Can You Find Mortgage Loan Records From 15 Years Ago

We donât think youâre going to get anywhere. Even if you have all of your payments and records, itâs possible that the refinancing and loan modification would supersede those records as you agreed to those amounts at that time. We wonder whether you could even prove that the lenders committed fraud against you and whether you waited too long to make that claim.

Itâs true that during the Great Recession, some of the biggest lenders didnât always do the right thing by their borrowers. Some made grave errors and put homes into foreclosure when the owners had made every payment on time.

And yet, weâre not hearing you accuse them of failing to properly credit your account each time you refinanced or modified your loan. We have to assume their computer systems did credit your loan account appropriately and that the amount of the refinancing and loan modification was right.

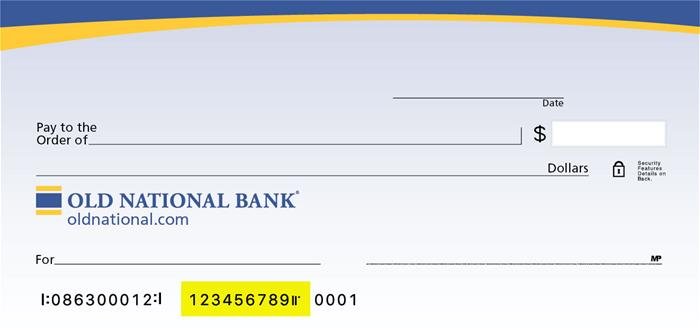

To Use Mobile Deposit

- Log in to your ONB Mobile app.

- At the bottom of the screen, chooseCheck Deposit.

- In the “To” section, select the account you want to deposit to and enter the amount.

- Endorse the check by signing your name on the back. Then print For Mobile Deposit Only, or check the mobile deposit box if available.

- Select the photo icon and capture an image of the front and back of your check.

- Verify the information and select Deposit.

You will receive an email confirmation once a Mobile Deposit has been submitted. A second email will be generated when the deposit has been reviewed to let you know the status of the deposit. An approval email does not guarantee that the funds are available immediately. If we receive your mobile deposit by our Mobile Deposit cut-off time of 8pm CST, Monday through Friday , we consider that business day to be the day of your deposit. Otherwise, we will consider that the deposit was made on the next business day we are open.

Next Steps: Protect Yourself From Identity Theft

Incorrect or unfamiliar information on your credit report could be a sign of identity theft. Monitoring your credit and regularly reviewing your credit reports could help you spot potential identity theft signals, such as a new credit account you didnt apply for or a new address you dont recognize.

The faster you act when you flag suspected identity theft, the more likely you are to minimize the financial impact of fraud. Here are six steps to take if youre a victim of identity theft.

About the author:

Read More

Recommended Reading: How To Get A Mortgage On A Foreclosure

Whats The Best Way To Store My Mortgage Paperwork

In this digital age, you might be tempted to upload everything to your online file-sharing service or cloud and forget about it. Unfortunately, these services arent tamper-proof. A hack or data breach can cause you to lose your information.

If you do keep online records, also keep a physical copy of all your important messages or documents in a locked fireproof cabinet in your home. Tell any other person on your loan where your documents are and how to access them.

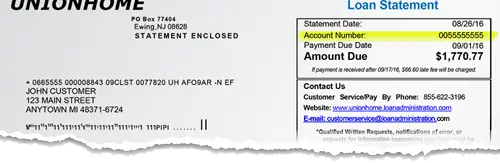

Confirm Your Loan Balance And Account Information

If youre looking to refinance or pay off your loan balance before the end of the loan term, youll need to confirm the payoff amount with the servicer. The payoff amount is what you still owe on your loan. Its not the same as your current loan balance because the payoff amount includes the interest accrued up through the day you expect to pay off the loan, and any fees you havent yet paid. Call your servicer to get your payoff amount as of a specific date.

Before you decide to pay off your mortgage, consider these questions.

1. Will you owe a prepayment penalty? Check your monthly billing statement, coupon book, or the paperwork you signed at the loan closing to see whether youll owe a prepayment penalty if you pay your loan back early. Usually, a penalty applies only if you pay off the entire loan .

2. Do you owe other money? It may make more sense to pay off other loans, credit cards, and car loans first especially if youre paying a higher interest rate on them.

3. Whats your situation? Decide whether it works in your favor to pay the loan early. Do you plan to stay in your home for the long term? Are you nearing retirement? Will there be tax implications to paying off your mortgage? Does any benefit offset having to pay a penalty?

Also Check: How Long Does A Mortgage Take

Where Can I Find My Old National Loan Account Number

Following are some options for obtaining your loan number:

- If you have enrolled in eStatements, view your full loan number on your eStatements within Digital Banking. Note that your full loan number is not visible within account details in Digital Banking.

- Look on your original loan paperwork, any loan coupon booklets or monthly paper statements you may have received.

- Visit any Old National banking center or call Client Care at , Option 4, for assistance.

What Is The Allpoint Atm Network

Allpoint is a network of 55,000 ATMs that provides Old National clients fee-free access to their accounts. Allpoint ATMs are listed as “partner ATMs” on our website locator at oldnational.com/locations.

To find an Allpoint ATM, go to our website locator at oldnational.com/locations. Select the Partner ATMs filter above the locator map. You can also use the locator within our Mobile App to find Allpoint ATMs.

Allpoint ATMS are located in local, regional and national retailers across all 50 states, Puerto Rico, Canada, Mexico, Australia and the United Kingdom. This includes merchants such as CVS, Kroger, Target, Walgreens, Winn-Dixie and many others.

Transactions that can be completed at Allpoint ATMs include withdrawals, transfers and balance inquiries. HSA and home equity cards cannot be used at Allpoint ATMs.

Allpoint ATMs will also have an Allpoint logo on them. Some may also be branded by other financial institutions, but you can still use them fee-free if they have the Allpoint logo showing they are part of the Allpoint Network.

Read Also: Can You Use Mortgage To Renovate

Understand What Information You’ll Receive

It’s a good idea to know what information you can expect to walk away with when conducting a public mortgage records search. Depending on the specific county, you’ll most likely discover the borrower’s name, the property address, maps or surveys of the property, the square footage of any dwellings and the property’s assessed value. You’ll also be able to see previous sales listings and the property’s tax assessment history.

Frequently Asked Questions About Insurance

What types of home insurance policies are available?

Homeowners insurance ensures that your home will be replaced or the damage will be repaired, up to the amount of coverage obtained, for losses from fire and other hazards covered by the standard extended coverage endorsement.

Flood insurance is required in areas where the dwelling is located in a Special Hazard Flood Area. The flood insurance policy should reflect the same zone as the property rating as determined by a Special Flood Hazard Determination.

Flood insurance is highly recommended for all clients, regardless of flood zone, to fully protect their interest. Please contact your insurance agent if you have questions regarding requirements for flood insurance. The flood insurance policy should also meet the National Flood Insurance Program requirements or the Federal Emergency Management Agency guidelines for a private flood insurance policy.

For condominium units, the homeowners association typically provides the minimum hazard and flood insurance required by us. You should consult an insurance professional for advice on any additional insurance you may need for your own protection. Keep in mind that if the associations policy is not sufficient, then you will be required to obtain additional coverage.

Earthquake insurance is usually carried on a voluntary basis.

What are my homeowners insurance responsibilities?

Should I inform Truist if I make changes to my homeowners insurance policy?

Insurance mailing address:

Read Also: What Is Typical Debt To Income Ratio For Mortgage

How Can I Find Fee Free Atms

With your Old National debit/ATM card, you can use any Old National or Allpoint ATM with no fees.

You can find Old National and Allpoint ATMs near you by using the locator on oldnational.com. When searching, select the ATMs and Partner ATMs filters above the locator map. You can also use the locator within our Mobile App to find your nearest ATMs.

The Allpoint ATM network provides 55,000 surcharge-free ATMs located in local, regional and national retailers across all 50 states, Puerto Rico, Canada, Mexico, Australia and the United Kingdom. This includes merchants such as CVS, Kroger, Target, Walgreens, Winn-Dixie and many others.

What If I Am Locked Out Of My Account In Digital Banking

To protect your account against unauthorized access, you may be “locked out” if you have attempted to log in to Digital Banking using incorrect login credentials multiple times. The length of time that you are locked out will depend on how many times you have attempted to log in using incorrect credentials. Here is how to regain access to your account:

Don’t Miss: How To Become A Mortgage Specialist

Why Do You Need To Keep Mortgage Documents

If a title, insurance, tax or legal question arises, your mortgage paperwork can prove invaluable.

For instance, your homeowners insurance agent may request some of this paperwork, particularly if there is an insurance claim involved, Ang says.

Lets say youve paid off your mortgage and are ready to sell your home. If your mortgage lender never filed a satisfaction of mortgage with the local recording office, your mortgage documents could save you from a dispute during the sale.

The easy fix is to hand over the document that you saved, pertaining to your payoff, whether it is a letter acknowledging payoff or the payoff itself, DAnnucci says.

Most crucially, you might need these documents if you ever face foreclosure.

The majority of my clients facing foreclosure did not keep their original documents, which may be used as a defense that could possibly win your case and, in some cases, wipe out the mortgage itself due to errors or non-compliance of certain laws and regulations, DAnnucci says.

The lesson here?

Keep everything, DAnnucci says. You never know what challenges you may face in the future that your carefully preserved paperwork can help resolve.

How To Track Down Your Mortgage Transfer Records

When your mortgage broker sells your loan to another lender, there might not be specific mortgage transfer records for your loan.

Q: Four years ago my husband and I refinanced our home with a mortgage broker, who immediately sold it to a big box lender, to whom we have been paying our mortgage payment for years. I happened to look at the records for our County Recorder of Deeds, but I donât see any evidence of the transfer to the big box lender.

Shouldnât I expect to see a recording of transfer from the mortgage broker to the big box lender and a recording of a satisfaction of the mortgage to the mortgage broker?

A: Weâll start with the easy part of your question. When a lender sells your loan or transfers the servicing of your loan, the loan or the lien that secures your loan is not âsatisfied.â So youâd never expect to see a release of your mortgage due solely to your lender selling off or transferring servicing rights to a different lender. As you have not repaid your loan, there is no release to be seen. Youâll see a release of the mortgage at the time the loan is paid off in full.

With that in mind, lenders will use MERS but when they need to file suit against the homeowner for a loan default, they will now file the assignment of the mortgage against the property.

Recommended Reading: What’s The Monthly Mortgage Payment

Boat: Required Documents For Obtaining A Lien Release

1. Title or Non-Negotiable Title or Inquiry Report

A copy of the Title or Non-Negotiable Title for the craft that you are requesting to be released. The copy must be legibleand clearly show:

- Owner’s Name

- Year

- Make and Model

If the Title or Non-Negotiable Title has been lost or is unavailable, you will have to request a printout from the State containing the title information, and provide it to us. This printout is sometimes called an Inquiry Report or Title Report. Depending on the State in which you live, you may have to go to the Department of Parks and Wildlife, Department of Motor Vehicles, Department of Public Safety, or the local Tax Office for this printout and there may be a small fee for it.

Please note that a registration certificate is not the same as a title report and is not acceptable.

If the boat is classified as an “Ocean Vessel” you will have to obtain a title report from the Coast Guard and provide it to us.

2. Proof of Payoff

Proof that the loan was paid in full. Proof of Payoff may include such things as a copy of a “PAID” Note, copies of payment checks, or any other documentation that would indicate payment. This should greatly reduce the amount of research time and expedite our handling of your request.

The FDIC will not accept a copy of the borrowerâs credit report as proof of payoff.

When Will The Check I Deposited Through Mobile Deposit Be Available

Checks deposited using Mobile Deposit are available for withdrawal based upon our typical funds availability policy. If we receive your mobile deposit by our Mobile Deposit cut-off time of 8pm CST, Monday through Friday , we consider that business day to be the day of your deposit. Otherwise, we will consider that the deposit was made on the next business day we are open.

Read Also: How Is A Home Appraised For Mortgage

Car Or Truck: Required Documents For Obtaining A Lien Release

1. Title or Non-Negotiable Title or Vehicle Inquiry Report, Title Report or a TWIX

A copy of the Title or Non-Negotiable Title for the vehicle that you are requesting to be released. The copy must be legible and clearly show:

- Owner’s Name

- Year

- Make and Model

If the Title or Non-Negotiable Title has been lost or is unavailable, you will have to request a printout from the State containing the title information, and provide it to us. This printout is sometimes called a Vehicle Inquiry Report, Title Report or a TWIX . Depending on the State in which you live, you may have to go to the Department of Motor Vehicles, Department of Public Safety, or the local Tax Office for this printout and there may be a small fee for it.

Please note that a registration certificate is not the same as a title report and is not acceptable.

2. Proof of Payoff

Proof that the loan was paid in full. Proof of Payoff may include such things as a copy of a “PAID” Note, copies of payment checks, or any other documentation that would indicate payment. This should greatly reduce the amount of research time and expedite our handling of your request.

The FDIC will not accept a copy of the borrower’s credit report as proof of payoff.

With The Onb Mobile App You Can Do The Following And More:

- Check balances

- You can view, search, save and print eStatements in Digital Banking.

- Under eStatements on the top menu, choose eStatements in the drop down.

- You will land on a page with links to eStatements you have previously viewed and those you haven’t yet viewed .

- Choose eStatements under the appropriate heading.

- This will pull up a copy of the most recent eStatement. On the right side of the screen, you can select any other statements you want to view by date.

- Once you have found and opened the desired eStatement, you can find options for downloading and saving it or printing it on the upper right of the statement.

Note: Another way to search for a specific eStatement is to use the Document Search option at the top of the eStatements page.

Don’t Miss: How Much Do You Owe On Your Mortgage

Home Building Or Land: Required Documents For Obtaining A Lien Release

1. Recorded Mortgage or Deed of Trust

A recorded copy of the Mortgage or Deed of Trust Document for which you are requesting a release. The copy must be legible and clearly show the recording information. This document can be obtained from the Public Records in the County where the property is located or from your title company or title attorney.

2. Recorded Assignments

Recorded copies of any and all assignments that reflect the chain of title leading to the FDIC Receivership.

3. Title Search, Title Commitment, or Attorney’s Title Opinion

A copy of a recent Title Search or Title Commitment or Attorney’s Title Opinion on the property for which you are requesting a release. This is especially helpful in cases where the Mortgage documents are of poor quality or difficult to read. Your Title Company or Title Attorney can usually provide you with this document.

4. Proof of Payment

Proof that the loan was paid in full. Proof of Payoff may include such things as a copy of a “PAID” Note, a Settlement Statement, copies of payment checks, or any other documentation that would indicate payment. This should greatly reduce the amount of research time and expedite our handling of your request.

The FDIC will not accept a copy of the borrowerâs credit report as proof of payoff.

Know Your Rights Under The Law

Under the Real Estate Settlement Procedures Act , your servicer must

- acknowledge your letter in writing within five business days of getting it

- correct your account or determine instead that there is no error generally, within 30 business days

- send you a written notice of the action it took and why, and the name and phone number of someone to contact for more information or help

You have a 60-day grace period after a transfer to a new servicer. That means you cant be charged a late fee if you send your on-time mortgage payment to the old servicer by mistake and your new servicer cant report that payment as late to a credit bureau.

Recommended Reading: What Would The Mortgage Be On A 500 000 House