Alternatives To Credit Karma To Check And Monitor Your Credit Score

You can check your credit score in a variety of ways. For example, your credit union, bank or credit card issuer might offer a free credit score. Other third-party sites besides Credit Karma also provide credit scores.

Credit bureaus also offer credit scores, but there may be a fee. You can pay to get your VantageScore from Equifax or TransUnion. MyFICO.com offers FICO Scores for a fee. Experian provides your FICO Score 8, the score the majority of lenders use, for free.

Monitoring your credit can alert you of suspicious activity and show you how your use of credit affects your score. TransUnion and Equifax offer paid credit monitoring services. Experian Creditworks is free and gives you monthly access to your Experian credit report and FICO Score. Theres also a paid version that includes access to FICO Scores and credit reports from all three credit bureaus monthly, and to Experian credit reports and FICO Scores daily.

Why Does It Matter

Because a free credit score can easily be 15 to 50 points or more higher than your mortgage score. The difference between a 615 and 620 score can be the difference between getting a home loan and being turned down. The difference between a 635 and 640, or 659 and 680, can be thousands of dollars in interest payments. Even small differences can have big consequences when youre trying to buy a home. Three things can happen to you:

Why Are My 3 Credit Scores Different

Your score differs based on the information provided to each bureau, explained more next. Information provided to the credit bureaus: The credit bureaus may not receive all of the same information about your credit accounts. Surprisingly, lenders arent required to report to all or any of the three bureaus.

Read Also: What Does Serious Delinquency Mean On Credit Report

Don’t Miss: Recasting Mortgage Chase

What Credit Score Is Used For Home Loans

There are five different FICO score models currently used by most lenders of all types. The vast majority of mortgage lenders use the same ones: FICO Score 2, 4 and 5. These are the models used by the credit bureaus Experian, TransUnion and Equifax respectively. They’re called FICO mortgage scores.

FICO Score 2, FICO Score 4 and FICO Score 5: remember these names when comparing the credit scores you get for free.

Check Your Mortgage Rates

Your credit score is only one factor that goes into determining your mortgage rate. Other important factors include your loan type, loan term , and the current interest rate market.

If you want to know what rate you qualify for, check with a mortgage lender. You can fill out a quick preapproval application that will give you a good idea of your interest rate, home buying budget, and future monthly payment.

Ready to get started?

Also Check: Requirements For Mortgage Approval

What Credit Scores Do I Need To Get Approved For A Credit Card

Theres no universal minimum credit score needed to get approved for a credit card. Credit card issuers have different score requirements for their credit cards, and they often consider factors beyond your credit scores when deciding to approve you for a card.

In general, if you have higher scores, youre more likely to qualify for most credit cards. But if your credit is fair or poor, your options will be more limited and you may receive a lower credit limit and higher interest rate.

What Else Do Mortgage Lenders Look At To Determine Mortgage Terms

Your credit scores can be an important factor in getting approved for a mortgage and the rates you’re offered. However, mortgage lenders also go beyond your credit scores when evaluating a potential borrower’s application.

They’ll also take a close look at the information within your credit reportsnot just your scores. For example, even if you have a good credit score, the lender might deny your application if you recently filed for bankruptcy or had a home foreclosed on. Or if you owe too much money to collection agencies.

Mortgage lenders may also request various financial records, including recent bank statements, investment account statements, tax returns and pay stubs. They can use these to determine your income, debts and debt-to-income ratio, which can be an important factor.

Other factors, such as the loan amount, the home’s location, your down payment and loan type can all play into whether you’ll be approved and your mortgage’s terms. Lenders may also have unique assessments, which is one reason shopping for a mortgage can be important.

