Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loans amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

What Is Cmhc Insurance

CMHC insurance protects lenders from mortgages that default. CMHC insurance is mandatory for all mortgages in Canada with down payments of less than 20% . This is an additional cost to you, and is calculated as a percentage of your total mortgage amount. For more information on mortgage default insurance rates, please read our guide to mortgage default insurance .

Read Also: Rocket Mortgage Requirements

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make. When youre ready to apply, compile necessary documentation like income verification and proof of assets and start shopping for the best rates.

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price, then select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youll need for closing costs. You can also use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up, and show what your outstanding balance will be over time.

If youre buying a new home, its a good idea to use the calculator to determine what you can afford before you start looking at real estate listings. If youre renewing or refinancing and know the total amount of the mortgage, use the Renewal or Refinance tab to estimate mortgage payments without accounting for a down payment.

You May Like: How Much Is Mortgage On 1 Million

Students Who Viewed This Also Studied

Chapter 13 Test bank – Stat.pdf

University of California, Irvine

Baruch College, CUNY ACCT 4300

Chapter 05 Questions

University of Windsor BUSINESS 0472271

Finance Ch5.pdf

University of California, Riverside BUS 106

Chapter 5 – Test Bank

Wilfrid Laurier University BU 603

5.pdf

University of California, Irvine ECON 134A

Chapter 13 Test bank – Stat.pdf

test_prep

Upload your study docs or become a

Course Hero member to access this document

Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

“In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.” – Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to “help” people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

Read Also: What Does Gmfs Mortgage Stand For

What Does Piti Stand For +

PITI is an acronym used to shorten the following terms:

- Principal the amount you owe your lender, not including interest

- Interest the payment made to your lender for the service of providing the loan

- Property Taxes added fees required by the government

- Home Insurance protection for your property and loan

This PITI calculator is designed to take all of these costs into consideration, giving you an accurate idea of your loans monthly and annual repayments.

Mortgage Calculator With Taxes And Insurance

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Don’t Miss: Reverse Mortgage For Mobile Homes

Loan Deposit And Credit Records

Most borrowers that qualify for financing save substantial funds for deposit. They also have a good credit history showing on-time payments without large outstanding balances. In the fourth quarter of 2020, only 0.37% of mortgages from borrowers with impaired credit history were approved by lenders.

What is Loan-to-value Ratio?

LTV stands for loan-to-value. Its a ratio that compares the size of the loan against the value of the dwelling.

For example, if you saved a £50,000 deposit for a £200,000 home, your loan amount would be £150,000. To calculate the LTV ratio, divide £150,000 by £200,000. In this example, the LTV ratio is 75%.

In the fourth quarter of 2020, a tiny 0.16% of gross advances went to loans with an LTV over 95%. Meanwhile, 1.06% went to loans with an LTV between 90% and 95%. An estimated 38.76% of advances were granted to loans between 75% and 90% LTV, while 60.02% of gross advances went to loans with an LTV below 75%.

Lenders prefer to extend credit to borrowers with relatively low LTV values. If a borrower obtained funding at 100% LTV, any weakness in the local property market could expose the lender to outright potential losses. For this reason, borrowers in the highest LTV quartile may pay 1% APR higher than borrowers in the lower half of the market.

Is Your Mortgage Payment Calculator Free

Yes, our mortgage payment calculator is free. In fact, all of our calculators, articles, and rate comparison tables are free. Ratehub.ca earns revenue through advertising and commission, rather than by charging users. We promote the lowest rates in each province offered by brokers, and allow them to reach customers online.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

How Much Do I Need To Put Down

A down payment of 20% or more will get you the best interest rates and the most loan options. But you dont have to put 20% down to buy a house. There are a variety of low-down-payment options available for home buyers. You may be able to buy a home with as little as 3% down, although there are some loan programs that require no money down.

