What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

Mortgage Legal Issues In Texas

Texas is considered relatively consumer-friendly for mortgages. The state put its own protection measures to help prevent foreclosures well before the housing crisis, which helped the state escape relatively unscathed during the real estate meltdown. Homeowners werent allowed to even get home equity loans until 1997. Another protection measure is that mortgage debt cannot exceed 80% of a homes market value, which means you cant borrow more money until you have more equity in your house. It can help prevent defaulting on the loan or getting into more debt. You also can only take one home equity loan per year, and you cant get a secondary loan prior to repaying your primary home equity loan. Theres a generous amount of time for closing, as well. You have 12 days after you apply and receive official notice of your rights to change your mind and opt out of the loan. This is helpful if you need time to review the terms and make sure your finances are in order.

The state itself also provides resources if youre in danger of foreclosure. You can find links to advice, government agencies that provide help and the Homeownership Preservation Foundation on the Texas Department of Housing and Community Affairs website.

Monthly Payments For A $150000 Mortgage

Your mortgage payment will include a few line items, including principal, interest, and sometimes, escrow costs.

Heres what those entail:

- Principal: This money is applied straight to your loan balance.

- Interest: This one is the cost of borrowing the money. How much youll pay is indicated by your interest rate.

- Escrow costs: Sometimes, your lender might require you to use an escrow account to cover property taxes, homeowners insurance, and mortgage insurance. When this is the case, youll pay money into your escrow account monthly, too.

Let us know where you are in the homebuying process below. Credible can help you find a great mortgage in just a few minutes and put you on the path to pre-approval.

See what your estimated monthly payment will be using our mortgage payment calculator below.

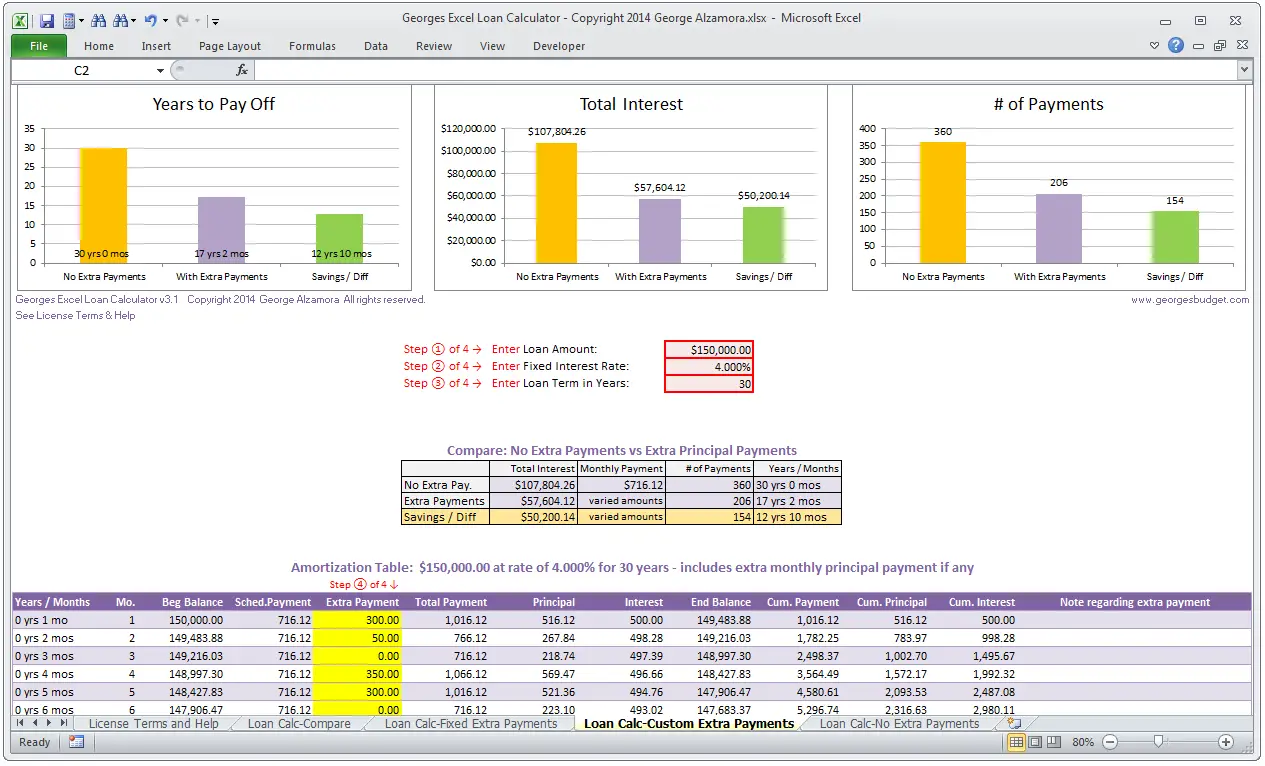

For a $150,000, 30-year mortgage with a 4% rate, your basic monthly payment meaning just principal and interest should come to $716.12. If you have an escrow account, the costs would be higher and depend on your insurance premiums, your local property tax rates, and more.

Heres an in-depth look at what your typical monthly principal and interest payments would look like for that same $150,000 mortgage:

| Interest rate |

|---|

Find Out: How Long It Takes to Buy a House

Also Check: Reverse Mortgage On Condo

How Much A $150000 Mortgage Will Cost You

A $150,000 30-year mortgage with a 4% interest rate comes with about a $716 monthly payment. The exact costs will depend on your loans term and other details.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

When you take out a mortgage, youll pay your balance off month by month for the life of the loan often 15 or 30 years for many homebuyers. But mortgage loans also come with additional costs, with interest being the biggest one.

If youre applying for a $150,000 mortgage, heres how much that loan should cost you each month with interest:

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

Also Check: 70000 Mortgage Over 30 Years

Total Interest Paid On A $150000 Mortgage

Longer-term loans will always come with more interest costs than loans with shorter lifespans. For example, a 15-year, $150,000 mortgage with a 4% fixed rate would mean spending $49,715 over the course of the loan. A 30-year mortgage with the same terms, however, would cost $107,804 in interest nearly $60,000 more once all is said and done.

Enter your loan information to calculate how much you could pay

Learn: How to Buy a House: Step-by-Step Guide

If You Go With A Fixed

When you get a fixed-rate mortgage, your interest rate on the mortgage will stay the same throughout the length of each payment term which, in this case, spans five years.

In Canada, you can only get a 25-year amortization period on insured mortgages. However, because you need to put down 20% on a home worth $1 million or more, that allows you to stretch your amortization to 30 years because the mortgage is not insured.

Based on these details, weve come up with the number below using the LowestRates.ca mortgage calculator.

Mortgage rate: 2.64%

Property taxes: $6,110.30/year, or $509.18/monthUtilities: $100Monthly payment once you qualify: $3,274.18/month, or $39,290.16/year

Read Also: Chase Recast

Determine What Your Ideal Down Payment Amount Should Be

A down payment is a portion of the cost of a home that you pay up front. It demonstrates your commitment to investing in your new home. Generally, the more you put down, the lower your interest rate and monthly payment. There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers. Use this down payment calculator to help you answer the question how much should my down payment be?.

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down-payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate of 3.946%.1

Multiply Your Annual Income By 25 Or 3

This was the basic rule of thumb for many years. Simply take your gross income and multiply it by 2.5 or 3, to get the maximum value of the home you can afford. For somebody making $100,000 a year, the maximum purchase price on a new home should be somewhere between $250,000 and $300,000.

Keep in mind that this is a very general rule of thumb, and there are several factors that will influence the results. For example, the lower the interest rate you can obtain, the higher the home value you can afford on the same income.

