Whats Moving Current Mortgage Rates

Expectations of a recession in Europe and probably most of the rest of the world heightened this week. The European Union is, globally, the biggest trading bloc. And, when it gets sick, it tends to be infectious.

Last week, Russia turned back on one of its natural gas pipelines into the EU after scheduled maintenance. But the quantity flowing is down to 40% of normal. The International Monetary Fund suggested earlier this week:

The partial shut-off of gas deliveries is already affecting European growth, and a full shutdown could be substantially more severe.

Meanwhile, the eurozones European Central Bank hiked its interest rates on Thursday by 50 basis points , making borrowing there more expensive. The change helped mortgage rates here.

Theres still a reasonable chance that the US will escape a recession. The Fed hopes to create a soft landing, reining in inflation without contracting the economy too far. But it would be even harder for it to achieve that if most of the rest of the world were hurting economically.

Of course, a recession is typically good for mortgage rates, usually driving them lower. But it comes with a steep price tag in terms of higher unemployment and poverty.

How Is The Prime Rate Determined

Each bank sets its own prime rate, so there isnt just one throughout the entire industry. They have to balance a profit motive with a need for their rate to be competitive in the market.

Banks usually base their prime rate on the federal funds rate, adding a margin. The federal funds rate is the only rate that the U.S. Federal Reserve sets itself.

If you read the Wall Street Journal daily, youve likely noticed the prime rate they mention each day. According to the Journal, this represents the base rate posted by at least 70% of the nations largest banks.

Who Sets The Prime Rate

Each bank or lender determines their own Prime rate. Banks in Canada usually look to the target overnight rate, or the Policy Interest Rate set by the Bank of Canada . Changes in the target overnight rate are usually followed by similar changes in Prime rates. As a result, most banks and lenders in Canada have similar Prime rates.

Recommended Reading: What Will My Mortgage Interest Rate Be

How Are Adjustable Rates Set

For decades, major global banks have used something called the London Interbank Offered Rate, or LIBOR, as the benchmark reference rate for government and corporate bonds, mortgages, student loans, credit cards, derivatives and other financial products.

Now, banks have switched to new replacement index alternatives which include the Secured Overnight Financing Rate . Learn more about how rates are set and how the switch to SOFR impacts adjustable rate mortgages.

NOTICE: This is not a commitment to lend or extend credit. Conditions and restrictions may apply. All home lending products, including mortgage, home equity loans and home equity lines of credit, are subject to credit and collateral approval. Not all home lending products are available in all states. Hazard insurance and, if applicable, flood insurance are required on collateral property. Actual rates, fees and terms are based on those offered as of the date of application and are subject to change without notice. Mortgage and Home Equity Lending products offered by KeyBank are not FDIC insured or guaranteed.

NMLS# 399797

Interest rate discount may not be available for all products. May be combinable with other offers. Ask us for details.

Mortgage Terms & Conditions:The Annual Percentage Rate is the cost of credit over the term of the loan expressed as an annual rate. The APR shown is based on interest rate, points and certain estimated finance charges. Your actual APR may be different.

Mortgages

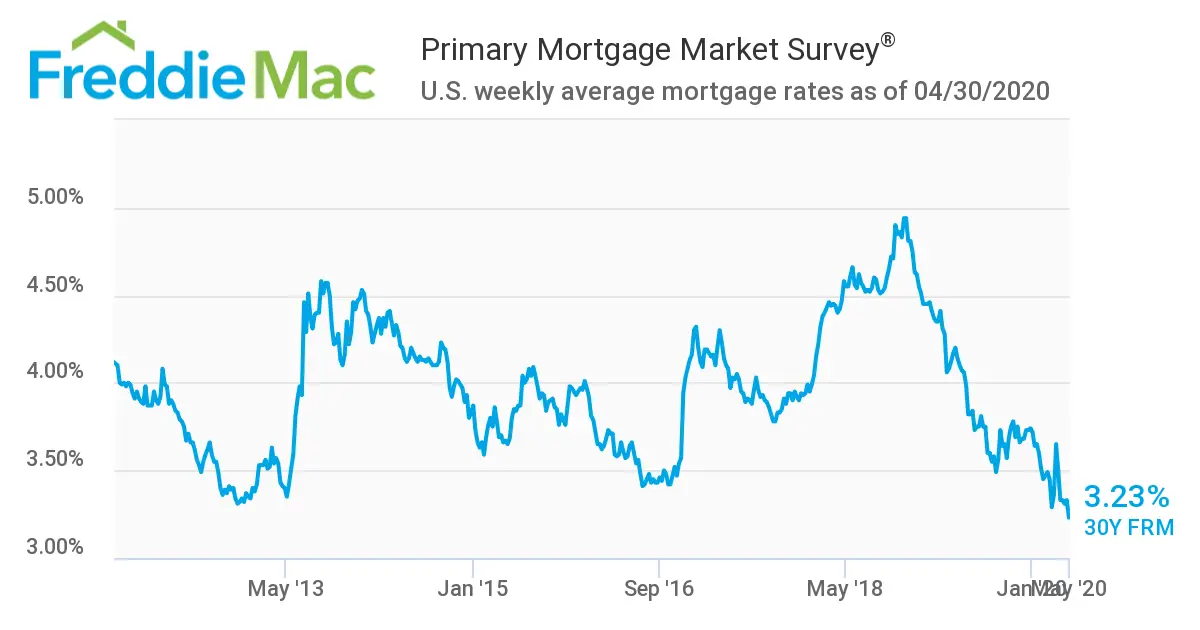

Very Low Mortgage Rates

Fixed rates have risen significantly from the pandemic-induced record lows, and they are expected to continue rising. As mortgage rates rise, they reduce homebuying budgets.

The impact of early rate increases on homebuying budgets will be greater than the subsequent rate increases.

Prospective homebuyers can take advantage of this effect by getting a pre-approved mortgage 4 months before making a purchase. By the time they find a place they like, rates may have risen, and competing bidders who didnt get a pre-approved committed rate might be saddled with smaller homebuying budgets.

If your bank doesnt offer a 4-month rate guarantee with their pre-approval, then talk to a mortgage broker.

Recommended Reading: Who Uses Equifax For Mortgages

How Your Initial 5/1 Arm Rate Is Set

Just like fixed mortgage rates, adjustable rates depend on your qualities as a borrower. Youll get the lowest rate if you have a:

- High credit score

- Big down payment

- Low debt-to-income ratio

And like fixed rates, your initial ARM rate and its fixed period is determined by market factors like supply and demand for mortgage-backed securities. But how is your rate determined after the initial fixed period?

How your ARM rate is set after the introductory fixed period

When an ARM loan enters its variable period, it is directly tied to a particular index like LIBOR or SOFR. Indices are measures of the current interest rate environment in an economy.

Your adjustable-period rate is determined by an index plus a margin, or a certain interest rate the lender charges above the index for its profit.

For instance, lets say your ARM is tied to the SOFR index which is 2.0% when the loan starts adjusting. The margin, set by the lender at loan origination, is 2.25%.

Your rate upon the first adjustment would be 4.25%, which is the index plus margin.

The margin never changes, but the index does. If the SOFR goes up to 5.0%, your rate would be 7.25%, limited by the caps discussed above.

So the variability of your rate is tied to the current market after your initial fixed period. This is why so many people avoid ARMs the future is highly unpredictable and most home buyers assume the worst, even if ARM holders have enjoyed dropping rates over the past few decades.

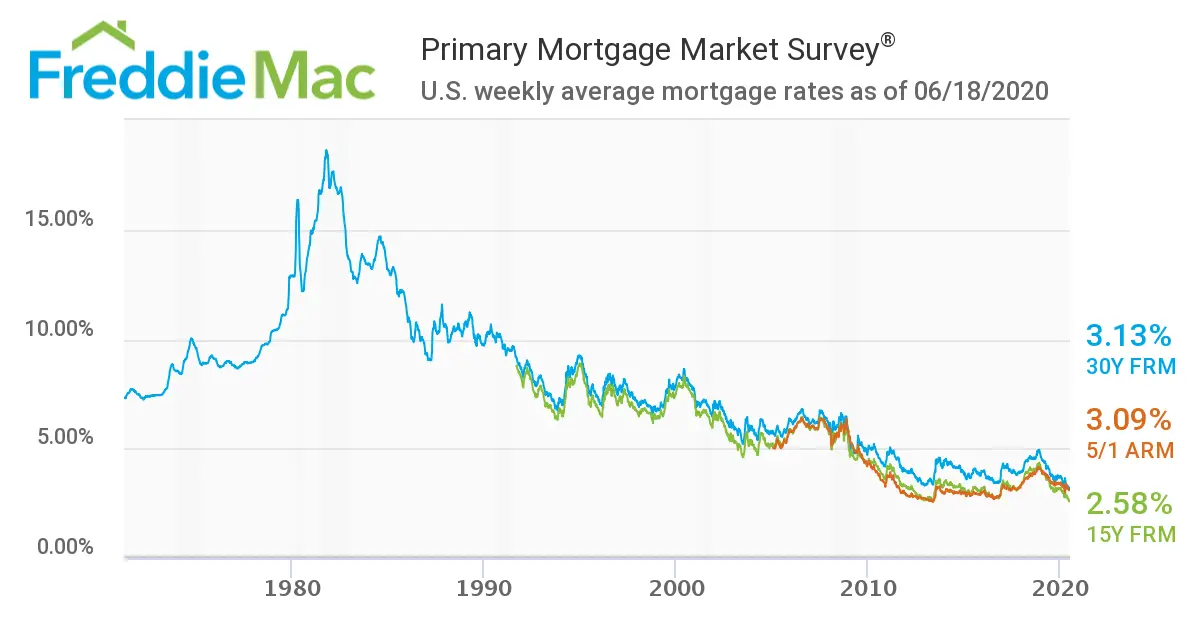

Historic Mortgage Rates: Important Years For Rates

The longterm average for mortgage rates is just under 8 percent. Thats according to Freddie Mac records going back to 1971.

But mortgage rates can move a lot from year to year even from day to day. And some years have seen much bigger moves than others.

Lets look at a few examples to show how rates often buck conventional wisdom and move in unexpected ways.

Don’t Miss: What Is Loan Servicing In Mortgage

What Is A Good Mortgage Rate

A good mortgage rate will depend on the borrower. Lenders will advertise the lowest rate offered but yours will depend on factors like your credit history, income, other debts, and your down payment. For instance, a good mortgage rate for someone who has a low credit score tends to be higher than for someone who has a higher credit score.

Its important to understand what will affect your individual rate and work towards optimizing your finances so you can receive the most competitive rate based on your financial situation.

Home Equity Line Of Credit Special Offers

| Home Equity Line of Credit**** | |

| Mortgage Rates*** |

4.55% HSBC Prime Rate – 0.15% |

Offer is available to all new HSBC Home Equity Line of Credit applications that start between February 28, 2022 to September 30, 2022 subject to credit approval.

The HSBC Premier advantage

HSBC Premier customers can take advantage of our mortgages in addition to the benefits of HSBC Premier1, a leading banking solution that gives you access to unlimited day-to-day banking2 and exclusive worldwide benefits.

HSBC Premier eligibility

To qualify for an HSBC Premier mortgage you must have an active HSBC Premier chequing account. The monthly fee of $34.95 is waived when you maintain:

1. Personal deposits & investments totalling $100,000 or more or

2. Hold a personal mortgage with an original amount of $500,000 or greater

OR achieve the thresholds noted in points 1 and 2 above by combining you and your spouse or common law partners balances through our Household Qualification Program. OR

3. $6,500 minimum monthly income deposits or

4. You qualify for HSBC Premier in another country

Discover all the advantages of HSBC Premier

Together, We Advance

Our HSBC Advance customers can access our Mortgage solutions in combination with HSBC Advance3. With our online and mobile banking services, youll have access and control of your money wherever you need it, wherever you are.

HSBC Advance eligibility

Discover all the advantages of HSBC Advance

Read Also: What Does A Cosigner Do For A Mortgage

The Ontario Housing Market: Things To Know

- Homes in Ontario typically cost above $675 000, which is higher than the national average.

- Residential property prices are expected to see steady gains, in part due to a growing demand for homes in Toronto and the greater Toronto region.

- The federal government has taken steps to make homeownership more affordable for certain first-time buyers whether in Ontario or nationally by introducing the First-Time Home Buyer Incentive.

- Before you start searching for your home, its important to consider how much debt you can take on. Enter your details to find out how much you might be able to borrow.

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

Also Check: How Long Will I Pay Off My Mortgage

What You Can Do To Protect Yourself If Interest Rates Rise

If the interest rate rises, your payments increase. Make sure that you can adjust your budget in case your payments increase.

Ask your lender if they offer:

- an interest rate cap: a maximum interest rate your lender can charge on a mortgage. You never have to pay more in interest than the maximum cap, even if the interest rates rise

- a convertibility feature: where, at any time during your term, you can convert or change your mortgage to a fixed interest rate

Note that if you choose a convertibility feature and change your mortgage to a fixed interest rate:

- you usually have to pay a fee

- certain conditions may apply

How To Get The Lowest 30

Strengthen your finances Increase your credit and down payment, if possible, to get access to todays lowest 30-year mortgage rates

Shop around Rates can vary a lot by lender. Get personalized quotes from at least 3-5 mortgage lenders to find the best deal

Consider discount points If you have extra cash, you can pay more upfront for a lower fixed mortgage rate over the life of the loan

Don’t Miss: How Long For Mortgage Pre Approval

How Does The Federal Funds Rate Impact The Prime Rate

The federal funds rate is an interest range set by the Federal Reserve. The fed funds rate is the Feds recommendation for what banks should charge when they lend money to each other overnight to meet reserve requirements.

There is a rule of thumb that the prime rate is fed funds plus 3, says Garretty. When the Fed funds rate changes, one bank will usually take the lead and announce a change in that banks prime rate that same day.

The prime rate moves only when the federal funds rate moves. This is unlike other rates , which move daily/weekly according to short term financial market conditions, says Garretty.

Once a bank changes its prime rate based on the new federal funds rate, it will then start adjusting rates for many of its other lending products in the same direction. And when the federal funds rate and prime rate go down, other rates fall too, making it less expensive to borrow.

Note that certain lending products, like fixed rate mortgages and some student loans, are based on measures like SOFR and are less tied to the movement of the prime rate.

How Does The Prime Rate Impact You

The prime rate sets the baseline for a variety of bank loans. When the prime rate goes up, so does the cost to access small business loans, lines of credit, car loans, certain mortgages and . Since the current prime rate is at a historic low, it costs less to borrow than in the past.

The prime rate is also important if you have any debt with a variable interest rate, where the bank can change your rate. This includes credit cards as well as variable rate mortgages, home equity loans, personal loans and variable rate student loans. If the prime rate goes up, the bank could end up charging you a higher interest rate so your monthly payment on variable debt would increase.

Decisions by a banks asset and liability committee will ultimately determine where those other rates will settle, says Garretty. They might also take into account their business strategies. For example, if one bank wants more credit card business on their books while another does not, they will quote different credit card rates, even though they are working off the same prime rate.

Thats why seeing the impact of a prime rate hike might not be immediately obvious. However, over time, the prime rate does push consumer rates in the same direction. By keeping an eye on the prime rate trends, you can get a sense of how expensive it will be to borrow and you can plan around any changes.

Don’t Miss: How Much Is The Average House Mortgage

The 10 Most Recent Prime Rate Changes

| Effective Date | |

|---|---|

| 9/27/18 | 5.25% |

As you can see from the table, plus the longer-term chart below, the prime rate today is at historic lows. It cant drop any further because the fed funds rate is the lowest it can be without going negative.

The last time rates were this low was during the financial crisis, when prime rates were also 3.25% starting in December of 2008, says Daniel Milan, managing partner of Cornerstone Financial Services in Southfield, Mich.

Rates began to rise in 2015 or so and continued to rise until March of 2020 due to Covid-19. If you go back further into history, you never saw rates this low as you would often see them in the mid-high single digits or even the low double digits especially in the 80s and 90s, he says.

Are Mortgage Rates Higher Than The Prime Rate

The prime rate has little direct effect on most mortgage interest rates. Only home equity loans and lines of credit are typically tied to the Wall Street Journals published prime rate. However, the prime rate does exert some indirect influence on many mortgage rates, particularly adjustable rate mortgages.

Read Also: What Is The Mortgage Rate In Florida

How Big A Mortgage Can I Afford

In general, homeowners can afford a mortgage thats two to two-and-a-half times their annual gross income. For instance, if you earn $80,000 a year, you can afford a mortgage from $160,000 to $200,000. Keep in mind that this is a general guideline and you need to look at additional factors when determining how much you can afford such as your lifestyle.

First, your lender will determine what it thinks you can afford based on your income, debts, assets, and liabilities. However, you need to determine how much youre willing to spend, your current expensesmost experts recommend not spending more than 28 percent of your gross income on housing costs. Lenders will also look at your DTI, meaning that the higher your DTI, the less likely youll be able to afford a bigger mortgage.

Dont forget to include other costs aside from your mortgage, which includes any applicable HOA fees, homeowners insurance, property taxes, and home maintenance costs. Using a mortgage calculator can be helpful in this situation to help you figure out how you can comfortably afford a mortgage payment.

Variable Interest Rate Mortgage

A variable interest rate can increase and decrease during your term. If you choose a variable interest rate, your rate may be lower than if you selected a fixed rate.

The rise and fall of interest rates are difficult to predict. Consider how much of an increase in mortgage payments youd be able to afford if interest rates rise. Note that between 2005 and 2015, interest rates varied from 0.5% to 4.75%.

Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, a fixed interest rate mortgage may be better for you. You may also consider fixed payments with a variable interest rate.

A variable interest rate mortgage may be better for you if youre comfortable with:

- your interest rate changing

- your mortgage payments potentially changing

- the need to follow interest rates closely if your mortgage has a convertibility option

Get information on current interest rates from the Bank of Canada or your lenders website.

You May Like: What Does Private Mortgage Insurance Cover