Recommended Reading: Reverse Mortgage For Mobile Homes

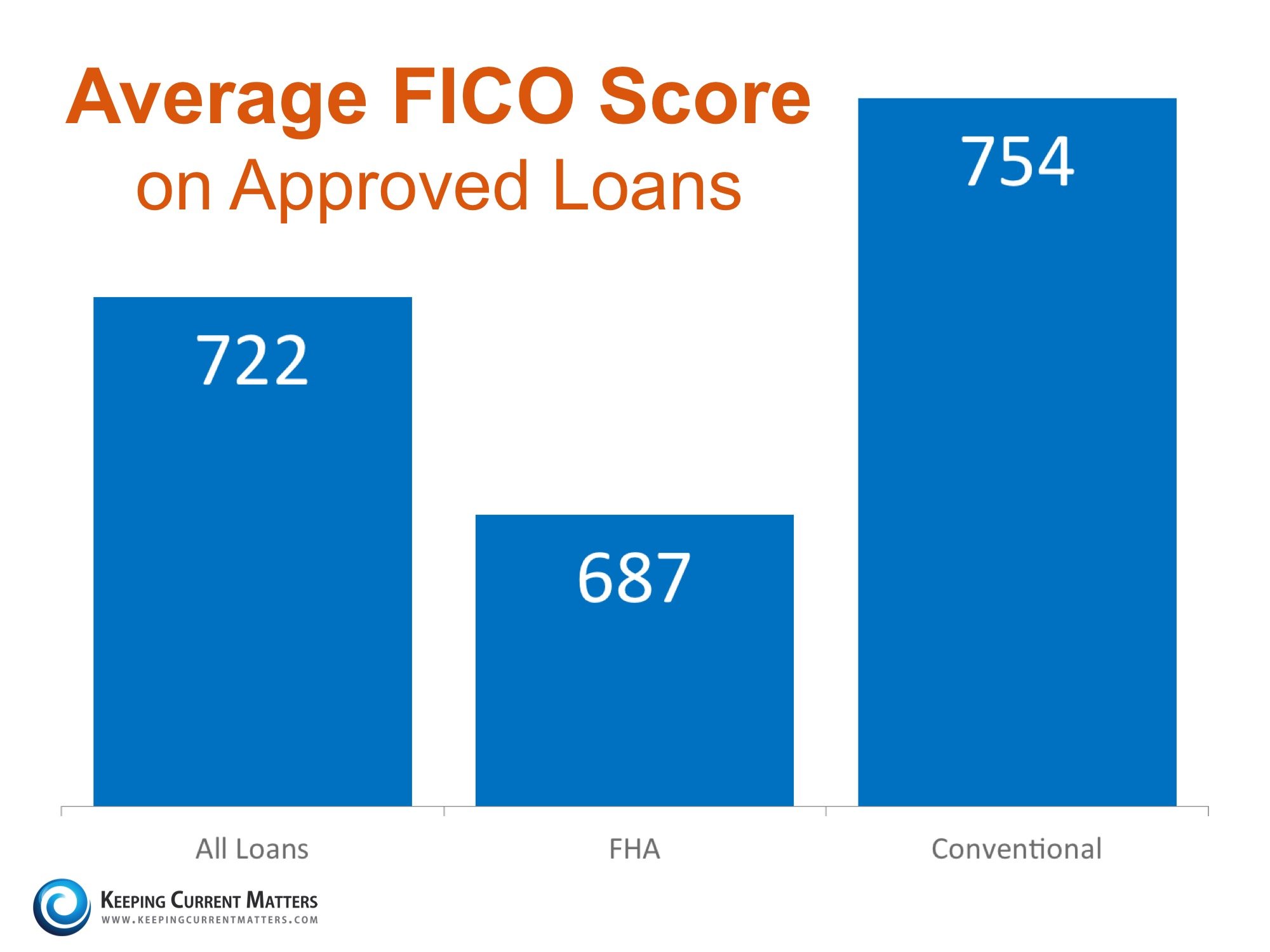

What Is A Good Fico Score For A Mortgage

Any score between 700 and 749 is typically deemed “good,” while scores from 650 to 700 are “fair.” Excellent scores are usually those over 750. While you can likely qualify for a home loan with a rate lower than the median, a higher credit score typically means better interest rates and loan options.

Which Credit Score Is My Lender Evaluating

Most people have multiple credit scores that are changing all the time.

These scores are industry-specific and include credit cards, auto loans, and mortgage loans.

Since FICO Scores were introduced more than 25 years ago, credit requirements and data collection practices have changed. As a result, there are multiple versions of the FICO Score models.