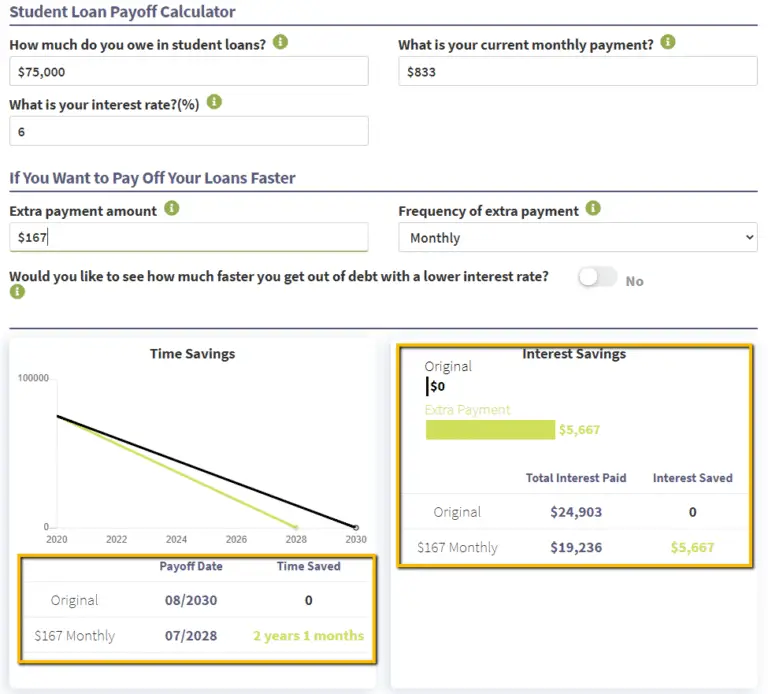

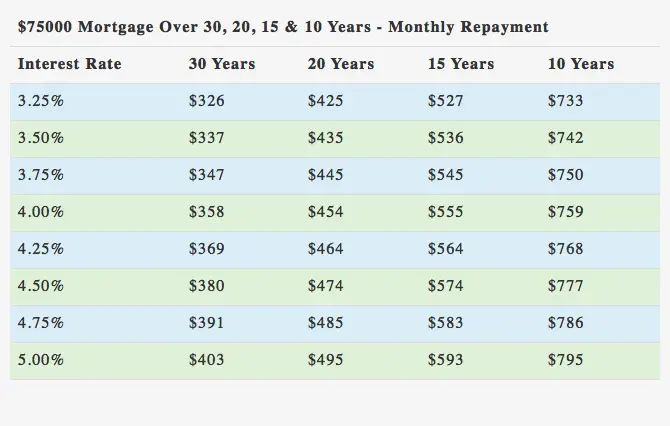

How Much Is The Monthly Payment For A $75000 Mortgage

The monthly payment is $402.62 for a $75,000 mortgage. Above is the repayments on a $75K mortgage with an amortization schedule that shows how much you have to pay each month, and how much interest and principal you are paying.

With the amortization schedule for a $75,000 mortgage, borrowers can easily see that at the beginning of the mortgage loan, the majority of the $402.62 monthly payments are for interest payment and little towards paying down the principal.As times go by, the principal and interest payments will get closer for each payment. Eventually, borrowers will be paying more in principal than interest and that’s when they can build equity in their house much quicker.There are other costs in addition to the monthly mortgage payments for your $75K mortgage, such as property tax, home insurance, HOA fees, PMI, utility bills, and home maintenance. First-time home buyers should keep track of these costs as they add up quickly.

Recommended Reading: Chase Mortgage Recast

How To Use The Mortgage Loan Calculator

We have done our best to make this calculator as simple and user-friendly as possible, but if you arent sure where to start, try following these steps:

How Do I Use The Mortgage Calculator

Start by providing the home price, down payment amount, loan term, interest rate and location. If you want the payment estimate to include taxes and insurance, you can input that information yourself or well estimate the costs based on the state the home is located in. Then, click Calculate to see what your monthly payment will look like based on the numbers you provided.

Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options.

Recommended Reading: Rocket Mortgage Payment Options

Who Is This Calculator For +

This calculator is most useful if you:

- Calculate mortgage rates you are considering

- Compare differences of various home loan term programs

- Haven’t decided on what type of loan you want yet

- Want to get an idea of monthly or annual cost of buying a property

- Are looking to assess the long term benefit of making prepayments in addition to regular loan repayments

Why Does Your Monthly Calculator Have Four Columns

We think it’s important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary amortization period as well as interest rates, so you’ll know how a variable vs. fixed mortgage rate changes your payment.

Read Also: 10 Year Treasury Yield Mortgage Rates

What To Consider When Comparing $75000 Loans

To qualify for a $75,000 personal loan, youll likely need good to excellent credit, steady income, and a relatively low debt-to-income ratio so the lender knows you can comfortably afford the payments.

If you dont meet these requirements, you might need to settle for a smaller loan amount or work on building your credit first.

Tip:

Even if you dont need a cosigner to qualify, having one could get you a lower interest rate than youd get on your own.

If youre ready to get a personal loan for $75,000, here are a few points to consider:

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

You May Like: Recast Mortgage Chase

Start With The Interest Rate

The higher your credit score, the lower the interest rate you will likely qualify for on a personal loan. If you think you might be in the market for a personal loan in the future, its a good idea to get to work building up your credit score. Contest any errors in your credit report, pay your bills on time and keep your credit utilization ratio below 30%.

Once you’re ready to shop for a personal loan, don’t just look at one source. Compare the rates you can get from credit unions, traditional banks, online-only lenders and peer-to-peer lending sites.

When you’ve found the best interest rates, take a look at the other terms of the loans on offer. For example, its generally a good idea to steer clear of installment loans that come with pricey credit life and credit disability insurance policies. These policies should be voluntary but employees of lending companies often pitch them as mandatory for anyone who wants a loan. Some applicants will be told they can simply roll the cost of the insurance policies into their personal loan, financing the add-ons with borrowed money.

This makes these already high-interest loans even more expensive because it raises the effective interest rate of the loan. A small short-term loan is not worth getting into long-term debt that you can’t pay off.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Read Also: Reverse Mortgage On Condo

Mortgage Loan Calculator For Refinancing Or Home Purchase Payments

Get estimates for home loan payments to help you decide what you can afford.

This simple Mortgage Loan Calculator enables you to calculate what your monthly mortgage payments will be – including the principal, interest, property taxes and home insurance . The result you get will be relevant for a wide variety of different mortgage types. It will also display your projected repayment schedule, taking into account your principal loan amount, interest rate, and any additional prepayments you intend to make

Mortgage Calculations And Mortgage Considerations

Use the free online Mortgage calculator to calculate your monthly repayments, compare Mortgage repayments over different periods and define what is the most affordable option for your financial situation. The Mortgage calculator will provide you a monthly interest repayment over 1 year,2 years,3 years,4 years,5 years, 10 years and compare them to a monthly repayment period of your choosing .

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates