Can You Get A Job As A Mortgage Loan Originator With No Experience

As the U.S. foreclosure rate continues to decrease, the demand for more Mortgage Loan Originators continues to grow. Making now a great time to start your career as a Mortgage Loan Originator .

There are many great reasons to become a Mortgage Loan Originator.

Annual earning potential is upwards of 6 figures.

Schedule is flexible.

Alternate between working in the office or remotely from home.

The best part of the job is the feeling you get helping someone get their dream home. Buying a home is one of the largest purchases a person makes in their lifetime. Its your job to navigate the home buyer through the home buying experience.

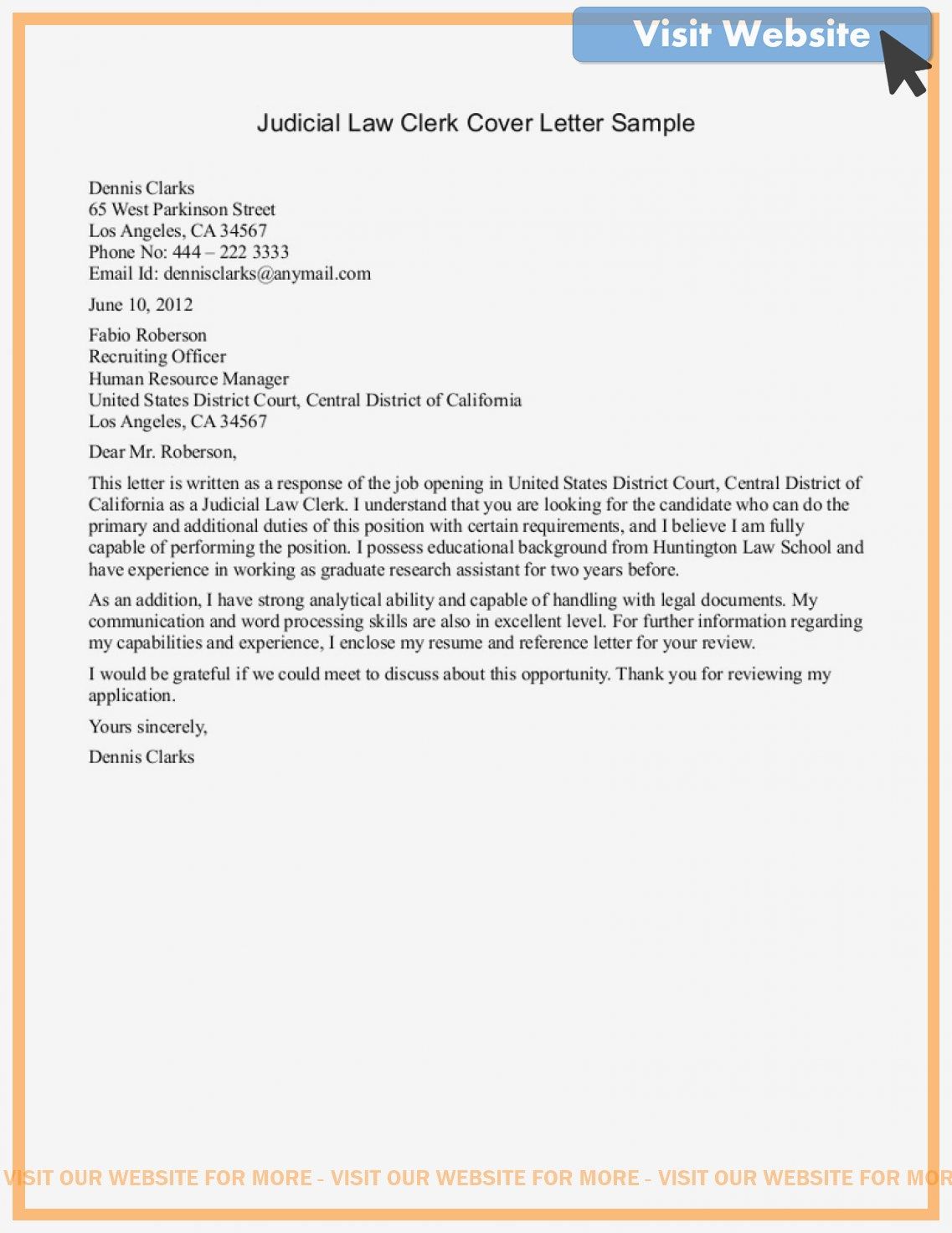

Starting your career as a Mortgage Loan Originator sounds exciting, but how much experience is necessary to become one? Having your high school diploma or GED equivalent is a requirement. You dont need a 4-year degree, but having one in business or finance is recommended.

If you dont have any experience in the financial industry, search for an entry-level position with a bank, financial service company or lending institution to work your way up. The best way to learn the finance industry is on-the-job.

You need to be licensed through the Nationwide Multistate Licensing System & Registry . If youd like to get a leg up on the competition, complete a loan officer certification through a bank association or college program.

Mortgage Underwriterresume Examples & Samples

- Incumbents will typically possess 4 or more years of mortgage loan underwriting experience and be responsible for mortgage loans of complex nature including conventional, FHA and VA, bond/housing authority, and non-conforming loans

- Possesses Bachelors Degree or comparable experience

- Prefer up to 4 years of credit analysis experience

Being A Loan Officer Can Be Really Lucrative

- There are few jobs other than doctors, lawyers, and sports stars

- That pay several hundred thousand dollars a year in salary

- Top loan officers have the potential to make that kind of money too

- And even average ones can make six-figures annually during good years

If a mortgage loan officer gets just one of those deals to go through, it often equates to a huge payday, sometimes as much as a few months salary working a minimum wage job or other lower paying jobs.

So thats the incentive, big money. But there are a number of questions you need to ask yourself before setting out in the mortgage industry as a loan officer.

