How Much House Can I Afford With An Fha Loan

To calculate how much house you can afford, weve made the assumption that with at least a 20% down payment, you might be best served with a conventional loan. However, if you are considering a smaller down payment, down to a minimum of 3.5%, you might apply for an FHA loan.

Loans backed by the FHA also have more relaxed qualifying standards something to consider if you have a lower credit score. If you want to explore an FHA loan further, use our FHA mortgage calculator for more details.

Conventional loans can come with down payments as low as 3%, although qualifying is a bit tougher than with FHA loans.

Also Trending : Mortgage Affordability Calculator

Calculate your loan based on your borrowing capacity

When you shop for a new house, the initial step is to determine how much you can afford .

Your budget is based on the income of households who want to buy a home, their monthly personal expenses , and the expenses associated with owning a house .

The mortgage calculator will take these factors into consideration and show you the maximum purchase price that you can afford.

You should check if you have enough cash to buy a home. The required capital is used for the down payment, as well as for the closing costs that must be paid to complete the purchase.

One has to estimate how much one can afford to pay, without suffocating. A conservative rule of thumb is to use the mortgage or financial capacity calculators or seek expert advice on the subject.

There are two debt rates, and you will need to know both to proceed with the purchase of a home and find out exactly where you put your feet. The first is oriented only around your housing costs.

Your debt limit for your home can not exceed 33% of your gross monthly income. So if you are coveting a house that would force you to go into debt more than the 33% limit, your financial institution should refuse the deal.

Even better, you should lower your selection criteria and expectations.

Thats why its important to honor your student, car or line of credit loans as quickly or diligently as possible.

Whats Included In A Mortgage Payment

Your mortgage payment consists of four costs, which loan officers refer to as PITI. These four parts are principal, interest, taxes, and insurance.

- Principal: The amount you owe without any interest added. If you buy a home for $400,000 with 20% down, then your principal loan balance is $320,000

- Interest: The amount of interest youll pay to borrow the principal. If the same $320,000 loan above has a 4% rate, then youll pay $12,800 for the first year in interest repayment

- Taxes: Property taxes required by your city and county government

- Insurance: Homeowners insurance and, if required, private mortgage insurance premiums on a conventional loan

When determining your home buying budget, consider your entire PITI payment rather than only focusing on principal and interest. If taxes and insurance are not included in a mortgage calculator, its easy to overestimate your home buying budget.

Don’t Miss: Can You Get Preapproved For A Mortgage Through 2 Banks

How Much Do You Have For A Down Payment

Your down payment affects the amount you can borrow to buy a home and the size of your payments. This will impact your monthly budget.

You must have at least 5% for a down payment if the home purchase price is less than $500,000.

If the home purchase price is between $500,000 and $999,999.99, you must have at least 5% for the first $500,000 and 10% for the remaining amount.

For home prices $1 million or over, the down payment must be 20%.

If you are a first-time home buyer, you can borrow up to $35,000 from your RSP towards your down payment.1

1. First time home buyers can withdraw up to $35,000, in a calendar year, from their RSPs for a home purchase . They then have 15 years to repay their RSP . Find out more about the RSP Home Buyers’ Plan.

Step 5 of 6

How To Budget For A House

Its important to understand the costs associated with buying a home before you start looking at homes for sale. Many homeowners find themselves surprised by these costs once theyve purchased a new home. Thats why we created the Home Affordability Calculator to arm you with the information youll need to make the best decision for you and your financial situation.

Don’t Miss: How To Estimate Your Mortgage Payment

How Much Can I Afford

How much you can afford to spend on a home in Canada is primarily determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow based on your current situation.

What Factors Help Determine ‘how Much House Can I Afford’

Key factors in calculating affordability are 1) your monthly income 2) cash reserves to cover your down payment and closing costs 3) your monthly expenses 4) your credit profile.

-

Income Money that you receive on a regular basis, such as your salary or income from investments. Your income helps establish a baseline for what you can afford to pay every month.

-

Cash reserves This is the amount of money you have available to make a down payment and cover closing costs. You can use your savings, investments or other sources.

-

Debt and expenses Monthly obligations you may have, such as credit cards, car payments, student loans, groceries, utilities, insurance, etc.

-

Credit profile Your credit score and the amount of debt you owe influence a lenders view of you as a borrower. Those factors will help determine how much money you can borrow and the mortgage interest rate youll earn.

Don’t Miss: Is Paying Points On A Mortgage Worth It

Types Of Mortgage For First

Youre considered a first-time homebuyer if you have never owned residential property in the UK or abroad. It also applies if youve only owned a commercial property with no attached living space, such as a pub with a small upstairs flat. If you fit this profile, you qualify as a first-time homebuyer.

On the other hand, you are not considered a first-time homebuyer if:

- Youve inherited a home, even if youve never lived in the property since its sold

- Youre buying a house with someone who owns or has previously owned a home.

- Youre having property purchased for you by someone who already owns a house, such as a parent or guardian.

There are a variety of mortgage products which are suitable for first-time buyers. Before finalizing a mortgage deal, look into the following types of mortgages:

Why Should You Use Our Home Affordability Calculator

Its easy to look at a potential monthly mortgage payment and say, I can cover that. But, the reality is theres a lot more to think through when youre preparing to buy a home.

Of course you want to make sure you have enough income to make your monthly payments, but what about future expenses? Your house will not only cost a lot of money every month, itll cost a lot of money for a long period of time. What happens when you want to send your kids to college? What if your parents need additional care as they age?

Theres also your savings to consider. How much of your savings can you allocate toward your down payment without leaving yourself in a financially vulnerable position?

Lenders certainly have their own set of qualifications for prospective borrowers, but theyre not responsible for your personal, long-term financial health, and they might be willing to lend you more than you should actually take out.

You and you alone must consider your financial circumstances, now and in the future, to determine the loan value and terms that work for you. But our calculator errs on the side of caution, and its a good start to your search for the perfect property

Also Check: How Much Would A Mortgage Be On 130 000

How To Lower Your Monthly Payments

If your mortgage calculator results are not yielding the lower monthly payments you hoped for, here are several techniques to try:

- Lower purchase price: The less you borrow, the lower your mortgage payment

- Bigger down payment: Putting more money down means youll borrow less. Also, the best mortgage rates generally go to borrowers with larger down payments, among other qualifying factors

- Avoid private mortgage insurance: When you put at least 20% down on a conventional loan or 20% home equity on a refinance you can avoid paying monthly private mortgage insurance premiums

- Longer loan term: A longer loan term means lower monthly payments. However, you will pay more in total interest over the life of the loan

- Shop for a lower rate: Rate shopping doesnt have to take long, and its well worth the savings. Here are tips to get your best mortgage rate

House Affordability Based On Fixed Monthly Budgets

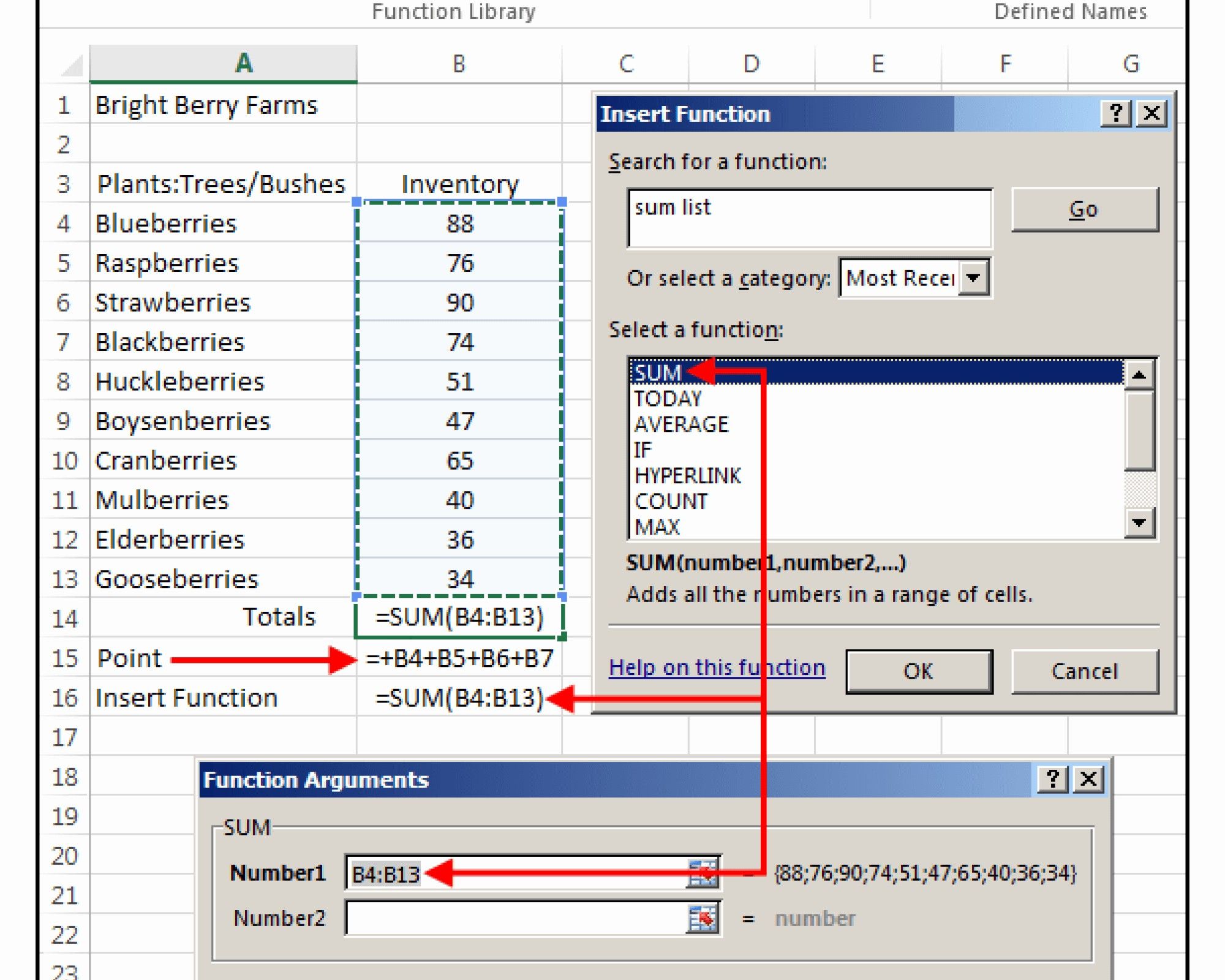

This is a separate calculator used to estimate house affordability based on monthly allocations of a fixed amount for housing costs.

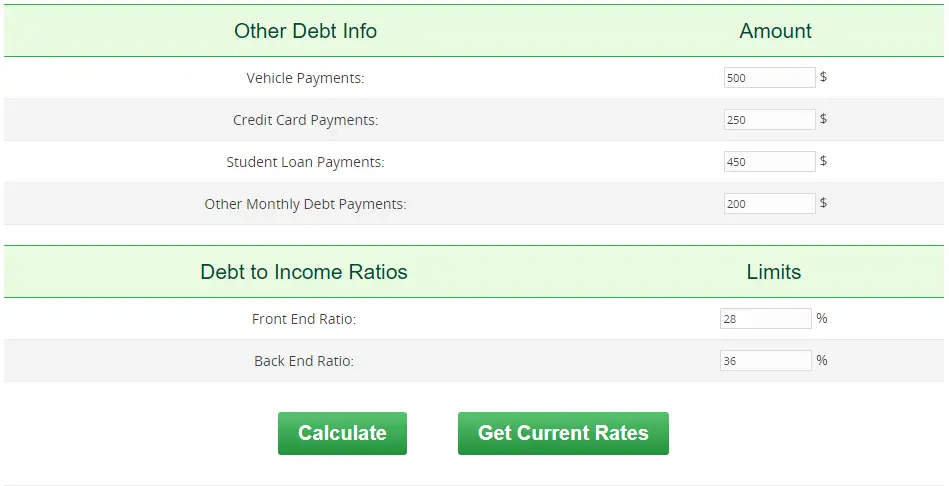

In the U.S., conventional, FHA, and other mortgage lenders like to use two ratios, called the front-end and back-end ratios, to determine how much money they are willing to loan. They are basic debt-to-income ratios , albeit slightly different and explained below. For more information about or to do calculations involving debt-to-income ratios, please visit the Debt-to-Income Ratio Calculator.

Because they are used by lenders to assess the risk of lending to each home-buyer, home-buyers can strive to lower their DTI in order to not only be able to qualify for a mortgage, but for a favorable one. The lower the DTI, the more likely a home-buyer is to get a good deal.

Also Check: Which Company Has The Lowest Mortgage Rates

View Affordability From Two Perspectives:

- Your overallmonthly paymentswhich included household expenses,mortgage payment, home insurance, property taxes, auto loans and any other financial considerations

- How lenders determine what you can afford. Just like lenders, our Affordability Calculator looks at your Debt-to-Income Ratio to determine what home price you can afford.

Bmo Bank Of Montreal Mortgage Affordability

Before you get a mortgage from BMO, it is important to know how BMO calculates your mortgage affordability. BMO takes into account the following factors:

- Your household income

- Your heating costs

- Any applicable condo fees or maintenance costs

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

BMO includes the cost of mortgage insurance in your mortgage affordability calculation. This allows you to borrow more with a smaller down payment.

BMO calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of39% and a maximum total debt service ratio of44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to BMO, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

You May Like: Can You Mortgage A Boat

Calculating Your Mortgage Payment

This mortgage calculator can answer some of the most challenging questions in the home search journey, short of talking to a lender, including what kind of payment can I afford? How much do I need to make to afford a $500,000 home? And how much can I qualify for with my current income?

We’re able to do this by not only considering the loan amount and interest rate but the additional factors that affect your ability to qualify for a mortgage. We include your other debts and liabilities that have to be paid each month and costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment. Doing so makes it easy to see how changes in costs and mortgage rates impact the home you can afford.

While determining mortgage size with a calculator is an essential step, it won’t be as accurate as talking to a lender. Get pre-approved with a lender today for exact numbers on what you can afford.

How Much Income Do I Need To Buy A $400k Home

This answer isnt just about your income. Your interest rate and your plans for a down payment play an important role. For example, if youre planning to secure an FHA loan and put down 3.5 percent on a $400,000 home, youll need to earn just over $102,000 per year for a 30-year mortgage with a 5 percent interest rate.

If youre sitting on the money you need for a 20 percent down payment, your income needs look a lot different. For example, if you can put down $80,000 and lock in a 4.75 percent interest rate on a 30-year mortgage, you only need to earn $78,000 per year.

Recommended Reading: How Much Mortgage For 60000 Income

Cmhc Backs Down From Covid

On July 5, 2021, the Canada Mortgage and Housing Corporation announced that it was reversing changes previously implemented in mid-2020:

- The Gross Debt Servicing ratio limit was reset to 39%

- The Total Debt Servicing ratio limit was reset to 44%

- At least one of the borrowers of the mortgage must have a credit score of at least 600

Understand The 28/36 Rule

Lenders may determine your ability to afford a new home by using the 28/36 rule. This rule states that:

- Housing expenses should be no more than 28% of your total pre-tax income. This includes your monthly principal and mortgage interest rate, home insurance, annual property taxes, and private mortgage insurance payments .

- Total debt should not exceed 36% of your total pre-tax income. This includes the housing expenses mentioned above as well as credit cards, car loans, personal loans, and student loans, so long as these monthly debt payments are expected to continue for 10 months or more. This does not include other monthly expenses such as groceries, gas or your current rent payments.

In concrete numbers, the 28/36 rule means that a borrower who makes $5,000 a month should not spend more than $1,400 on housing costs every month.

If youre a renter making $5,000 a month, its a good rule of thumb to spend a maximum of $1,400 on rent. However, for a homeowner making the same amount, $1,400 should cover your monthly mortgage payment, as well as homeowners insurance premiums and property taxes.

You May Like: What Does It Mean To Close On A Mortgage

Improve Your Credit Score

Lenders view your as an indicator of how likely you are to repay your loan or how likely you are to default. Consequently, it affects both the interest rate and the loan amount a lender is willing to offer you.

By taking concrete steps to improve your credit score, youll show lenders that you are a trustworthy borrower, and theyll reward you with a reasonable rate and, hopefully, a large enough mortgage to afford the home of your dreams.

Read more: How Your Credit Scores Affect Mortgage Rates

What Are The Different Types Of Home Loans

There are several types of home loans, but which one is right for you will depend entirely on what you qualify for and what ultimately makes the most sense for your financial situation. Below are the five most common home loans you will encounter.

Fixed-Rate Loan

Fixed-rate loans have the same interest rate for the entire duration of the loan. That means your monthly home payment will be the same, even for long-term loans, such as 30-year fixed-rate mortgages. Two benefits to this mortgage loan type are stability and being able to calculate your total interest on your home upfront.

Adjustable-Rate Loan

Adjustable-rate mortgages have interest rates that can change over time. Typically, they start out at a lower interest rate than a fixed-rate loan and hold that rate for a set number of years before changing interest rates from year to year. For example, if you have a 5/1 ARM, you will have the same interest rate for the first 5 years, and then your mortgage interest rate will change from year to year. The main benefit of an adjustable-rate loan is starting off with a lower interest rate to improve affordability.

FHA Loan

USDA Loan

This loan type is specifically designed for families looking to buy homes in rural areas. Similar to the FHA loan, this home loan lets lower-income families become homeowners. The loan does not require a down payment, but you will have to get private mortgage insurance.

VA Loan

Also Check: Do Multiple Mortgage Pre Approvals Affect Credit Score

How Much House Can You Afford

| Monthly Pre-Tax Income | |

|---|---|

| $3,000 | $523,000 |

The table above used $600 as a benchmark for monthly debt payments, based on average $400 car payment and $200 in student loan or credit payments. The mortgage section assumes a 20% down payment on the home value. The payment reflects a 30-year fixed-rate mortgage for a home located in Kansas City, Missouri. Plug your specific numbers into the calculator above to find your results. Since interest rates vary over time, you may see different results.

In practice that means that for every pre-tax dollar you earn each month, you should dedicate no more than 36 cents to paying off your mortgage, student loans, credit card debt and so on. This percentage also known as your debt-to-income ratio, or DTI. You can find yours by dividing your total monthly debt by your monthly pre-tax income.