Is 325% A Good Mortgage Rate

Let’s preface this by mentioning that some borrowers are scoring rates in the 2s. Others, meanwhile, also timed the process right and locked in a 3% mortgage rate.

But don’t be discouraged if you end up with a 3.25% rate. Even a 0.75% difference, when compared to a 4% rate, will prove to be worthwhile in the long run.

Know When To Refinance Your Home

There are a number of reasons why you should refinance your home, but many homeowners consider refinancing when they can lower their interest rate, reduce their monthly payments or pay off their home loan sooner. Refinancing also may help you access your homes equity or eliminate private mortgage insurance .

A home loan refinance may make sense particularly if you plan to remain in your home for awhile. Even if you score a lower interest rate, you need to take the loan costs into consideration. Calculate the break-even point where your savings from a lower interest rate exceed your closing costs by dividing your closing costs by the monthly savings from your new payment.

Our mortgage refinance calculator could help you determine if refinancing is right for you.

Strategies To Get A Lower Interest Rate

Heres a recap of the best strategies to get a lower interest rate and save on your mortgage loan:

And, if you have time before you plan to buy or refinance:

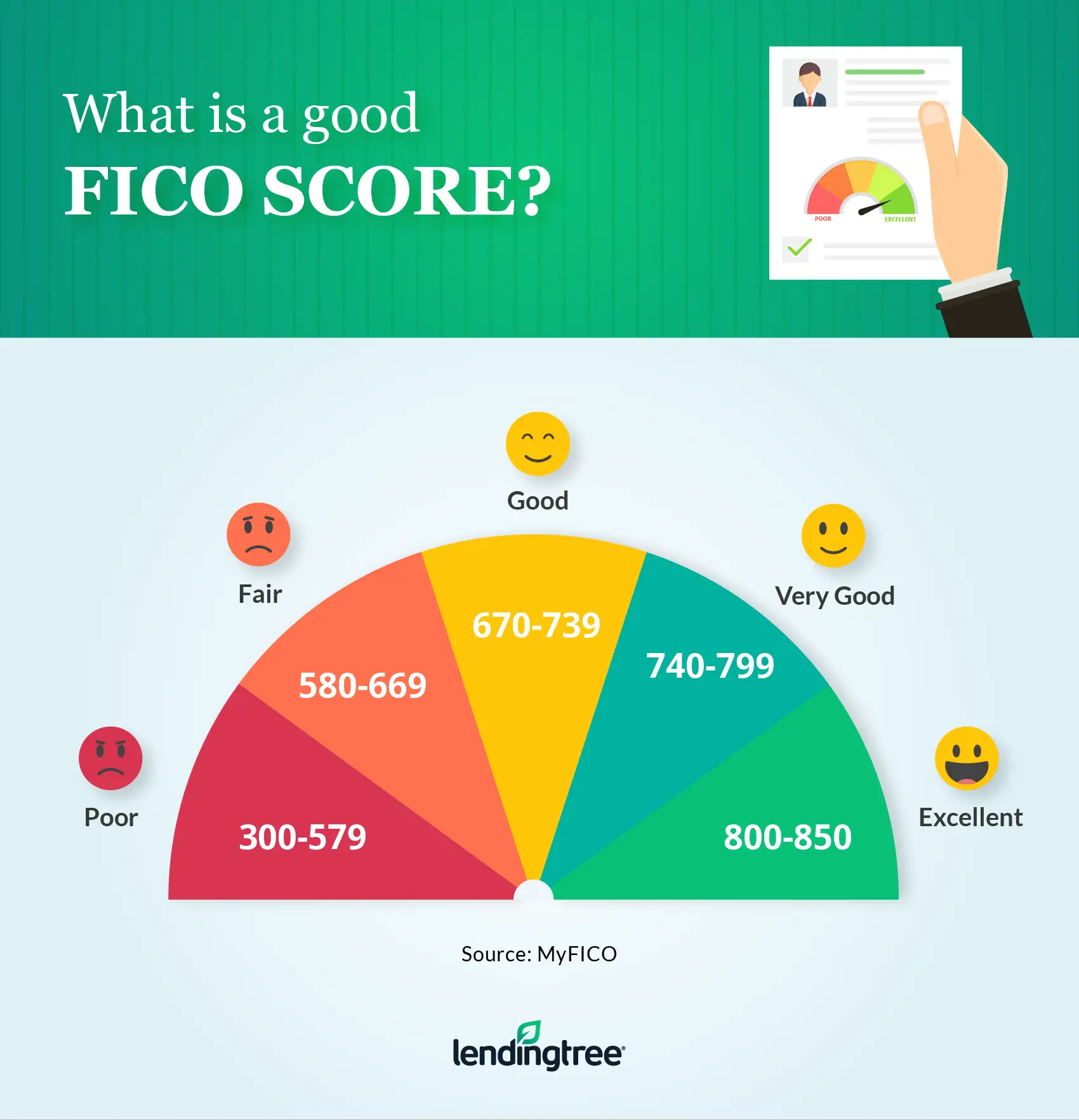

- Boost your credit score before you apply

- Reduce your debts before you apply

- Save a bigger down payment. The higher your down payment, the lower your mortgage rate is likely to be

With those last three, theres only so much you can do. Few of us could save more at the same time were paying down debt.

But prioritize areas where you think you have the most room to grow as a borrower. And just do what you can. Because even a little can sometimes help a lot.

Also Check: How To Create A Rocket Mortgage Account

How To Get A Mortgage

Because a home is usually the biggest purchase a person makes, a mortgage is usually a households largest chunk of debt. Getting the best possible terms on your loan can mean a difference of hundreds of extra dollars in or out of your budget each month, and tens of thousands of dollars in or out of your pocket over the life of the loan. It’s important to prepare for the mortgage application process to ensure you get the best rate and monthly payments within your budget.

Here are quick steps to prepare for a mortgage:

> > Read more: How to get a mortgage guide

Different types of mortgages

There are many different types of mortgages and its important to understand your options so you can select the loan thats best for you: conventional, government-insured or jumbo loans, also known as non-conforming mortgages.

