How To Get Rid Of Pmi

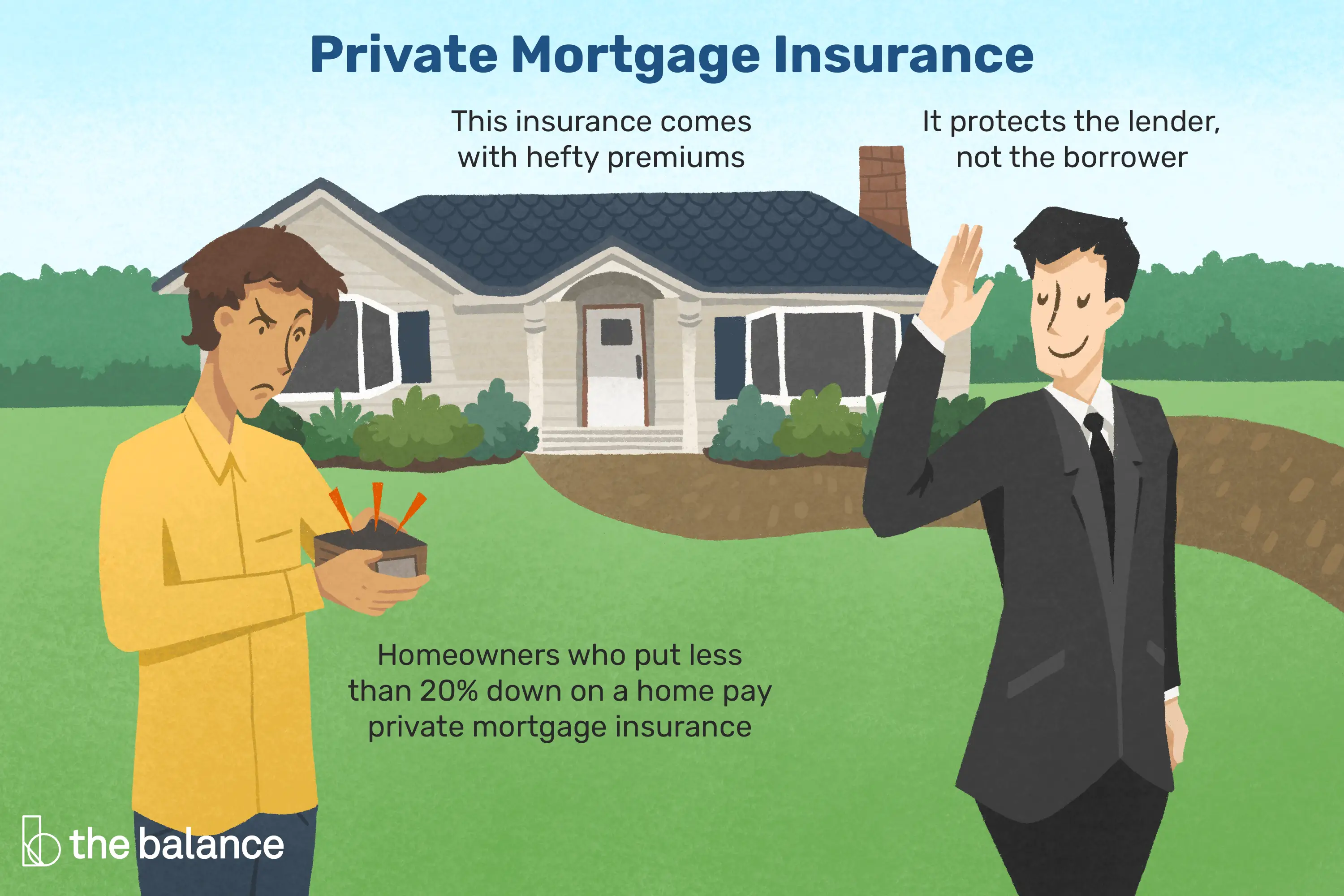

You probably had to add private mortgage insurance to your conventional loan if you bought a home with less than 20% down. PMI can add hundreds of dollars to your monthly payment but you dont need to pay for it forever.

Well go over the basics of PMI and what it covers, and well also show you how and when you can stop paying it.

