How Can I Calculate How Much My Ontario Mortgage Payments Would Be

Our Ontario Mortgage Payment Calculator will help you figure out how much youll pay with any rate you find on the site. It only takes a few minutes to use, so give it a try. You can modify the mortgage amount, mortgage term and type, amortization and payment type to see how your mortgage options and payment amount are impacted.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Factors That Affect Your Mortgage Interest Rate

For the average homebuyer, tracking mortgage rates helps reveal trends. But not every borrower will benefit equally from todays low mortgage rates.

Home loans are personalized to the borrower. Your credit score, down payment, loan type, loan term, and loan amount will affect your mortgage or refinance rate.

Its also possible to negotiate mortgage rates. Discount points can provide a lower interest rate in exchange for paying cash upfront.

Lets look at some of these factors individually:

Also Check: Requirements For Mortgage Approval

Rate Trends: Where Are Mortgage Rates Headed

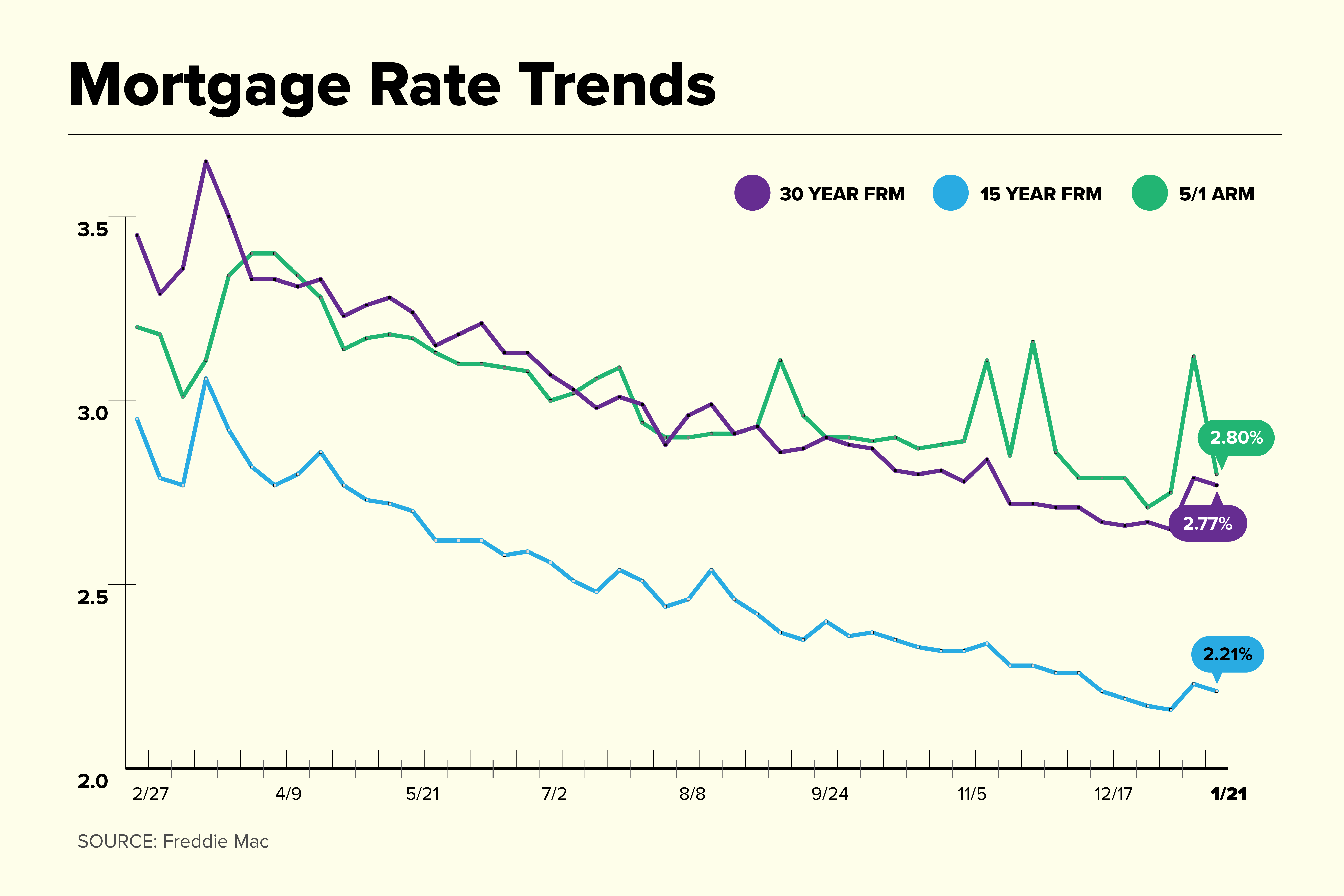

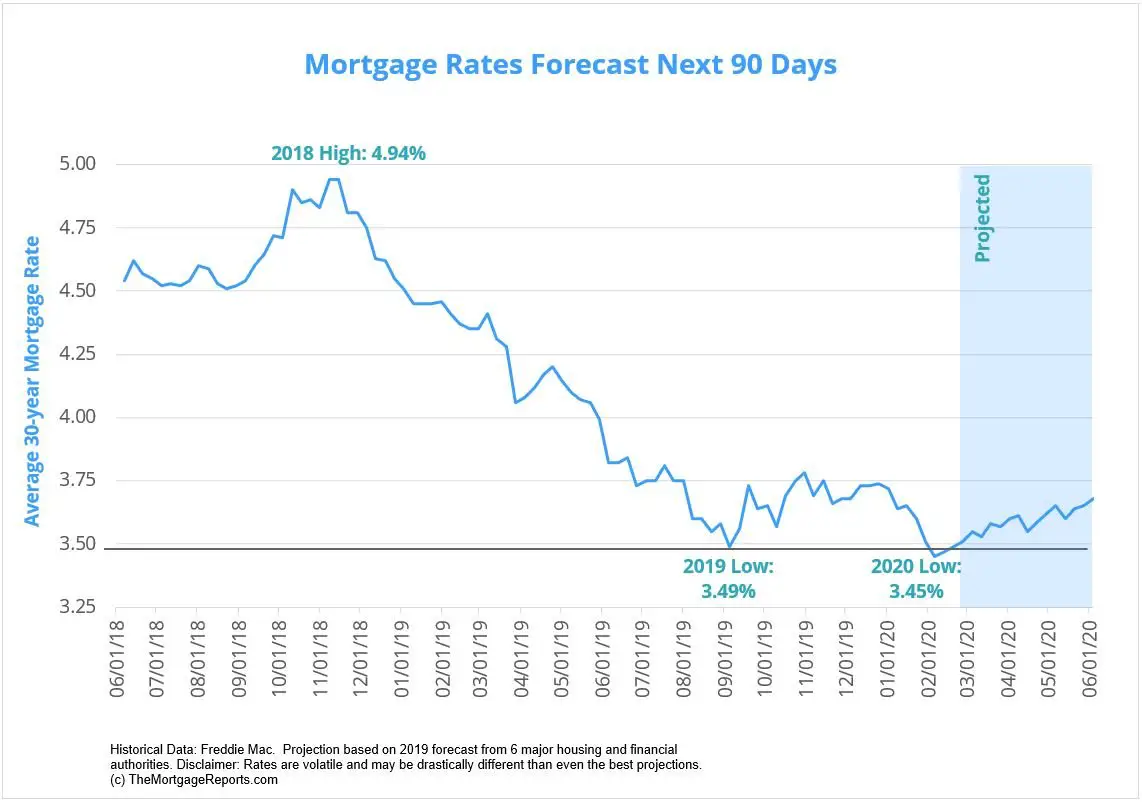

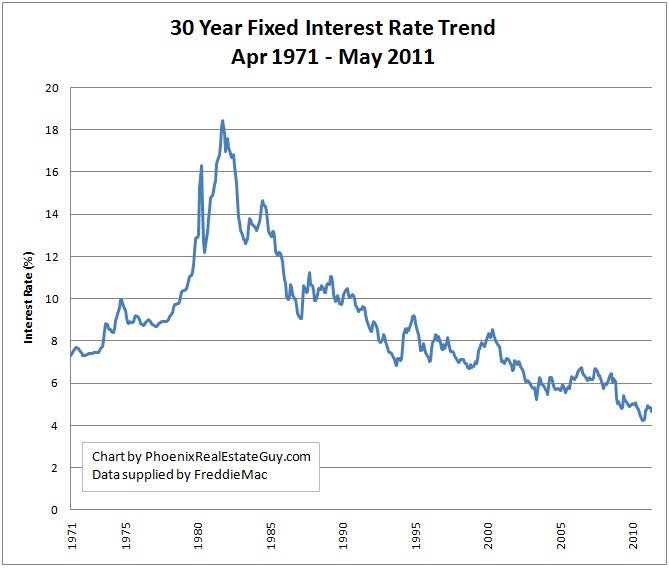

Mortgage rates plunged early in the pandemic and scraped record lows below 3 percent at the start of 2021. The new year, however, has been characterized by rising rates. The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and many experts think the average rate on this loan will be 3.5 to 4 percent by the end of 2022. Thats still great by historical standards though. The ultra-low rates of 2020 and 2021 were an anomaly, but even 4 percent is a deal in the scheme of things.

Mortgage rates continue to surge, as they have since the beginning of the year, as the outlook takes shape for Fed rate hikes that are sooner and faster than previously expected, McBride says. Mortgage rates are still well below 4 percent but in an environment of already sky-high home prices, more would-be homebuyers are priced out with each move higher in mortgage rates.

