Use A Mortgage Affordability Calculator As A Starting Point

- Before you start perusing real estate listings

- Use an affordability calculator to determine if homeownership

- Makes sense financially and is within reach

- Then you can look into a pre-qual or pre-approval to fine-tune the numbers and make sure all red flags are addressed

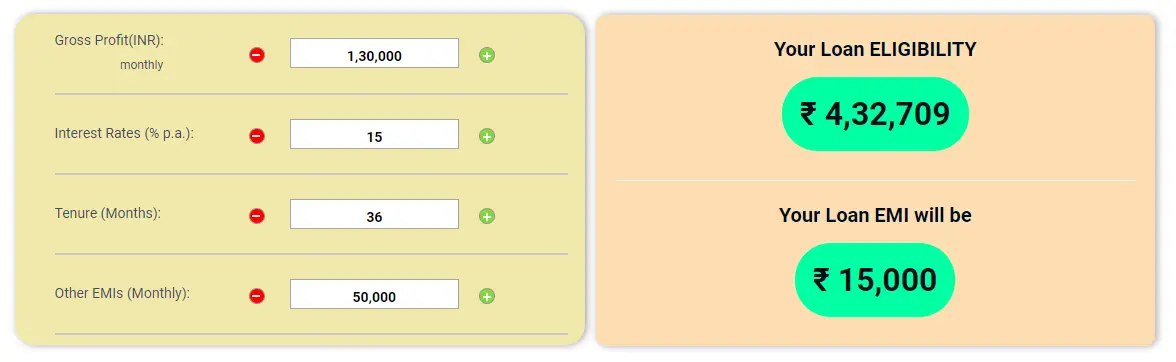

The mortgage affordability calculator below can give you a head start in front of other prospective home buyers competing for the same property.

Can I Get A Mortgage

Your ability to get a mortgage depends on a number of things, including the amount you’re looking to borrow, the size of your deposit and your credit score. Some other things to consider include:

- your employment status and income

- your expenses

- your life stage

- dependants

Before applying for a mortgage, its a good idea to work out your budget so you have an idea of how much you can afford to cover your deposit and monthly repayments, and still have enough money for any fees that come with the mortgage.

Its also a good idea to check your credit file before you apply to make sure it doesnt contain any errors even a small mistake like getting your date of birth wrong could affect your mortgage application.

You can get free credit checks from each of the three credit reference agencies Experian, Equifax and TransUnion.

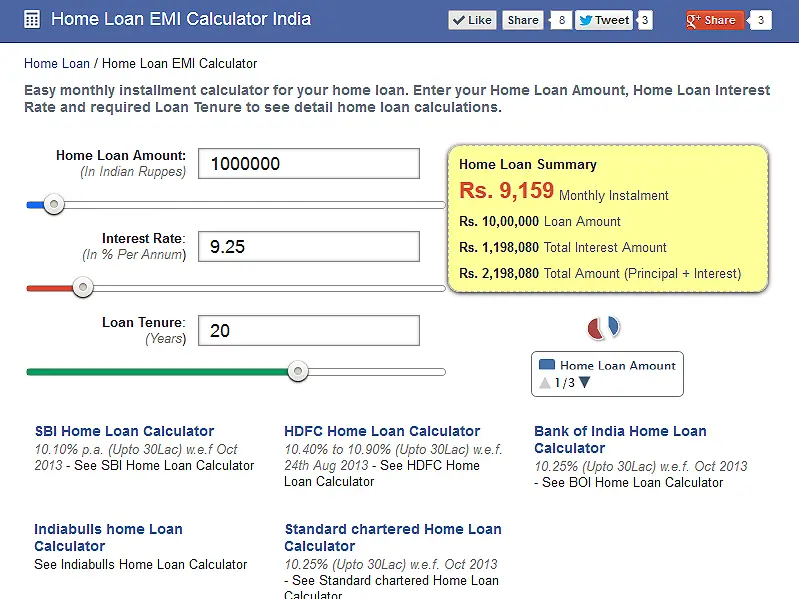

How Our Mortgage Affordability Calculator Works

Our affordable mortgage calculator first uses your income, expenses, and down payment to arrive at a monthly payment your budget can support when buying a home. From there, it will calculate a mortgage you can afford, considering current interest rates, loan term, and additional factors.

Annual income: Enter your gross annual income from all sources. If you have a co-borrower, be sure to include their income.

Monthly debt:Total your monthly debt payments, including car loans, student loans, credit card payments, personal loans, and any court-ordered payments. Do not include recurring household expenses such as utility bills or the estimated home loan payment in the mortgage income calculator.

Down payment:Enter how much you have available for a down payment. Your lender may require a minimum down payment depending on the loan program youre applying for.

Debt-to-income ratio: To calculate your DTI ratio, divide your total monthly debt payments by your gross monthly income. Our affordability calculator mortgage DTI ratio is auto-populated with 36% however, some loan programs allow up to a 45% DTI ratio. And in some cases, lenders may approve a DTI ratio above program limits. If you know the maximum DTI ratio your lender allows or to enter your desired ratio, adjust this field accordingly.