First and foremost, it is not an easy job. Sure, a mortgage broker or bank may tell you that its simple. And yes, you may not have to work very hard in the traditional sense, or take part in any back-breaking work.

But factor in the stress, the near misses, lost deals, the shots to your ego, and the wheel-spinning and it isnt as effortless as they may make it out to be.

You will see deals fall through and you will waste a lot of time. You will have mental breakdowns as loans slip through your fingers, and brokers and real estate agents scream at you as deadlines close in.

You will undoubtedly make mistakes, which will require a phone call to the borrower to let them know you cant do the deal. It will be embarrassing and unpleasant.

All that aside, lets look at a loan officers typical day, not that any day is ever typical

You May Like: How Much Money Should You Spend On Mortgage

Get Training And Experience

Apply for an entry-level position

Entry-level mortgage underwriter jobs are usually assistant or trainee positions. These positions offer you the opportunity to get more familiar with the industry. Assistant or trainee positions often lead to working in higher positions and making important connections.

On-the-job training

Most entry-level positions include on-the-job training that will help you be a better mortgage underwriter. These trainings can include formal or informal software classes. These opportunities will help you better understand what daily work life is like, build your professional network, and take advantage of networking opportunities.

Mortgage Underwriter Job Description Template

We are looking for an experienced mortgage underwriter to evaluate and determine the eligibility of loan applications. The mortgage underwriter’s responsibilities include analyzing and verifying loan applications, evaluating risks, and making loan eligibility decisions.

A successful mortgage underwriter should be able to exercise sound judgment based on detailed analysis and ensure that all documentation is in compliance with the relevant regulations.

Don’t Miss: How To Watch Rocket Mortgage Classic

What Does An Entry

An entry-level insurance underwriter works as a trainee or assistant while learning how to assess an insurance application, define risk, determine eligibility, calculate policy premiums, and accept or deny each request for coverage. You perform your duties under the supervision of a senior underwriter.

