Construction And Land Loans

Along similar lines, you might use a balloon loan for temporary financing while building a home. To encourage you to keep progressing on your project, lenders might use loans that feature a balloon payment in two to five yearsbut the monthly payments are calculated as if you have a 30-year mortgage. That gives you time to buy land, build, and refinance with more traditional permanent financing.

You May Not Qualify For Refinancing

Refinancing your auto loan is sometimes presented as an option if youre unable to make the final balloon payment. But if your credit declines during your balloon loan term, you may find that you no longer qualify to a refinance a loan. If so, your only option may be to sell or return the car to the lender to avoid defaulting on the loan.

Types Of Balloon Mortgages

A balloon mortgage can be structured in several ways:

- Balloon payment In this case, the initial monthly payments might be calculated based on a typical 15-year or 30-year amortization schedule, even though the loan term might only be for five or seven years. When the term ends, youd need to pay the remaining balance in one lump sum. In another version of this type of structure, you make payments on a fixed-rate basis for a period of time, then your rate increases. Lets say you take out a $250,000 balloon mortgage at 3.5 percent, amortized over 30 years and with a loan term of seven years. Using Bankrates balloon mortgage calculator, youd pay roughly $1,123 every month for seven years, after which the remaining $213,734 would come due in one balloon payment.

- Interest-only payments In this scenario, you only pay interest for an initial period. Once that periods over, you owe the remaining balance of the loan.

- No payments For this type, you wont make any monthly payments for a very short term, but youll accrue interest. Once the terms up, both the interest and principal are due in one large payment.

Read Also: Can You Have 3 Mortgages On One Property

Pros And Cons Of Loans With A Balloon Payment

Balloon loans are a complex financial product and should only be used by qualified income-stable borrowers. For example, this type of loan would be a good choice for the investor who wishes to minimize short term loan costs to free up capital. For businesses, balloon loans can be used by companies who have immediate financing needs and predictable future income.

For the average borrower, it’s risky to take out a balloon loan with the assumption that your future income will grow. If you’re looking to purchase a house or a car, a better choice would be to make a monthly budget and take out a loan that you can pay on your current income. Alternatively, you can save for a bigger down payment if you’re not in a rush to make a purchasewhich will let you purchase a more expensive asset with lower monthly payment.

Pros:

- Low or no initial payments

- Enables borrowers to access affordable short-term capital

- Can help cover financing gaps

Cons:

- Costs of loan can be higher in the long term, especially if the loan is interest-only

- Poses more risk than traditional loans due to payment schedule

- There’s no guarantee that you’ll be granted a refinance to switch the debt obligation

Why Would You Get A Balloon Payment Mortgage

Lets start with the obvious reason why you would opt for a balloon mortgage. Perhaps youre in the market for a home but dont intend to stay in the property for 10-plus years. Or maybe you want to spend the next few years saving as much money as possible for your forever home.

So who would most benefit from a balloon mortgage? Well, this type of loan may cross your mind if you see yourself earning significantly more income in the future. Balloon mortgages are also viable options for borrowers expecting to receive a windfall of cash, whether its from the sale of another property or an inheritance.

Read Also: What Is Loan Servicing In Mortgage

Advantages Of A Balloon Mortgage

Balloon mortgages should come with a lower interest rate than either fixed-rate or adjustable-rate mortgages, making them a cheaper loan for the right consumers.

Those consumers who plan to live in a home for only a short period of time, might do well to take out a balloon mortgage. Say they plan to move in three years. They can take out a five-year balloon mortgage at a lower interest rate and then sell their home long before that massive balloon payment becomes due.

This can also be an option for people who gets large bonuses but a more moderate salary. A balloon loan would allow the monthly mortgage payments to fit into their budget, and then they could use the larger yearly lump sums toward the balloon payment.

Options At The End Of A Balloon Loan

When this balloon payment comes due, you may have a few options, depending on the lender. Here are a few.

- Make the balloon payment and keep the car.

- Refinance the loan balance and retain possession of the vehicle.

- Trade in the vehicle for a new one depending on the lender, you may still be responsible for some or all of the balloon payment and additional costs.

- Return the vehicle to the lender to help pay down the remaining balance on the loan and then walk away from the car. But know that if the value of the car doesnt cover the balloon payment though, you may still be on the hook for the remaining balance.

If you choose to trade in or return your car to the lender, you might face some additional fees.

- Disposition fee This fee covers the lenders costs to prepare the vehicle for sale, which may include expenses such as vehicle transportation costs, cleaning and reconditioning, and administrative fees.