Recommended Reading: Reverse Mortgage Mobile Home

How Does The Mortgage Pre

The information that you entered is calculated and will give you more detailed estimates of the home purchase price and loan amount that you can afford along with the down payment amount that would be required. You will also see your debt-to-income ratio when using our mortgage affordability calculator. This ratio reflects your ability to manage monthly payments and repay debts.

The last section of the mortgage pre-qualification and affordability calculator will give you a total monthly payment and amountbroken down into principal, interest, taxes and insurance detailthat you can afford based on the information you provided.

Whats Behind The Numbers In Our How Much Can I Borrow Mortgage Calculator

When buying a home, the question How much can I borrow? should be the second question you ask. The most important consideration is, How much house can I afford? Thats because, even with all the angst involved in applying for and being approved for a home loan, lenders are often inclined to loan you more money than you expect.

Thats a surprising and important reality.

As much as you want to buy a home, lenders want to loan you money. And the bigger the loan, the happier they are. Youll know why when you see the estimate of the interest youll pay over the life of the loan. Its a really big number.

But if you know how much home you can afford, of course, youll want to learn how much you can borrow. The NerdWallet How much can I borrow? calculator can give you a solid estimate.

The calculator considers standard mortgage payment elements, such as principal and interest. Then, we take things a few steps further, factoring in taxes, insurance even homeowner association dues to help determine a real-life monthly payment.

We also examine your income and debt, just as a lender would, to determine the maximum home loan amount youre likely to qualify for.

Getting ready to buy a home? Well find you a highly rated lender in just a few minutes.

Enter your ZIP code to get started on a personalized lender match.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

What To Provide To Your Lender Or Mortgage Broker

Before preapproving you, a lender or mortgage broker will look at:

- your assets

- your income

Youll need to provide the following:

- identification

- proof you can pay for the down payment and closing costs

- information about your other assets, such as a car, cottage or boat

- information about your debts or financial obligations

For proof of employment, you may have to provide:

- a proof of your current salary or hourly pay rate (for example, a recent pay stub

- your position and length of time with the employer

- notices of assessment from the Canada Revenue Agency for the past 2 years, if youre self-employed

Your lender or mortgage broker may ask you to provide recent financial statements from bank accounts or investments. This will help them determine if you have the down payment.

Your debts or financial obligations may include your monthly payments for:

How The Stress Test Can Impact Your Qualification

Federally regulated entities, like banks require that you pass a stress test to get a mortgage. This means that you need to prove you can afford payments at a qualifying interest rate. This rate is typically higher than the actual rate in your mortgage contract.

You need to pass this stress test even if you dont need mortgage loan insurance.

The bank must use the higher interest rate of either:

- 5.25%

- the interest rate you negotiate with your lender plus 2%

If you already have a mortgage, youll need to pass this stress test if you:

- refinance your home

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Rbc Royal Bank Mortgage Affordability

Before you get a mortgage from RBC, it is important to know how RBC calculates your mortgage affordability. RBC takes into account the following factors:

- Your household income

- Your down payment

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

If your down payment is less than 20%, RBC’s mortgage affordability calculator also considers your mortgage insurance premiums. Unlike some other mortgage affordability calculators, RBC’s mortgage affordability calculator does not take into account your location for property taxes and utility costs.

RBC calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 32% and a maximum total debt service ratio of 40%. These ratios are more strict than CMHC regulations, but you may still be able to get a mortgage with RBC even if you exceed these limits.

Another factor in determining your mortgage affordability is your down payment. According to RBC, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

My Monthly Rbc Mortgage Payment Will Be

$0*/month

The mortgage amount is based on the qualifying rate of%.* The payment amount is calculated based on an interest rate of %.

View Legal DisclaimersHide Legal Disclaimers

Enter your annual household salary. This includes your spouse/partner.

Consider car payments, credit cards, lines of credit and loan payments. This should not include your rent.

Enter the amount of money you plan to use as a down payment. Donât forget you can also leverage your RRSPs.

The Home Buyers’ Plan allows you to borrow funds from your RRSP to purchase your first home. Here are some of the key facts:

- You and your spouse can each withdraw up to $35,000 from your RRSP.

- The funds must have been on deposit at least 90 days before you withdrew them.

- At least 1/15 of the funds must be repaid each year, beginning two years after the funds were withdrawn.

- A signed agreement to buy or build a qualifying home is required.

- You can only participate in the program once.

For details,watch this video or seeCanada Revenue Agency

Default insurance covers the lender in case of a failure to pay off the full mortgage amount. If your down payment is from 5-19%, a default insurance premium will automatically be applied to your mortgage.

Other monthly expenses you may want to consider include such items as alimony and condo fees .

Read Also: Can You Refinance A Mortgage Without A Job

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

Your Mortgage And Your Overall Budget

The question isn’t how much you could borrow but how much you should borrow. These home affordability calculator results are based on your debt-to-income ratio . Industry standards suggest your total debt should be 36% of your income and your monthly mortgage payment should be 28% of your gross monthly income.