Loandepot Best For Repeat Borrowers

Overview

The Foothill Ranch, California-headquartered loanDepot was founded in 2010. It has more than 200 locations throughout the U.S. and is licensed to lend in all 50 states.

What to keep in mind

LoanDepot offers an entirely online application process, including proprietary software that allows you to digitally verify your information. Although, it also has physical locations if you prefer face-to-face interactions. Once youve taken out a mortgage with this lender, it offers incentives if you refinance with it. It will waive lender fees and reimburse you for the appraisal fees if you qualify for its Lifetime Guarantee offer.

Read Also: How Much Loan Can I Get For Mortgage

Pay Attention To Loan Fees

Anytime you take out a home loan, youll want to be aware of the closing costs. These fees include loan origination fees, prepaid interest, and property taxes, and can range from 3 to 6% of the loan amount.. Accepting a higher interest rate, in exchange for lender credits can assist you in reducing your out-of-pocket costs. You can save money in the short term by using this strategy, so dont overlook it if you plan on selling your house or refinancing in five to eight years.

How Do I Refinance A 30

Refinancing is when you replace your existing mortgage with a new home loan. When 30-year refinance rates are significantly lower than your existing mortgage rate, you may be able to save money with a refinance. Keep in mind that the potential savings will need to outweigh the upfront closing costs youll pay to refinance, which are typically 3% to 6% of the loan balance.

Another factor to consider when you refinance is, how many years have you been paying off your current mortgage? If youre 10 years into a 30-year loan, taking out a new 30-year mortgage adds those 10 years back onto your repayment term. Even though you may be lowering your monthly payment and rate in that scenario, you could end up paying more interest over the long term even if you have a lower rate.

For more information on how to refinance a mortgage, see NextAdvisors refinance page.

Recommended Reading: What Types Of Loans Does Rocket Mortgage Have

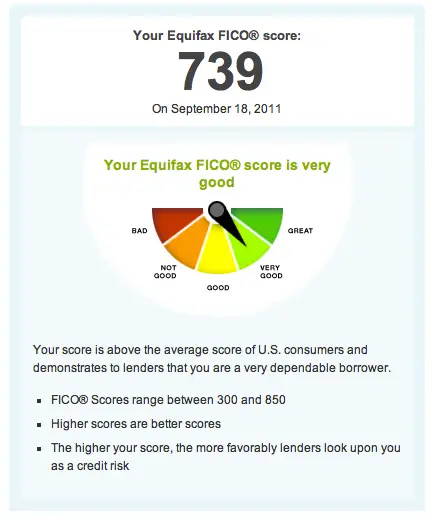

How Our Mortgage Interest Rates Are Calculated

We use Bankrates daily mortgage interest rate data for our mortgage rate trends. These overnight rates are based on a specific borrower profile, which only includes loans for primary residences where the borrower has a FICO score of 740+. Bankrate is part of the same parent company as NextAdvisor.

The table below compares todays average rates to what they were a week ago, and is based on information provided to Bankrate by lenders nationwide:

Current average mortgage interest rates| Loan type |

|---|

Todays Mortgage and Refinance Rates

| Product | |

|---|---|

| 3.450% | 3.750% |

Additionally, is 3.375 a good mortgage rate? The lowest rate Ive seen advertised by the top 10 mortgage lenders is the 3.375% on offer at Flagstar Bank. At U.S. Bank you can get a jumbo 30-year fixed as low as 3.625% with similar APR. Their FHA 30-year fixed is currently 3.5%, but APR is over 5% because of pricey mortgage insurance premiums.

Then, is 4.75 A good mortgage rate?

*Interest rates assume a good credit rating and 20% down payment. **Amount doesnt include property taxes, homeowners insurance, or HOA dues . The Cost Savings of Different Interest Rates for a $200K 30-Year Fixed Loan.

| Interest Rate* |

|---|

| $175,592 |

Is 3.875 a good mortgage rate?

Historically, its a fantastic mortgage rate. The average rate since 1971 is more than 8% for a 30-year fixed mortgage. To see if 3.875% is a good rate right now and for you, get 3-4 mortgage quotes and see what other lenders offer.

Also Check: Rocket Mortgage Loan Types

Benefits Of A Home Equity Line Of Credit

While many people use HELOCs to fund a remodel or home expansion, you can borrow money for many reasons. This includes:

- Hospital bills and other medical expenses: Since a HELOC is a revolving credit line, theyâre helpful for ongoing medical expenses.

- Education costs: A home equity line of credit has lower interest rates than a student loan.

- Real estate investments: Borrow against the equity of your home to finance the purchase of another property. Of course, there are many risks since real estate market values fluctuate.

- Vacations: Indeed, some people take out HELOCs to fund their travels. It might be cheaper, but itâs still gratuitous. Plus, defaulting on credit card payments doesnât result in losing your home.

- Auto purchases: This is not recommendable since your vehicle will depreciate 10-20 years down the line.

Don’t Miss: How Much Do You Owe On Your Mortgage

Mortgage Rates: 3 Things That Affect How Much You Pay

If youre considering buying a home, youve probably played with a few online calculators or noted the compelling mortgage interest rates advertised on billboards, banner ads, and bank branch placards.

But will you actually qualify for those rates?

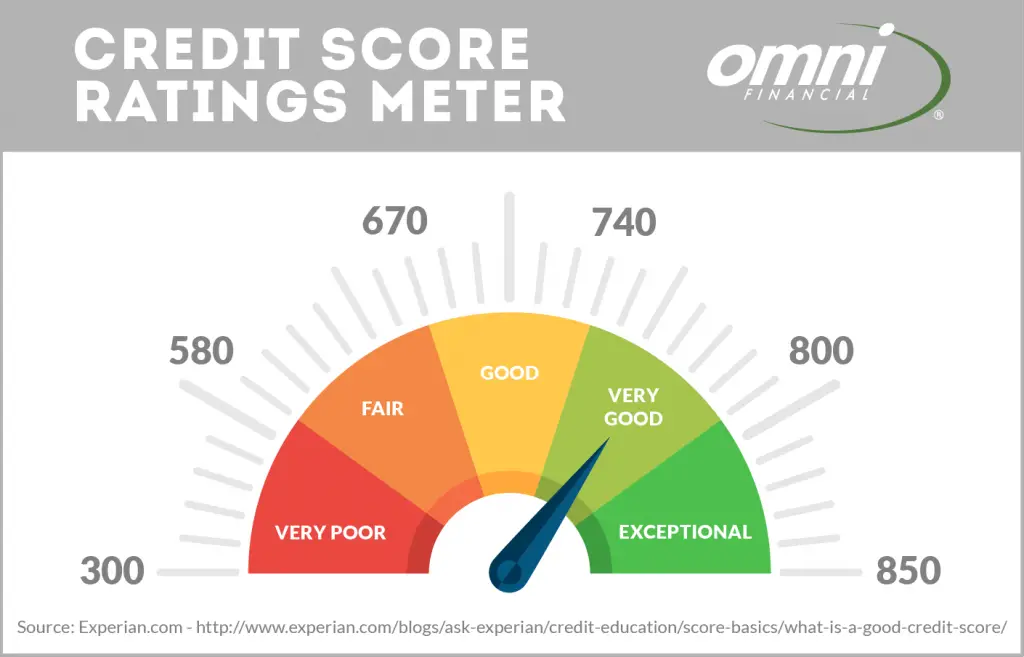

Its a smart question. If youre new to the mortgage market, there are two kinds of mortgage interest rates: There is the best-advertised rate, and then there is the slightly different rate you may pay based on factors including your credit score, loan size, and home purchase price.

So what exactly is the best-advertised rate? Its that 3% 30-year fixed loan marketed in your bank branch that looks really gooduntil you squint to read the signboard footnotes explaining that to get it youd need an 800+ FICO score, 30% down payment, and dozens of additional criteria to qualify.

Heres a look at several factors that can impact your borrowing power and how lenders apply them to mortgage decisions. You may not be able to change some factorsfor instance, it can take many months to improve a depressed credit scorebut understanding them can help you set expectations.

Vad Anses Vara Ett Hgt Boln

Om din belåningsgraden är större än 80 %, anses det vara högt, och det utsätter långivaren för en större risk. Detta kan resultera i en högre bolåneränta, särskilt i kombination med en lägre kreditvärdighet.

Även Vilket är det högsta belåningsvärdet? Ju högre belåningsgraden är desto högre finansieras andelen av en fastighets köpeskilling. Belåningsgraden är ett riskmått som används av långivare när de bestämmer hur stort ett lån som ska godkännas. För ett bostadslån är den maximala belåningsgraden typiskt 80%.

Vilken LTV behövs för att refinansiera?

Tumregeln är att din LTV-kvot ska vara 80 % eller lägre till refinansiera. Det betyder att du har minst 20% eget kapital i ditt hem. Du kan dock kunna refinansiera med ett högre förhållande, särskilt om du har en mycket bra kreditvärdighet.

Vad är ett bra LTV UK? Som en allmän tumregel bör ditt idealiska förhållande mellan lån och värde vara någonstans under 80%. Allt över 80 % anses vara en hög LTV det finns gott om bolån tillgängliga för personer med LTV på 80, 90 eller till och med 95 %, men du kommer att betala mycket mer på ränta.

Dont Miss: Does Chase Allow Mortgage Recast

Recommended Reading: How Do I Shop For Mortgage Rates

Are Fha Loans Fixed

Though the vast majority of FHA loans are 30-year, fixed-rate mortgages, other options are available, including both shorter-term fixed-rate mortgages and adjustable rate mortgages . In recent years, fixed-rate mortgages have been much more common, as home buyers have sought to lock in low interest rates. But if you dont plan to stay in the home long, an ARM may be worth a look.

Good Mortgage Rates Look Different To Everyone

What is a good mortgage rate? Thats a tricky question. Because many of the rates you see advertised are available only to prime borrowers: those with high credit scores, few debts, and very stable finances. Not everyone falls into that category.

Of course, you can look at average mortgage rates. But how reliable are those as a guide?

On the day this was written , Freddie Macs weekly average for a 30-year, fixed-rate mortgage was 5.30 percent. But the daily equivalent from The Mortgage Reports rate survey was 5.912% . So theres clearly some variance across the market.

Don’t Miss: What Are The Lowest Home Mortgage Rates

How To Shop For And Compare Mortgages

Shopping around and comparing offers is critical to get the best deal on your mortgage refinance. Make sure to get quotes from at least three lenders, and pay attention not just to the interest rate but also to the fees they charge and other terms. Sometimes its a better deal to choose a slightly higher interest loan if the other aspects are favorable.

Also Check: Chase Mortgage Recast Fee

How Does A Mortgage Interest Rate Work

Mortgage interest rates can vacillate, depending on larger economic factors and investment activity. The secondary market also plays a role.