The most widely used version is FICO Score 8, but the most frequently used versions in mortgage lending are:

- Experian: FICO Score 2

Industry-specific scores are fine-tuned based on the specific risks of each industry.

You May Like: Does Rocket Mortgage Service Their Own Loans

When It Comes To Getting A Mortgage There Are Enough Numbers Flying Around To Make Any Mathematician Happy Lenders Will Look At A Number Of Items Which Can Include Your Credit History Your Income And How Much Debt You Have Among Other Things

But one number is perhaps one of the most important numbers of all. Your FICO® scores can impact whether you get a loan or not, and if so, at what interest rate. Thats why its important to understand the nuances of your FICO® scores. Luckily, its not rocket science. Heres the scoop on how your FICO® scores can affect your mortgage.

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower rate and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If youre not sure about a lenders credentials, ask for its NMLS number and search for online reviews.

Don’t Miss: 70000 Mortgage Over 30 Years

Why Do Credit Scores Matter

Ultimately, your credit score is important in many ways. To give just a few examples:

- Your credit score determines the types of loans you can get

- It determines the mortgage interest rates you pay

- It affects how large of a house or how expensive of a car you can afford

- Insurers in most states use credit scores to set premiums for auto and homeowners coverage. Policyholders with bad credit scores often pay more

- Landlords use credit scores to decide who gets to rent their apartments

- Cell phone companies might require a deposit if your credit is too low

Whether youre looking for a mortgage or any other financial product, your credit score makes a big difference. Thats why its so important to know yours before you apply.