Business Management Bs Business Administration

Hone your business acumen and garner added respect:…

Hone your business acumen and garner added…

Hone your business acumen and garner added respect:

- Time: 70% of graduates finish within 41 months.

- Tuition and fees: $3,720 per 6-month term.

Sample careers and jobs this business degree will prepare you for:

- Account executive

Read Also: What Is The Mortgage Rate On Investment Property

Do Underwriters Make A Lot Of Money

Currently, the national mean salary for insurance underwriters is $76,880, which is noticeably higher than the U.S. average salary for all occupations, $51,960. But the salaries for insurance underwriters vary depending on where you work, so find out which states pay the most and which pay the least.

How Long Does It Take To Become An Underwriter

It takes 6 years of professional experience to become an underwriter. That is the time it takes to learn specific underwriter skills, but does not account for time spent in formal education. If you include the normal education requirements to complete a college degree, then it takes 9 to 11 years years to become an underwriter.

Read Also: How To Get A 2nd Mortgage

Senior Residential Mortgage Underwriterresume Examples & Samples

- Three or more years of successful investment sales experience and the desire to work in a fast-paced, goal and commission based environment required

- Series 7 before hire

- State Life and Health before hire

- Proven organizational skills and ability to work successfully, independently, and proactively in a team environment required

Mortgage Underwriter Jobs Responsibilities

As a mortgage underwriter, your job duties cut across the following:

- Conduct a thorough examination of mortgage loan files, including income, assets, credit, and collateral.

- Utilize the clients loan operating system to ensure accurate data entry

- These professionals underwrite loans in accordance with client guidelines utilizing manual guidelines

- Examine and ensure that all loan documents are correct, complete, and compliant.

- Issue loan decision and condition file accordingly

- Examine and approve loan file compliance and completion conditions

- Provide outstanding customer service to both internal and external clients

- Maintain current knowledge of client and investor requirements

- Resolve pre and post-closing issues as they relate to underwriting

- Assist Processors/Loan Officers in understanding underwriting decisions and conditions

Read Also: What Is Considered A High Interest Rate On A Mortgage

Is Becoming A Mortgage Underwriter Right For You

You can become a mortgage underwriter and earn a nice salary. This financial career offers plenty of advancement opportunities, and you can start without a college degree. But, of course, with a degree, you can open up doors. Adding the right certifications will also help you gain the career you desire as a mortgage underwriter.

Jordan Fabel

Covering different ‘paths’ that people’s lives can take. Creative, foster parent, ticket dismissal, you get the idea. Exploring the requirements, certifications, exams, and obviously, approved courses along each path. I, personally, am the high school dropout son of two teacher parents. So how did I get here? That story is coming soon!

Faqs About How To Become Mortgage Underwriter

Is mortgage underwriting a viable career path in the USA?

Yes, mortgage underwriting is a rewarding profession. This is a good career for people who want to work in the finance and banking industries and make a decent living.

Does every mortgage go to an underwriter?

When planning to buy a home, its useful to have an idea of how long it might take, as well as which processes might take longer and what they entail. Mortgage underwriting is an important part of any home purchase that requires a mortgage, regardless of the type of mortgage you apply for.

What is a mortgage underwriter?

An underwriter is a financial expert who examines your finances and determines how much risk a lender will take on if you are approved for a loan.

Recommended Reading: How To Sell A Private Mortgage Loan

Sr Mortgage Underwriter Full

$75,000 / year

Position SummaryThe Underwriter underwrites loans in accordance with Company and Investor guidelines following the companys policies and procedures under general supervision. Makes sound underwriting decisions and ensures that all decisions meet legal and policy requirements. Perform all duties in accordance with the companys policies and procedures, all US state and federal laws and regulations, wherein the company operates.

