Should I Choose A Fixed Or Variable Rate

Variable rates allow you to take advantage of future decreases in interest rate. On the other hand, fixed rates are preferable if interest rates rise in the future. Unfortunately, long-term fluctuations in the prime rate are difficult if not impossible to predict.

However, a2001 studyfound that between 19502000, choosing a variable interest rate resulted in lower lifetime mortgage cost than a fixed rate up to 90% of the time. According to the study, if you are comfortable with the risks involved, a variable rate may reduce your long-term mortgage cost.

How To Shop For The Best Mortgage Rate

Getting an optimal rate on a home loan can save you a significant amount of money over time. Here are some tips that can help you get the best rate possible for your situation:

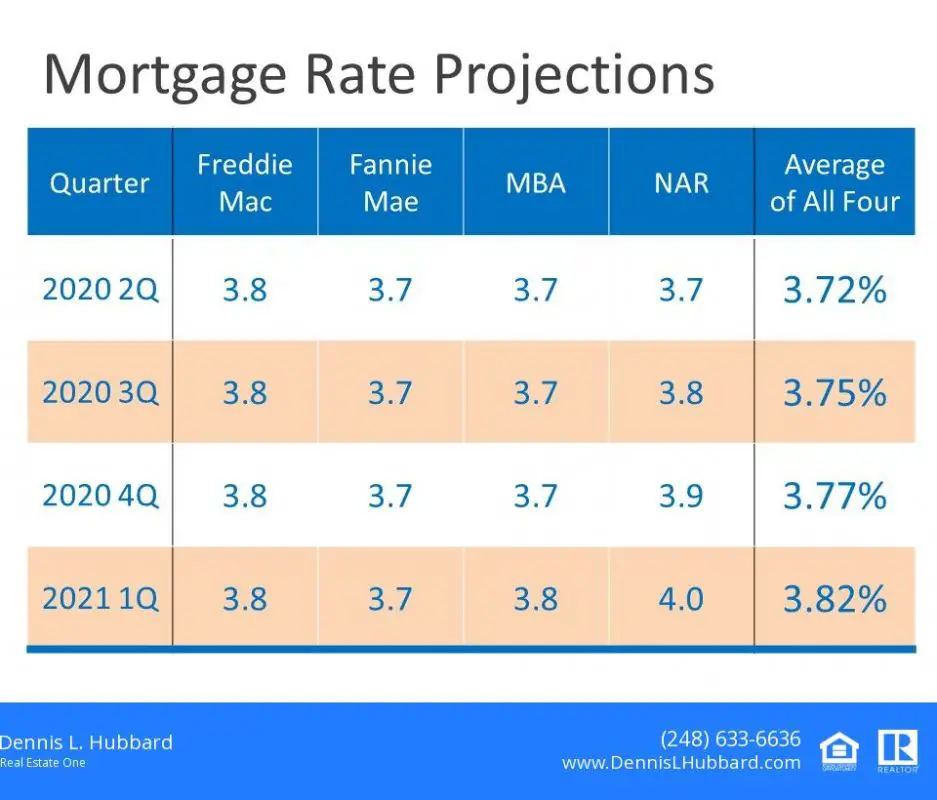

- Keep your eye on rates. Mortgage rates are constantly changing. Keeping a close watch will make it easier to find and lock in a better rate.

- Check your credit. When you apply for a mortgage, the lender will review your credit to determine your creditworthiness as well as your interest rate. In general, the higher your , the better your rate will be. To get an idea of where you stand, check your credit before you apply and dispute any errors with the appropriate credit bureau to potentially boost your score.