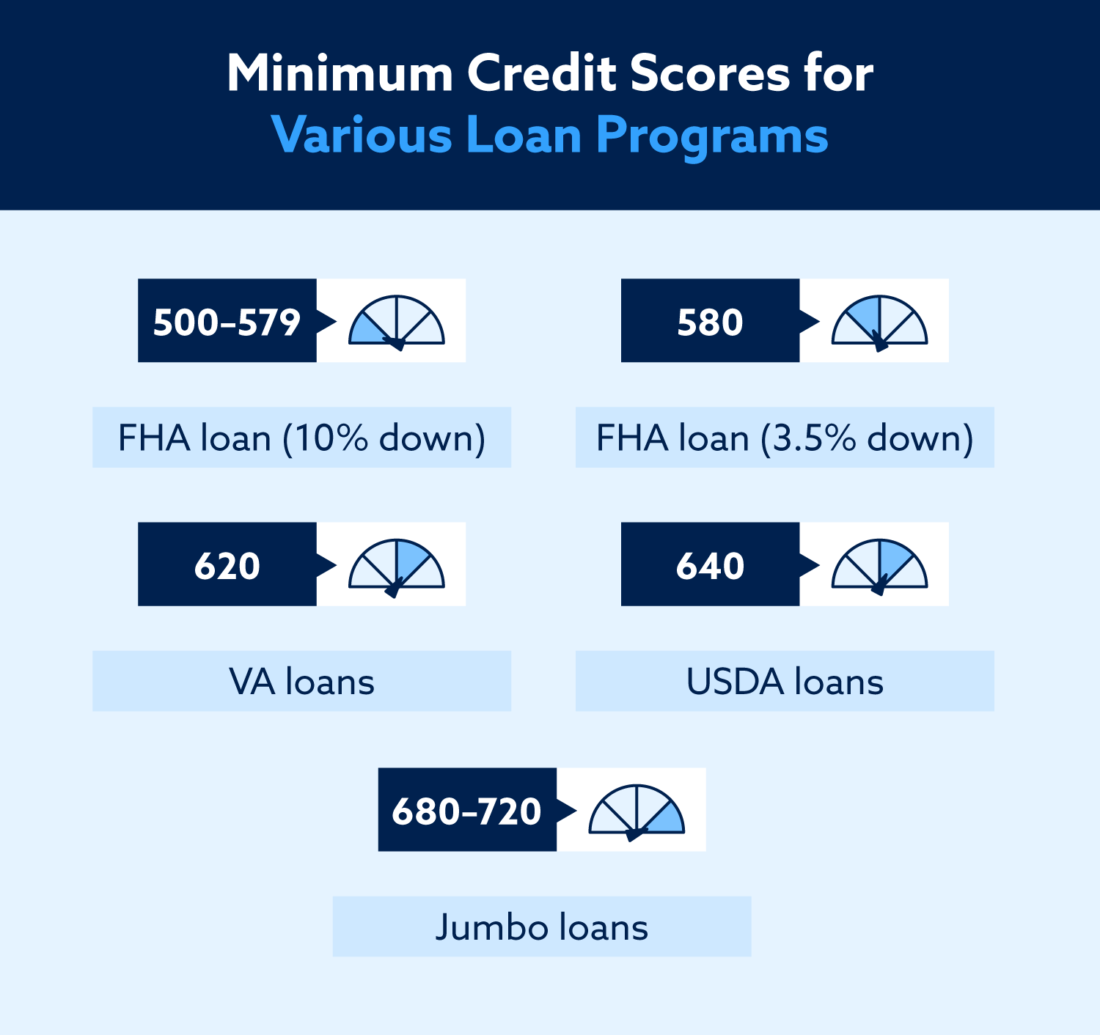

Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage youre trying to obtain. Scores differ whether youre applying for a loan insured by the Federal Housing Administration, better known as an FHA loan one insured by the U.S. Department of Veterans Affairs, known as a VA loan or a conventional mortgage loan from a private lender:

|

Type of loan |

|

|

FHA loan requiring 3.5% down payment |

|

|

FHA loan requiring 10% down payment |

500 – Quicken Loans® requires a minimum score of 580 for an FHA loan. |

|

VA loan |

Also Check: 10 Year Treasury Yield And Mortgage Rates

How Your Credit Score Affects Your Mortgage Eligibility

When it comes to getting a mortgage, your credit score is incredibly important. It determines:

- What loan options you qualify for

- Your interest rate

- Your loan amount and home price range

- Your monthly payment throughout the life of the loan

For example, having a credit score of excellent versus poor could save you over $200 per month on a $200,000 mortgage.

And if your credit score is on the lower end, a few points could make the difference in your ability to buy a house at all.

So, it makes sense to check and monitor your credit scores regularly especially before getting a mortgage or other big loan.

The challenge, however, is that theres conflicting information when it comes to credit scores.

There are three different credit agencies and two credit scoring models. As a result, your credit score can vary a lot depending on whos looking and where they find it.

Most Important: Payment History

Your payment history is one of the most important credit scoring factors and can have the biggest impact on your scores.

Having a long history of on-time payments is best for your credit scores, while missing a payment could hurt them. The effects of missing payments can also increase the longer a bill goes unpaid. So a 30-day late payment might have a lesser effect than a 60- or 90-day late payment.

How much a late payment affects your credit can also vary depending on how much you owe. Dont worry, though: If you start making on-time payments and actively reduce the amount owed, then the impact on your scores can diminish over time.

If youre having trouble making payments at all, you could also wind up with a public record, such as a foreclosure or tax lien, that ends up on your credit reports and can hurt your scores. Sometimes a single derogatory mark on your credit, such as a bankruptcy, could have a major impact.

Dont Miss: How To Get Rid Of Repossession On Credit Report

Also Check: Mortgage Rates Based On 10 Year Treasury

The Basics: What Is A Fico Score

A FICO® Score is a credit score model from Fair Isaac Corporation that is used by thousands of lenders to help them assess the credit risk of individual consumers. Its a three-digit number ranging from 300 to 850, where higher is better , and has been the industry standard since the products founding in 1989.

Tom Quinn, vice president of Scores at FICO, says that there are numerous versions of FICO credit scores because they are periodically redeveloped to incorporate new analytic tools. Through the updating process, FICO releases new FICO Score versions to the market, at which point lenders determine if theyre going to migrate to a newer version of the FICO® Score or continue using the version they are currently using.

In addition, there are FICO® Score versions tailored to assess the credit risk for specific types of financial products. In addition to the base model, which is designed to predict the general risk of any credit obligation, Quinn points out that there are industry-specific versions focused on auto and bankcard risk.