Qualifications A thorough knowledge of mortgage loan underwriting. Maintains highly confidential information concerning loan applicants. Requires a high level of organizational skills and ability to work on several tasks simultaneously. Constant contact with Loan Officers and internal office staff. Significant coordination of various duties required. Ability to communicate effectively both verbally and in writing. Ability to handle detailed assignments. Strong customer service skills. Ability to organize and prioritize workload and meet deadlines. Excellent computer skills and working knowledge of Microsoft Office products.

EDUCATION, EXPERIENCE AND/OR LICENSES: Five plus years of FHA mortgage underwriting work experience. Paperless Loan Origination System experience preferred. FHA Direct Endorsement designation and/or VA SAR designation highly preferred. DU and LP experience required. Experience working in a paperless environment preferred.

619 South Bluff Street Tower 1 Ste 301 or Tower 2 Ste 1BSt. George, Utah 84770

How Long Does The Mortgage Underwriting Process Take

In normal times, a purchase should close within 30 to 45 days from the time of contract, says Jared Maxwell, vice president and direct sales division leader at Embrace Home Loans, located throughout the East Coast. However, low mortgage rates have caused a flurry of activity.

Closing time should actually be one of your criteria for evaluating a lender. Many lenders have taken steps to control the amount of business that we want and are able to take in, Maxwell explains. Those who have not, however, may have slower underwriting periods.

Its also important to avoid incurring any new debt during the underwriting process, whether through a credit card, a new auto loan, or anything else. If they see five inquiries with auto finance companies, youll have to write a letter of explanation on what the inquiries were for and if you obtained new credit, says Maxwell. And if you did, youll need a new debt-to-income calculation. In other words, new credit can both delay and derail the underwriting process.

Recommended Reading: What Would A 100 000 Mortgage Cost

Cres Mortgage Underwriterresume Examples & Samples

- Utilizes Fannie Maes Desktop Underwriter to determine loan eligibility for sale to Fannie Mae, as appropriate

- Ensures all file documentation requirements are met

- Underwrites loan files through a review process of analyzing and evaluating income, assets, liabilities, and property, while maintaining designated time frames as determined by management. Review of self-employed, corporate and partnership tax returns, profit and loss, as well as financial statements to ascertain borrowers income. Able to apply Uniform and Industry standard Underwriting principals to arrive at accurate decisions

- Have a full working knowledge of Appendix Q and ability to repay and understand the difference between QM and Non-QM as it applies to underwriting

- Provides written letters of commitment for each loan decision detailing required documentation, and mortgage amount

- Identify common errors and report via loan origination system- UNIFI that compiles data for trainers and Regional and Area Sales Managers

- Secures relevant information and documentation needed to render lending decisions on SIDs, PUDs, and HOAs. Seeks formal legal opinions when/if required

- Gathers information in order to solve problems and make decisions through phone contact to managers, BOTW Mortgage Bankers, or others as needed

- Performs all other duties as assigned by their manager

How Do Underwriters Assess Risk

Insurers will evaluate historical loss for perils, examine the risk profile of the potential policyholder, and estimate the likelihood of the policyholder to experience risk and to what level. … If the insurer underestimates the risks associated with extending coverage, it could pay out more than it receives in premiums.

Also Check: How Much Money Does A Bank Make On A Mortgage

Can An Underwriter Deny A Loan

Yes, a mortgage loan underwriter can deny a loan. The main responsibility of a mortgage loan underwriter is to ensure that a loan applicant meets all the requirements.

So, after the underwriter reviews, various documents like the applicant’s income, credit history, and debt ratios, the underwriter has the final say on whether to approve or deny the loan.

What Is Meant By Underwriter

An underwriter is someone who evaluates and assesses financial risks to see if it’s worth investing. Underwriters typically work in industries like finance, mortgage, and insurance.

An underwriter’s responsibility will mainly revolve around using their extensive expertise on how a company will achieve financial gains and assessing the possible financial risks of a client by reviewing various aspects to determine their capacity to uphold monetary obligations.

Read Also: Should I Refi To A 15 Year Mortgage

What Are The Requirements To Be A Mortgage Loan Originator

You must have at least your high school diploma or GED equivalent. However, most employers will prefer candidates with a 4 year degree in finance or business. Also, many bank associations and colleges offer loan officer certification courses to help you stand out against the competition.

Mortgage Loan Originators are required to be licensed. So you need to complete 20 hours of pre-licensure education and pass the NMLS exam with a score of 75% or greater.

Once you pass the exam, complete a criminal background check and get your credit report through the NMLS or other 3rd party company. This information is vital for future employers to prove youre trustworthy.

Are Underwriters Paid Well

Yes, underwriters are paid well. In some industries, they can make six-figure salaries.

The average underwriter’s salary is $68,217 per year or $32.80 per hour. On the lower end of the salary range, people can make around $46,000, usually those in entry-level positions. On the higher end, underwriters can make $100,000 or more. As most jobs go, factors like industry, location, and experience can decide salary.

Also Check: Can You Use Mortgage To Renovate

Remote Senior Mortgage Underwriterresume Examples & Samples

- Leads the way with an upfront review and makes the initial credit decision based on company checklists and guidelines

- Reviews everything and issues the final approval after all items are gathered by the Loan Processor and keeps the Loan Origination System up to date

- Works with the post-closing team on any stipulations for closed files to push them over the finish line

- Methodical and analytical personality with the ability to underwrite FHA loans using our unique, upfront method

- Reviews loan files for self-employed applicants and FHA loans and income analysis for self-employed applicants

- In order to work remotely, you must be located within one of our four Operations sites

- You may chose 5 days a week or 2 days a week, if 2 days a week are chosen the two days that will be remote will be Tuesday and Thursday

Underwriter Job Description Example

Acme Insurance Company is seeking a detail-oriented insurance underwriter. As part of our team, you will review insurance applications and conduct credit, background checks and other necessary research on applicants. We will look to you to provide competitive insurance premium quotes and negotiate the specific policy terms. This is a full-time salaried position with the opportunity for advancement.

The right candidate will have:

- Exceptional analytical skills

- Excellent computer and mathematical skills

- Good communication skills

- Bachelors degree or higher in a business or finance field

- Minimum of two years underwriting experience

Read Also: Is Closing Cost Part Of Mortgage

Recommended Reading: How To Increase Mortgage Score

Three Steps To Becoming A Successful Mortgage Underwriter

Step One: Earn Your High School Diploma and/or an Advanced Degree

While a formal degree is not necessarily required, you must have at least a high school diploma or GED to meet the educational requirements for a career as a mortgage underwriter at Freedom Mortgage. To go the extra mile, earning an associate or bachelors degree in finance, accounting, or business administration may improve both your hiring and earning potential.

Step Two: Pursue an Internship or Entry-level Position

To gain hands-on mortgage experience, build your expertise, and repertoire of mortgage knowledge, its important to either start with an internship or entry-level position at a financial institution. Youll be able to study how to read credit reports and histories, learn how to analyze various risk factors to understand what makes a suitable mortgage applicant, work with senior underwriters to hone your abilities, and nurture your communication skills to ensure world-class customer service.

Step Three: Get Certified

After you have a few years of underwriting experience, take courses to become a certified mortgage loan underwriter. By furthering your education and becoming certified, youll have a better chance of gaining employment and growing into higher-level positions. Refer to the Nationwide Multistate Licensing System to check licensing requirements in your state for mortgage underwriters.

The Freedom Difference

How To Become A Mortgage Underwriter In 5 Steps

If youre looking for a career field where you can use your strong analytical skills, you may be interested in becoming a mortgage underwriter. A mortgage underwriter is specifically responsible for assessing risk within the mortgage and real estate industries. If you have the skills and educational background, you can help people achieve their dreams of owning property. In this article, we discuss what a mortgage underwriter is and what their requirements are, provide five steps for how to become an underwriter, and explain what its like in their typical work environment.

Also Check: How To Sell A Mobile Home With A Mortgage