How Much Of My Mortgage Am I Paying Off Each Month

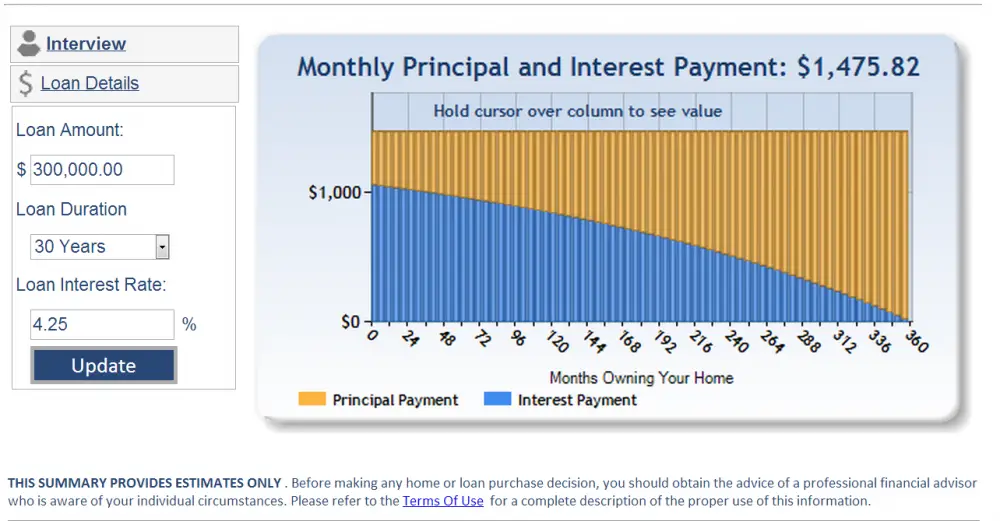

In the early years of your mortgage, a big chunk of your repayments will simply be paying interest on the capital you’ve borrowed, and a smaller part will pay off your capital.

But the more capital you pay off, the lower your interest repayments will be.

Once you get to the end of your mortgage term, the capital you have borrowed will be repaid – the mortgage will be repaid in its entirety. The table below shows how your interest and capital repayments will change over the term of your mortgage.

In this scenario, you have borrowed £200,000 over a 25-year term, at an interest rate of 3%. Your monthly mortgage repayments are £948.

| Year |

| 98% |

Calculate Monthly Interest Amount

Current Annual Mortgage Interest Amount / 12 Months = Monthly Mortgage Interest Amount

This formula calculates the total interest on your mortgage per month.

From the previous example we have an annual interest amount of $6,375.

$6,375 / 12 months = $531.25 per month

Here you would pay $531.25 in interest per month.

What Youll Pay Back

SMI is paid as a loan. Youll need to repay the money you get with interest when you sell or transfer ownership of your home .

The interest added to the loan can go up or down, but the rate will not change more than twice a year. The current rate is 0.8%.

If you want to pay the loan back more quickly, you can also make voluntary repayments. The minimum voluntary repayment is £100 or the outstanding balance if its less than £100.

Also Check: 10 Year Treasury Yield And Mortgage Rates

Should You Pay Off Your Mortgage Early

By Romana King on December 15, 2021

There are some serious advantages to paying off your largest debt early. But to make the best choice, first consider your options.

Lets face it, we all dream of a debt-free life, and paying off your mortgage can be a big part of that. Even if its a distant goal, its fun to imagine the financial freedom that comes with settling one of lifes biggest loansyour mortgage.

Thats just one of the reasons paying off mortgage debt should be on every homeowners priority list. It can also save you tons of money in interest fees. That doesnt mean you dont have other potentially lucrative options, though. To determine if you should prioritize your mortgage debt, youll need to consider both the pros and the cons of paying off your mortgage. Is it better to pay on your mortgage now to save on fees later, or to invest your money instead?

To help, take a read of these scenarios.

Knowing Your Mortgage Interest Rate

Before you even apply for a mortgage, you have to get preapproved. That means going to your bank, telling them you have the intent to buy a home, and submitting some basic information about your credit and finances. Once youâre preapproved, youâll get a loan estimate document, which, in addition to your mortgage amount and any up-front costs, will also list your estimated interest rate.

Get essential money news & money moves with the Easy Money newsletter.

