What Is Your Personal Situation

Your marital status will affect your eligibility for a £400,000 home loan.

If youre married, you can use both of your incomes to determine the amount you can borrow . However, bear in mind that if your partner has a low credit score, or is in a significant amount of debt, this could affect your chances of not only getting a mortgage in the first place, but enjoying competitive interest rates on your loan amount.

If youre single, youre no less likely to be accepted for a £400,000 mortgage. The lender will just need to make sure that you are generating enough income to qualify for a loan.

Self-employed mortgage applicants will usually need to provide proof of earnings from the last two years in order to be considered for a £400,000 house mortgage. Those with more complex income structures may be subjected to further investigations during the application process, so if you rely on bonuses, dividends or inconsistent wages, be prepared to answer more questions.

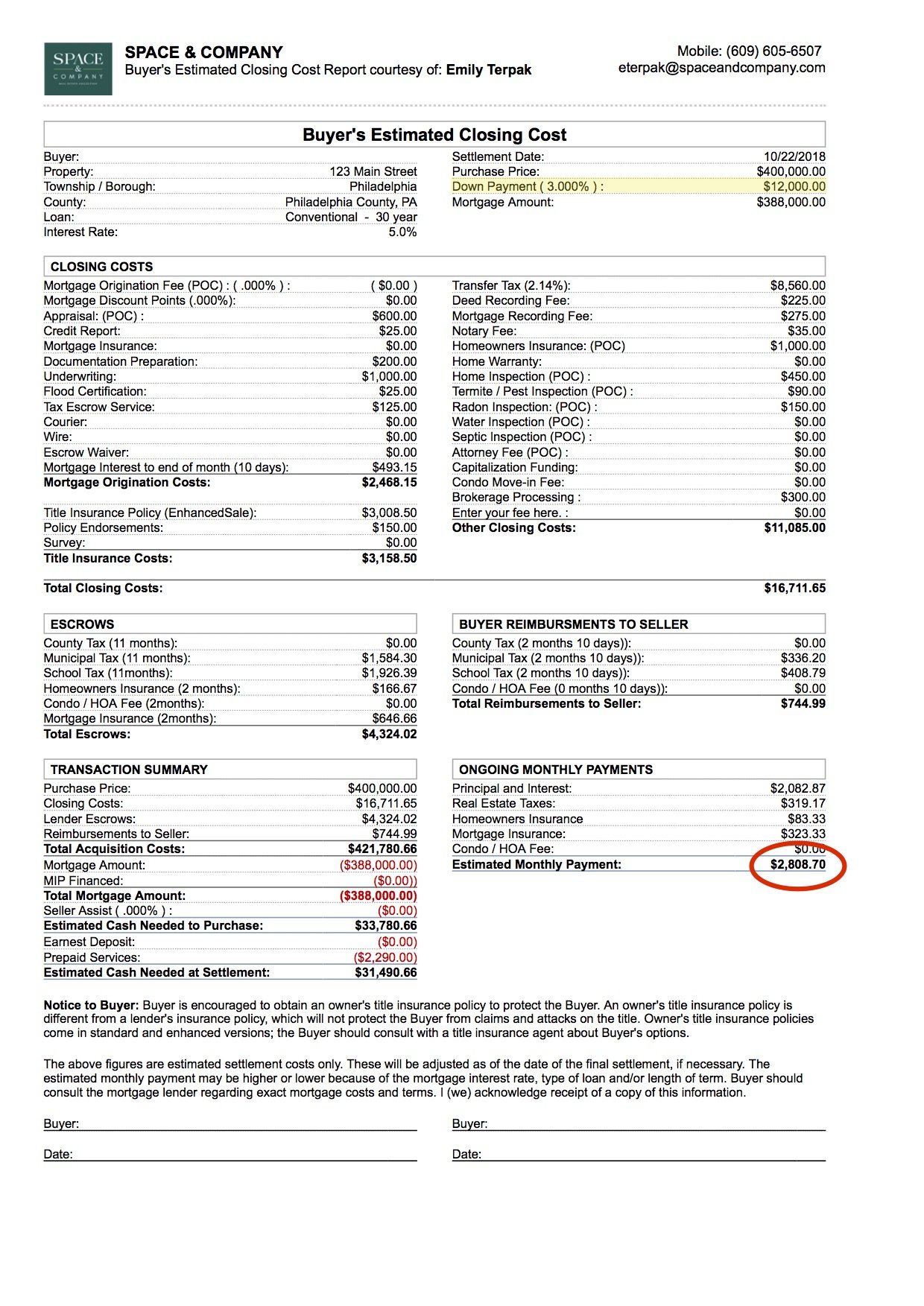

Monthly Payment: Whats Behind The Numbers Used In Our Mortgage Payment Calculator

