How Does The Naca Program Work

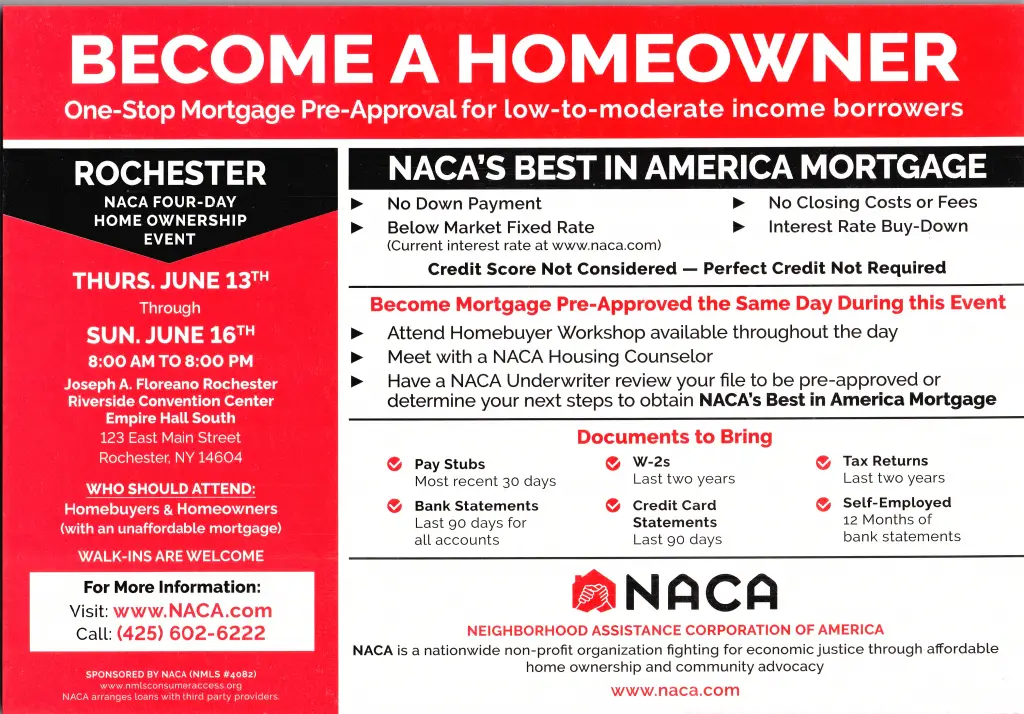

The NACA is known for its purchase program, which it calls the Best in America Mortgage Program. This purchase program is designed to make homeownership more affordable for everyone.

If you applied for a mortgage through a bank or credit union, you would undergo an extensive credit check. But the NACA makes it possible to buy a home with:

- No down payment

- No requirement for perfect credit

- No limits on your income

- No fees The lender pays the appraisal costs, attorney fees, title insurance, transfer tax, settlement agent fees, and buyer closing costs.

And all of this is available at a below-market interest rate. Currently, the NACA is offering a 30-year fixed-rate mortgage of 2.125% APR and a 15-year fixed-rate mortgage of 1.75% APR. Youd be hard-pressed to find a better deal anywhere else.

Close On Your Mortgage

Now its time to close on your home! There are no closing costs for a NACA mortgage. Also, NACA members do not pay private mortgage insurance . Instead, your NACA membership provides you with a post-purchase assistance program through NACAs Membership Assistance Program . But this is the final step that allows you to close on your new home and finalize the process.

How The Naca Home Buying Program Works

The process of getting a NACA mortgage is slightly different from other types of home loans. Heres what you can expect:

1. Attend a homeownership workshop

This is the first step to getting a NACA mortgage. The workshop not only provides information about homeownership, but also explains how the NACA program works in detail. Workshops are held multiple times throughout the month in different cities.

To find a workshop near you, visit naca.com.

2. Meet with a housing counselor

Youre also required to meet with a housing counselor. Your counselor reviews your income and your current debts to gauge whether youre financially ready to purchase a home. If so, theyll determine how much you can spend on a house.

If youre not financially ready, your counselor will provide instructions on how to become NACAqualified, and then help monitor your progress.

3. Attend a purchase workshop

Once youre NACAqualified, youll attend a home purchase workshop to learn more about the home buying process. Youre also assigned a real estate agent who youll work with to find a home within your budget.

A NACA qualification is only valid for six months. If you dont buy a house within this timeframe, youll have to requalify.