Free in your inbox each Friday.

Sign up now

Preapproval is the first step in the mortgage process. After you lock down a home you like, you need to get approved. Before the mortgage is official, youâll receive a closing disclosure, which lists your actual mortgage amount and interest rate. Once you sign, these become what you have to pay.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

Figuring Out Your Unpaid Principal Loan Balance

If you want to know your unpaid principal loan balance that is remaining after you make your first mortgage payment, you can use our amortization calculator. But if you’d like to understand how to figure it out on your own, read on.

First, take your principal loan balance of $100,000 and multiply it by your 6% annual interest rate. The annual interest amount is $6,000. Divide the annual interest figure by 12 months to arrive at the monthly interest due. That number is $500.

Since your December 1 amortized payment is $599.55, to figure the principal portion of that payment, you would subtract the monthly interest number from the principal and interest payment . The result is $99.55, which is the principal portion of your payment.

Now, subtract the $99.55 principal portion paid from the unpaid principal balance of $100,000. That number is $99,900.45, which is the remaining unpaid principal balance as of December 1. If you are paying off a loan, you must add daily interest to the unpaid balance until the day the lender receives the payoff amount.

You know now that your unpaid principal balance after your December payment will be $99,900.45. To figure your remaining balance after your January 1 payment, you will compute it using the new unpaid balance:

With each consecutive payment, your unpaid principal balance will drop by a slightly higher principal reduction amount over the previous month.

Fixed V Variable Home Loan

A fixed rate loan is a loan that has a fixed interest rate and therefore fixed loan repayments. The time period of these loans can vary, but you can usually lock in your repayments for between 1-5 years. Although the fixed rate period may be 3 years, the loan term may still be 20-30 years.

At the end of the fixed loan period you can decide whether to fix the loan again for a specified time and interest rate, or convert the loan to a variable interest rate for the remainder of the loan term.

The rate charged on a variable loan changes in accordance with a number of factors, primarily, the official cash rate set by the Reserve Bank. Australians have benefited from an extended period of a record low cash rate which has resulted in the lowest interest rates in decades. It is fair to assume that interest rates will not stay low forever and borrowers should prepare for eventual rate rises.

Read Also: Rocket Mortgage Qualifications

Paying Prepaid Interest On A Home Mortgage

Elizabeth Weintraub is a nationally recognized expert in real estate, titles, and escrow. She is a licensed Realtor and broker with more than 40 years of experience in titles and escrow. Her expertise has appeared in the New York Times, Washington Post, CBS Evening News, and HGTV’s House Hunters.

What is prepaid interest? It’s actually pretty self-explanatoryit’s interest paid in advance. You will most often hear this term used in association with a principal and interest payment for a mortgage.

Unlike rent for an apartment, which is paid in advance, mortgage interest is usually paid in arrears. That means it is paid after the amount accrues. A mortgage payment on April 1, for example, pays the interest for March. When interest is paid before it accrues, that payment is an example of prepaid interest.

Can I Reduce My Mortgage Repayments

You may be able to extend your mortgage term in order to lower your monthly mortgage repayments.

For example, if your mortgage is currently on a 25-year term and you move it to a 30-year term, your monthly repayments will fall as you are taking longer in order to clear the capital youve borrowed.

While this will reduce your monthly outgoings, it will increase the overall amount you repay. Because you are taking longer to clear the capital youve borrowed, youll also be charged interest for longer, meaning a larger total repayment.

Let’s look at an example. If you borrowed £200,000 over 25 years at an interest rate of 3%, you’d repay £948 and repay £284,478 in total.

Extending your term to 30 years will reduce your monthly repayments to £843, but you’ll repay 303,495 – an extra £19,000.

You may also be able to switch part or all of your mortgage debt onto an interest-only mortgage. Lenders may offer this as an option if you are experiencing some financial difficulties to help you avoid falling into arrears.

Remember, while this will mean lower monthly payments, you will still need to find a way to repay the capital you borrowed at the end of your mortgage term.

Also Check: Reverse Mortgage Manufactured Home

Typical Costs Included In A Mortgage Payment

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, youll have an additional policy, and if youre in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it’s due.

- Mortgage insurance: If your down payment is less than 20 percent of the homes purchase price, youll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

Interest Rate And The Apr

Whenever you see a mortgage interest rate, you are likely also to see an APR, which is almost always a little higher than the rate. The APR is the mortgage interest rate adjusted to include all the other loan charges cited in the paragraph above. The calculation assumes that the other charges are spread evenly over the life of the mortgage, which imparts a downward bias to the APR on any loan that will be fully repaid before term which is most of them.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

What You Can Do To Protect Yourself If Interest Rates Rise

If the interest rate rises, your payments increase. Make sure that you can adjust your budget in case your payments increase.

Ask your lender if they offer:

- an interest rate cap: a maximum interest rate your lender can charge on a mortgage. You never have to pay more in interest than the maximum cap, even if the interest rates rise

- a convertibility feature: where, at any time during your term, you can convert or change your mortgage to a fixed interest rate

Note that if you choose a convertibility feature and change your mortgage to a fixed interest rate:

- you usually have to pay a fee

- certain conditions may apply

Can You Roll The Leftover Amount Of A Mortgage Into A New Mortgage

Unlike most loans, mortgage principal and interest are paid in arrears. This means that when you make your payment on the first of a month all contemporary mortgage loans are written as of the first of the month you are paying the previous month’s interest. Over the long-term, this difference means little. However, at the beginning or the end of the mortgage, it may be significant.

TL DR

The mortgage payment you make each month normally includes the interest for the previous month.

Recommended Reading: Can You Get A Reverse Mortgage On A Condo

How Your Mortgage Payments Are Calculated

Mortgage lenders use factors to determine your regular payment amount. When you make a mortgage payment, your money goes toward the interest and principal. The principal is the amount you borrowed from the lender to cover the cost of your home purchase. The interest is the fee you pay the lender for the loan. If you agree to optional mortgage insurance, the lender adds the insurance charges to your mortgage payment.

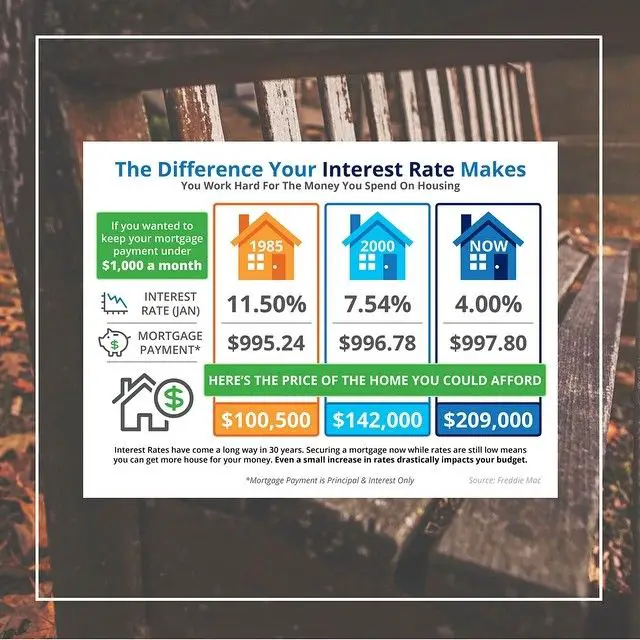

How Much Do You Pay With Different Interest Rates

The lowest interest rate is always the best. But how much of a difference does it make?

The median listing pricefor homes in Minneapolis and St. Paul was $345,000 in September 2021. That means half of the homes for sale were more expensive and half were less expensive.

Lets look at a loan for $345,000. It has a fixed interest rate and will last for 30 years. This is the most common kind of mortgage loan. Some mortgages last for 20 years, but it is unusual.

- With a 2% interest rate, you will pay about $114,067 in interest over 30 years $459,067 total, including principal and interest.

- With a 3% interest rate, you will pay about $178,632 in interest over 30 years $523,632 total, including principal and interest.

- With a 4% interest rate, you will pay about $247,949 in interest over 30 years $592,949 total, including principal and interest.

Thats a big difference: Nearly $134,000 more between the 2% rate and the 4% rate. If youre not careful, youll end up paying for your new home twice over!

Naturally, this changes your monthly payments as well.

- With a 2% interest rate, you will pay about $1,275 per month

- With a 3% interest rate, you will pay about $1,454 per month

- With a 4% interest rate, you will pay about $1,647 per month

Don’t Miss: Chase Mortgage Recast Fee

Principal And Interest: Paying Off Your Home Loan

There’s more than one way to pay back your home loan. We outline your options.

The two biggest components of your home loan repayments are typically the principal component and the interest component. You may be able to take out a home loan with both principal and interest repayments, or interest-only home loans that include a period where you only pay the interest.

Depending on your situation, one of these types of loans may be more suitable than the other.

Pay Attention To When Youre Charged Interest

Most standard mortgages in Canada charge interest semi-annually. That means twice a year the lender calculates the interest you owe, based on the outstanding principal debt and the accumulated interest on outstanding debt. This is known as semi-annual compounding interest . The rate at which compound interest grows depends on the frequency of compounding. The higher the frequency , then the greater the compound interest. For that reason, a loan with an interest rate of 10% compounded annually will actually accrue less interest than a loan with 5% interest that is compounded semi-annually, over the same time period.

Don’t Miss: Reverse Mortgage For Mobile Homes

If Youre Having Problems With Other Debts

You might not get an SMI loan if you think you could either:

- go bankrupt

- make another agreement to help pay your debts, like an individual voluntary arrangement

Check if you can get SMI by calling the office you usually talk to about your benefits. You can find the contact details for your benefit on GOV.UK.

If youll struggle to pay your mortgage until your SMI payments start, check what help you can get with your other living costs.

Paying Ahead On Your Loan

Your monthly mortgage payment can change if you make an additional payment on your loan. This is because you only need to pay interest on the amount of money you owe. Most of your monthly payment goes toward interest at the beginning of your loan.

Over time the amount you pay each month chips away at your principal and the amount of interest you owe. This process, called mortgage amortization, gradually reduces your principal and what you owe in interest.

Paying just a little extra money each month on your principal can save you a lot of money over your loan term, or the number of years until you have to pay it off. For example, lets say you have a $150,000 loan with a 4% interest rate and a 30-year term. Your monthly mortgage payment would be $716.12. Paying an extra $100 a month would reduce the amount of interest you pay over the course of your loan by $25,205.78. You would also pay off your loan 6 years earlier than you would if you made no extra payments.

You might consider budgeting some extra money each month to make an additional principal payment toward your principal balance. Be sure to tell your lender that you want the extra payment to go toward the principal only.

Also Check: Requirements For Mortgage Approval

Open And Closed Mortgages

There are a few differences between open and closed mortgages. The main difference is the flexibility you have in making extra payments or paying off your mortgage completely.

Open mortgages

The interest rate is usually higher than on a closed mortgage with a comparable term length. It allows more flexibility if you plan on putting extra money toward your mortgage.

An open mortgage may be a good choice for you if you:

- plan to pay off your mortgage soon

- plan to sell your home in the near future

- think you may have extra money to put toward your mortgage from time to time

Closed mortgages

The interest rate is usually lower than on an open mortgage with a comparable term length.

Closed term mortgages usually limit the amount of extra money you can put toward your mortgage each year. Your lender calls this a prepayment privilege and it is included in your mortgage contract. Not all closed mortgages allow prepayment privileges. They vary from lender to lender.

A closed mortgage may be a good choice for you if:

- you plan to keep your home for the rest of your loans term

- the prepayment privileges provide enough flexibility for the prepayments you expect to make

The Structure Of Mortgage Interest Rates

On any given day, Jones may pay a higher mortgage interest rate than Smith for any of the following reasons:

- Jones paid a smaller origination fee, perhaps receiving a negative fee or rebate.

- Jones had a significantly lower credit score.

- Jones is borrowing on an investment property, Smith on a primary residence.

- Jones property has 4 dwelling units whereas Smiths is single family.

- Jones is taking cash-out of a refinance, whereas Smith isnt.

- Jones needs a 60-day rate lock whereas Smith needs only 30 days.

- Jones waives the obligation to maintain an escrow account, Smith doesnt.

- Jones allows the loan officer to talk him into a higher rate, while Smith doesnt.

All but the last item are legitimate in the sense that if you shop on-line at a competitive multi-lender site, such as mine, the prices will vary in the way indicated. The last item is needed to complete the list because many borrowers place themselves at the mercy of a single loan officer.

Also Check: Rocket Mortgage Conventional Loan