Read Also: Who Is Rocket Mortgage Owned By

Budget For Mortgage Set

Mortgage set-up fees typically include the product arrangement fee and booking fee. To determine the mortgages annual interest calculation, lenders include valuation fees and redemption fees. The valuation fees are often referred to as the overall cost for comparison. When you apply for a mortgage, all your fees must be specified under the key facts illustration. This is a document prepared by the lender to outline the details of your mortgage and what they recommend during the early stages of application.

Take note of the following fees when you apply for a mortgage:

How To Use Credit Karmas Home Affordability Calculator

If youre planning to buy a house, youll need to get a sense of how much home you can afford.

Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and closing costs. This calculator provides an estimate based on the information you provide. It doesnt consider other costs associated with home ownership, such as maintenance and utilities.

Keep in mind that home price isnt the only factor that affects affordability. The interest rate on your home loan, your down payment and your loan term can all affect how much you end up paying for your home.

Our home affordability calculator considers the following factors:

Read Also: Rocket Mortgage Loan Types

What Monthly Expenses Do You Have

! Please enter an amount less than }.

Estimate your monthly expenses such as groceries, transportation, child care, insurance, shopping, media and regular contributions to savings.

Please do not include rent or housing expenses.

If you’re buying a home with a spouse, partner, friend or family member, include their monthly expenses as well.

If this amount is higher than your monthly income before taxes, please contact us to discuss your options.

Step 6 of 6

Percentage Of Income Toward Monthly Payment

While the 28% rule is a good starting guideline, there are other factors to think about. Lenders are legally obligated to learn about your assets, expenses and credit history before offering you a mortgage. How reliable your income is can also matter. If much of your earnings come from a source that varies from month to month, like commissions, a lender might not be willing to lend as much to you as it would to someone who earns a consistent salary.

Consider what you can comfortably afford to spend on a monthly basis without affecting other financial goals, such as saving for an emergency fund or investing toward retirement.

Read Also: Can You Do A Reverse Mortgage On A Condo

Land Transfer Tax In Ontario

Ontarios land transfer tax is calculated as a percentage of the propertys value, using the purchase price as an estimate. The LTT is a marginal tax with rates varying from 0.5% to 2.0% of a homes value depending on its purchase price. For detailed information on rates and calculations see our Ontario land transfer tax page.

Why Its Smart To Follow The 28/36% Rule

Most financial advisors agree that people should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36 percent on total debt that includes housing as well as things like student loans, car expenses and credit card payments. The 28/36 percent rule is the tried-and-true home affordability rule that establishes a baseline for what you can afford to pay every month.

Example: To calculate how much 28 percent of your income is, simply multiply your monthly income by 28. If your monthly income is $6,000, for example, your equation should look like this: 6,000 x 28 = 168,000. Now, divide that total by 100. 168,000 ÷ 100 = 1,680.

Depending on where you live and how much you earn, your annual income could be more than enough to cover a mortgage or it could fall short. Knowing what you can afford can help you take financially sound next steps. The last thing you want to do is jump into a 30-year home loan thats too expensive for your budget, even if you can find a lender willing to underwrite the mortgage.

You May Like: Mortgage Rates Based On 10 Year Treasury

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

How To Calculate Your Required Income

To use the Mortgage Income Calculator, fill in these fields:

-

Homes price

-

Loan term

-

Mortgage interest rate

-

Recurring debt payments. Heres where you list all your monthly payments on loans and credit cards. If you dont know your total monthly debts, click No and the calculator will ask you to enter monthly bill amounts for:

-

Car loan or lease

-

Minimum credit card payment

-

Personal loan, child support and other regular payments

Monthly property tax

Monthly homeowners insurance

Monthly homeowners association fee

You May Like: 10 Year Treasury Yield And Mortgage Rates

Checking Your Credit Report

A potential lender will look at your credit report before approving you for a mortgage. Before you start shopping around for a mortgage, order a copy of your credit report. Make sure it doesnt contain any errors.

If you dont have a good credit score, the mortgage lender may:

- refuse to approve your mortgage

- only consider your application if you have a large down payment

- require that someone co-sign with you on the mortgage

- require that you get mortgage loan insurance even if you have a down payment of 20% or more

How Much House Can I Afford

Your house will likely be your biggest purchase, so figuring out how much you can afford is a key step in the home-buying process. The good news is that coming up with a smart budget is pretty straightforward and not too time-consuming especially with the Bankrate Home Affordability Calculator.

Recommended Reading: Rocket Mortgage Payment Options

Ontario Sales Tax On Cmhc Insurance

When applicable, the cost of CMHC insurance is added to your mortgage balance and paid off over the amortization of your mortgage. However, Ontario provincial sales tax on CMHC insurance must be paid out in cash at the time your purchase closes.

Our tools automatically calculate these taxes – you’ll see them under the “Cash Needed” drop down menu.

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

You May Like: Reverse Mortgage Manufactured Home