4. Request a qualification letter

Once youve found a house, contact your housing counselor to request a qualification letter. This letter is proof that youre qualified to buy the home, and youll include it with your purchase offer.

5. Wait for the home inspection

Don’t Miss: Does Rocket Mortgage Sell Their Loans

Once Youre Naca Qualified

Once we were NACA qualified, we had to attend another workshop on purchasing a home. We received a qualification letter before the meeting that we were told was good for 90 days, so we attended the first workshop available so that we could get started on buying. If there is one time in your life to be 100% alert, it is at the purchasing workshop.

The workshop presenter went over the entire NACA homebuying process and he was very blunt about how difficult and time consuming the process can be. He warned that if anyone was under a tight deadline, that NACA may not work. Do not leave with any unanswered questions I asked questions for about an hour afterwards.

Naca Mortgage Help Offered

The NACA has been providing services to homeowners since 1988. The organization allows members to buy or refinance a home on the following terms:

- No down payment

- No fees

- No closing costs

Interest is charged at below market rates and an applicant does not need to have perfect credit to take advantage of this program.

All NACA members get the same terms for their mortgage loans, no matter what their credit score happens to be. Rather than using the standard risk-focused formula that traditional lenders use, NACA members are evaluated based on their character. An applicant’s individual circumstances are taken into account to determine what they can afford.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Attend A Naca Purchase Workshop And Find A Home

Once NACA Qualified, attend a Purchase Workshop to learn from a NACA In-House real estate agent the best practices in the housing search, how to address property issues and the NACA’s mortgage process. You can sign-up with the NACA IHA to represent you in your housing search. You will receive your NACA Qualification letter and Affordability form after completing this step and can.

Naca Mortgage: What It Is And How It Works

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

If you want to buy a home, but you have bad credit or limited assets, the Neighborhood Assistance Corporation of America may be able to help. NACA is a nonprofit and HUD-certified homeownership and advocacy organization that is committed to assisting economically disadvantaged individuals with becoming homeowners .

Read Also: 10 Year Treasury Yield And Mortgage Rates

Requirements For The Naca Program

Buying a home with no down payment or closing costs probably sounds like a pretty good deal. It might even sound too good to be true.

The catch? This program isnt available to everyone. To qualify for NACAs Best in America Mortgage program, borrowers need to meet certain eligibility requirements.

Heres a rundown of what youll need:

With most mortgage programs, you typically need a minimum credit score of 580 to 620 to qualify.

NACA, on the other hand, doesnt rely on credit scores. Instead, the program examines your payment history over the previous 12 months. NACA wants to see youve paid your rent and other obligations on time consistently over the last year.

You may be able to get a mortgage with a low score, providing you meet other loan requirements.

Income limits

Although NACA helps economically disadvantaged homebuyers, the program doesnt set household income limits.

Even so, borrowers with incomes that exceed the median income for their area can only use the program to buy homes in priority areas. These are low-to-moderate income communities.

But if a buyers income is lower than the local median income, they can purchase a home anywhere in the area.

Loan limits

The purchase price of a NACA home cannot exceed the conforming loan limit for an area. In 2021, the limit for a single-family home is $548,250 in most areas, and $822,375 in high-cost areas.

Debt-to-income ratio

Payment shock savings

Eligible property types

Who Qualifies For Naca Program

NACA focuses on low-to-moderate income homebuyers called Priority Members and low-to-moderate income areas Priority Areas. Thus everyone is eligible adhering to the following: Priority Members: Homebuyers whose income is less than 100% of the median income for the Metropolitan Statistical Area .

Also Check: Reverse Mortgage For Mobile Homes

Naca’s Best Mortgage In America

NACA Best in America Mortgage is a program designed to help low- and middle-income borrowers realize their dream of owning a home.

This non-profit organization is owned by the U.S. Department of Housing and Urban Development has set itself the goal of helping economically disadvantaged families buy a house.

The program is unique from other mortgage programs in that borrowers can buy a home with:

Low CreditNo Down PaymentNo Closing CostsNo Personal Mortgage Insurance

NACA borrowers also get lower mortgage rates, which can help lower their monthly mortgage payments and make home ownership more affordable.

Key Points In The Naca Program

- Borrowers with low credit scores can qualify.

- Borrowers must complete an education session about the program and submit all necessary documents, from income statements to phone bills.