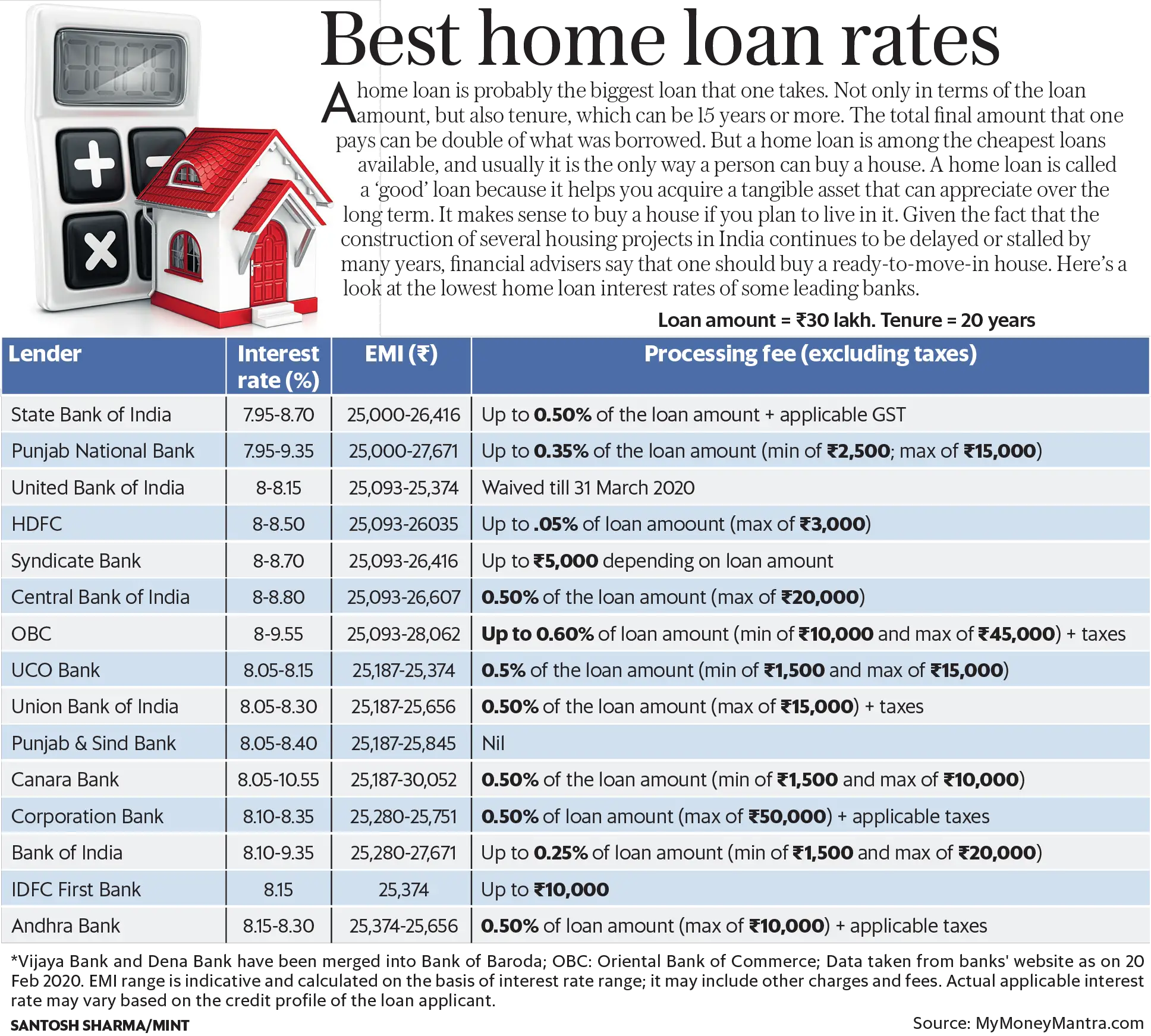

- Shop around and compare lenders. Consider options from as many mortgage lenders as possible to find the best deal for you. Prospective buyers have saved more than $1,500 over a loans term by getting two quotes from lenders, and saved roughly $3,000 when they sought five quotes, according to Freddie Mac.

How Do I Get A Mortgage

To get a mortgage, you need to start by getting your finances in order. Having a strong financial profile will a) increase your chances of being approved for a loan, and b) help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford. The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need. Each type of mortgage requires a different credit score, and requirements can vary by lender. You’ll probably need a score of at least 620 for a conventional mortgage. You can increase your score by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment. Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.

Then, it’s time to shop around and get quotes from multiple lenders before deciding which one to use.

Recommended Reading: How Many People Can Be On A Mortgage

/1 Arm Interest Rates

A 5/1 ARM has an average rate of 5.48%, the same rate from the same time last week.

An ARM is ideal for individuals who will sell or refinance before the rate changes. If thats not the case, their interest rates could end up being markedly higher after a rate adjusts.

For the first five years, a 5/1 ARM will typically have a lower interest rate compared to a 30-year fixed mortgage. Keep in mind that your payment could end up being hundreds of dollars higher after a rate adjustment, depending on the terms of your loan.