- Excess mileage fee Some lenders place a limit on the number of miles youre allowed to drive each year.

- Excess wear-and-tear charge Lenders may charge for damage beyond typical wear and tear, such as broken or missing parts, cracked glass, dents or fabric stains.

Before taking on a balloon loan, be sure you understand all your options at the end of the loan term and any associated fees.

You May Like: What Happens To My Mortgage If I Die

Can You Refinance Your Balloon Payment

Yes, you can. As weve already discussed, this is the ordinary way people go about paying one off. Unless youre in a particularly strong financial position, theres no way most people can afford a balloon payment. After only 5-7 years of repayments, youve mostly been paying interest, and a large portion of the balance will still be outstanding. This is something a large business can absorb if they own many properties. But for ordinary individuals, the only realistic choice is to refinance or sell the home before the balloon payment is due.

That said, refinancing is not a sure thing. As with any mortgage, you still need to get approval. Under most circumstances, this wont be a problem. You already got approved for your original loan, and now that youve been making payments, your new loan will be for less money. That said, you still have to maintain good credit, and a sudden drop in income could affect whether or not you can get approved.

Another potential issue is if your homes value has dropped. If youre underwater on your existing mortgage, it could be impossible to get approved for refinancing. At this point, it helps to have a strong credit history.

If you find yourself in one of these situations, call your lender right away, and see if you can negotiate a new payment plan. Foreclosure is messy for the bank as well as for you, and theyll more than likely be willing to work with you rather than go through that process.

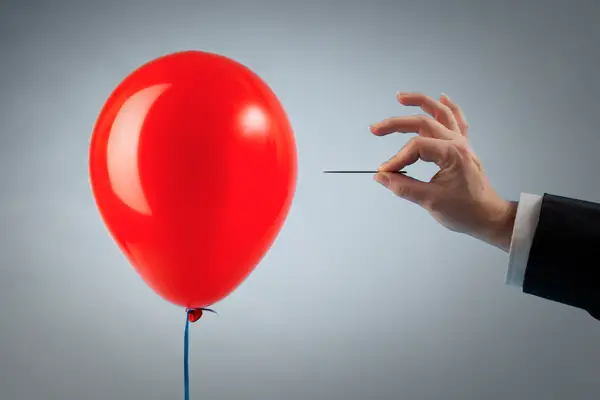

What Makes It A Balloon

Picture a balloon in the process of being inflated. The section connected to the air tank is stretched out long and straight, and rather thin. At the far end, however, its substantially larger big and round and potentially ready to burst at some point. Thats the shape of a balloon loan. Or, if you prefer a more technical description, traditional loans like your 5-year fixed rate truck loan or a 30-year adjustable rate mortgage are fully amortizing. You pay a combination of interest and principal until your balance is zero. A balloon payment mortgage doesnt fully amortize. The balance comes due before your monthly payments naturally reduce it to zero.

Balloon mortgages allow the borrower to make small, sometimes minimal payments for a brief period at the start of the loan . After that initial period, however, the full balance of the loan is due hence the balloon imagery used to describe these sorts of loans. Early payments may be comparable to what theyd be for a twenty- or thirty-year loan, or possibly lower. Other times theyre set up so the borrower only pays towards the interest until the balloon payment comes due. In some circumstances, borrowers pay nothing at all for the first several years.

You May Like: How To Calculate Interest Only Mortgage Payment

How Do I Get A Balloon Mortgage

Since many mortgage lenders dont offer balloon loans due to the amount of risk involved, finding a lender willing to extend you one could take some legwork, and your options might be limited. If you already have a relationship with a bank or lender, you could start by asking if it offers them, or if it can refer you to another reputable source. There are also other types of mortgages that might work for your situation, so be sure to explore all the options.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: How Does Mortgage Appraisal Work

Pay Down The Principal Faster

If youre not interested in selling or refinancing the property but you want to keep it, the only way to get out of your balloon loan will be to pay it off. This might mean paying several thousand dollars a month throughout your loan term far more than the minimum.

Other possibilities include coming up with the lump sum from a savings or brokerage account, a retirement account, or by selling another asset. Consult a financial advisor before choosing one of these options because of their potential long-term consequences.

You Could End Up Taking On More Debt

A balloon loan comes with a big one-time payment at the end of the term. Lenders may present refinancing as an option for paying your one-time balloon payment. Refinancing would mean that rather than making the balloon payment , youd be taking on a new loan and paying interest on that loan over a new loan term.