Is It Important To Compare Mortgage Rates

Comparing mortgage rates is one way to save money on your home loan. If you accept the first offer you see, you may regret it later. With so much competition in the lending industry today, you can usually find a lower rate if you do a little price comparison.

The easiest way to find low rates is to shop around. This is really easy in todays internet-driven world. There are loan calculators, comparison tools, lender portals, and more all designed to help you line up offers to see which is giving you the right deal.

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

Mortgage Rate Forecasting Explained

The constant mortgage rate fluctuations over the last few months may have left even the most informed consumers scratching their heads. They may also have you wondering what exactly goes into predicting future rates.

There are a few key factors that experts use in mortgage rate forecasting:

- Federal Reserve policy: The Fed doesnt directly set interest rates, but it sets short-term rates, which can influence long-term rates.

- Economic growth: As the economy improves, interest rates tend to rise, and vice versa. Indicators of economic growth include employment numbers and gross domestic product .

- Inflation: Inflation refers to the increase in the price of goods and services. As inflation rises, so do interest rates so that lenders can ensure a profit on their loans.

- Bond rates: Mortgage rates and bond rates are interconnected. First, mortgages are repackaged and sold as bonds, and so mortgage rates have to be high enough to make those bonds an attractive investment. Additionally, mortgage lenders often use the 10-year Treasury bond as a benchmark for mortgage rates.

Using the information listed above, historic mortgage rates, and other economic factors, financial experts can make mortgage interest rate forecasts.

Each quarter, Freddie Mac publishes a quarterly report with its mortgage rate predictions. Using the economic outlook at past and current rates, Freddie Macs Economic & Housing Research Group forecasts what we can expect from rates in the coming months.

Mortgage Rates In 2020 And 2021

2020 saw new lows for mortgage rates, with the 30-year fixed rate diving to just under 3 percent, according to Bankrate data, and averaging 3.38 percent for the year. Amid the pandemic, fearful investors were attracted to safer products such as Treasury and mortgage bonds, pushing yields and rates lower, explains McBride.

The onset of the COVID-19 pandemic in 2020 spurred mortgage rates to new record lows, as the economy was faced initially with a rapid contraction that was the worst since the Great Depression and followed up by unprecedented accommodation by the Federal Reserve, McBride says.

While rates ticked up slightly in 2021, that trend has since reversed, and the 30-year fixed rate continues to hover at a low point: 3.2 percent as of early August 2021. You can view current 30-year mortgage rates on Bankrate.

Also Check: Bofa Home Loan Navigator

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How Much Does 1 Point Lower Your Interest Rate

The exact amount that your interest rate is reduced depends on the lender, the type of loan, and the overall mortgage market. Sometimes you may receive a relatively large reduction in your interest rate for each point paid. Other times, the reduction in interest rate for each point paid may be smaller. Each lender has their own pricing structure, and some lenders may be more or less expensive overall than other lenders – regardless of whether you’re paying points or not. When comparing offers from different lenders, ask for the same amount of points or credits from each lender to see the difference in mortgage rates.

Also Check: Can I Get A Reverse Mortgage On A Condo

Mortgage Rate Trends In The 1990s

The 1990s saw a dramatic shift in the 30-year rates movement, as it plunged to an average of 6.91 percent in 1998, according to Bankrate data. This was spurred by the dot-com bubble, an era when investors rushed to buy stocks from technology companies that were overvalued. When these stocks plummeted, investors turned their focus to fixed-income investments, such as bonds. As bond prices rose and yields fell, mortgage rates, which follow the 10-year Treasury yield, also declined.

Consider Different Types Of Home Loans

The 30-year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficialdepending on your situation.For example, if you require a lower interest rate, adjustable-rate mortgages offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time . Given that ARM loans are variable, the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. A 15-year fixed rate mortgage, on the other hand, may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed rate mortgage. Consider all your options and choose the home loan that is most comfortable for you.

Read Also: Rocket Mortgage Launchpad

How To Find The Best Mortgage Rates

When you are ready to apply for a loan, you can reach out to a local mortgage broker or search online. When looking into home mortgage rates, think about your goals and current financial situation. Specific interest rates will vary based on factors including credit score, down payment, debt-to-income ratio and loan-to-value ratio. Generally, you want a higher credit score, a higher down payment, a lower DTI and a lower LTV to get a lower interest rate. The interest rate isn’t the only factor that affects the cost of your home â be sure to also consider other factors such as fees, closing costs, taxes and discount points. You should talk to multiple lenders — like local and national banks, credit unions and online lenders — and comparison shop to find the best mortgage for you.

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

What Are Origination Fees

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan. You can find origination fees on the Loan Estimate.