- Borrowers must go through counseling to understand their monthly budget and ensure they can afford the mortgage payment.

- NACA offers below-market interest rates on 15-year or 30-year mortgage loans.

NACA believes in economic justice through home ownership. NACAs current mortgage rates are highly competitive:

- 2.75% 30-YR FIXED APR

- 2.125% 15-YR FIXED APR

NACA is a non-profit, community advocacy and homeownership organization with access to 13 billion in mortgage funds for primarily low- and moderate-income people and people purchasing in low- moderate-income communities. But NACA is open to everyone. There is no eligibility limitation based on ones income, credit score or other criteria as long as certain requirements are met.

According to their website NACA s track record of helping people who have credit problems become homeowners or modify their predatory loan debunks the myth that high rates and fees are necessary to compensate for their credit risk.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

How Much Does It Cost To Be A Member Of Naca

NACA Membership Agreement read and sign electronically. D. Payments: Membership Dues Dues are $20 per household per year with no payment after you close. Credit Reports Reimbursement of the cost for each credit report . MEMBERSHIP SERVICES NACA is committed to provide the best member services.

Nacas Best In America Mortgage

The NACA Best in America Mortgage is a program that helps lowincome and moderateincome borrowers realize their dream of homeownership.

This nonprofit organization is certified by the U.S. Department of Housing and Urban Development , and its goal is to assist economically disadvantaged families through the home buying process.

The program is unique from other mortgage programs because borrowers can buy a home with:

- Low credit scores

- No closing costs

- No private mortgage insurance

NACA borrowers also receive belowmarket mortgage rates, which can help lower their monthly mortgage payments and make homeownership more affordable.

Read Also: Bofa Home Loan Navigator

Bank Of America And Naca Expand Mortgage Program To $15 Billion To Help Low

Mortgage Program Proven to Significantly Reduce the Wealth Disparity Gap

Bank of America and the Neighborhood Assistance Corporation of America today announced the expansion of their national affordable homeownership mortgage program, with a goal of providing $15 billion in mortgages to low-to-moderate income homebuyers through May 2027. This partnership continues to be instrumental in helping to build wealth for those historically locked out of affordable homeownership, thus reducing the racial disparity gap.

For 25 years, the NACA/Bank of America Homeownership Program has provided mortgages for individuals and families. The mortgages come with no down payment, no closing costs , at a below market fixed rate. This partnership has provided affordable homeownership for more than 9,100 households over the last two years and over 42,000 mortgages through the program since 1996.

âExpanding this relationship enables Bank of America to provide more mortgages to families at a time of substantial need and opportunity in America,â said Andrew Plepler, global head of Environment, Social, and Governance at Bank of America. âWe are focused on helping stabilize neighborhoods, maximize homeownership opportunities for working people and families, and build generational wealth through homeownership.â

$20 Billion Of Nacas Best In America Mortgage Is Available To Alabama Residents

The program provides mortgages to predominately minority low-to-moderate income homebuyers who otherwise might not have the opportunity to become a homeowner.

NACA the nations largest nonprofit HUD-certified housing counseling and community advocacy organization announced Tuesday a commitment of $20 billion for NACAs Best in America mortgage that is now available to Alabama homebuyers. NACA is also bringing jobs and is seeking community activists across the state.

The Neighborhood Assistance Corporation of America and Bank of America recently announced the extension of their affordable homeownership program through May 2027.

The program provides mortgages to predominately minority low-to-moderate income homebuyers who otherwise might not have the opportunity to become a homeowner.

NACA has made affordable homeownership a reality for more than 9,100 households over the last two years and more than 70,000 mortgages since 1996.

The NACA mortgage is extraordinary with no down payment, no closing costs, no private mortgage insurance and with broad underwriting criteria. The new agreement with Bank of America provides an incredible fixed interest rate of just 2.0 percent for a 30-year mortgage and just 1.375 percent for a 15-year mortgage for all low- to moderate-income borrowers. This is also available to higher-income borrowers who are buying in a lower-income area.

Bruce Marks is NACAs CEO and founder.

Read Also: How Much Is Mortgage On A 1 Million Dollar House

Interested In Owning Your Own Home Or Apartment

Neighborhood Assistance Corporation of America is partnering with NYCHAs Office of Resident Economic Empowerment and Sustainability to host a mortgage and homeownership workshop for NYCHA public housing residents and NYCHA Section 8 voucher holders.

