What Does It Take

If youve seen or heard Bob, you already know income, down payment and credit are the key factors required to obtain a mortgage. But, did you know there are other factors, such as the Stress Test.

Lenders use qualifying rates to ensure borrowers can handle their payments if rates are higher on renewal. This allows a little breathing room so we can continue to enjoy the benefits of home ownership. The current qualifying rate is 4.94%.

Bringing It All Together

As you can see, there are a number of factors that determine how large of a mortgage you can get. If you get access to your FICO score and crunch some numbers, you can get a rough idea of your borrowing capacity. You can also seek assistance from your bank or a mortgage broker.

All of this, however, still leaves one important question.

When Do Consumers Choose An Arm

Adjustable-rate mortgages , on the other hand, have interest rates that change depending on market conditions. ARMs usually start with a low introductory rate or teaser period, after which the rate changes annually for the remaining term.

ARMs come in 30-year terms that can be taken as a straight adjustable-rate mortgage with rates that change annually right after the first year. However, borrowers usually take them as a hybrid ARM, which come in 3/1, 5/1, 7/1, and 10/1 terms. For example, if you get a 5/1 ARM, your rate remains fixed for the first 5 years of the loan. After the 5-year introductory period, your rate adjusts every year for the rest of the payment term.

When does taking an ARM make sense? ARMs are usually chosen by consumers who plan to sell their house in a few years or refinance their loan. If you need to move every couple of years because of your career, this type of loan might work for you. ARMs usually have a low introductory rate which allows you to make affordable monthly payments, at least during the teaser period. Before this period ends, you can sell your home, allowing you to avoid higher monthly payments once market rates start to increase.

You May Like: Does Fha Require Mortgage Insurance

Ready To Start Your Home Buying Journey

Whether you’re just thinking about buying or you’re ready to buy, you can get started online!

The Mortgage Affordability Calculator estimates a range of home prices you may be able to afford based on the accuracy and completeness of the data and information you enter. The results are intended for illustrative and general purposes only, and do not constitute, nor should they be relied upon as financial or other advice. To discuss your full range of home-buying options, please contact your branch or call

The results are calculated and generated based on the accuracy and completeness of the data and information you have entered and provide an estimate only. The results are intended for illustrative and general information purposes only, and do not constitute, nor should they be relied upon as, financial or other advice. The interest rate shown is calculated either semi-annually not in advance for fixed interest rate mortgages or monthly not in advance for variable interest rate mortgages. These rates are only available for already built, owner-occupied properties with amortization periods of 25 years or less. Any application is subject to credit approval. For more information, please contact us to discuss your home-financing options.

The Importance Of Credit Scores For Mortgage Applications

To assess your financial records, lenders usually use three major credit reference agencies . These are Experian, Equifax, and TransUnion. While there are other CRAs, these are most preferred by lenders across the UK. Out of the three, Equifax is the largest credit reference agency used by most lending institutions.

UK Experian credit scores range between 0 to 999, with good credit ratings from 881 to 960. If youre aiming for an excellent rating, your credit score must fall between 961 to 999. As for Equifax, the scoring system starts from 0 to 700, with a good credit rating from 420 to 465. To get an excellent Equifax rating, your credit score should be between 466 to 700. Meanwhile, credit scores for TransUnion range from 0 to 710, with a good credit rating from 604 to 627. If you want an excellent TransUnion rating, your credit score must fall between 628 to 710.

To distinguish different CRA ratings between major credit agencies, refer to the chart below:

| Borrowers likely declined by lenders, usually gets mortgages with high rates. |

Here are several steps to improve and maintain your credit score:

Recommended Reading: How Much Average Mortgage Payment

Tips For Buying An Affordable Home

Suppose you qualify for a large home loan. While your lender is willing to loan you a substantial amount of money, that doesnt mean you have to borrow the entire amount if it would put you under significant financial strain.

Assessing how much you should spend on a house requires a bit of a look into your current and predicted future financial situation. Before you take on the maximum loan you can get and start looking at more expensive houses, consider these tips.

How Piti Affects Your Mortgage Qualification

When lenders assess whether or not you can afford a mortgage loan, theyll compare your estimated PITI with your gross monthly income .

Your PITI, combined with any existing monthly debts, should not exceed 43% of your monthly gross income this is called your debt-to-income ratio .

Your DTI is a primary factor in whether or not youll qualify for a mortgage.

Read Also: Who Owns Prosperity Home Mortgage

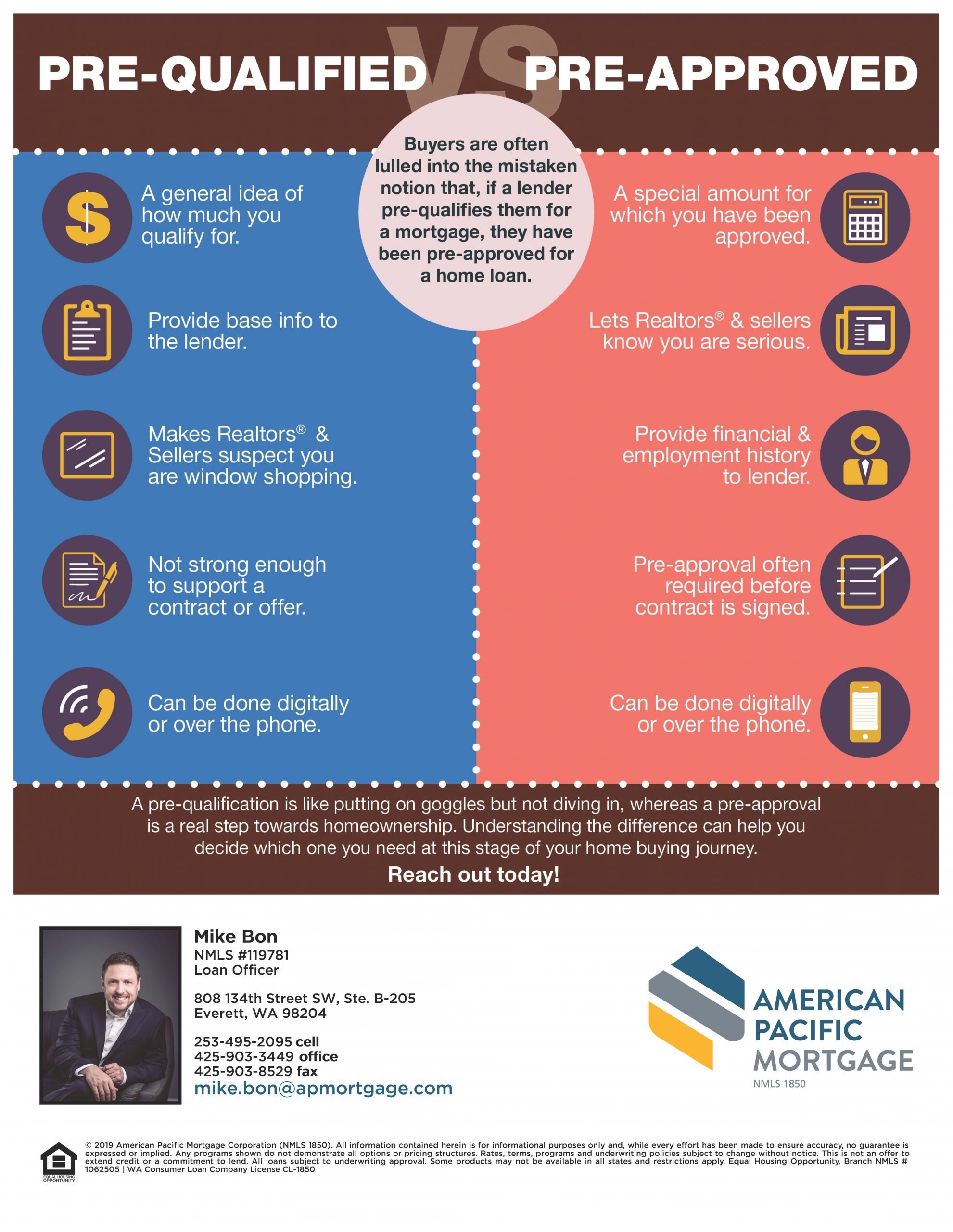

Whats The Difference Between Pre

Unlike pre-qualification, preapproval requires proof of your debt, income, assets, and credit score and history.

To get preapproved, youll supply documentation such as pay stubs, tax records and proof of assets. Once the lender verifies your financial information, which may take a few days, it should supply a preapproval letter you can show a real estate agent or seller to prove youre ready and able to purchase a home.

Keep in mind, pre-qualification doesnt guarantee preapproval. You can still be turned down if your financial documents dont support the numbers you reported.

» MORE: Learn more about the difference between pre-qualification and preapproval

Who Is The Mortgage Qualifying Calculator For

This calculator is most useful if you:

- Are a potential homeowner needing to know your budget constraints

- Have decided on a new home but want to ensure you can afford it

- Are looking to plan and budget for the future

If you’re ready to connect with a trusted lender and receive exact figures, fill out this short form here and request personalized rate quotes tailored to you. This will give you a better idea of what interest rate to expect and help gauge your ability to qualify for a mortgage.

Also Check: What Mortgage Rate With 650 Credit Score

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

The Mortgage Qualifying Calculator Says I Cant Afford My Dream Home What Can I Do

It can be disappointing to learn that the home you have set your heart on is out of financial reach, but donât give up hope! It may be that you can reach your goal by adjusting some of your other constraints. Perhaps you can save for a little longer in order to amass a larger down payment, or wait until your credit card and loans are paid off.

These small but significant changes could make all the difference and enable you to get the mortgage you require. If the down payment is causing you an issue, you might consider an FHA loan, which offers competitive rates while requiring only 3.5 percent down, even for borrowers with imperfect credit.

You May Like: What Are The Requirements To Get A Reverse Mortgage

Types Of Mortgage For First

Youre considered a first-time homebuyer if you have never owned residential property in the UK or abroad. It also applies if youve only owned a commercial property with no attached living space, such as a pub with a small upstairs flat. If you fit this profile, you qualify as a first-time homebuyer.

