Key Facts About Mortgage Points

The terms around buying mortgage points can vary significantly from lender to lender so consider the following carefully.

-

The lender and marketplace determine the interest rate reduction you receive for purchasing points so its never fixed.

-

Mortgage points and origination fees are not the same things. Mortgage or discount points are fees paid in addition to origination fees.

-

You can potentially receive a tax benefit from purchasing mortgage points. Make sure to contact a tax professional to learn how buying points could affect your tax situation.

-

Mortgage points for adjustable-rate mortgages usually provide a discount on the loans interest rate only during the initial fixed-rate period. Calculate the break-even point to determine if you can recoup what you paid for in points before the fixed-rate period expires.

-

Crunch the numbers if youre on the fence on whether to put a 20% down payment or buying mortgage points. If you choose to make a lower down payment, you may be required to carry private mortgage insurance so factor this additional cost because it could offset the interest savings earned from purchasing points.

How To Calculate Mortgage Points

Picture this scenario. You take out a 30-year-fixed-rate mortgage for $200,000 with an interest rate at 5.5%. Your monthly payment with no points translates to $1,136.

Then, say you buy two mortgage points for 1% of the loan amount each, or $4,000. As a result, your interest rate dips to 5%. You end up saving $62 a month because your new monthly payment drops to $1,074.

To figure out when youd get that money back and start saving, divide the amount you paid for your points by the amount of monthly savings . The result is 64.5 months. So if you stay in your home longer than this, you end up saving money in the long run.

Keep in mind that our example covers only the principal and interest of your loan. It doesnt account for factors like property taxes or homeowners insurance.

Why Do Points Exist

According to Jon Ingram, senior mortgage advisor for The Yi Team Mortgage in Maryland, points have been around a long, long time.

Thats because they encourage borrowers to keep their loans longer offering a potentially extended period of profits for lenders and investors in the mortgage market.

Points are beneficial from the lenders and investment communitys perspective in that it discourages serial refinancing and prepayments, says Marina Walsh, vice president of industry analysis at the Mortgage Bankers Association. That steadiness is what the investor community is looking for. They know the loan wont prepay, which means theyd lose their investment at that point in time.

Though lenders dont have any outright guarantees a borrower with points will keep their loan longer, theres certainly the extra motivation to do so.

As Walsh puts it, a borrower who pays for points has to think long and hard about refinancing. If they havent recouped the costs of those points yet, they could lose out on money plus owe the additional fees and closing costs for refinancing on top of that.

Its this potential for extended returns that makes investors willing to accept lower interest rates. Keep this in mind if a lender offers you a lower rate, and be extra sure the points work in your favor not just the investors.

Also Check: 10 Year Treasury Yield And Mortgage Rates

When Paying Points Is Worth It

When you buy discount points, you decrease your monthly payment, but you increase the upfront cost of your loan. Due to the difference in monthly payments, it usually takes between five and 10 years to recoup the upfront cost of discount points.

Instead of buying points, many borrowers instead choose to make larger down payments in order to build equity in their homes quicker and pay off their mortgages early, another way to save money on interest payments.

Still, in some cases, buying points may be worthwhile, including when:

- You need to lower your monthly interest cost to make a mortgage more affordable

- Your credit score doesnt qualify you for the lowest rates available

- You have extra money to put down and want the upfront tax deduction

- You plan to keep your home for a long time, so you may recoup the cost

Of course, this really only applies to discount points. Origination points, on the other hand, are closing costs paid to a lender in order to secure a loan. While these fees are sometimes negotiable, borrowers usually have no choice about whether to pay them in order to secure a loan.

How Do Mortgage Points Save You Money

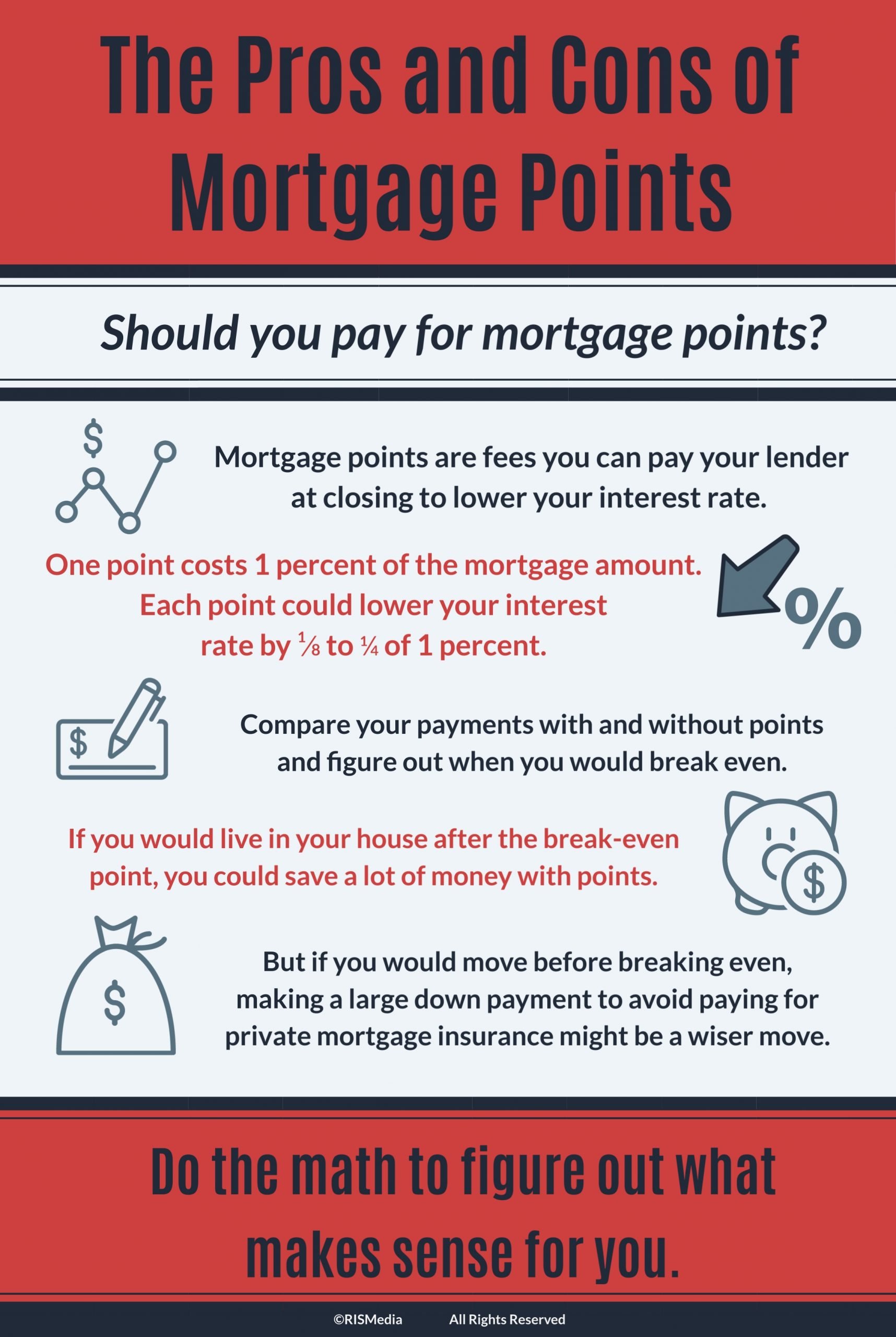

To evaluate if mortgage points are smart for your home purchase, youll need an idea of how long youll stay in the home. In order for points to be worth their price, youll have to reach the breakeven point or the point at which you save more than you spent.

In the previous example, a point would cost about $3,000. At a savings of $33 per month, it would take around 91 months to break even on that $3,000. If you think youll move before that point, then its probably not a smart move to buy the points.

Find Out: How to Buy a House: Step-by-Step Guide

Don’t Miss: Requirements For Mortgage Approval

How Much Can Mortgage Points Save

How much a mortgage point is worth varies by the lender. There isnât a set amount for one point, but usually one mortgage point equals an eighth or a quarter of a percent . For example, if you have a 5% interest rate, buying one point might lower the interest rate to 4.75% or 4.875%, depending on your lenderâs terms. If youâre buying mortgage points, you can buy more than one, or even a fraction of one, if the lender allows it. While the government sets a limit to how much in origination fees a lender can charge, there isnât an overall limit on how much in closing costs a borrower might pay.

If youâre interested in mortgage points and lowering your interest rate, ask your lender for a rate sheet to see the interest rates and corresponding mortgage points. Better yet, you should ask the lender for the specific dollar amount youâd have to pay to lower your mortgage rate by a specific percentage, since points can be confusing.

Tips For Homebuyers Facing Higher Mortgage Rates Home Prices

While its an extremely tough market for homebuyers, housing experts say its important to take your time and not feel rushed into a dealthis could lead to overpaying or giving up contingencies meant to protect you if theres major issues with the house.

There are many local and federal housing nonprofits that help consumers improve their financial profile to obtain better financing, specifically for low-income and first-time homebuyers. There are also housing down-payment assistance programs by state to help relieve some of the initial financial costs to getting a mortgage.

Be patient, stay optimistic. Really put your personal finances under a microscope because there are things you can do to increase your purchasing power, Gonzales says. Look in your community to see if there are down payment resources. Get the free education you can.

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

How To Shop For Loans With Mortgage Points

As of this writing, for instance, one national lender offers a 30year fixed loan at 4.5 percent with no points. You can knock .25 percent off that and get 4.25 percent by paying half a discount point.

But a 4.125 percent rate costs an additional point. Paying more doesnt necessarily get you a better deal.

When shopping for a mortgage with discount points, the easiest way to compare offers is to decide how much you want to spend, then see who offers the lowest rate at that price.

Alternatively, you can decide what rate you want, and see which lender charges the least for it.

When Is It Worth It To Buy Points

Typically, most financial advisors would say that if you cant break even in 36 months or less then it wont make sense.

If you’re planning to move or refinance in a couple of years, paying points is probably not a good move.

Think of it as if youre putting money in a bank to make interest. The longer you have to wait to get the return is also a factor. Waiting longer than 36 months in most cases means that you may have been able to put those same funds in a different investment vehicle and make more money than what the cost wouldve saved you.

Recommended Reading: Mortgage Rates Based On 10 Year Treasury

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

For many borrowers, however, paying for discount points on top of the other costs of buying a home is too big of a financial stretch, and buying points might not always the best strategy for lowering interest costs.

It may make financial sense to apply these funds to a larger down payment, says Boies.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Overall, borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

Can You Negotiate Mortgage Points

Points are definitely open to negotiation. The number of points you buyor whether you buy any at allis up to you. Typically, when lenders are displaying the mortgage options for which you qualify, theyll show you several different rates, including the ones that you can get if you purchase discount points.

Strictly speaking, youre not negotiating the points themselves but a lower interest rate for the life span of the loan. The terms of the pointsthe cost of each point, and how much it lowers the annual percentage rate are pretty much fixed by the financial institution. But they arent set in stone. If youve shopped around and can show them a better deal elsewhere, then they might match itespecially if you have a strong credit history and seem like a responsible, desirable client.

Although both are types of mortgage points, do not confuse discount points with origination points. Origination points are fees that lenders charge for finalizing a mortgagepart of the closing costs on a home purchase. Origination points essentially are a surcharge that doesnt relate to the interest rate and generally arent optional, negotiable, or tax deductible.

Read Also: Does Rocket Mortgage Service Their Own Loans

Disadvantages Of Purchasing Points

While lower monthly payments and potential savings over the life of the loan are clear benefits of buying mortgage points, there are some reasons you may be better off not purchasing points.

First, paying one or more points ties up your cash. If youre making a down payment of less than 20% or have less than 20% in home equity when refinancing, youll probably have to pay for private mortgage insurance if you have a conventional loan.

Have a lender or mortgage broker compare the impact of making a larger down payment to reduce or avoid PMI.

In addition, the sample calculation does not consider that you may have better uses for that money for example, paying off high-interest credit card debt, making investments, or saving for future home improvements.

You may also want to use that money to invest in assets other than real estate for diversification, to boost a college tuition fund, or to pad your retirement account.

The money you pay towards lowering your mortgage interest rate may not bring the same rewards as other investment vehicles, but for homeowners who plan to stay put for the long-term, a lower interest rate could be a smart move.

Should You Buy Mortgage Points

Whether you should buy points depends mostly on how long you plan to stay in the home.

Points can cost thousands of dollars upfront, adding to the cost of getting your mortgage. But because your interest rate is reduced, the money you save on monthly payments can eventually make up for the initial cost. After youve covered the cost of the points you paid at closing, all additional savings from the lower interest rate is extra cash in your pocket.