Where Are Mortgage Rates Headed This Year

During the first part of 2022, rates for home loans rocketed and currently sit at about 6.81% for the popular 30-year fixed-rate mortgage. Experts are divided on whether theyll continue to risesome forecasts put the year-end average at nearly 7%or stay flat from here. If youre in the market for a mortgage, you should check rates frequently, and always comparison shop for lenders.

Read Also: When Should I Refinance My Mortgage Dave Ramsey

Best Mortgage Rates December 2022

Theres finally some good news this month as we see fixed rates drop across the board. But with Standard Variable Rates increasing its vital to check your deal. Read on for the best rates, including fees, best remortgaging deals, best 5 year fixed rate, Buy To Let mortgage deals, green mortgage deals and more this month.

Finding the best mortgage rates in a sea of mortgage deals is hard work. So every month well be showcasing the best deals for you, with input from the mortgage experts at L& C.

Is There Still Time To Refinance

Americans watch mortgage rates closely, and any time rates pull back even the slightest amount, more people apply for mortgages. With rates still substantially higher than a year ago, however, applications remain stuck near the lowest level in more than two decades, according to MBA data.

While refinancing options can lead to a lower monthly payment, not all of the options yield less interest over the life of the loan. For example, refinancing from a 5% mortgage with 26 years left on it to a 4% rate, but for 30 years, will cause you to pay more than $13,000 in additional interest.

Before you start shopping around for a lender, you can find out how much you could save by using a mortgage refinancing calculator.

Youll also want to consider how long you plan on staying in your home as the closing costs can eat up your savings if you sell shortly after refinancing. The closing costs to refinance run between 2% to 5% of the loan amount, depending on the lender. So you should plan on keeping your home long enough to cover those costs and realize the savings from refinancing at a lower rate.

Keep in mind that the rate you qualify for also depends on other factors such as your credit score, debt-to-income ratio, loan-to-value ratio and proof of steady income.

You May Like: Can You Take Out Two Mortgages

Short Term 2nd Mortgage Loan

Short term 2nd mortgage loans are no longer than a 12 month period or as short as one month. Prime Finance settles 2nd mortgages upon registration of a caveat allowing very fast settlement to occur. This allows your client to obtain very fast funding at the lowest interest rate. Business loans 1%, residential bridging loans 2% per month. Prime Finance can also assist you with refinancing your 2nd mortgage facility with our lowest interest in Australia, as we are the specialists in 2nd mortgage finance and you can rest easy knowing your finances are in the right hands.

2nd mortgages are great for alternative to mainstream lending so if you have been turned away from the banks or other lenders, call Prime Finance today.

Whats Happening With Mortgage Rates

After soaring for much of 2022, mortgage rates and other long-term rates are starting to come down.

The average rate on a 30-year mortgage has fallen 0.75 percentage points in the past month or so, after hitting a 20-year high of 7.08% in early November. Rates reached 6.33% on Dec. 8, the lowest level since September. This occurred over the same period as the Fed lifted its benchmark interest rate 1.5 percentage points.

Another key rate that fell is the yield on 10-year Treasury bonds, which has declined by a similar amount, to 3.5%.

