British Columbia Housing Market

British Columbia is home to some of the highest average home prices in the country, despite experiencing a housing downturn in 2018 and early 2019, which quickly caused a 180 from a sellers market to a buyers market.

In 2019, the average home price was $700,397, down 1.6% from the previous year according to the British Columbia Real Estate Association . B.C. home prices are expected to rise by 4.8% in 2020 to $734,000.

There was a total of 77,349 sales in 2019, a 1.5% decline from 2017, though thats expected to rebound by 10% in 2020 to more than 85,000 sales. Keep in mind that these forecasts were derived prior to the COVID-19 pandemic and are likely to be revised down.

What Are Interest Rates

A mortgage is a loan, and interest is the extra money you pay on that loan. An interest rate is the percentage of extra money you pay on your mortgage term. You don’t pay that rate for the whole mortgage, just for a period of time – the mortage term . If your mortgage has a variable-rate, your interest rate can go up or down. If your mortgage is fixed, your interest rates stays the same. We cover them shortly.

If you’re buying property in Canada, there are three interest rates to watch:

1) The Bank of Canada interest rate

2) A Bank or lenders Prime Rate – usually a few points higher than the benchmark rate

3) Mortgage Rate – whatever you negotiate and/or qualify for

The Bank of Canada changes the benchmark rate to influence and moderate the economy. Canadas banks lend and borrow money at the BoC’s rate.

Each Canadian bank sets its own Prime Rate. A banks Prime Rate sets the benchmark for its lending rates . Canadas five main banks tend to have a similar Prime Rate.

When the BoC policy rate goes up, banks tend to increase their Prime Rate, which could increase their available mortgage rates. A variable-rate mortgage will rise and fall in-step with the banks Prime Rate. A fixed-rate mortgage will be affected by changes in the banks Prime Rate when the mortgage comes up for renewal.

How Are Mortgage Rates Determined

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

Dont Miss: Chase Recast Mortgage

Also Check: How Does Rocket Mortgage Work

Consumer Uses For Basis Points

When you compare mortgage rates and terms, you will eventually encounter basis points. For example, you talk to a loan officer, telling him/her that you want to lock — guarantee your rate at closing — your rate for 60 days. The loan officer then advises you that the lender charges 50 basis points to lock your rate for that period. This means that it will cost you one-half of 1 percent of your mortgage loan balance to lock your rate for 60 days.

Where Does The Term Basis Point Come From

The origins of the term basis point come from the term basis, which refers to the difference between two interest rates. Oftentimes, traders will refer to basis points when describing the change in one instrument relative to another, such as when comparing the yield on a corporate bond against the interest rate offered on Treasury securities. Basis points are also commonly used when comparing the management expense ratios of competing investment products.

Also Check: Reverse Mortgage On Condo

How Do Basis Point Changes Affect My Monthly Payments

Its important to know that your monthly payments will only change if you have a specific type of mortgage an ARM. Any payments you make on a fixed-rate mortgage will always remain the same.

All rate changes will depend on your loan terms. Check with your lender for exact information about how your payments will change.

A Guide To Basis Points

Whether youre familiar with financial terminology or have never heard of the term basis point before, its a good idea to understand the basics of basis points they can affect your monthly mortgage payments. You may also want to know how they work in the context of interest rate changes when youre buying a home.

Heres what you need to know the basis point definition, how to calculate them and more.