This is one reason why your credit score is so important. A good credit score of 760 or higher could net you an interest rate that is 1.5% lower than if you had a fair score of, say, 620. A 1.5% lower rate can easily translate into savings of tens of thousands of dollars over the life of a mortgage.

If you dont know your credit score, you can get your FICO score for free from one of several credit scoring companies.

Also, keep in mind that others may suggest using higher or lower multiples to determine your ideal home purchase price. Ive seen banks recommend ratios as low as 1.5 times your salary or as high as 5 times your salary. I think that for most situations, a good starting point is 2.5 times your income.

You May Like: Bofa Home Loan Navigator

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

I Don’t Know What To Enter For Property Taxes Or Homeowners’ Insurance

You can leave these and most other boxes blank if you don’t know what those costs might be, and the Mortgage Qualifying Calculator will generate an answer without them. The same for the inputs under Down Payment and Closing Costs, and Total Monthly Debt Payments. But your results will be more accurate and useful if you can provide these figures.

You May Like: Chase Mortgage Recast Fee

Costs To Expect When Buying A Home In Texas

One of the first things to consider when you find a home youd like to buy is a home inspection. In Texas, expect to pay $350 to $600 for the service. If you want a termite or mold inspection or radon testing, youll pay an additional fee for each service. If youre curious about your inspectors education, Texas issues inspector licenses so the industry is regulated.

Closing costs are another expense youll have to consider before buying a home. Luckily, these fees are only charged once at the closing of the mortgage, and dont carry on annually like insurance and property taxes. On average, to cover closing costs for a home in Texas, you’ll need to save around 2.1% of the purchase price. Fortunately, Texas is one of the few states that doesnt levy transfer taxes or include a state recordation tax, which will save you a percentage of overall costs.

Local Economic Factors In California

While the West Coast is attractive to many with its long stretches of coastline, warm weather and plethora of exciting cities, it comes at a price: high taxes. California’s taxes are some of the highest in the U.S., with a base sales tax rate of 7.25% and a top marginal income tax rate of 13.3%.

Although the Golden State has high taxes, it does play host to a number of bustling industries. Data from Statista.com shows the state has the second-most Fortune 500 company headquarters at 53, which is only one behind the top state, New York, which has 54 companies.

Some of the most notable employers in the state include Apple, Chevron, Alphabet, Intel, Disney and Oracle. Of course, California is well-known for Silicon Valley, home to many startups and tech companies. Los Angeles, home of Hollywood, is key in the entertainment industry which is another large source of revenue. Theres also a number of military bases in the state in the San Diego area as well as northern California. And for tourism, the wine region of Napa Valley is a huge draw for many out-of-state visitors, as well as native Californians.

In December 2020, the overall unemployment rate for California was 9% compared to the national rate of 6.7%, according to the Bureau of Labor Statistics. However, California’s per capita personal income in 2019 was $66,619, while the national average was $56,490, based on data from the U.S. Bureau of Economic Analysis.

Read Also: Chase Mortgage Recast

What Is Mortgage Affordability

Mortgage affordability refers to how much youâre able to borrow, based on your current income, debt, and living expenses. Itâs essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term âaffordabilityâ is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but itâs important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrowincluding the household income of the applicants purchasing the home, the personal monthly expenses of those applicants , and the expenses associated with owning a home .

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

Also Check: Mortgage Recast Calculator Chase

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Recommended Reading: Rocket Mortgage Loan Types

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

How To Get A $150000 Mortgage

Applying for a mortgage isnt as hard to come by as most people think. It just takes a little preparation. Using a tool like Credible puts that $150,000 loan well within reach.

Here are the steps youll want to follow to get a mortgage and buy that dream house:

Credible makes getting a mortgage easy

Also Check: 10 Year Treasury Yield And Mortgage Rates

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Can You Afford A 15000000 Mortgage

Is the big question, can your finances cover the cost of a £150,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £150,000.00

Do you need to calculate how much deposit you will need for a £150,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit