How Much Can I Borrow

The amount you can borrow for your mortgage should depend on your annual income, lending terms, interest rate, and monthly debt. By good rule of thumb, you should only be spending 25% to 30% of your monthly income on housing each month.

The Federal Housing Administration and Fannie Mae set loan limits for conventional loans. By law, all mortgage loans have a maximum limit of 115% of median home prices. Currently, the loan limit for a single unit within the United States is $510,400. For high-cost areas, the limit is increased to $765,600 for a single unit.

Government-insured loans such as FHA have similar limits based on current housing prices. At the end of 2019, the FHA limit was increased to $331,760 in most parts of the country. VA loan limits were eliminated in early 2020.

Jumbo Mortgage Interest Rate Declines

The average rate for a 30-year jumbo mortgage is 7.05 percent, down 1 basis point since the same time last week. Last month on the 10th, the average rate for jumbo mortgages was below that, at 6.07 percent.

At todays average rate, youll pay a combined $662.62 per month in principal and interest for every $100,000 you borrow.

Consider Different Types Of Home Loans

The 30-year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficialdepending on your situation.For example, if you require a lower interest rate, adjustable-rate mortgages offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time . Given that ARM loans are variable, the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. A 15-year fixed rate mortgage, on the other hand, may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed rate mortgage. Consider all your options and choose the home loan that is most comfortable for you.

You May Like: How To Get A Mortgage Preapproval

What’s An Apr And Why Is It Important

The APR, or annual percentage rate, includes the mortgage interest rate and lender fees over the life of the loan. This is an important figure because it gives borrowers a better snapshot of what they will pay for a mortgage as it shows the total cost of a mortgage if you keep it for the entire term.

Year Fixed Mortgage Rates

This mortgage loan is fully amortized over a 15-year period and features constant monthly payments. It offers all the advantages of the 30-year loan, plus a lower interest rateand you’ll own your home twice as fast. The disadvantage is that, with a 15-year mortgage loan, you commit to a higher monthly payment. Many borrowers opt for a 30-year fixed-rate loan and voluntarily make larger payments that will pay off their loan in 15 years. This approach is often safer than committing to a higher monthly mortgage payment since the difference in interest rates is not that great.

Also Check: How To Find Total Interest Paid On A Mortgage

Hybrid Adjustable Rate Mortgage

Hybrid Adjustable Rate Mortgages offer the consumer a low interest rate for a certain period of time. Then, they increase or adjust to the current rate after fixed rate period has elapsed. These rates can be an entire point lower than 30 year fixed rates. Therefore, there may be significant savings in terms of interest paid to the lender. Some common hybrid ARMs are 1 year fixed, 1 year adjustable rates 5 years fixed, 1 year adjustable and 7 years fixed, 1 year adjustable . The adjustable rates will be based upon the federal rate when the fixed term elapses. These loans are also appealing to investors or home buyers who plan to sell in a short period of time.

How Do You Shop For Mortgage Rates

First, start by comparing rates. You can check rates online or call lenders to get their current average rates. Youll also want to compare lender fees, as some lenders charge more than others to process your loan.

Thousands of mortgage lenders are competing for your business. So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate.

Each lender is required to give you a loan estimate. This three-page standardized document will show you the loans interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years.

You May Like: What Are The 3 Types Of Mortgages

Take A Look At Our Mortgage Payment Calculator And Learn How Much Home You Can Afford

With a 30 year fixed mortgage, borrowers have the advantage of knowing the mortgage payments they make each month will never increase, allowing them to budget accordingly.

Each monthly payment goes towards paying off the interest and principal, to be paid in 30 years, thus these monthly mortgage payments are quite lower than a shorter-term loan. You will, however, end up paying considerably more in interest this way.

What Is The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing the money, and it is advertised as a percentage of the loan. , and it includes the interest rate plus other fees associated with the mortgage. So the APR will provide you with a better idea of the total cost of financing the loan. You may find lenders offering the same interest rate and monthly payments, but if one is charging higher upfront fees, then the APR will be higher.

The Federal Truth in Lending Act requires lenders to disclose the APR, but the fees can vary. When comparing APRs between lenders, ask which fees are not included for better comparison.

