Mortgages Where Credit Score Matters Less

With conventional loans those backed by Fannie Mae and Freddie Mac a lot of focus is put on your credit score, says Dan Keller, a mortgage professional in Seattle.

The impact of a lower score wont be as substantial on some types of loans as it would be with a conventional loan, Keller notes. For the best interest rates on a Federal Housing Administration or Department of Veterans Affairs loan, the focus isnt on a 760 score as it is with conventional loans, he says its on 700-plus.

-

For an FHA loan, you may be able to have a score as low as 500.

-

VA loans don’t require a minimum FICO score, although lenders making VA loans usually want a score of 620 or more.

-

USDA loans backed by the Agriculture Department usually require a minimum score of 640.

So, theres some leniency on credit scores and underwriting guidelines with government loans. But the loan fees are more expensive: Youll have to pay mortgage insurance as well as an upfront and an annual mortgage insurance premium for an FHA loan.

But those credit score guidelines dont tell the whole story. Most lenders have overlays, which are extra requirements or standards that allow them to require higher credit scores as a precaution, regardless of mortgage type.

Here are some of the best ways to build your credit score:

How Credit Score Impacts Your Mortgage: Examples

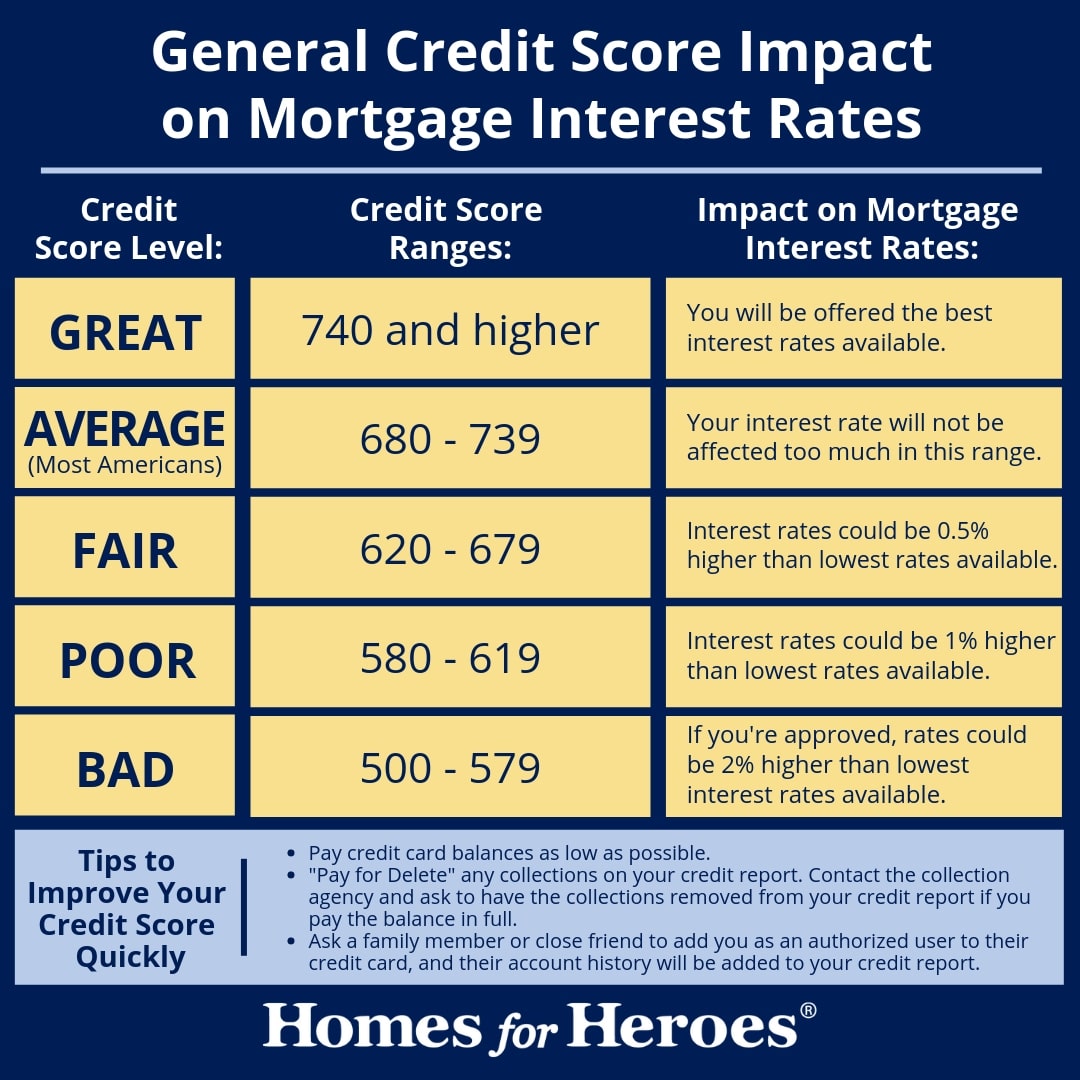

Theres often a stark difference between mortgage interest rates at the highest and lowest ends of the credit score spectrum. And that equates to a big difference in monthly mortgage payments and long-term interest costs for homeowners.

Here are a few examples to show how your those differences in credit score can impact your mortgage costs.

The Relationship Between Credit Scores And Interest Rates

The better your credit scores, the better your interest rates might be.

When you apply for things like credit cards or loans, your credit scores may be checked. Many companies use your scores to predict your future financial behaviors. And good credit scores may suggest youâre responsible and practice good financial habitsâlike paying your bills on time and paying back the money you borrow.

Think of it like this: One way lenders limit risk is by charging interest. And in the eyes of a lender, the higher your credit scores, the less risky you are as a borrower. So the less risky you are as a borrower, the more likely you are to qualify for low interest ratesâand the lower those rates might be.

As the Consumer Financial Protection Bureau points out, this is true when it comes to all different kinds of credit products, including credit cards, auto loans and mortgages.

âThe credit card company may decide which interest rate to charge you based on your application and your credit history,â ââthe CFPB explains. âCredit card companies typically offer their best rates to customers who have the highest credit scores.â

Want to learn more about credit card interest? Check out this deep dive into how credit card interest works.

Auto Loan Interest Rates