The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance. Youll just need to plug in the numbers. The more info youre able to provide, the more accurate your total monthly payment estimate will be.

For example, you may have homeowners association dues built into your monthly payment. Or mortgage insurance, if you put down less than 20%. And then theres property taxes and homeowners insurance. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up. If you dont consider them all, you may budget for one payment, only to find out that its much larger than you expected.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

-

M = monthly mortgage payment

-

P = the principal, or the initial amount you borrowed.

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

How Do I Use The Mortgage Calculator

Start by providing the home price, down payment amount, loan term, interest rate and location. If you want the payment estimate to include taxes and insurance, you can input that information yourself or well estimate the costs based on the state the home is located in. Then, click Calculate to see what your monthly payment will look like based on the numbers you provided.

Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options.

Recommended Reading: What Are Basis Points In Mortgage

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Details Of Arizona Housing Market

Despite being the last state in the contiguous U.S. to join the Union, Arizona has 7.408 million residents. The largest cities in Arizona include Phoenix, Tucson, Mesa, Glendale and Scottsdale. All but Tucson are in Maricopa County in the south-central region of the state. Tucson is about 115 miles southeast of Phoenix. In the northeast corner of the state, Arizona is home to the largest Native American Reservation in the U.S. The Navajo Nation Reservation crosses into New Mexico, Utah and Colorado. Its not the only reservation, either. Arizona is home to the third-largest Native American population in the U.S. and has multiple reservations across the state.

Turning to Arizonas housing market, youll notice some issues, mainly with foreclosures during the recession. But overall, the state has made headway in recovery. In SmartAssets Healthiest Housing Markets study, the state ranked 26th in the U.S. We looked at stability, affordability, risk and ease-of-sale factors to determine the rankings.

The good news is Arizona is considered one of the more affordable states to own property. Arizonas median home value is $255,900, according to U.S. Census Bureau. Maricopa County is pretty close to the state average with a median home value of $242,700.

Also Check: How Do I Find Out Who Owns My Mortgage Loan

How Do You Find Initial Velocity With Only Time

Additionally Can I afford a 300k house on a 60k salary? The usual rule of thumb is that you can afford a mortgage two to 2.5 times your annual income. Thats a $120,000 to $150,000 mortgage at $60,000. Lenders want your principal, interest, taxes and insurance referred to as PITI to be 28 percent or less of your gross monthly income.

How much do I need to earn for a 750000 mortgage? If you or your household make between $250,000-$300,000, you are in the sweet spot to take on a $750,000 dollar mortgage. This is because you shouldnt spend much more than 3X your annual income on a home after putting 20% down. This is my 30/30/3 rule for home-buying.

Have A Question About Our Mortgage Calculators

What is a mortgage calculator?

Its a tool that gives you an estimate of how much you could borrow from us or what your monthly repayments and other costs might be, for a mortgage in the UK.

We have different calculators that can help you in different ways each calculator does something slightly different.

Who is a mortgage calculator for?

Its for you if youre a first time buyer, youre looking to remortgage, move or buy an additional home, or youre a buy-to-let landlord.

What information do I need to use a calculator and how do you decide what I can afford?

When you apply for a mortgage or use our calculator, well ask you for information like

- How many people are applying

- Your income

- How much you regularly spend on things like your credit or store cards, loans, overdrafts, maintenance and pension

- Why youre applying for example, buying your first home, moving home, or buying a second home

We wont ask about groceries, utility bills or travel.

How much can I afford to borrow?

Our calculators give you a idea of what you might be able to borrow from us to buy a home, and what your monthly and total mortgage payments could be, for different types of mortgages.

Which mortgage calculator is right for me?

The most popular place to start is our borrowing calculator or our affordability calculator.

Read Also: How Can Self Employed Refinance Mortgage

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Today’s Mortgage Rates In Arizona

| Product |

|---|

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Total Monthly Payment

Based on a $350,000 mortgage

Based on a $350,000 mortgage

| Remaining Mortgage Balance |

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

Not sure how much you can afford? Try our home affordability calculator.

Don’t Miss: Can You Get Preapproved For A Mortgage Through 2 Banks

The Mortgage Qualifying Calculator Says I Cant Afford My Dream Home What Can I Do

It can be disappointing to learn that the home you have set your heart on is out of financial reach, but dont give up hope! It may be that you can reach your goal by adjusting some of your other constraints. Perhaps you can save for a little longer in order to amass a larger down payment, or wait until your credit card and loans are paid off.

These small but significant changes could make all the difference and enable you to get the mortgage you require. If the down payment is causing you an issue, you might consider an FHA loan, which offers competitive rates while requiring only 3.5 percent down, even for borrowers with imperfect credit.

Do Mortgage Calculators Require A Credit Check

No, you wont need to undergo a when using mortgage calculators, as the only information youre inputting is your basic salary no other personal details are required. This means therell be no searches appearing on your credit report and no impact on your score, but if youre concerned that your current score may be holding you back from getting the best deals, nows the time to work on improving it. Find a free credit check service.

Don’t Miss: How To Be A Mortgage Consultant

Can You Get A Mortgage On The Property You Wish To Buy

Many providers wont offer mortgages on certain types of properties. Conversions, thatched properties and Grade 1 listed buildings are notoriously tricky to purchase unless youre a cash buyer homes near floodplains and properties with short leaseholds do not normally appeal to lenders, either.

If you are keen to invest in an unusual property, but youre concerned that you will be turned down by the High Street banks, contact our mortgage brokers. Our team have access to a wider pool of specialist lenders who may be able to offer the right product for your requirements.

Why You Need A Good Credit Score For A Mortgage

In order to qualify for a mortgage, you have to show the lender how your credit score stands. Your credit score is based on how well you handle managing debt and how much of it you have outstanding at any given time. You can request a free credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228.

Its important that these numbers are good in order to get approved for a mortgage so make sure there are no late payments on your credit report and that youre paying off any balances as soon as possible.

Don’t Miss: How To Find Mortgage History On A Property

What Mortgage Can I Afford With My Salary

The general rule is that you can afford a mortgage that is 2x to 2.5x your gross income. Total monthly mortgage payments are typically made up of four components: principal, interest, taxes, and insurance .

Also How much mortgage can I get with a 650 credit score? With a credit score of 650, your mortgage interest rate would be approximately 3.805%, which would cost you about $203,541 in interest on a $300,000, 30-year loan. If you could increase your credit score by even 30 points, you stand to save over $25,000.

How much house can I afford on 120k salary?

If you make $50,000 a year, your total yearly housing costs should ideally be no more than $14,000, or $1,167 a month. If you make $120,000 a year, you can go up to $33,600 a year, or $2,800 a monthas long as your other debts dont push you beyond the 36 percent mark.

How much do you have to make a year to afford a $500000 house? Income needed for a 500k mortgage? + A $500k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $121,582 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator.

How Much Can I Borrow On A Mortgage

Before you start looking for your dream home, you need to know how much you’re able to borrow in order to fund it. Generally, how much you can borrow will depend on four things. The amount you want to borrow in relation to the property’s value , your , your income and your outgoings.

You should be able to comfortably afford the mortgage when you take it out so that unforeseen events don’t put your home in jeopardy later on. Remember, although the lender or mortgage broker is responsible for checking whether you can afford a particular mortgage, making sure you can easily manage the repayments you’re taking on will give you valuable peace of mind before you apply.

Also Check: What Were The Lowest Mortgage Rates Ever

Table Of $400000 Mortgage Monthly Repayments

|

10 Years |

Copyright 2022 Mortgage Choice Pty Limited and Smartline Operations Pty Limited are owned by REA Group Limited. Your broker will advise whether they are a credit representative of Mortgage Choice or Smartline.