How Can You Get Out Of Paying Pmi

In most cases, when you buy a home with a down payment of less than 20% of the purchase price, you have to pay private mortgage insurance. If your down payment gives you more than 20% equity, then congratulations. PMI probably won’t be something you have to worry about.

Many homebuyers, however, can’t afford to make that large of a down payment at the time of purchase. If this is your situation, don’t stress. Make extra mortgage payments to the principle until you owe just 80% of your home value.

But your lender won’t simply remove PMI when you hit the 20% equity mark. You have to ask, and the lender can say no — for a while. A lender has to drop PMI when you reach 22% equity based on the original purchase price of the home .

You could also look for a loan that doesn’t require PMI. Although most do, USDA and FHA loans require mortgage insurance instead of private mortgage insurance. A VA loan is another option if you meet the eligibility requirements.

Understanding Pmi With Different Loan Programs

VA loans: One of the significant benefits of VA mortgages is that they do not require mortgage insurance premiums. Yes, you read that correctly no PMI. With no PMI requirements, you can put that money elsewhere when buying a home.

In order to be eligible for a VA loan, you must have served or be serving in the military. The lack of paying a PMI premium is a good reason to consider a VA loan if you have that option. With no PMI requirements that saved money can be used elsewhere to help with building equity in the home.

Increasing the value of the home means more money in your pocket when it comes time to sell.

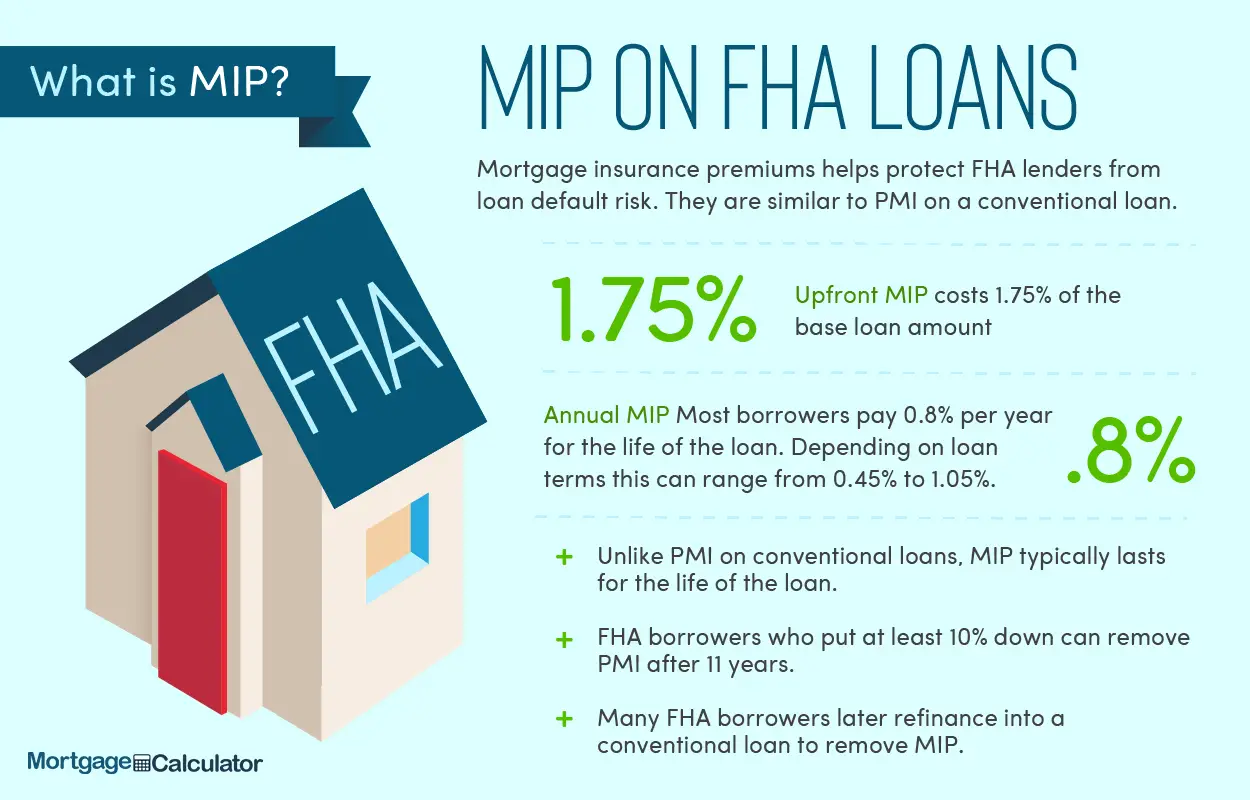

FHA mortgage: An FHA loan is sponsored by the Federal Housing Administration. Homebuyers using an FHA mortgage can purchase a home with as little as 3,5% down. FHA mortgage loans do not require you to pay PMI. FHA loans, however, require you to pay an up front mortgage insurance premium and a mortgage insurance premium or MIP.

Most FHA mortgages will require MIP for the life of the loan. The FHA up-front mortgage premium gets paid at the closing either by financing it into the mortgage or by paying for it with cash. The UFMIP will be a one-time charge. The MIP will be continuous throughout the loan term.

Conventional loan: With conventional loans, you will pay PMI when you dont have a 20 percent down payment. The types of loans are the most common and therefore many people pay the additional cost of PMI.

Recommended Reading: Chase Recast Mortgage

Remove Your Mortgage Insurance For Good

PMI is a big cost for homeowners often $100 to $300 extra per month.

Fortunately, youre not stuck with PMI forever. Once youve built up some equity in your home, there are multiple ways to get rid of PMI and lower your monthly payments.

Some homeowners can simply request PMI cancellation others will need to refinance into a loan that doesnt require mortgage insurance.

With mortgage rates near historic lows, its a great time to get rid of your PMI and lock in a lower interest rate on your loan.

Refinance To Remove Fha Mip

Most FHA homeowners today have a loan with the following characteristics:

- Opened on or after June 3, 2013

- Less than 10% original down payment

- 30year loan

These FHA mortgage loans are not eligible for automatic mortgage insurance cancellation.

To stop paying mortgage insurance premiums youd need to refinance out of your FHA loan.

The good news is that there are no restrictions on refinancing out of FHA into a conventional loan with no PMI. Plus, there are never any prepayment penalties on FHA loans, so you can refinance any time you want.

You will need about 20% home equity to do so. To find your home equity, subtract your current mortgage balance from the value of your home.

You also need a credit score of at least 620 to refinance into a conventional loan with most lenders. The higher your credit score, the more you could save on your monthly mortgage payments.

Don’t Miss: Bofa Home Loan Navigator

Federal Law And Minnesota Law

Some lenders are regulated by the federal government and must abide by federal law, while others are regulated by a state and must comply with state law.

Under both federal and Minnesota law, you can request cancellation of PMI once you owe 80 percent or less on the value of your home, but there is a big difference in how the value of your home is determined under federal and Minnesota law. Because federally chartered lenders do not have to abide by state law, you must first determine whether your lender is Minnesota or federally chartered. Generally, a lender is federally chartered if it includes the word “National” in its name or uses “National Association,” or “N.A.” as part of its designation. You can usually find out if your lender is state or federally chartered with a quick call to your lender.

Should I Refinance To Get Rid Of Pmi

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

To put it mildly, refinancing activity has exploded in the past year or so. As you might expect, the main reason is that interest rates are at historic lows. Many borrowers can dramatically reduce their monthly mortgage payments by obtaining a new loan with a lower refinancing interest rate.

However, what if you already have a relatively low mortgage interest rate, but you’re paying private mortgage insurance, or PMI, because you put less than 20% down when buying your home? Can you refinance to get rid of this expense? Here’s what homeowners with PMI need to know.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

How To Get Rid Of Mortgage Insurance

Putting 20% down on a house may not be feasible for everyone. Thats why many homebuyers get stuck paying private mortgage insurance . Having to pay mortgage insurance can make owning a home more expensive. But you may not be responsible for making those payments over the entire life of your loan. Depending on your circumstances, your PMI can either be canceled automatically or upon request. Read on to find out how to get rid of PMI.

Check out our mortgage calculator.

How To Remove Private Mortgage Insurance From Conventional Loans

Many homeowners have conventional loans which are often called “traditional mortgages” or just “mortgages.” When you buy a house with a conventional loan, you will most likely need to pay for private mortgage insurance unless you make a down payment of at least 20%. The same is true when you refinance. Your home equity needs to be at least 20% or you will probably need to pay for PMI.