âYour credit score plays a large part in determining what kind of auto loan you can get, and how much interest you will pay for the loan,â says the CFPB.

Mortgage Interest Rates

Also Check: What’s The Mortgage Rate

Make Sure Its A Fico Score

One final thing the variances in rates described above are based on FICO credit scores the ones lenders typically ask for when evaluating a borrower for a mortgage. However, if you order your credit score from one of the three credit rating agencies, theres a good chance it will be based on a proprietary rating system and not a FICO score.

These proprietary systems can produce scores that vary significantly from a FICO score and may give a consumer the impression their credit is better than it is. You can obtain your Equifax or Transunion FICO score for free through MyFico.com or for a fee from either company just make sure the score youre obtaining is specifically identified as your FICO score. You cannot obtain your FICO score from Experian, as it no longer provides customers with FICO scores but will only provide them with scores produced by alternative credit scoring systems.

What You Need To Know

- Your credit score affects the mortgage rate you receive

- You can improve your credit score by making on-time payments, not maxing out your credit and diversifying the types of credit you have

- Other factors like income, the state of the housing market and economic inflation also impact mortgage rates

Don’t Miss: How To Stop Foreclosure On Reverse Mortgage

How Your Mortgage Affects Your Credit Score

A Tea Reader: Living Life One Cup at a Time

Financial gurus are constantly warning consumers to keep their in tip-top shape if theyre planning to purchase a home in the near future. The higher your credit score, the more likely you are to get the best mortgage rates. A mortgage calculator can show you the impact of different rates on your monthly payment. Once you have the mortgage, however, it can affect your credit score going forward.

How Credit Score Affects Your Mortgage Rate

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Without a high credit score, you wont qualify for the best mortgage rates available, which could mean youll end up paying more money over the term of your mortgage. The difference between 3% and 3.25%, for example, can add up, especially if youre applying for a 30-year fixed-rate mortgage.

Read Also: Is 3.6 A Good Mortgage Rate

How Can You Boost Your Credit Score

There are one-off actions that can improve your credit score, such as registering yourself on the electoral roll and clearing errors on your credit report. However, careful, long-term credit use is the most effective way to improve your credit score.

Its easy to think that never taking out a credit card would show youre good with money, but it can actually lower your credit score. Thats because lenders dont know how reliable youre going to be with repayments, as theres no record of you ever borrowing. If youre looking to improve your credit score, try:

- Spending and paying off a small amount each month on a credit card to show lenders you can responsibly manage your credit.

