The Mortgage Insurance Requirement

Private mortgage insurance, or PMI, is a policy that protects your lender in the event that you default on your mortgage loan. The insurer will pay off your balance if this occurs. Your lender is the beneficiary of the policy, but it wont pay for it. You must pay the mortgage insurance premiums, and these can be added on to your mortgage payment as well.

Mortgage insurance is almost universally required if you make a down payment of less than 20 percent, and FHA and USDA loans require it as well. These premiums can be higher for 30-year mortgage terms because you have an additional 15 years to default.

Read More:What Is PMI?

How Can I Improve The Likelihood That I Will Be Approved For Loans That Do Not Require W2s

- Pay off outstanding debt. This improves your debt to income ratio and your credit score. It indicates to lenders that you are eliminating the likelihood that you will default on future loans.

- Stash the cash. The more money you have in savings, the better. Again this helps your debt to income ratio making you a better lending prospect.

- Create a larger down payment. This applies for any home loan. The more money you have for a down payment, the less money needed to be borrowed.

- Find a co-signer. Another option is to find someone with a steady stream of income to co-sign on the loan with you.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Rocket Mortgage Loan Types

Fixed Versus Adjustable Rate Loans

On a fixed rate mortgage, the interest rate remains the same through the entire term of the loan, rather than the interest rate doing what is called float or adjust. What characterizes a fixed rate mortgage is the term of the loan and its interest rate. There are a number of popular fixed-rate mortgage loan terms: the 30-year fixed rate mortgage is the most popular, while the 15-year is next. Other loan terms tend to be quite rare in comparison. People paying off smaller loans may want to try to pay them in 10 years, while people with pristine credit who are afforded credit cheaply could choose to extend their credit out to a 40-year or 50-year term. Those who want to remain highly levered & have other financial assets to back their position may opt for interest-only or balloon mortgages.

In the United States fixed-rate mortgages are the most popular option. In many other countries like Canada, the United Kingdom & Australia adjustable rate loans are the standard. If a large portion of the economy is structured into variable rate loans or interest-only payments, then if the housing market gets soft it can create a self-reinforcing vicious cycle where rising interest rates spark further defaults, which then reduces home prices & home equity, driving further credit tightening & defaults..

Explore Your Options

Use our free calculators to compare loans with different lenghts or compare fixed, adjustable & interest-only mortgages side by side.

How Long Do I Pay Escrow On My Mortgage

4.5/5mustescrow paymentsmortgagemortgage

Many banks will not allow you to remove the escrow account if your loan-to-value ratio exceeds 80 percent. This means your balance can be no more than 80 percent of your home’s appraised value. Your lender may have a pre-printed escrow account change request form that can be used in place of a letter.

Also, how long do you have an escrow account? 30 days

Also question is, do you ever pay off escrow?

The bank sets up the escrow to protect their investment in the house. If you can show them you pay your bills and aren’t a risk, they’re likely to remove the payments. Don’t forget you‘ll pay those taxes and insurance once or twice a year, so you‘ll still need to budget for them.

How can I lower my escrow payment?

12 ways to reduce your mortgage payment

You May Like: Rocket Mortgage Requirements

You Have Another Option

You have some control over when you pay off and retire your loan, even if you opt for a 30-year term. You dont absolutely have to take 30 years to satisfy your mortgage, although the rules for this can be a bit tricky.

Nothing stops you from throwing a little extra money in the form of extra payments at your principal balance in addition to your monthly mortgage payments if you want to pay the loan off sooner than 30 full years. Youd ultimately be cutting down on all that interest you would pay otherwise. But and this is a big but some mortgage loans come with prepayment penalties.

Youre generally OK if you make separate, extra principal-only payments occasionally, but you could be hit with a prepayment penalty if you pay off your entire mortgage early, or at least too early. These penalties usually only apply for the first five years or so of the loan term, so theyd mostly be a concern if you want to refinance prior to this time or if you somehow managed to pay off your entire principal balance in 60 months or less.

The bottom line is that even if you take out a 30-year mortgage, you’re not necessarily obligated to wait all that time before you pay off the loan.

References

No Tax Returns Required For W2 Income Wage Earners On Fha Va Conventional Loans

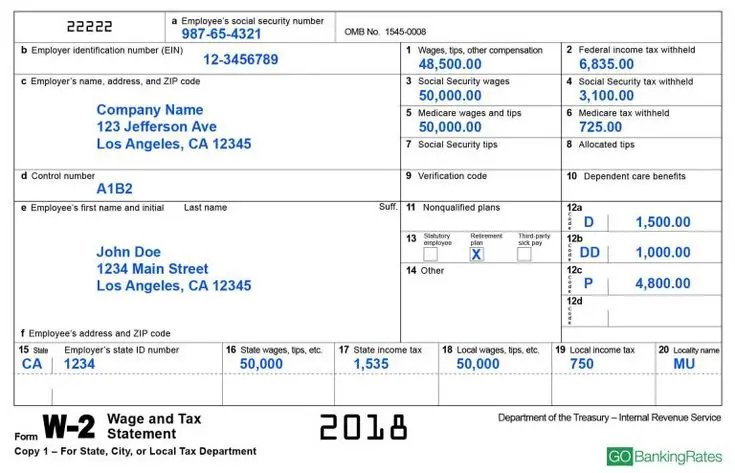

With W2 Income Mortgages, income tax returns are not required. If borrowers did not file their income taxes, that is alright with this loan program. Only the W2 income transcripts will be verified from the Internal Revenue Service:

Borrowers who also need to purchase tools and equipment for their work normally have un-reimbursed employee expenses.

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

Can You Get A Mortgage With No Tax Returns

Most people assume that you cannot get a mortgage unless you provide your tax returns for the last two years. However, there are mortgage options for people who cannot provide tax returns or if your tax returns do not show enough income to qualify for a mortgage.

The lenders who offer mortgages without providing tax returns typically design these loan programs for self-employed individuals. In most instances, they have a lot of business deductions lowering their net income to the point where the tax returns show very little income or even a loss.

Lenders who offer mortgages with no tax return requirement understand that the net income on your tax returns is not as important as the amount of money that you are bringing in each month. As a result, they are instead asking to see 12-24 months bank statements. It is a great way to finance your dream home without having to provide tax returns.

Contact us to find out more about your options or to get an idea what your rate would be. If you can just quickly complete the form to the right or at the bottom of your screen if you are reading this on a mobile device. We will get back to you right away.

Can you get a mortgage with no tax returns? There are lenders who have loan programs for individuals who cannot provide tax returns. They are designed for self employed borrowers who have not filed returns or show a very low net income.

How To Use A W2 To Calculate Income For A Mortgage

A W2 form is an employers statement of your annual earnings. It lists gross income and includes amounts paid to the differing agencies for taxes and social security. For the purposes of calculating how much you can borrow and afford to pay back on a mortgage, lenders use the W2 as the basis of their qualifying calculations. Mortgage lenders have stringent guidelines, with documentation and W2s required from the borrower for the past two years.

1.

Add the annual gross income on your past two years W2 forms and divide by 24 to arrive at your gross monthly income — GMI, if youre a salaried employee. Get a letter from your employer verifying an increase in salary or earnings going into the current year, and submit current pay stubs to the loan originator to substantiate this claim.

2.

Supplement your stated earnings by submitting a second W2 from a part-time job, but use it only if youve worked at that job or held a similar position during the two-year qualifying period. Calculate overtime earnings and bonuses if theyve been recorded for two years. Get your supplemented GMI by calculating the amount of overtime earned weekly for the past two years, multiply by 104 and divide by 24. Add this number to your earnings if youre paid on an hourly basis.

References

Read Also: Rocket Mortgage Conventional Loan

Using Business Accounts For Your Down Payment And Closing Costs

In some cases, you can use funds from your business accounts from your down payment.

Sometimes, though, the underwriter will ask you for a letter from your CPA saying that taking money from the business wont jeopardize ongoing health of the business. Your CPA may or may not be willing to write this letter.

The underwriter wants to verify your business wont be short on cash and be forced to take out loans or shut its doors due to lack of funds. After all, your business is the source of your income, and if your income stream stops, you may default on your loan.

Any business funds used for closing costs or the down payment on a home should be excess money that the business will not need for the foreseeable future.

What If A Self

It happens. You don’t have to put a bag over your head or anything just fire up plan B.

AskBy law, any time you’re declined for mortgage financing, the lender must provide a letter stating the reason within 30 days or tell you who to contact to learn that information. Base your next action on the reasons you’re given.

If decreasing business income was the reason, you’ll have to make a strong case to overcome it. First, ask yourself why you are not concerned about your ability to make a loan payment despite the dip in revenue. Is it because that’s your normal business cycle? Because you have many months of reserves? Or because your revenue is already back on track? Pull your evidence together new financial statements, a CPA letter, more years of tax returns and take a shot with another lender. On the other hand, perhaps you should be concerned about your business’s health.

Ask AgainYour lender may help you find an alternative. One advantage of automated underwriting systems is loan officers can run various scenarios to see if changing some of the variables in your application will get you an approval for instance, buying a cheaper property, making a larger down payment, adding more reserves or paying off some debt. If qualifying income is the problem, you may want to do your taxes less aggressively in the future. Check with a tax accountant to learn if you should change your tax strategy.

About the Author

Don’t Miss: How Does The 10 Year Treasury Affect Mortgage Rates

Will You Need To Pay Mortgage Insurance On The Loan

If you put down less than 20%, you may need to pay mortgage insurance for a period of time, which is based on the loan amount.

Mortgage insurance protects lenders in the event that you stop making payments on your loan, so expect your lender to require it if your down payment is less than 20% on a conventional loan, or if youre taking out a FHA loan .

Your mortgage insurance amount will depend on various factors, including the amount of your down payment, your credit score, and which state the home is in.

Different banks and lenders have different ways of calculating this, but you can safely calculate your mortgage insurance rate to be somewhere between 0.25% and 1% of your mortgage loan amount annually. It will be split up and included in your monthly mortgage payments.

If you use a conventional loan, you can opt out of mortgage insurance once you own 20% of the homes equity, so paying for mortgage insurance may be a short-term expense, depending on your homes price and relative down payment. For FHA loans, however, the mortgage insurance typically lasts for the lifetime of the loan, unless you make a down payment of 10% or higher.

How To Get A Mortgage When Youre Self

3-minute read

When youre self-employed and you want to buy a home, you fill out the same application as everyone else. Lenders also consider the same things: your , how much debt you have, your assets and your income.

So whats different? When you work for someone else, lenders go to your employer to verify the amount and history of that income, and how likely it is youll keep earning it.

You May Like: 70000 Mortgage Over 30 Years

Irs Tax Return Schedules For Self

Schedule C: Reports income or loss from a sole proprietorship.

Schedule D: Reports income from capital gains or losses. This type of income comes from sale of stock or real estate typically. Usually these are one-time events and cant be counted toward ongoing income. However, day traders, property flippers and the like may be able to use schedule D income if they prove three years worth of consistent income.

Schedule E: Income and loss from leased and rented real estate is reported on this form. Borrowers who maintain a full time job while owning rental properties will have net income or loss from schedule E. The lender will add or subtracted this income from their employment income. Depreciation claimed on the schedule E can typically be added back to the borrowers income.

Schedule F: This schedule is used for farming income.

Do You Need 2 Years Of Tax Return For House

When you apply for a home loan, lenders generally request a W-2 form that dates back at least two years. As a part of their application process, lenders examine your tax returns. A person must demonstrate that they have earned enough in recent years to meet their monthly mortgage payments if they want to qualify for a mortgage.