The good news is that you can request your lender remove PMI once your home equity reaches 20%. You can build home equity by paying down the principal on your mortgage. Your home equity also can increase when the value of your home increases. If the price of houses in your neighborhood is going up, it can be worthwhile to check the current value of your home. You may have enough home equity that you qualify to have your private mortgage insurance cancelled.

You will need to request in writing your lender cancel your PMI. You typically need to be current on your loan with a good payment history to get your cancellation request approved. Note that these rules apply to single-family primary homes financed on or after July 29, 1999.

Wait for automatic removal of PMI

Refinancing to remove PMI

Recommended Reading: Rocket Mortgage Loan Requirements

By Refinancing Your Home

If you believe your home value has increased and you have at least 20% equity in your home, you may be able to refinance in order to terminate PMI sooner. When you refinance your home, the new lender will not require Private Mortgage Insurance since you have reached the 20% equity milestone.

TIP: Make sure that you include any closing costs that may get rolled into your mortgage to make sure the total New Loan amount is at or below 80% of what the appraisal value will be.

Check Your Credit And Consider Refinancing

When your creditworthiness improves or interest rates drop, refinancing your mortgage may help you save money. And even if you don’t have enough equity to get rid of your PMI, refinancing could lower your interest rate and monthly payment.

Along with your income, current debts and the home’s value, your credit history and scores can impact your options. Check your Experian credit report for free, which comes with free credit monitoring that can alert you to unusual activity. You can also check and monitor your FICO® Score 8 based on your Experian credit report, which may help you determine when refinancing makes sense.

Recommended Reading: How Does Rocket Mortgage Work

How Much Is Private Mortgage Insurance

Thecost of your PMI will depend on a few different variables like the size of yourdown payment and your credit score. PMI payments can range between 0.3% all theway to 1.5%.

Generally,a loan with a smaller down payment will carry a much higher interest rate. Iftrying to decide between a loan with PMI and one without, you need to calculatethe overall monthly cost of both loans before deciding.

When youunderstand these costs, it will help you determine what the best option is foryou and your current financial situation. You should also consider otherpopular loan programs like an FHA mortgage.

No onewants to over pay on a mortgage because thats just throwing money away! Thatswhy knowing exactly how to cancel your private mortgage insurance is of extremeimportance to you.

How To Lower Your Ltv

Lowering your LTV ratio can happen one of two ways: You can save more money to make a larger down payment on your dream property, or you can find a cheaper property.

If you find a $250,000 home, for instance, instead of the $500,000 one in the previous scenario, a $50,000 down payment will give you an 80 percent LTV ratio, which can help eliminate the additional cost of mortgage insurance and put you much closer to paying off the loan from day one.

You can determine how much house you can afford using Bankrates calculator.

Recommended Reading: Monthly Mortgage On 1 Million

How Is Private Mortgage Insurance Paid

When you know you have less than a 20 percent down payment and will be paying private mortgage insurance, it is essential to determine how it will be paid.

You should ask the lender specifically if you have a choice in how to pay the PMI.

There are mostly four ways you can pay private mortgage insurance, including the following:

These are the kinds of mortgage insurance you will encounter when purchasing primary residences. It will be crucial to figure out which type of mortgage insurance is best for your financial circumstances.

Remodeling Could Help You Stop Paying Pmi

If you can rebuild your home so that it increases your homes value enough, you may be able to hit the 80% mark and get rid of the PMI. Not every remodeling project will achieve drastic increases in value, so be extremely choosy in what you decide to do to your home.

Many homeowners will ask themselves should I remodel or move. Just as refinancing, you can easily spend more money on a remodel than you will save on getting rid of PMI.

Recommended Reading: Chase Mortgage Recast Fee

Option : Reappraise Your Home If It Has Gained Value

In a hot real estate market, your home equity could reach 20 percent ahead of the loan payment schedule. In this case, it might be worth paying for a new appraisal. If youve owned the home for at least five years, and your loan balance is no more than 80 percent of the new valuation, you can ask for PMI to be cancelled. If youve owned the home for at least two years, your remaining mortgage balance must be no greater than 75 percent.