Also Check: Could I Qualify For A Mortgage

Why Does My Mortgage Interest Rate Matter

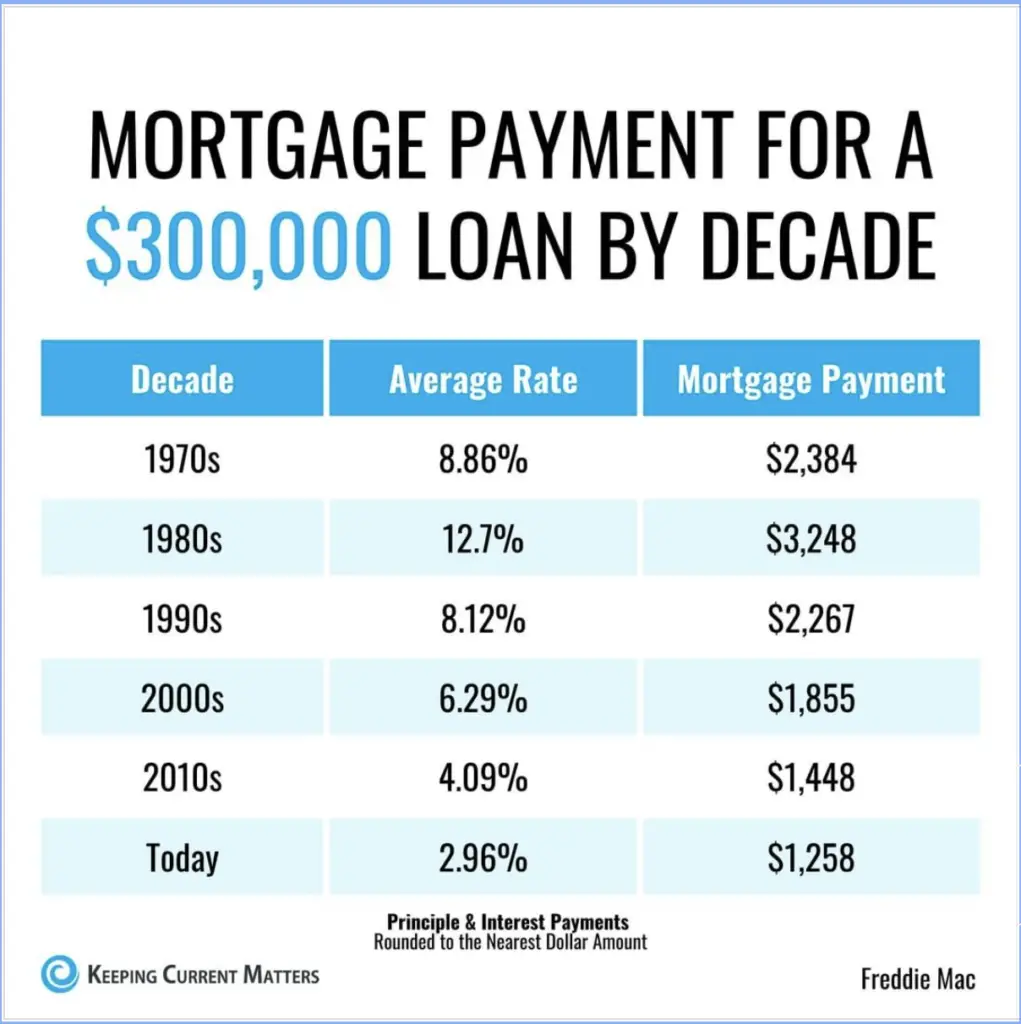

Your mortgage interest rate impacts the amount youll pay monthly as well as the total interest costs youll pay over the life of your loan. While it may not seem like a lot, a lower interest rate even by half of a percent can add up to significant savings for you.

For example, say a borrower with a good credit score and a 20 percent down payment takes out a 30-year fixed-rate loan for $300,000. In this case, an interest rate of 4.75% instead of 5.25% translates to more than $90 per month in savings in the first five years, thats a savings of $5,500.

Its equally important to look at the total interest cost of your loan. In the same scenario, a half percent decrease in interest rate means a savings of almost $33,000 in total interest owed over the life of the loan.

Your Monthly Overpayment Amount

Overpayments are not affected by the base rate because they’re a separate amount you set yourself.

When you make a regular monthly overpayment, it’s just an extra amount on top of whatever your contractual monthly mortgage payment is at the time.

If your monthly mortgage payments are increasing because of the base rate change, we won’t use your overpayments to pay the difference. So, you may want to tell us to reduce your overpayments so you can put the money towards your monthly mortgage payment instead.

Make overpayments, change your regular overpayments, or manage your preferences by logging in to Mortgage Manager with your mortgage account number. You can also access Mortgage Manager through our Banking App.

Recommended Reading: How Does Making Extra Payments On Mortgage Work

Renting Vs Buying A Home

Deciding whether it makes sense to rent or buy is about more than just comparing your monthly rent to a potential mortgage payment. How long you plan on staying in that area should also factor into the decision. Buying a home requires you to pay thousands of dollars in upfront fees. If you sell the house in the next two or three years, then you may not have enough equity built up in the home to offset the fees you wouldnt have paid if you were renting. You also need to factor in maintenance and upkeep costs with owning a home.

However, over the long term, buying a home can be a good way to increase your net worth. And when you buy, you can lock in a fixed interest rate, which means your monthly payments are less likely to increase compared to renting. Owning a home also has the added benefit of providing a stronger sense of stability for you and your family. And when you own, you have the freedom to customize your living space however you like.

Jumbo Mortgage Rate Moves Upward +009%

The average rate for a 30-year jumbo mortgage is 6.62 percent, up 9 basis points over the last week. This time a month ago, the average rate was above that, at 6.88 percent.

