Interest Rate And The Apr

Whenever you see a mortgage interest rate, you are likely also to see an APR, which is almost always a little higher than the rate. The APR is the mortgage interest rate adjusted to include all the other loan charges cited in the paragraph above. The calculation assumes that the other charges are spread evenly over the life of the mortgage, which imparts a downward bias to the APR on any loan that will be fully repaid before term which is most of them.

Why Use An Apr Mortgage Calculator

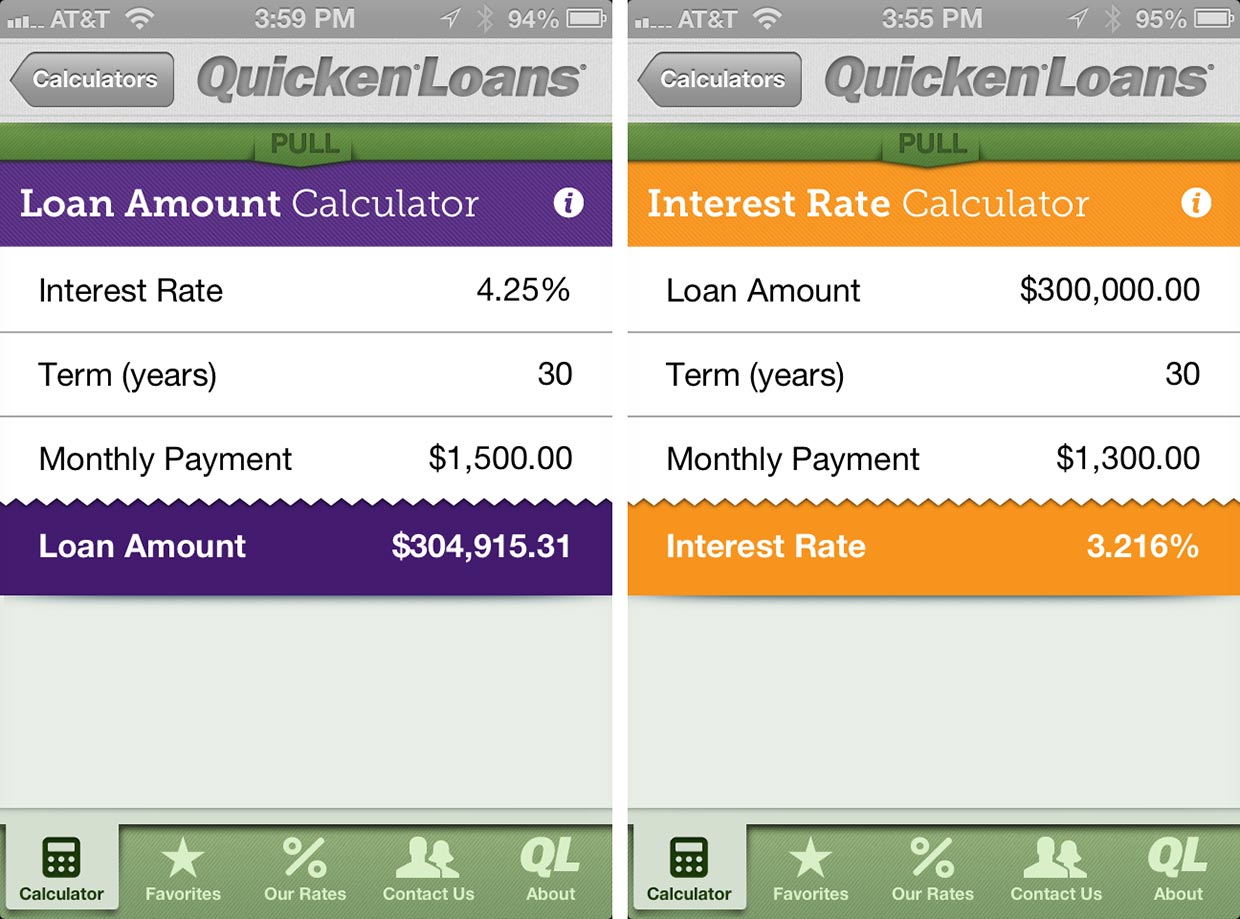

Your lender will figure your APR for you, and will advertise it in loan offers. However, you may wish to see yourself how the APR will vary if you make certain changes in the loan, such as buying more or fewer points. Or you may want to compare loan offers from lenders with different fee schedules and want to see how different fee schedules affect the APR and total cost of the loan.

