Find Your Lowest Rate Today

You should comparison shop widely, no matter what sort of mortgage you want. As federal regulator the Consumer Financial Protection Bureau says:

Shopping around for your mortgage has the potential to lead to real savings. It may not sound like much, but saving even a quarter of a point in interest on your mortgage saves you thousands of dollars over the life of your loan.

Mortgage rate methodology

The Mortgage Reports receives rates based on selected criteria from multiple lending partners each day. We arrive at an average rate and APR for each loan type to display in our chart. Because we average an array of rates, it gives you a better idea of what you might find in the marketplace. Furthermore, we average rates for the same loan types. For example, FHA fixed with FHA fixed. The end result is a good snapshot of daily rates and how they change over time.

Best 5 Year Fixed Rate Mortgage

While the lowest rate on a 5 year fix this month is from Barclays at 2.99%. Youll need a deposit of 45% and it has an arrangement fee of £749. However its only available for purchases.

If youre remortgaging the lowest rate on a 5 year fix is also from Barclays, at 3.10%. Youll need a 40% deposit and it has an arrangement fee of £999.

Last month the AIB offered the best rate on a 5 year fix at 2.60% at 85% LTV.

Compare Mortgage Rates In British Columbia

Nobody should begin their mortgage journey without first comparing mortgage rates in order to have a better understanding of what constitutes the lowest mortgage rates in British Columbia.

The difference between British Columbia’s best and worst mortgage rates can be as much as a full percentage point or more. Comparing mortgage rates can give you a better idea of the best rates that are available from reputable mortgage providers in British Columbia.

While banks and credit unions do offer discounted rates that can be competitive, the best rates are typically found from brokers, who often buy down rates using their commission and then offer their clients’ cashback to lower their effective mortgage rate.

Don’t Miss: How Much Mortgage Can I Afford For 1000 Per Month

Expert Mortgage Rate Forecasts

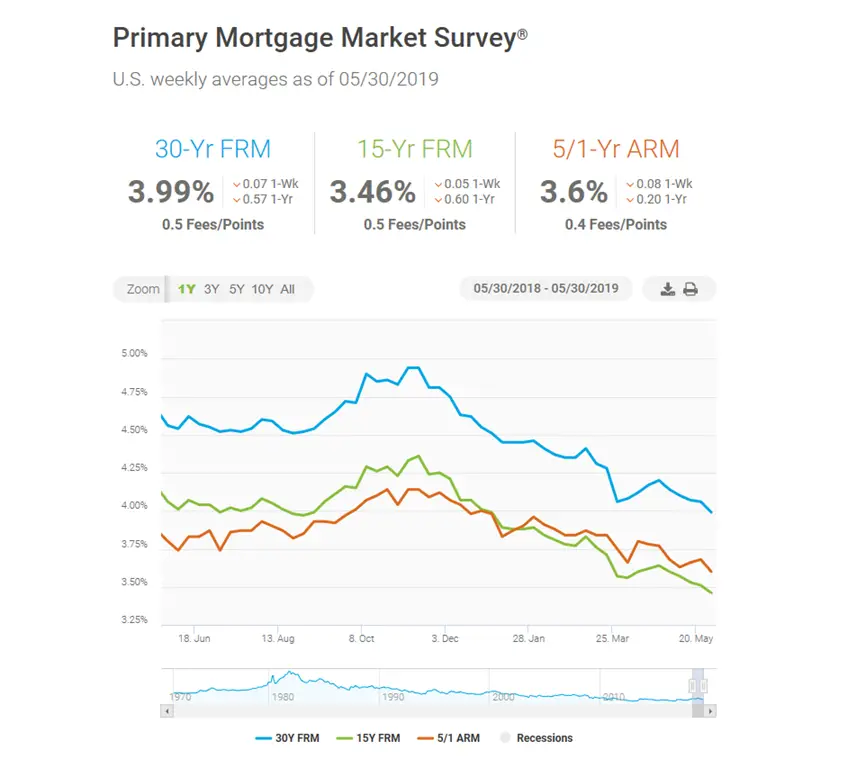

Looking further ahead, Fannie Mae, Freddie Mac and the Mortgage Bankers Association each has a team of economists dedicated to monitoring and forecasting what will happen to the economy, the housing sector and mortgage rates.