According to myFICO.com, the industry-specific FICO credit scores leverage all the predictive power of the base FICO® Scores while also providing lenders a further-refined credit risk assessment tailored to the type of credit the consumer is seeking.

And then we have three bureaus, so you multiply everything by three, says Quinn.

Why Are There Different Fico Scores

When you apply for credit, whether its your first credit card or a second mortgage, lenders need to decide whether youre enough and likely to repay the money. To do this they check your credit scores or get credit reports from one or more of the major credit bureaus: Equifax, Experian, and TransUnion. Each has its own credit score that is developed by FICO, and these scores are calculated based on your credit history and other information that goes into your credit report.

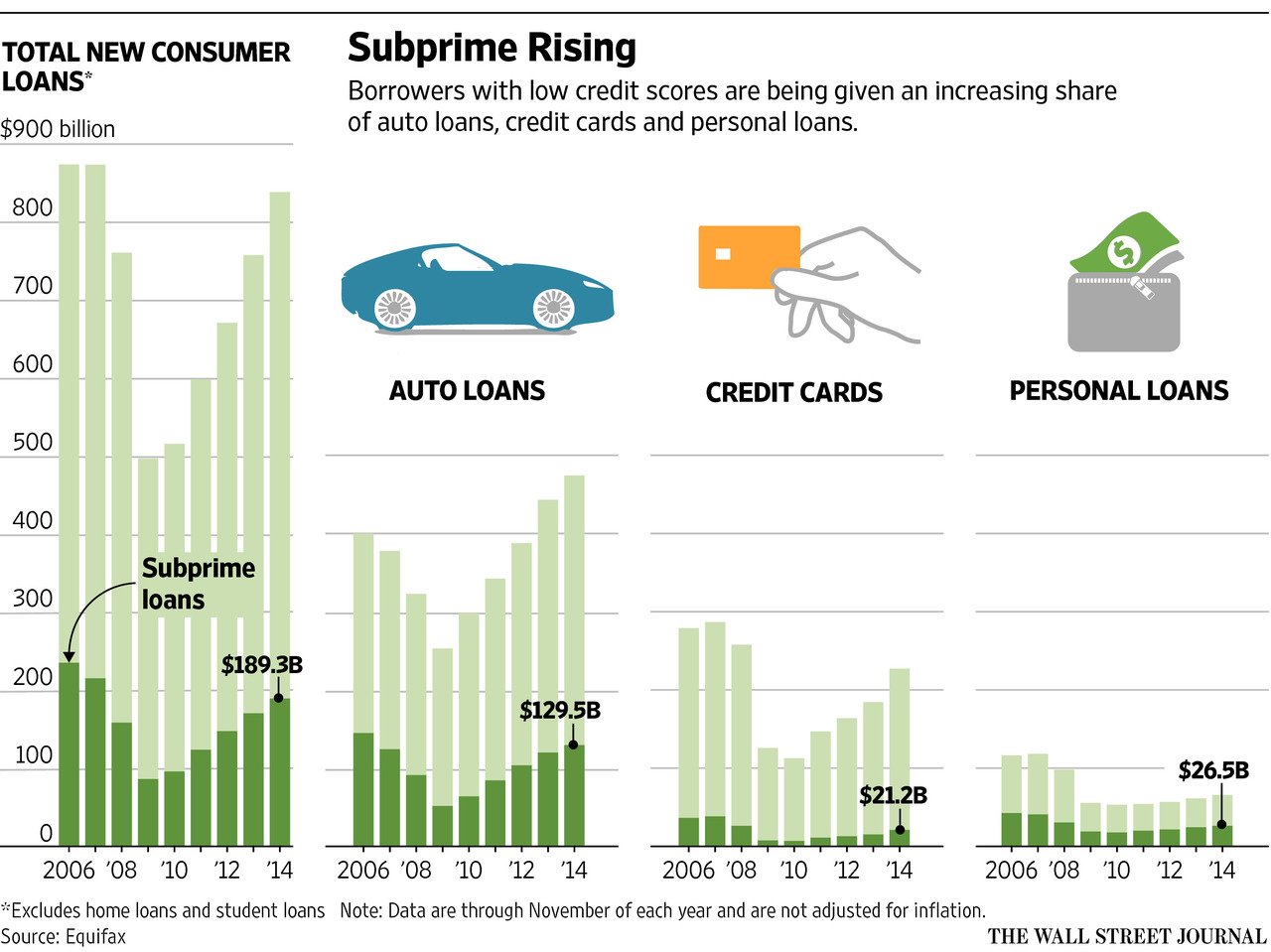

There are also multiple versions of FICO scores, reflecting the evolution of the credit market and consumer behavior since the scores first became a tool for lenders back in 1989. Just in terms of the amount of credit we use, theres been a big increase over the past few decades, with consumer borrowing rising by approximately 15% over the last four years. A typical borrower today probably would have been considered a higher credit risk under older methods of calculating credit scores.

FICO has rolled out 10 versions of its base score over the years, and most of them are still in use by lenders to some extent. Lenders can choose from the following base versions:

- FICO 2

- FICO 9

- FICO 10 and 10T

Read Also: Can You Do A Reverse Mortgage On A Mobile Home

Increase Your Available Credit

Another thing lenders look at when assessing a borrowers creditworthiness is their credit utilization ratio. This ratio compares the borrowers debt, particularly credit card debt, to their overall credit limits.

For example, if you have one credit card with a $2,000 balance and a $4,000 credit limit, your credit utilization would be 50%. Lenders look for borrowers with lower credit utilization because maxing out credit cards can be a sign of default risk.

A credit utilization of 30% is good, but less than 10% is better. So if you have a card with a $1,000 credit limit, to optimize your credit score youll want no more than $100 outstanding on the statement date for the card.

That means that one of the easiest ways to boost your credit score is to decrease your credit utilization ratio. You can do this by paying down debt or increasing your credit limits.

If youve had a credit card for a while and have built a good payment history, most card issuers will be willing to offer a credit limit increase. You can typically request an increase through your online account.