To figure out if buying points makes sense for you, calculate how long it will take you to cover the upfront cost based on how much you might save.

Say you want to borrow $200,000 for a house, with the upfront cost of a point at $2,000. Divide $2,000 by the amount you save each month thanks to reducing your interest rate to see how many monthly payments it will take for you to break even.

Since the specific amount you save varies based on your lender, youd need to calculate what your rate and monthly payment would be both with points and without. Lets look at an example.

Recommended Reading: Monthly Mortgage On 1 Million

Can You Negotiate Points On A Mortgage

You can decide whether or not to pay points on a mortgage based on whether this strategy makes sense for your specific situation. Once you get a quote from a lender, run the numbers to see if its worth paying points to lower the rate for the length of your loan.

Sometimes, origination points can also be negotiated. Homebuyers who put 20 percent down and have strong credit have the most negotiating power, says Boies.

A terrific credit score and excellent income will put you in the best position, Boies says, noting that lenders can reduce origination points to entice the most qualified borrowers.

Should I Pay For Points On My Mortgage

If you cant afford to make sizable upfront payments at the closing of your mortgage application, you may want to keep the current interest rate and refinance your mortgage at a later date. Refinancing a mortgage is basically taking out a new loan to pay off your first mortgage, but you shop for a better interest rate and terms on the new one. This makes sense if youve made timely payments on your old mortgage, have paid off a decent amount of your principal, and improved your credit score since you first obtained the initial mortgage.

If youve got some money in your reserves and can afford it, buying mortgage points may be a worthwhile investment. In general, buying mortgage points is most beneficial when you both intend to stay in your home for a long period of time and can afford mortgage point payments.

If this is the case for you, it helps to first crunch the numbers to see if mortgage points are truly worth it. A financial advisor can help you through this process if you dont know where to start.

Read Also: What Does Gmfs Mortgage Stand For

A Lower Interest Rate Can Save You Money Over The Long Term

With a fixed-rate mortgage, the amount you’ll pay in total for principal and interest remains the same over the entire mortgage term because the interest rate stays the same. So, buying down the rate can save you money if you plan to stay in the property long-term. A small difference in the interest rate can add up to big savings over the 30 or so years you’ll be paying off your mortgage.

Example. If you took out a 30-year, $300,000, fixed-rate loan at 3%, you’d have monthly payments of about $1,265 and pay a total of $455,332 by the time you’ve paid off the loan. But if your interest rate is 2.75%, your monthly payments would be approximately $1,225, and you’d pay a total of $440,900.

With an adjustable-rate mortgage, though, paying points on a mortgage often reduces the interest rate only until the end of the initial fixed-rate period the reduction probably won’t apply over the life of the loan. Some lenders might also allow you to apply points to reduce the margin . So, you could potentially lower the interest rate for longer than just the introductory period.

How Much Do Mortgage Points Cost

The cost you pay for mortgage points is calculated based on how much youre borrowing. As we mentioned in the earlier section, one discount point costs 1% of the loan amount. So, if you have a $600,000 loan, one point will cost you $6,000.

However, if you have a large down payment, excellent credit score, and low debt-to-income ratio, you may be able to negotiate the amount you pay for each discount point.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

What Are The Pros And Cons Of Mortgage Points

Whether or not mortgage points are a good option for you largely comes down to your financial situation, including the amount of liquid money you have available to put towards paying for points. If you plan to stay in the home youre mortgaging long-term , mortgage points can be a great way to lower your interest rate in the long run. On the opposite side of the coin, if you dont plan to stay in your home until you reach the break-even point, then purchasing them may not be your best play.

Its also vital to consider how much each point is worth. While a 0.25% interest decrease might be worth paying for, if the decrease is on the lower end , then you might opt to keep your money in the bank.

Last but not least, some people argue that investing extra money upfront in your home could decrease the moneys value because you could invest it in the stock market instead . This comes down to your personal investing preference, however, as many homeowners would rather invest in a home that could eventually triple in value than take their chances on the market.

Whether or not investing in mortgage points is right for you will depend on a variety of factors. Some of these include:

- Whether or not theyre an investment you can afford to make

- The amount each point brings down your monthly interest rate

- Whether you plan to stay in the home until at least your break-even point