At the average rate today for a jumbo loan, you’ll pay a combined $639.98 per month in principal and interest for every $100,000 you borrow. Compared to last week, that’s $5.94 higher.

Don’t Miss: Can I Refinance My Mortgage With The Same Bank

Best Buy To Let Mortgages Rates

The best rate on a fixed rate buy to let mortgage this month is a 2 year fix from The Mortgage Works at 4.29%. Youll need a deposit of 35% and it has a rather hefty arrangement fee of £3,750. The best rate on a fixed rate buy to let mortgage last month was also a 2 year fix from The Mortgage Works with a rate of 5.04%.

A Quick Guide To Types Of Mortgage

- General principal and interest

A table mortgage is repaid by periodic repayments of principal and interest over the loan term, resulting in a declining principal balance and eventual repayment of the loan.

- Interest-only mortgage

- Fixed rate mortgage

- Floating rate mortgage

- Revolving credit mortgage

- Offset mortgage

Also Check: How To Pay Down Mortgage Without Refinancing

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The5-year fixed rate mortgageis the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wont have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

How To Get The Best 30

Studies have shown that borrowers who comparison shop get better rates than those who go with the first lender they find. Financial experts recommend getting quotes from at least three different lenders. You may also want to consult a mortgage broker, who will shop around on your behalf.

If your credit profile isnt strong enough for you to get the best mortgage rate possible, financial experts at your current bank, a housing counseling organization or a good mortgage broker can help offer tips on how to improve your score.

You May Like: What Can You Include In A Mortgage

What Do I Need To Refinance My Mortgage With A Fixed Rate Loan

A 30 year mortgage could be very beneficial, but you need to consider how long you plan to stay in your new home. If what matters most to you is having lower mortgage payments each month, you should consider a 30 year fixed rate mortgage with the help of a loan officer.

How Much Can I Save By Comparing Mortgage Interest Rates In Canada

Because of the significant amount of money being borrowed under a mortgage, even the slightest difference in the mortgage interest rate may result in you saving money over the course of a mortgage term, and even more over an entire amortization period. While the mortgage rate is a very important consideration, you should also be sure to evaluate the terms and conditions of each type of mortgage to make sure you choose the right one for you.

Don’t Miss: How Is A Mortgage Rate Determined

Your Rights And Responsibilities As A Borrower

Its important to know your rights as a mortgage borrower. When applying for a mortgage, your lender must provide information such as your mortgage principal amount, your mortgage interest rate, yourannual percentage rate , term, payments, amortization, prepayment privileges and charges, and other fees. This can be provided in an information box in your mortgage agreement.

Changes to your mortgage agreement will need to be made in writing within 30 days, or it can be disclosed electronically. Your lender must also give you a renewal statement at least 21 days before the end of your term, or let you know if they will not be renewing your mortgage. If your lender is a member of the Canadian Banking Association, which includes most major banks operating in Canada, your lender may have agreed to provide additional information, such asonline financial calculatorsor other information that can be used to calculate mortgage prepayment charges.

Your lender also has rights, such as the right to inspect your title or the right to sell your home if you dont make your mortgage payments.

You also have responsibilities as a mortgage borrower. It’s important to carefully read your mortgage agreement and ask your lender questions if you don’t fully understand any terms or conditions.

How Do You Shop For Mortgage Rates

First, start by comparing rates. You can check rates online or call lenders to get their current average rates. Youâll also want to compare lender fees, as some lenders charge more than others to process your loan.

Thousands of mortgage lenders are competing for your business. So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate.

Each lender is required to give you a loan estimate. This three-page standardized document will show you the loanâs interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years.

Don’t Miss: How To Apply For A House Mortgage

How Is My Mortgage Interest Rate Determined

Lenders determine your mortgage interest rate based on the type of loan you take out, your credit score, and the overall loan amount, as well as your down payment amount and the length of the loan.

- Loan Type: Government-backed loans are handled differently than conventional loans.

- : People with high credit scores generally receive lower interest rates. Although those with lower credit scores may still qualify, their mortgage terms may not be as favorable.

- Loan Amount: Your mortgage rate will be influenced by the total amount of money you need to borrow. Higher amounts tend to suggest higher interest rates.

- Down Payment Amount: A higher down payment can significantly lower your interest rate.

- Length of Loan: Long-term loans tend to bring lower monthly payments with higher interest rates, while short-term loans bring higher monthly payments and lower interest rates.