Theres no risk when requesting a credit limit increase. The worst a lender can do is say no, leaving you exactly where you started. In the best-case scenario, youll get a big credit limit increase, dropping your credit utilization ratio and giving your credit score an immediate boost.

Loan Companies In Atlanta

1. ATLANTA, GA | Quick Short-Term Payday Loans Company nameAddressZip codePhone numberALL Cash Express381 Moreland Ave SE, Ste B30316 5251668Insta Loan2690 Sylvan RD30344 5102010ALL Cash Express5513 Peachtree Blvd30341 4550990View 152 more rows Atlanta emergency loans. · ACE Cash Express Address is 3583 M.L.K. · ADR Financial Services. 1260 Glenwood Ave

Also Check: Can You Do A Reverse Mortgage On A Condo

How To Get Started

If youre ready to begin the homebuying or refinance process but are unsure about your credit situation, check with your bank or credit card issuer to get an idea of your score. You also should download your full report yearly to evaluate your history and ensure there are no errors.

Your credit history might be complicated.

To help you learn more about your situation and improve your score, consider working with your lender or a financial counselor to help you get where you need to be.

How Can I Access My Credit Score

Per the Federal Trade Commission, you can pull one free copy of your credit report from each of the three main agencies per year.

You also may have frequent access to your score for free through your bank or credit card issuer.

Keep in mind that the free score you have access to through your bank or credit card company is not your comprehensive report, but it will give you a snapshot of where you are to help you get where you want to go.

Recommended Reading: Bofa Home Loan Navigator

Do Banks Use Fico Or Vantage

Mortgage lenders typically use FICO Scores 5, 2 and 4 when determining whether or not to approve a loan. Additionally, one type of credit score to keep an eye on moving forward is the VantageScore, a score that was developed by the three main credit bureaus and currently serves as a competitor to FICO.

What Is A Credit Score

The term “credit score” usually refers to a FICO score. FICO stands for the Fair Isaac Corporation, the company that developed the most commonly used credit scoring system. With FICO, everyone is assigned a score ranging from 300 to 850. The higher the number, the better the credit.

Your credit score takes several things into account including current debt, payment history, new credit and types of credit.

Your credit score is important because it’s one of the key factors lenders look at when deciding whether to offer you a loan.

Also Check: Chase Recast Calculator