Also Check: How Long To Pay Off Reverse Mortgage After Death

What The Forecast Means For You

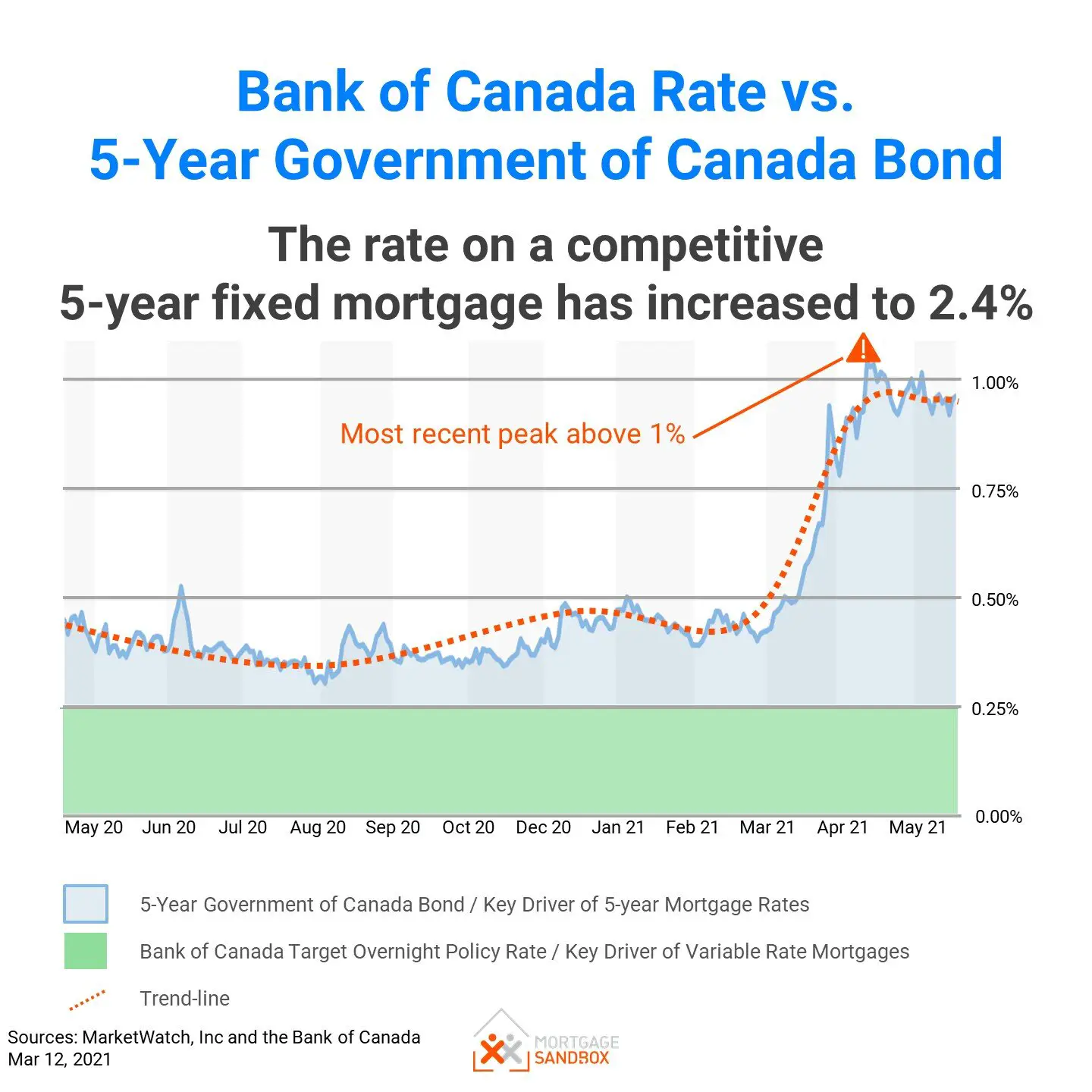

Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years.

Higher interest rates mean higher monthly payments for borrowers. For example, on a $400,000 home with a 5.10% interest rate, the monthly mortgage payment is around $2,172. This doesnt include insurance, taxes or other loan costs. If the rate rises to 6%, the monthly payment jumps to $2,398.

This means time is running out for homeowners who hope to lock in a lower interest rate by refinancing.

Current Mortgage Rates For Oct 11 202: Rates Trend Upward

Today some key mortgage rates climbed higher. See how the Fed’s interest rate hikes could affect your home loan payments.

A number of important mortgage rates rose over the past week. The average 15-year fixed and 30-year fixed mortgage rates both grew. The average rate of the most common type of variable-rate mortgage, the 5/1 adjustable-rate mortgage, also floated higher.

Mortgage rates have been increasing consistently since the start of 2022, following in the wake of a series of interest hikes by the Federal Reserve. Interest rates are dynamic and unpredictable — at least on a daily or weekly basis — and they respond to a wide variety of economic factors. But the Fed’s actions, designed to mitigate the high rate of inflation, are having an unmistakeable impact on mortgage rates.

If you’re looking to buy a home, trying to time the market may not play to your favor. If inflation continues to increase and rates continue to climb, it will likely translate to higher interest rates — and steeper monthly mortgage payments. As such, you may have better luck locking in a lower mortgage interest rate sooner rather than later. No matter when you decide to shop for a home, it’s always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific situation.

Don’t Miss: Which Bank Is Best To Get A Mortgage

About Our Data Source For This Tool

The lenders in our data include a mix of large banks, regional banks, and credit unions. The data is updated semiweekly every Wednesday and Friday at 7 a.m. In the event of a holiday, data will be refreshed on the next available business day.

The data is provided by Informa Research Services, Inc., Calabasas, CA. www.informars.com. Informa collects the data directly from lenders and every effort is made to collect the most accurate data possible, but they cannot guarantee the datas accuracy.

Are Mortgage Rates High Right Now

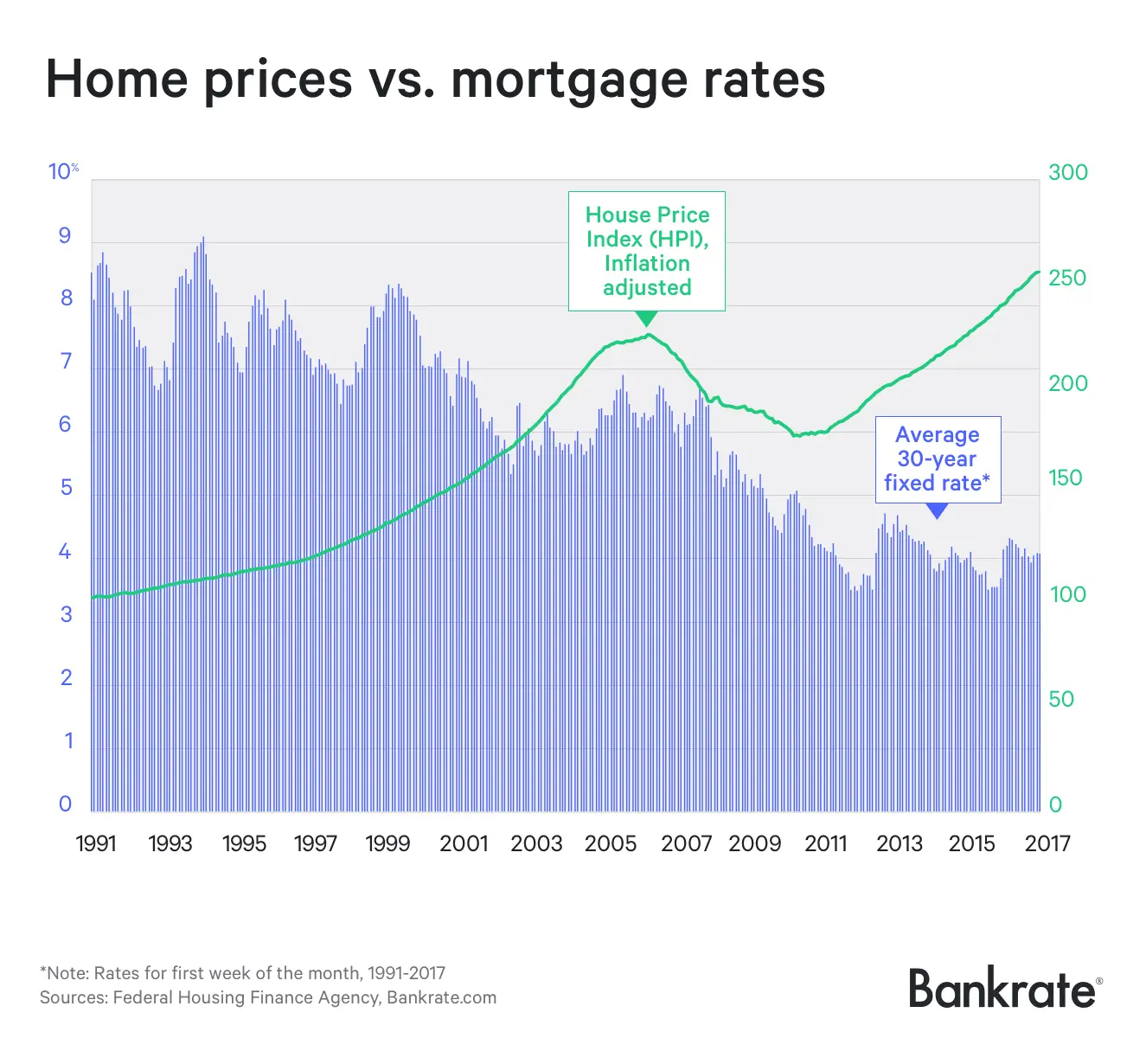

Rates have been higher a lot higher than they are today. In October of 1981, for example, average rates topped 18 percent. Forty years later, in October of 2021, average rates on 30-year mortgages were below 3 percent. So, most homebuyers today are paying rates much closer to record lows than to record highs.

Tim Lucas

Editor

Don’t Miss: Can I Get A Mortgage At Age 70

Mortgage Interest Rates Forecast: Will Rates Go Down

Mortgage rates have risen since the start of 2022, reflecting investors’ concerns that the economy is heating up and that the Fed will cool it down and reign in inflation. U.S. Treasury bond rates, which mortgage rates follow, encountered two tough patches this year: in late February, when Russia invaded Ukraine, and in mid-May when investors worried about poor consumer spending. Bond yields and mortgage rates declined throughout these times.

Most mortgage-market analysts predict rates will be choppy over the next few months but will settle above where they are nowwith the 30-year fixed-rate mortgage just around 5 percentfor the next year or two. The Fed raised interest rates by 75 points in June the biggest increase since 1994.

Then it enacted its second consecutive 0.75 percentage point interest rate increase in July, taking its benchmark rate to a range of 2.25%-2.5%. Now, it is set for another 75-basis-point rate hike in the coming weeks due to the hot U.S. consumer price inflation data released for August. Before the data, the majority of economists anticipated that the Fed would slow the pace of rate hikes in November to a half-point increase, but now a 0.75-point increase is predicted.

< < < Also Read: How To Invest in Mortgage Estate Notes?> > >

Whats The Difference Between Interest Rate And Apr

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

A major component of APR is mortgage insurance a policy that protects the lender from losing money if you default on the mortgage. You, the borrower, pay for it.

Lenders usually require mortgage insurance on loans with less than 20% down payment or less than 20% equity .

Also Check: Can Closing Costs Be Rolled Into Mortgage

How To Use Our Mortgage Rate Table

Our mortgage rate table is designed to help you compare the rates youre being offered by lenders to know if it is better or worse. These rates are benchmark rates for those with good credit and not the teaser rates that make everyone think they will get the lowest rate available. Of course, your personal credit profile will be a significant factor in what rate you actually get quoted from a lender, but you will be able to shop for either new purchase or refinance rates with confidence.

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan and is built into your monthly payment. Mortgage fees are usually paid upfront and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

You May Like: How Much Is An Application Fee For A Mortgage

When Should I Lock My Mortgage Rate

Its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, ask your lender for a float down. With this option, you get the lower of the two rates. Pay attention to the fine print, though. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

How To Compare Mortgage Rates

Mortgage rates like the ones you see on this page are sample rates. In this case, they’re the averages of rates from multiple lenders, which are provided to NerdWallet by Zillow. They let you know about where mortgage rates stand today, but they might not reflect the rate you’ll be offered.

When you look at an individual lender’s website and see mortgage rates, those are also sample rates. To generate those rates, the lender will use a bunch of assumptions about their sample borrower, including credit score, location and down payment amount. Sample rates also sometimes include discount points, which are optional fees borrowers can pay to lower the interest rate. Including discount points will make a lender’s rates appear lower.

To see more personalized rates, you’ll need to provide some information about you and about the home you want to buy. For example, at the top of this page, you can enter your ZIP code to start comparing rates. On the next page, you can adjust your approximate credit score, the amount you’re looking to spend, your down payment amount and the loan term to see rate quotes that better reflect your individual situation.

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

» MORE: Mortgage points calculator

You May Like: Should You Roll Closing Costs Into Mortgage

What Is A Mortgage Rate Lock

A mortgage rate lock means that your interest rate won’t change between the day your rate is locked and closing as long as you close within the specified timeframe of the rate lock, and there are no changes to your application. If your interest rate is locked, your rate won’t change as a result of market fluctuations, but it can still change if there are changes in your application – such as your loan amount, credit score or verified income.

How Much House Can I Afford

Buying a house is a huge purchase and can put a big dent in your savings. Before you start looking, its important to figure out both what you can afford and youre willing to spend.

Not only do you want to consider your income and debt, but you also want to factor in emergency savings and any long-term financial goals such as retirement or college.

These are some basic financial factors that go into home affordability:

You May Like: How To Pay Mortgage Online

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

Determining How Much House You Can Afford

If youre not sure how much of your income should go toward housing, follow the traditional 28/36 percent rule. Most financial advisers agree that people should spend no more than 28% of their gross income on housing , and no more than 36% of their gross income on total debt, including mortgage payments, credit cards, student loans, medical bills and the like. Calculate how much house you can afford and determine your monthly payments.

Also Check: Can You Get A Mortgage On A Foreclosed Property