Recommended Reading: Bofa Home Loan Navigator

When To Lock Your Mortgage Rate

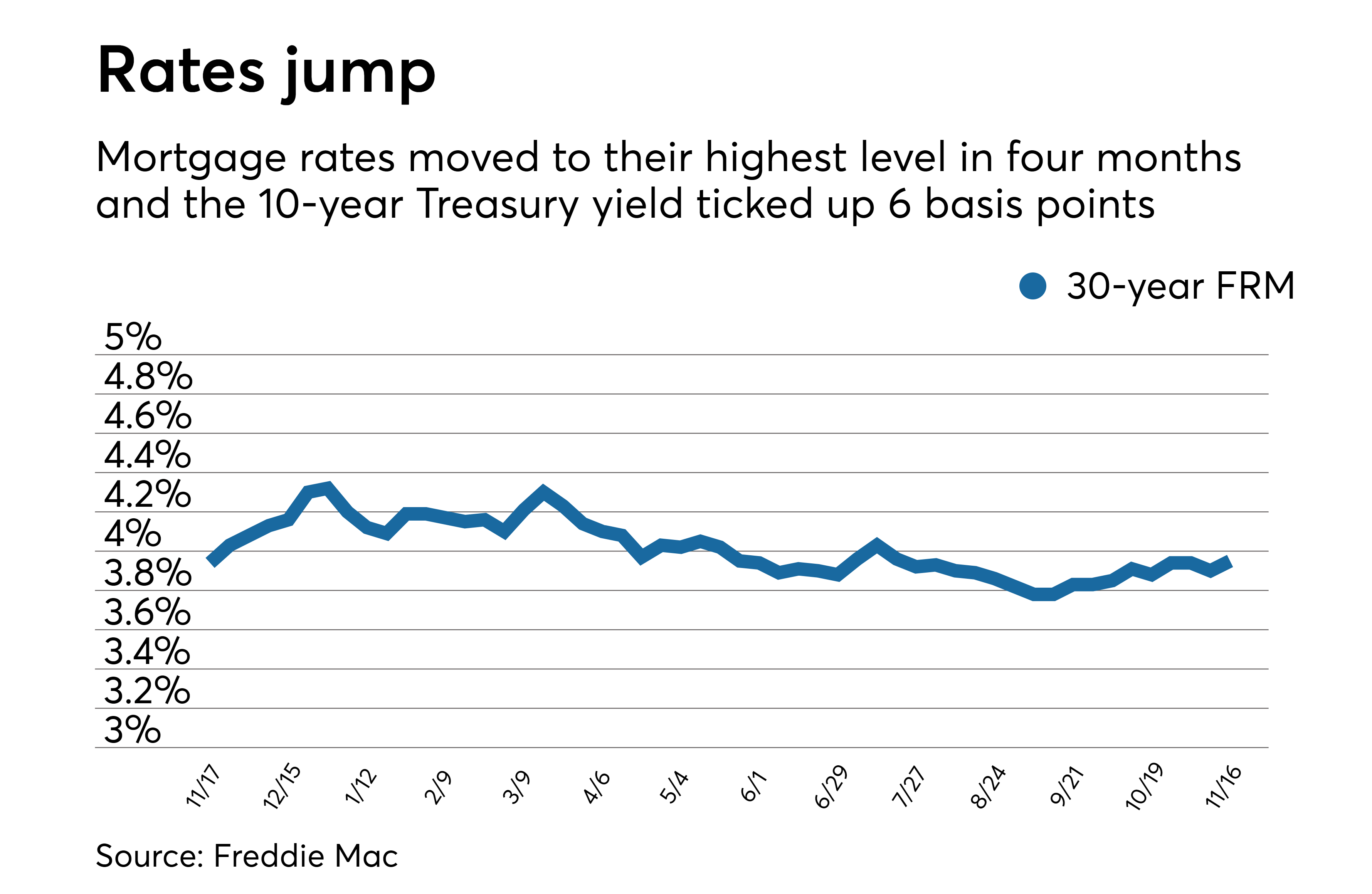

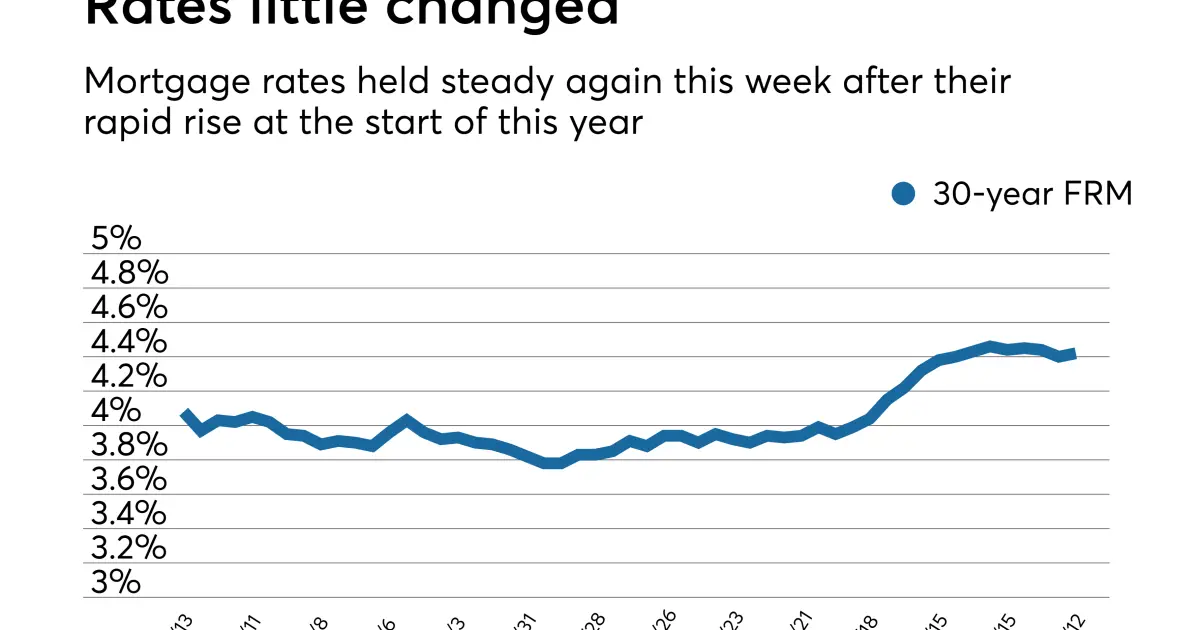

A rate lock guarantees your interest rate for a specified period of time. Its common for lenders to offer 30-day rate locks for a fee or to include the price of the rate lock into your loan. Some mortgage lenders will lock rates for longer periods, even exceeding 60 days, but those locks can be pricey. In todays unstable market, some lenders will lock an interest rate for just two weeks to avoid unnecessary risk.

The benefit of a rate lock is that if interest rates rise, youre locked into the guaranteed rate. Some lenders have a floating-rate lock option, which allows you to get a lower rate if interest rates fall before you close your loan. In a falling rate environment, a float-down lock could be worth the cost. Because mortgage rates are not predictable, theres no guarantee that rates will stay where they are from week to week or even day to day. So, if you can lock in a low rate, then you should do so rather than gamble on interest rates falling even lower.

Remember: During the pandemic, all aspects of real estate and mortgage closings are taking much longer than usual. Expect the closing on a new mortgage to take at least 60 days, with refinancing taking at least a month.

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rate and an annual percentage rate . Thats understandable, since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing the money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

Dont Miss: Does Prequalifying For A Mortgage Affect Your Credit

Recommended Reading: 70000 Mortgage Over 30 Years

How Do Basis Point Hikes Affect A Mortgage

A basis point is equal to one-100th of a percent. The term is frequently used to describe changes to interest rates. For instance, if a mortgage’s rate goes from 4.63 to 4.41 percent, you would say that it went down by 22 basis points. This term is more precise than saying it went down by 0.22 percent. Basis point hikes occur when interest rates go up and can have a significant effect on a mortgage’s payment.

Break Your Mortgage Contract To Change Lenders

You may decide to renegotiate your mortgage contract and change lenders because another lender offers you a lower interest rate. In this case, you may need to pay a prepayment penalty to break your mortgage contract. Make sure the benefits of breaking your mortgage contract will save you money once you include all the fees.

You May Like: Rocket Mortgage Vs Bank

You May Like: Mortgage Rates Based On 10 Year Treasury

How Can Loan Officers Use Tools Like Scoremaster To Close More Loans

Because most mortgage loan professionals work on commission, they might spend hours with prospective borrowers on loan scenarios. They also help borrowers improve credit scores, pull necessary documentation, assist in the completion of applications, order title reports, verify assets and undertake other activities.

Loan officers usually do not get paid if a prospective borrower decides not to buy or refinance, the application is denied, or the prospect changes lenders. Working for free is a big part of this business.

To help allay a borrowerâs fears of taking on the huge burden of a mortgage, loan officers can use a credit modeling tool like ScoreMaster to provide scenarios showing what the prospective borrowerâs total debt â and monthly payments â will look like. ScoreMaster can help the loan officer appear not as a commission-seeking salesperson but as a trusted personal finance advisor.

References:

What Is Cmhc Insurance

CMHC insurance protects lenders from mortgages that default. CMHC insurance is mandatory for all mortgages in Canada with down payments of less than 20% . This is an additional cost to you, and is calculated as a percentage of your total mortgage amount. For more information on mortgage default insurance rates, please read our guide to mortgage default insurance .

Read Also: Rocket Mortgage Payment Options

You May Like: Rocket Mortgage Requirements

Why Basis Points Are Used

Basis points are popular with larger investments such as bonds and mortgages because small increases or decreases in interest rates can represent large dollars. Unless you work in the world of finance, you may not be aware of the popularity of basis points. From a mortgage perspective, small increases in basis points can mean larger changes in the interest rate you might pay.

For example, if large mortgage buyers like the Federal National Mortgage Association increase their “buy rate” by 18 basis points, many lenders will raise their published interest by 25 basis points one-quarter of 1 percent.

Jumbo Loan Interest Rate Moves Upward +020%

The average jumbo mortgage rate is 4.20 percent, up 20 basis points over the last seven days. This time a month ago, the average rate was below that, at 3.68 percent.

At todays average jumbo rate, youll pay $482.04 per month in principal and interest for every $100k you borrow. Thats $6.93 higher compared with last week.

You May Like: Reverse Mortgage Mobile Home

Basis Points And Fixed

First, let’s consider basis points for a fixed-rate mortgage.

A mortgage lender tells you they can offer a 30-year, fixed-rate mortgage for $300,000 at an interest rate of 4%. But your lender then finds out they can lower the interest rate by 50 basis points to 3.5%.

In this example, the monthly payment for the mortgage with the 4% rate would be $1,432.25. Over the life of the loan, you’d pay a total of $515,608, including $215,608 in interest.

But if you’re able to get the same loan at 3.5%, the monthly payment would be $1,347.13. That’s $85.12 less per month than the 4% loan. More importantly, the total amount paid over the life of the loan would be $484,968 roughly $30,000 less than the 4% loan. That reflects a drop in interest paid from $215,608 for the 4% loan to $184,968 for the 3.5% loan.

How Do You Calculate Basis Points For Commission

Read Also: Can You Get A Reverse Mortgage On A Condo

Converting Basis Points To Percentages

The easiest way to convert basis points into a percent form is to simply take the number of basis points and multiply by 0.0001, which will convey the percent in decimal form. For example, if you wish to convert 384 basis points into a percent, simply multiply 384 by 0.0001. This will give you 0.0384, which is 3.84% .

Understanding Basis Points

This calculation can also be done in reverse in order to ascertain the number of basis points that a percent represents, simply by dividing the percent by 0.0001. For example, assuming the rate on a bond has risen 2.42%, an individual would take 0.0242 and divide by 0.0001 to get 242 basis points.

Tipton Increase Max Ltv For Capital Raising

Tipton & Coseley Building Society has increased its maximum LTV for capital raising to 80%. The higher LTV threshold applies in cases where the borrower is not using the money released for commercial purposes. Cash raised can be used for home improvements, to buy additional land, to purchase a freehold, to extend a lease, to

Also Check: 10 Year Treasury Vs 30 Year Mortgage

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Why Does The Difference Of One

A fraction of a percent doesnt seem like much, but a hundredth of a point on a mortgage can mean tens of thousands of dollars over time.

Lets say youre looking at a $200,000 home with a 30-year loan term. Your mortgage payment would be $718.47 with a 3.5% interest rate.

A basis point jump to 25 basis points to 3.75% means that your payment would jump to $740.98 . This extra little bit every month translates to paying over $8,000 more over the course of the loan.

Paying attention to basis points even tiny numbers can help you save a lot of money when youre buying a home.

Also Check: Can You Do A Reverse Mortgage On A Mobile Home

Basis Points Vs Discount Points

When you’re getting a mortgage, you may hear about “basis points” and “discount points.” These points aren’t the same, though.

As explained, a basis point represents 1/100th of a percentage point. Therefore, 100 basis points equal 1%. By contrast, one discount point equals 1% of the loan amount. For example, one point on a $200,000 mortgage would work out to $2,000. When you take out a mortgage, you can buy discount points to reduce the interest rate over the life of the loan. This can lead to lower monthly payments and lowered interest costs in the long term.

So, let’s say you pay $2,000 for one discount point on a $200,000 loan. If you started with an interest rate of 4.5%, buying a single point generally brings the interest rate down to 4.25%. In this case, the monthly mortgage payment would dip from $1,013.37 to $983.88.

How To Convert Basis Points To Percents

The easiest way is to put a number into any field of the basis point calculator and let it do the math for you!

It’s not, however too difficult to do it by hand, so if you want to convert:

For example:

You read that: “The average rate for a 30-year fixed mortgage is 4.09 percent, an increase of 9 basis points since the same time last week.” To know what the rate used to be, divide bps by 100:

9 / 100 = 0.09

Since it has increased, subtract the value from the current rate:

4.09 – 0.09 = 4

The average rate used to be 4%.

You want to say that Australia’s central bank’s benchmark interest rate decreased from 1.5% to 1.25%.

To express the percentage in basis points, calculate the difference and multiply it by 100:

1.5% – 1.25% = 0.25%

You can say that the interest rate decreased by 25 BPS.

Don’t Miss: Recast Mortgage Chase

What Is Bps In Mortgage

Jacksonville, United States

One peculiar thing only seen in India?

One peculiar thing that can only seen in India! There are plenty but the one which is absolutely peculiar to me and make no sense is people love cow so much that out of respect or faith or whatsoever reason, they collect and consume cow urine. I am not at all disrespecting any one’s emotions or sentiments here but bit strange to know this much blind faith. I agree cow dung has so many benefits. It is used as fuel in cooking. People polish their floor with cow dungs. …

Why Do We Use Basis Points

Basis points are used to remove any uncertainty when talking about percentage change. To say my commission is usually 10%, but it increased by 10% last quarter is needlessly ambiguous is your commission now 20%, or 11%? This is why we use basic points, so that we know when someone says a 100 basis point increase they mean an increase of 1%.

Recommended Reading: Reverse Mortgage Manufactured Home

What You Should Know

- Variable mortgage rateshave historically performed better than fixed mortgage rates, although interest rates have generally fallen over the past few decades

- 5-year fixed mortgages are the most popular in Canada

- Insured high-ratio mortgageswill have the lowest possible mortgage rate, but youll need to pay formortgage default insurance

- Typically, longer mortgage term lengths will have a higher mortgage rate compared to shorter mortgage terms.

- Closed mortgage rates are lower than open mortgage rates, but open mortgages allow you to make principal prepayments of any amount withoutmortgage penalties