And here are their current rate forecasts for the remaining two quarters of 2022 and the first two quarters of next year .

The numbers in the table below are for 30-year, fixed-rate mortgages. Fannies forecast appeared on Aug. 22 and the MBAs on Aug. 23. Freddies came out around Jul. 21. But it now releases forecasts only quarterly. So, expect its figures to look stale soon.

| Forecaster | |

| 5.1% | 5.0% |

Of course, given so many unknowables, the whole current crop of forecasts might be even more speculative than usual. And their past record for accuracy hasnt been wildly impressive. Personally, I think theyre wildly optimistic.

How Mortgage Rates Are Determined In Ontario And What Influences Them

Mortgage rates in Ontario are determined much like they are in the rest of Canada .

The prime rate is the target lending rate that banks use to set interest rates for variable loans, lines of credit and/or mortgages. Because of stiff competition among the banks, each bank sets its own prime rate, and getting the best Ontario mortgage rates is not too difficult given that most banks follow each other if one of them lowers or raises its rates by a point or two.

The prime rates used by the individual banks are generally set based on the Bank of Canada overnight target rate. The target rate is used by the Central Bank to influence how the banks set their own rates and acts as a barometer for the rate at which banks borrow and lend among themselves.

Recommended Reading: What’s An Average Mortgage Interest Rate

Best Mortgage Lenders In British Columbia

British Columbia has a robust mortgage market comprised of mortgage brokers, credit unions, Canadas big banks, and of course a small percentage of private and alternative lenders.

British Columbias mortgage market, like many other parts of Canada, also sees aggressive competition from international banks and financial institutions, such as HSBC, as well as Canadas Big 5 banks. CIBC and BMO have tended to dominate the market for higher-end properties, which comprises a large part of the Vancouver and Victoria real estate markets

Mortgage brokers are a third and vital component of British Columbia’s competitive landscape, and they are a major reason why the province has the second-best mortgage rates of any province in the country.

What Are Today’s Mortgage Rates

Although mortgage rates fluctuate daily, 2020 and 2021 were years of record lows for mortgage and refinance rates across the US.

While low average mortgage and refinance rates are a promising sign for a more affordable loan, remember that they’re never a guarantee of the rate a lender will offer you. Mortgage rates vary by borrower, based on factors like your credit, loan type, and down payment. To get the best rate for you, you’ll want to gather rates from multiple lenders.

| Mortgage type |

Don’t Miss: Can You Buy A House With A Reverse Mortgage

How Can I Calculate How Much My Ontario Mortgage Payments Would Be

Our Ontario Mortgage Payment Calculator will help you figure out how much youll pay with any rate you find on the site. It only takes a few minutes to use, so give it a try. You can modify the mortgage amount, mortgage term and type, amortization and payment type to see how your mortgage options and payment amount are impacted.

Is A Variable Rate Better

If youâre comparing a variable rate and a fixed rate at the same point in time, a variable rate will almost always be lower than a fixed rate. Just as how a longer term mortgage will have a higher rate when compared to a shorter term mortgage, borrowers will pay a premium for locking-in a fixed rate.

Historically, variable rates have performed better than fixed rates, as found in a 2001 study by theIndividual Finance and Insurance Decisions Centre. Thatâs because interest rates have generally fallen over the past few decades, meaning that borrowers with a variable mortgage rate would have benefited from falling interest rates.

In 2020, a low interest rate environment increased the popularity of variable rate mortgages as borrowers were enticed to low mortgage rates. However, interest rates have been rising and are expected to increase further into 2023.