FAQ: It is also helpful if you: Are working with a tight budget and need to know exactly how much you can afford.

FAQ: You want to compare the true total monthly payment required from two or more providers. For the best way to do this, .

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

You May Like: Mortgage Rates Based On 10 Year Treasury

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

What Is Principal And Interest

2016RISKSUMMIT.ORG” alt=”Monthly interest rate calculator > 2016RISKSUMMIT.ORG”>

2016RISKSUMMIT.ORG” alt=”Monthly interest rate calculator > 2016RISKSUMMIT.ORG”> The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Recommended Reading: Reverse Mortgage For Mobile Homes

Is There Anything Else That Lenders See As Risk

There is one more risk that the lenders end up facing. The risk of you prepaying the loan.

What? Why is that a risk? As a lender, wouldnt I be happy if the money is paid back in full and before time? In full, yes. All lenders love that. But before time, not really.

Banks and other lenders are in the business of making loans. The original principal is what they owe to depositors. Their revenue solely comes from the interest you pay them. If you pay back early, they will not be earning interest from you any more.

One would ask, well they can make a new loan and start earning interest again. A very fair point.

Unfortunately, people prepay and refinance their loan only when interest rates go down. For a bank to be paid the loan amount in full is bad because the new loan the bank will make will be at a lower rate than what you were paying him so far.

This type of risk is called reinvestment risk. Because most mortgages in the US dont have a prepayment penalty associated with them, people can refinance whenever rates fall. So lenders face that risk. Unfortunately, no one refinances when rates go up to make it even for the lenders.

That risk is not with specific borrowers only. Its a risk they face with all borrowers in general. If borrowers were prohibited from early payment, all of us would have had slightly lower mortgage rates. But most borrowers are fine to have the option to prepay for a small cost in the form of a slightly higher mortgage rate.

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

You May Like: Reverse Mortgage Mobile Home

How To Lower Your Mortgage Payments

There are a few ways to lower your monthly mortgage payments. You can reduce the purchase price, make a bigger down payment, extend the amortization period, or find a lower mortgage rate. Use the calculator to see what your payment would be in different scenarios.

Keep in mind that if your down payment is less than 20%, your maximum amortization period is 25 years. As for finding a lower mortgage rate, its a good idea to speak to a mortgage broker for assistance.

My Mortgage Payment Plan

This line graph shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.

Find out how much you can save by changing your payment frequency.

This table shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.| Amortization |

|---|

* These calculations are based on the information you provide they are approximate and for information purposes only. Actual payment amounts may differ and will be determined at the time of your application. Please do not rely on this calculator results when making financial decisions please visit your branch or speak to a mortgage specialist. Calculation assumes a fixed mortgage rate. Actual mortgage rates may fluctuate and are subject to change at any time without notice. The maximum amortization for a default insured mortgage is 25 years.

** Creditor Insurance for CIBC Mortgage Loans, underwritten by The Canada Life Assurance Company , can help pay off, reduce your balance or cover your payments, should the unexpected occur. Choose insurance that meets your needs for your CIBC Mortgage Loan to help financially protect against disability, job loss or in the event of your death.

Recommended Reading: Chase Mortgage Recast Fee

Mortgage Interest Is Paid In Arrears

In the United States, interest is paid in arrears. Your principal and interest payment will pay the interest for the 30 days immediately preceding your payment’s due date. If you are selling your home, for example, your closing agent will order a beneficiary demand, which will also collect unpaid interest. Let’s take a closer look.