Also Check: How Much Is Mortgage On A 1 Million Dollar House

When Should You Get A No

You should consider a no-income verification loan if you cant easily verify your monthly earnings, have complex tax returns or just dont want the hassle of providing a ton of earnings documentation.

Lenders analyze self-employed income differently from salaried or hourly earnings. Because income isnt guaranteed, lenders take extra care to verify a borrowers earnings history, the stability of their income, how financially sound their business is and even the demand for the type of service or product that their company offers.

You may want to consider a no-income-verification loan in the following scenarios:

What Is Your Interest Rate

When calculating your monthly payments, youll want to look at the interest rate rather than the annual percentage rate because your monthly payments will not reflect your closing costs. Youll use your APR when calculating the overall cost of the loan.

Its important to shop around for the best interest rate available to you for the type of loan youre considering. Know that factors like your loan term, type of mortgage, down payment percentage, and credit score will all have an impact on your interest rate.

Don’t Miss: Recasting Mortgage Chase

Can You Get A Mortgage While Owing Back Taxes

There is no tax lien on your house, which means your taxes went unpaid until suddenly they were unpaid and, thus, they trigger collection actions. If you owe money to the Internal Revenue Service and/or the state, your taxes will be considered delinquent. IRS liens can greatly reduce your mortgage eligibility chances, as your income and assets will be scrutinized.

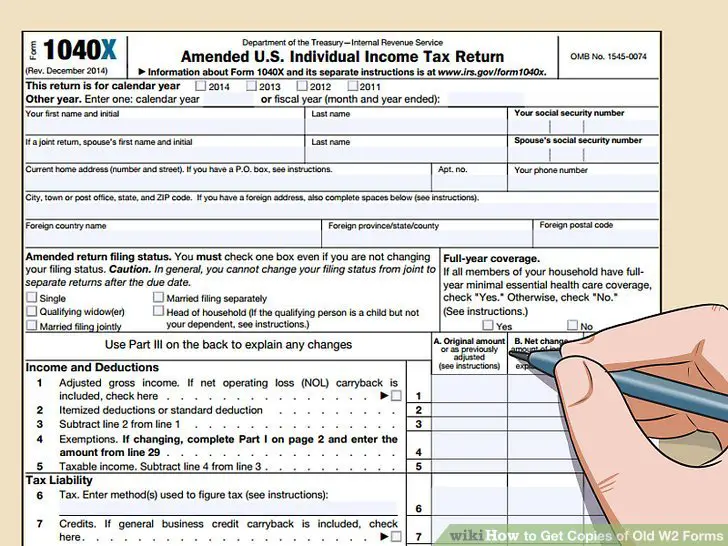

What Do Mortgage Lenders Look For On Your Tax Returns

When you apply for a mortgage, your lender is likely to ask you to provide financial documentation, which may include 1 to 2 years worth of tax returns. Youre probably wondering exactly how those tax returns can affect your mortgage application. Well break it down for you.

Why do mortgage lenders request tax returns?

Your tax returns, along with the other financial documents. in your mortgage application, are used to determine how much you can afford to spend on your home loan every month. Because a mortgage commits you to years of payments, lenders want to make sure your loan is affordable to you both now and years down the road.

To help calculate your income, mortgage lenders typically need:

- 1 to 2 years of personal tax returns

- 1 to 2 years of business tax returns

Depending on your unique financial picture, we might ask for additional paperwork. For example, if you have any real estate investments, you may need to submit your Schedule E paperwork for the past 2 years. If youre self-employed, you may have to provide copies of your Profit and Loss statements. On the other hand, if youre not required to submit tax returns, lenders may be able to use your tax transcripts instead. If you are self-employed, a business owner, or earn income through other sources , youre more likely to be asked for your tax returns along with additional paperwork. Heres a guide to what documents lenders might need for your specific situation.

- More

Recommended Reading: Mortgage Rates Based On 10 Year Treasury