Appraisals for a single-family home typically cost between $250 and $500, depending on your area. Some lenders might be willing to accept a broker price opinion instead, which can be a substantially cheaper option than a professional appraisal. On the flip side, professional appraisals are highly regulated and provide an unbiased assessment.

Who this affects: Borrowers who live in areas that are particularly red-hot might have seen their home values shoot up in the last couple years. In fact, the value might have increased enough to bump you out of the PMI range. If this is the case, its time to talk with your lender about getting a new appraisal and potentially cancelling your PMI requirement.

Other Requirements To Cancel Pmi

Requirements for discharging PMI depend on the type of loan.

For example, for Fannie Mae-owned loans, if youve had it between two and five years and its your primary or second home, you could get PMI removed if the home value has appreciated enough to move the current LTV ratio to 75%

Also, if you have a loan for an investment property through Freddie Mac and your home value increased enough to request PMI removal, you would need to have a current LTV rate of 65% and have made mortgage payments for at least two years. You also shouldnt have any 30-day late payments for the last year or 60-day late payments for the last two years.

Fannie and Freddies regulations also change if youve had the loan for less than two years but have made significant improvements on the home that has increased its value.

Read Also: Can You Refinance A Mortgage Without A Job

Fha And Va Loan Programs Have Different Rules

The Homeowners Protection Act of 1998 applies to conventional home loans. It does not apply to FHA-insured or VA-insured loans.

VA loan programs do not require monthly mortgage insurance. The only insurance due is the VA Funding Fee. This is a one-time fee that is paid at the beginning of the loan. The VA Funding Fee is usually financed into the mortgage.

FHA loan programs require an Up Front Mortgage Insurance Premium, and a monthly mortgage insurance premium. In most cases, the monthly premium is charged for the life of the loan. If you get an FHA loan, there is no canceling mortgage insurance. The only way to stop paying mortgage insurance is to refinance into a non-FHA program.

How Does Mip Work

If you have an FHA loan, you pay a portion of the premium up front at the close of the loan and then continue to pay mortgage insurance premiums on a monthly basis. The upfront premium is always 1.75% of the loan amount. If you cant afford to pay this at closing, it can be financed into your loan amount.

In addition to the upfront premium, theres an annual premium thats based on your loan type as well as your down payment or equity amount. If you have a standard FHA loan with a 3.5% down payment on a loan of no more than $625,500, the annual MIP is 0.85% broken into monthly payments.

If you have an FHA Streamline where you go from one FHA loan to another for the purpose of lowering your rate and/or changing your term, the MIP rates are a little better. In this case, theres an upfront rate of 0.01% of your loan amount and an annual MIP rate of 0.55%.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

Check Your Refinance Eligibility

Refinancing to get rid of PMI can cut your mortgage costs by a large margin and save money for months or years to come.

In addition to dropping mortgage insurance, you could potentially lower your rate significantly and save on interest over the life of the loan.

Todays rates are at historic lows, so its a great time to get rid of private mortgage insurance and lock in a lower payment.

Wait For Final Pmi Cancellation

Final PMI termination is an automatic cancellation of your PMI payments when you reach your loan terms midpoint. For instance, if you have a 30-year mortgage, youll stop paying PMI at the 15th year mark, regardless of your LTV ratio or your mortgage balance.

This is your best option if youve agreed to a balloon payment arrangement and dont reach the 78% within that time. It can also apply when you have a mortgage forbearance agreement after being delinquent in your payments.

Also Check: Reverse Mortgage For Mobile Homes

Can You Get Rid Of Pmi On An Fha Loan Without Refinancing

It could be possible to eliminate your FHA mortgage insurance premium without refinancing. But only if you got your loan before 2013 or put at least 10% down when you bought the home.

- If you got an FHA loan between January 2001 and June 3, 2013: Your MIP will go away once you have 22% in home equity

- If you got an FHA loan after June 3, 2013: Your MIP will go away after 11 years of payments if you put at least 10% down. If you put less than 10% down, the coverage lasts until you pay off the loan

If your MIP wont expire on its own, you will need to refinance out of your FHA loan to eliminate its MIP.

Even if your MIP will expire in a few years, a refinance could still save you thousands of dollars, especially if you can lower your interest rate in the process.