the best option if your budget is tight.

Youâll stop paying PMI when your mortgage reaches about 78% of the homeâs value. While certain homebuyers can qualify for little or no down payment, through VA loans or other 0% down payment programs, most homeowners who donât have a large enough down payment will have to pay the extra expense for PMI.

Read Also: Who Is Rocket Mortgage Owned By

Cash Reserve And Your Ability To Pay Your Mortgage

| Cash Reserve | |

|---|---|

| $1,425 | 17.5 |

The table above is for a $250,000 home in Kansas City, Missouri. The mortgage payments assume a 20% down payment, and they include property taxes and home insurance.

Think of your cash reserve as the braking distance you leave yourself on the highway – if thereâs an accident up ahead, you want to have enough time to slow down, get off to the side or otherwise avoid disaster.

Your reserve could cover your mortgage payments – plus insurance and property tax – if you or your partner are laid off from a job. It gives you wiggle room in case of an emergency, which is always helpful. You donât want to wipe out your entire savings to buy a house. Homeownership comes with unexpected events and costs , so keeping some cash on hand will help keep you out of trouble.

Documents Needed For Mortgage Application

Here are a few documents you should gather to help you understand your financial situation and how much house you can afford. This information will also be required when you apply for a pre-approved home loan.

- Recent statements from all bank and investment accounts

- Pay stubs and W-2 income tax forms

- Total monthly expenses, including all bills, groceries, clothing budgets, etc.

- All of your assets, including stocks, 401, IRAs, bonds, cash, rental properties, etc.

- All debt including credit cards, student loans, car loans, mortgages, etc.

- Profit and loss statements if you are self-employed

- Gift letters if you are using a gift to help with your down payment

Don’t Miss: Reverse Mortgage Manufactured Home

What Does Mortgage Affordability Mean

Your lender wants to make sure you can afford your mortgage repayments not just on paper, but in practice. This means that they will look at your other outgoings and spending both essential and non-essential to determine how much you can really afford.

For example, if you work in a city but your home will be outside that city, you will have to spend money on commuting. This is an essential expense so your income is effectively reduced. The lender will want assurance that you can afford both your mortgage repayments and £200 a month in train tickets.

When making your mortgage application, youll have to reveal how much you typically spend per month, as accurately as you can. A good tip is to reduce your non-essential spending as much as possible in the months before you apply . Also see how much you can trim your essential spending try shopping in cheaper stores, swapping the train for a bike, etc.

Provided you can show a regular surplus each month that would comfortably cover your monthly mortgage repayment, you should be able to borrow the amount you want.

Donât Miss: Chase Mortgage Recast

Higher Outgoings Reduce How Much You Could Borrow

Your regular household expenses, debts and insurances can all affect what a mortgage lender will let you borrow. Outgoings that a lender may take into consideration include:

Loan and credit card repayments Council tax Domestic utilities Insurances Car running costs Child maintenance payments

Some lenders also apply a reduction to the amount you can borrow for the number of children you have , while others have started to take things like discretionary spending into account. Theyâll also require you to prove that you can afford the repayments in the event of an increase to interest rates, so make sure you have suitable means to ensure that ideally through reducing your unnecessary expenditure as this could have a clear impact on the amount of mortgage youâll be able to borrow.

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

Tips To Determine How Much Mortgage You Can Afford

Whats a rule of thumb to determine how much mortgage you can afford? Theres no one rule, but these four tips will tell you.

Home ownership should make you feel safe and secure, and that includes financially. Be sure you can afford your home by calculating how much of a mortgage you can safely fit into your budget.

Why not just take out the biggest mortgage a lender says you can have? Because your lender bases that number on a formula that doesnt consider your current and future financial and personal goals.

Think ahead to major life events and consider how those might influence your budget. Do you want to return to school for an advanced degree? Will a new child add day care to your monthly expenses? Does a relative plan to eventually live with you and contribute to the mortgage? Do you like to travel?

Consider those lifestyle issues as you check out these four methods for estimating the amount of mortgage you can afford.

You May Like: Reverse Mortgage For Mobile Homes

You May Like: Rocket Mortgage Launchpad

Why You Should Wait To Buy A Home

Along the same lines of thinking, you might consider holding off on buying the house.

The bigger the down payment you can bring to the table, the smaller the loan you will have to pay interest on. In the long run, the largest portion of the price you pay for a house is typically the interest on the loan.

In the case of a 30-year mortgage the loanâs interest can add up to three or four times the listed price of the house . For the first 10 years of a 30-year mortgage, you could be paying almost solely on the interest and hardly making a dent in the principal on your loan.

Thatâs why it can make a significant difference if you make even small extra payments toward the principal, or start with a bigger down payment .

If you can afford a 15-year mortgage rather than a 30-year mortgage, your monthly payments will be higher, but your overall cost will be drastically lower because you wonât be paying nearly so much interest.