Participants will learn about NACAs low interest rate mortgage program that enables thousands of working people to afford homeownership.

Are You Ready to Buy a House/Co-op/Condo?

Learn about the NACA mortgage which allows NACA Members to purchase their homes with:

- No down payment

How Does Naca Calculate Income

If the checks varied from payday to payday, we would take the year-to-date amount, divide it by the number of paychecks received so far that year to determine the average paycheck amount, then multiply by 26 and divide by 12. In short, there are several criteria that determine how your income is calculated.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

Restrictions On Mortgage Type And Program

The NACA Mortgage Program only applies to purchase mortgages and you cannot use the program to refinance an existing mortgage. Several other low or no down payment mortgage programs apply to both purchase mortgages and refinances including the HomeReady, Home Possible, FHA and VA mortgage programs. Additionally, only 15 and 30 year fixed rate mortgages are eligible for the program. Borrowers cannot use adjustable rate mortgages or interest only mortgages with the program. Restricting the mortgage program that borrowers can use may limit your financial flexibility. On the positive side, a fixed rate mortgage offers borrowers certainty that their interest rate and monthly payment will not change over the life of their loan.

Naca Can Make Homeownership Possible With Credit Problems

Homeownership can be a dream fulfilled with the help of NACA, even if you have bad credit.

Since 1988 the Neighborhood Assistance Corporation of America has been helping distressed homeowners retain their homes, fight predatory lending as well as providing a mortgage loan programs for homebuyers that lack good credit.

Read Also: Recast Mortgage Chase

Nacas Committed Staff & Contacting Naca

Our staff of hundreds of dedicated staff is committed to working with you to access this incredible mortgage product and to advocate for strong neighborhoods and economic justice. We are always looking for qualified staffsee our current job listings for details. To keep updated on NACA services, campaigns, and relevant legislative happenings, sign up by clicking Contact Us.

Heres What You Need To Know About Naca

Though it has roots in the 1990s, NACA really broke through to public consciousness during the housing bust of last decade. At that time, NACA used aggressive tactics like staging massive protests outside the businesses and homes of the CEOs in charge of our nations largest banks.

Their goal? Make them modify your mortgage so you didnt have to lose your home during the Great Recession!

Through loud and in-your-face efforts, NACA basically publicly shamed the nations lenders into ponying up millions of dollars to restructure predatory loans with deep interest rate cuts. Meanwhile, on a parallel track, NACA also facilities the mortgage underwriting to make it possible for new homeowners to get into their first home with fair terms thus reducing the likelihood of default to begin with.

Lets take a closer look at NACA

Recommended Reading: 10 Year Treasury Yield Mortgage Rates

Getting To The Closing Table

At long last, our file was transferred to a closing coordinator. I immediately contacted her and asked her the same communication preferences I asked the MC. She was very efficient. At this point the seller had finished the repairs he had agreed to and the home inspector re-inspected the house.

We also had to find a contractor for the repairs we were required to fix. To speed up the process, I choose a few contractors from the NACA approved list and luckily, they were able to provide bids on the needed work quickly. In fact, because these contractors understood the NACA process and were quick with their responses, we received our Clear to Close ahead of schedule!

Naca Mortgage Pros And Cons

| Pros | Cons |

| No minimum credit score requirement. This can make buying a home considerably easier if you have poor credit that would disqualify you from a conventional loan or require you to pay high interest rates. | You must live in a NACA service area. You cannot buy a home unless you live in a state and service area that NACA covers. |

| No fees. These loans come with no origination fee, no application fees and no other hidden fees. These loans also come without closing costs. | Limited purchase areas. If your household income exceeds the median income where you hope to buy a home, you can only purchase a home in a NACA priority area. |

| Low interest rates. Your NACA mortgage will come with a below-market interest rate. | Plenty of red tape. NACA mortgages require many in-person meetings, which can take time out of your schedule and make the path to homeownership significantly longer. |

| No private mortgage insurance . All you have to pay is NACAs $25 annual membership fee, which is considerably cheaper than the average PMI payment. | Purchase limits. Your home loan cannot exceed the conforming loan limits of $510,400 in most areas and $765,600 in high-cost areas. |

| Financial counseling. NACA offers financial counseling throughout the process. This assistance can be helpful to manage your bills and housing payments. | Ongoing commitment. NACA members are required to pledge to attend at least five NACA events per year. |

You May Like: Reverse Mortgage Mobile Home