While the focus can be on the direction of the change, you should also pay attention to how large the interest rate changes can be. The pace that rate hikes are occurring, due to highinflation in Canadaand countering Bank of Canada rate hikes, might slow down or stop entirely. This can affect your variable vs. fixed rate decision.

Since variable rates are often already priced at a discount to fixed rates, variable rates would be a better choice if interest rates donât move at all. Variable rates might still be a better choice if interest rates only increase slightly and later on in your mortgage term.

Also Check: How Many Mortgages Can You Have For Rental Property

British Columbia Housing Market

British Columbia is home to some of the highest average home prices in the country, despite experiencing a housing downturn in 2018 and early 2019, which quickly caused a 180 from a sellers market to a buyers market.

In 2019, the average home price was $700,397, down 1.6% from the previous year according to the British Columbia Real Estate Association . B.C. home prices are expected to rise by 4.8% in 2020 to $734,000.

There was a total of 77,349 sales in 2019, a 1.5% decline from 2017, though thats expected to rebound by 10% in 2020 to more than 85,000 sales. Keep in mind that these forecasts were derived prior to the COVID-19 pandemic and are likely to be revised down.

How Do I Get The Best Mortgage Rate In Canada In 2022

Make sure you compare mortgage rates across the different banks, credit unions and top mortgage lenders in Canada. You can use our rate table above to compare the best mortgage rates in just a glance.

After comparing the different mortgage rates currently available, you should then get a personalized quote to see which mortgage rate you can actually get given your situation. At Ratehub.ca, we can provide you a quote in just 2 minutes. and enter some basic information so we can show you the lowest rate you can actually get.

You May Like: Which Mortgage Lenders Use Fico Score 2

Beyond The Mortgage What Else Should A Homebuyer Budget For

Securing a great mortgage rate is just the first of many things you need to consider. Were pretty sure you knew this, but homeownership doesnt come cheap. Here are some of the other things youll need to budget for as a prospective homeowner.

Land transfer fees: In every province except Alberta and Saskatchewan, you have to pay a land transfer tax once you close the sale on your new home. The exact calculation varies depending on which province you live in, but its a cost youll need to consider come closing time.

Property taxes: A property tax is an annual charge depending on where you live. If you live inside a municipality, youll be required to pay a municipal property tax. If you live outside a town or city, youll have to pay a provincial property tax. Property taxes can either be rolled into your mortgage or paid in installments depending on the lender youre working with.

Home insurance: While home insurance isnt a legal requirement in Canada, youll be hard-pressed to find a lender to offer you a mortgage contract without it. Home insurance provides compensation in case your home is damaged by unexpected events, such as flooding or fire.

Land transfer taxes: These are additional taxes that are calculated as a percentage of the purchase price of the home. Land transfer taxes vary by province, though some municipalities charge an additional land transfer tax. Toronto, for example.

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

You May Like: What Are The Different Types Of Mortgage Loans

How Do I Know Im Getting The Lowest Rate

We have a strong selection of lenders on LowestRates.ca including the big banks and many independent providers. This ensures were always delivering you a competitive rate. Even if youre not ready to commit to anything, you can use our site as a starting point for research .

The better informed you are, the more likely you’ll negotiate a better deal for yourself. And, really, thats what we care about the most.

*Based on the difference between estimated deep-discount 5-year fixed rates from Canada’s top six banks and the lowest comparable rates on LowestRates.ca, as of January 14, 2022.

LowestRates.ca Staff

What Are The Pre

Your mortgage pre-payment option determines how you can increase the size of your monthly payments, or whether you can make a lump-sum payment directly towards the principal on your mortgage. Your options will be set out in your mortgage contract.

The first pre-payment option you have is to increase your monthly payment amount by a certain, set percentage. This increase in payment will reduce youramortization period and thus, the total interest paid on your mortgage.