For example, suppose your payment of $599.55 is due December 1. Your loan balance is $100,000, bearing interest at 6% per annum, and amortized over 30 years. When you make your payment by December 1, you are paying the interest for the entire month of November, all 30 days.

If you are closing your loan on October 15, you will prepay the lender interest from October 15 through October 31.

It may seem like you get 45 days free before your first payment is due on December 1, but you do not. You will pay 15 days of interest before you close, and another 30 days of interest when you make your first payment.

Interest Rate Changes With Variable Reverse Mortgages

Variable rates can change over time as market interest rates change. Rates are based on two key factors:

- Index: Each variable-rate loan is tied to a particular rate index, such as U.S. Treasury rates or the London Inter-Bank Offered Rate .

- : Each lender adds an additional percentage to the index rate, known as the margin. The margin generally stays the same for the entire loan term.

As the interest-rate market changes, so does the rate on variable-rate loans. A reverse mortgage can have either yearly-variable or monthly-variable rates. A yearly-variable rate can change annually, while a monthly-variable rate can change each month.

No matter how often the rate on a variable-rate reverse mortgage can change, theres generally a cap on how much it can increase, both in a single change and over the life of the loan.

Unlike with other types of loans, borrowers of reverse mortgages wont feel the rate increase right away, since they only have to repay the loanincluding the interestonce they leave the home.

Also Check: Chase Recast

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Compare top mortgage lenders

Reach out to multiple lenders to see how much you can save. It pays to compare your options.

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make. When youre ready to apply, compile necessary documentation like income verification and proof of assets and start shopping for the best rates.

You May Like: Rocket Mortgage Payment Options

Access To More Funds In The Future

The principal limit for a reverse mortgage is generally set at the time the loan is originated. For a variable-rate loan, the principal limit can increase over time, giving borrowers access to more money. But the principal limit on a fixed-rate loan wont increase. The lump sum the borrower received at the beginning of the loan term is the most they can receive.

What Mortgage Payment Options Do I Have

The frequency of your mortgage payments can be monthly, weekly or bi-weekly, depending on your mortgage terms and conditions.

Mortgage payments can be made in the following ways:

- Monthly mortgage payments

- Weekly accelerated payments

- Semi-monthly (twice a month, e.g., on the 1st and 16th of each month.

Accelerated payments help you pay off your mortgage quicker compared to other payment schedules, helping you avoid thousands of dollars in interest. About 350,000 borrowers increased their payment frequency in 2019, found MPC.

When you choose to make accelerated mortgage payments, you end up making the equivalent of 13 monthly payments per year. The result is that you pay off the mortgage years earlier, saving thousands of dollars on interest.

Heres an example of how payments change based on frequency, assuming a $100,000 mortgage at 3% interest amortized over 25 years.

Read Also: Rocket Mortgage Loan Requirements

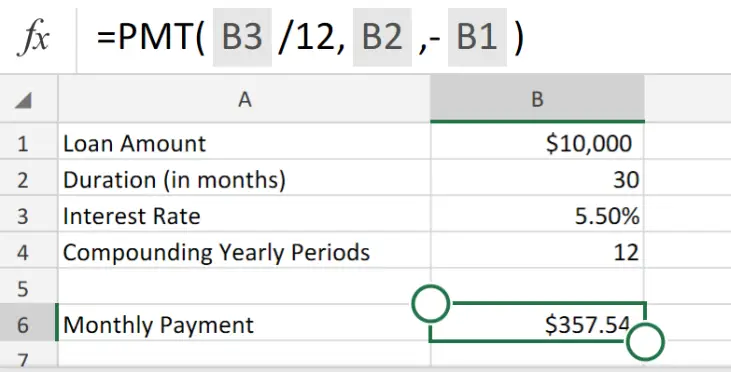

How To Calculate A Mortgage Loan Payment

There is a set formula that can be used to calculate a mortgage loan payment. It goes like this:

M = P

If that looks like Greek to you, dont worrythe point of the calculator above is so that you wont have to do this calculation yourselfbut it is helpful to know what the number you receive from our calculator truly represents. Here are what the components of the formula mean:

- M = The total monthly mortgage payment

- P = The principal balance of your mortgage loan, which is the entire loan amount that you are borrowing

- r = The monthly interest rate that you pay on your mortgage loan. When you get your rate from your lender, it will be expressed as an annual rate. To find out what the monthly rate is, youd divide your annual interest rate by the 12 months of the year. If your annual rate was 4.5%, you would divide .0045/12 to get your monthly rate of .00375.