Fannie Mae and Freddie Mac bundle mortgage loans. They sell them to investors who are looking to make a profit. Whatever interest rate those investors are willing to pay for mortgage-backed securities determines what rates lenders can set on their loans.

-

Unemployment is low, and jobs are increasing.

This chart illustrates how 30-year fixed-rate mortgage rates have changed since 2000.

Interest rates aresimply cited and agreed-upon percentages. The amount of interest you will pay each month will decrease as you pay off the principal balance you borrowed and as that number also decreases. Your percentage interest rate applies to that remaining balance.

Read Also: Can You Get A Mortgage If You Filed Bankruptcy

Where Are Mortgage Rates Heading This Year

Mortgage rates sank through 2020. Millions of homeowners responded to low mortgage rates by refinancing existing loans and taking out new ones. Many people bought homes they may not have been able to afford if rates were higher. In January 2021, rates briefly dropped to the lowest levels on record, but trended slightly higher through the rest of the year.

Looking ahead, experts believe interest rates will rise more in 2022, but also modestly. Factors that could influence rates include continued economic improvement and more gains in the labor market. The Federal Reserve has also begun tapering its purchase of mortgage-backed securities and raised the federal funds rate for the first time in March to combat rising inflation. The Fed has signaled six more hikes are likely this year.

While mortgage rates are likely to rise, experts say the increase wont happen overnight and it wont be a dramatic jump. Rates should stay near historically low levels through the first half of the year, rising slightly later in the year. Even with rising rates, it will still be a favorable time to finance a new home or refinance a mortgage.

Factors that influence mortgage rates include:

Definition And Example Of A Mortgage Interest Rate

Your mortgage interest rate is what it costs you each month to finance your property. It’s an amount you must pay to your lender in addition to paying off the amount that you’ve borrowed. Interest makes up part of your monthly mortgage payment. Your interest rate is effectively the lender’s compensation for letting you use its money to purchase your property.

Use this mortgage calculator to get a sense of what your monthly mortgage payment could end up being.

You’d pay 5% of your total loan balance in interest if you have a 5% mortgage interest rate. but your principal balance should be much less after 10 years of making payments.

Recommended Reading: Could I Qualify For A Mortgage

Is Now A Good Time To Remortgage

While we have seen some of the cheapest mortgage deals disappear from the market over the last few months, there are still some good rates available. But if you want to remortgage, you should act quickly to grab deals before they disappear.

Due to the current high demand, it is taking longer to remortgage than in previous years.

If youre on a SVR, locking into to a fixed rate not only means you will have certainty over how much youll be paying on your mortgage each month but you may also find your repayments drop too.

If youre locked into a deal, you may still be able to save by remortgaging onto a better deal. But you should check if you need to pay any fees like an early repayment charge. Its a good idea to speak to a broker who can talk you through your options. Theyll also crunch the numbers for you you may find that even after you pay any fees youre still going to be better off by remortgaging.

How Do I Know If I’m Working With The Most Affordable Lender

The truth is, you really won’t know if you are getting a good interest rate on your first home mortgage unless you compare rates from different lenders. Once you’ve compared, you can choose the lender who provides the best rate. That lender will answer your questions and get you the best loan terms.

We highly recommend exploring your options, because you may even qualify for an affordable first mortgage with mortgage assistance. As a wholly-owned subsidiary of Twin Cities Habitat for Humanity, TCHFH Lending Inc. for instance provides affordable mortgages to low-and-moderate-income households across the Twin Cities seven-county metro. .

You May Like: Can You Add A Person To A Mortgage

What Is A Discount Point

A discount point is a fee you can choose to pay at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

Today’s National Mortgage Rate Trends

For today, Saturday, August 06, 2022, the current average rate for the benchmark 30-year fixed mortgage is 5.41%, increasing 1 basis point from a week ago. If you’re looking to refinance, today’s national average rate for a 30-year fixed refinance is 5.40%, increasing 2 basis points over the last week. In addition, today’s current average 15-year fixed refinance rate is 4.66%, falling 1 basis points since the same time last week. Whether you’re looking to buy or refinance, Bankrate often has access to offers below the national average, displaying the rate, APR and estimated monthly payment to help you compare deals and fund your home for less. With rates on the rise, its more important than ever to compare today’s mortgage rates before committing to a loan

Read Also: Are Mortgage Rates Based On Credit Score