On the other hand, you are not considered a first-time homebuyer if:

- Youve inherited a home, even if youve never lived in the property since its sold

- Youre buying a house with someone who owns or has previously owned a home.

- Youre having property purchased for you by someone who already owns a house, such as a parent or guardian.

There are a variety of mortgage products which are suitable for first-time buyers. Before finalizing a mortgage deal, look into the following types of mortgages:

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

Also Check: What Do Points On Mortgage Mean

How Much Down Payment Should You Save

Before buying a house, be sure to give yourself enough time to save for a down payment. While the amount depends on your budget, the homes price, and the type of loan you have, most financial advisers recommend saving for a 20% down payment. This is a sizeable amount, which is more expensive if your homes value is higher.

In September 2020, the median sales price for new homes sold was $326,800 based on data from the U.S. Census Bureau. If this is the value of your home, you must save a down payment worth $65,360. Paying 20% down lowers risk for lenders. Its a sign that you can consistently save funds and reliably pay back your debts.

Down Payments Vary

Down payment requirements are different per type of loan. However, many conventional mortgage lenders require at least 5% down. For government-backed loans such as an FHA loan, a borrower with a credit score of 580 can make a down payment as low as 3.5% on their loan. Take note: A smaller down payment subjects you to a higher interest rate.

Nonetheless, its still worth making a larger down payment on your mortgage. Heres why paying 20% down is more beneficial for homebuyers.

Checking Your Credit Report

A potential lender will look at your credit report before approving you for a mortgage. Before you start shopping around for a mortgage, order a copy of your credit report. Make sure it doesnt contain any errors.

If you dont have a good credit score, the mortgage lender may:

- refuse to approve your mortgage

- only consider your application if you have a large down payment

- require that someone co-sign with you on the mortgage

- require that you get mortgage loan insurance even if you have a down payment of 20% or more

Read Also: How Much Is Monthly Payment On 600 000 Mortgage

General Guideline: 3x To 45x Annual Income

Lenders typically like to see borrowers put at least 5% down on their property. When borrowers put down less than 5% they are typically charged a significantly higher interest rate to offset the additional risk the lender is taking.

Borrowers can typically borrow from 3 to 4.5 times their annual income. Lenders may allow borrowers to borrow up to 5 times their annual income, though regulatory restrictions prohibit lenders from having more than 15% of their loans above 4.5 times annual income.

How Much Can I Borrow Detailed Considerations

Lenders presume borrowers spend about 3% to 5% of their outstanding debts on servicing costs. In our above calculation for individuals we subtract £3 for each £1 of debt for individuals and £2.4 for each £1 of debt for couples with multiple income providers.

In addition to your income level, lenders consider recent financial troubles, missed payments, and general living expenses when they determine suitability and lending limits.

Money Advice Service offers an affordability calculator which takes into account your outgoings. In general lenders do not like more than 60% of a person’s income going toward their mortgage and monthly outgoings. Nationwide also offers a similar calcualator, though it has quite a few steps in it and collects some personal data like your birthday.

You May Like: How Much Income To Qualify For 1 Million Mortgage

Have A Question About Our Mortgage Calculators

What is a mortgage calculator?

Its a tool that gives you an estimate of how much you could borrow from us or what your monthly repayments and other costs might be, for a mortgage in the UK.

We have different calculators that can help you in different ways each calculator does something slightly different.

Who is a mortgage calculator for?

Its for you if youre a first time buyer, youre looking to remortgage, move or buy an additional home, or youre a buy-to-let landlord.

What information do I need to use a calculator and how do you decide what I can afford?

When you apply for a mortgage or use our calculator, well ask you for information like

- How many people are applying

- Your income

- How much you regularly spend on things like your credit or store cards, loans, overdrafts, maintenance and pension

- Why youre applying for example, buying your first home, moving home, or buying a second home

We wont ask about groceries, utility bills or travel.

How much can I afford to borrow?

Our calculators give you a idea of what you might be able to borrow from us to buy a home, and what your monthly and total mortgage payments could be, for different types of mortgages.

Which mortgage calculator is right for me?

The most popular place to start is our borrowing calculator or our affordability calculator.

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Recommended Reading: What’s A Good Ltv For Mortgage

How To Lower Your Monthly Payments

If your mortgage calculator results are not yielding the lower monthly payments you hoped for, here are several techniques to try:

- Lower purchase price: The less you borrow, the lower your mortgage payment

- Bigger down payment: Putting more money down means youll borrow less. Also, the best mortgage rates generally go to borrowers with larger down payments, among other qualifying factors

- Avoid private mortgage insurance: When you put at least 20% down on a conventional loan or 20% home equity on a refinance you can avoid paying monthly private mortgage insurance premiums

- Longer loan term: A longer loan term means lower monthly payments. However, you will pay more in total interest over the life of the loan

- Shop for a lower rate: Rate shopping doesnt have to take long, and its well worth the savings. Here are tips to get your best mortgage rate

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

Also Check: How Many Payments Left On Mortgage