And if interest rates have gone up or your financial situation has changed since you took out the balloon loan, you could end up paying a higher interest rate on your new loan than you did on the original balloon loan.

Read Also: How Can I Mortgage My House

How To Calculate Balloon Payments

Balloon mortgages are given for a certain term, with a separate amortization term. For example, a 7/15 loan would have a term of 7 years, but would only amortize after 15 years. Knowing this information, along with the interest and the loan amount, its easy to calculate a balloon payment. But first, you need to know the formula.

The formula to calculate a balloon payment is:

FV = PV*nP*

Heres a quick explanation of the variables:

-

FV is the final value of the balloon payment.

-

PV is the present value, or the original loan balance.

-

r is the interest rate.

-

n is the total number of payments.

-

P is the amount of the monthly payment.

Does this all sound a bit complicated? Its easier to understand if we use an example.

Dave borrows $240,000 on a 10/15 balloon mortgage with a 6% fixed interest rate. This works out to a monthly payment of $2,025. So, we know our present value and the monthly payment amount. On a 10-year loan, we also know that there will be 120 monthly payments. This gives us all the information we need to fill out the equation. And with a 6% fixed interest rate, the actual interest rate per month will be 0.5%.

We get:

FV=$240,000*120-2,025*

This works out to:

FV=$104,960

So after 10 years of $2,025 monthly payments, Dave will make a final balloon payment of $104,960.

When A Balloon Mortgage Might Be Right For You

A balloon mortgage may be a good idea if:

-

You know with a high degree of certainty that you aren’t going to still be in the property when the balloon payment comes due

-

You expect, again with a great deal of confidence, that you’re going to receive a lump sum at least equal to the balloon payment that will come due. That could be something like a bonus or series of annual bonuses, an inheritance or the sale of another property.

-

You believe theres that confidence again that you’ll be able to refinance the loan before the end of the term

Also Check: Do Multiple Mortgage Pre Approvals Affect Credit Score

How Do Balloon Mortgages Work

Balloon mortgages allow you to make lower monthly payments than what would normally be allowed with other types of mortgages. In exchange, you have to repay the full amount borrowed sooner than you would with, say, a conventional mortgage.

The most common type of mortgage a 30-year fixed-rate home loan gives you three decades to repay the principal. By comparison, a balloon mortgage might require you to pay off the principal after five years. During the five years that you carry the mortgage, you might pay only interest, or interest plus a small amount of principal it just depends on the type of balloon mortgage you take out.

Tip:

What You Need To Know

- A balloon mortgage lets you make low monthly payments over the life of the loan. At the end of loans term, you make one large payment for the outstanding loan balance

- Balloon mortgages come with three payment options: regular mortgage monthly payments that cover interest and principal, interest-only payments or no payments at all

- A balloon mortgage is best for borrowers who are interested in low living costs or dont plan on living in the home very long

Also Check: How Much Do You Pay On A 30 Year Mortgage

What Happens If You Cant Afford Your Mortgage Balloon Payment

Ideally, homebuyers would set aside money throughout the life of their loan so when their balloon payment comes due, theyve got the money to pay it. But there are some cases where this doesnt happen.

If you cant make your balloon payment, you may be able to work out a payment plan with your lender. You can also see if the lender is willing to modify your loan, which may change your payment amounts for a period of time. Finally, you may need to either sell the home or relinquish ownership to the lender to cover the debt.

Regardless of which choice you believe is right for you, you should reach out to your loan servicer as soon as you know you wont be able to pay. The last thing you want is to miss a payment without having communicated to your lender ahead of time. Doing so can lead to negative marks on your , which can make it more difficult to borrow money in the future. In an even worse case scenario, failing to make your mortgage payments can cause your lender to take actions toward foreclosure.

Why Get A Balloon Mortgage

People who expect to stay in their home for only a short period of time may opt for a balloon mortgage. It comes with low monthly payments and a much lower overall cost, since it is paid off in a few years rather than in 20 or 30 years like a conventional mortgage.

Others may intend to stay in their homes and refinance before the balloon payment is due. They may be counting on a higher income by then, and they are sure that they will be able to handle a larger monthly payment. Or they may foresee a fall in interest rates.

Another type of homebuyer who might find the balloon mortgage appealing is a professional whose main income comes as a year-end bonus. If that bonus is a certainty, then it allows the buyer to get into the home earlier.

Also Check: What Is The Biggest Mortgage I Can Get