Legal disclaimer and information.

*Note: the home loan with the lowest current interest rate is not necessarily the most suitable for your circumstances, you may not qualify for that particular product, and not all products are available in all states and territories.

#The comparison rate provided is based on a loan amount of $150,000 and a term of 25 years. WARNING: This Comparison Rate applies only to the example or examples given. Different amounts and terms will result in different Comparison Rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the Comparison Rate but may influence the cost of the loan.

~Not all brokers or advisers offer the products of all lenders or solution providers.

How Much Interest Will I Pay On A $400000 Mortgage

The mortgage interest you pay depends on the rate your lender charges and the length of the loan. Longer loan terms typically have higher interest rates. And youll usually pay more in interest over the life of a longer-term loan.

You may see the interest rate quoted as APR, which stands for “annual percentage rate.” The APR is a broader measure of the costs of a mortgage, including the interest rate and fees. Interest rates or APRs are dictated by overall market conditions and your credit history. The better your credit score, the lower the interest rate youll be able to get.

Credible makes it easy to compare mortgage rates from various lenders.

Recommended Reading: Are Low Mortgage Rates Good

Short History Lessons Of Mortgages

Before the subprime mortgage crisis of 2008-2009, just about anyone could get a mortgage . Lenders pushed sub-prime loans on people with poor credit knowing they probably could not keep up with the payments and would default on their loans and lose their homes.

The lending habits were not healthy and this led to a sharp increase in those high-risk mortgages ending up in default. This contributed to the most severe recession in decades. Some have blamed lenders for inappropriately approving loans for subprime applicants, despite signs that people with poor scores were at high risk for not repaying the loan. By not considering whether the person could afford the payments if they were to increase in the future, many of these loans may have put the borrowers at risk of default.

I used to work in the Underwriting Department at SunTrust in 2012, and the criteria they used to determine whether to make a loan is more rigorous.

However, that does not mean that millennials would have a tough time getting a mortgage it is just important to do your research first and make sure youre financially prepared to take on a mortgage payment.

In order to get a solid grasp on the terms and processes of buying a home. Take the time to understand the process and requirements of being a first-time home buyer.

1. Do the research

Your credit score and any credit issues in the past few years:

How much cash you can put down:

Shop for loan programs:

2. Prepare the paperwork

3. Find a lender

How Much House Can I Afford With A 100k Salary

Asked by: Elvie Pollich

When attempting to determine how much mortgage you can afford, a general guideline is to multiply your income by at least 2.5 or 3 to get an idea of the maximum housing price you can afford. If you earn approximately $100,000, the maximum price you would be able to afford would be roughly $300,000.

Read Also: How Do You Work Out Monthly Mortgage Payments

Should I Speak To A Mortgage Broker

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that arent available to the public. Mortgage brokers are regulated by the Financial Conduct Authority and are required to pass specific qualifications before they can give you advice.

Call or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for Moneyfacts visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Local Economic Factors In Arizona

The Grand Canyon State isnt just home to spectacular natural beauty and ideal weather, its also known for its growing gross domestic product and growing industries. The Arizona Commerce Authority lists aerospace and defense, tech, renewable energy, bioscience optics and photonics, business services and advanced manufacturing as top industries in the state. Arizonas largest employers, according to AZCentral’s list, include Banner Health, Walmart, Kroger and Wells Fargo & Co.

The states unemployment rate for the last year has hovered above the national average. In December 2021, Arizonas unemployment rate sat at 4.1% compared to the national rate of 3.9%, according to the Bureau of Labor Statistics . In addition, Arizonas per capita personal income was $49,648 in 2020 according to the Bureau of Economic Analysis.

If you work in Arizona, youll pay a state income tax as well as the federal income tax. Arizona levies taxes based on income brackets, with the lowest rate at 2.59% and the highest at 4.50%. Theres also sales tax, which Arizona levies as transaction privilege tax. Its actually on the sellers behalf to pay it, but most vendors pass the charge to customers. The statewide rate is 5.6% and counties can add additional percentages. Cities also have the authority to add an additional rate.

Read Also: What Are Essential For Completing An Initial Mortgage Loan Application