A second option is to make a lump-sum payment directly towards the principal of your mortgage. The percentage amount by which you are allowed to make this lump sum repayment is based upon your mortgage’s initial principal value.

Read Also: How Much Income For Mortgage Calculator

Typical Mortgage Amounts In British Columbia

A typical mortgage amount depends on where you live, the price of the home and the size of your down payment. In 2021, the average price of a house in B.C. rose by 15.9% to $843,830 from last years average price of $728,269. Thats slightly below the Canadian average, which grew 22.8% in the same period.

On a home that costs $843,830, a 20% down payment would come to $168,766. The remainder, $675,064, would be the remaining mortgage amount.

Of course, that amount only represents the principal amount of the mortgage, and does not include interest payments. Thats more difficult to calculate as it depends on the mortgage rate acquired, which is different in each situation, and the amortization period of the loan.

The payments on a typical house in B.C. could be even higher when you take into account the CMHC down payment rule of mortgage default insurance, if the down payment is between 5% and 20% of the original price.

Are Mortgage And Refinance Rates Rising Or Falling

So, it would take a miracle today and tomorrow for this month to be less than a disaster. And, even then, it would still have been bad.

Yesterday, I suggested that September may be less awful than August. Thats because its usually a poor month for stocks, and investors might put some of the money from their sales into mortgage bonds. That should exert downward pressure on mortgage rates. Unfortunately, there should be other forces notably inflation likely pushing them higher.

Personally, I see little prospect of sustained falls in mortgage rates this side of 2023. But the expert economists at Fannie Mae and the Mortgage Bankers Association disagree. You pays yer money and you takes yer choice.

Recommended Reading: Should I Have A Mortgage In Retirement

How Do You Calculate A Mortgage Payment

In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees.

Your lender will be able to provide you with a line-item breakdown of your mortgage payment. Using a mortgage calculator is an easy way to find out what your monthly payments will be. You can also look at an amortization schedule, which shows you how much youll pay over time.

What Are Mortgage Rates

Mortgage rates are the costs associated with taking out a loan to finance a home purchase. Because properties cost so much, most people cant pay for them with cash, so they opt to stretch the payments over long periods of time, often as much as 30 years, to make the regular monthly payments more affordable.

When interest rates rise, reflecting changes in the economy and financial markets, so too do mortgage ratesand vice versa.

Recommended Reading: What License Do You Need To Sell Mortgage Insurance

Will Mortgage Rates Go Back Down

Theres a real push-and-pull in the market right now, creating a lot of volatility in mortgage rates. Thats why weve seen large spikes followed by equally significant drops in recent weeks.

As Freddie Mac explained on August 4, Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth. The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, especially as the Federal Reserve attempts to navigate the current economic environment.

In other words, its nearly impossible to predict what will happen to mortgage rates in late 2022.

The Fed is likely to keep hiking interest rates, which often leads to higher mortgage rates. But if the Feds actions lead to a recession, that could actually tug mortgage interest rates down.

As a borrower, it doesnt make much sense to try to time your rate in this market. Our best advice is to buy when youre financially ready and can afford the home you want regardless of current interest rates.

Remember that youre not stuck with your mortgage rate forever. If rates drop significantly, homeowners can always refinance later on to cut costs.

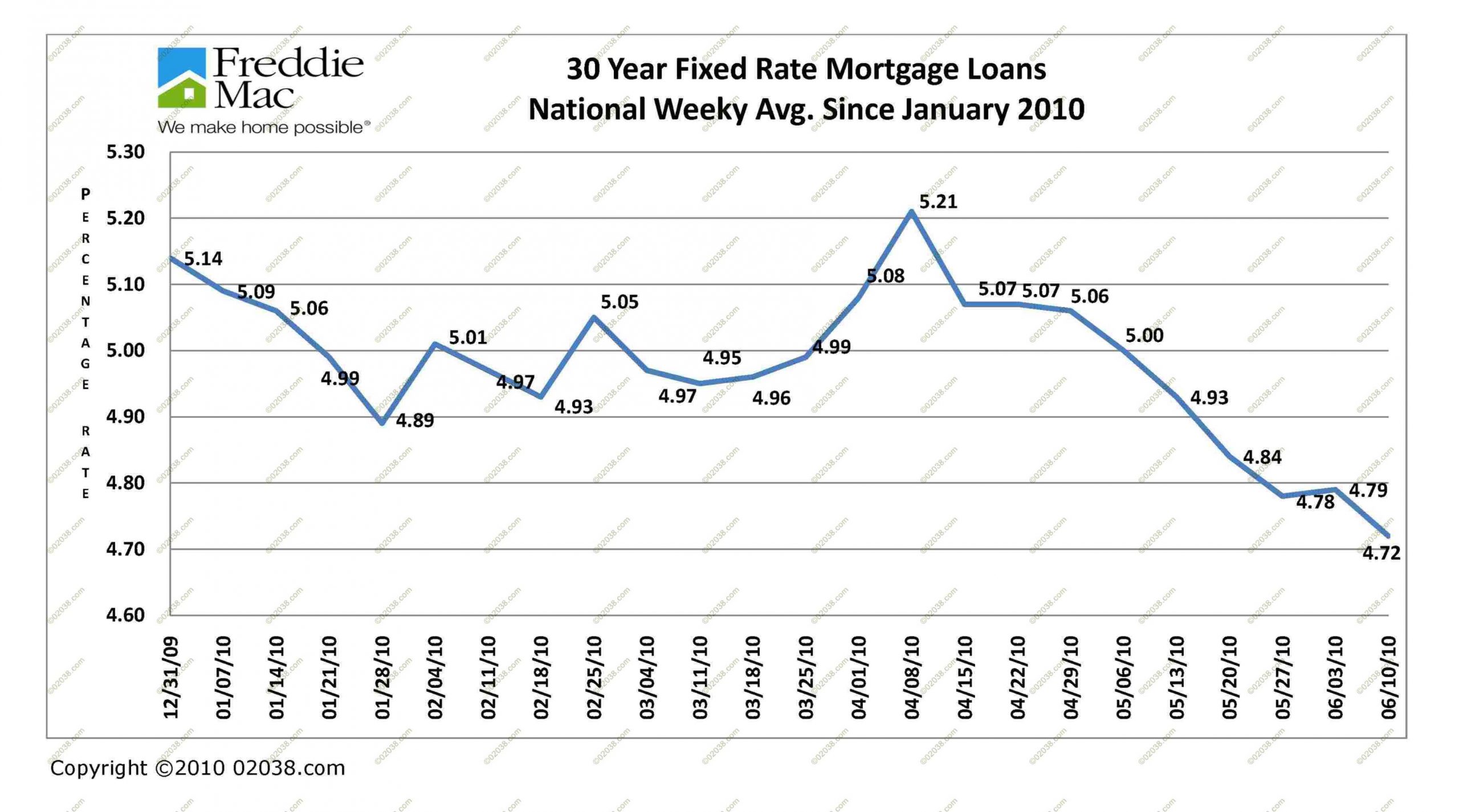

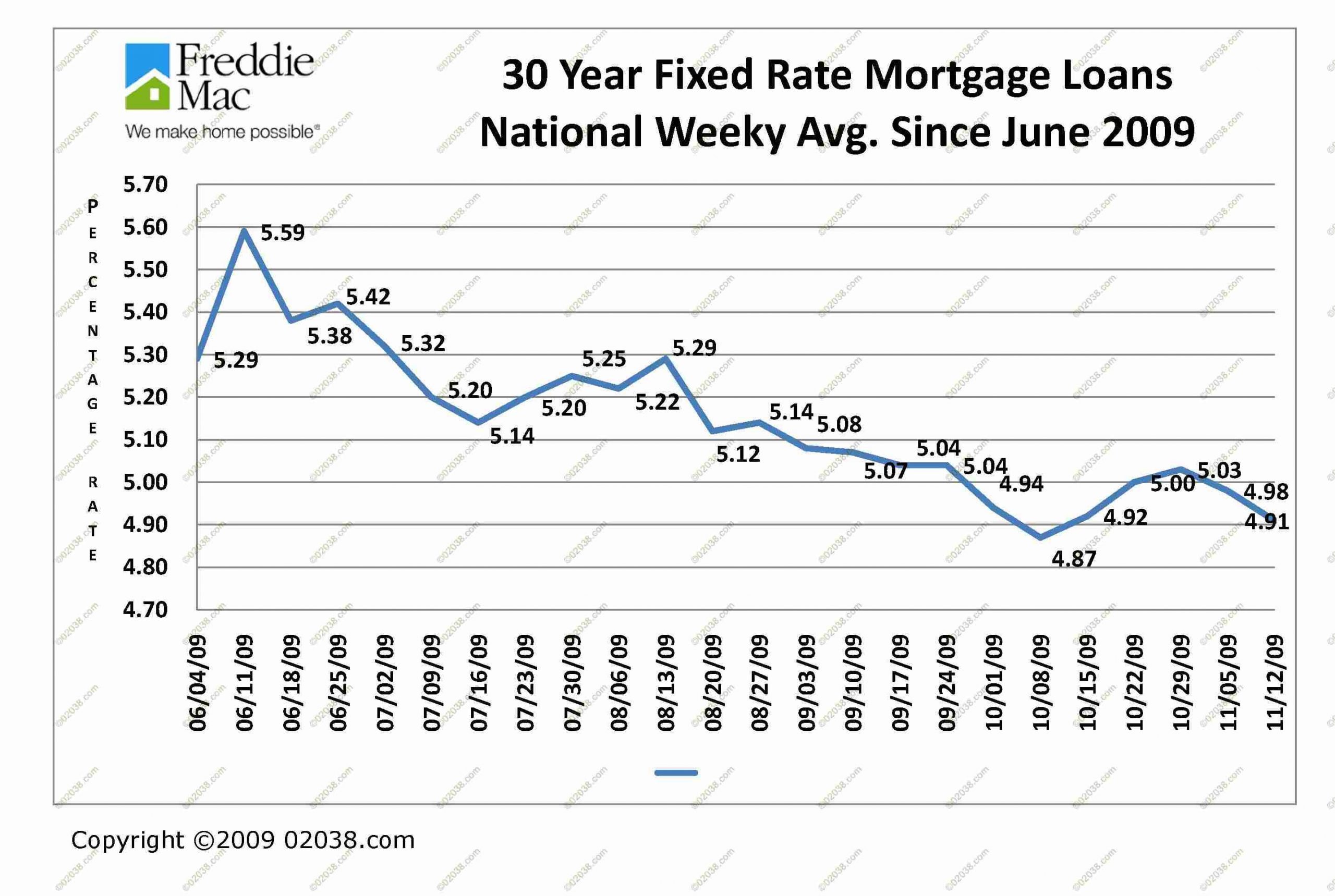

Monthly Average Commitment Rate And Points On 30

Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Macs economists and other researchers, do not necessarily represent the views of Freddie Mac or its management, and should not be construed as indicating Freddie Macs business prospects or expected results. Although the authors attempt to provide reliable, useful information, they do not guarantee that the information or other content in this document is accurate, current or suitable for any particular purpose. All content is subject to change without notice. All content is provided on an as is basis, with no warranties of any kind whatsoever. Information from this document may be used with proper attribution. Alteration of this document or its content is strictly prohibited. ©2022 by Freddie Mac.

You May Like: What Is The Mortgage Rate On Investment Property