Are Interest Rates And Apr The Same

Interest rates and APR are not the same. An annual percentage rate reflects additional charges associated with your mortgage, which includes the interest. The interest rate reflects the cost homeowners pay to borrow money. These fees include charges such as origination fees and discount points, which is why the APR is typically higher than the interest rate.

Read Also: How Does The 10 Year Treasury Affect Mortgage Rates

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 3.6% right now.

About Mnd’s Daily Rate Index

Our Rate Index is update each weekday afternoon .

The MND Rate Index is the best way to follow day-to-day movement in mortgage rates.Unlike mortgage rate surveys, our index is driven by real-time changes in actual lender rate sheets. This has two huge advantages.

TimelinessBecause were not waiting for responses to a survey , we can update our index any time rates change.

AccuracyBecause were gathering data from actual lender rate sheets, theres never any doubt that our index is the most accurate representation of the actual rates available in the marketplace. The elements of human error and lender-to-lender inconsistencies are also avoided.

More InfoThe index itself is based on the average lenders rate on a top tier scenario , with little to no discount/origination .

This top tier rate quote can varysometimes substantiallyfrom lender to lender. Rate quotes can also vary massively based on the details of your specific scenario. As such, the best use of any timely, accurate rate index is to observe the day-to-day change.

The index is expressed as an average. Actual rates tend to be offered in 0.125% increments. For instance, if the index is at 4.07, the predominant top tier rates would be 4.00% and 4.125%.

You May Like: Does Rocket Mortgage Service Their Own Loans

Mortgage Interest Rate Trends In Canada

What are todays mortgage interest rate trends? The answer depends in large part on who you talk to and when you talk to them.

When the economy is in recovery mode after a recession and the unemployment rate remains high, economic news varies from month to month. And with current interest rates at historic lows, the question on most peoples minds is: Where are rates headed?

Better Mortgage Company: Best Online Lender

Better.com is an online mortgage lender offering a range of loan products in the majority of states in the U.S, and one of Bankrates best mortgage lenders overall.

Strengths: Better.com can save you time and money with three-minute preapprovals and 21-day closings, on average, and no lender fees. If you get a more competitive mortgage rate from another lender, you can also take advantage of the Better Price Guarantee, in which Better.com either matches that rate or gives you $100. The lender offers seven-days-a-week support by phone, as well, if you need it.

Weaknesses: If youre looking for a VA loan or USDA loan, youll have to search elsewhere Better.com currently doesnt offer these loan types. Although the Better Price Guarantee can help you get a lower rate, its only available if you apply online directly through the lender.

> > Read Bankrate’s full Better Mortgage review

You May Like: Chase Mortgage Recast

Will Mortgage Rates Go Down In December

Mortgage rates keep trending sideways, only making small moves week-to-week driven by the opposing pulls of worsening coronavirus numbers and an improving economy. However, the latest news from the Federal Reserve points to rate hikes on the horizon for 2022.

Mortgage rates inched up as a result of economic improvement and a shift in monetary policy guidance, said Freddie Mac Chief Economist Sam Khater.

We expect rates to continue to increase into 2022 which may leave some potential homebuyers with less room in their budgets on the sideline.

Most housing experts are expecting an overall upward trend through the end of 2021 and into 2022. And thats because the forces pushing mortgage rates higher arent going away:

- Inflation Higher inflation typically leads to higher rates. And the annual U.S. inflation rate was at a 30-year high in October

- Economic recovery Retail sales increased by a wider margin than expected in October. And unemployment claims fell to their lowest level since March 2020. Both are strong indicators of an improving economy, which should lead to increased rates

- Fed policy changes As the Federal Reserve continues to pull back on its Covid-era stimulus, mortgage rates should continue to rise

But there are other forces working to pull rates down, which is why weve seen spikes and drops over the past few weeks.

As has been the case since 2020, Covid trends are one of the biggest indicators for mortgage rates right now.

How Do I Qualify For Better Mortgage Rates

Qualifying for better mortgage rates can help you save tens of thousands of dollars over the lifetime of the loan. Here are a few ways you can ensure you find the most competitive rate possible:

- Raise your credit score: A borrowers credit score is a major factor in determining mortgage rates. The higher the credit score, the more likely a borrower can get a lower rate. Its a good idea to review your credit score to see how you can improve it, whether thats by making on-time payments or disputing errors on your credit report.

- Increase your down payment: Most lenders offer lower mortgage rates for those who make a larger down payment. This will depend on the type of mortgage you apply for, but sometimes, putting down at least 20 percent could get you more attractive rates.

- Lower your debt-to-income ratio: Also called DTI, your debt-to-income ratio looks at the total of your monthly debt obligations and divides it by your gross income. Usually, lenders don’t want a DTI of 43% or higher, as that may indicate that you may have challenges meeting your monthly obligations as a borrower. The lower your DTI, the less risky you will appear to the lender, which will be reflected in a lower interest rate.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home