- Prioritising paying off debt to improve your debt/income balance.

- Making sure you know when payments are coming out and always having enough money in your account to cover them.

- Closing any old credit card accounts youre no longer using having too many open will make it look like youre relying on credit too much.

- Encouraging your partner or spouse to work on their credit score too, particularly if theyre an associated financial partner .

How To Prepare For A Mortgage With No Credit

If you dont have a lot of credit history, you may need to open a credit card to help you establish one. Lenders are often as wary of people with no credit history as those with bad credit. Just know it takes about six months before the account will be reported and have a positive impact.

It also takes about two years for negative information to have a reduced effect on your credit score. So, work to add positive information that is newer and wait for the old negative stuff to lose its impact before gearing up for your mortgage application. That way, you can get the best mortgage rates and terms possible.

Recommended Reading: Will Mortgage Rates Keep Dropping

Having A High Cibil Score Can Get You A Lower Rate Of Interest

CIBIL score is an important factor that is taken into consideration by lenders at the time of offering you a loan. Having a higher CIBIL score not only makes you eligible to avail a loan but also helps you in getting a lower rate of interest. A CIBIL score is a numerical representation of your ability to repay the credit. It is computed by TransUnion CIBL credit bureau after considering your past payments, credit history, current and old credit accounts, among others. An interest rate is one of the most important factors a borrower considers while availing a loan.

A CIBIL score falls in the range of 300-900. Majority of lenders consider a CIBIL score of 750 and above as ideal. If you want to have easier access to credit, your CIBIL score should be closer to 900. Lenders like banks and non-banking finance companies prefer giving loans to people who have a high credit score as they have a lesser probability of turning a defaulter.

Read Also: How Much Money Should Go To Mortgage

What Credit Rating Do You Need To Buy A House

Youve spent years saving up your deposit for a new home. Youve waited for the right moment. Now its here. The only thing left is to secure your mortgage. We can help show you how.

If youre thinking of buying a home, youll need a credit rating thats good enough to secure a mortgage. Your credit rating is a snapshot of how youve managed money in the past including past borrowing, repayments, how much of your available credit you routinely use, how many payments youve missed and several other factors to create a score. The higher the score, the better your chance of being offered a better deal on your mortgage.

There are three major credit reference agencies each with a slightly different scoring system. So its a good idea to check your credit rating with all three to find out how you rate. That way, youll know whether youre likely to get a mortgage.

Also Check: How Do You Buy Back A Reverse Mortgage

How To Maintain A Good Credit Score During Covid

Taking steps to protect and maintain your credit score has always been important. Thats especially true if youre planning on buying a home.

So its important to stay on top of your finances during this challenging time. That includes paying your bills on time, and contacting lenders and service providers if you do run into trouble. Here are a few things you can do:

- Create a budget to know where you stand. The Barclays Budget Planner can help.

- If you foresee problems paying your loan or credit cards, contact them right away to explore your options.

- If you think youll be late paying your phone, utilities or other service providers, contact them to let them know and to discuss a possible arrangement. You can also find helpful advice at Barclays money management.

- To help you manage during this period, you can also find valuable ideas and resources at Barclaycard coronavirus help and support about protecting yourself from fraud and managing your finances.

- Youll also find other information about managing your Barclaycard account during the crisis at the Frequently Asked Questions page.

Why Do Lenders Care About Credit Scores

From the lenders point of view, a credit score is a mathematical construct that demonstrates a borrowers creditworthiness and the likelihood they will meet future financial obligations. The minimum score needed for FHA loan or a conventional loan typically varies because FHA loans offer financing options with less restrictive credit guidelines than conventional loans. Several scoring algorithms generate consumer credit scores, with the FICO Score the most widely known tool.

Recommended Reading: What Do You Need To Get A Second Mortgage

Can I Get A Mortgage With A Low Credit Score

It is possible to get a mortgage with a low credit score, but youll pay higher interest rates and higher monthly payments. Lenders may be more stringent about other aspects of your finances, such as your DTI ratio, if your credit is tarnished.

Keep in mind that credit requirements vary from lender to lender. Shop around with multiple lenders to find one that will work with you.

What Credit Scores Are Required For A Digital Mortgage

Digital mortgages are growing in popularity as they eliminate the need for paperwork and manual processes. Simply put, theyre all about convenience. The benefits of a digital mortgage are faster approval and lower fees compared to the traditional method.

To take advantage of this convenience and the other benefits that come with a digital mortgage, youll need a higher minimum credit score than you would for a conventional mortgage. Ratecloud requires a minimum credit score of 680 when applying for a digital mortgage.

Also Check: Can You Undo A Reverse Mortgage

Determining A Qualifying Credit Score

Before we get into the credit score you need to qualify, you might be wondering how lenders determine your credit score. After all, your FICO® Score is reported by three different bureaus.

If you’re applying for a loan on your own, lenders get your from each of the three major credit rating agencies and use the middle or median score to qualify you.

If there are two or more borrowers on a loan, the lowest median score among all clients on the mortgage is generally considered the qualifying score. The exception to this is a conventional mortgage with multiple clients being backed by Fannie Mae. In that case, they average the median scores of the borrowers on the loan.

If you have a median score of 580 and your co-borrower has a 720 credit score, the average credit score would be 650. Because the minimum qualifying score for conventional loans is 620, this can mean the difference between qualifying for a mortgage and not.

One thing you should know is that for the purposes of your rate and mortgage insurance, the lowest median score is the one that gets reported, so your rate might be slightly higher. There are also certain situations in which Fannie Mae still uses the lowest middle score for qualification. We recommend speaking with a Home Loan Expert.

How Mortgage Rates Impact Your Payments

Many people look at interest rates on mortgages and think that it cant make a big difference. After all, how big of a deal is it whether you get a loan with an interest rate of 3.45% versus one with a rate of 3.15%?

Youre talking less than one point, so it may not seem important. However, youre also talking about a loan of more than $100,000 or more, plus a timeline of 30 years.

This magnifies the impact of even a small change in interest rate, which can mean the difference of thousands of dollars for how much youll pay. For an immediate impact, it also changes your monthly payment, which limits the amount you can borrow or determines if the payment fits in your budget.

You May Like: Are Taxes And Insurance Included In Mortgage

Why You Want A Nice Credit Score For A Mortgage

In the example above, your monthly payment goes up slightly as your interest rate increases. The numbers might not seem alarming because your interest rate changes by less than a percent. However, over the life of the loan, the amount of interest paid is a difference of tens of thousands of dollars.

To make a long story short, your credit score matters.

Pro tip: You can use Alliants mortgage rate calculator to get a better idea of how your interest rate will change based on your credit score.

What Is A Good Mortgage Rate

Mortgage rates change based on economic conditions, so a good mortgage rate now may not be the same as a good mortgage rate one year or five years from now. Published mortgage rates are typically based on an applicant with an excellent credit score, so they may not apply to you if your credit score isn’t high. To find a good mortgage rate for you, get quotes from at least a few lenders so you can compare them and get a sense of what’s available.

Don’t Miss: Are Cash Out Mortgage Rates Higher

How Can I Improve My Credit Score

is not something you can do overnight but what you may be able to do in a short period of time is assess your current financial situation, and put together a plan to help guide you towards a better credit score.

This plan could include:

- Figuring out your regular expenses

- Putting together a disciplined payment schedule for any current debts

- Building a budget that allows you to save a regular amount every fortnight/month while still making any debt repayments necessary

- Setting a reminder for paying bills

- Consider , if that is beneficial for your personal situation

- Putting the brakes on any further discretionary spending.

Changing your credit score for the better can be a challenge, but the sooner you start, the sooner your credit score might start creeping up.

This article was reviewed by our Finance Editor, Sean Callery, before it was published as part of our fact-checking process.

Follow Canstar on and for regular financial updates.

Thanks for visiting Canstar, Australias biggest financial comparison site*

Approving Your Mortgage Application

Mortgage lenders rely heavily on credit scores as do other lenders to help them determine whether to accept or deny your application for a mortgage. A credit score is an indication of how big of a risk they are taking by loaning money to you. The lower your credit score, the higher the risk that you will default on a loan.

Almost all creditors use credit scores when reviewing applications today. Even landlords and insurance companies will sometimes look at credit history to find out if you have a reputation for paying your bills or falling behind on debt.

You May Like: What Will Mortgage Rates Do Tomorrow