- n = The total number of payments that you will make over the life of your mortgage loan. You can determine the total number of payments by multiplying the number of years of your mortgage loan by 12 months in a year. So, if you have a 15-year mortgage at a fixed rate, you would multiply 15 x 12 to get 180 total payments

When you plug your numbers into this formula, the biggest factors that affect the cost of your mortgage payment are the total cost of the home that youre buying, the amount of your down payment, and the length of the term of your mortgage loan.

What Costs Are Included In A Monthly Mortgage Payment

Your lender will split your monthly payment into three separate elements:

- Principal: This portion goes toward paying down your mortgage balancethe original amount you borrowed.

- Interest: This portion goes into the lenders pocket. Its their fee for lending you the money.

- Escrow: This goes into a holding fund that your lender or mortgage servicer uses to pay your property taxes and homeowners insurance. They use this holding fund to make sure these crucial bills get paid. Once your mortgage is paid off, youll have to pay your property taxes and homeowners insurance on your own.

The above costs are included in every persons monthly mortgage payment. But depending on your situation, you may also need to budget for these fees:

- PMI: If you make a down payment of less than 20% with a conventional mortgage, youll need to pay an additional payment for private mortgage insurance. Certain other loans, like FHA or USDA loans, also require a similar monthly payment regardless of the size of your down payment. These costs will usually be added to your monthly mortgage payment.

- HOA fees: As noted above, if your new home is within a homeowners association , condominium, or co-op, youll need to pay its fees either monthly or quarterly. Often, this cost wont be included in your mortgage payment, and youll need to pay it on your own.

Also Check: 70000 Mortgage Over 30 Years

The Structure Of Mortgage Interest Rates

On any given day, Jones may pay a higher mortgage interest rate than Smith for any of the following reasons:

- Jones paid a smaller origination fee, perhaps receiving a negative fee or rebate.

- Jones had a significantly lower credit score.

- Jones is borrowing on an investment property, Smith on a primary residence.

- Jones property has 4 dwelling units whereas Smiths is single family.

- Jones is taking cash-out of a refinance, whereas Smith isnt.

- Jones needs a 60-day rate lock whereas Smith needs only 30 days.

- Jones waives the obligation to maintain an escrow account, Smith doesnt.

- Jones allows the loan officer to talk him into a higher rate, while Smith doesnt.

All but the last item are legitimate in the sense that if you shop on-line at a competitive multi-lender site, such as mine, the prices will vary in the way indicated. The last item is needed to complete the list because many borrowers place themselves at the mercy of a single loan officer.

How To Determine How Much House You Can Afford

Your housing budget will be determined partly by the terms of your mortgage, so in addition to doing an accurate calculation of your existing expenses, its important to get an accurate picture of your loan terms and shop around to different lenders to find the best offer.

Mortgage interest rates are near all-time lows right now, which has made borrowing easier for many buyers. Unfortunately those low rates, coupled with limited available listings, have pushed prices up to record highs. But, if your budget works out, it can still be a great time to buy. Here are some of the factors that can affect your loan terms, which in turn will affect how much you can borrow.

Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments.

You May Like: Monthly Mortgage On 1 Million

In Loan Amortization Interest Payments And Principal Payments Have Inverse Relationship

1. CSR 342 Exam 2 Flashcards | Quizlet Credit cards have different liabilities than debit cards. In loan amortization , interest payments and principal payments have inverse relationship. An amortized loan is a type of loan with scheduled, periodic payments that are applied to both the loans principal amount and